Jorm 990-PF 2013 40

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ONFI-2017-990-PF.Pdf

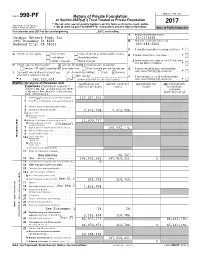

OMB No. 1545-0052 Form 990-PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation 2017 G Do not enter social security numbers on this form as it may be made public. Department of the Treasury Internal Revenue Service G Go to www.irs.gov/Form990PF for instructions and the latest information Open to Public Inspection For calendar year 2017 or tax year beginning , 2017, and ending , A Employer identification number Omidyar Network Fund, Inc 20-1173866 1991 Broadway St #200 B Telephone number (see instructions) Redwood City, CA 94063 650-482-2500 C If exemption application is pending, check here. G G Check all that apply: Initial return Initial return of a former public charity D1Foreign organizations, check here. G Final return Amended return Address change Name change 2 Foreign organizations meeting the 85% test, check here and attach computation . G H Check type of organization:X Section 501(c)(3) exempt private foundation Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation E If private foundation status was terminated under section 507(b)(1)(A), check here. G IJFair market value of all assets at end of year Accounting method: CashX Accrual (from Part II, column (c), line 16) Other (specify) F If the foundation is in a 60-month termination G $ 545,202,008. (Part I, column (d) must be on cash basis.) under section 507(b)(1)(B), check here. G Part I Analysis of Revenue and (a) Revenue and (b) Net investment (c) Adjusted net (d) Disbursements Expenses (The total of amounts in expenses per books income income for charitable columns (b), (c), and (d) may not neces- purposes sarily equal the amounts in column (a) (cash basis only) (see instructions).) 1 Contributions, gifts, grants, etc., received (attach schedule). -

Investing in Inclusive Business in Asia: a Regional Forum

1 26 Nov 2012 ASIA INCLUSIVE BUSINESS FORUM 28-29 November 2012, Manila, ADB Office Resource Speakers James ADDO is the Senior Manager of SNV‟s Impact Investment Advisory Services practice. He manages the development and execution of global impact investment strategy across SNV‟s 36 countries and 4 continents. James is an experienced investment banker with a specialty in private equity and venture capital opportunities. He is a well-rounded Investment Banking Professional with broad experience in conventional and impact investments. James has multi-year experience in establishing and managing development finance programs in 6 sub Saharan African countries. He brings to SNV‟s impact investment advisory practice, the rigor of the private equity and venture capital investment process to together with an understanding of multi-sector development venture finance. He served until April 30 2010 as Group Chief Executive Officer of Securities Africa Limited, a full service Pan-African investment bank with offices in UK, US, Malta, Bermuda and 7 countries in Africa‟s main markets. He covered all 53 countries and 25 capital markets. Prior to that he was a Portfolio Manager of Finch Africa Fund, a $50MM Africa focused equity fund. James, in the previous 8 years, worked in development venture investments with the US Government. He was a Senior Investment Banker from 1992 through 2001 with major firms, including Merrill Lynch. James received his BA from Dartmouth College and completed his MBA from Frank Zarb School of Business (Hofstra University) and Stern University both in New York in 1992. Anurag AGRAWAL is a Co-Founder, Board member and Chief Operating Officer at Intellecap, a firm founded in 2002 which provides innovative business solutions that help build and scale profitable and sustainable enterprises dedicated to social and environmental change. -

From Start-Up to Scale Conversations from the Harvard Business Review- Bridgespan Insight Center on Scaling Social Impact

Created with support from From Start-up to Scale Conversations from the Harvard Business Review- Bridgespan Insight Center on Scaling Social Impact Collaborating to accelerate social impact May 2013 Table of Contents Introduction ��������������������������������������������������������������������������������������������������������������������������������� 3 Scaling Social Impact: What to Do and How to Fund it �������������������������������������������������� 5 Should Your Business Be Nonprofit or For‑Profit? ������������������������������������������������������� 7 When You Should Seek Capital from an Impact Investor ���������������������������������������� 10 Social Impact Investing Will Be the New Venture Capital ����������������������������������������13 Venture Capital with a Twist: How to Pitch an Impact Investor �����������������������������16 It’s Not All About Growth for Social Enterprises ����������������������������������������������������������19 The Talent Needed for Social Impact ������������������������������������������������������������������������������������23 To Change the World, Fear Means Go �����������������������������������������������������������������������������25 Entrepreneurs: You’re More Important Than Your Business Plan �������������������������28 Build Your Bench Strength Without Breaking the Bank �������������������������������������������31 Want to Change the World? Be Resilient� ����������������������������������������������������������������������34 Lessons from a Failed Social Entrepreneur �������������������������������������������������������������������37 -

From Start-Up to Scale (Pdf)

Created with support from From Start-up to Scale Conversations from the Harvard Business Review- Bridgespan Insight Center on Scaling Social Impact Collaborating to accelerate social impact May 2013 Table of Contents Introduction ��������������������������������������������������������������������������������������������������������������������������������� 3 Scaling Social Impact: What to Do and How to Fund it �������������������������������������������������� 5 Should Your Business Be Nonprofit or For‑Profit? ������������������������������������������������������� 7 When You Should Seek Capital from an Impact Investor ���������������������������������������� 10 Social Impact Investing Will Be the New Venture Capital ����������������������������������������13 Venture Capital with a Twist: How to Pitch an Impact Investor �����������������������������16 It’s Not All About Growth for Social Enterprises ����������������������������������������������������������19 The Talent Needed for Social Impact ������������������������������������������������������������������������������������23 To Change the World, Fear Means Go �����������������������������������������������������������������������������25 Entrepreneurs: You’re More Important Than Your Business Plan �������������������������28 Build Your Bench Strength Without Breaking the Bank �������������������������������������������31 Want to Change the World? Be Resilient� ����������������������������������������������������������������������34 Lessons from a Failed Social Entrepreneur �������������������������������������������������������������������37 -

From Blueprint to Scale: the Case for Philanthropy in Impact Investing

MONITOR PRODUCED BY MONITOR GROUP IN COLLABORATION WITH ACUMEN FUND CREATED WITH FUNDING FROM THE BILL & MELINDA GATES FOUNDATION FROM Blueprint TO Scale THE CASE FOR PHILANTHROPY IN IMPACT INVESTING by Harvey Koh, Ashish Karamchandani and Robert Katz April 2012 HOW WE ARRIVED HERE This report springs from a point of view shared by Monitor and Acumen Fund — that philanthropy is the essential but often overlooked catalyst that unlocks the impact potential of inclusive business and impact investing. The re- port has been created with funding from the Bill & Melinda Gates Foundation. The key themes discussed here are based on the sum of Monitor’s extensive research into more than 700 inclusive businesses in Africa and India, and Acumen Fund’s decade of experience as a pioneering impact investor. They also draw together the experiences and observations of dozens of impact investors, grant funders, academics and other experts who were generous enough to share their thoughts with us. In addition, a Monitor team conducted a three-month study of companies in the Acumen Fund portfolio whose development had been significantly affected by grant subsidies, to further develop our insights and provide helpful illustrations. Four company case studies are contained in the main report, and two further case studies can be found as an appendix. Finally, a thoughtful, diverse and generous group of external expert review- ers helped us to fine-tune the report and its recommendations for clarity and impact. This report has focused on developing an in-depth, demand-side under- standing of the needs and challenges facing inclusive businesses, rather than on studying the drivers and constraints of grantmakers and investors.