To Form 990 Or Form 990-EZ

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

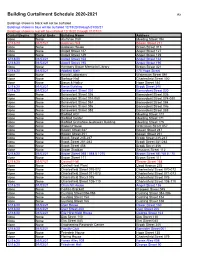

Building Curtailment Schedule 2020-2021 R2

Building Curtailment Schedule 2020-2021 R2 Buildings shown in black will not be curtailed Buildings shown in blue will be curtailed 12/18/20 through 01/03/21 Buildings shown in red will be curtailed 12/18/20 through 01/07/21 Curtail Begins Curtail Ends Building Name Address None None Alumnae Hall Meeting Street 194 12/18/20 01/07/21 Andrews Hall Bowen Street 211 None None Andrews House Brown Street 013 None None Angell Street 127 Angell Street 127 None None Angell Street 129 Angell Street 129 12/18/20 01/03/21 Angell Street 164 Angell Street 164 12/18/20 01/03/21 Angell Street 195 Angell Street 195 None None Annmary Brown Memorial Library Brown Street 021 12/18/20 01/03/21 Applied Math 170 Hope Street None None Arnold Laboratory Waterman Street 091 None None Barbour Hall Charlesfield Street 100 None None Barus & Holley Hope Street 184 12/18/20 01/03/21 Barus Building Brook Street 340 12/18/20 01/03/21 Benevolent Street 020 Benevolent Street 020 None None Benevolent Street 026 Benevolent Street 026 None None Benevolent Street 074-080 Benevolent Street 074-080 None None Benevolent Street 084 Benevolent Street 084 None None Benevolent Street 086 Benevolent Street 086 None None Benevolent Street 088 Benevolent Street 088 None None BioMed ACF Meeting Street 173 None None BioMed Center Meeting Street 171 None None BioMed Grimshaw-Gudewicz Building Meeting Street 175 None None Blistein House Waterman Street 057 None None Bowen Street 247 Bowen Street 247 None None Bowen Street 251 Bowen Street 251 None None Brook Street 245-247 Brook Street 245-247 -

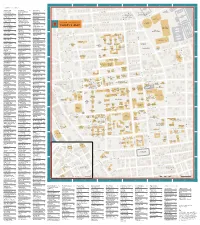

Campus Map 2005

S AV OY STR H.C. Hall EET Potter L E U N E V A Butler Hospital T F A T Taft Avenue Daycare E L M G R O V E Goddard A V E N U E Brown Stadium TREET SESSIONS S T E E R OBSERVATORY AVENUE T S E P O H Ladd Observatory DOYLE AVENUE F Management 1 2 3 4 5 6 campus listings Ó Facilities Admission Office C2 Ecology and D3 Judaic Studies E4 Management T Facilities (undergraduate) Evolutionary Biology 163 George Street E STREET KEEN H Ó Management Corliss-Brackett House Walter Hall A Brown Stadium Y (Elmgrove Ave. Ó Kassar House E4 E Ladd Observatory E R and Sessions St.) NU E Ó Advancement Office G1 Economics D2 151 Thayer Street (Hope St. S AV T and Doyle Ave.) YD T Facilities 110 Elm Street Robinson Hall E STR REET O KEEN H Ó L Management E L A Brown Stadium Pizzitola Keeney Quad F2 E Ó A Y (Elmgrove Ave. R E T Sports Center Ladd Observatory E L A R and Sessions St.) U A Africana Studies C3 Education Alliance for F2 N I (Hope St. E N S AV G T and Doyle Ave.) YD Churchill House Equity and Excellence King House E5 R LO T O E L H Pizzitola E N VENUE T Sports Center 154 Hope Street LLOYD A O Meehan in the Nation’s Schools BROWN UNIVERSITY A P V N B E Auditorium E Alumnae Hall B3 H N 222 Richmond Street R D AVENUE O Meehan LLOY S U L P O E B T Auditorium 194 Meeting Street Laboratories F1 E R R W S CAMPUS MAP O E T R for Molecular Medicine W Education D4 E E N E N T T Olney-MargoliesOlney-Margolies American Civilization D3 70 Ship Street S Barus Hall S Athletic Center T Athletic Center T R Norwood House R E Erickson E EET E R T BOWEN ST Athletic Complex -

Directory of Institutions in the United States and Canada with Pre-1600 Manuscript Holdings

Directory of Institutions in the United States and Canada with Pre-1600 Manuscript Holdings The Directory of Institutions is the first part of a continuation of the Census of Medieval and Renaissance Manuscripts in the United States and Canada, published in 1935 and 1937, and its 1962 Supplement.1 The present Directory details, when known, the current location of the collections listed in the original Census and Supplement, and identifies an additional 281 North American repositories of pre-1600 European manuscripts in Western languages that were not included in the earlier works. For all of the 475 North American repositories, this Directory provides updated contact data and general information on pre-1600 manuscript holdings. Detailed descriptions of individual manuscripts are outside the scope of this Directory, but bibliographical references to published catalogues and internet addresses giving access to on-line cataloguing records are provided when available. Following the organizational scheme of the original Census and Supplement, the Directory entries are organized alphabetically by State and City, with public collections listed first for each city, followed by private. (Due to privacy issues, modern private collections are not included). As in the original publications, the Canadian Provinces are found in a separate listing at the end of the directory. We would like to thank the hundreds of individuals who have contributed to this updated directory through their gathering and sharing of information regarding the whereabouts of pre- 1600 manuscripts in North American collections. To keep this information current, we ask that any updates or corrections be reported to us at [email protected]. -

Macmillan Hall

ACADEMIC Hunter Psychology Lab D3 Race and Ethnicity in E5 1 2 3 4 5 6 Psychology America, Center for Study of Africana Studies C3 295 Ll oyd Dyer House EET Churchill House Institute for Molecular D3 BARNES STR Av enue and Nanoscale Innovation Religious Studies E2 Alpert Medical School D3 Medical Research Laboratory Shirley Miller House Arnold Laboratory H Brown Stadium BROWN UNIVERSITY O (Left on Elmgrove Ave. International Studies E4 Renaissance and Early E3 E Alumnae Hall B3 N P proceed to Sessions Street) NU E AVE Watson Institute Modern Studies Program ING Cogut Center for the S IRV Annmary Brown Memorial CAM PUS MA P T Italian Studies D4 R Humanities; Pembroke Center A E A T E 190 Hope Street Rites and Reason Theatre C3 REET T for Training and Research on EENE ST H K A A Berylson Family R Churchill House Y Women John Nicholas Brown F2 E Central L STREET E U Fields I KEENE N Heat N R VE American Civilization D3 Center Robinson Hall D2 A Plant G D T S Stevenson B Y O O Nightingale-Brown House Economics T Ladd Observatory L Norwood House R L Field N R O (Hope St. and Doyle Ave.) Pizzitola E W A Ancient Studies E3 Joukowsky Institute D2 Rochambeau House B1 E Sports Center N T V for Archaeology and French and Hispanic Studies E Annmary Brown Memorial N S B U T the Ancient World R Temporary E R Annenberg Institute F3 Salomon Center D2 O Meehan Swim Center E 70 Waterman Street NUE O Auditorium for Teaching OYD AVE E LL K for School Reform T Judaic Studies D4 S Hoppin House Sayles Hall D2 OYD LANE LL T 163 George Street R Olney-Margolies -

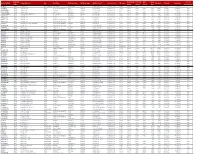

Property Abbr Property Code Property Name Site Portfolio Building Usage Building Type Address Line 1 City and State ZIP Code

Property Ownership Property Grid Gross Year of Property Abbr Property Name Site Portfolio Building Usage Building Type Address Line 1 City and State ZIP code Net Area Latitude Longitude Code Status Status Coord Area Construction ALDRICH 100315 Aldrich House OFF_CAMPUS Unassigned INDEPENDNT House 110 Benevolent St Providence, RI 02906 Affilliated Active 0 0 41.825249 -71.396270 0 ALUMNAE 100076 Alumnae Hall MAIN Academic Non-Research ACAD Building 194 Meeting St Providence, RI 02912 Owned Active DH29 32635 26961 41.829641 -71.402101 1926 ANDREWHALL 100103 Andrews Hall MAIN Dormitory RES HALL Building 211 Bowen St Providence, RI 02912 Owned Active DI22 133711 114087 41.830568 -71.402512 1947 ANDREWSHSE 100200 Andrews House MAIN Student Life SUPPORT House 13 Brown St Providence, RI 02912 Owned Active FM68 22148 17405 41.823932 -71.402315 1900 ANDREWSMEM 100135 Andrews Memorial Building MAIN Admin/Support SUPPORT Building 295 Lloyd Ave Providence, RI 02912 Owned Active AA07 53435 48501 41.832953 -71.395556 2003 ANGELL127 100115 Angell St 127 MAIN Auxiliary AUXILIARY House 127 Angell St Providence, RI 02912 Owned Active DJ40 5361 4550 41.827769 -71.402539 1853 ANGELL129 100141 Angell St 129 MAIN Auxiliary AUXILIARY House 129 Angell St Providence, RI 02912 Owned Active DK40 4250 3560 41.827776 -71.402401 1849 ANGELL164 100144 Angell St 164 MAIN Academic Non-Research ACAD Building 164 Angell St Providence, RI 02912 Owned Active DC38 79865 72136 41.828285 -71.400982 1969 ANGELL195 100186 Angell St 195 MAIN Academic Non-Research ACAD Building -

Liaison Services in ARL Libraries. SPEC Kit 189. INSTITUTION Association of Research Libraries, Washington, D.C

DOCUMENT RESUME ED 359 971 IR 054 602 AUTHOR Latta, Gail F., Comp. TITLE Liaison Services in ARL Libraries. SPEC Kit 189. INSTITUTION Association of Research Libraries, Washington, D.C. Office Management Services. REPORT NO ISSN-0160-3582 PUB DATE Dec 92 NOTE 193p. AVAILABLE FROMAssociation of Research Libraries, Office of Management Services, 21 Dupont Circle, Suite 800, Washington, DC 20036 (members, $25; non-members, $40; shipping, U.S. $5.50, Canada $6.50, other countries $15; prepayment required). PUB TYPE Reports Research/Technical (143) Tests /Evaluation Instruments (160) EDRS PRICE MF01/PC08 Plus Postage. DESCRIPTORS *Academic Libraries; Definitions; Evaluation Criteria; Guidelines; *Librarians; *Library Cooperation; Library Networks; Library Services; Library Surveys; Professional Associations; Questionnaires; *Research Libraries; Telecommunications; Training IDENTIFIERS *Association of Research Libraries; *Liaison Administrators ABSTRACT To gather more information on the role of the liaison in research libraries, the Association of Research Libraries (ARL) Office of Management Services conducted a survey in 1992 of its academic library members. Completed surveys were returned by 49 libraries. Liaisons in both technical and public services were reported by 59 percent, while 31 percent reported having only public service liaisons. While no typical liaison position could be identified, 13 libraries reported having written definitions of liaison practice, 24 reported policies or guidelines, and 15 formulated definitions for purposes -

Chapter 18. the University Library and Media Services

Handbook of Academic Administration August 10, 2020 Chapter 18. The University Library and Media Services 18.1 Organization and Administration The Brown University Library system includes the John D. Rockefeller Jr. Library, the Sciences Library, the Virginia M. Orwig Music Library, the John Hay Library, the Art Slide Library, the Annmary Brown Memorial, and the Library Collections Annex. The library also has administrative responsibility for Media Services which provides technology/equipment support for classrooms and events. The Rockefeller Library serves as the teaching and research library for the humanities and social sciences; it also houses the administrative offices, the Center for Digital Initiatives, and the centralized technical services. The Sciences Library provides an integrated collection for the physical, biological, and medical sciences. The Susan P. and Richard A. Friedman Study Center is located on the lower levels of the Sciences Library. The Virginia M. Orwig Music Library consolidates all of Brown's music materials. The John Hay Library is the location for most of the University’s rare books, manuscripts, special collections, and archives. Information about all of the libraries is available at http://dl.lib.brown.edu/libweb/about/index.php. The John Carter Brown Library, an independent research institution which is not affiliated with the University Library, specializes in the field of early Americana. The chief operational officer of the Brown University Library is the Joukowsky Family University Librarian (x3-2162), who reports directly to the Provost. The library is organized into several departments covering a range of services from collection development to digital initiatives to direct user services. -

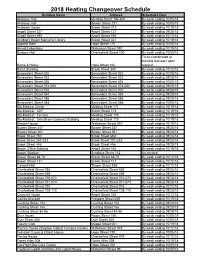

2018 Heating Changeover Schedule

2018 Heating Changeover Schedule Building Name Address Scheduled Date Alumnae Hall Meeting Street 194-200 By week ending 10/05/18 Andrews Hall Bowen Street 211 By week ending 10/05/18 Andrews House Brown Street 013 By week ending 10/19/18 Angell Street 127 Angell Street 127 By week ending 09/28/18 Angell Street 195 Angell Street 195 By week ending 10/12/18 AnnMary Brown Memorial Library Brown Street 021 By week ending 10/19/18 Applied Math Hope Street 170 By week ending 10/05/18 Arnold Laboratory Waterman Street 091 By week ending 10/19/18 Barbour Hall Charlesfield Street 100 By week ending 10/05/18 To be coordinated w/ building manager upon Barus & Holley Hope Street 184 request Barus Building Brook Street 340 By week ending 10/12/18 Benevolent Street 020 Benevolent Street 020 By week ending 10/05/18 Benevolent Street 022 Benevolent Street 022 By week ending 09/28/18 Benevolent Street 026 Benevolent Street 026 By week ending 10/05/18 Benevolent Street 074-080 Benevolent Street 074-080 By week ending 09/28/18 Benevolent Street 070 Benevolent Street 070 By week ending 09/28/18 Benevolent Street 084 Benevolent Street 084 By week ending 09/28/18 Benevolent Street 086 Benevolent Street 086 By week ending 09/28/18 Benevolent Street 088 Benevolent Street 088 By week ending 10/05/18 Bio-Medical Center Meeting Street 171 By week ending 10/19/18 Bio-Medical: ACF Brown Street 173 By week ending 10/19/18 Bio-Medical: Terrace Meeting Street 175 By week ending 10/19/18 Bio-Medical: Grimshaw-Gudewicz Building Meeting Street 175 By week ending 10/19/18 -

Family Weekend Welcome to October 18-20, 2019

WELCOME TO FAMILY WEEKEND OCTOBER 18-20, 2019 EVENT GUIDE WELCOME TO FAMILY WEEKEND We are delighted you are here for this very special occasion! Family Weekend is an important event in our community — a time when students share their lives on campus with their families. We hope your visit provides you a glimpse of the intellectual and cultural vitality of your student’s home away from home. Get a taste of learning at Brown by attending an Academic Forum with one of our celebrated faculty members. No papers to write, no exams to take – just pure immersion in fascinating topics like sustainability, research and Brown’s Open Curriculum. Watch a special screening of the Oscar-winning documentary “Period. End of Sentence.” followed by a panel discussion with one of the film’s executive producers, Charlotte Silverman ’22, and current Brown students working on solving big global problems. And if you would like to learn more about how Brown’s Open Curriculum has supported the intellectual and personal development of individual students, encouraged students’ active participation, and forged learning communities across disciplines for the last 50 years, join us for “Educating your Student at Brown: Life and Learning Inside and Outside the Classroom.” At the Weekend Keynote Address, hear firsthand from President Christina Paxson P’19 and Undergraduate Council of Students President William Zhou ’20 about the innovative ways we are making a Brown education the signature experience of a lifetime — and preparing students for “lives of usefulness and reputation” as engaged citizens of the global community. Following President Paxson’s remarks, Uber CEO Dara Khosrowshahi ’91, P’22 will deliver the keynote address. -

NEASC Self-Study Team Combined Efforts to Propose Methods for Capturing More Direct Measures of Student Learning Outcomes

BROWN UNIVERSITY REPORT TO THE NEW ENGLAND ASSOCIATION OF SCHOOLS AND COLLEGES JANUARY 2009 BROWN UNIVERSITY Report to the New England Association of Schools and Colleges Table of Contents Institutional Characteristics and Organizational Charts Preface ............................................................................................................................................................. i Overview ....................................................................................................................................................... iii Standard One: Mission and Purpose ............................................................................................................... 1 Overview ................................................................................................................................................... 1 Description................................................................................................................................................. 1 Appraisal .................................................................................................................................................... 2 Projection ................................................................................................................................................... 3 Institutional Effectiveness ......................................................................................................................... 3 Standard Two: Planning and Evaluation ....................................................................................................... -

Guide to Brown for ENTERING GRADUATE STUDENTS

2012 Guide to Brown FOR ENTERING GRADUATE STUDENTS | Guide to Brown | 1 Guide to Brown FOR ENTERING GRADUATE STUDENTS CONTENTS Calendar 3 Message from the Dean 4 About Brown 5 About the Graduate School 6 Living at Brown 9 Academics and Research 11 Professional Development 20 Financing Graduate School 22 International Students 25 Campus Offices and Services 27 Brown Email and Computing 27 The Brown Card 29 Dining Services 31 Health Services 33 Public Safety 35 Writing Center 38 Brown University Box 1867 Providence, RI 02912 Athletics and Physical Education 38 (401)863-2600 [email protected] Beyond the Gates 41 http://www.brown.edu/gradschool 2 | Guide to Brown | CONTENTS Calendar for 2012-2013 Semester I Semester II August 1 January 1 Last day for Graduate School to receive: Last day for payment of charges • Final transcripts of all undergraduate and graduate work in progress at time of application January 21 • Last day for payment of charges Martin Luther King Jr. holiday; no classes August 24 January 21 International Graduate Student Pre-Orientation Registration for new students for spring semester August 31 January 23 New Graduate Student Orientation First day of Semester II classes September 4 February 5 Registration of new students for fall semester Last day to add a course online without a fee September 5 February 16-19 • First day of Semester I classes Long weekend; no classes • Opening Convocation February 20 September 18 Last day to add a course, change from audit to credit, or Last day to add a course without a fee change -

Postdoctoral Trainee Handbook

Division of Biology & Medicine Postdoctoral Trainee Handbook Office of Graduate & Postdoctoral Studies 91 Waterman St, 2nd floor Box G-A2, Providence, RI 02912 Phone: (401) 863-1614 E-mail: [email protected] TABLE OF CONTENTS Overview.………………………………………………...... 3 Support ………………………..…………………………… 3 Diversity…………………………………………………….. 4 Representation…………………………………………... 4 Criteria…………………………………………………….... 5 Classification of Titles…………………………………. 5 Policies……………………………………………………….. 6 What to do on the first day at Brown……….... 6 Benefits………………………………………………………. 6 Workday…………………………………………………….. 7 Communication………………………………………….. 8 Mentoring…………………………………………………... 8 Annual Evaluation………………………………………. 9 Professional Development………………………….. 9 Ethics Training…………………………………………….. 11 Research…………………………………………………….. 12 Funding Opportunities………………………………… 13 Brown Card Office……………………………………….. 14 Transportation……………………………………………. 15 Housing………………………………………………………. 16 Family Resources………………………………………… 17 Accessibility Services………………………….………. 17 International Postdocs………………………………… 17 Exiting Brown……………………………………………… 19 Forms………………………………………………………….. 19 2 Overview (back to top) The Division of Biology &Medicine and the Graduate School work to enhance the training environment for more than 200 postdoctoral appointees at Brown University. Both are involved in support and professional development for their respective postdoctoral researchers. At the Graduate School, the primary contact is Vanessa Ryan, Ph.D., Associate Dean of the Graduate School. In the Division of Biology & Medicine,