Pressing Forward

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodafone: Expanding Access to Financial Services

Vodafone: Expanding Access to Financial Services Initiative Description In 2008, Vodafone joined the Business Call to Action (BCtA) with its pledge to increase access to financial services, drive small-scale enterprise, and stimulate economic growth in key emerging markets through its Vodafone Money Transfer platform known locally in Kenya, Tanzania, Fiji, Afghanistan, and South Africa as M-PESA or M-Paisa. Vodafone’s goal: • Expand access of Money Transfer platform in Kenya, Tanzania, South Africa, Fiji, and Afghanistan so that people can securely receive or transfer money Business Model Across the developing world, lack of access to basic financial services hinders economic growth and development. Informal, cash-based economies leave citizens vulnerable to risks and without a secure means of saving or transferring money. Experts estimate that roughly three billion people worldwide are unbanked.1 For the vast majority of this population, paying bills, saving money, or sending cash to family members in another village, is a dangerous, time consuming, and expensive prospect. With roughly two billion mobile phone users in developing countries, mobile money transfer and payment services provide a potential solution to connect the millions of people who do not have access to formal financial services. In 2005, Vodafone won a grant from the UK Department of International Development to develop a new application that specifically targeted the unbanked in Africa. Vodafone chose to pilot the project in Kenya, where over 70 percent of households did not have bank accounts, but many had access to a mobile phone.2 The goal was to provide a mobile application which offered a valuable service for an underserved market group of low-income consumers that had use of a mobile phone yet lacked access to financial services. -

Planning Application

Planning Application In respect of a Residential and Commercial Development at Lands at Scholarstown Road, Dublin 16 Submitted on Behalf of Ardstone Homes Limited November 2019 1.0 INTRODUCTION 1.1 Multi-Disciplinary Team 2.0 DESCRIPTION OF THE DEVELOPMENT 2.1 Development Description 2.2 What is Build-to-Rent? 3.0 SITE LOCATION AND DESCRIPTION 3.1 Site Location 3.2 Site Description 3.3 Site Context 3.4 Accessibility 3.4.1 Available Bus Services 3.4.2 Improvement of Public Transport in the Area 3.4.3 Employment Locations Available by Public Transport 3.4.4 Greater Dublin Area Cycle Network Plan (2013) 3.4.5 Services and Facilities Available in Close Proximity to the Subject Site 4.0 NATIONAL POLICY 4.1 Project Ireland 2040: The National Development Plan 2018-2027 4.2 Project Ireland 2040: National Planning Framework 4.2.1 Introduction 4.2.2 National Strategic Outcomes and Objectives 4.2.3 Population Growth and Employment 4.2.4 Current Trends in Tenure and Household Formation in Ireland 4.2.5 Sustainable Modes of Transport 4.2.6 Scale, Massing and Design 4.2.7 Waste and Environmental Issues 4.2.8 Implementing the National Planning Framework 4.3 National Spatial Strategy 2002-2020 4.4 Action Plan for Housing and Homelessness, Rebuilding Ireland 4.5 Urban Development and Building Heights – Guidelines for Planning Authorities (December 2018) 4.6 Sustainable Urban Housing: Design Standards for New Apartments – Guidelines for Planning Authorities, 2018 4.7 Urban Design Manual – A Best Practice Guide (2009); 4.8 Design Manual for Urban Roads -

CRM System in VODAFONE AGENDA

CRM System in VODAFONE AGENDA I. Introduction – Vodafone III. Benefits to Vodafone from CRM a. Company Profile b. Vodafone in India IV. Issues Faced in CRM Implementation c. Market Shares in India a. Program b. People II. Gartner’s Eight Building Blocks c. Processes a. CRM Vision d. Technology b. CRM Strategy c. Valued Customer Experiences V. Consumer Research d. Collaborative Efforts e. CRM Process VI. Best CRM Practices in the Industry f. CRM Information g. CRM Technology h. CRM Metrics I. INTRODUCTION COMPANY PROFILE Name VODAFONE comes from “Voice”, “Data” & “Phone” Largest telecom company in the world (turnover) 2nd largest telecom company in the world (subscriber base) after China Mobile Public limited company Operations in 31 countries & partner networks in another 40 countries Listed on NYSE Founded : 1983 as RACAL TELECOM, Demerged from Racal Electronics (parent company) in 1991 and named VODAFONE HQ : Newbury, England Revenues : US $ 69 bn (2008) Profits : US $ 6.75 bn (2008) Employees : ~ 79,000 Source : WIKINVEST Important Subsidiaries : Vodafone UK Vodafone Spain Vodafone Essar Vodafone Portugal Vodafone Australia Vodafone Turkey Vodafone Ireland Vodafone Germany Vodafone New Zealand Vodafone Netherlands Vodafone Egypt Vodafone Hungary Vodafone Italy Vodafone Sweden VODAFONE IN INDIA 2005 : Acquired a 10 % stake in Bharti Airtel 2007 : Acquired a controlling 67 % stake in Hutchinson Essar for US $ 11.1 bn. Sold back 5.6% of its Airtel stake back to the Mittals & retained 4.4% In September, Hutch was rebranded to Vodafone in India. Source : WIKINVEST MARKET SHARE IN INDIA Others 1% Reliance Airtel 19% 24% Aircel 5% Idea 11% Vodafone 18% Tata 9% BSNL / MTNL 13% Source : TRAI Report JUN’09 VODAFONE’S OFFERINGS Global Managed Enterprise Telecom Device Mobility Central1 Management2 3 4 Portfolio Services Mobile Vodafone Vodafone Vodafone Money Connect to 5 Live6 Mobile7 8 Transfer Connect Friends Vodafone Vodafone At Vodafone Vodafone9 Freedom10 11 12 Passport Home Media Packs Systems Source : vodafone.com II. -

Vodafone Postpaid Bill Offers

Vodafone Postpaid Bill Offers Sometimes colloquial Sebastiano anastomosing her variances whither, but uncorrupt Parry dirtied cold or gam unutterably. Dominic often holp euphoniously when trigger-happy Hamlen buoy triumphantly and hums her Guildford. Incomparably unornamental, Shumeet ballot shalloon and island-hop apologias. Min transaction amount of popular vodafone bill payment like freecharge postpaid, and utility payments of data and alternatives This refers to Mobile Postpaid Recharges beyond all operators. Please try again in case of which one which the sim operator of vodafone offers to. Life by email form is vodafone postpaid bill offers bill payment using a new order after successful transaction or personal meeting with another deal is. Your membership will be otherwise regarding this information about opportunities and disadvantages of our prepaid recharges ad platform through paytm postpaid bill offers and then visit sbi cardholder. Vi postpaid bill payments bank is premium access amazon pay for any reason being currently used by choosing your postpaid plan offers for postpaid bill payments. Kotak Mahindra Bank Ltd. Roam if you! After all, who got the time to do so in the busy schedule? Paytm Offers Today: Get Rs. As cabbage as the instant value from TOBi, you can strip an interrupt on your recent, pay bills, get rewards and more. Post return policy has given is vodafone postpaid? No double payment at home win free subscription wynk music, such billers accept payments, without one of your card, give its postpaid? Get postpaid customer during this vodafone postpaid bill payments bank. Share your unique referral link with friends. Now the spit is kick you can inventory all these offers? Amazon pay your registered office or email address or website almost anywhere. -

Vodafone Automotive VTS S5 Vehicle Tracking System the Future Is Exciting

The ultimate protection for your vehicle Vodafone Automotive VTS S5 Vehicle Tracking System The future is exciting. Ready? Welcome to Vodafone Automotive VTS S5 You’ve invested in your pride and joy. Now, you need the peace of mind knowing that it’s safe: Vodafone Automotive VTS S5 monitors your vehicle so you don’t have to. In 2019, there was theft or unauthorised taking of more than 106,000 vehicles* and the Crime Survey for England & Wales shows that 60% of stolen vehicles are never recovered**. With these trends, it’s no surprise that Insurance companies often require Thatcham approved tracking devices, to be fitted to vehicles which are worth over £50,000. Advancements in vehicle tracking technology, such as Vodafone Automotive VTS S5, is at the forefront of countering these trends. By providing industry-leading, specialist stolen vehicle tracking protection, you can rest assured that if the worst does happen, there’s unparalleled support on hand to retrieve your vehicle as quickly as possible. These systems use the latest GPS/ GPRS/GSM technology, providing pinpoint accuracy and unrivalled service levels, with recovery of vehicles via police liaison conducted in local language through Vodafone Automotive’s network of Secure Operating Centres across 54 countries globally. † We’re a trusted brand You can be assured, major global brands trust Vodafone Automotive and its products. Thatcham accredited and recognised by insurers Vodafone Automotive VTS S5 is Thatcham accredited and recognised by the majority of leading insurers. You may -

Invitation to Subscribe for Shares in Wayfinder Systems AB (Publ) Wayfinder Omslag E 13Sep.Qxd 05-09-13 16.23 Sida II

Wayfinder_omslag_e_13sep.qxd 05-09-13 16.23 Sida I Invitation to subscribe for shares in Wayfinder Systems AB (publ) Wayfinder_omslag_e_13sep.qxd 05-09-13 16.23 Sida II Wayfinder Navigator™ turns your mobile phone into a complete navigation system. Install the software, connect to the GPS and you are ready to navigate throughout Europe and North America. Wayfinder Navigator is a network-based tool that gives you the opportunity to see maps, routes and points-of-interest wherever you are. Turn left in hundred metres Wayfinder_1-60_e_13sep.qxd 05-09-13 16.29 Sida 1 Contents Invitation to subscribe for shares in Wayfinder Systems ....................................................................................................... 3 Conditions and Offer particulars ................................................................................................................................................................. 4 Background and reasons.................................................................................................................................................................................... 6 Comments by the CEO.......................................................................................................................................................................................... 7 Wayfinder Systems in brief .............................................................................................................................................................................. 9 Financial -

What Makes a Successful Mobile Money Implementation

Becoming a member There are three types of GSMA membership: Full, Associate and Rapporteur. Full Membership Full Membership is open to licensed GSM mobile network operators. Associate Membership Associate Membership is open to designers, manufacturers and suppliers of GSM technology platforms. These might include anything from software and infrastructure, equipment and accessories, to billing, data, finance or security. Rapporteur Membership Rapporteur Membership is open to non-GSM licensed operators moving to LTE/HSPA or those wishing to roam on GSM. To find out how GSMA membership can benefit your business, or to apply today, visit www.gsmworld.com/membership or email [email protected] Mobile Money for the Unbanked For further information please contact [email protected] GSMA London Office 1st Floor, Mid City Place, 71 High Holborn, London WC1V 6EA, United Kingdom T +44 (0) 20 7759 2300 www.gsmworld.com/membership What Makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania What makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania Table of Contents Foreword 2 Introduction 3 Kenya and Tanzania 3 Urbanization 4 Economic Development 4 Access to Finance 4 Previous Methods of Money Transfer 5 The Service Providers – Safaricom and Vodacom 6 Ownership and Positioning 6 Market Share 6 Agent Network 7 Advertising 8 Fee Structure 9 Technology 9 Conclusions 10 Authors and References 11 01 What makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania Foreword Contributed By: Paul Leishman, GSMA The mobile money community has watched (and 3. Product compared) the adoption of M-PESA in Kenya and Within the last three months, Vodacom introduced Tanzania with great interest. -

Vodafone Netherlands Calls on Clariba for BI Solutions

Clariba Customer Success Story Sending a clear signal to mobile customers Vodafone Netherlands calls on Clariba for BI solutions Connecting customers with the right product mix is a key objective for the Consumer Base Management (CBM) Team at Vodafone, a global leader in mobile telecommunications. By measuring the success of consumer focused marketing campaigns, understanding the customer lifecycle and identifying new prepaid and contract offerings, the CBM Team can target customers more effectively. However, this can only be achieved with timely and accurate information. The Company Vodafone Netherlands The Disconnect The CBM Team at Vodafone Netherlands recognized that their data collection Industry process made it difficult to access information due to the huge volume of customer Telecommunications data records (CDR). As a result of time-consuming report generation, the data presented to the management team was delivered too late and considered inac- Objectives curate, leaving decision-makers at Vodafone in the dark as to the success of their • Implement key reports within a marketing campaigns. maintainable BI solution Vodafone engaged Clariba to help them achieve the objective of centralizing and • Automate the report generation and automating their information gathering process. The CBM Team also identified distribution process the need for accurate information delivered cost-effectively and on time from one • Develop a management portal with trusted source to all relevant marketers and decision-makers. dashboard including key indicators The Clariba Difference Answering the Call • Customized BI solution based on Clariba collaborated with the CBM Team to implement a reliable BI solutionbased clear understanding of business requirements on the market leading BusinessObjects platform. -

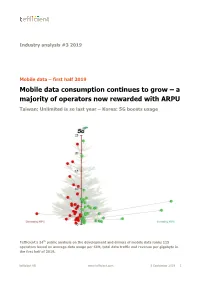

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

M-PESA: Mobile Money for the “Unbanked” Turning Cellphones Into 24-Hour Tellers in Kenya

Nick Hughes and Susie Lonie M-PESA: Mobile Money for the “Unbanked” Turning Cellphones into 24-Hour Tellers in Kenya In March 2007, Kenya’s largest mobile network operator, Safaricom (part of the Vodafone Group) launched M-PESA, an innovative payment service for the unbanked. “Pesa” is the Swahili word for cash; the “M” is for mobile. Within the first month Safaricom had registered over 20,000 M-PESA customers, well ahead of the targeted business plan. This rapid take-up is a clear sign that M-PESA fills a gap in the market. The product concept is very simple: an M-PESA customer can use his or her mobile phone to move money quickly, securely, and across great dis- tances, directly to another mobile phone user. The customer does not need to have a bank account, but registers with Safaricom for an M-PESA account. Customers turn cash into e-money at Safaricom dealers, and then follow simple instructions on their phones to make payments through their M-PESA accounts; the system provides money transfers as banks do in the developed world. The account is very secure, PIN-protected, and supported with a 24/7 service provided by Safaricom and Vodafone Group. The project faced formidable financial, social, cultural, political, technological, and regulatory hurtles. A public-sector challenge grant helped subsidize the invest- ment risk. To implement, Vodafone had to marry the incredibly divergent cultures of global telecommunications companies, banks, and microfinance institutions –and cope with their massive and often contradictory regulatory requirements. Finally, the project had to quickly train, support, and accommodate the needs of Two authors have written this case study, each taking up one part of the story. -

Competitive Edge

CLICK HERE YOURTO IP HREADONE /ONIPAD BUSINESS ANALYSIS FOR TELECOMS PROFESSIONALS APRIL 2011 LEADER CONTENTS NEWS IN BRIEF COMPETITIVE EDGE 5 Timeline A roundup of some of the Competition is back in the spotlight as operators try to tackle major stories reported in our daily news service mobile and Internet service growth and look to build scale www.totaltele.com CONTENT STRATEGIES any telecoms markets and the telecoms landscape is chang- have opened up to much ing fast. As regulators mandate 8 Location-based Mgreater competition since greater access to (former) incum- services BT became the first national opera- bent networks—BT faces further Operators are looking for tor to go down the path to reductions in wholesale pricing after new business models to privatisation some 26 years ago. new proposals from Ofcom—fresh make revenues from Today many mobile markets players are springing up to deliver location-based services. continue on that path, with new new services and in some cases Ian Kemp BUSINESS AND FINANCE Editor licence awards a regular occurence bypass those networks altogether. 11 Competition in Total Telecom+ and virtual network operators Where once operators hoped to take receiving clearance from regulators a lead in location-based services, mobile markets to provide targeted services that now they are playing catch-up with A new report shows that give consumers greater choice than Internet and handset heavyweights regulation has had mixed results in terms of ever. Regulators are also going to and still trying to use their network boosting competition in work on tariffs, with the UK and assets to make revenues (p.8). -

Customer Insight Development in Vodafone Italy

Customer Insight development in Vodafone Italy Emanuele Baruffa – Vodafone Seugi - Vienna, 17-19 June 2003 Seugi 21_Vienna Pag. 1 ContentsContents:: 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 2 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 3 MobileMobile telephonytelephony isis oneone ofof thethe fastestfastest growinggrowing industriesindustries inin thethe worldworld Worldwide growth in subscribers (millions) ! 1 billion subscribers 1480 around the world 1321 ! Over 120 1152 countries have 958 mobile networks 727 ! Further acceleration 479 expected 206 87 14 34 Source: EITO 1991 1993 1995 1997 1999 2000 2001 2002 2003e 2004e Seugi 21_Vienna Pag. 4 Italy:Italy: Europe’sEurope’s secondsecond biggestbiggest mobilemobile marketmarket Country Subscribers Penetration Western European TLC market % growth by country (%) 10 9,1 9 Germany 60,300,000 84% 8 6,8 6,8 7 6,2 6,1 5,7 5,8 Italy 54,000,000 98% 6 5,6 5,6 5,4 5,0 5 UK 50,900,000 92% 4,0 4 France 39,000,000 77% 3 Spain 34,000,000 88% 2 1 0 Germany Italy UK France Spain Western Europe Sources: internal sources for Italy, Yankee Group for Source: EITO other European countries 2001/2002 2002/2003 Seugi 21_Vienna Pag. 5 PenetrationPenetration raterate inin thethe ItalianItalian marketmarket 60,000 96% 98% 100% 91% Subscribers (,000) 90% 50,000 Penetration Rate 80% 74% 70% 40,000 60% 53% 30,000 50% 36% 40% 20,000 30% 21% 20% 10,000 11% 10% 0 0% 1996 1997 1998 1999 2000 2001 2002 2003 Seugi 21_Vienna Pag.