ALBERTA UTILITIES COMMISSION Application by the Alberta Electric System Operator for Approval of the First Set of ISO Rules to E

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Moneylab Reader: an Intervention in Digital Economy

READER A N INTERVENTION IN DIGITAL ECONOMY FOREWORD BY SASKIA SASSEN EDITED BY GEERT LOVINK NATHANIEL TKACZ PATRICIA DE VRIES INC READER #10 MoneyLab Reader: An Intervention in Digital Economy Editors: Geert Lovink, Nathaniel Tkacz and Patricia de Vries Copy editing: Annie Goodner, Jess van Zyl, Matt Beros, Miriam Rasch and Morgan Currie Cover design: Content Context Design: Katja van Stiphout EPUB development: André Castro Printer: Drukkerij Tuijtel, Hardinxveld-Giessendam Publisher: Institute of Network Cultures, Amsterdam, 2015 ISBN: 978-90-822345-5-8 Contact Institute of Network Cultures phone: +31205951865 email: [email protected] web: www.networkcultures.org Order a copy or download this publication freely at: www.networkcultures.org/publications Join the MoneyLab mailing list at: http://listcultures.org/mailman/listinfo/moneylab_listcultures.org Supported by: Amsterdam University of Applied Sciences (Hogeschool van Amster- dam), Amsterdam Creative Industries Publishing and the University of Warwick Thanks to everyone at INC, to all of the authors for their contributions, Annie Goodner and Morgan Currie for their copy editing, and to Amsterdam Creative Industries Publishing for their financial support. This publication is licensed under Creative Commons Attribution NonCommercial ShareAlike 4.0 Unported (CC BY-NC-SA 4.0). To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/. EDITED BY GEERT LOVINK, NATHANIEL TKACZ AND PATRICIA DE VRIES INC READER #10 Previously published INC Readers The INC Reader series is derived from conference contributions and produced by the Institute of Network Cultures. They are available in print, EPUB, and PDF form. The MoneyLab Reader is the tenth publication in the series. -

Accountant - Bookkeeping Employers - USA

www.Jobcorpsbook.org - Accountant - Bookkeeping Employers - USA Company Business Street City State Zip Phone Fax Web Page Alaska Society of Certified Public Accountants 341 West Tudor Road, Suite 105 Anchorage AK 99503 (907) 562-4334 Information Processing 551 W Dimond Boulevard, # 101 Anchorage AK 99515 (907) 245-0000 (907) 245-0101 Kimura & Associates 225 East Fireweed Lane, Suite 300 Anchorage AK 99503 (907) 279-5207 Mikunda Cottrell Accounting & Consulting 3601 Centre Street, Suite 600A Anchorage AK 99503 (907) 646-7350 Payroll Connection 605 W Tudor Road Anchorage AK 99503 (907) 562-6677 (907) 770-5545 Profit Plus Inc 12350 Industry Way, # 216 Anchorage AK 99515 (907) 345-7402 (907) 345-0536 http://www.timepluspayroll.com R Jack Bohnert EA 3820 Lake Otis Parkway Anchorage AK 99508 (907) 561-8987 Terry W Jackson CPA 2606 Centre Street, # 2A Anchorage AK 99503 (907) 278-4617 (907) 277-2342 http://www.terryjacksoncpa.com LPD Bookkeeping & Accounting 17025 Park Place Street Eagle River AK 99577 (907) 694-4129 Fairbanks Accountants 191 N Cushman St Fairbanks AK 99701 (888) 784-5762 Fairbanks Tax Preparation Service 223 N Cushman St Fairbanks AK 99701 (888) 691-9093 Star Consulting LLC 422 Glacier Avenue Fairbanks AK 99701 (907) 456-6856 http://www.starconsultingcpa.com A Counting 4 U Mi 44 Tok Cutoff (hc60 Bx 300) Gakona AK 99586 (907) 822-4050 Copper Basin Business Center (bx 65) Glennallen AK 99588 (907) 822-3500 Sundog Consultants 1213 Ocean Drive Homer AK 99603 (907) 235-5971 http://www.sundogconsultants.com College Accounting Service -

Virtual Debit Cards and Consumer Protection

Virtual debit cards and consumer protection RESEARCH REPORT Produced by Option consommateurs and presented to Industry Canada’s Officer of Consumer Affairs June 2014 Virtual debit cards and consumer protection Option consommateurs received funding for this report under Industry Canada’s Program for Non-Profit Consumer and Voluntary Organizations. The opinions expressed in the report are not necessarily those of Industry Canada or of the Government of Canada. Reproduction of limited excerpts of this report is permitted, provided the source is mentioned. Its reproduction or any reference to its content for advertising purposes or for profit, are strictly prohibited, however. Legal Deposit Bibliothèque nationale du Québec National Library of Canada ISBN: 978-2-89716-017-3 Option consommateurs Head Office 50, rue Ste-Catherine Ouest, Suite 440 Montréal (Québec) H2X 3V4 Tel.: 514 598-7288 Fax: 514 598-8511 Email: [email protected] Website: www.option-consumers.org Option consommateurs, 2014 ii Virtual debit cards and consumer protection Table of Contents Option consommateurs ................................................................................................................... iv Acknowledgements .......................................................................................................................... v Summary .......................................................................................................................................... vi 1. Introduction .................................................................................................................................7 -

Download/File> Acesso Em: 01 Mai

Oria na Alme i Citado muitas vezes como da, S Se existe um tema que tem o desenvolvimento que procura ganhado centralidade no debate i satisfazer às necessidades da lv cientíco mundial desde a segunda i geração atual, sem comprometer a o L metade do século passado esse capacidade das gerações futuras de ima F tema é o do desenvolvimento. satisfazerem as suas próprias Muitas teorias clássicas abordaram igu necessidades, a partir do Rela- suas formas elementares concei- e ir tório Nosso Futuro Comum, o e tuais ligadas principalmente à d desenvolvimento passou a incor- o e S Economia e à Economia Política. porar a sustentabilidade e essa foi E s s a s pr i m ei r a s for m a s s e a assumida como um paradigma do in traduziram em questões que hoje t-C pensamento acadêmico e das são tratadas como crescimento la práticas sociais. Não raro, entre- ir T e c o n ô m i c o ap e n a s , p o i s o tanto, o conceito atual de desenvol- rindad moderno conceito de desenvol- vimento tem sugerido e recebido vimento nasceu do encontro de críticas pela ênfase a uma ou duas e J suas vertentes de histórias episte- de suas dimensões, notadamente úni mológicas diferentes. Primeiro, o aquelas de natureza ecológica e o reconhecimento da existência do r econômica. Hoje cada vez mais no A presente coletânea reúne o resultado de diversas pesquisas que se mundo subdesenvolvido, que desenvolveram no seio do Núcleo de Altos Estudos Amazônicos (NAEA) da meio acadêmico aquele argu- DE mereceria estudos especícos e a UFPA, criado em 1973. -

2013 Annual Report and Form 10-K 1 a Letter from the CEO

Contents Financial Metrics 1 Letter from the CEO 2 Cardtronics At A Glance 4 Infographic: A Cashless Society? 5 Traditionally Strong 6 Transformative Acquisitions 8 Enterprising ATM Estate 10 Executive Leadership 12 Inside Back Contact Information and Notices Cover Where Cash Meets Commerce Financial Metrics Total Revenue (in millions) 2009 493.4 2010 532.1 +12% vs. 2012 2011 624.6 2012 780.4 2013 876.5 218.8 1.93 1.61 +15% 189.5 +20% vs. 2012 vs. 2012 1.37 156.3 130.8 1.00 110.4 0.68 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 Adjusted EBITDA* Adjusted Diluted Earnings per Share* (in millions) 2009 30.2% 2009 74.9 2010 32.3% +1.8% 2010 105.2 +34.6% 2011 32.7% vs. 2012 2011 113.3 vs. 2012 2012 31.3% 2012 136.4 2013 33.1%* 2013 183.6 Adjusted Gross Profit Margin* Operating Cash Flows (in millions) *For details on the calculation of Adjusted EBITDA, Adjusted Diluted Earnings per Share and Adjusted Gross Profit Margin, please see the reconciliation included in the Form 10-K. 2013 Annual Report and Form 10-K www.cardtronics.com 1 A Letter From the CEO Dear Cardtronics Shareholders, 2013 proved to be a productive blend of solid execution, growth, strategic investment and creation of shareholder value. Our model for investors emphasizes steady, reliable growth. And on that note, we are pleased with our performance. In 2013, solid performance from our traditional core drivers melded together with two transformative acquisitions and a series of strategic investments and realignments that will drive our future growth — including creation of the Enterprise Growth Group, whose sole charge is to deliver the most valuable consumer ATM experience. -

Visa Inc. Fiscal 2019 Annual Report

Annual Report 2019 Annual Report 2019 Advancing the growth of digital payments. Visa enables money movement for everyone, everywhere. In 2019, we made significant strides in advancing our goal to be a single connection point for initiating any transaction, both on the Visa network and beyond. YEAR-END FINANCIAL HIGHLIGHTS Operational Highlights 12 months ended September 30 (except where noted) 2017 2018 2019 Total volume, including payments and cash volume1 $10.3 T $11.3 T $11.6 T Payments volume1 $7.4 T $8.3 T $8.8 T Transactions processed on Visa’s networks 111.2 B 124.3 B 138.3 B Cards2 3.2 B 3.3 B 3.4 B Financial Highlights (GAAP) In millions (except for per share data) FY 2017 FY 2018 FY 2019 Net revenues $18,358 $20,609 $22,977 Operating expenses $6,214 $7,655 $7,976 Operating income $12,144 $12,954 $15,001 Net income $6,699 $10,301 $12,080 Stockholders’ equity $32,760 $34,006 $34,684 Diluted class A common stock earnings per share $2.80 $4.42 $5.32 Financial Highlights (Non-GAAP)3 In millions (except for per share data) FY 2017 FY 2018 FY 2019 Net revenues $18,358 $20,609 $22,977 Operating expenses $6,022 $6,860 $7,606 Operating income $12,336 $13,749 $15,371 Net income $8,335 $10,729 $12,367 Diluted class A common stock earnings per share $3.48 $4.61 $5.44 1 Total volume is the sum of payments volume and cash volume. -

Offer Memorandum

This Offer expires at 18:00 hours, Amsterdam time (12:00 hours (noon), New York time), on 31 August 2012, unless extended OFFER MEMORANDUM Dated 21 June 2012 RECOMMENDED CASH OFFER BY UPS BIDCO B.V. FOR (I) ALL THE ISSUED AND OUTSTANDING ORDINARY SHARES AND (II) ALL ISSUED AND OUTSTANDING AMERICAN DEPOSITARY SHARES, EACH REPRESENTING ONE ORDINARY SHARE, OF TNT EXPRESS N.V. This Offer expires at 18:00 hours, Amsterdam time (12:00 hours (noon), New York time), on 31 August 2012, unless extended OFFER MEMORANDUM Dated 21 June 2012 RECOMMENDED CASH OFFER BY UPS BIDCO B.V. FOR (I) ALL THE ISSUED AND OUTSTANDING ORDINARY SHARES AND (II) ALL ISSUED AND OUTSTANDING AMERICAN DEPOSITARY SHARES, EACH REPRESENTING ONE ORDINARY SHARE, OF TNT EXPRESS N.V. This offer memorandum (the Offer Memorandum) contains the details of the recommended public offer by UPS BidCo B.V. (the Offeror), an indirectly wholly-owned subsidiary of United Parcel Service, Inc. (UPS), to all holders of issued and outstanding ordinary shares with a nominal value of EUR 0.08 each (the Ordinary Shares) and all American depositary shares representing Ordinary Shares (each, an ADS), each ADS representing one Ordinary Share (Ordinary Shares and ADSs are referred to herein as the Shares and each a Share, the holders of such Shares the Shareholders), in the share capital of TNT Express N.V. (TNT Express) to purchase for cash their Shares on the terms and subject to the conditions and restrictions set forth in this Offer Memorandum (the Offer). As at the date of this Offer Memorandum, 543,272,474 Ordinary Shares are issued by TNT Express and subject to the Offer, approximately 2.7 million of which are held in the form of ADSs representing approximately 0.5% of the issued and outstanding Ordinary Shares. -

The Ultimate Residency Resource Guide TABLE of CONTENTS

The Ultimate Residency Resource Guide TABLE OF CONTENTS Preface . .p. vi I. Organizational Setup 1. Forming a Nonprofit Advantages and disadvantages of a 501(c)(3) . .p. 3 Life cycle of a public charity . .p. 5 Filing with the IRS . .p. 7 2. Articles of Incorporation Introduction . .p. 9 Standard templates . .p. 10 3. Mission Statements Introduction . .p. 16 How to develop or revise a mission statement . .p. 17 Samples . .p. 20 4. Bylaws Introduction . .p. 23 Samples . .p. 24 5. Insurance Requirements Basic insurance needs for nonprofits . .p. 43 Directors and officers liability insurance . .p. 47 Additional resources . .p. 48 6. Board Development Overview of a nonprofit board . .p. 50 Basic responsibilities of nonprofit boards . .p. 51 Legal responsibilities of nonprofit boards . .p. 52 Setting up board responsibilities . .p. 53 Board and staff responsibilities . .p. 56 Board officers descriptions . .p. 57 Board committees . .p. 58 Board recruitment . .p. 60 Basic guidelines for board orientation . .p. 62 Guidelines for board manuals . .p. 63 Samples—board manuals/handbooks . .p. 64 Additional resources . .p. 87 iii The Ultimate Residency Resource Guide II. Personnel Management 1. Organizational Charts Samples . .p. 90 2. Job descriptions Samples—Executive Director/President . .p. 97 Samples—Artistic Director/Residency Director . .p. 99 Samples—development staff . .p. 101 Samples—Assistant Director/program and communications staff . .p. 104 Samples—facilities/maintenance/housekeeping staff . .p. 105 Samples—kitchen staff . .p. 107 Samples—additional administrative staff . .p. 109 Samples—intern/work exchange staff . .p. 111 3. Personnel Policies Introduction . .p. 116 Samples—personnel handbooks . .p. 118 Samples—personnel evaluation . .p. 141 Sample—employment contract . -

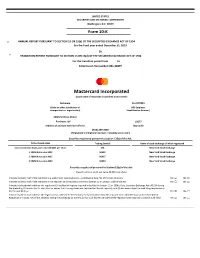

Mastercard Incorporated (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 Or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-32877 Mastercard Incorporated (Exact name of registrant as specified in its charter) Delaware 13-4172551 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification Number) 2000 Purchase Street Purchase, NY 10577 (Address of principal executive offices) (Zip Code) (914) 249-2000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange of which registered Class A Common Stock, par value $0.0001 per share MA New York Stock Exchange 1.100% Notes due 2022 MA22 New York Stock Exchange 2.100% Notes due 2027 MA27 New York Stock Exchange 2.500% Notes due 2030 MA30 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Class B common stock, par value $0.0001 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Operational-Scale Carbon Budget Model of the Canadian Forest Sector (Cbm-Cfs3) Version 1.2: User’S Guide

S S A M OPERATIONAL-SCALE IO B CARBON BUDGET MODEL OF THE ANADIAN OREST C F T N SECTOR (CBM-CFS3) E M E G A N A M T S E R O F D I S T U R B A N C E S D E A D VERSION 1.2: O R G A N I USER’S GUIDE C M A TT ER S.J. KULL, G.J. RAMPLEY, S. MORKEN, J. METSARANTA, E.T. NEILSON, AND W.A. KURZ NORTHERN FORESTRY CENTRE The Canadian Forest Service’s Northern Forestry Centre is responsible for fulfilling the federal role in forestry research and technology transfer in Alberta, Saskatchewan, Manitoba, Nunavut, and the Northwest Territories. The main objective is research in support of improved forest management for the economic, social, and environmental benefit of all Canadians. The Northern Forestry Centre is one of five centers of the Canadian Forest Service, which has its headquarters in Ottawa, Ontario. Le Service canadien des forêts, Centre de foresterie du Nord, représente le gouvernement fédéral en Alberta, en Saskatchewan, au Manitoba, au Nunavut et dans les Territoires du Nord– Ouest en ce qui a trait aux recherches forestières et au transfert de technologie. Cet organisme s’intéresse surtout à la recherche en vue d’améliorer l’aménagement forestier afin que tous les Canadiens puissent en profiter aux points de vue économique, social et environnemental. Le Centre de foresterie du Nord constitue l’un des cinq établissements du Service canadien des forêts, dont l’administration centrale est à Ottawa (Ontario). Cover photographs provided by Natural Resources Canada, Canadian Forest Service. -

Cable/Telecom & Communications Infrastructure 2020.12.24

RBC Capital Markets, LLC Jonathan Atkin (Analyst) Kutgun Maral, CFA (Analyst) (415) 633-8589 (212) 437-9151 [email protected] [email protected] Bora Lee (Analyst) Michael J. Tang (Associate) (212) 618-7823 (646) 618-6772 [email protected] [email protected] December 24, 2020 Cable/Telecom & Communications Infrastructure 2020.12.24 Weekly news roundup C-Band auction update. C-band auction bids have reached $69.83B in gross proceeds after 45 rounds of bidding. Bidding is set to resume January 4 after taking a break for the holidays. After 45 rounds, EQUITY RESEARCH the nationwide price for A block licenses per MHz Pop was $1.21, while BC prices were $1.11 per MHz PoP according to BitPath COO Sasha Javid. New York has commanded the highest total price, standing at around $515M for category A and BC. “Gross proceeds have been driven by surprisingly robust and persistent demand,” wrote Javid. “In Round 36, I suspect that a large bidder pulled back significantly in the largest markets given that all the top 10 markets experienced a drop in demand.” There are 57 participants in the clock phase, though winners won’t be disclosed until the auction ends. T-Mobile, AT&T, Verizon and Dish are all among registered bidders. (Fierce Wireless) FCC update. Outgoing Chairman Ajit Pai will use his last FCC meeting on Jan. 13 to showcase the commission’s work over the past four years. “Serving as chairman of the FCC has been the honor of a lifetime,” Pai wrote in a blog post. -

Mastercard Incorporated

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 Or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-32877 Mastercard Incorporated (Exact name of registrant as specified in its charter) Delaware 13-4172551 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification Number) 2000 Purchase Street Purchase, NY 10577 (Address of principal executive offices) (Zip Code) (914) 249-2000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange of which registered Class A Common Stock, par value $0.0001 per share MA New York Stock Exchange 1.1% Notes due 2022 MA22 New York Stock Exchange 2.1% Notes due 2027 MA27 New York Stock Exchange 2.5% Notes due 2030 MA30 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Class B common stock, par value $0.0001 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.