1990/21 the Takeover Panel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coins Medals 27Th Ocrober 2016.Indd

Coins & Medals Thursday 27th October 2016 Coins & Medals Thursday 27th October 2016 at 11:00am Index Antique & Modern Jewellery Gold Coins 1 - 166 Silver & Base Metal Coins 167 - 224 Medallions & ingots 225 - 245 Military & World Medals 246 - 280 Civil & Sporting Medals 281 - 283 Fraternal Medals 284 - 290 Viewing Times 22nd October 2016 11.00am - 4.00pm 24th October 2016 10.00am - 4.00pm Vintage Jewellery & 26th October 2016 10.00am - 4.00pm Accessories 27th October 2016 8.30am - 11.00am Jewellery Watches 19 Augusta Street | Birmingham B18 6JA | Tel 0121 212 2131 | www.fellows.co.uk | [email protected] | Company No. 7155090 General Information Why Buy? Why Sell? COMPETITIVE buyer’s premium HIGH PRICES consistently achieved LIVE online bidding FLEXIBLE commission rates FULLY illustrated catalogue FREE valuations with no obligation to consign EASY to use, functional website RAPID turnaround for your goods ACCURATE condition reports TARGETED advertising to a global audience SPECIALISTS on hand to offer advice SUPERIOR quality catalogues TRACKED AND INSURED shipping* FULLY integrated website *Please contact Fellows for further information. Contact the Coins and Medals Department... Follow Us On... Naomi Clarke Sarah Isaacs Senior Specialist Administrator 0121 212 2131 0121 212 2131 facebook.com/fellowsauctions [email protected] [email protected] Further Information @fellowsauctions fellowsauctions Additional Images and Condition Telephone Bidding is available if you Reports can be found online at our cannot attend an auction. Please ring website www.fellows.co.uk 0121 212 2131 to arrange a phone line. Download our catalogue app today and view our printed catalogues on Live Bidding your device. -

Collecting Chinese Coins

“The Bulletin” June, 2003 Collecting Chinese Coins The next meeting of the North York Coin Club, will be held on Tuesday, June 24, 2003, at the Edithvale Community Centre, 7 Edithvale Drive. We start gathering about 7:30 p.m. with meeting start scheduled for 8:00. President’s Message This month we will have a subject which is not familiar to many of us. Shawn The most important message that I must Hamilton and Del Murchison will talk about Chinese numismatics. Del, along with a deliver this month is that our June meet- few of his books, will tell about the oldest Chinese coinage while Shawn will talk ing will be our last until September. about his approach to collecting and more recent Chinese coinage. Unlike other years, there will be no meet- ing in July or August. We will return with We have a small listed auction this month (see page 3) and you are encouraged to meetings on September 23, the first day bring additional auction material for this meeting. Hope to see you at the meeting! of fall. As I announced at the May meeting (and is also mentioned in the minutes), Paul Coming Events Johnson has agreed to be our delegate to the C.N.A. Convention. There seem to be Torex, June 28-29 at the Novotel To- 9:30am, CMNS Sat. 2 p.m. to 4 p.m., quite a few of our members planning to ronto - Centre, 45 The Esplanade. Sat. CPMS Sat. Noon to 2 p.m., CTCCC Sun. register or at least planning to make the 10am-5pm, Sun. -

Why a Country Needs a Mint?

EA ON M H IT W N O I T A I C O S S A N I S W E N Y C P N U E B R L I R S U H C E Y D B VOLUME 3 / SEPTEMBER 2016 Why a Country Needs a The Historical Mint? Or Does a Country Perspective… Need a Mint? or Why a State In 2016, Denmark closes its mint and Mints Coins thereby ends a tradition going back Who does not know the background more than a thousand years. only knows half of the story. That is This is not an isolated incident. In Europe why we have briefly summarised here alone, five nations have privatised, sold the reasons why states started to mint or closed their mints within the last two their own coins. decades. Time after time, governments weigh their options and how much money Private interests group At some time in the second half of the 7th it is worth to them to produce their coins century BC, the minting of coins started. in a state mint. Who was responsible is still a matter of The current economic crisis might be scholarly debate. In all probability, it was a reason why some governments have not any government. It is more plausible reduced their mints to profit centres, that coins were used either by mercenary and why it has become immaterial that leaders to pay their soldiers or by temples for centuries state minting activity was a to personalise votive gifts. matter of pride and national security. -

War Medals, Orders and Decorations Including the Suckling Collection of Medals and Medallions Illustrating the Life and Times of Nelson

War Medals, Orders and Decorations including the Suckling Collection of Medals and Medallions illustrating the Life and Times of Nelson To be sold by auction at: Sotheby’s, in the Upper Grosvenor Gallery The Aeolian Hall, Bloomfield Place New Bond Street London W1 Day of Sale: Thursday 3 July 2008 at 12.00 noon and 2.00pm Public viewing: 45 Maddox Street, London W1S 2PE Tuesday 1 July 10.00 am to 4.30 pm Wednesday 2 July 10.00 am to 4.30 pm Thursday 3 July 10.00 am to 12.00 noon Or by previous appointment. Catalogue no. 33 Price £10 Enquiries: James Morton or Paul Wood Cover illustrations: Lot 3 (front); Lot 281 (back); Lot 1 (inside front) and Lot 270 (inside back) in association with 45 Maddox Street, London W1S 2PE Tel.: +44 (0)20 7493 5344 Fax: +44 (0)20 7495 6325 Email: [email protected] Website: www.mortonandeden.com This auction is conducted by Morton & Eden Ltd. in accordance with our Conditions of Business printed at the back of this catalogue. All questions and comments relating to the operation of this sale or to its content should be addressed to Morton & Eden Ltd. and not to Sotheby’s. Important Information for Buyers All lots are offered subject to Morton & Eden Ltd.’s Conditions of Business and to reserves. Estimates are published as a guide only and are subject to review. The actual hammer price of a lot may well be higher or lower than the range of figures given and there are no fixed “starting prices”. -

New TNA Members!

may/June 2014 TNA News Vol. 56 - no. 3 Serving the Numismatic Community of Texas Welcome NeW TNA members! May/June 2014 Volume 56, Number 3 Greetings................................................................1. Ron Kersey It was my pleasure to present Literary Awards during this year’s TNA Convention & Show at the 2014 Annual From.the.President...............................................2.&.4 Member Meeting and Awards Presentation. Debbie Williams First Place for the Kalvert K. Tidwell Secretary’s.Report.....................................................5 Award went to Henry Brasco for his Larry Herrera article, “Thirty Pieces of Silver” which TNA.Ad.Rates.&.Copy.Information...............................6 appeared in the 2013 July/August issue. First Runner Up went Treasurer’s.Report......................................................7 Jack Gilbert to John Barber for, “The Blessing of Hoards” ANA.News.............................................................8 appearing in the January/February Collecting.Efficiently..................................................9 issue in 2013. Second Runner Up for John Barber this award went to Sam Fairchild for his article, Affordable.Gold................................................. 10-11 “1896 Education Notes” Mark Benvenuto also appearing in the July/ Anchor.Coinage................................................. 12-14 August issue in 2013. These writers also Mike Ross contributed other excellent articles for the TNA News. Choosing the winners was Red-Brown.Cents................................................... -

Coin Catalogue.Qxp

Islamic, Ancient, British and World Coins Medals and Memorabilia relating to Edward VIII Historical and Renaissance Medals and Plaquettes To be sold by auction at: Sotheby’s, in the Upper Grosvenor Gallery The Aeolian Hall, Bloomfield Place New Bond Street London W1A 2AA Day of Sale: Thursday 11 November 2010 at 10.30 am and 2.00 pm Public viewing: 45 Maddox Street, London W1S 2PE Monday 8 November 10.00 am to 4.30 pm Tuesday 9 November 10.00 am to 4.30 pm Wednesday 10 November 10.00 am to 4.30 pm Or by previous appointment. Catalogue no. 46 Price £10 Enquiries: James Morton, Tom Eden, Paul Wood, Jeremy Cheek or Stephen Lloyd Tim Wilkes (consultant) Cover illustrations: Lot 272 (front); Lot 378 (back); Lot 421 (inside front cover) in association with 45 Maddox Street, London W1S 2PE Tel.: +44 (0)20 7493 5344 Fax: +44 (0)20 7495 6325 Email: [email protected] Website: www.mortonandeden.com This auction is conducted by Morton & Eden Ltd. in accordance with our Conditions of Business printed at the back of this catalogue. All questions and comments relating to the operation of this sale or to its content should be addressed to Morton & Eden Ltd. and not to Sotheby’s. Online Bidding Morton & Eden Ltd offer an online bidding service via www.the-saleroom.com. This is provided on the understanding that Morton & Eden Ltd shall not be responsible for errors or failures to execute internet bids for reasons including but not limited to: i) a loss of internet connection by either party; ii) a breakdown or other problems with the online bidding software; iii) a breakdown or other problems with your computer, system or internet connection. -

William Butler Yeats and the Irish Coinage

Published in: Numismatics International Bulletin Dallas, Texas, Vol. 39 Nr 4 April 2004, pp. 77-83. The text below is identical with the text published – page numbers from the edition are given in parenthesis { }. When quoting, please, make sure to include complete bibliographical address and page numbers! Krzysztof Fordonski William Butler Yeats and the Irish Coinage {77} Non-literary activities of writers or poets seldom arise much interest of scholars unless they are of crucial importance or have a tangible influence on their work. They are usually even less interesting for coin-collectors whose attention may only rarely be drawn to a mysterious portrait on a foreign coin. And yet, sometimes when we dig deeper into writers' biographies we may find information that will tell us something more about coins from our own collections. Coins which seemed common may start to mean a little more to us. Public activities of the Irish poet and playwright William Butler Yeats (1865-1939) were so many and so various, especially at the turn of the centuries, they were so much connected with his literary work that even his chairing the Commission on Coinage, "his most notable contribution to the proceedings of the Seanad", as his biographer J. Norman Jeffares called it, is very often neglected. One might agree that these activities to which he applied his shaping skills as the Irish Manuscripts, Literary Copyright, the Lane pictures, the National Museum, the National Gallery and Art School to mention but a few, were, if compared to his literary achievements, of mediocre importance. The question must be asked therefore why such an eminent man, Nobel Prize winner, a poet universally recognized by his peers as the greatest poet writing in the English language of this century participated in such activities? J. -

Medals, Banknotes and Coins and Banknotes Medals

Wednesday 23 November 2016 Wednesday Knightsbridge, London MEDALS, BANKNOTES AND COINS MEDALS, BANKNOTES AND COINS | Knightsbridge, London | Wednesday 23 November 2016 23563 MEDALS, BANKNOTES AND COINS Wednesday 23 November 2016 at 10am Knightsbridge, London BONHAMS ENQUIRIES IMPORTANT INFORMATION Montpelier Street John Millensted The United States Government Knightsbridge + 44 (0) 20 7393 3914 has banned the import of ivory London SW7 1HH [email protected] into the USA. Lots containing www.bonhams.com ivory are indicated by the symbol Fulvia Esposito Ф printed beside the lot number VIEWING + 44 (0) 20 7393 3917 in this catalogue. Monday 21 November 2016 [email protected] 9am – 4.30pm Tuesday 22 November 2016 PRESS ENQUIRIES 9am – 4pm [email protected] BIDS CUSTOMER SERVICES +44 (0) 20 7447 7447 Monday to Friday +44 (0) 20 7447 7401 fax 8.30am – 6pm To bid via the internet +44 (0) 20 7447 7447 please visit www.bonhams.com SALE NUMBER: Please note that bids should be 23563 submitted no later than 24 hours prior to the sale. CATALOGUE: £15 New bidders must also provide proof of identity when submitting LIVE ONLINE BIDDING IS bids. Failure to do this may result AVAILABLE FOR THIS SALE in your bids not being processed. Please email [email protected] Bidding by telephone will only be with “Live bidding” in the subject accepted on a lot with the excess line 48 hours before the auction of £500. to register for this service. Bonhams 1793 Limited Bonhams International Board Bonhams UK Ltd Directors Registered No. 4326560 Robert -

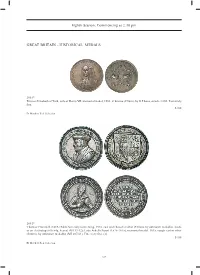

Eighth Session, Commencing at 2.30 Pm GREAT BRITAIN

Eighth Session, Commencing at 2.30 pm GREAT BRITAIN - HISTORICAL MEDALS 2081* Princess Elizabeth of York, wife of Henry VII, memorial medal, 1503, in bronze (39mm), by D.F.Loos, struck c1800. Extremely fi ne. $100 Ex Matthew Rich Collection. 2082* Thomas Cromwell (1485-1540), Secretary to the King, 1534, cast and chased in silver (51mm), by unknown medallist, made as an electrotype (66.54g, heavy) (MI 39/32); Lady Arbella Stuart (1575-1615), memorial medal, 1615, rough cast in silver (50mm), by unknown medallist (MI 207/41). Fine; very fi ne. (2) $150 Ex Matthew Rich Collection. 247 2084* Commonwealth, Sir Thomas Fairfax (1612-1671), Lord General to the Parliamentary Forces, 1645-1650, in gilt bronze (40x55mm) by unknown artist (MI 319/153), also Cromwell, in bronze, by Dassier (1731) (MI 435/87, Eimer 526, 203). Good extremely fi ne. (2) $100 Ex Matthew Rich Collection. 2083* Mary I, portrait medal as Queen of England (1555), in bronze (36x40mm), after J.Jonghelink (MI 72/19); Elizabeth, Marchioness of Northampton, 1562, in silver (40mm), by S.V.Herwijck (MI 104/29; Eimer 43), a high quality British Museum electrotype, R R stamped on edge (Robert Ready); Queen Elizabeth I, personal badge in gilt bronze (38x47mm), unknown medallist (MI 132/85), probably 19th century product. Extremely fi ne; very fi ne; good very fi ne. (3) $200 Ex Matthew Rich Collection. Lot 2085 248 2085* Charles I, Release of Giles Strangways, 1648, in silver (60mm) by J.Rottier (struck c1670), obverse, bust armoured and draped right, reverse, the White Tower of London fl ying the Royal Standard, above, the sun bursting from clouds (Eimer 153, Forrer V/165 & 168 illustrated, MI i 333/77). -

PDF Version of Report

MINUTES OF EVIDENCE TAKEN BEFORE THE COMMITTEE OF PUBLIC ACCOUNTS WEDNESDAY 23 OCTOBER 2002 Members present: Mr Ian Davidson Mr David Rendel Angela Eagle Mr Gerry Steinberg Mr George Howarth Jon Trickett Mr Brian Jenkins Mr Alan Williams Mr Nigel Jones In the absence of the Chairman, Mr Alan Williams was called to the Chair. Sir John Bourn KCB, Comptroller and Auditor General, further examined. Mr Brian Glicksman, Treasury OYcer of Accounts, further examined. REPORT BY THE COMPTROLLER AND AUDITOR GENERAL: ROYAL MINT TRADING FUND: 2001–02 ACCOUNTS Memorandum submitted by the Royal Mint PAC HEARING 23 OCTOBER 2002: THE ROYAL MINT The Committee will be aware that the Report of the Comptroller and Auditor General (C&AG) makes reference to the theft of banknotes from the Royal Mint (paragraphs 30 to 38 refer). As part of my preparations for the PAC hearing, information came to my attention on Friday 18 October about a previous loss of banknotes. I investigated immediately. The detail is that on 29 October 1997 a consignment of banknotes was transferred from the Bank of England Printing Works to our oYce in London. On 5 November the consignment was transferred to our factory in Llantrisant. The consignment included 1,500 £10 banknotes (serial numbers HM50 000001 to HM50 001500) which were to be used to create a special, limited edition banknote and coin collectors’ set. By early December the first 1,001 banknotes had been packed. However, the balance (£4,990 face value) could not be found when they were required for packing in mid-December. -

Matthew Boulton and the Soho Mint Numismatic Circular April 1983 Volume XCI Number 3 P 78

MATTHEW BOULTON AND THE SOHO MINT: COPPER TO CUSTOMER by SUE TUNGATE A thesis submitted to The University of Birmingham for the degree of DOCTOR OF PHILOSOPHY Department of Modern History College of Arts and Law The University of Birmingham October 2010 University of Birmingham Research Archive e-theses repository This unpublished thesis/dissertation is copyright of the author and/or third parties. The intellectual property rights of the author or third parties in respect of this work are as defined by The Copyright Designs and Patents Act 1988 or as modified by any successor legislation. Any use made of information contained in this thesis/dissertation must be in accordance with that legislation and must be properly acknowledged. Further distribution or reproduction in any format is prohibited without the permission of the copyright holder. ABSTRACT Matthew Boulton (1728-1809) is well known as an eighteenth-century industrialist, the founder of Soho Manufactory and the steam-engine business of Boulton and Watt. Less well known are his scientific and technical abilities in the field of metallurgy and coining, and his role in setting up the Soho Mint. The intention of this thesis is to focus on the coining activities of Matthew Boulton from 1787 until 1809, and to examine the key role he played in the modernisation of money. It is the result of an Arts and Humanities Research Council-funded collaboration with Birmingham Museum and Art Gallery, where, after examination of their extensive collection of coins, medals, tokens and dies produced at the Soho Mint, .research was used to produce a catalogue. -

Royal Mint Annual Report 2002-03 Royal Mint Management Structure

Royal Mint Annual Report 2002-03 Royal Mint Management Structure As at 31 March 2003 Gerald Sheehan Chief Executive EXECUTIVE DIRECTORS Keith Cottrell Director of Sales Graham Davies Director of Finance Allan Pearce Director of Human Resources and Corporate Affairs Michael Slater Director of Circulating Coin Production Alan Wallace Director of Collector Coin NON-EXECUTIVE DIRECTORS David Stark (Chairman) Contents Lyndon Haddon Review of the Year Jan Smith Chief Executive’s Report 3 David Trapnell Financial Summary 5 United Kingdom Circulating Coinage 7 Overseas Circulating Coins and Blanks 9 Collector Coin 11 People 13 Bankers Bank of England Medals 17 External Auditors Comptroller and Auditor General Royal Mint Advisory Committee, 2002-03 20 Internal Auditors PricewaterhouseCoopers LLP Royal Mint Trading Fund Secretariat Royal Mint, Llantrisant CF72 8YT Financial and General Reports 22 Telephone: 01443 623060/061 Statement of Trading Fund’s E-mail: informationoffi[email protected] and Accounting Officer’s Website: www.royalmint.com Responsibilities 24 Corporate Governance – Statement on Internal Control 24 The Accounts of the Royal Mint Trading Fund The Certificate of the as at 31 March 2003 together with the Certificate Comptroller and Auditor General and Report of the Comptroller and Auditor to the Houses of Parliament 26 General thereon are prepared pursuant to section Operating Account 27 4(6) of the Government Trading Funds Act 1973. Balance Sheet 29 (In continuation of House of Commons Paper No 1181 of 2001-02.) Presented pursuant to Cash Flow Statement 30 Act 1973, c.63, s.4(6). Notes to the Accounts 31 821 Ordered by the House of Commons to be printed 16 July 2003.