2014 Nielsen Music U.S. Report * * *

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Soundtrack Walt Disney

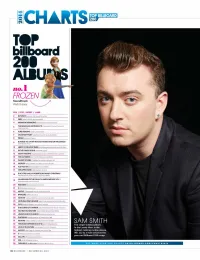

TOP BILLBOARD CHARTS200 TOP billboard 2011 ALB no.1 FROZEN Soundtrack Walt Disney POS / TITLE / ARTIST / LABEL 2 BEYONCEBeyonce Parkwood/Columbia 3 1989 TaylorSwilt Big Machine/BMW 4 MIDNIGHT MEMORIES OneOgrecuon SYCO/Columbia THE MARSHALL MAINERS LP 2 Emlnem Web/Shady/Aftermath/ Interscope/IGA 6 PURE HEROINE Lade Lava/Republic 7 CRASH MY PARTY Luke Bryan Capitol Nashville/UMGN 8 PRISM KutyPenyCapitol BLAME IT ALL ON MY ROOTS: FIVE DECADES OF INFLUENCES 9 Garth Brooks Pearl 10 HERE'S TOTHE GOODDMES RaidaGeogiaLine Republic Nastwille/BMLG 11 IN THE LONELY HOUR Sam Smith Capitol 12 NIGHT VISIONS imaginegragons KIDinaKORNER/interscope/IGA 13 THE OUTSIDERS Eric Church EMI Nashville/UPAGN 14 GHOST STORIES ColciplayParlophone/Atlantic/AG 15 NOW 50 Various Artists Sony Music/Universal/UMe 16 JUST AS I AM BrantleyGilben Valory/BMLG 17 WItAPPED IN RED KellyClarkson 19/RCA 18 DUCK THE HALLS:A ROBERTSON FAMILY CHRISIMAS TheRobertsons 4 Beards/EMI Nashville/UMGN GUARDIANS OF THE GALAXY: AWESOME MIX VOL.1 19 Soundtrack Marvel/Hollywood 20 PARTNERS Barbra Streisand Columbia 21 X EdSheeran Atlantic/AG 22 NATIVE OneRepublic Mosley/Interscope/IGA 23 BANGERZ MileyCyrus RCA 24 NOW 48Various Artists Sony Music/Universal/UMe 25 NOTHING WAS THE SAME Drake Young money/cash Money/Republic 26 GIRL Pharr,. amother/Columbia 27 5 SECONDS OF SUMMER 5Seconds MummerHey Or Hi/Capitol 28 OLD BOOTS, NEW DIRT lasonAldean Broken Bow/BBMG 29 UNORTHODOX JUKEBOX Bruno Mars Atlantic/AG 30 PLATINUM Miranda Lambert RCA Nashville/SMN 31 NOW 49 VariousArtists Sony Music/Universal/UMe SAM SMITH 32 THE 20/20 EXPERIENa (2 OF 2) Justin Timberlake RCA The singer's debut album, 33 LOVE IN THE FUTURE lohnLegend G.O.O.D./Columbia In the Lonely Hour, is the 34 ARTPOPLadyGaga Streamline/Interscope/IGA highest-ranking rookie release 35 V Maroon5222/Interscope/IGA (No. -

Daft Punk Collectible Sales Skyrocket After Breakup: 'I Could've Made

BILLBOARD COUNTRY UPDATE APRIL 13, 2020 | PAGE 4 OF 19 ON THE CHARTS JIM ASKER [email protected] Bulletin SamHunt’s Southside Rules Top Country YOURAlbu DAILYms; BrettENTERTAINMENT Young ‘Catc NEWSh UPDATE’-es Fifth AirplayFEBRUARY 25, 2021 Page 1 of 37 Leader; Travis Denning Makes History INSIDE Daft Punk Collectible Sales Sam Hunt’s second studio full-length, and first in over five years, Southside sales (up 21%) in the tracking week. On Country Airplay, it hops 18-15 (11.9 mil- (MCA Nashville/Universal Music Group Nashville), debutsSkyrocket at No. 1 on Billboard’s lion audience After impressions, Breakup: up 16%). Top Country• Spotify Albums Takes onchart dated April 18. In its first week (ending April 9), it earned$1.3B 46,000 in equivalentDebt album units, including 16,000 in album sales, ac- TRY TO ‘CATCH’ UP WITH YOUNG Brett Youngachieves his fifth consecutive cording• Taylor to Nielsen Swift Music/MRCFiles Data. ‘I Could’veand total Made Country Airplay No.$100,000’ 1 as “Catch” (Big Machine Label Group) ascends SouthsideHer Own marks Lawsuit Hunt’s in second No. 1 on the 2-1, increasing 13% to 36.6 million impressions. chartEscalating and fourth Theme top 10. It follows freshman LP BY STEVE KNOPPER Young’s first of six chart entries, “Sleep With- MontevalloPark, which Battle arrived at the summit in No - out You,” reached No. 2 in December 2016. He vember 2014 and reigned for nine weeks. To date, followed with the multiweek No. 1s “In Case You In the 24 hours following Daft Punk’s breakup Thomas, who figured out how to build the helmets Montevallo• Mumford has andearned Sons’ 3.9 million units, with 1.4 Didn’t Know” (two weeks, June 2017), “Like I Loved millionBen in Lovettalbum sales. -

Enrique Iglesias' “Duele El Corazon” Reaches Over 1 Billion Cumulative Streams and Over 2 Million Downloads Sold Worldwide

ENRIQUE IGLESIAS’ “DUELE EL CORAZON” REACHES OVER 1 BILLION CUMULATIVE STREAMS AND OVER 2 MILLION DOWNLOADS SOLD WORLDWIDE RECEIVES AMERICAN MUSIC AWARD FOR BEST LATIN ARTIST (New York, New York) – This past Sunday, global superstar Enrique Iglesias wins the American Music Award for Favorite Latin Artist – the eighth in his career and the most by any artist in this category. The award comes on the heels of a whirlwind year for Enrique. His latest single, “DUELE EL CORAZON” has shattered records across the globe. The track (click here to listen) spent 14 weeks at #1 on the Hot Latin Songs chart, held the #1 spot on the Latin Pop Songs chart for 10 weeks and has over 1 billion cumulative streams and over 2 million tracks sold worldwide. The track also marks Enrique’s 14th #1 on the Dance Club Play chart, the most by any male artist. He also holds the record for the most #1 debuts on Billboard’s Latin Airplay chart. In addition to his recent AMA win, Enrique also took home 5 awards at this year’s Latin American Music Awards for Artist of the Year, Favorite Male Pop/Rock Artist and Favorite Song of the Year, Favorite Song Pop/Rock and Favorite Collaboration for “DUELE EL CORAZON” ft. Wisin. Earlier this month, Enrique went to France to receive the NRJ Award of Honor. For the past two years, Enrique has been touring the world on his SEX AND LOVE Tour which will culminate in Prague, Czech Republic on December 18th. Remaining 2016 Tour Dates Nov. -

183 Anti-Valentine's Day Songs (2015)

183 Anti-Valentine's Day Songs (2015) 4:24 Time Artist Album Theme Knowing Me Knowing You 4:02 Abba Gold Break up Lay All Your Love On Me 5:00 Abba Gold cautionary tale S.O.S. 3:23 Abba Gold heartbreak Winner Takes it All 4:55 Abba Gold Break up Someone Like You 4:45 Adele 21 Lost Love Turning Tables 4:08 Adele 21 broken heart Rolling in the Deep 3:54 Adlele 21 broken heart All Out Of Love 4:01 Air Supply Ulitimate Air Supply Lonely You Oughta Know 4:09 Alanis Morissette Jagged Little Pill broken heart Another heart calls 4:07 All American Rejects When the World Comes Down jerk Fallin' Apart 3:26 All American Rejects When the World Comes Down broken heart Gives You Hell 3:33 All American Rejects When the World Comes Down moving on Toxic Valentine 2:52 All Time Low Jennifer's Body broken heart I'm Outta Love 4:02 Anastacia Single giving up Complicated 4:05 Avril Lavigne Let Go heartbreak Good Lovin' Gone Bad 3:36 Bad Company Straight Shooter cautionary tale Able to Love (Sfaction Mix) 3:27 Benny Benassi & The Biz No Matter What You Do / Able to Love moving on Single Ladies (Put a Ring On It) 3:13 Beyonce I Am Sasha Fierce empowered The Best Thing I Never Had 4:14 Beyonce 4 moving on Love Burns 2:25 Black Rebel Motorcycle Club B.R.M.C. cautionary tale I'm Sorry, Baby But You Can't Stand In My Light Anymore 3:11 Bob Mould Life & Times moving on I Don't Wish You Were Dead Anymore 2:45 Bowling for Soup Sorry for Partyin' broken heart Love Drunk 3:47 Boys Like Girls Love Drunk cautionary tale Stronger 3:24 Britney Spears Opps!.. -

Een Greep Uit De Cd-Releases 2012

Een greep uit de cd-releases 2012 Artiest/groep Titel 1 Aborted Global flatline 2 Allah -las Allah -las 3 Absynthe Minded As it ever was 4 Accept Stalingrad 5 Adrenaline Mob (Russel Allen & Mike Portnoy) Omerta 6 After All Dawn of the enforcer 7 Aimee Mann Charmer 8 Air La voyage dans la lune 9 Alabama Shakes Boys & girls 10 Alanis Morissette Havoc and bright lights 11 Alberta Cross Songs of Patience 12 Alicia Keys Girl on fire 13 Alt J An AwsoME Wave 14 Amadou & Mariam Folila 15 Amenra Mass V 16 Amos Lee As the crow flies -6 track EP- 17 Amy MacDonald Life in a beautiful light 18 Anathema Weather systems 19 Andrei Lugovski Incanto 20 Andy Burrows (Razorlight) Company 21 Angus Stone Broken brights 22 Animal Collective Centipede Hz 23 Anneke Van Giersbergen Everything is changing 24 Antony & The Johnsons Cut the world 25 Architects Daybreaker 26 Ariel Pink Haunted Graffitti 27 Arjen Anthony Lucassen Lost in the new real (2cd) 28 Arno Future vintage 29 Aroma Di Amore Samizdat 30 As I Lay Dying Awakened 31 Balthazar Rats 32 Band Of Horses Mirage rock 33 Band Of Skulls Sweet sour 34 Baroness Yellow & green 35 Bat For Lashes Haunted man 36 Beach Boys That's why god made the radio 37 Beach House Bloom 38 Believo ! Hard to Find 39 Ben Harper By my side 40 Berlaen De loatste man 41 Billy Talent Dead silence 42 Biohazard Reborn in defiance 43 Black Country Communion Afterglow 44 Blaudzun Heavy Flowers 45 Bloc Party Four 46 Blood Red Shoes In time to voices 47 Bob Dylan Tempest (cd/cd deluxe+book) 48 Bob Mould Silver age 49 Bobby Womack The Bravest -

The BET HIP-HOP AWARDS '09 Nominees Are in

The BET HIP-HOP AWARDS '09 Nominees Are In ... Kanye West Leads The Pack With Nine Nominations As Hip-Hop's Crowning Night Returns to Atlanta on Saturday, October 10 and Premieres on BET Tuesday, October 27 at 8:00 p.m.* NEW YORK, Sept.16 -- The BET HIP-HOP AWARDS '09 nominations were announced earlier this evening on 106 & PARK, along with the highly respected renowned rapper, actor, screenwriter, film producer and director Ice Cube who will receive this year's "I AM HIP-HOP" Icon Award. Hosted by actor and comedian Mike Epps, the hip-hop event of the year returns to Atlanta's Boisfeuillet Jones Civic Center on Saturday, October 10 to celebrate the biggest names in the game - both on the mic and in the community. The BET HIP-HOP AWARDS '09 will premiere Tuesday, October 27 at 8:00 PM*. (Logo: http://www.newscom.com/cgi-bin/prnh/20070716/BETNETWORKSLOGO ) The Hip-Hop Awards Voting Academy which is comprised of journalists, industry executives, and fans has nominated rapper, producer and style aficionado Kanye West for an impressive nine awards. Jay Z and Lil Wayne follow closely behind with seven nominations, and T.I. rounds things off with six nominations. Additionally, BET has added two new nomination categories to this year's show -- "Made-You-Look Award" (Best Hip Hop Style) which will go to the ultimate trendsetter and "Best Hip-Hop Blog Site," which will go to the online site that consistently keeps hip-hop fans in the know non-stop. ABOUT ICE CUBE Veteran rapper, Ice Cube pioneered the West Coast rap movement back in the late 80's. -

10 April VLUS Weekly

http://vassallane.cpsd.us/school_news/school_newspaper/ April 10, 2015 VLUS WEEKLY Stories by and About the Vassal Lane Upper School’s Scholars Vassal Lane Upper School, 197 Vassal Lane, Cambridge, MA 02138 Image by Susan Peloquin Connect to the VLUS Update on the April 17th VLUS Day of Silence Weekly: By Susan Peloquin http://vassallane.cpsd.us/ school_news/school_newspaper/ Just a reminder that VLUS students and staff will be participating in the National Day of Silence as part of our In this issue of the work in the Gay Straight Alliance next Friday, April 17. VLUS Weekly: Students can choose to participate in 2 ways. The first is to wear a sticker stating that the student pledges to be silent Essays! Reviews! that day to recognize the silence that LGBTQ peers and Articles by New families feel regularly. The second is to wear a sticker that Authors! states the student supports the Day of Silence and its Our First Reader’s purpose but isn't committing to be silent. Teachers will be Write Original Story! modifying the classes that day to allow for students who are choosing to be silent to be able to participate through writing. http://vassallane.cpsd.us/school_news/school_newspaper/ !1 http://vassallane.cpsd.us/school_news/school_newspaper/ April 10, 2015 On the Road Again: Journalism for a Moving World Effects on Streets By Fiona O’Loughlin Image by Fiona O’Loughlin After three weeks of almost constant blizzards and snow, Cambridge streets were nearly impassable. Plows pushed snow to the sides of streets, causing them to lose one or more lanes of traffic. -

1. Summer Rain by Carl Thomas 2. Kiss Kiss by Chris Brown Feat T Pain 3

1. Summer Rain By Carl Thomas 2. Kiss Kiss By Chris Brown feat T Pain 3. You Know What's Up By Donell Jones 4. I Believe By Fantasia By Rhythm and Blues 5. Pyramids (Explicit) By Frank Ocean 6. Under The Sea By The Little Mermaid 7. Do What It Do By Jamie Foxx 8. Slow Jamz By Twista feat. Kanye West And Jamie Foxx 9. Calling All Hearts By DJ Cassidy Feat. Robin Thicke & Jessie J 10. I'd Really Love To See You Tonight By England Dan & John Ford Coley 11. I Wanna Be Loved By Eric Benet 12. Where Does The Love Go By Eric Benet with Yvonne Catterfeld 13. Freek'n You By Jodeci By Rhythm and Blues 14. If You Think You're Lonely Now By K-Ci Hailey Of Jodeci 15. All The Things (Your Man Don't Do) By Joe 16. All Or Nothing By JOE By Rhythm and Blues 17. Do It Like A Dude By Jessie J 18. Make You Sweat By Keith Sweat 19. Forever, For Always, For Love By Luther Vandros 20. The Glow Of Love By Luther Vandross 21. Nobody But You By Mary J. Blige 22. I'm Going Down By Mary J Blige 23. I Like By Montell Jordan Feat. Slick Rick 24. If You Don't Know Me By Now By Patti LaBelle 25. There's A Winner In You By Patti LaBelle 26. When A Woman's Fed Up By R. Kelly 27. I Like By Shanice 28. Hot Sugar - Tamar Braxton - Rhythm and Blues3005 (clean) by Childish Gambino 29. -

The Representation of the Bangtan Boys in the News of Billboard Music Awards in 2017

i THE REPRESENTATION OF THE BANGTAN BOYS IN THE NEWS OF BILLBOARD MUSIC AWARDS IN 2017 A FINAL PROJECT In Partial Fulfillment of the Requirement For S-1 Degree in Linguistics In English Department, Faculty of Humanities Diponegoro University Submitted by: Asteriana Alika Aisyah 13020114130051 FACULTY OF HUMANITIES DIPONEGORO UNIVERSITY SEMARANG 2018 PRONOUNCEMENT I state truthfully that this project is compiled by me without taking the results from other research in any university, in S-1, S-2, and S-3 degree and in diploma. In addition, I ascertain that I do not take the material from other publications or someone’s work except for the references mentioned in bibliography. Semarang, July 2018 Asteriana Alika Aisyah ii MOTTO AND DEDICATION “So verily with the hardship there is relief, verily with the hardship there is relief” (Qur’an 94: 5-6) “You educate a man; you educate a man. You educate a woman; you educate a generation”. (Brigham Young) I sincerely dedicate this project to my mother, my father, and everyone who helped me in finishing this thesis. iii THE REPRESENTATION OF THE BANGTAN BOYS IN THE NEWS OF BILLBOARD MUSIC AWARDS IN 2017 Written by Asteriana Alika Aisyah NIM: 13020114130051 is approved by the project advisor On 9th July, 2018 Project Advisor Dr. Nurhayati, M.Hum. NIP. 196610041990012001 The Head of the English Department Dr. Agus Subiyanto, M. A. NIP: 196408141990011001 iv VALIDATION Approved by Strata 1 Project Examination Committee Faculty of Humanity Diponegoro University On 10th August 2018 Chair Person First Member Dr. Deli Nirmala, M.Hum Drs. Mualimin, M.Hum NIP. -

Death, Beauty, and Iconoclastic Nostalgia: Precarious Aesthetics and Lana Del Rey

Death, beauty, and iconoclastic nostalgia: Precarious aesthetics and Lana Del Rey Arild Fetveit NECSUS 4 (2): 187–207 DOI: 10.5117/NECSUS2015.2.FETV Abstract The obsolescence of analogue media along with a rapid succession of digital formats has sensitised us to the mortality of media. It has also spawned what Dominik Schrey has called ‘a golden age of nostalgia for these allegedly “dead media”’, now explored by visual artists, filmmakers, cinematographers, Do-It- Yourself enthusiasts, Polaroid fans, Instagram users, music video directors and others. Since the mid-1990s a partially-iconoclastic impulse focused on exploring the mortality of media materials has often taken the form of medium-specific noise. However, in recent years alternative strategies that counteract clarity, involving iconoclastic disruptions of the process of mediation, supported by a host of degrading techniques and strategies that thicken and foreground the medium and its materiality, have partially replaced uses of medium-specific noise. Cultural analysts awake to these and related developments have responded with a series of productive interventions. Drawing on many of these, I propose a media aesthetic approach where the disruptions in question are conceived as involving instances of precarious mediation to be examined within a precarious aesthetics. The music videos of Lana Del Rey effectively articulate ways in which precarious mediation is used in contemporary popular culture. In many of her music videos, like Summertime Sadness (2012) and Summer Wine (2013), the precarious mediation is given a nostalgic inflection, where an ambiguous yearning for the past is imbricated with cunning attempts to perfect imperfec- tion. This nostalgia appears iconoclastic on the level of mediation as well as in its yearning for the past greatness of America. -

J Cole Album Forest Hills Drive Download J Cole Album Forest Hills Drive Download

j cole album forest hills drive download J cole album forest hills drive download. 1) Select a file to send by clicking the "Browse" button. You can then select photos, audio, video, documents or anything else you want to send. The maximum file size is 500 MB. 2) Click the "Start Upload" button to start uploading the file. You will see the progress of the file transfer. Please don't close your browser window while uploading or it will cancel the upload. 3) After a succesfull upload you'll receive a unique link to the download site, which you can place anywhere: on your homepage, blog, forum or send it via IM or e-mail to your friends. 2014 Forest Hills Drive. Purchase and download this album in a wide variety of formats depending on your needs. Buy the album Starting at $9.99. 2014 Forest Hills Drive. Copy the following link to share it. You are currently listening to samples. Listen to over 70 million songs with an unlimited streaming plan. Listen to this album and more than 70 million songs with your unlimited streaming plans. 1 month free, then $14.99/ month. J. Cole, Associated Performer, Main Artist, Producer - Jermaine Cole, Composer, Executive Producer, Lyricist - James Rodgers, Bass, Trombone - Casey James, Saxophone - Travis Antoine, Trumpet - Ronald Gilmore, Producer - Juro "Mez" Davis, Mixing Engineer, Recording Engineer - Jeremy Cimino, Assistant Engineer - Jack Mason, Assistant Engineer, Recording Engineer - Dreamville, Executive Producer - Mark Pitts, Executive Producer - Roc Nation, Executive Producer - Brian Gardner, Mastering -

GSN Edition 06-24-20

The MIDWEEK Tuesday, June 24, 2014 Goodland1205 Main Avenue, Goodland, Star-News KS 67735 • Phone (785) 899-2338 $1 Volume 82, Number 50 12 Pages Goodland, Kansas 67735 inside Run with the Law today More lo- cal news and views from your Goodland Star-News Outlaws win tourney The Goodland American Legion Baseball team won the Levi Hayden Memorial Tournament on Saturday. See Page 11 Goodland Police Chief Cliff Couch holds the torch for the opening lap of the Run with as well as from Golden West. For more pictures, See Page 5. the Law held Saturday at the Goodland High School track. Couch was surrounded Photo by Pat Schiefen/The Goodland Star-News by fellow law enforcement officers. Runners and walkers were from the community weather Intentional burn 69° Police seek help 10 a.m. Monday Today finding vandals • Sunset, 8:18 p.m. Wednesday The Goodland Police Depart- be in the thousands of dollars. • Sunrise, 5:22 a.m. ment is asking for help locating the The department is asking that • Sunset, 8:18 p.m. perpetrators of a string of thefts and anyone with information about the Midday Conditions vandalism that has been occurring case contact the police at (785) 890- • Soil temperature 68 degrees since last Tuesday. 4570 or the Crimestoppers hotline • Humidity 68 percent Based on the department’s inves- at (785) 899-5665. Those providing • Sky mostly sunny tigation, suspects have stolen solar tips may remain anonymous. Any- • Winds north 7 mph powered yard lights from several one providing information leading • Barometer 30,30 inches homes and are using them as projec- to an arrest in this case is eligible for and falling tiles to smash nearby car windows.