Dependent Tuition Assistance Program Guidelines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Memory,Ritual and Place in Africa TWIN CITIES AFRICANIST SYMPOSIUM

Sacred Ground: Memory,Ritual and Place in Africa TWIN CITIES AFRICANIST SYMPOSIUM Carleton College February 21-22, 2003 Events Schedule Friday, February 21 Great Hall, 4 to 9 p.m. Welcoming Remarks Allen Isaacman, University of Minnesota Keynote Lecture “The Politics and Poetics of Sacred Sites” Sandra Greene, Professor of History, Cornell University 4 to 6 p.m. Reception with African Food, Live Music Musical performance by Jalibah Kuyateh and the Mandingo Griot Ensemble 6 to 9 p.m. Saturday, February 22 Alumni Guest House Meeting Room Morning panel: 9 to 10:30 a.m. Theme: Sacred Ground: Memory, Ritual and Place in Africa Chair: Sandra Greene, Cornell University William Moseley, Department of Geography, Macalester College, “Leaving Hallowed Practices for Hollow Ground: Wealth, Poverty and Cotton Production in Southern Mali” Kathryn Linn Geurts, Department of Anthropology, Hamline University, “Migration Myths, Landscape, and Cultural Memory in Southeastern Ghana” Jamie Monson, Department of History, Carleton College, “From Protective Lions to Angry Spirits: Local Discourses of Land Degradation in Tanzania” Cynthia Becker, Department of Art History, University of St. Thomas, “Zaouia: Sacred Space, Sufism and Slavery in the Trans-Sahara Caravan Trade” Coffee Break Mid-Morning panel: 11 a.m. to 12:30 p.m. Theme: Memory, Ritual and Performance in Africa Chair: Dianna Shandy, Macalester College Michele Wagner, Department of History, University of Minnesota, “Reburial in Rwanda: Ritual of Healing or Ritual of Revenge?” Tommie Jackson, Department of English, St. Cloud State University, “‘Fences’ in the drama by August Wilson and ‘Sizwe Bansi is Dead,’ by Athol Fugard” Helena Pohlandt-McCormick, Department of History, University of Minnesota, “Memory and Violence in Soweto” Pamela Feldman-Savelsberg, Department of Anthropology, Carleton College, “Remembering the Troubles: Collective Memory and Reproduction in Cameroon” Break 12:30 to 2 p.m. -

Coe College Courier Spring 2020

CONTENTS VOL. 119 NO. 3 SPRING 2020 FEATURES DEPARTMENTS COVER Coming home Looking back: Coe Campu s Briefs Longtime Coe College 10 23 alumni In World War 11 04 photographer George Henry '49 reflects on his time In Coe' s ROTC and In World War II. Legend s of Coe: The evolution of Sports Shorts 12 Coni>-shaped shoes 35 Coe College Rewrve 07 Officers' Training Corpo (ROTC) Coe alumni are Clas.sN otes 16 Incredibly social 39 Scholarshlp s make 20 It possible 2019-2020 BOARD OF TRUSTEES Wale Adeos un '84 Ken Go lder '82 Paul Meyer '74 LIFE TRUSTEES Jerre L Stead '65 A lan A nder son '78 Denni s Green spo n '68 Sumit Nijhawan '93 Terry J , Abe rnath y '70 J ohn 0 , Strohm '79 R. Darryl Banks '72 Gene Henderson '68 Sigr id Stro ng Reynolds '9 4 Jack B, Evans '70 Peter Birkey '91 Kent Herink '76 Brett Rule '8 6 Jo hn Girott o HONORARY TRUSTEE Mary Neff Kevin Bu ck ner '93 Shirley Hug hes '67 Tim Sagers '97 Do ug Hyde '74 J, Dav id Carso n '72 Mary Cook Jorgenso n '80 Wi lliam Schalk '65 W illi am P, Jo hnson '53 Steven L Caves Steve n Kline '76 Larry L Shryoc k '65 Vi nce Martin Robe rt Chiu sano Mary Jeanne Krob '73 Kr istin Strohm 'OS Chuck Peter s Doug Eden'n Kr ist in Patters on Lenz '96 Craig Stru ve '70 James R, Phifer Sam Freit ag '78 Dav e Lusson '87 Lori Sturdev ant '74 Jo hn M, Sagers Chri st ine Kaufman n Gall oway '73 Julie Jo hnson Mc lean '78 Carson Veac h '74 Gary Schlar baum '6S Dav id Gehr ing '8 9 Curt Menefee '87 Ed Walsh '70 Bruce Sp ivey 'S6 2 I www.co•.•du WWW.CO E.EDU LETTER FROM THE CHAIRMAN OF THE BOARD The beg innin g of a new decad e provi des a special o pportuni ty to loo k forward to the many exci ting possibiliti es ahead of us, W ith Dave Mclnall y's announcement o f hi s plan to retire following the 2020 -202 1a cade mic year, we loo k into a new d ecad e that will Inc lude new leade rship in th e ro le of presid ent. -

Colleges and University Acceptances

Colleges and University Acceptances Adelphi University North Carolina State University Agnes-Scott University North Virginia Community College Albright College Northern Kentucky University Auburn University Northwood University Austin College Nova Southeastern University Ave Maria University Oglethorpe University Barry University Ohio State University Baylor University Pace University Belmont Abbey College Palm Beach Atlantic University Bethune-Cookman University Pasco-Hernandez State College Boston College Pennsylvania State University Brenau University Point University Eastern Florida State College Pratt Institute - New York Bridgewater State University Queens University of Charlotte Campbell University Randolph Macon University Case Western Reserve University Rensselaer Polytechnic Institute Chaminade University of Honolulu Rhodes College College of Charleston Roanoke College College of William & Mary Rollins College College of Wooster Saint Johns River State College Concordia University Wisconsin Saint Johns University Converse College Saint Joseph’s University Cornell College Saint Leo University DePaul University Saint Mary’s College Doane College Samford University Drexel University Sanford-Brown College Mendota Heights East Carolina University Santa Fe College East Stroudsbury University Savannah College of Art & Design Embry Riddle Aeronautical University Seattle Pacific University Emory & Henry College Seton Hall University Emory University Sewanee: The University of the South Evergreen State College Slippery Rock University -

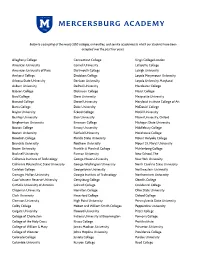

Below Is a Sampling of the Nearly 500 Colleges, Universities, and Service Academies to Which Our Students Have Been Accepted Over the Past Four Years

Below is a sampling of the nearly 500 colleges, universities, and service academies to which our students have been accepted over the past four years. Allegheny College Connecticut College King’s College London American University Cornell University Lafayette College American University of Paris Dartmouth College Lehigh University Amherst College Davidson College Loyola Marymount University Arizona State University Denison University Loyola University Maryland Auburn University DePaul University Macalester College Babson College Dickinson College Marist College Bard College Drew University Marquette University Barnard College Drexel University Maryland Institute College of Art Bates College Duke University McDaniel College Baylor University Eckerd College McGill University Bentley University Elon University Miami University, Oxford Binghamton University Emerson College Michigan State University Boston College Emory University Middlebury College Boston University Fairfield University Morehouse College Bowdoin College Florida State University Mount Holyoke College Brandeis University Fordham University Mount St. Mary’s University Brown University Franklin & Marshall College Muhlenberg College Bucknell University Furman University New School, The California Institute of Technology George Mason University New York University California Polytechnic State University George Washington University North Carolina State University Carleton College Georgetown University Northeastern University Carnegie Mellon University Georgia Institute of Technology -

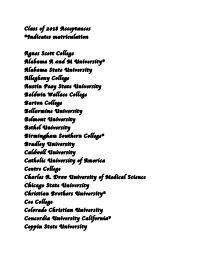

Class of 2018 Acceptances *Indicates Matriculation Agnes Scott

Class of 2018 Acceptances *Indicates matriculation Agnes Scott College Alabama A and M University* Alabama State University Allegheny College Austin Peay State University Baldwin Wallace College Barton College Bellarmine University Belmont University Bethel University Birmingham Southern College* Bradley University Caldwell University Catholic University of America Centre College Charles R. Drew University of Medical Science Chicago State University Christian Brothers University* Coe College Colorado Christian University Concordia University California* Coppin State University DePaul University Dillard University Eckerd College Fordham University Franklin and Marshall College Georgia State University Gordon College Hendrix College Hollins University Jackson State University Johnson C. Smith University Keiser University Langston University* Loyola College Loyola University- Chicago Loyola University- New Orleans Mary Baldwin University Middle Tennessee State University Millsaps College Mississippi State University* Mount Holyoke College Mount Saint Mary’s College Nova Southeastern University Ohio Wesleyan Oglethorpe University Philander Smith College Pratt Institute Ringling College or Art and Design Rollins College Rust College Salem College Savannah College or Art and Design Southeast Missouri State University Southwest Tennessee Community College* Spellman College Spring Hill College St. Louis University Stonehill College Talladega College Tennessee State University Texas Christian University Tuskegee University* University of Alabama at Birmingham University of Dayton University of Houston University of Kentucky University of Alabama at Tuscaloosa University of Memphis* University of Mississippi University of North Alabama University of Florida University of Southern Mississippi University of Tampa University of Tennessee Chattanooga* University of Tennessee Knoxville* University of Tennessee Marin Virginia State University Voorhees College Wake Forest University* Wiley College Xavier University, Louisiana Xavier University, Ohio . -

Omaha Fair-Participating Clgs

OMAHA AREA COLLEGE FAIR PARTICIPATING COLLEGES (Registered as of 10/1/07) FOUR YEAR PUBLIC Augustana College, IL Hillsdale College, MI Valparaiso University, IN Chadron State College, NE Austin College, TX Johnson & Wales University, CO Vassar College, NY Colorado State University, CO Baker University, KS Kansas City Art Institute, MO Wartburg College, IA Dakota State University, SD Bellevue University, NE Kansas Wesleyan University, KS Washington University in St. Louis, MO Emporia State University, KS Beloit College, WI Knox College, IL Webster University, MO Indiana University, IN Benedictine College, KS Lake Forest College, IL Wellesley College, MA Iowa State University, IA Bethany College, KS Lawrence University, WI Westminster College, MO Kansas State University, KS Boston University, MA Lincoln University, MO William Jewell College, MO Kansas State-College of Technology & Aviation, KS Bradley University, IL Loyola University New Orleans, LA William Penn University, IA Missouri State University, MO Briar Cliff University, IA Luther College, IA William Woods University, MO Missouri Western State College, MO BryanLGH College of Health Sciences, NE Marquette University, WI York College, NE New Mexico Tech, NM Buena Vista University, IA McPherson College, KS Northern State University, SD Central Christian College, KS MidAmerica Nazarene University, KS TWO YEAR Northwest Missouri State University, MO Central College, IA Midland Lutheran College, NE Alegent Health School of Radiologic Technology, NE Peru State College, NE Central Methodist -

Memorial High School Has an Enrollment of 2,086 Students in Grades 9-12 and Is Baylor University Howard College Ringling Coll

College Attendance for the Class of 2021 District-Wide Abilene Christian University Fort Scott Commun. College Pacific University of Oregon University of Chicago MEMORIAL Allen College Friends University Paul Mitchell School Univ. of Cincinnati College American University Georgia Institute of Tech. Pennsylvania State University University of Colorado Angelo State University Georgia Southern University Pepperdine University Univ. of Colorado at Boulder HIGH SCHOOL Arizona State University Gonzaga University Pittsburg State University University of Colorado at Arkansas Tech University Grambling State University Prairie View A&M University Colorado Springs Arlington University Hampton University Pratt Institute University of Dallas Art Institute of Dallas Hardin-Simmons University Princeton University University of Evansville ASPIRE / Frisco ISD Harding University Purdue University University of Florida 12300 Frisco St Frisco, Texas 75033 469.633.7300/7350 Auburn University Harvard University Quinnipiac University University of Georgia Austin College Henderson State University Rensselaer Poly. Institute University of Houston Austin Community College High Point University Rhodes College University of Illinois Chicago SCHOOL - CEEB: 440-416 Aveda Cosmetology Institute Houston Baptist University Rice University University of Indianapolis Aveda Institute Houston community college Richland College University of Iowa Memorial High School has an enrollment of 2,086 students in grades 9-12 and is Baylor University Howard College Ringling Coll. of Art & Design University of Kansas accredited by the Texas Education Agency and has set a high standard of excellence. Belhaven University Howard Payne University Rutgers University of Louisville Out of the class of 2021 nine-one percent of the student body was college-bound. Belmont University Howard University Saint Joseph’s University Univ. -

COLLEGES and UNIVERSITIES REPRESENTED in the 2009-2010-2011 ENTERING CLASSES – FULL and PART-TIME STUDENTS Abilene Christian U

COLLEGES AND UNIVERSITIES REPRESENTED IN THE 2009-2010-2011 ENTERING CLASSES – FULL AND PART-TIME STUDENTS Abilene Christian University City University of New York Hendrix College Alvernia College -Hunter College High Point University Alverno College College of the Holy Cross Hope College American University (DC) Colorado State University Hunan Normal Univ. (China) American University Columbia College (IL) Huntingdon College of Beirut (Lebanon) Concordia University (WI) Illinois Institute of Technology Amherst College Cornell College (IA) Illinois State University Anderson University Cornell University (NY) Illinois Wesleyan Univ. Arizona State University Creighton University Indiana University Auburn University Dartmouth College Iowa State University Baylor University Davidson College Jacksonville University Belmont University DePaul University Kenyon College Beloit College DePauw University Knox College Benedictine University Drake University Lake Forest College Bethany Lutheran College Duke University Lakeland College Boston College Earlham College Lawrence University Boston University Eastern Illinois University Louisiana State University Bradley University Edgewood College Loyola Marymount University Brown University Emerson College Loyola University-Chicago Bucknell University Emory University Marian University California Polytechnic State Fairfield University Marquette University Univ-San Luis Obispo Florida Atlantic University Martin Luther College California State University Florida International Univ. Mercer University -Northridge -

Spring 2021 Online College Fair Participants – April 22

Spring 2021 Online College Fair Participants – April 22 Allen College Mount Mercy University Augustana University Nebraska Wesleyan University Aveda Institute Des Moines North Iowa Area Community College Bellevue University Northeast Community College (Nebraska) Briar Cliff University Northeast Iowa Community College Buena Vista University Northwest Iowa Community College Central College Northwestern College Clarke University Peru State College Clarkson College Saint Mary's University of Minnesota Coe College Simpson College Cornell College South Dakota School of Mines Creighton University South Dakota State University Dakota State University Southeast Technical College DMACC Southeastern Community College Drake University Southwest Minnesota State University Eastern Iowa Community Colleges St. Ambrose University Grand View University St. Luke's College Grinnell College University of Dubuque Hawkeye Community College University of Iowa Indian Hills Community College University of Nebraska - Lincoln Iowa Central Community College University of Nebraska at Omaha Iowa Lakes Community College University of Northern Iowa Iowa State University University of Sioux Falls Iowa Wesleyan University University of South Dakota Iowa Western Community College University of Wisconsin - Eau Claire Kirkwood Community College University of Wisconsin - La Crosse Luther College University of Wisconsin - Platteville Mercy College of Health Sciences Upper Iowa University Michigan Technological University Van Wall Equipment Midland University Waldorf University Minnesota State University, Mankato Wartburg College Minnesota West Community & Technical College Wayne State College Missouri Western State University William Penn University Morningside University Winona State University . -

FALL 2007 Sp2007orts Schedules

VOL. XXVII, NO. 4 NO. XXVII, VOL. MonmouthMAGAZINE UNIVERSITY Groundbreaking For The MAC Unearthing Joseph Bonaparte’s Royal Residence Memories Of Vietnam Celebrating 10 Years Of Ex-Ed MonmouthMAGAZINE CALENDAR UNIVERSITY O F E V E N T S VOL. XXVII, NO. 4 2007 ALUMNI EVENTS PAUL G. GAFFNEY II President NOVEMBER 1-8 FEBRUARY 16 Alumni trip to Peru, including Machu Wine Tasting JEFFERY N. MILLS Picchu Wilson Hall—6-8 PM Vice President for University Advancement JANUARY 19 Publisher Beer Tasting MARILYNN W. PERRY Magill Commons—7-9 PM Director of Alumni Affairs SPECIAL EVENTS For more information, contact 732-571-3509 or 571-3494 MICHAEL SAYRE MAIDEN, JR. Editor NOVEMBER 9 DECEMBER 1 Sports Hall of Fame Induction Dinner Holiday Ball HEATHER MCCULLOCH MISTRETTA Wilson Hall—6:30 PM-10:30 PM Wilson Hall—8 PM Assistant to Editor Master of Ceremonies—Jack Ford HEATHER MCCULLOCH MISTRETTA SEAN P. SMITH, ‘97 MUSIC & THEATRE PERFORMING ARTS Contributing Writers LAUREN K. WOODS THEATRE NOVEMBER 8 JIM REME Metheny Trio—8 PM University Photographer NOVEMBER 8-18 NOVEMBER 16 R. DAVID BEALES All in the Timing by David Ives Photography 8 PM (3 PM—November 11 and 18) Hampton String Quartet—8 PM DECEMBER 6 DECEMBER 7 R. DAVID BEALES Father Alphonse & Orchestra of Saint ROCHELLE RITACCO Winter Concert (on the Grand Staircase of Peter By the Sea—8 PM Digital Imaging Wilson Hall)—8 PM FEBRUARY 22 DESIGN OF 4 POLLAK THEATRE Screening of State of Fear—7 PM Design For more information contact the box office at 732-263-5730. -

NCAA Div III Pre-National CC Invitational 10/4/2008 Hanover

NCAA Div III Pre-National CC Invitational 10/4/2008 Hanover College Women 6k Run CC ================================================================================== Name Year School Avg Mile Finals Points ================================================================================== 1 #73 Borner, Marie JR Bethel University 5:44.5 21:24.27 1 2 #467 Jordahl, Becca JR Wisconsin River 5:45.5 21:27.99 3 #417 Scherer, Jenny JR St Norbert College 5:47.8 21:36.36 2 4 #389 Stephens, Taylor FR Rhodes College 5:51.8 21:51.60 3 5 #225 Corken, Mary Bridge SR Loras College 5:53.8 21:58.99 4 6 #157 Reich, Lauren JR DePauw University 6:03.4 22:34.70 5 7 #80 Potter, Alex SO Bethel University 6:05.7 22:43.32 6 8 #307 Wentz, Jacqui JR Massachusett 6:06.7 22:47.18 7 9 #145 Case, Alison JR DePauw University 6:07.3 22:49.25 8 10 #380 Covic, Cybil JR Rhodes College 6:08.1 22:52.33 9 11 #322 Beyer, Mary Kate SO Monmouth College 6:09.2 22:56.21 10 12 #130 Wampler, Amy JR Christopher 6:10.3 23:00.36 13 #302 Holt-Gosselin, Anna SO Massachusett 6:11.6 23:05.38 11 14 #297 Bradshaw, Andrea SR Massachusett 6:12.6 23:08.90 12 15 #306 O'Brien, Janice FR Massachusett 6:13.1 23:10.67 13 16 #409 Graybill, Ashley SR St Norbert College 6:13.5 23:12.47 14 17 #236 Weiss, Hannah JR Loras College 6:14.6 23:16.41 15 18 #75 Jelen, Heather SR Bethel University 6:16.3 23:22.61 16 19 #438 Lemire, Allie SR Trinity College 6:18.3 23:30.18 17 20 #56 Symoniak, Mia JR Allegheny College 6:19.2 23:33.63 18 21 #77 Mork, Kristin SO Bethel University 6:20.0 23:36.43 19 22 #235 Stevens, -

Glenbard West School Profile

Glenbard WEST GLENBARD TOWNSHIP HIGH SCHOOL DISTRICT 87 DISTRICT AND COMMUNITY GLENBARD WEST HIGH SCHOOL Glenbard Township High School District 87 is the third largest high school 670 Crescent Blvd district in Illinois. Glenbard District 87 encompasses 45 square miles within Glen Ellyn, IL 60137 DuPage County, a suburban area approximately 25 miles west of Chicago. (630) 469-8600 ph The communities of Glen Ellyn, Carol Stream, Glendale Heights and Lombard (630) 469-8611 fax lie within the district’s boundaries, along with portions of Bloomingdale, www.glenbardwesths.org Hanover Park, Addison, Downers Grove, Wheaton and unincorporated areas. Glenbard District 87’s four comprehensive high schools serve students in CEEB Code: 142075 grades 9-12. These schools are: Glenbard East in Lombard, Glenbard North in Carol Stream, Glenbard South in Glen Ellyn and Glenbard West in Glen Ellyn. PRINCIPAL Of Glenbard District 87’s 8,029 students, 32% come from low-income families. Peter Monaghan The demographic makeup is: white 48.3%, Black 7.1%, Hispanic 25%, Asian 16.2%, (630) 942-7473 American Indian 0.3% and two or more races 3%. Source: 2019-20 Illinois Report Card [email protected] GLENBARD WEST HIGH SCHOOL COUNSELORS Anthony Bergantino (Fr-Ho) Glenbard West High School, which opened in 1922, is one of Glenbard Township (630) 942-7485 High School District 87’s four comprehensive high schools. Glenbard West anthony_ [email protected] serves the Chicago suburban communities of Glen Ellyn, Glendale Heights, Kate Culloton (Rog-Ste) Lombard and Wheaton. (630) 942-7733 Of Glenbard West’s 2,360 students, 24% come from low-income families.