Research in China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

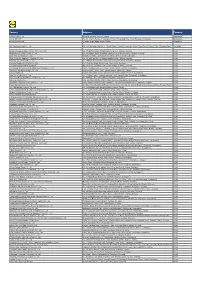

Risk Factors for Carbapenem-Resistant Pseudomonas Aeruginosa, Zhejiang Province, China

Article DOI: https://doi.org/10.3201/eid2510.181699 Risk Factors for Carbapenem-Resistant Pseudomonas aeruginosa, Zhejiang Province, China Appendix Appendix Table. Surveillance for carbapenem-resistant Pseudomonas aeruginosa in hospitals, Zhejiang Province, China, 2015– 2017* Years Hospitals by city Level† Strain identification method‡ excluded§ Hangzhou First 17 People's Liberation Army Hospital 3A VITEK 2 Compact Hangzhou Red Cross Hospital 3A VITEK 2 Compact Hangzhou First People’s Hospital 3A MALDI-TOF MS Hangzhou Children's Hospital 3A VITEK 2 Compact Hangzhou Hospital of Chinese Traditional Hospital 3A Phoenix 100, VITEK 2 Compact Hangzhou Cancer Hospital 3A VITEK 2 Compact Xixi Hospital of Hangzhou 3A VITEK 2 Compact Sir Run Run Shaw Hospital, School of Medicine, Zhejiang University 3A MALDI-TOF MS The Children's Hospital of Zhejiang University School of Medicine 3A MALDI-TOF MS Women's Hospital, School of Medicine, Zhejiang University 3A VITEK 2 Compact The First Affiliated Hospital of Medical School of Zhejiang University 3A MALDI-TOF MS The Second Affiliated Hospital of Zhejiang University School of 3A MALDI-TOF MS Medicine Hangzhou Second People’s Hospital 3A MALDI-TOF MS Zhejiang People's Armed Police Corps Hospital, Hangzhou 3A Phoenix 100 Xinhua Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Provincial People's Hospital 3A MALDI-TOF MS Zhejiang Provincial Hospital of Traditional Chinese Medicine 3A MALDI-TOF MS Tongde Hospital of Zhejiang Province 3A VITEK 2 Compact Zhejiang Hospital 3A MALDI-TOF MS Zhejiang Cancer -

Taizhou Water Group Co., Ltd. 台州市水務集團股份有限公司

The Stock Exchange of Hong Kong Limited and the Securities and Futures Commission take no responsibility for the contents of this Post Hearing Information Pack, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Post Hearing Information Pack. Post Hearing Information Pack of Taizhou Water Group Co., Ltd.* 台州市水務集團股份有限公司 (the “Company”) (a joint stock company incorporated in the People’s Republic of China with limited liability) WARNING The publication of this Post Hearing Information Pack is required by The Stock Exchange of Hong Kong Limited (the “Exchange”)/ the Securities and Futures Commission (the “Commission”) solely for the purpose of providing information to the public in Hong Kong. This Post Hearing Information Pack is in draft form. The information contained in it is incomplete and is subject to change which can be material. By viewing this document, you acknowledge, accept and agree with the Company, its sole sponsor, advisers or member of the underwriting syndicate that: (a) this document is only for the purpose of providing information about the Company to the public in Hong Kong and not for any other purposes. No investment decision should be based on the information contained in this document; (b) the publication of this document or supplemental, revised or replacement pages on the Exchange’s website does not give rise to any obligation of the Company, its sole sponsor, advisers or members of the underwriting syndicate to proceed with an offering in Hong Kong or any other jurisdiction. -

GENERAL PRESENTATION Raymond SU 1 CONTENTCONTENT

INVESTOR DAYS – 21-23 Nov, 2018 GENERAL PRESENTATION Raymond SU 1 CONTENTCONTENT 1. China macro-economics 2. SUPOR business overview 3. Product and market competition 4. Main levers 2 Sound macro-economic backdrop Average growth rate over 4 years GDP growth driven by domestic at 6.8% consumption GDP growth rate Consumption contribution to GDP growth 8.0% 100% 79% 80% 7.5% 67% 60% 59% 60% 7.0% 6.9% 6.9% 6.7% 6.7% 40% 6.5% 20% 6.0% 0% 2015 2016 2017 2018.1-9 2015 2016 2017 2018H1 Source: State Statistical Bureau 3 Consumption upgrade driven by strong structural fundamentals Fast-growing middle-class Stronger consumption-ability by young generation Household number: Consumption in city (million) (tril.USD) 100% 100% 90% 7% 90% 80% 80% 33% 43% 44% 70% 54% 70% 52% 60% 60% 50% 50% 40% 40% 30% 91% 30% 67% 54% 56% 20% 42% 20% 48% 10% 10% 0% 0% 2010 2016 2020E 2011 2016 2021 Mass class Middle Class Wealthy Class Old Generation Young Generation Monthly disposable Monthly disposable Monthly disposable Consumer age 35+ Consumer age 18 - 35 income: income: income: < 12 TCNY 12~26 TCNY > 26 TCNY Source: McKinsey research 2017 Source: BCG research 2017 4 Robust momentum in the cookware market RSP Mil. RMB 25000 2014-17 CAGR 7% 20000 19,459 18,102 16,862 16,035 15000 10000 5000 0 2014 2015 2016 2017 Source: GFK 2014-2017 5 Robust momentum in the small kitchen electric market RSP Mil. RMB 2014-17 CAGR 6% 60,000 55,876 52,134 48,773 50,000 46,652 40,000 30,000 20,000 10,000 - 2014 2015 2016 2017 Source: CMM 2014-2017 6 CONTENTCONTENT 1. -

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Commission Decision of 2 August 2013 Accepting an Undertaking

L 209/26 EN Official Journal of the European Union 3.8.2013 COMMISSION DECISION of 2 August 2013 accepting an undertaking offered in connection with the anti-dumping proceeding concerning imports of crystalline silicon photovoltaic modules and key components (i.e. cells and wafers) originating in or consigned from the People’s Republic of China (2013/423/EU) THE EUROPEAN COMMISSION, consumption on the Union market and are linked to several factors established and analysed in the investi gation that led to the imposition of provisional measures. Having regard to the Treaty on the Functioning of the European Union, (4) Changes in price levels can sometimes be addressed in an undertaking by an indexation method which links Having regard to Council Regulation (EC) No 1225/2009 of minimum import prices to prices of raw materials as 30 November 2009 on protection against dumped imports 1 quoted in recognized and publicly available sources. from countries not members of the European Community ( ) However, no correlation between prices of raw (‘the basic Regulation’), and in particular Articles 7, 8 and 9 materials and those of final products that would allow thereof, for a reliable indexation method could be established in the present case. In order to address an established change in price levels, an alternative method had to be After consulting the Advisory Committee, established and price reports by representative and publicly available databases (Bloomberg ( 3) and pvXchange ( 4)) specialised in the sector concerned have Whereas: been used as a reference. A. PROCEDURE (5) In order to ensure that the undertaking is practicable, the (1) By Regulation (EU) No 513/2013 ( 2 ), the Commission Chinese exporters presented a joint undertaking offer imposed a provisional anti-dumping duty on imports with one minimum import price for photovoltaic into the Union of crystalline silicon photovoltaic modules and one for each of their key components modules and key components (i.e. -

Attachment I

Foreign Producers of Steel Threaded Rod: The People's Republic of China Barcode:3795402-02 A-570-104 INV - Investigation - Shipper Shipper Full Address Shipper Email Shipper Phone Number Shippper Fax Number Shipper Website Aaa Line International Room 502-A01 East Area Bldg., 129 Jiatai Road, Shanghai, Shanghai, China 200000 Not Available +86 21 5054 1289 Not Available Not Available Ace Fastech Co., Ltd. No. 583-28, Chang'An North Road, Wuyan Town, Haiyan, Zhejiang, China, 314300 Not Available Not Available Not Available Not Available Aerospace Precision Corp. (Shanghai) Room 3E, 1903 Pudong Ave., Pudong, Shanghai, China 200120 Not Available +86 187 2262 6510 +86 187 5823 7600 Not Available Aihua Holding Group Co., Ltd. 12F, New Taizhou Building, Jiaojiang, Zhejiang, China, 318000 Not Available +86 576 8868 5829 +86 576 8868 5815 Not Available All Tech Hardware Ltd. Suite 2406, Dragon Pearl Complex, No. 2123 Pudong Ave. Shanghai, China 200135 Not Available Not Available Not Available Not Available All World Shipping Corp. Room 503, Building B, Guangpi Cultural Plaza, No. 2899A Xietu Road, Shanghai, China 20030 [email protected] +86 21 6487 9050 +86 21 6487 9071 allworldshipping.com Alloy Steel Products Inc. No. 188 Siping Road No.89, Hongkou, Shanghai, China 200086 Not Available +86 21 6409 2892 Not Available Not Available America And Asia Products Inc. Rm. 508, No. 188 Siping Road, Hongkou, Shanghai, China 200086 Not Available +86 21 6142 8806 Not Available Not Available Ams No Chinfast Co., Ltd. 68 Qin Shan Road, Haiyan, Jiaxing, Zhejiang, China 314000 Not Available +86 573 8211 9789 Not Available Not Available Ams No Jiaxing Xinyue Standard Parts Co., Ltd. -

Federal Register/Vol. 77, No. 171/Tuesday, September 4, 2012/Notices

53856 Federal Register / Vol. 77, No. 171 / Tuesday, September 4, 2012 / Notices Tianjin Master Fastener Co., Ltd. (a/k/a Yuhuan Yazheng Importing; Tianjin Chentai International Trading Co., Master Fastener Co., Ltd.); Zhangjiagang Lianfeng Metals Products Co., Ltd.; Tianjin Mei Jia Hua Trade Co., Ltd.; Ltd.; Tianjin Jurun Metal Products Co., Ltd.; Tianjin Metals and Minerals; Zhangjiagang Longxiang Packing Materials Tianjin Xiantong Material & Trade Co., Ltd.; Tianjin Port Free Trade Zone Xiangtong Intl. Co., Ltd.; Tradex Group, Inc.; Industry & Trade Corp.; Zhejiang Hungyan Xingzhou Industria; Wintime Import & Export Corporation Tianjin Products & Energy Resources dev. Zhejiang Jinhua Nail Factory; Limited of Zhongshan; Co., Ltd.; Zhejiang Minmetals Sanhe Imp & Exp Co.; Wuhu Shijie Hardware Co., Ltd.; Tianjin Qichuan Metal Products Co., Ltd.; Zhejiang Qifeng Hardware Make Co., Ltd.; Wuhu Sin Lan De Industrial Co., Ltd.; Tianjin Ruiji Metal Products Co., Ltd.; Zhejiang Taizhou Eagle Machinery Co.; Wuxi Chengye Metal Products Co., Ltd.; Tianjin Senbohengtong International; Zhejiang Yiwu Huishun Import/Export Co., Xuzhou CIP International Group Co., Ltd.; Tianjin Senmiao Import and Export Co., Ltd.; Ltd.; Yitian Nanjing Hardware Co., Ltd. Tianjin Shenyuan Steel Producting Group Zhongshan Junlong Nail Manufactures Co., [FR Doc. 2012–21708 Filed 8–31–12; 8:45 am] Co., Ltd.; Ltd.; BILLING CODE 3510–DS–P Tianjin Shishun Metal Product Co., Ltd.; ZJG Lianfeng Metals Product Ltd. Tianjin Shishun Metallic Products Co., Ltd.; Appendix III Tianjin Xiantong Fucheng Gun Nail DEPARTMENT OF COMMERCE Manufacture Co., Ltd.; Companies that filed no-shipment Tianjin Xiantong Juxiang Metal MFG Co., certifications, collectively (‘‘No Shipment International Trade Administration Ltd.; Respondents’’): Tianjin Xinyuansheng Metal Products Co., (1) Jining Huarong Hardware Products Co., [A–570–893] Ltd.; Ltd.; Tianjin Yihao Metallic Products Co., Ltd.; (2) Chiieh Yung Metal Ind. -

Crystalline Silicon Photovoltaic Cells from the People's Republic of China

UNITED STATES DEPARTMENT OF COMMERCE International Trade Administration Washmgton. D.C. 20230 C-570-980 Administrative Review POR: 03/26/12-12/31112 Public Document E&C, Office VII: EB December 31, 2014 MEMORANDUM TO: Paul Piquado Assistant Secretary for Enforcement and Compliance FROM: Gary Taverman ~ Associate Deputy Assistant Secretary for Antidumping and Countervailing Duty Operations SUBJECT: Decision Memorandum for the Preliminary Results of the Countervailing Duty Administrative Review of Crystalline Silicon Photovoltaic Cells, Whether or Not Assembled Into Modules, from the People's Republic of China I. SUMMARY In response to requests from interested parties, the Department of Commerce (Department) is conducting the administrative review of the countervailing duty (CVD) order on crystalline silicon photovoltaic cells, whether or not assembled into modules (Solar Cells), from the People's Republic of China (PRC), covering the period of review (POR) of March 26,2012, through December 31, 2012. The Department of Commerce (Department) preliminarily determines that countervailable subsidies are being provided to producers and exporters of Solar Cells from the PRC. The Department also is rescinding the review of 78 companies for which the Department initiated a review. 1 If these preliminary results are adopted in our final results of review, we will instruct U.S. Customs and Border Protection (CBP) to assess countervailing duties on all appropriate entries of subject merchandise during the POR. Unless extended, we intend to issue final results no later than 120 days from the date of publication of this notice, pursuant to section 751(a)(3)(A) of the Tariff Act of 1930, as amended (the Act). -

Global Factory List As of August 3Rd, 2020

Global Factory List as of August 3rd, 2020 Target is committed to providing increased supply chain transparency. To meet this objective, Target publishes a list of all tier one factories that produce our owned-brand products, national brand products where Target is the importer of record, as well as tier two apparel textile mills and wet processing facilities. Target partners with its vendors and suppliers to maintain an accurate factory list. The list below represents factories as of August 3rd, 2020. This list is subject to change and updates will be provided on a quarterly basis. Factory Name State/Province City Address AMERICAN SAMOA American Samoa Plant Pago Pago 368 Route 1,Tutuila Island ARGENTINA Angel Estrada Cla. S.A, Buenos Aires Ciudad de Buenos Aires Ruta Nacional N 38 Km. 1,155,Provincia de La Rioja AUSTRIA Tiroler Glashuette GmbH Werk: Schneegattern Oberosterreich Lengau Kobernauserwaldstrase 25, BAHRAIN WestPoint Home Bahrain W.L.L. Al Manamah (Al Asimah) Riffa Building #1912, Road # 5146, Block 951,South Alba Industrial Area, Askar BANGLADESH Campex (BD) Limited Chittagong zila Chattogram Building-FS SFB#06, Sector#01, Road#02, Chittagong Export Processing Zone,, Canvas Garments (Pvt.) Ltd Chittagong zila Chattogram 301, North Baizid Bostami Road,,Nasirabad I/A, Canvas Building Chittagong Asian Apparels Chittagong zila Chattogram 132 Nasirabad Indstrial Area,Chattogram Clifton Cotton Mills Ltd Chittagong zila Chattogram CDA plot no-D28,28-d/2 Char Ragmatia Kalurghat, Clifton Textile Chittagong zila Chattogram 180 Nasirabad Industrial Area,Baizid Bostami Road Fashion Watch Limited Chittagong zila Chattogram 1363/A 1364 Askarabad, D.T. Road,Doublemoring, Chattogram, Bangladesh Fortune Apparels Ltd Chittagong zila Chattogram 135/142 Nasirabad Industrial Area,Chattogram KDS Garment Industries Ltd. -

The Order of Local Things: Popular Politics and Religion in Modern

The Order of Local Things: Popular Politics and Religion in Modern Wenzhou, 1840-1940 By Shih-Chieh Lo B.A., National Chung Cheng University, 1997 M.A., National Tsing Hua University, 2000 A.M., Brown University, 2005 Submitted in Partial Fulfillment for the Degree of Doctor of Philosophy in the Department of History at Brown University PROVIDENCE, RHODE ISLAND May 2010 © Copyright 2010 by Shih-Chieh Lo ii This dissertation by Shih-Chieh Lo is accepted in its present form by the Department of History as satisfying the dissertation requirement for the degree of Doctor of Philosophy. Date_____________ ________________________ Mark Swislocki, Advisor Recommendation to the Graduate Council Date_____________ __________________________ Michael Szonyi, Reader Date_____________ __________________________ Mark Swislocki, Reader Date_____________ __________________________ Richard Davis, Reader Approved by the Graduate Council Date______________ ___________________________ Sheila Bonde, Dean of the Graduate School iii Roger, Shih-Chieh Lo (C. J. Low) Date of Birth : August 15, 1974 Place of Birth : Taichung County, Taiwan Education Brown University- Providence, Rhode Island Ph. D in History (May 2010) Brown University - Providence, Rhode Island A. M., History (May 2005) National Tsing Hua University- Hsinchu, Taiwan Master of Arts (June 2000) National Chung-Cheng University - Chaiyi, Taiwan Bachelor of Arts (June 1997) Publications: “地方神明如何平定叛亂:楊府君與溫州地方政治 (1830-1860).” (How a local deity pacified Rebellion: Yangfu Jun and Wenzhou local politics, 1830-1860) Journal of Wenzhou University. Social Sciences 溫州大學學報 社會科學版, Vol. 23, No.2 (March, 2010): 1-13. “ 略論清同治年間台灣戴潮春案與天地會之關係 Was the Dai Chaochun Incident a Triad Rebellion?” Journal of Chinese Ritual, Theatre and Folklore 民俗曲藝 Vol. 138 (December, 2002): 279-303. “ 試探清代台灣的地方精英與地方社會: 以同治年間的戴潮春案為討論中心 Preliminary Understandings of Local Elites and Local Society in Qing Taiwan: A Case Study of the Dai Chaochun Rebellion”. -

Nothing Is Difficult If You Have Ingenuity-Visit Notes of Supor Home Appliance Manufacturing Company GMSCM2018 Fu Qiushi & Xiao Guofang December 27, 2019 Sunny

Nothing is difficult if you have ingenuity-Visit Notes of Supor Home Appliance Manufacturing Company GMSCM2018 Fu Qiushi & Xiao Guofang December 27, 2019 Sunny Today we have met the rare sunshine after the Winter Solstice Festival in Hangzhou. GMSCM2013, 2015, 2017, 2018, 2019, 25 companions crossing 5 grades followed Year 2015 senior Kong Qingqin and Supor companion Zhang Ting to visit Supor Park located at Binjiang Jugong Road under the organization of Professor Ma. Here we visited the stretching, painting, injection and assembly workshops, and had a good lunch at the supplier special dining hall of staff canteen. In the afternoon, we deeply discussed with the management personnel of E-commerce data center, Supply Chain Department etc. of Supor on the inventory prediction of E-commerce channel that the enterprise is currently facing. On one hand, we expressed admiration and appreciation to Supor’s willingness to launch this scene and open communication. On the other hand, it also promoted us to more cherish every meeting, as well as fully applied the communication opportunities with the students of each industry to mobilize the resources, and transfer the knowledge that we learned from class and the knowing of others to solve the practical problems for enterprise and society; “Nothing is difficult if you have ingenuity”, enable the thoughts and practice to magnify the values in collision. Supor that you don’t know Listed Company+Multinational Enterprise As one comprehensive mass household supplies brand, Supor was only one pressure-cooker -

An Analysis of Blood Pressure Screening Results in China—East Asia

European Heart Journal Supplements (2019) 21 (Supplement D), D37–D39 The Heart of the Matter doi:10.1093/eurheartj/suz088 May Measurement Month 2017: an analysis of blood pressure screening results in China—East Asia Xin Chen1, Shao-Kun Xu2, Yan Li2, Chang-Sheng Sheng2, Qian-Hui Guo2,WeiYu3, Wei-Hua Li4, Guo-Bao Tang4, Hai-Feng Zhang5, Yin Dong6, Sheng-Huang Wang7, Hong-Yu Wang8, Jing Yu9, Thomas Beaney10, Xin Xia10, Neil R. Poulter10, and Ji-Guang Wang1,2* 1Department of Hypertension, Ruijin Hospital North, Shanghai Jiaotong University School of Medicine, Xiwang Street 999, Jiading District, Shanghai 201801, China; 2Department of Hypertension, The Shanghai Institute of Hypertension, Ruijin Hospital, Shanghai Jiaotong University School of Medicine, Ruijin 2nd Road 197, Huangpu District, Shanghai 200025, China; 3Department of Cardiology, Zhejiang Hospital, Lingyin Road 12, Xihu District, Hangzhou 310007, Zhejiang Province, China; 4Department of Cardiology, The First Affiliated Hospital of Xiamen University, Zhenhai Road 55, Siming District, Xiamen 361003, Fujian Province, China; 5Department of Cardiology,The First Affiliated Hospital of Nanjing Medical University, Guangzhou Road 300, Gulou District, Nanjing 210029, Jiangsu Province, China; 6Yuhuan Municipal Bureau of Health and Family Planning, Zhuchengdong Road 28, Yuhuan 317600, Zhejiang Province, China; 7Department of Cardiology, Ningbo First Hospital/Ningbo Hospital of Zhejiang University, Liuding Street 59, Haishu District, Ningbo 315010, Zhejiang Province, China; 8Department of Cardiology, Second Hospital of Shanxi Medical University, Wuyi Road 382, Yingze District, Taiyuan 030001, Shanxi Province, China; 9Department of Hypertension, Lanzhou University Second Hospital, Cuiyingmen 82, Chengguan District, Lanzhou 730030, Gansu Province, China; and 10Imperial Clinical Trials Unit, Imperial College London, Stadium House, 68 Wood Lane, London W12 7RH, UK Elevated blood pressure (BP) is a growing burden worldwide, leading to over 10 million deaths each year.