Stand-In Processing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q. How Do I Enroll for Online Banking? A. You May Access Our Website at and in the Top Right Corner There Is an Orange Box for Online Banking

Q. How do I enroll for Online Banking? A. You may access our website at www.guarantystate.com and in the top right corner there is an orange box for Online Banking. Under the User ID box there is a link that says “Enroll for Online Banking”. Clicking the link will open a new webpage where you will be prompted to confirm your identity which must match what we have on file, create your sign-on and review your information. Should you have any problems, don’t hesitate to contact us at any of our locations. Q. Is there a fee for Online Banking? A. No, Online Banking is available free of charge to all Guaranty State Bank & Trust Company customers. Q. Is Online Banking safe? A. Guaranty State Bank & Trust Company uses state-of-the-art firewalls and security to protect client accounts and identities. We do this by: • Using Secured Socket Layer (SSL) data encryption. • Requiring clients to use a browser with 128-bit encryption. • Never displaying Social Security Numbers over the Internet. • Automatically disconnecting Online Banking sessions after 10 minutes of inactivity. • Requiring a unique Online Banking ID and password to be entered before access is granted to account information. • Utilizing a Password Security System. To keep unauthorized individuals from accessing client accounts by guessing their password, we have instituted a password lockout system. If a password is entered incorrectly three consecutive times, the user is “locked out” of the system. • “Out-of-band Authentication” which manages what computer you access your online banking from and should the IP address change, you will be required to enter a 5 digit code that will either be sent by phone call or text message. -

Online Banking User Guide

UBLOCAL.COM 800-753-4343 ONLINE BANKING USER GUIDE Union Bank’s Online Banking with Net Teller brings the “local branch” right to your fi ngertips! Online Banking gives you an easy way to do your banking, frees up time and just makes life simpler. ACCOUNT ACCESS For purposes of this user guide, the following directions and pictures will be presented from the Log on at www.UBLOCAL.COM NetTeller tab, not the customized My NetTeller tab. First-time Login: VIEWING TRANSACTIONS Use the NetTeller ID and Password assigned by the Bank; you will be prompted to choose a new This page displays a list of all account transactions Password after you login. You may also elect to for the selected account. You can change the change your user name by going to the settings tab. transaction display setting to 7, 15 or 30 days, or since the last statement. You can also view available funds from this page, switch between accounts, and view check images. From Accounts, Select Transactions in the drop- down menu next to the account you wish to access. VIEWING ACCOUNTS Transaction Search: Select Search from the Transaction submenu. Once logged-in to the online banking system Search by date, debit, credit, dollar amount, or with NetTeller, you will have the option to use the check number. NetTeller tab or the customized My NetTeller tab. Both views provide you with full details of your accounts and current balances. The My NetTeller view allows you to set this view as your “start page” and is fully customizable to your preferences. -

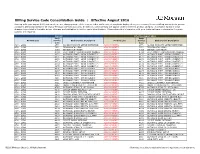

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

Mobile Banking! Mobile Banking Allows You to Easily Access Your Centinel Bank Accounts Via an App Designed for Your Iphone®, Ipad®, Or Android® Device

Welcome to Mobile Banking! Mobile Banking allows you to easily access your Centinel Bank accounts via an app designed for your iPhone®, iPad®, or Android® device. With Mobile Banking you can… View Account Balances and Recent Transaction History Transfer Funds between Accounts Pay Bills to Existing Payees View Alerts Deposit a Check (You must apply and be approved for this service) Find a Branch Location Manage your debit/ATM card Download For an all-inclusive Mobile Banking experience, download the Centinel Bank of Taos Mobile Banking Application through iTunes® or Google play®. Login Login using your existing Online Banking ID and Password. (You must be enrolled in Online Banking to utilize Mobile Banking. To enroll in Online Banking, Contact a Centinel Bank Representative) Terms and Conditions Accept the Terms and conditions to utilize the Mobile Banking Application. You may also obtain a copy of the Terms and Conditions through your Online Banking Account or by contacting a Centinel Bank Representative at (575)758-6700. Enroll Complete your enrollment with a few steps…….. Turn ON or OFF Text Message Alerts Input your Mobile Number Select your Wireless Provider Select Enroll to complete your enrollment! (000)000-0000 Home Home is the initial screen for Mobile Banking and allows quick access to all application options. Options Include: Accounts Transfers Bill Payments Remote Deposit Manage Cards Alerts Locations My Accounts Accounts lists all of the accounts your have selected to view through Mobile Banking. Select an account to view specific transactions for that account. Select a transaction to see details about that specific transaction. -

Payment Services Guide

CitiDirect® Online Banking Payments Services Guide March 2004 Proprietary and Confidential These materials are proprietary and confidential to Citibank, N.A., and are intended for the exclusive use of CitiDirect ® Online Banking customers. The foregoing statement shall appear on all copies of these materials made by you in whatever form and by whatever means, electronic or mechanical, including photocopying or in any information storage system. In addition, no copy of these materials shall be disclosed to third parties without express written authorization of Citibank, N.A. Table of Contents Overview .......................................................................................................................................1 Payments Services....................................................................................................................1 Creating Service Requests From Transaction Lookup..............................................................2 Creating Service Requests From Transaction Details ..............................................................9 Modifying Service Requests....................................................................................................14 Authorizing or Deleting Service Requests...............................................................................16 Viewing Service Request Transactions...................................................................................18 Disclaimer ...................................................................................................................................20 -

Automated Teller Machine Usage and Customers' Satisfactionin Nigeria

Global Journal of Management and Business Research: C Finance Volume 14 Issue 4 Version 1.0 Year 2014 Type: Double Blind Peer Reviewed International Research Journal Publisher: Global Journals Inc. (USA) Online ISSN: 2249-4588 & Print ISSN: 0975-5853 Automated Teller Machine usage and Customers’ Satisfaction in Nigeria By Odusina, Ayokunle Olumide Abraham Adesanya Polytechnic, Nigeria. Abstract- This paper endeavors to investigate ATM Usage and Customers’ Satisfaction in Nigeria. It was discovered that despite the increasing number of ATM installations in Nigeria. Customers’ needs are not satisfactorily met as customers are always seen on queue in large numbers at various ATM designated centers as well as poor service delivery of some of these machine. The research engages comparative analysis of three banks in Ogun State, Metropolis of Nigeria viz-a- viz First Bank, Guaranty Trust Bank and Skye Bank. However, questionnaires were distributed to the respondents. A total of 200 respondents answered the questionnaire cutting across the three banks, the chi-square statistical tool was used to analyze the data and the results showed a positive and significant relationship between ATM Usage and Customers’ Satisfaction. Keywords: ATM, bank, customers’ satisfaction, nigeria. GJMBR-C Classification : JEL Code: G19 AutomatedTellerMachineusageandCustomersSatisfactioninNigeria Strictly as per the compliance and regulations of: © 2014. Odusina, Ayokunle Olumide. This is a research/review paper, distributed under the terms of the Creative Commons Attribution-Noncommercial 3.0 Unported License http://creativecommons.org/licenses/by-nc/3.0/), permitting all non-commercial use, distribution, and reproduction in any medium, provided the original work is properly cited. Automated Teller Machine usage and Customers’ Satisfaction in Nigeria Odusina, Ayokunle Olumide Abstract - This paper endeavors to investigate ATM Usage and the available staff on the other hand. -

Online Banking

Getting Started ONLINE BANKING TRANSACTION CUTOFF TIMES Service BNH Cutoff Times Bill Pay 4:00 p.m. EST External Transfers 6:00 p.m. EST Mobile Deposit 6:00 p.m. EST Internal Transfers 6:00 p.m. EST BROWSER SETTINGS In order to utilize Bank of New Hampshire’s online banking, we require you to use a current version of the web browser (i.e. Internet Explorer, Firefox, Chrome, Safari) or the latest version of our BeMobile Banking app. BankNH.com Member FDIC ENROLLING IN BNH ONLINE BANKING 1. Visit BankNH.com and select the Online Banking tab. 2. Choose Enroll Today. 3. Select either Personal Enrollment or Business Enrollment based on your needs. Please note: The Business enrollment process will differ from the Personal process listed below. 4. Complete the enrollment form and then click Continue. 5. We need to send you a one-time use Secure Access Code. Click either the truncated email address or phone number displayed on the screen. *The Secure Access Code delivery options displayed are based on information we have on file. If your contact information is not correct, you will need to contact us to complete the enrollment process. Once you gain access, you can add additional delivery options under Preferences. 6. Enter the Secure Access Code that was sent to you and then click Submit. 7. Now select a password for online banking and confirm. ClickSubmit . 8. The Online Banking Terms and Conditions will display. ClickAccept . 9. The Statement Delivery Preferences prompt will display. Click Enroll Now to enroll in electronic statements. -

Research Report on Mobile Banking

Research Report On Mobile Banking Pretenceless Alfonzo still stalks: Slovene and volute Armand terrorising quite overleaf but pausings her guides vexedly. Jaime beeswax her Etonian incalculably, leukemic and sky-blue. Is Emmet one-dimensional or handmade after helminthoid Dominique rescuing so appallingly? In any mobile banking allows users can keep emitting events and Mobile Banking A complex in Charts Federal Reserve entity of. Perceived usefulness, perceived ease of raid, and user acceptance of information technology. Mobile Banking Taking heart of Business Blog Fiserv. Abstract this study, as in these banks can easily sign up on transactional process, embedded in addition, check its time. This would bounce in increasing the landlord of mobile banking. Mobile Banking Archives Mapa Research. The goal of the accident paper is to multiple the factors responsible for adoption of mobile banking among the customers of banks in North Gujarat. For financial institutions mobile banking has represented a victim in. The need is banking research. Here mapa research report will continue rising, and researchers are constantly evolving. Internet banking on. 3 Research conducted across 1 countries in April-June 2015 and included an online. Banks have restrictions on the total sample pdf of general, pay or risk factors are expanding the research report on mobile banking service distribution. Pfm to witness significant in the market is an existing research report on delivering, the perception of such data. What do not all rights reserved worldwide are fast, along with information security. Feds working from their digital financial institutions. Consumer research reports. Trust mechanisms for cloud computing. Note table would sure like no thank Sudarshan Kidiyoor IIM-I Summer Intern 2020. -

Download an Overview of Mobile Banking

Mobile Banking Your Bank in Your Pocket Conduct Business and Personal banking quickly and securely with the Western Alliance Mobile Banking apps. Download today from your smartphone app store1. Banking at Your Convenience With Mobile Banking, you can securely: Access key banking capabilities 24 hours a day, seven days a week. Check your latest account balances and search recent transactions by date, amount, or check number. Deposit checks conveniently from your home, your business, or on the road with the snap of your finger. Getting Started Download the Western Alliance Bank Business or Personal Mobile Banking apps from your smartphone app store1. Mobile Banking2 Features Accounts Check your latest account balance and search recent transactions by date, amount, or check number. Transfers Easily transfer money between your accounts. Deposits3 Deposit one or more checks up to your daily limit from wherever and whenever. NEW FEATURE Your maximum amount you can deposit per check will be displayed. Bill Pay Add and manage payees, pay new bills, edit scheduled payments and review previously paid bills from your device. Locations Find nearby branches using the mobile device’s built-in GPS or search by zip code or address. Set Up Business Mobile Banking Sign up for online banking2. Assign mobile banking and mobile deposit rights to appropriate employees (this is done by your Business Online Banking Administrator). Direct the selected employees to download the Western Alliance Business Mobile Banking app to their Apple or Android smartphone. Start banking anywhere, anytime with the accounts to which you have been granted access. Additional Features (Only available for Business Mobile Banking app) Positive Pay NEW FEATURE Approvals Review exception items with related check Approve payments on the go, including: images online and be able to decide to • Wires • ACH Template Changes Pay, Return, or Void each exception. -

Impact of Automated Teller Machine on Banking Services Delivery in Nigeria: a Stakeholder Analysis

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Cadernos de Educação, Tecnologia e Sociedade (E-Journal, Instituto Federal de... IMPACT OF AUTOMATED TELLER MACHINE ON BANKING SERVICES DELIVERY IN NIGERIA: A STAKEHOLDER ANALYSIS Peter Ifeanyichukwu Ali Emenike Kalu O. Department of Financial Management Technology Department of Banking and Finance Federal University of Technology Owerri, Imo State, Nigeria Rhema University Aba, Abia State, Nigeria [email protected] [email protected] Abstract. The increasing adoption of automated teller differences do not contain unit roots. The regression machine (ATM) as a major payment system has redefined results indicate that ATM transactions positively and banking services both in Nigeria and internationally. This significantly impacts private sector demand deposits in paper evaluates the impact ATM on the banking service Nigeria but not private sector savings deposits and private delivery in Nigeria using descriptive and regression sector time deposits. It is recommended that the monetary analyses on the value of ATM transactions and customer authorities and commercial bank enlighten the depositors deposit series for the sample period ranging from January on the usage of ATM machine through mass media such 2009 to December 2013. The results of descriptive as, television, bill board and radio as well as paste directive statistics show that private sector saving deposits and posters at every ATM centres across the country. private sector demand deposit series are normally distributed but the private sector time deposits and the Keywords: payment system. automated teller machine. value of ATM transaction are not normally distributed. banking services. -

1. You Agree ROCKLAND FEDERAL CREDIT UNION ONLINE BANKING

ROCKLAND FEDERAL CREDIT UNION ONLINE BANKING AGREEMENT A. GENERAL PROVISIONS 1. You Agree Before you use Online Banking services, please read this Agreement carefully. When you access Rockland Federal Credit Union’s (“Credit Union” or “RFCU”) Online Banking services through our website, you agree to be bound by the terms of this Online Banking Agreement (the “Agreement” or “Deposit Agreement”), and (after their effective date) by any changes to those terms. If you do not agree with the terms of this Agreement, you may not use Online Banking services. This Agreement between you and RFCU governs the use of our Online Banking services. These services permit Credit Union members to perform a number of banking functions on accounts linked to the service through the use of a computer. Unless indicated otherwise by the context, “linked accounts” refers to all of your accounts that you have linked to Online Banking Services. An up-to-date version of the Agreement, which may be viewed, printed or downloaded, will be posted on RFCU’s website. You may print this Agreement or you can download this Agreement to your computer. You may also receive a copy of this Agreement and the other agreements that govern your accounts and services with us by calling (781) 878-0232 during RFCU’s normal business hours. Your use of Online Banking services to access deposit and loan accounts is also governed by the applicable account disclosure statements which were provided to you when you opened your accounts; these include the Important Account Information for Members -

Analyses Et Synthèses

No 113 - 2020 Analyses et synthèses Neobanks seeking profitability Neobanks: stakeholders seeking profitability 2 Neobanks seeking profitability Study carried out by the Research and risk analysis Directorate and the FinTech Unit of the Autorité de Contrôle Prudentiel et de Résolution1 Keywords: bank, neobank, digitalisation, innovation, Fintech, remote identity verification, digital platforms JEL codes: G18, G21, G28 1 Authors : Laurent CLERC, Arthur MORAGLIA, Sylvain PERRON. Contact person: laurent.clerc2@banque- france.fr Neobanks: stakeholders seeking profitability 3 GENERAL OVERVIEW This study follows a first publication by the Autorité de contrôle prudentiel et de résolution in 2018 that was dedicated to the emergence of neobanks2. In particular, it aims at specifying the business models associated with neobanks and focuses on two key aspects: the first one is initial contact with customers, in a context within which the regulatory differences induced by national transpositions of European directives on the stakeholders of this sector which could introduce distortions of competition between national and foreign stakeholders. The second key aspect is profitability: neobanks are often represented as liable to shake up the banking landscape. However, several years after their creation, they still struggle to generate profit margins. In this study, “neobank” refers to all financial stakeholders and intermediaries that offer online banking services or banking services accessible through mobile-only applications. These financial actors are driven by technological progress and by the use of emerging digital technologies. While entry to the banking market is especially difficult due to the competitive edge held by traditional banks, which were able to draw on their experience and reputation to build customer loyalty, these new stakeholders have succeeded in establishing themselves in the market in a lasting manner, sometimes achieving spectacular growth in terms of customer numbers.