Egypt Economic Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Egypt Education Legacy 35 Years of a Partnership in Education

EGYPT EDUCATION LEGACY 35 YEARS OF A PARTNERSHIP IN EDUCATION January 2012 This report was produced for review by the United States Agency for International Development, Mission to Egypt (USAID/Egypt), under a task order of the Global Evaluation and Monitoring (GEM II) IQC, Contract No. EDH-E-23-08- 00003-00. It was prepared by the Aguirre Division of JBS International, Inc. Cover page photo by GILO project EGYPT EDUCATION LEGACY January 2012 The authors’ views expressed in this publication do not necessarily reflect the views of the United States Agency for International Development or the United States Government. This document is available in printed and online versions. The online version is stored at the Development Experience Clearinghouse (http://dec.usaid.gov). Additional information can be obtained from [email protected]. ACKNOWLEDGMENTS The U.S. Agency for International Development (USAID) would like to express sincere gratitude to the many institutions and people who have made the 35-year partnership in Egypt’s education sector so fruitful. The education system has benefited from the valuable collaboration of many Egyptian officials and policy makers. First, we would like to express our sincere gratitude to the Government of Egypt, primarily the Ministry of Education. Several officials have led this office over the years, and we acknowledge each and every one of them. We are also grateful to staff in departments and units at the central, governorate (Muddiraya), district (Idara), and school levels. Success in the sector is due largely to the support and sincere cooperation of all these key actors. USAID would especially like to thank Dr. -

October 2018

OCTOBER 2018 VOLUME 35 | ISSUE 10 Inside 12 Editor’s Note 14 Viewpoint The Newsroom 16 In Brief An analytical view of the top monthly news Investor Focus 18 Road to Recovery Is Egypt’s apparel industry a potential cash cow? Regional Focus 40 Investing in EGX vs. Tadawul Choosing your best bet American Impact 44 Shadow Banking Is the global economy approaching another crisis? Market Watch 48 Not a Bear Market … Yet © Copyright Business Monthly 2018. All rights reserved. No part of this magazine may be reproduced without the prior written consent of the editor. The opinions expressed in Business Monthly do not necessarily reflect the views of the American Chamber of Commerce in Egypt. 8• Business Monthly - OCTOBER 2018 OCTOBER 2018 VOLUME 35 | ISSUE 10 Cover Story 34 Egypt as a Cashless Society Public and private sector join forces to lessen the dependency on print money Cover Design: Nessim N. Hanna In Depth 22 The Long-Awaited IPO Program Egypt’s equity financing future At a Glance 26 Investing in Egypt A market overview Executive Life 50 A Beautiful Investment Investing in Egypt’s art scene The Chamber 54 Events 63 Exclusive Offers 64 Media Lite An irreverent glance at the press © Copyright Business Monthly 2018. All rights reserved. No part of this magazine may be reproduced without the prior written consent of the editor. The opinions expressed in Business Monthly do not necessarily reflect the views of the American Chamber of Commerce in Egypt. 10 • Business Monthly - OCTOBER 2018 Editor’s Note Director of Publications & Research Khaled F. -

Healthcare Protection Policies During the COVID-19 Pandemic: Lessons Towards the Implementation of the New Egyptian Universal Health Insurance Law

American University in Cairo AUC Knowledge Fountain Faculty Journal Articles 1-31-2021 Healthcare Protection Policies during the COVID-19 Pandemic: Lessons towards the Implementation of the New Egyptian Universal Health Insurance Law Alaa Ghannam Ayman Sebae Follow this and additional works at: https://fount.aucegypt.edu/faculty_journal_articles Part of the Civic and Community Engagement Commons, Community-Based Research Commons, Emergency and Disaster Management Commons, Health Policy Commons, Medicine and Health Commons, Policy Design, Analysis, and Evaluation Commons, Politics and Social Change Commons, Social Policy Commons, and the Social Welfare Commons Recommended Citation APA Citation Ghannam, A. & Sebae, A. (2021). Healthcare Protection Policies during the COVID-19 Pandemic: Lessons towards the Implementation of the New Egyptian Universal Health Insurance Law. Social Protection in Egypt: Mitigating the Socio-Economic Effects of the COVID-19 Pandemic on Vulnerable Employment, https://fount.aucegypt.edu/faculty_journal_articles/876 MLA Citation Ghannam, Alaa, et al. "Healthcare Protection Policies during the COVID-19 Pandemic: Lessons towards the Implementation of the New Egyptian Universal Health Insurance Law." Social Protection in Egypt: Mitigating the Socio-Economic Effects of the COVID-19 Pandemic on Vulnerable Employment, 2021, https://fount.aucegypt.edu/faculty_journal_articles/876 This Research Article is brought to you for free and open access by AUC Knowledge Fountain. It has been accepted for inclusion in Faculty Journal Articles by an authorized administrator of AUC Knowledge Fountain. For more information, please contact [email protected]. Healthcare Protection Policies during the COVID-19 Pandemic: Lessons towards the Implementation of the New Egyptian Universal Health Insurance Law Alaa Ghannam1 and Ayman Sabae2 January 31st, 2021 1 Right to Health Program Director at the Egyptian Initiative for Personal Rights (EIPR). -

School of Business Annual Report 2016

AUC AVENUE • P.O. BOX 74 NEW CAIRO 11835 • EGYPT TEL 20.2.2615.3290 [email protected] WWW.AUCEGYPT.EDU/BUSINESS AUC.BUSINESS AUC_BUSINESS Annual Report 2016 - 2017 TABLE OF CONTENTS 2 Letter from the Dean 6 Vision 2030 8 School Highlights 2016 - 2017 40 Statistics LETTER FROM THE DEAN Nizar Becheikh 1 The academic year 2016 - 2017 has been another year full of achievements for the AUC School of Business. Maintaining our Triple Crown accreditation came to confirm the school’s academic leadership in Egypt, the Arab region, Africa and beyond. We are proud to continue to be the only triple-crown accredited business school in the Middle East and North Africa region, and among less than 1 percent of business schools worldwide to receive the AACSB, EQUIS and AMBA accreditations. The Triple Crown, together with the ACCA accreditation obtained by our Department of Accounting, and the ACCET accreditation received by our Executive Education unit, represent a clear vote of confidence in the school’s strategy, governance and processes, and a recognition of the world-class quality of our programs, the high caliber of our research, and the depth and impact of our engagement at the local, regional and international level. We have also successfully joined CEMS to become the first business school in the Middle East and Africa to join the prestigious Global Alliance in Management Education. Jointly offering the top-ranked CEMS master’s in Management will provide our students with another opportunity to pursue a world-class academic program that is in line with the school’s liberal-arts, experiential-learning and “glocalized” approach to business education. -

Private Equity in Egypt: a Growing Industry

Private Equity and Venture Capital in Emerging Markets: A Case Study of Egypt and the MENA Region By Ayman Ismail BSc in Engineering, American University in Cairo, 1995 MBA, American University in Cairo, 1997 ARCHIVES MCP, Massachusetts Institute of Technology, 1999 Submitted to the Department of Urban Studies and Planning in partial fulfillment of the requirements of the degree of DOCTOR OF PHILOSOPHY MASSACHUSETTS 04MMI r-. in OF TECHNOLOGY INTERNATIONAL ECONOMIC DEVELOPMENT at the SEP 2 4 2009 MASSACHUSETTS INSTITUTE OF TECHNOLOGY LIBRARIES September 2009 © Ayman Ismail. All Rights Reserved. The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document/ in wholer in part. Signature of Author I -- -epetment6 of Urban Studies and Planning / August 24, 2009 Certified by VI Alice H. Amsden Barton L. Weller Professor of Political Economy Thesis Supervisor Accepted by. Eran Ben-Joseph Chair, Ph.D. Committee Z.Z'z Department of Urban Studies and Planning Private Equity and Venture Capital in Emerging Markets: A Case Study of Egypt and the MENA region By Ayman Ismail Submitted to the Department of Urban Studies and Planning on August 10, 2009 in partial fulfillment of the requirements of the degree of Doctor of Philosophy in International Economic Development ABSTRACT Private equity and venture capital investments in emerging markets grew significantly over the past five years (2003-2008), both in absolute and relative terms. In this study, we examine the industry's role in emerging markets, in terms of key actors, business processes, and impact on portfolio companies. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Towards a New Political Order

PDF hosted at the Radboud Repository of the Radboud University Nijmegen The following full text is a postprint version which may differ from the publisher's version. For additional information about this publication click this link. http://hdl.handle.net/2066/150133 Please be advised that this information was generated on 2021-09-29 and may be subject to change. CITIZENSHIP RIGHTS AND THE ARAB UPRISINGS: TOWARDS A NEW POLITICAL ORDER January 2015 Report written by Dr. Roel Meijer in consultation with Laila al-Zwaini Clients of Policy and Operations Evaluations Department (IOB) Ministry of Foreign Affairs The Netherlands I. Table of Contents I. Table of Contents ............................................................................................................................ 1 II. Biographical information authors ................................................................................................... 4 III. List of abbreviations ........................................................................................................................ 5 Figures Figure 1. Overlapping consensus of political currents in the Arab world ........................................... 38 Figure 2. Virtuous circle of citizenship ................................................................................................ 41 Figure 3. Index of the results of the Arab uprisings ............................................................................ 72 INTRODUCTION ...................................................................................................................................... -

Citizenship Rights and the Arab Uprisings: Towards a New Political Order

CITIZENSHIP RIGHTS AND THE ARAB UPRISINGS: TOWARDS A NEW POLITICAL ORDER January 2015 Report written by Dr. Roel Meijer in consultation with Laila al-Zwaini Clients of Policy and Operations Evaluations Department (IOB) Ministry of Foreign Affairs The Netherlands I. Table of Contents I. Table of Contents ............................................................................................................................ 1 II. Biographical information authors ................................................................................................... 4 III. List of abbreviations ........................................................................................................................ 5 Figures Figure 1. Overlapping consensus of political currents in the Arab world ........................................... 38 Figure 2. Virtuous circle of citizenship ................................................................................................ 41 Figure 3. Index of the results of the Arab uprisings ............................................................................ 72 INTRODUCTION ....................................................................................................................................... 7 1 FACTORS AND ACTORS BLOCKING A DEMOCRATIC TRANSITION ................................................. 8 1.0 Introduction ........................................................................................................................ 8 1.1 Islam ................................................................................................................................... -

Renewing the American- Egyptian Alliance

NOVEMBER 2017 / BRIEFING PAPER Renewing the American- Egyptian Alliance SAMUEL TADROS AND ERIC BROWN Renewing the American-Egyptian Alliance 1 © 2017 Hudson Institute, Inc. All rights reserved. For more information about obtaining additional copies of this or other Hudson Institute publications, please visit Hudson’s website, www.hudson.org. ABOUT HUDSON INSTITUTE Hudson Institute is a research organization promoting American leadership and global engagement for a secure, free, and prosperous future. Founded in 1961 by strategist Herman Kahn, Hudson Institute challenges conventional thinking and helps manage strategic transitions to the future through interdisciplinary studies in defense, international relations, economics, health care, technology, culture, and law. Hudson seeks to guide public policy makers and global leaders in government and business through a vigorous program of publications, conferences, policy briefings and recommendations. Visit www.hudson.org for more information. Hudson Institute 1201 Pennsylvania Avenue, N.W. Suite 400 Washington, D.C. 20004 P: 202.974.2400 [email protected] www.hudson.org Cover: Tahrir Square, Cairo, in the early morning. Photo Credit: Frank Schulenburg 2 HUDSON INSTITUTE NOVEMBER 2017 / BRIEFING PAPER Renewing the American- Egyptian Alliance SAMUEL TADROS AND ERIC BROWN ABOUT THE REPORT The following brief on Egypt is part of a series of occasional papers that assess the challenges and opportunities facing governments across North Africa and the Middle East. Specifically, these reports focus on those polities where political stability is increasingly threatened but which, under the right conditions, also hold the potential to become long-term U.S. allies. The analysis and recommendations contained in each brief are largely drawn from field research conducted by the authors, and from interviews with each polity’s political and military leaders, religious and secular actors, and academic community, among others. -

Table of Contents

table of contents Highlights 2008 2 chairman’s statement 4 about eK Holding 6 our Portfolio 10 fertilizers: Investing in Growth 14 energy Gas & Power: Investing in solutions 18 energy oil: Investing in Potential 22 Manufacturing: Investing in Quality 28 Information technology: Investing in Innovation 32 Insurance: Investing in the future 36 our Values 38 executive board 42 board of Directors 44 Management team 48 financial statements 50 2 egypt Kuwait Holding company Annual Report 2008 Annual Report 2008 egypt Kuwait Holding company 1 HIGHlIGHTS 2008: Measured Success Total Assets Revenues Annual Profit Year Year 2002 231.7 2002 21.6 Year 231.7 413.2 437.6 491.0 528 977.5 1,679.00 2003 413.2 21.6 102.1 128.4 117.1 110 236.2 369.3 2003 102.1 1998 5.2 2004 437.6 2004 128.4 5.2 12.1 14.5 16 17.4 20.3 29.0 55.3 56.2 108 119.6 2005 491.0 2005 117.1 2002 2003 2004 2005 2006 2007 2002 2003 2004 2005 2006 2007 1999 12.1 2008 2006 528.02008 2006 109.7 2007 977.5 2007 236.2 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2000 14.5 2008 1,679.0 2008 369.3 0 300 600 900 1,200 1,500 1,800 0 50 100 150 200 250 300 350 400 Total (in USD millions) Total (in USD millions) 2001 16.0 Net Profit Net Worth 2002 17.4 Year Year 2002 17.4 2002 151.9 17.4 20.3 29.0 55.3 56 107.8 119.6 2003 20.3 151.9 156.1 174.8 219.4 275 534.5 568.5 2003 156.1 2003 20.3 2004 29.0 2004 174.8 2005 55.3 2005 219.4 2004 29.0 2002 2003 2004 2005 2006 2007 2002 2003 2004 2005 2006 2007 2008 2006 200856.2 2006 275.4 2007 107.8 2007 534.5 2005 55.3 2008 119.6 2008 568.5 0 20 -

IDH Receives Approval from the Egyptian Exchange for the Dual Listing of Its Ordinary Shares

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION. THIS ANNOUNCEMENT INCLUDES INSIDE INFORMATION. IDH receives approval from the Egyptian Exchange for the dual listing of its ordinary shares Trading on the EGP-denominated shares will be under the ticker code IDHC.CA, with listing being complementary to the trading of IDH's shares on the London Stock Exchange 5 May 2021 (Cairo and London) — Integrated Diagnostics Holdings ("IDH," "the Company" or "the Group," IDHC on the London Stock Exchange), a leading consumer healthcare company with operations in Egypt, Jordan, Sudan, and Nigeria, announces that it has received approval from the Egyptian Exchange ("the EGX") listing committee for the dual listing of the Company's ordinary shares on the EGX's main market under the EGX ticker code IDHC.CA and ISIN code EGS99021C015. With the EGX's approval, IDH has now completed the regulatory requirements necessary for the Company's listing on the EGX. Further, the Company will obtain approval from the Egyptian Financial Regulatory Authority ("FRA") to proceed with publication of the local disclosure form in connection with the listing and trading on the EGX, as required prior to commencement of trading on the EGX. Further details to follow upon the receipt of the final FRA approval. The technical listing is without any concurrent offering of new shares by the Company, the first of its kind on the EGX, and meets the regulatory requirements of the EGX listing and delisting rules, including a 5% minimum free float (equivalent to 30,000,000 shares) on the exchange. -

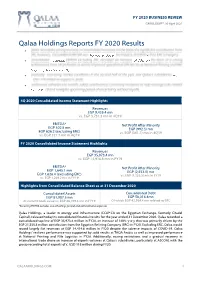

Qalaa Holdings Reports FY 2020 Results •

FY 2020 BUSINESS REVIEW CAIRO, EGYPT: 30 April 2021 Qalaa Holdings Reports FY 2020 Results • • • • 4Q 2020 Consolidated Income Statement Highlights Revenues EGP 9,435.4 mn vs. EGP 3,731.3 mn in 4Q19 EBITDA* Net Profit After Minority EGP 302.8 mn EGP (992.3) mn EGP 626.2 (excluding ERC) vs. EGP (361.1) mn in 4Q19 vs. EGP 327.7 mn in 4Q19 FY 2020 Consolidated Income Statement Highlights Revenues EGP 35,973.4 mn vs. EGP 14,916.8 mn in FY19 EBITDA* Net Profit After Minority EGP 1,645.1 mn EGP (2,553.0) mn EGP 1,626.4 (excluding ERC) vs. EGP (1,135.5) mn in FY19 vs. EGP 1,249.2 mn in FY19 Highlights from Consolidated Balance Sheet as at 31 December 2020 Consolidated Assets Consolidated Debt EGP 81,987.5 mn EGP 58,016.4mn At current book value vs. EGP 86,199.3 mn in FY19 Of which EGP 42,984.4 mn related to ERC *Recurring EBITDA excludes one-off selling, general and administrative expenses Qalaa Holdings, a leader in energy and infrastructure (CCAP.CA on the Egyptian Exchange, formerly Citadel Capital), released today its consolidated financial results for the year ended 31 December 2020. Qalaa recorded a consolidated top line of EGP 35,973.4 million in FY20, an increase of 148% y-o-y that was primarily driven by the EGP 21,558.8 million contribution from the Egyptian Refining Company (ERC) in FY20. Excluding ERC, Qalaa would record largely flat revenues at EGP 14,414.6 million in FY20 despite the adverse impacts of COVID-19.