The Chinese Banking System: Structure, Potential Risks, and Reforms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Public Banks and People's Bank of China: Confronting

Chapter 13 Godfrey Yeung THE PUBLIC BANKS AND PEOPLE’S BANK OF CHINA: CONFRONTING COVID-19 (IF NOT WITHOUT CONTROVERSY) he outbreak of Covid-19 in Wuhan and its subsequent dom- ino effects due to the lock-down in major cities have had a devastating effect on the Chinese economy. China is an Tinteresting case to illustrate what policy instruments the central bank can deploy through state-owned commercial banks (a form of ‘hybrid’ public banks) to buffer the economic shock during times of crisis. In addition to the standardized practice of liquidity injection into the banking system to maintain its financial viability, the Chi- nese central bank issued two top-down and explicit administra- tive directives to state-owned commercial banks: the minimum quota on lending to small- and medium-sized enterprises (MSEs) and non-profitable lending. Notwithstanding its controversy on loopholes related to such lending practices, these pro-active policy directives provide counter-cyclical lending and appear able to pro- vide short-term relief for SMEs from the Covid-19 shock in a timely manner. This has helped to mitigate the devastating impacts of the pandemic on the Chinese economy. 283 Godfrey Yeung INTRODUCTION The outbreak of Covid-19 leading to the lock-down in Wuhan on January 23, 2020 and the subsequent pandemic had significant im- pacts on the Chinese economy. China’s policy response regarding the banking system has helped to mitigate the devastating impacts of pandemic on the Chinese economy. Before we review the measures implemented by the Chinese gov- ernment, it is important for us to give a brief overview of the roles of two major group of actors (institutions) in the banking system. -

China Construction Bank 2018 Reduced U.S. Resolution Plan Public Section

China Construction Bank 2018 Reduced U.S. Resolution Plan Public Section 1 Table of Contents Introduction .................................................................................................................................................. 3 Overview of China Construction Bank Corporation ...................................................................................... 3 1. Material Entities .................................................................................................................................... 4 2. Core Business Lines ............................................................................................................................... 4 3. Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources .................... 5 3.1 Balance Sheet Information ........................................................................................................... 5 3.2 Major Funding Sources ................................................................................................................. 8 3.3 Capital ........................................................................................................................................... 8 4. Derivatives Activities and Hedging Activities ........................................................................................ 8 5. Memberships in Material Payment, Clearing and Settlement Systems ............................................... 8 6. Description of Foreign Operations ....................................................................................................... -

Inward Remittance — Quick Reference Guide

Inward Remittance — Quick Reference Guide How to instruct a Remitting Bank to remit funds to your account with BOCHK Please instruct the Remitting Bank to send a detailed payment instruction in SWIFT MT103 format to us using the below SWIFT BIC of BOCHK. To designate BOCHK as the Beneficiary’s bank, please provide below details. SWIFT BIC: BKCHHKHHXXX Bank Name: BANK OF CHINA (HONG KONG) LIMITED, HONG KONG Main Address: BANK OF CHINA TOWER, 1 GARDEN ROAD, CENTRAL, HONG KONG Bank Code: 012 (for local bank transfer CHATS / RTGS only) Please provide details of your account for depositing the remittance proceeds. Beneficiary’s Account Number: Please provide the 14-digit account number to deposit the incoming funds. (Please refer to Part 3 for further explanation.) Beneficiary’s Name: Please provide the name of the above account number as in our record. Major Clearing Arrangement and Correspondent Banks of BOCHK CCY SWIFT BIC Name of Bank Details Bank of China (Hong Kong) Ltd - RMB BKCHHKHH838 BOCHK’s CNAPS No.: 9895 8400 1207 Clearing Centre CNY BKCHCNBJXXX Bank of China Head Office, Beijing Direct Participant of CIPS (Payment through CIPS) BKCHCNBJS00 Bank of China, Shanghai Correspondent Bank of BOCHK in the mainland CCY SWIFT BIC Name of Bank CCY SWIFT BIC Name of Bank AUD BKCHAU2SXXX Bank of China, Sydney NOK DNBANOKKXXX DNB Bank ASA, Oslo Bank Islam Brunei Darussalam NZD BND BIBDBNBBXXX ANZBNZ22XXX ANZ National Bank Ltd, Wellington Berhad CAD BKCHCATTXXX Bank of China (Canada), Toronto SEK NDEASESSXXX Nordea Bank AB (Publ), Stockholm CHF UBSWCHZH80A UBS Switzerland AG, Zurich SGD BKCHSGSGXXX Bank of China, Singapore DKK DABADKKKXXX Danske Bank A/S, Copenhagen THB BKKBTHBKXXX Bangkok Bank Public Co Ltd, Bangkok Commerzbank AG, Frankfurt AM COBADEFFXXX CHASUS33XXX JPMorgan Chase Bank NA, New York EUR Main BKCHDEFFXXX Bank of China, Frankfurt USD CITIUS33XXX Citibank New York GBP BKCHGB2LXXX Bank of China, London BOFAUS3NXXX Bank of America, N.A. -

Chinese Construction Bank

China Construction Bank 2013 Tailored U.S. Resolution Plan Public Section 1 Table of Contents Introduction .................................................................................................................................................. 3 Overview of China Construction Bank Corporation ...................................................................................... 3 1. Material Entities .................................................................................................................................... 4 2. Core Business Lines ............................................................................................................................... 4 3. Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources .................... 5 3.1 Balance Sheet Information ........................................................................................................... 5 3.2 Major Funding Sources ................................................................................................................. 7 3.3 Capital ........................................................................................................................................... 7 4. Derivatives Activities and Hedging Activities ........................................................................................ 7 5. Memberships in Material Payment, Clearing and Settlement Systems ............................................... 7 6. Description of Foreign Operations ....................................................................................................... -

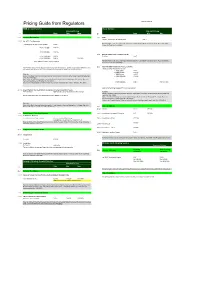

Pricing Guide from Regulators Version 2013-03

Pricing Guide from Regulators Version 2013-03 RMB Account Service Trade Service Standard Pricing Standard Pricing Z1 Rate Min. Max. Z3 Rate Min. Max. Z1.1 Outward Remittance Z3.1 Draft Issuance of Bank Accepted Draft (BAD) 0.05% Z1.1.1 Via HVPS - Per Transaction Ruled by: Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking - Handling Fee: Amount <= CNY10,000.- CNY5.- Settlement Tariff (No. 184 [1996]) <= CNY100,000.- CNY10.- <= CNY500,000.- CNY15.- Z3.2 Bank Accepted Draft / Commercial Draft <= CNY1,000,000.- CNY20.- Per Batch CNY7.- > CNY1,000,000.- 0.002% CNY200.- Ruled by: Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking Plus additional handling charge CNY0.50.- Settlement Tariff (No. 184 [1996]) Z3.3 Domestic RMB Remittance (Through CNAPS) Note: The bank will use the best approach to process your payment instruction. However, the procedure in different city may vary, which in term affects our price. We encourage you to check with the related branch for the exact price. Handling Charge: Transaction Amount <= RMB10,000.- CNY5.- <= RMB100,000.- CNY10.- Ruled by: <= RMB500,000.- CNY15.- Notice of the State Planning Commission and the People's Bank of China on further Rules of Banking Settlement <= RMB1,000,000.- CNY20.- Tariff (No. 184 [1996]) Notice of the State Planning Commission and the People's Bank of China on Making the Fee Charge Rates for Electronic Remittance and Transfer (No. 791 [2001]). > RMB1,000,000.- 0.002% Flat CNY200.- Notice of the People's Bank of China on Rules of Electronic Remittance and Transfe Tariff (No. -

Bank of China (UK) Limited for Apparent Violations of the Sudan Sanctions Regulations

DEPARTMENT OF THE TREASURY WASHINGTON, D.C. Enforcement Release: August 26, 2021 OFAC Enters Into a $2,329,991 Settlement with Bank of China (UK) Limited for Apparent Violations of the Sudan Sanctions Regulations Bank of China (UK) Limited (“BOC UK”), located in London, the United Kingdom, has agreed to remit $2,329,991 to settle its potential civil liability for processing transactions in apparent violation of OFAC’s now-repealed Sudan sanctions program, which prohibited the exportation, directly or indirectly, to Sudan of any goods, technology, or services from the United States. Specifically, between September 4, 2014 and February 24, 2016, BOC UK exported financial services from the U.S. by processing 111 commercial transactions totaling $40,599,184 through the U.S. financial system on behalf of parties in Sudan. This settlement amount reflects OFAC’s determination that BOC UK’s self-identified apparent violations were voluntarily self-disclosed and constitute a non- egregious case. Description of the Conduct Leading to the Apparent Violations As a result of an internal investigation triggered by a Sudanese customer’s request to process a payment, BOC UK conducted a lookback review to identify potential Sudan-related transactions. That review identified two customers of BOC UK who had engaged in Sudan-related transactions that BOC UK processed through the U.S. financial system. One of the customers was an entity incorporated outside of Sudan that maintained a branch in Sudan that, in 2014, became the instructing party and account signatory to transactions processed by BOC UK on behalf of the entity. Written communications from that customer contained references to the location of the branch in Sudan. -

2020 Annual Report Contents

2020 Annual Report Contents ABOUT US CORPORATE GOVERNANCE i Five-Year Summary 116 Corporate Governance Report 1 Introduction 131 Changes in the Share Capital and ’ 2 Business Performance at a Glance Shareholders Profile Directors, Supervisors, Senior Management 4 Chairman’s Statement 134 and Employees 152 Report of the Board of Directors and MANAGEMENT DISCUSSION AND ANALYSIS Significant Events 170 Report of the Supervisory Committee 8 Customer Development 14 Technology-Powered Business Transformation FINANCIAL STATEMENTS 20 Business Analysis 20 Performance Overview 172 Independent Auditor’s Report 23 Life and Health Insurance Business 179 Consolidated Income Statement 32 Property and Casualty Insurance Business 180 Consolidated Statement of Comprehensive 38 Investment Portfolio of Insurance Funds Income 181 Consolidated Statement of Financial Position 44 Banking Business 183 Consolidated Statement of Changes In Equity 54 Asset Management Business 184 Consolidated Statement of Cash Flows 60 Technology Business 185 Notes to Consolidated Financial Statements 68 Analysis of Embedded Value 79 Liquidity and Capital Resources 85 Risk Management OTHER INFORMATION 100 Sustainability 327 Ping An Milestones 113 Prospects of Future Development 328 Honors and Awards 329 Glossary 332 Corporate Information Cautionary Statements Regarding Forward-Looking Statements To the extent any statements made in this Report contain information that is not historical, these statements are essentially forward- looking. These forward-looking statements include but are not limited to projections, targets, estimates and business plans that the Company expects or anticipates may or may not occur in the future. Words such as “potential”, “estimates”, “expects”, “anticipates”, “objective”, “intends”, “plans”, “believes”, “will”, “may”, “should”, variations of these words and similar expressions are intended to identify forward-looking statements. -

Notice of Annual General Meeting for the Year 2020

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 中國石油天然氣股份有限公司 PETROCHINA COMPANY LIMITED (a joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 857) NOTICE OF ANNUAL GENERAL MEETING FOR THE YEAR 2020 NOTICE IS HEREBY GIVEN that an annual general meeting of PetroChina Company Limited (the “Company”) for the year 2020 will be held at V-Continent Wuzhou Hotel, No. 8, North 4th Circle, Middle Road, Chaoyang District, Beijing, the PRC on Thursday, 10 June 2021 at 9:00 a.m. to consider, approve and authorise the following matters: ORDINARY RESOLUTIONS To consider and, if thought fit, to pass the following as ordinary resolutions: 1. To consider and approve the report of the board of directors of the Company (the “Board”) for the year 2020; 2. To consider and approve the report of the supervisory committee of the Company for the year 2020; 3. To consider and approve the financial report of the Company for the year 2020; 4. To consider and approve the declaration and payment of the final dividends for the year ended 31 December 2020 in the amount and in the manner recommended by the Board; 5. To consider and approve the authorisation of the Board to determine the distribution of interim dividends for the year 2021; 6. -

RFID and China

RFID and China China is the manufacturing capital of the world and the largest market for technology. Currently, the country is home to 95 million Internet users. With usage growing faster then 20 percent a year, China will have more Internet users than any other country by 2006. It already has the largest installed base of both landlines (314 million) and mobile telephones (334 million). Within this economic framework, China lays claim to being the largest potential RFID market in the world. And since the standards bearer holds an economic advantage, Chinese political officials have stated that their nation needs to be involved in the setting of RFID standards. In late April, a group of senior Chinese government officials discussed their views at the RFID China Forum (RCF) in Beijing. The RCF was the largest and most influential RFID gathering in mainland China, attended by representatives of the Chinese, American and Korean governments. It featured more than 50 speakers from such organizations as IBM, Microsoft, Oracle, Savi Technology, Nokia, NTT Data, ISO, UID, EPCglobal, CompTIA and the Korean Association of RFID. The event also included five key Chinese government officials, including the three department heads of the Ministry of Information Industry, which is leading the formation of China’s RFID standards. Standards and Strategy China’s central government believes standard setting is a strategic activity to forge the following objectives: convert trading power to technology power; develop intellectual property (IP); and use RFID as an inflection point in China’s quest for high-tech differentiation and infrastructure efficacy in the global market. -

Bank of Communications Co., Ltd

Bank of Communications Co., Ltd. Bank of Communications Co., Ltd. (A joint stock company incorporated in the People’s Republic of China with limited liability) Address and Postcode 2020 188 Yin Cheng Zhong Lu, Pudong New District, Shanghai, P.R. China 200120 Annual Report www.bankcomm.com Contents Important Reminders 02 Definitions 03 General Information 04 Financial Highlights 07 Statement from Chairman of the Board of Directors 08 Statement from President 12 Management Discussion and Analysis Economic and Financial Environment 17 Financial Statement Analysis 17 Business Review 34 Risk Management 59 Deepen the Reform 69 Outlook 71 After restructuring, BoCom BoCom was listed BoCom is one of the became the first nationwide on the Hong Kong note-issuing banks with state-owned joint-stock Stock Exchange. the longest history in commercial bank in China modern China. 2005 Founded in 1987 1908 i Bank of Communications Co., Ltd. Corporate Governance Changes in Shares and Shareholders 73 Directors, Supervisors, Senior Management and Human Resource Management 81 Corporate Governance Report 103 Report of the Board of Directors 120 Report of the Board of Supervisors 126 Social Responsibilities 130 Significant Events 132 Organisation Chart and List of Institutions 134 Consolidated Financial Statements and Others Independent Auditor’s Report 141 Consolidated Financial Statements 148 Notes to the Consolidated Financial Statements 154 Unaudited Supplementary Financial Information 298 Supplementary Information on Leverage Ratio, Liquidity Coverage Ratio and 305 Net Stable Funding Ratio BoCom carries out FinTech and digital transformation. BoCom builds the leading bank The State Council approved the Scheme on the Deepening in the Yangtze River Delta. -

The Globalization of Chinese Energy Companies: the Role of State Finance

Global Economic Governance Initiative The Globalization of Chinese Energy Companies: The Role of State Finance Bo Kong Kevin P. Gallagher Boston University’s Global Economic Governance Initiative (GEGI) is a research program of the Frederick S. Pardee School of Global Studies, the Frederick S. Pardee Center for the Study of the Longer- Global Economic Range Future, and the Center for Finance, Law & Policy at Boston University. GEGI was founded in 2008 Governance Initiative to advance policy-relevant knowledge about governance for financial stability, human development, and the environment www.bu.edu/gegi. Bo Kong is a non-resident faculty fellow at Boston University’s Global Economic Governance Initiative and the ConocoPhillips Petroleum Professor of Chinese and Asian Studies and Assistant Professor at the University of Oklahoma’s College of International Studies. He is also Senior Fellow of the Foreign Policy Institute of the Johns Hopkins University School of Advanced International Studies (SAIS), Senior Associate in the Energy and National Security Program of the Center for Strategic and International Studies (CSIS), member of the Advisory Board for the Revenue Watch Institute, member of the International Editorial Board for the Universiti of Kebangsaan Malaysia’ journal— JEBAT: Malaysian Journal of History, Politics, and Strategic Studies, and member of the ChinaFAQs Expert Group. Kevin P. Gallagher is a Professor of Global Development Policy at Boston University’s Frederick S. Pardee School of Global Studies, where he co-directs the Global Economic Governance Initiative. His latest books are The China Triangle: Latin America’s China Boom and the Fate of the Washington Consensus and Ruling Capital: Emerging Markets and the Reregulation of Cross-border Finance. -

Industrial and Commercial Bank of China Limited First Quarterly Report of 2021

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Stock Code: 1398 EUR Preference Shares Stock Code: 4604 USD Preference Shares Stock Code: 4620 INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED FIRST QUARTERLY REPORT OF 2021 The Board of Directors of Industrial and Commercial Bank of China Limited (“the Bank”) announces the results of the Bank and its subsidiaries (“the Group”) for the first quarter ended 31 March 2021. This announcement is made in accordance with Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) and Rule 13.09 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited. 1. IMPORTANT NOTICE 1.1 The Board of Directors, the Board of Supervisors, Directors, Supervisors and Senior Management members of Industrial and Commercial Bank of China Limited undertake that the information in this report contains no false record, misleading statement or material omission, and assume individual and joint and several liability for the authenticity, accuracy and completeness of the information in this report. 1.2 The First Quarterly Report of 2021 has been considered and approved at the meeting of the Board of Directors of the Bank held on 29 April 2021. All directors of the Bank attended the meeting.