Open Protocol I Revised

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The JPY/AUD Carry Trade and Its Causal Linkages to Other Markets

The JPY/AUD Carry Trade and Its Causal Linkages to Other Markets Brian D. Deaton McMurry University This study analyzes the causal structure underlying the popular Japanese Yen/Australian Dollar (JPY/AUD) carry trade and related financial variables. Three causal search algorithms are employed to find the relationships amongst the JPY/AUD exchange rate, the S&P 500 stock index, the Nikkei 225 stock index, the Australian Securities Exchange 200 stock index, the 10-year U.S. Treasury Note, the 10- year Japanese government bond, and the 10-year Australian government bond. The results from all three algorithms provide evidence against the theory of uncovered interest rate parity. Keywords: currency carry trade, uncovered interest rate parity, causality, vector autoregression, market linkages INTRODUCTION Long used by hedge funds and institutional investors, currency carry trade investment strategies are now becoming popular with individual investors. Several exchange-traded vehicles, such as the Invesco DB G10 Harvest Fund and the iPath Optimized Currency Carry ETN, have been developed to make it easy for the small investor to participate in carry trade strategies. The popularity of carry trade strategies coupled with ever increasing financial integration between financial markets might lead to spillover effects from currencies to stocks and bonds or vice versa. It is the goal of this paper look for these types of linkages between markets. A currency carry trade is constructed by borrowing money in a currency with low interest rates (funding currency) and simultaneously investing that money in a currency with higher interest rates (target currency) with the goal of profiting on the interest rate differential. -

Connectedness Between Exchange Rates: How Machine Learning Opens up Fresh Insights Timo Bettendorf and Reinhold Heinlein

Research Brief 28th edition – September 2019 Connectedness between exchange rates: how machine learning opens up fresh insights Timo Bettendorf and Reinhold Heinlein Are the exchange rates between certain currencies more What our study shows is that the results of such an estimation closely connected than those of other currencies? Answers depend, in some cases considerably, on how the contempo- to this question can be provided by econometric methods. A raneous relationships between the time series are incorporated. new study shows how machine learning can deliver useful Contemporaneous causal structures, especially, had not been insights into this issue. fully taken on board in earlier studies, which is why in our study previously used procedures led to at times considerably Exchange rates are of major importance for macroeconomic biased results. We solve this problem by using an algorithm developments and are often a topic of political debate. In a for machine learning (see Spirtes et al., 2001). This algorithm recent study (Bettendorf and Heinlein, 2019), we study how uses statistical methods to search for contemporaneous causal bilateral exchange rates between various currencies are con- structures between the variables. These causal structures are nected. We show that the US dollar and, surprisingly, the thus obtained from the data and not, as in other studies, Norwegian krone exert a relatively strong influence on other defined by the user. This means that our study generally models currencies. Such a causal relationship between two currencies contemporaneous causal effects better than previously ap- exists if the pattern of one currency’s exchange rate can be plied procedures. -

Currency Order Flow and Real-Time Macroeconomic Information∗

Currency Order Flow and Real-Time Macroeconomic Information Pasquale DELLA CORTE Dagfinn RIME Imperial College London Norges Bank [email protected] [email protected] Lucio SARNO Ilias TSIAKAS Cass Business School & CEPR University of Guelph [email protected] [email protected] February 2013 Acknowledgements: The authors are indebted for constructive comments to Rui Albuquerque, Philippe Bac- chetta, Ekkehart Boehmer, Nicola Borri, Giuseppe De Arcangelis, Martin Evans, Charles Jones, Nengjiu Ju, Michael King, Robert Kosowski, Michael Moore, Marco Pagano, Alessandro Palandri, Lasse Pedersen, Tarun Ramadorai, Thomas Stolper, Adrien Verdelhan, Paolo Vitale, Kathy Yuan, Sarah Zhang and seminar participants at LUISS Guido Carli University, University of Lugano, Warwick Business School, the 2011 Capital Markets and Corporate Finance Meetings in Kunming, the 2011 Central Bank Workshop on the Microstructure of Financial Markets in Stavanger, the 2011 Conference on Advances in the Analysis of Hedge Fund Strategies in London, the 2011 Workshop on Finan- cial Determinants of Exchange Rates in Rome, the 2012 CFA Society Masterclass Series in London, the 2012 SIRE Econometrics Workshop in Glasgow, the 2012 Rimini Conference in Economics and Finance in Toronto, and the 2012 Northern Finance Association Conference in Niagara Falls. We thank UBS for providing the customer order flow data used in this paper. Sarno acknowledges financial support from the Economic and Social Research Council (No. RES-062-23-2340). Tsiakas acknowledges financial support from the Social Sciences and Humanities Research Council of Canada. The views expressed in this paper are those of the authors, and not necessarily those of Norges Bank. -

Time-Varying Global Dollar Risk in Currency Markets

Time-Varying Global Dollar Risk in Currency Markets Ingomar Krohn∗ JOB MARKET PAPER Link to the latest version November 20, 2019 ABSTRACT This paper documents that the price of dollar risk exhibits significant time variation, switching sign after large realized dollar fluctuations, when global dollar demand is high and funding constraints are tight. To exploit this feature of dollar risk, I propose a novel currency investment strategy which is effectively short the dollar in normal states, but long the dollar after large dollar movements. The proposed strategy is not exposed to standard risk factors, yields an annualized return exceeding 4%, and has an annualized Sharpe ratio of 0.34, significantly higher than that of well-known currency strategies. Furthermore, I show that currencies other than the dollar do not exhibit the same sign-switching pattern in their price of risk, consistent with the view that the dollar is special. Keywords: foreign-exchange, U.S. dollar, systematic FX risk, trading strategies, currency betas, FX options, derivative markets. This Version: November 2019. ∗Copenhagen Business School, Solbjerg Pl. 3, 2000 Frederiksberg, DK, Email: [email protected] 1 I. Introduction Conventional wisdom places a special role to the U.S. economy and to its currency in international financial and foreign exchange (FX) markets.1 Indeed, the U.S. dollar is on one side of over 88% of all foreign exchange transactions, it is the dominant invoicing currency, and it is the numeraire of the world's largest equity market.2 However, the literature disagrees on whether the dollar is a unique currency in the sense that it is a risk factor driving risk premia in the cross-section of all other currencies. -

Risk and Return Spillovers Among the G10 Currencies

Risk and return spillovers among the G10 currencies Matthew Greenwood-Nimmoa, Viet Hoang Nguyenb, Barry Raffertya,∗ aDepartment of Economics, University of Melbourne, 111 Barry Street, Melbourne 3053, Australia. bMelbourne Institute of Applied Economic & Social Research, 111 Barry Street, Melbourne 3053, Australia. Abstract We study spillovers among daily returns and innovations in the option-implied risk-neutral volatility and skewness of the G10 currencies. Using an empirical network model, we uncover substantial time variation in the interaction of returns and risk measures, both within and between currencies. We find that aggregate spillover intensity is countercyclical with respect to the federal funds rate and increases in periods of financial stress. Cross-currency spillovers of volatility and especially of skewness increase in times of stress, reflecting greater systematic risk. Similarly, in such times, returns become more sensitive to risk measures and vice versa. Keywords: Foreign exchange markets, risk-neutral volatility, risk-neutral skewness, spillovers, coordinated crash risk. JEL classifications: C58, F31, G01, G15. ∗Corresponding author. Tel.: +61 (0)3-8344-7198. Email addresses: [email protected] (Matthew Greenwood-Nimmo), [email protected] (Viet Hoang Nguyen), [email protected] (Barry Rafferty) 1. Introduction To what extent are currency markets connected to one another? This is a central question facing foreign exchange (FX) investors as they form and manage portfolios conditional on the risk-return profiles of a basket of currencies, typically seeking to manage their exposure to idiosyncratic risk through diversification. Changes in currencies' risk-return profiles will often induce portfolio rebalancing. However, in the act of rebalancing, investors' collective actions are likely to further change the risk-return profiles. -

Consent Order Against Citibank Regarding FOREX

UNITED STATES OF AMERICA DEPARTMENT OF THE TREASURY COMPTROLLER OF THE CURRENCY ) In the Matter of: ) ) AA - EC -14-101 Citibank, N.A. ) Sioux Falls, South Dakota ) ) ) CONSENT ORDER The Comptroller of the Currency of the United States of America ("Comptroller"), through his national bank examiners and other staff of the Office of the Comptroller of the Currency (“OCC”), has conducted an examination of Citibank, N.A., Sioux Falls, South Dakota (“Bank”). The Bank engages in foreign exchange business (including G10 and other currencies, sales and trading in spot, forwards, options, or other derivatives) and the OCC has identified certain deficiencies and unsafe or unsound practices related to the Bank’s wholesale foreign exchange business where it is acting as principal (“FX Trading”). The OCC has informed the Bank of the findings resulting from the examination. The Bank, by and through its duly elected and acting Board of Directors (“Board”), has executed a “Stipulation and Consent to the Issuance of a Consent Order,” dated November 11, 2014, that is accepted by the Comptroller (“Stipulation”). By this Stipulation and Consent, which is incorporated by reference, the Bank has consented to the issuance of this Consent Cease and Desist Order (“Order”) by the Comptroller. The Bank has committed to taking all necessary and appropriate steps to remedy the deficiencies and unsafe or unsound practices identified by the OCC and has begun implementing procedures to remediate the practices addressed in this Order. ARTICLE I COMPTROLLER’S FINDINGS The Comptroller finds, and the Bank neither admits nor denies, the following: (1) The foreign exchange (“FX”) market is one of the largest and most liquid markets in the world. -

Forex Markets Under the Spell of the Corona Crisis

Forex markets under the spell of the corona crisis News from the financial markets The foreign exchange markets have also been rattled by What is meant by “G10 currencies”? the COVID-19 pandemic. The currencies traditionally Many people think of the G10 currencies as being viewed as “safe havens” are in demand, whilst the rest those of the (political) G10 countries. However, the have been left in the dust, with some of them suffering groupings are not an exact match. The G10 actually massive losses. Investors may now be of a mind to bot- comprises eleven countries: Belgium, Canada, tom-fish. However, it is important to take a closer look France, Germany, Italy, Japan, the Netherlands, Swe- before jumping into the water. den, Switzerland, the United Kingdom, and the Unit- The corona crisis has stirred things up in the forex mar- ed States. kets, and several of the less prominent currencies have Belgium, France, Germany and the Netherlands all taken major hits. Amongst the so-called G10 currencies share the euro, so there is room on the G10 currency (see text box at the right), the Norwegian krone has suf- list for others such as the Australian dollar, New Zea- fered severely. As to the emerging market currencies, the land dollar and Norwegian krone. Brazilian real is the standout: It has lost more than 30% of All told, the G10 currencies are: its value since the beginning of the year. On the other hand, relatively little has transpired in the world’s foremost •US dollar (USD) currency pair, namely EUR/USD. -

Case 1:13-Cv-07789-LGS Document 619 Filed 06/03/16 Page 1 of 186

Case 1:13-cv-07789-LGS Document 619 Filed 06/03/16 Page 1 of 186 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ECF CASE IN RE FOREIGN EXCHANGE BENCHMARK RATES ANTITRUST No. 1:13-cv-07789-LGS LITIGATION JURY TRIAL DEMANDED THIRD CONSOLIDATED AMENDED CLASS ACTION COMPLAINT REDACTED Case 1:13-cv-07789-LGS Document 619 Filed 06/03/16 Page 2 of 186 TABLE OF CONTENTS NATURE OF THE ACTION ........................................................................................................ 1 JURISDICTION, VENUE, AND COMMERCE ........................................................................... 5 PARTIES ........................................................................................................................................ 6 Plaintiffs .............................................................................................................................. 6 Defendants ........................................................................................................................ 14 CLASS ACTION ALLEGATIONS .............................................................................................. 22 FACT ALLEGATIONS................................................................................................................ 25 I. THE FX MARKET ................................................................................................... 25 A. Background ........................................................................................................... 25 B. Spot Transactions -

VIA CFTC Portal 29 January 2021 Mr Christopher Kirkpatrick Commodity

VIA CFTC Portal 29 January 2021 Mr Christopher Kirkpatrick Commodity Futures Trading Commission 115 21st Street NW Three Lafayette Centre Washington DC 20581 LCH Limited Self Certification: rule changes related to tenors and currency pairs extensions of NDFs cleared in the ForexClear service Dear Mr Kirkpatrick Pursuant to CFTC regulation §40.6(a), LCH Limited (“LCH”), a derivatives clearing organization registered with the Commodity Futures Trading Commission (the “CFTC”), is submitting for self- certification changes to its rules regarding tenors and currency pairs extensions of Non-Deliverable Forwards (“NDFs”) cleared in the ForexClear service. Part I: Explanation and Analysis The ForexClear service currently clears NDFs on five G10 currency pairs (AUD/EUR/GBP/JPY/CHF vs USD) and 12 emerging market (“EM”) currency pairs with a maximum tenor of two years and settled against USD. ForexClear is extending this term to 5 years for the G10 NDF currency pairs and BRL/USD NDF. In addition, LCH proposes to extend the ForexClear product offering to include NDF Contracts in the following currency pairs (together “the new currency pairs”) settled against USD with a maximum tenor of two years: - USD/Canadian Dollar (“CAD”) - USD/Swedish Krona (“SEK”) - USD/Danish Krone (“DKK”) - USD/Norwegian Krone (“NOK”) - USD/South African Rand (“ZAR”) - USD/Singapore Dollar (“SGD”) - USD/Mexican Peso (MXN) The initiative to add new currency pairs to ForexClear’s product offering is mainly driven by Clearing Members’ demand to benefit from the risk and operational efficiencies on a broader set of products cleared via LCH. Clients will also have access to this extended product offering. -

Global Currency Outlook – Spring 2021

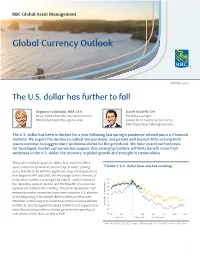

HNW_NRG_B_Inset_Mask Global Currency Outlook SPRING 2021 The U.S. dollar has further to fall Dagmara Fijalkowski, MBA, CFA Daniel Mitchell, CFA Head, Global Fixed Income & Currencies Portfolio manager, RBC Global Asset Management Inc. Global Fixed Income & Currencies RBC Global Asset Management Inc. The U.S. dollar has been in decline for a year following last spring’s pandemic-related panic in financial markets. We expect the decline to outlast the pandemic and persist well beyond 2021, as long-term issues continue to suggest more weakness ahead for the greenback. We have raised our forecasts for developed-market currencies but suspect that emerging markets will likely benefit more from weakness in the U.S. dollar, the recovery in global growth and strength in commodities. The path laid out by past U.S.-dollar bear markets offers some indication of what we should expect in the coming Exhibit 1: U.S. dollar bear-market roadmap years (Exhibit 1). As with the significant long-running declines that began in 1985 and 2002, the first stage of the current U.S.- dollar bear market is proving to be robust – both in terms of 100 the relentless pace of decline and the breadth of currencies 95 90 against which the dollar is falling. Almost all developed- and 85 emerging-market currencies have risen since the U.S. election 80 at the beginning of November. Biden’s election refocused 75 attention on the large U.S. fiscal and current-account deficits 70 (Exhibit 2), and his agenda includes further fiscal support that Indexedto 100 at cycle peak 65 would lead total pandemic-related government spending to 60 55 rise above US$4 trillion, or 16% of GDP. -

Treasury and Federal Reserve Foreign Exchange Operations

TREASURY AND FEDERAL RESERVE FOREIGN EXCHANGE OPERATIONS January – March 2018 The U.S. dollar, as measured by the Federal Reserve Board’s trade-weighted major currencies index, depreciated 1.4 percent in the first quarter of 2018. The dollar was viewed as driven by a variety of factors, including the greater scope for monetary tightening abroad, improving global growth, and an anticipated rise of U.S. fiscal and current account deficits. Among major currencies, the dollar depreciated 2.6 percent against the euro and 5.7 percent against the Japanese yen, and appreciated 2.6 percent against the Canadian dollar. The dollar depreciated against most emerging market currencies, including 7.5 percent against the Mexican peso and 3.6 percent against the Chinese renminbi. The Federal Reserve and U.S. Treasury did not intervene in foreign exchange markets during the quarter. This report, presented by Simon Potter, Executive Vice President, Federal Reserve Bank of New York, and Manager of the System Open Market Account, describes the foreign exchange operations of the U.S. Department of the Treasury and the Federal Reserve System for the period from January through March 2018. Patrick Douglass was primarily responsible for preparation of the report. 1 Chart 1 MAJOR CURRENCY TRADE-WEIGHTED U.S. DOLLAR Index Index 91 91 90 90 89 89 88 88 87 87 86 86 85 85 84 84 September 30 October 31 November 30 December 31 January 31 February 28 March 31 Sources: Board of Governors of the Federal Reserve System; Bloomberg L.P. Chart 2 EURO–U.S. DOLLAR EXCHANGE RATE Dollars per euro Dollars per euro 1.26 1.26 1.24 1.24 1.22 1.22 1.20 1.20 1.18 1.18 1.16 1.16 1.14 1.14 1.12 1.12 September 30 October 31 November 30 December 31 January 31 February 28 March 31 Source: Bloomberg L.P. -

Deviations from Covered Interest Rate Parity∗

Deviations from Covered Interest Rate Parity∗ Wenxin Du y Alexander Tepper z Adrien Verdelhan § Federal Reserve Board Columbia University MIT Sloan and NBER November 2016 Abstract We find that deviations from the covered interest rate parity condition (CIP) imply large, persistent, and systematic arbitrage opportunities in one of the largest asset markets in the world. Contrary to the common view, these deviations for major currencies are not explained away by credit risk or transaction costs. They are particularly strong for forward contracts that appear on the banks’ balance sheets at the end of the quarter, pointing to a causal effect of banking regulation on asset prices. The CIP deviations also appear significantly correlated with other fixed-income spreads and much lower after proxying for banks’ balance sheet costs. Keywords: exchange rates, currency swaps, dollar funding. JEL Classifications: E43, F31, G15. ∗First Draft: November 2, 2015. The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or any other person associated with the Federal Reserve System. We thank Claudio Borio, Francois Cocquemas, Xavier Gabaix, Benjamin Hebert, Arvind Krish- namurthy, Robert McCauley, Charles Engel, Hanno Lustig, Matteo Maggiori, Warren Naphtal, Brent Neiman, Jonathan Parker, Thomas Philippon, Arvind Rajan, Adriano Rampini, Hyun Song Shin, and seminar participants at the Bank for International Settlements, the Federal Reserve Board, MIT Sloan, the Federal Reserve Bank at Dallas – University of Houston Conference on International Economics, the Federal Reserve Bank of Philadelphia, the Federal Reserve Bank of San Francisco, the Bank of Canada, Harvard, the NBER Summer Institute, the MIT Sloan Finance Advisory Board, the International Monetary Fund, the Third International Macro-Finance Conference at Chicago Booth, Vanderbilt, and Washington University for comments and suggestions.