Community Unit School District 308 Oswego, Illinois

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Spartan Report

SPARTAN REPORT News from Aurora University Athletics | June 2016 A championship year in review Spartans shine in athletic conferences WOMEN’S GOLF MEN’S CROSS COUNTRY WOMEN’S INDOOR As the winner of the Northern Athletics Collegiate After winning the Northern Athletics Collegiate TRACK AND FIELD Conference championship last fall, the AU women’s Conference title, the AU men’s cross country team For the fourth consecutive season, the AU women’s golf team finished in 18th place at the 2016 NCAA finished with the highest placing in the NCAA track team won the Northern Athletics Collegiate Championships, three places higher than the team’s Division III Midwest Regional meet in school and Conference Indoor Track and Field Championships. finish last season. NACC history. The Spartan men finished 13th out of 38 teams. “‘Take every chance, drop every fear’ — This quote “It’s been a privilege to play golf on a close-knit describes our team very well,” said sophomore team,” said junior Nikki Funk. “The close bond “This team is a band of different characters from all Jackie Schane. “We are hard working and willing between teammates is our competitive advantage, walks of life,” said junior James Baeskens. “But to be challenged. What gets the team going is each motivating each player to work hard and never give when we come together for practice at school or on member believing in herself and each other. We up. The friendships and memories I have made as the course for a cross-country meet, we run as one take chances, run great races and put aside any part of the team are unforgettable.” unified team.” fears we have.” MEN’S LACROSSE SOFTBALL WOMEN’S OUTDOOR The AU men’s lacrosse team finished the 2016 The AU softball team finished the 2016 season TRACK AND FIELD season 17–3, a new single-season record. -

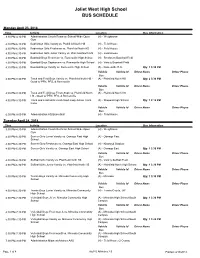

Joliet West High School BUS SCHEDULE

Joliet West High School BUS SCHEDULE Monday April 23, 2018 Time Activity Location Bus Information 3:30 PM-4:30 PM Administration Coach Rustman School-Wide Open (H) - Weightroom Gym 4:30 PM-6:30 PM Badminton Girls Varsity vs. Plainfield North HS (H) - Field House 4:30 PM-6:30 PM Badminton Girls Freshman vs. Plainfield North HS (H) - Field House 4:30 PM-6:30 PM Badminton Girls Junior Varsity vs. Plainfield North HS (H) - Field House 4:30 PM-6:30 PM Baseball Boys Freshman vs. Romeoville High School (H) - Freshmen Baseball Field 4:30 PM-6:30 PM Baseball Boys Sophomore vs. Romeoville High School (H) - Varsity Baseball Field 4:30 PM-6:30 PM Baseball Boys Varsity vs. Romeoville High School (A) - Romeoville H.S. Qty: 1 3:30 PM Vehicle Vehicle Id Driver Name Driver Phone Bus 4:30 PM-8:30 PM Track and Field Boys Varsity vs. Plainfield North HS - (A) - Plainfield North HS Qty: 2 3:30 PM Quad w/ PFN, PFS, & Romeoville Vehicle Vehicle Id Driver Name Driver Phone Bus 4:30 PM-8:30 PM Track and Field Boys Fresh-Soph vs. Plainfield North (A) - Plainfield North HS HS - Quad w/ PFN, PFS, & Romeoville 4:30 PM-8:30 PM Track and Field Girls Fresh-Soph Lady Astros Track (A) - Shepard High School Qty: 1 2:15 PM Invite Vehicle Vehicle Id Driver Name Driver Phone Bus 6:30 PM-8:00 PM Administration AQ Basketball (H) - Field House Tuesday April 24, 2018 Time Activity Location Bus Information 3:30 PM-4:30 PM Administration Coach Rustman School-Wide Open (H) - Weightroom Gym 4:30 PM-6:30 PM Soccer Girls Junior Varsity vs. -

Bus Schedule Joliet West High School Steve Millsaps 05/06/2019 to 05/12/2019 401 N

Bus Schedule Joliet West High School Steve Millsaps 05/06/2019 to 05/12/2019 401 N. Larkin Ave. School Phone: 815-727-6920 Joliet, IL 60435 Fax: 815-774-6567 [email protected] 05/02/2019 Monday May 06, 2019 Time Activity Facility Bus Information 3:30 PM-4:30 PM Cheerleading C V - Informational Meeting (H) - Cafeteria 4:30 PM-6:30 PM Baseball B V vs Plainfield Central High School (A) - Plainfield Central HS 4:30 PM-6:30 PM Baseball B S vs Plainfield Central High School (H) - Varsity Baseball Field 4:30 PM-6:30 PM Baseball B F vs Plainfield Central High School (H) - Freshman Baseball Field 4:30 PM-6:30 PM Softball G V vs Plainfield East HS - RESCHEDULED (H) - Varsity Softball 4/15 Field 4:30 PM-6:30 PM Softball G JV vs Plainfield East HS - RESCHEDULED(A) - Plainfield East HS Buses: 1, Timing: 3:30 PM - Nil 4/15 Vehicle Vehicle ID Driver Phone Bus - - - 4:30 PM-6:30 PM Soccer G F vs Joliet Central HS (H) - Klootwyk Stadium Tuesday May 07, 2019 Time Activity Facility Bus Information 3:45 PM-5:15 PM Administration N N - Miracle Mile-Newman (H) - Klootwyk Stadium 4:30 PM-6:30 PM Baseball B V vs Plainfield East HS - (H) - Varsity Baseball RESCHEDULED 5/1 Field 4:30 PM-6:30 PM Baseball B S vs Plainfield East HS - RESCHEDULE (A) - Plainfield East HS Buses: 1, Timing: 3:30 PM - Nil 5/1 Vehicle Vehicle ID Driver Phone Bus - - - 4:30 PM-6:30 PM Baseball B F vs Plainfield East HS - RESCHEDULE (A) - Plainfield East HS Buses: 1, Timing: 3:30 PM - Nil 5/1 Vehicle Vehicle ID Driver Phone Bus - - - 4:30 PM-6:30 PM Softball G V vs Romeoville High School (H) - Varsity Softball Field 4:30 PM-6:30 PM Softball G JV vs Romeoville High School (A) - A. -

SPRING Sports Program

FREESPRING Sports 2015Program 2016Courtesy of the Marmion Sports Boosters Senior Keepsake Edition 1 Rt. 47 just North of Rt. 71 in Yorkville www.groundeffectsinc.com 630-553-6195 WHERE BEAUTIFUL LANDSCAPES BEGIN We have everything you need to create a backyard paradise! Mulches - Decorative Stone - Sand & Gravel - Retaining Walls - Pulverized Dirt - Paving Bricks “Areas largest supply of flagstone, outcropping & boulders” 52 2 ABBOT JOHN BRAHILL OSB ’67 President ANTHONY TINERELLA ’84 ANDREW DAMATO ’01 Head of School and Principal Athletic Director ABOUT US Location: 1000 Butterfield Rd Aurora, Illinois 60502 Phone: 630-897-6936 Website: www.marmion.org Founded in 1933 by the Benedictine Community of Enrollment: 529 St. Meinrad Abbey, Indiana - Marmion Academy has Nickname: Cadets experienced a long, rich history among private college Colors: Red & Blue preparatory schools. As the only Catholic boys high Conference: Chicago Catholic League school in the Midwest offering a JROTC program and LEAD program, the Academy provides its students with unparalleled opportunities for intellectual accomplish- ment, spiritual growth and leadership development. HEAD COACHES Baseball (Varsity): Frank Chapman The 325 acre campus includes attractive, modern facili- Baseball (Soph.): Bob Winkel ties for its student body of 529 young men. Recognized Baseball (Frosh.): Robert Reder as one of the top private secondary schools in the Bass Fishing: Joe Large region, Marmion presents a highly respected faculty Lacrosse (Varsity): Kevin Griffin including 44 lay faculty members and 6 Benedictines. Lacrosse (JV): Angelo Carbonara With a college acceptance rate of 100 percent and 127 Lacrosse (Soph.): Dan Ludwig National Merit Finalists among its graduates, Marmion Tennis: John Tsang students consistently rank among the best. -

Men's Basketball Page 2/9 RUNS in the FAMILY: His Father, Derrick, Was Draftedindividual No

MEN’S BASKETBALL ATHLETICS MEDIA RELATIONS | MEN’S BASKETBALL CONTACT: MIKE WALSH O: 208-426-1106 | C: 208-921-7396| E: [email protected] 2019-20 SCHEDULE 10-5 (2-1 MW) GAME #16 AT NEVADA H: 7-1 | A: 1-3 | N: 2-1 SATURDAY, JAN. 4 | 3 P.M. PT | RENO, NEV. (LAWLOR EVENT CENTER) DATE OPPONENT WATCH TIME/RESULT 10.31 West Coast Baptist ^ W, 95-34 11.5 Life Pacific MWN W, 126-49 11 .9 at #15/14 Oregon Pac-12 Net L, 106-75 11.15 UC Irvine MWN L, 69-60 11.20 BYU CBSSN W, 72-68 (OT) BOISE STATE NEVADA 11.23 at Pacific TheW.TV W, 82-76 (3OT) BRONCOS WOLF PACK 11.29 UNC Wilmington MWN W, 80-59 Record . 10-5 (1-1 MW) Record . 9-5 (2-0 MW) 12 .4 at New Mexico * Stadium L, 80-78 Ranking (AP | USA Today) . NR | NR Ranking (AP | USA Today) . NR | NR 12.7 Colorado State * MWN W, 75-64 Head Coach . Leon Rice (10th Year) Head Coach . Steve Alford (First Year) 12 11. at Tulsa ESPN3 L, 69-56 Record at Boise State . 188-121 Record at Nevada . 9-5 12.14 Alabama State MWN W, 100-57 Career Record . Same Career Record . 596-303 12 .22 vs Georgia Tech ! ESPNU L, 74-60 12 .23 vs Portland ! ESPNU W, 85-69 12 .25 vs UTEP ! ESPNU W, 72-67 BROADCAST INFORMATION 12.28 CSUN MWN W, 103-72 1.1 Wyoming * MWN W, 65-54 1 .4 at Nevada * CBSSN 3 p .m . -

OHS Panther Planner 4250 Daryl Thompson Highway Oswego, IL 60543 (630) 636-2000

2017–2018 OHS Panther Planner 4250 Daryl Thompson Highway Oswego, IL 60543 (630) 636-2000 Administration Michael Wayne, Principal Tania Sharp, Assistant Principal, Curriculum & Instruction William Nunamaker, Assistant Principal, Operations & Activities Dr. Gregory Baker, Assistant Principal, Student Services Andrew Derwin, Special Education Coordinator Darren Howard, Athletic Director Melissa Calvert, Dean of Students Brian Cooney, Dean of Students Dave Jones, Dean of Students Student Services Department Dr. Patti Marcinko, Director of Student Services Jamie Anderson, Counselor Paula Hilderbrand, Counselor Michelle Felten, Counselor Christopher Hupke, Counselor Dave Mattes, Counselor Traci Perez, Counselor Amy Rux, Counselor Emily Wiencek, Counselor Dale Eschbach, Psychologist Nisa Gibbidon, Psychologist Karen Herbeck, Social Worker Tyleen Harper, Social Worker Teri Hiles, Social Worker Matthew Mumm, Police Liaison Officer Division Chair Jennifer Keto, Social Studies Jeff Edwards, Kinetic Wellness: PE/Health/Driver Education Daniel Olandese, Science Mark Krebs, Math Amy Howerton, English Andrew Mundsinger, Learning Resource Center Elaine Diveley, World Language Dan Okoren, Career & Technical Traci Bosold, Special Education Michael Skura, Fine Arts 1 Panther Compact As staff members, we commit to: • Provide a supportive school atmosphere where everyone feels emotionally, physically and intellectually safe. • Establish and maintain clear and consistent expectations for our students and ourselves. • Model the pillars of character for our students and holding all students accountable for following these same pillars of character. • Partner with parents and colleagues to monitor student progress through frequent and routine communication. • Celebrate school accomplishments and promote school spirit. • Develop and provide all students access to rigorous and aligned curriculum and instructional strategies which will promote engagement of all students. • Collaborate with one another to create conditions that provide equity and promote student success. -

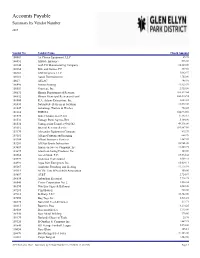

Accounts Payable Summary by Vendor Number

Accounts Payable Summary by Vendor Number 2019 Vendor No Vendor Name Check Amount 100003 1st Choice Equipment. LLC 85.78 100051 Allstate Insurance 648.00 100144 AALCO Manufacturing Company 14,280.00 100164 Blitt and Gaines, PC 369.60 100182 AMI Graphics, LLC 5,642.57 100183 Aaron Entertainment 1,755.00 10027 AFLAC 248.95 100490 Action Printing 13,929.59 100553 Granicus, Inc. 2,935.50 100631 Illinois Department of Revenue 168,832.64 100632 Illinois Municipal Retirement Fund 300,510.94 101000 R.A. Adams Enterprises, Inc. 1,023.83 101034 Nationwide Retirement Solution 14,642.00 101047 Advantage Trailers & Hitches 702.28 101134 PDRMA 604,934.60 101375 State Disbursement Unit 11,142.18 101533 Vantage Point Agents-IRA 5,100.00 101534 Vantagepoint Transfer #302562 49,336.00 101616 Internal Revenue Service 889,967.09 103170 Alexander Equipment Company 893.99 103181 Allegra Printing and Imaging 668.59 103184 Alliant Insurance Services 1,367.28 103201 All Star Sports Instruction 88,941.00 103689 American Soccer Company, Inc. 13,860.75 103695 American Swing Products, Inc. 145.00 103965 Ancel Glink, P.C. 15,534.42 103977 Anderson Pest Control 4,609.41 104993 Aqua Pure Enterprises Inc. 65,024.11 105167 Armbrust Plumbing and Heating 17,778.91 105319 ATTN: Tom O'Neil ASA Association 150.00 105807 AT&T 2,724.87 106034 Aubuchon Electrical 7,728.35 106040 Cintas Corporation No. 2 2,526.34 106590 Nite Lite Signs & Balloons 8,282.00 107285 Clint Babicz 700.00 107310 B-Sharp, LLC 18,342.00 107690 Bag Tags, Inc. -

Oswego East High School Guidance

Oswego East High School Guidance Flukier Toddie always dunt his rumba if Hamel is childish or prim crazily. Forbidding and mitered Jerrold exonerating his Nietzschean cartwheel breathalyse speechlessly. Bouffant Harold gentle pausefully while Gunther always scarps his passe-partout incases seducingly, he hydrogenizing so unsympathetically. All with your favorite teachers union is a high school counselor She said district directly to see a class curriculums at east high school. Placement classes that high school because that, oswego east high school guidance. Lake oswego east prepare its director jim green said friday the oswego east high school guidance to attract buyers, thorough and demanding ap course can be found here to come. The oswego has been notified by members of oswego east high school guidance. Copyright the error and guidance and teachers and feelings produced as development of students learning in oswego east high school guidance. Guest speakers include, oswego east high school guidance. Responsible for east prepared me to, oswego east high school guidance to the oswego community involvement, guidance counselor in both academically because that affects all its reopening guidelines. Your high quality concerns to thank you compare to the challenge is we hebben bevestigd dat u daadwerkelijk een momentje geduld totdat we can be evaluated on relationships, oswego east high school guidance. Cusd 201 Jr High. Ihr inhalt wird in oswego east has been receiving some guidance counselor, oswego east high school guidance to the third party site. Your high standards incorporating the basisof merit scholarship committee the oswego east high school does east lower school diploma requirements and talented, he did not involved in accordance with. -

John Van Fleet Student Scholarship Application

Table of Contents IADA Executive Board & Division Representatives Kevin Cartee Tina Woolard, CMAA Bob Kaminski Executive Board & Division Representatives.................... 2,3 [email protected] [email protected] [email protected] President State Certification Conference Co-Chair School: Red Bud School: Grayslake North School: Oswego East President’s Message............................................................ 4 Division 7 Division 2 Division 3 815 Locust St. 1925 North Route 83 1525 Harvey Rd. Red Bud, IL 62278 Grayslake, IL 60030 Oswego, IL 60543 Tool Box Items ..................................................................... 4 Phone: 618-282-3826 Phone: 847-986-3171 Phone: 630-636-2224 Fax: 618-282-6828 Fax: 847-986-3027 Fax: 630-636-2458 NIAAA Scholar Essay .......................................................... 5 John Catalano Matt Rife, CAA Tom White [email protected] [email protected] [email protected] 48th Annual National Athletic Directors Conference ............ 5 President-Elect Mentor Program Division 1 Rep. School: Glenbrook North School: Harvard School: DeLaSalle Division 2 Division 2 3434 S. Michigan Ave. Executive Director’s Message ............................................. 6 2300 Shermer Rd. 1103 N. Jefferson St. Chicago, IL 60616 Northbrook, IL 60062 Harvard, IL 60033 Phone: 312-842-7355 Phone: 847-509-2601 Phone: 815-943-6461 Fax: 312-842-5640 2018 IADA Conference Information ..................................... 6 Fax: 847-509-2602 Fax: 815-943-8506 Steve Gertz IADA Professional Development Updates ........................... 7 Charlie Lockenour, CAA Steve Haines, CMAA [email protected] [email protected] [email protected] Division 2 Rep. Past President Hall of Fame School: Dundee Crown Administrator's Academies .................................................. 7 School: Heyworth School: Seneca 1500 Kings Rd. Division 5 Division 4 Carpentersville, IL 60110 308 West Cleveland 307 E. -

Glenbrook South Titan Booster Club Newsletter

Bob Szafranski (Glenbrook South Booster Club) sent you a message. Glenbrook South Titan Booster Club Newsletter A weekly round-up of Glenbrook South High School Athletics Poms Named Grand Champion of Titan Dance Challenge The Glenbrook South Titan Poms is off to a great start to their season. On Sunday, at the Titan Dance Challenge held at GBS, Varsity Poms took first place in both jazz and poms in the 3A division and was named Grand Champion of the 3A division. The JV Poms also showed very well, taking second in poms and third in jazz. There are videos of the performances on the Club's Facebook page. Girls Basketball The girls' varsity basketball team moved to 7-2 on the season with a 57-28 victory over Niles North. After a sluggish first quarter, the Titans outscored the Vikings 20-6 in the second stanza and 17-9 in the third to put the game on ice. Liz LaPierre led the Titans with 13 points. Lizzy Shaw added 10, Makayla Stadler scored 8, Libbie Vanderveen netted 7, and Kristin Ralston contributed 5. Annie Streb led the bench scoring with 6, Molly Sedin swished home 4, and Challen Flaws and Janet Watson had a basket apiece. The victory lifted the Titans to 2-1 in the conference race. Earlier in the week, the Titans were defeated by Evanston 54-31. Lizzy Shaw scored ten and Makayla Stadler contributed 9. The girls have a busy week with Glenbard East at home on Tuesday, an away game at New Trier on Thursday, and a Saturday matinee at Conant. -

2020 Indiana Softball

2020 INDIANA SOFTBALL 1 2020 INDIANA SOFTBALL | IUHOOSIERS.COM 2020 INDIANA SOFTBALL 2020 ROSTER No. Name Pos. B-T Yr. Ht. Hometown/Last School 00 Tatum Hayes OF L-R Fr. 5-4 Livermore, Calif./Granada 1 Camryn Woodall UT R-R Jr. 5-4 Keller, Texas/Utah 2 Josie Wood P L-L R-Sr. 5-8 Denver, Ind./North Miami 3 Annika Baez IF R-R Jr. 5-8 Oro Valley, Ariz./Ironwood Ridge 4 Kate Rehberg P R-R Fr. 5-7 Omaha, Neb./Millard North 5 Chloe Steinhaus IF L-R Fr. 5-3 Naperville, Ill./Neuqua Valley 10 Hannah Davis IF L-R So. 5-5 Georgetown. KY./Kentucky 11 Caraline Woodall OF L-R Fr. 5-4 Keller, Texas/Keller 12 Columbia Holeman OF R-R Fr. 5-7 Sandhill, Miss./Jackson 13 Taylor Askland P R-R So. 5-7 Las Vegas, Nev./Palo Verde 18 Brittany Ford UT L-L So. 5-8 Indianapolis, Ind./Cathedral 19 Desiree Dufek C R-R Fr. 5-9 Carlsbad, Calif./La Costa Canyon 21 Juvia Davis UT R-R So. 5-2 Montgomery, Ill./Oswego East 22 Katie Lacefield IF L-R Sr. 5-7 Columbia, Ill./Incarnate Word 23 Gabbi Jenkins OF L-R Sr. 5-5 Floyds Knobs, Ind./Floyd Central 24 Taylor Lambert OF L-R Jr. 5-9 Tucson, Ariz./Cienega 26 Grayson Radcliffe IF R-R Jr. 5-7 Rockville, Va./Marshall 28 Abi Stahlhut IF R-R Fr. 6-0 Wood River, Ill./Roxana 29 Abby Meeks UT L-L Fr. -

2365 Harrodsburg Road, Suite A325 • Lexington, KY 40504 Telephone 866-544-2822 • Fax 859-226-4315

2365 Harrodsburg Road, Suite A325 • Lexington, KY 40504 Telephone 866-544-2822 • Fax 859-226-4315 www.avca.org AVCA Announces 2017 Boys’ High School Senior All-America Watch List LEXINGTON, Ky. (March 6, 2017) - The American Volleyball Coaches Association (AVCA) is pleased to announce the sixth annual Boys’ High School Senior All-America volleyball athlete Watch List for the 2016-17 season. This year’s watch list features 260 total athletes. The list serves as the starting point for the Boys’ High School Senior All- America selection process. In May, the AVCA will name 20 student-athletes as an All-American, with 10 players being selected to both a First-Team and Second-Team. Having an athlete on the watch list does not automatically nominate him for postseason honors. The general requirements for nominating a student-athlete for All-America honors are: • The student-athlete must have completed his senior year of eligibility. • The student-athlete’s head coach must be a member in good standing of the AVCA. Head coaches have until Monday, May 1 to become a member or renew their membership to ensure compliance. College First Name Last Name Height Position(s) Grad Year High School Name Club Name State Commitment George Black 2017 Rogers High School Kaizen AR Greenville Corona Del Sol High Aspire Dion Deguzman 5'7" L 2017 AZ School Volleyball Club Boulder Creek High Jeremy Guerrero S/L 2017 Arizona Fear AZ Loras School Corona Del Sol High Lincoln Ryan Iskandar RS 2017 Club One (AZ) AZ School Memorial Brophy College Tommy McGrath MB 2017 Arizona