The UK Speech Radio Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

Reuters Institute: the Future of Voice and the Implications for News

DIGITAL NEWS PROJECT NOVEMBER 2018 The Future of Voice and the Implications for News Nic Newman Contents About the Author 4 Acknowledgements 4 Executive Summary 5 1. Methodology and Approach 8 2. What is Voice? 10 3. How Voice is Being Used Today 14 4. News Usage in Detail 23 5. Publisher Strategies and Monetisation 32 6. Future Developments and Conclusions 40 References 43 Appendix: List of Interviewees 44 THE REUTERS INSTITUTE FOR THE STUDY OF JOURNALISM About the Author Nic Newman is Senior Research Associate at the Reuters Institute and lead author of the Digital News Report, as well as an annual study looking at trends in technology and journalism. He is also a consultant on digital media, working actively with news companies on product, audience, and business strategies for digital transition. Acknowledgements The author is particularly grateful to media companies and experts for giving their time to share insights for this report in such an enthusiastic and open way. Particular thanks, also, to Peter Stewart for his early encouragement and for his extremely informative daily Alexa ‘flash briefings’ on the ever changing voice scene. The author is also grateful to Differentology andY ouGov for the professionalism with which they carried out the qualitative and quantitative research respectively and for the flexibility in accommodating our complex and often changing requirements. The research team at the Reuters Institute provided valuable advice on methodology and content and the author is grateful to Lucas Graves and Rasmus Kleis Nielsen for their constructive and thoughtful comments on the manuscript. Also thanks to Alex Reid at the Reuters Institute for keeping the publication on track at all times. -

Resolution No. 118 Authorizing an Agreement with Insite Wireless Group for Distributed Antenna System for the Times Union Center

RESOLUTION NO. 118 AUTHORIZING AN AGREEMENT WITH INSITE WIRELESS GROUP FOR DISTRIBUTED ANTENNA SYSTEM FOR THE TIMES UNION CENTER Introduced: 4/12/17 By Civic Center Committee: WHEREAS, The Department of General Services through the Purchasing Agent issued a Request for Proposals regarding a Distributed Antenna System (DAS) for the Times Union Center, and WHEREAS, Four Proposals were received and representatives of the Department of General Services reviewed said Proposals and recommended awarding the contract to InSite Wireless Group as the lowest responsible bidder, and WHEREAS, The Commissioner of the Department of General Services indicated that the Times Union Center and Albany Capital Center will split the projected revenues of $500,000 over a ten year period, guaranteed by InSite Wireless Group with the Times Union Center will retain seventy-five percent of revenues and the Albany Capital Center will retain twenty-five percent of revenues collected and paid by InSite Wireless Group, and WHEREAS, The Commissioner of the Department of General Services has proposed to enter into an agreement with InSite Wireless Group for the DAS project to combine services at the Times Union Center and the Albany Capital Center with InSite Wireless Group is responsible for funding of the project, now, therefore be it RESOLVED, By the Albany County Legislature that the County Executive is authorized to enter into an agreement with InSite Wireless Group regarding a Distributed Antenna System, in collaboration with the Times Union Center and Albany Capital Center for a term commencing May 1, 2017 and ending April 30, 2027, and, be it further RESOLVED, That the County Attorney is authorized to approve said agreement as to form and content, and, be it further RESOLVED, That the Clerk of the County Legislature is directed to forward certified copies of this resolution to the appropriate County Officials. -

Pocketbook for You, in Any Print Style: Including Updated and Filtered Data, However You Want It

Hello Since 1994, Media UK - www.mediauk.com - has contained a full media directory. We now contain media news from over 50 sources, RAJAR and playlist information, the industry's widest selection of radio jobs, and much more - and it's all free. From our directory, we're proud to be able to produce a new edition of the Radio Pocket Book. We've based this on the Radio Authority version that was available when we launched 17 years ago. We hope you find it useful. Enjoy this return of an old favourite: and set mediauk.com on your browser favourites list. James Cridland Managing Director Media UK First published in Great Britain in September 2011 Copyright © 1994-2011 Not At All Bad Ltd. All Rights Reserved. mediauk.com/terms This edition produced October 18, 2011 Set in Book Antiqua Printed on dead trees Published by Not At All Bad Ltd (t/a Media UK) Registered in England, No 6312072 Registered Office (not for correspondence): 96a Curtain Road, London EC2A 3AA 020 7100 1811 [email protected] @mediauk www.mediauk.com Foreword In 1975, when I was 13, I wrote to the IBA to ask for a copy of their latest publication grandly titled Transmitting stations: a Pocket Guide. The year before I had listened with excitement to the launch of our local commercial station, Liverpool's Radio City, and wanted to find out what other stations I might be able to pick up. In those days the Guide covered TV as well as radio, which could only manage to fill two pages – but then there were only 19 “ILR” stations. -

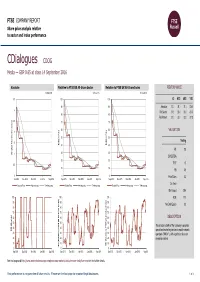

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

Langley Bath Clearwater Middle

Together Forward—Full Steam Ahead! PURPOSE: DIRECTION: TOGETHER FORWARD Full STEAM Ahead! Together We Stand Future Leaders Science Open-Minded Original Thinkers Technology Global Thinkers Responsible Citizens Engineering Encouraging Work Career College Ready Arts Teaching Integrity Advocates for Life-Long Learning Mathematics High Expectations Real World Problem Solvers Enriching Experiences Devoted to Kindness Respect for All ELA Doesn’t Meet ELA Approaches ELA Meets ELA Exceeds South Carolina College andCareer Ready Carolina College South Grade 2018 Grade 2018 Grade 2018 Grade 2018 6 34.6 6 35.7 6 21.1 6 8.6 ELA 7 36.9 7 34.8 7 17.6 7 10.7 8 42.0 8 27.8 8 17.2 8 13.0 ELA Not Met ELA Approaches ELA Met ELA Exemplary Grade 2016 2017 Grade 2017 Grade 2016 2017 Grade 2016 2017 6 22.1 39.6 6 40.6 6 22.1 16.0 6 7.6 3.7 7 29.7 43.2 7 37.9 7 21.3 14.2 7 6.9 4.7 8 31.7 40.5 8 11.8 4.5 8 34.5 8 24.5 20.5 Math Doesn’t Meet Math Approaches Math Meets Math Exceeds Grade 2018 Grade 2018 Grade 2018 Grade 2018 MATH 6 44.8 6 24.6 6 18.6 6 12.0 7 41.5 7 38.8 7 13.8 7 5.9 8 30.2 8 47.9 8 10.7 8 11.2 — SC Ready Math Not Met Math Approaches Math Met Math Exemplary Grade 2016 2017 Grade 2017 Grade 2016 2017 Grade 2016 2017 6 30.8 45.5 6 36.9 6 10.5 12.3 6 7.6 5.3 7 30.9 34.9 7 36.7 7 22.5 15.4 7 6.9 13.0 8 40.5 39.0 8 39.5 8 11.7 14.5 8 11.8 7.0 Langley Bath Clearwater Middle Paul Spadaro Principal Marlee Calloway Catherine Neal Emily Harvey & Myasha Witherspoon Casey Rogers Guidance Counselors Assistant Principals Catherine Corbett Charish Saunders Secretary/Bookkeeper -

Inside … 28....MW Loop Source 2....AM Switch Book

• Serving DX’ers since 933 • Volume 74, No. 23 • March News9, 2007 • (ISSN 0737-659) DX Inside … 28 ...MW Loop Source 2 ...AM Switch Book .. 5 ...Professional Sports Networks 34 ...Musings of the 6 ...DDXD Members 6 ...IDXD 35 ...Boise 2007 25 ...NRC Contest 36 ...Your name Station Test Calendar e-mail reports for members who don’t have com- KMTI UT 650 Mar. 19 0200-0400 puters. Our next DXN: April 2. Happy DX! From the Publisher … Check out page 35 for DXN Publishing Schedule, Volume 74 more information about the unprecedented joint NRC-WTFDA convention in Boise, August 31- Iss. Deadline Pub. Date Iss. Deadline Pub. Date September 2. 24. Mar. 23 Apr. 2 28. July 6 July 6 DXChange … Richard Wood, Ph.D. - HCR 3, 25. Apr. 6 Apr. 6 29. Aug. 3 Aug. 3 Box 11087 - Keaau, HI 96745 is looking for a phas- 26. May. 4 May 4 30. Sept. 7 Sept. 8 ing unit for two or more beverage antennas; must 27. June 8 June 8 work on MW. State asking price. DX Time Machine Unfilled positions… We’re still in need of vol- From the Pages of DX News unteers for the following positions, as described 50 years ago … from the March 16, 1957 DXN: in detail in V73, #27, the June ‘06 DXN: A person Len Kruse, Dubuque, IA, reported that BCB reception proficient with phpBB to maintain the e-DXN site; on Monday am., 2/25 was extremely bad, the worst one or more additional moderators for e-DXN; one he’d had ever remembered for the month of February, or more persons to edit future NRC publications; having heard only WKLM-790 of the 6 NRC DX programs scheduled. -

BMJ in the News 29 March

BMJ in the News is a weekly digest of journal stories, plus any other news about the company that has appeared in the national and a selection of English-speaking international media. A total of 27 journals were picked up in the media last week (29 March-4 April) - our highlights include: ● Research published in The BMJ finding that levels of adherence to the UK’s test, trace, and isolate system are low made national headlines, including BBC News, The Guardian, and The Daily Telegraph. ● A BJSM study suggesting that physical inactivity is responsible for up to 8% of non-communicable diseases and deaths worldwide was picked up by CNN, ITV News, and Gulf Today. ● A study in The BMJ revealing that people discharged from hospital after covid-19 appear to have increased rates of organ damage compared with similar individuals in the general population made headlines in the Times of India, Huffington Post, and Asian Image. BMJ PRESS RELEASES The BMJ | British Journal of Ophthalmology British Journal of Sports Medicine | Thorax EXTERNAL PRESS RELEASES BMJ Nutrition, Prevention & Health | BMJ Open Gut | Journal for Immunotherapy of Cancer Stroke & Vascular Neurology OTHER COVERAGE The BMJ | Annals of the Rheumatic Diseases BMJ Case Reports | BMJ Global Health BMJ Open Gastroenterology | BMJ Open Ophthalmology BMJ Open Science | BMJ Open Sport & Exercise Medicine BMJ Supportive & Palliative Care| Heart Journal of Epidemiology & Community Health | Journal of Medical Ethics Journal of Medical Genetics | Journal of NeuroInterventional Surgery Journal -

Report of the 7 July Review Committee

cover2.qxd 5/26/06 3:41 pm Page 1 Report of the 7 July Review Committee - Volume 2 Volume - Committee Report of the 7 July Review Report of the 7 July Review Committee Volume 2: Views and information from organisations Greater London Authority City Hall The Queen’s Walk More London London SE1 2AA www.london.gov.uk Enquiries 020 7983 4100 June 2006 Minicom 020 7983 4458 LA/May 06/SD D&P Volume 2: Views and information from organisations Contents Page Transcript of hearing on 3 November 2005 3 Transport for London, Metropolitan Police Service, City of London Police, British Transport Police, London Fire Brigade and London Ambulance Service Transcript of hearing on 1 December 2005 Telecommunications companies: BT, O2, Vodafone, Cable & Wireless 61 Communication with businesses: London Chamber of Commerce & Industry 90 and Metropolitan Police Service Transcript of hearing on 11 January 2006 Local authorities: Croydon Council (Local Authority Gold on 7 July), Camden 109 Council, Tower Hamlets Council and Westminster City Council Health Service: NHS London, Barts & the London NHS Trust, Great Ormond 122 Street Hospital, Royal London Hospital and Royal College of Nursing Media: Sky News, BBC News, BBC London, ITV News, LBC News & Heart 132 106.2, Capital Radio and London Media Emergency Forum, Evening Standard, The Times Transcript of hearing on 1 March 2006 147 Ken Livingstone, Mayor of London Sir Ian Blair, Metropolitan Police Commissioner Written submissions from organisations Metropolitan Police 167 City of London Police 175 London Fire Brigade -

BMJ in the News 10

BMJ in the News is a weekly digest of national and international news coverage in English for BMJ, The BMJ, and BMJ Journals. The content is provided daily by Cision and Google Alerts. The views expressed are those of the individual journalists/outlets: they are intended to represent the breadth of media coverage, not endorsement by BMJ or the media relations team. A total of 23 journals were picked up in the media last week (10-16 May). Our highlights include: ● A study in The BMJ suggesting that delaying the second dose of covid-19 vaccines could result in up to 20% lower mortality, but only under certain conditions, made headlines in The Guardian, The Independent, and The Times. ● Research in BMJ Open finding that long term use of prescription meds for insomnia is not linked to better quality sleep was covered widely, including the Daily Mail, NBC News, and CNN. ● A letter published in the Archives of Disease in Childhood revealing a fivefold rise in young children swallowing magnets over the past 5 years in the UK was picked up by The Telegraph, The Guardian, and The Straits Times. PRESS RELEASES The BMJ | Archives of Disease in Childhood BMJ Open | Journal of Medical Ethics EXTERNAL PRESS RELEASES Thorax OTHER COVERAGE The BMJ | Annals of the Rheumatic Diseases BMJ Case Reports | BMJ Evidence-Based Medicine BMJ Global Health | BMJ Nutrition, Prevention & Health BMJ Open Diabetes Research & Care | BMJ Open Ophthalmology BMJ Open Science | BMJ Quality & Safety British Journal of Ophthalmology | British Journal of Sports Medicine Gut -

Title: Radio Frequency Energy Harvesting for Autonomous Systems

Title: Radio frequency energy harvesting for autonomous systems Name: Ivan K. Ivanov This is a digitised version of a dissertation submitted to the University of Bedfordshire. It is available to view only. This item is subject to copyright. RADIO FREQUENCY ENERGY HARVESTING FOR AUTONOMOUS SYSTEMS by IVAN K. IVANOV A thesis submitted to the University of Bedfordshire in partial fulfilment of the requirements for the degree of Doctor of Philosophy April 2018 Declaration of Authorship I, Ivan Ivanov declare that this thesis and the work presented in it are my own and has been generated by me as the result of my own original research. Radio Frequency Energy Harvesting for Autonomous Systems I confirm that: 1. This work was done wholly or mainly while in candidature for a research degree at this University; 2. Where any part of this thesis has previously been submitted for a degree or any other qualification at this University or any other institution, this has been clearly stated; 3. Where I have cited the published work of others, this is always clearly attributed; 4. Where I have quoted from the work of others, the source is always given. With the exception of such quotations, this thesis is entirely my own work; 5. I have acknowledged all main sources of help; 6. Where the thesis is based on work done by myself jointly with others, I have made clear exactly what was done by others and what I have contributed myself; 7. Either none of this work has been published before submission, or parts of this work have been published as indicated in Section 4.2. -

Appendices for Section 1

INTERIM REPORT 3G SPECTRUM STUDY 2500-2690 MHz BAND APPENDICES FOR SECTION 1 A-1 APPENDIX 1.1 PLAN TO SELECT SPECTRUM FOR THIRD GENERATION (3G) WIRELESS SYSTEMS in the UNITED STATES October 20, 2000 I. PRESIDENTIAL MEMORANDUM (PM) President Clinton signed a memorandum dated October 13, 2000, (Attachment 1) that states the need and urgency for the United States to select radio frequency spectrum to satisfy the future needs of the citizens and businesses for mobile voice, high speed data, and Internet accessible wireless capability; the guiding principles to be used for the development of 3G wireless systems; and the direction to the Federal agencies to carry out the selection of spectrum. In summary, the President directed · the Secretary of Commerce in cooperation with the Federal Communications Commission (FCC) to: · develop a plan by October 20, 2000, for the identification and analysis of possible spectrum bands for 3G services that would enable the FCC to select specific frequencies by July 2001 for 3G and complete the auction for licensing 3G wireless providers by September 30, 2002. · issue an interim report by November 15, 2000, on the current spectrum uses, and the potential for the sharing or segmenting, of two of the bands identified at the World Radiocommunication Conference (WRC-2000) for 3G wireless use, 1755-1850 MHz and 2500-2690 MHz, about which the United States does not have sufficient knowledge at present to make a considered decision about allocation. · work with government and industry representatives through a series of public meetings to develop recommendations and plans for identifying spectrum for 3G wireless systems.