Printarticle | Www3.Cfo.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Young Scientists

Young Scientists Applied mathematics Erez Aiden is an Assistant Professor in the Department of Genetics at the Baylor College of Medicine, where he directs the Center for Genome Architecture, and in the Department of Computer Science and Computational and Applied Mathematics at Rice University. His research has made fundamental contributions to a large variety of disciplines, including molecular biology, polymer physics, historical linguistics, wearable computing, and mathematics. These include: development of a three-dimensional genome sequencing method; discovery of dynamic reorganization of the genomic architecture to facilitate gene expression or silencing; the characterization of the genome as a “fractal globule;” quantitative analysis of the evolutionary dynamics of language which led to the discovery that the rate of verb regularization depends on the inverse-square of its usage frequency. He has over 20 patents in various stages of filing. Co- inventors include Bob Langer, Nathan Myhrvold and Bill Gates. Microfluidic methods Adam Abate is Assistant Professor in Bioengineering at the School of Pharmacy of the University of California at San Francisco. He is a physicist whose research employs microfluidics for high-throughput biological applications. He has developed microfluidic methods to create emulsions that consist of droplets of very precise and consistent sizes that are used to create micro-compartments, which can be loaded with single cells and other active materials, such as drugs, nutrients, and assay reagents. The droplets can be used as tiny “test tubes” for performing chemical and biological reactions. This approach is used for directed evolution, genetic sequencing and cell sorting. Optical sensors Andrea Armani is the Fluor Early Career Chair in Engineering and Associate Professor of Chemical Engineering and Materials Science at the University of Southern California. -

The Atlantic Online | June 2008 | the Sky Is Falling | Gregg Easterbrook

The Atlantic Online | June 2008 | The Sky Is Falling | Gregg Easter... http://www.theatlantic.com/doc/print/200806/asteroids Print this Page Close Window JUNE 2008 ATLANTIC MONTHLY The odds that a potentially devastating space rock will hit Earth this century may be as high as one in 10. So why isn’t NASA trying harder to prevent catastrophe? BY GREGG EASTERBROOK The Sky Is Falling Image credit: Stéphane Guisard, www.astrosurf.com/sguisard ALSO SEE: reakthrough ideas have a way of seeming obvious in retrospect, and about a decade ago, a B Columbia University geophysicist named Dallas Abbott had a breakthrough idea. She had been pondering the craters left by comets and asteroids that smashed into Earth. Geologists had counted them and concluded that space strikes are rare events and had occurred mainly during the era of primordial mists. But, Abbott realized, this deduction was based on the number of craters found on land—and because 70 percent of Earth’s surface is water, wouldn’t most space objects hit the sea? So she began searching for underwater craters caused by impacts VIDEO: "TARGET EARTH" rather than by other forces, such as volcanoes. What she has found is spine-chilling: evidence Gregg Easterbrook leads an illustrated that several enormous asteroids or comets have slammed into our planet quite recently, in tour through the treacherous world of space rocks. geologic terms. If Abbott is right, then you may be here today, reading this magazine, only because by sheer chance those objects struck the ocean rather than land. Abbott believes that a space object about 300 meters in diameter hit the Gulf of Carpentaria, north of Australia, in 536 A.D. -

A Simple Guide to NEOWISE Data Problems Nathan Myhrvold May 25, 2016

A Simple Guide to NEOWISE Data Problems Nathan Myhrvold May 25, 2016 In a paper recently submitted to a scientific journal and posted as a preprint on arXiv, I pointed out a number of weaknesses in results previously published – and widely cited – from the NEOWISE asteroid mission. The 110-paGe manuscript is full of detailed arguments about statistics and the physics of how asteroids absorb and reflect sunlight and then emit infrared light. It’s all pretty complicated stuff, written for an audience of professional astronomers, physicists, and statisticians. But the most eGreGious problems with the NEOWISE project are dead simple to explain; indeed, this miGht be a Good project for a middle-school science class. In this guide, I show how anyone can examine the data themselves and spot the most critical errors. It’s a great example of how scientific debates that seem complicated sometimes come down to really simple issues. Background Let’s begin with a little backGround. NEOWISE is a NASA-funded project that spent millions of taxpayer dollars to estimate the diameter of more than 150,000 asteroids, as well as other physical properties of the objects. It did this by analyzinG observations of the infrared (IR) liGht given off by the asteroids and picked up by the WISE satellite. WISE is a space telescope that is a bit like a supersized and more sophisticated version of the thermal cameras used to spot heat leaks in a buildinG. The NEOWISE project used a technique called thermal modelinG to convert the briGhtness of each asteroid at several different infrared “colors” (wavelenGth bands) into an estimate of the object’s diameter. -

The Photography of Modernist Cuisine PDF Book

THE PHOTOGRAPHY OF MODERNIST CUISINE PDF, EPUB, EBOOK Nathan Myhrvold | 312 pages | 12 Jul 2016 | The Cooking Lab | 9780982761021 | English | United States The Photography of Modernist Cuisine PDF Book This book is You also have the option to opt-out of these cookies. The Photography of Modernist Cuisine also takes you into The Cooking Lab's revolutionary kitchen and its photo studio on a visual tour that reveals the special equipment and techniques the Modernist Cuisine team uses to create its culinary inventions and spectacular images. Add to Wishlist. Just a moment while we sign you in to your Goodreads account. Close Share options. The final broccoli cutaway image. Matthew Lafleur rated it it was amazing Dec 16, Download as PDF Printable version. Discover all of the award-winning books from the Modernist Cuisine team. The critical reception was generally positive, citing detail on molecular gastronomic techniques and strong illustrations. View All Books. He holds additional master's degrees in geophysics and space physics and a bachelor's degree in mathematics from the University of California, Los Angeles. I love that there's a section including the photographic techniques. Nathan Myhrvold. Non-necessary Non-necessary. But if you are looking for some food photography inspiration, this is a must-have! Modernist Bread French Edition. Jose Picazo rated it really liked it Jun 06, Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. -

Nathan P. Myhrvold DPS48 in the Presence of Reflected Sunlight EPSC11

Asteroid Thermal Modeling Nathan P. Myhrvold DPS48 in the Presence of Reflected Sunlight EPSC11 Abstract Many Studies Violate Kirchhoff’s Law Impact on Estimates of D and pIR pace telescopes that use mal Model (NEATM) that incorpo- It has been common practice in A more correct method solves for Incorporating Kirchhoff’s law into the a synthetic data set of asteroid obser- short-wavelength infrared (IR) rates Kirchhoff’s law and correctly many previous asteroid studies, in- emissivity in the short-wave IR bands NEATM could have significant ef- vations, using models that enforced or bands observe light from as- accounts for the presence of reflected cluding the NEOWISE studies1–10, to (W1 and W2) and then uses Kirch- fects on the best estimates of asteroid violated Kirchhoff’s law. Resulting es- Steroids that is a mixture of reflected sunlight. Monte Carlo simulations set the emissivity ϵ to a constant val- hoff’s law to estimate the albedo. In diameters and IR albedos from ob- timates of diameter D and short-wave sunlight and thermal emission. Kirch- were run on a synthetic data set of ue and to solve for the IR albedo pIR. long-wave IR bands (W3 and W4), servational data. To explore the mag- emissivity ϵ1,2 show that enforcing hoff’s law of thermal radiation applies 33,000 asteroids having properties This approach is incorrect, however, the emissivity can be set to a constant nitude and direction of these effects, Kirchhoff’s law reduces error in these and has important implications. Pre- identical to those in NEOWISE ob- because it violates Kirchhoff’s law of value of 0.9, which implies an albedo Monte Carlo trials were performed on estimates by a factor of 10 or more. -

Intellectual Ventures Comments

INTELLECTUAL VENTURES" July 3, 2018 By Mail & Email ([email protected]) The Honorable Andrew lancu Under Secretary of Commerce for Intellectual Property Director of the United States Patent and Trademark Office United States Patent & Trademark Office Mail Stop Patent Board P.O. Box 1450 Alexandria, VA 22313-1450 Attention Vice Chief Administrative Patent Judges Michael Tierney or Jacqueline Wright Bonilla, PTAB Notice of Proposed Rulemaking 2018. Dear Under Secretary lancu: Intellectual Ventures Management LLC ("Intellectual Ventures") thanks the Director for the opportunity to present its views on the United States Patent & Trademark Office ("Office") Notice of Proposed Rulemak ing entitled "Changes to the Claim Construction Standard for Interpreting Claims in Trial Proceedings Be fore the Patent Trial and Appeal Board" as published in the May 9, 2018 issue of the Federal Register, 83 Fed. Reg. 21,221 ("Notice"). Intellectual Ventures urges the Office to adopt the rules proposed in the Notice. About Intellectual Ventures Intellectual Ventures fosters conception, development, and investment in inventions. It was co-founded by Dr. Nathan Myhrvold, who is also its Chief Executive Officer. Dr. Myhrvold was previously the Chief Tech nology Officer of Microsoft, and he holds a doctorate in theoretical and mathematical physics and a mas ter's degree in mathematical economics from Princeton University, as well as a master's degree in geo physics and space physics and a bachelor's degree in mathematics from the University of California at Los Angeles. He was a postdoctoral fellow in the quantum physics laboratory of Dr. Stephen Hawking at Cambridge University. And he is a named inventor on hundreds of issued patents. -

'Star Wars' Scientists Create Laser Gun to Kill Mosquitoes Anouk Lorie Mon March 16, 2009 LONDON, England -- Scientists in the U.S

'Star Wars' Scientists Create Laser Gun To Kill Mosquitoes Anouk Lorie Mon March 16, 2009 LONDON, England -- Scientists in the U.S. are developing a laser gun that could kill millions of mosquitoes in minutes. The laser, which has been dubbed a "weapon of mosquito destruction" fires at mosquitoes once it detects the audio frequency created by the beating of its wings. The laser beam then destroys the mosquito, burning it on the spot. Developed by some of the astrophysicists involved in what was known as the "Star Wars" anti-missile programs during the Cold War, the project is meant to prevent the spread of malaria. Lead scientist on the project, Dr. Jordin Kare, told CNN that the laser would be able to sweep an area and "toast millions of mosquitoes in a few minutes." Malaria is a life-threatening disease caused by parasites that are transmitted to people from the bites of female mosquitoes. It is particularly prevalent in tropical and sub-tropical regions of the world and kills an African child every 30 seconds, according to the World Health Organization. There are an estimated 300 million acute cases of malaria each year globally, resulting in more than one million deaths, the WHO reports. Responding to questions about any potential harm the laser could pose to the eco-system, Kare said: "There is no such thing as a good mosquito, there's nothing that feeds exclusively on them. No one would miss mosquitoes," he said. "In any case," he added. "The laser is able to distinguish between mosquitoes that go after people and those that aren't dangerous. -

Steakhouse Science

BOOKS & ARTS COMMENT with leeks, Worcestershire sauce, garlic, sugar, wine and vinegar, among other ingredients) with the sous vide version in Q&A Nathan Myhrvold Modernist Cuisine. This technique — in which ingredients are vacuum-sealed in a plastic bag before being cooked at low temperature in a water bath or combi Steakhouse science oven — plays a major part in the set, and Nathan Myhrvold trained as a quantum cosmologist with Stephen Hawking and was chief the authors go to great lengths to argue technology officer of Microsoft before founding Intellectual Ventures, a US company that funds its value. I have tasted meats cooked this inventors and acquires patents. As he publishes a six-volume work on the science of cooking, way, and am unconvinced that it is essen- Myhrvold explains why chemistry techniques could soon be seen in every restaurant. tial to home cooking. But I am willing to give the pasta marinara a shot. It calls for tomato water, which I was happy to Why did you write a six-volume discover could be produced with a sim- scientific cookbook? ple wine filter (to separate the flavourful When I was two years old, I told my mother water from the pulp after first processing that I would be a scientist; when I was nine the tomatoes in a juicer) rather than with I insisted on cooking Thanksgiving dinner. the preferred piece of kitchen equipment In the mid-1990s, I took a leave of absence in Modernist Cuisine, the centrifuge. from Microsoft and went to culinary school The format of the recipes will also chal- in France, and got back into cooking with R. -

From Fake Apple Stores to Wiredoo: 2011'S Craziest Tech Stories December 31, 2011 | 6:00 Am

BUSINESS Technology THE BUSINESS AND CULTURE OF OUR DIGITAL LIVES, FROM THE L.A. TIMES From fake Apple stores to WireDoo: 2011's craziest tech stories December 31, 2011 | 6:00 am 2011 was a big year for tech news--Steve Jobs died, Facebook and Twitter revolutionized the revolutionary experience in the Middle East, a new iPad came out, a new iPhone came out, and the world got to meet SIRI, Google+ and the Kindle Fire. It was also a hilarious year, as tech reporters and savvy Facebook sharers and Tweeters found a steady stream of crazy tech stories to keep them entertained. From the spate of fake Apple Stores in China to the news that Amazon founder Jeff Bezos was building a 10,000-year clock, here is a list of 11 great stories from 2011 that made us grateful to be alive and paying attention in this completely insane age of the Internet. 1. Fake Apple stores popping up in China: We'd heard of people knocking off purses and shoes and wallets, but a whole store? That was new. So when a young American living in China blogged about a spate of fake Apple stores that had opened in her adopted city of Kunming, the Internet went crazy. The best part were the photos she had on her blog that showed the familiar pale wood surfaces, the glowing white Apple logo, and even workers dressed in those distinctive blue shirts. 2. The IE IQ hoax: For one brief, glorious moment, tech reporters thought it just might be possible that people who used the Internet Explorer browser were actually dumber than those who used other browsers. -

A Brief History of Time - Stephen Hawking

A Brief History of Time - Stephen Hawking Chapter 1 - Our Picture of the Universe Chapter 2 - Space and Time Chapter 3 - The Expanding Universe Chapter 4 - The Uncertainty Principle Chapter 5 - Elementary Particles and the Forces of Nature Chapter 6 - Black Holes Chapter 7 - Black Holes Ain't So Black Chapter 8 - The Origin and Fate of the Universe Chapter 9 - The Arrow of Time Chapter 10 - Wormholes and Time Travel Chapter 11 - The Unification of Physics Chapter 12 - Conclusion Glossary Acknowledgments & About The Author FOREWARD I didn’t write a foreword to the original edition of A Brief History of Time. That was done by Carl Sagan. Instead, I wrote a short piece titled “Acknowledgments” in which I was advised to thank everyone. Some of the foundations that had given me support weren’t too pleased to have been mentioned, however, because it led to a great increase in applications. I don’t think anyone, my publishers, my agent, or myself, expected the book to do anything like as well as it did. It was in the London Sunday Times best-seller list for 237 weeks, longer than any other book (apparently, the Bible and Shakespeare aren’t counted). It has been translated into something like forty languages and has sold about one copy for every 750 men, women, and children in the world. As Nathan Myhrvold of Microsoft (a former post-doc of mine) remarked: I have sold more books on physics than Madonna has on sex. The success of A Brief History indicates that there is widespread interest in the big questions like: Where did we come from? And why is the universe the way it is? I have taken the opportunity to update the book and include new theoretical and observational results obtained since the book was first published (on April Fools’ Day, 1988). -

Geopiracy: the Case Against Geoengineering I Geopiracy: the Case Against Geoengineering

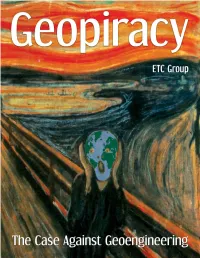

“We cannot solve our problems with the same thinking we used when we created them.” Albert Einstein “We already are inadvertently changing the climate. So why not advertently try to counterbalance it?” Michael MacCracken, Climate Institute, USA About the cover ETC Group gratefully acknowledges the financial support of SwedBio The cover is an adaptation of The (Sweden), HKH Foundation (USA), Scream by Edvard Munch, painted in CS Fund (USA), Christensen Fund 1893, shown on the right. Munch (USA), Heinrich Böll Foundation painted several versions of this image (Germany), the Lillian Goldman over the years, which reflected his Charitable Trust (USA), Oxfam Novib feeling of "a great unending scream (Netherlands), and the Norwegian piercing through nature." One theory is Forum for Environment and that the red sky was inspired by the Development. ETC Group is solely eruption of Krakatoa, a volcano that responsible for the views expressed in cooled the Earth by spewing sulphur this document. into the sky, which blocked the sun. Geoengineers seek to artificially Copy-edited by Leila Marshy reproduce this process. Design by Shtig (.net) Geopiracy: The Case Against Acknowledgements Geoengineering is ETC Group We also thank the Beehive Collective Communiqué # 103 ETC Group is grateful to Almuth for artwork and all the participants of First published October 2010 Ernsting of Biofuelwatch, Niclas the HOME campaign for their ongoing Second edition November 2010 Hällström of the Swedish Society for participation and support as well as the Conservation of Nature (that Leila Marshy and Shtig for good- All ETC Group publications are published Retooling the Planet from humoured patience and professionalism available free of charge on our website: which some of this material is drawn). -

The Intellectual Venturer by Michael Watts | 21 January 11

The intellectual venturer By Michael Watts | 21 January 11 This article was taken from the February 2011 issue of Wired magazine. There has never been a company quite like Intellectual Ventures: It's a hybrid of think tank, private-equity firm, venture-capital investor, research and development lab and law firm. In a little over a decade since it was founded by two former Microsoft executives -- Nathan Myhrvold and Edward Jung (later joined by Peter Detkin, a former Intel 1 From www.wired.co.uk/magazine/archive/2011/02/features/intellectual-ventures 22 January 2011 intellectual-property lawyer) -- it has never brought a single product to market under its own name. As Jung likes to say, "Our best years are still ahead of us." The partners may have learned from Bill Gates that it's not enough to be technologically brilliant or ruthless in business -- you must also set out to change humanity. Thousands of inventions have poured out of IV, spanning computer software and hardware, user- interface design, semiconductors, biomedical devices, advanced medical procedures, digital imaging, nanotechnology, nuclear energy and advanced particle physics. They range in importance from modified red-blood cells that deliver cancer treatment, to temperature-controlled kegs for beer and wine. That one has Gates's name on the patent application. Among the headliners is the Salter Sink, a wave-powered pump that diffuses the energy of hurricanes by funnelling to colder depths the warm ocean-surface water that they feed on; it was developed with Stephen Salter, an engineering professor at Edinburgh University. A second invention, the Stratoshield, mimics the temperature-cooling effect of some volcanic eruptions by hosing sulphur-dioxide particles high into the stratosphere.