China A-Shares Growth Fund Class I (USD)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FSSA China a Shares Fund Class III USD a Subfund of First Sentier Investors Global Umbrella Fund Plc (The Company)

Monthly Fund Factsheet 31 August 2021 FSSA China A Shares Fund Class III USD a subfund of First Sentier Investors Global Umbrella Fund plc (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests at least 70% of its assets in shares of companies listed Chinese Stock Exchanges. China Merchants Bank Co., Ltd. Class A 8.8 The Fund may invest up to 100% of its assets in any industry and in companies of Zhejiang Weixing New Building any size. 8.4 Materials Co. Ltd. Class A The Fund may invest up to 100% of its assets in China A Shares and up to 10% in China B shares. Bank of Ningbo 7.4 The Fund may use derivatives with the aim of risk reduction or efficient management. China Mengniu Dairy Co. Ltd. 5.4 Fund information Midea Group 4.4 China Resources Land Limited 4.1 Fund Launch Date 04 June 2019 S.F. Holding Co., Ltd. Class A 4.0 Share Class Launch Date 26 July 2019 Gree Electric Appliances, Inc. of Zhuhai Fund Size (US$m) 974.2 3.1 Co., Ltd. Class A Benchmark MSCI China A Onshore Net Index Zhejiang Chint Electrics Co., Ltd Class A 3.1 Number of holdings 43 Ping An Insurance (Group) Company of 2.9 Fund Manager(s) Winston Ke/Martin Lau China, Ltd. Class A Minimum Investment US$500,000 Initial charge 0%< Sector Breakdown Ongoing Charges † 1.50% Industrials 32.4% (15.5%*) Financials 21.8% (18.1%*) Share Type Accumulation Consumer Discretionary 10.5% (8.3%*) Sedol BKF2S62 Health Care 9.4% (9.5%*) Consumer Staples 9.1% (11.7%*) ISIN IE00BKF2S627 Real Estate 4.7% -

2014 ANNUAL REPORT 1 BANK of NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK of NINGBO Co.,Ltd 1

2014 ANNUAL REPORT 1 BANK OF NINGBO Co.,Ltd 2 2014 ANNUAL REPORT 3 BANK OF NINGBO Co.,Ltd 1 Chapter One Important Notes The Board of Directors, Board of Supervisors, directors, supervisors and senior managers of the Company ensure the authenticity, accuracy and completeness of contents, and guarantee no fraulds, misleading statements or major omissions in this report. They are willing to burden any individual and joint legal responsibilities. All the directors, supervisors and senior managers are able to guarantee the authenticity, accuracy and completeness of this report without any objection. The 6th meeting of the 5th Board of Directors of the company approval the text and abstract of 2014 Annual Report on 24 April 2015. 15 out of 17 directors were present. Director Li Hanqiong authorize director Chen Guanghua to vote. Director Ben Shenglin authorize director Zhu Jiandi to vote. Part of supervisors attended this meeting as well. The Company's profit distribution plan was passed by the Board of Directors as follows: taking the total share capital on 31 Dec. 2014 as the base number, cash bonus of RMB 4.5 yuan (including tax) per 10 shares was distributed to all shareholders, and 2 shares for every 10 shares were given by converting capital reserve into share capital. This plan will be submitted to 2014 general meeting of stockholders for further approval. The Chairman of the board Mr. Lu Huayu, the president Mr. Luo Mengbo, the vice president Mr. Luo Weikai, who is in charge of accounting, and the general manager of accounting department Ms. Sun Hongbo hereby declare to pledge the authenticity, accuracy and completeness of financial statements in the annual report. -

FTSE Publications

2 FTSE Russell Publications 01 October 2020 FTSE Value Stocks China A Share Indicative Index Weight Data as at Closing on 30 September 2020 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Agricultural Bank of China (A) 4.01 CHINA Fuyao Glass Group Industries (A) 1.43 CHINA Seazen Holdings (A) 0.81 CHINA Aisino Corporation (A) 0.52 CHINA Gemdale (A) 1.37 CHINA Shanghai Fosun Pharmaceutical Group (A) 1.63 CHINA Anhui Conch Cement (A) 3.15 CHINA GoerTek (A) 2.12 CHINA Shenwan Hongyuan Group (A) 1.11 CHINA AVIC Investment Holdings (A) 0.61 CHINA Gree Electric Appliances Inc of Zhuhai (A) 7.48 CHINA Shenzhen Overseas Chinese Town Holdings 0.66 CHINA Bank of China (A) 2.23 CHINA Guangdong Haid Group (A) 1.24 CHINA (A) Bank Of Nanjing (A) 1.32 CHINA Guotai Junan Securities (A) 1.99 CHINA Sichuan Chuantou Energy (A) 0.71 CHINA Bank of Ningbo (A) 2 CHINA Hangzhou Hikvision Digital Technology (A) 3.56 CHINA Tbea (A) 0.86 CHINA Beijing Dabeinong Technology Group (A) 0.56 CHINA Henan Shuanghui Investment & Development 1.49 CHINA Tonghua Dongbao Medicines(A) 0.59 CHINA China Construction Bank (A) 1.83 CHINA (A) Weichai Power (A) 2.09 CHINA China Life Insurance (A) 2.14 CHINA Hengtong Optic-Electric (A) 0.59 CHINA Wuliangye Yibin (A) 9.84 CHINA China Merchants Shekou Industrial Zone 1.03 CHINA Industrial and Commercial Bank of China (A) 3.5 CHINA XCMG Construction Machinery (A) 0.73 CHINA Holdings (A) Inner Mongolia Yili Industrial(A) 6.32 CHINA Xinjiang Goldwind Science&Technology (A) 0.74 -

First State China a Shares Fund Class III USD a Subfund of First State Global Umbrella Fund Plc (The Company)

Monthly Fund Factsheet 31 August 2020 First State China A Shares Fund Class III USD a subfund of First State Global Umbrella Fund plc (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests at least 70% of its assets in shares of companies listed Chinese Stock Exchanges. Bank of Ningbo 7.9 The Fund may invest up to 100% of its assets in any industry and in companies of China Merchants Bank Co., Ltd. Class A 7.3 any size. The Fund may invest up to 100% of its assets in China A Shares and up to 10% in Zhejiang Weixing New Building 7.2 China B shares. Materials Co. Ltd. Class A The Fund may use derivatives with the aim of risk reduction or efficient management. Midea Group 5.7 Fund information S.F. Holding Co., Ltd. Class A 5.2 China Mengniu Dairy Co. Ltd. 5.2 Fund Launch Date 04 June 2019 Gree Electric Appliances, Inc. of Zhuhai Share Class Launch Date 26 July 2019 4.8 Co., Ltd. Class A Fund Size (US$m) 699.2 Shanghai M&G 3.9 Benchmark MSCI China A Onshore Index Yunnan Baiyao 3.9 Number of holdings 42 Anhui Heli Co Ltd - A 3.2 Fund Manager(s) Winston Ke/Martin Lau Minimum Investment US$500,000 Sector Breakdown < Initial charge 0% Industrials 28.1% (11.7%*) Ongoing Charges † 1.50% Consumer Discretionary 19.2% (8.2%*) Financials 17.8% (21.3%*) Share Type Accumulation Consumer Staples 9.7% (14.9%*) Sedol BKF2S62 Information Technology 6.9% (16.0%*) Health Care 6.4% (11.0%*) ISIN IE00BKF2S627 Real Estate 2.2% (3.4%*) Materials 1.8% (8.1%*) Annual Performance -

First State All China Fund Class B GBP a Subfund of First State Investments ICVC (The Company)

Monthly Fund Factsheet 31 August 2020 First State All China Fund Class B GBP a subfund of First State Investments ICVC (the Company) Investment objective and policy Ten Largest Company Holdings The Fund aims to grow your investment. Stock Name % The Fund invests primarily in a smaller portfolio of shares of companies with either assets in, or revenues derived from mainland China. The shares may be China Mengniu Dairy Co. Ltd. 6.2 listed in China, Hong Kong, Singapore or in a member state of the Organisation Shanghai Liangxin Electrical Co Ltd - A 6.1 for Economic Co-operation and Development. The Fund may use derivatives to reduce risk or to manage the Fund more Meituan Dianping 5.1 efficiently. Bank of Ningbo 4.9 Fund information Tencent Holdings Ltd. 4.7 Fund Launch Date 01 March 2017 Midea Group 4.1 Share Class Launch Date 24 November 2017 China Merchants Bank Co., Ltd. Class H 3.9 Fund Size (£m) 23.5 China Resources Land Limited 3.9 UK's Investment Association Zhejiang Weixing New Building China/Greater China 3.4 Sector Materials Co. Ltd. Class A Benchmark MSCI China All Shares Net Index* Alibaba Group Holding 3.4 Number of holdings 49 Fund Manager(s) Winston Ke/Helen Chen Sector Breakdown Available as ISA Yes, subject to ISA limits Industrials 24.7% (7.1%*) Consumer Discretionary 22.0% (25.9%*) Minimum Investment £1,000/£50 per month Financials 11.8% (16.1%*) Initial charge 0%< Information Technology 9.4% (8.4%*) Consumer Staples 9.3% (8.7%*) Ongoing Charges † 1.25% Health Care 8.8% (7.3%*) Share Type Accumulation Communication Services 6.5% (15.0%*) Real Estate 3.9% (3.9%*) Sedol BZCCYN9 Other 0.0% (7.5%*) Cash 3.4% (0.0%*) ISIN GB00BZCCYN91 Fund Yield 0.6% * The benchmark and IA sector for this Fund have been identified as a means by which *Index Weight investors can compare the performance of the Fund and have been chosen because their constituents most closely represent the scope of the investable assets. -

Banks and Investors Against Future: NGO Research Reveals Top Financiers of New Coal Power Development

Media Briefing & Press Conference Banks and Investors Against Future: NGO Research Reveals Top Financiers of New Coal Power Development Japanese and European banks top lenders, Chinese banks top underwriters US companies biggest institutional investors in the coal plant pipeline Madrid | December 5, 2019 Urgewald, BankTrack and 30 partner NGOs publish new research identifying the top financiers and investors behind the expansion of the world’s coal plant fleet. Following today’s release of the data, Urgewald, BankTrack and further NGO partners will discuss findings and provide further insights at a panel dis- cussion and a press conference at the UN Climate Summit on Saturday, Dec 7th at 11:30am and Monday, Dec 9th at 5:30pm. “The UN Secretary General, the IPCC and climate scientists worldwide have ti- me and again called for a speedy phase-out of coal-based energy production, but most financial institutions are still turning a deaf ear. Over the past 3 years, financial institutions have channeled US$ 745 billion to companies planning new coal power plants,” says Heffa Schuecking, director of Urgewald. The NGOs’ data covers both lending and underwriting between January 2017 and September 2019 for all 258 coal plant developers identified on Urgewald’s Global Coal Exit List. Altogether, there are still over 1,000 new coal power sta- tions or units in the pipeline. If built, these projects would add 570 GW to the global coal plant fleet, an increase of 28%. “Most of the top banks providing loans or investment banking services to the- se companies acknowledge the risks of climate change, but their actions are a slap in the face to the Paris Climate Agreement,” says Greig Aitken, climate campaigner at BankTrack. -

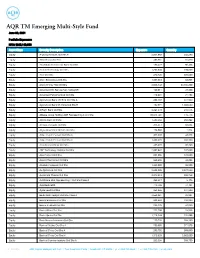

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Issuance Overpricing of China's Corporate Debt Securities

Internet Appendix for “Issuance Overpricing of China’s Corporate Debt Securities” Yi Ding Wei Xiong Jinfan Zhang In this Internet Appendix, we report the following figures, tables, and additional analyses omitted from the main paper. Fig. A1 depicts debt security issuance across the interbank market and the exchange market from 2009 to 2019. In Table A1, we list the 68 licensed underwriters in the interbank market at the end of 2019. Information on underwriters is obtained from NAFMII. In Table A2, we summarize overpricing for CP and MTNs separately for both before and after the rebate ban period. Although the magnitude declined after the ban for both CP and MTNs, overpricing remains statistically significantly. Taken together, we find significant overpricing in all these issuance categories. In Table A3, we report summary statistics of issuance overpricing by using excess returns of the first secondary-market trading day as the overpricing measure. The table shows that the overpricing is robust across time, debt securities, and issuers with different characteristics, consistent with Table 3 in the main paper. In Tables A4 and A5, we conduct difference-in-difference analyses to examine how the underwriter rebate ban affects the excess return across different issuers and across different underwriters. Consistent with results in Tables 5 and 6 of the main paper from using the yield-spread measure, these tables show that after the ban, the drop in overpricing is significantly greater for securities issued by central SOEs than for those issued by other firms, and the drop in overpricing is significantly smaller for issuances underwritten by the Big Four banks. -

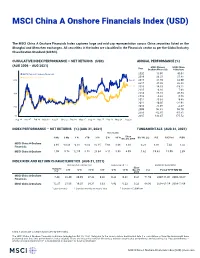

MSCI China a Onshore Financials Index (USD) (NET)

MSCI China A Onshore Financials Index (USD) The MSCI China A Onshore Financials Index captures large and mid cap representation across China securities listed on the Shanghai and Shenzhen exchanges. All securities in the index are classified in the Financials sector as per the Global Industry Classification Standard (GICS®). CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI China A MSCI China Year Onshore Financials A Onshore MSCI China A Onshore Financials 2020 13.95 40.04 MSCI China A Onshore 2019 36.27 37.48 600 599.61 2018 -21.59 -32.99 2017 27.55 20.28 518.63 2016 -14.53 -19.11 2015 -6.16 7.08 400 2014 85.16 46.53 2013 -5.68 0.75 2012 25.68 9.48 2011 -10.05 -22.91 200 2010 -22.95 -4.37 2009 98.61 96.70 2008 -62.85 -61.81 50 2007 133.47 175.52 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 29, 2000 Div Yld (%) P/E P/E Fwd P/BV MSCI China A Onshore 3.98 -13.48 -0.08 -8.83 10.15 5.98 8.66 8.38 3.21 8.86 7.43 1.02 Financials MSCI China A Onshore 1.09 -5.78 12.50 0.55 20.34 8.11 5.98 6.99 1.62 19.63 15.09 2.39 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 29, (%) Period YYYY-MM-DD (%) 2000 MSCI China A Onshore 7.44 22.49 20.99 27.48 0.48 0.32 0.41 0.36 71.50 2007-11-01—2008-10-27 Financials MSCI China A Onshore 12.27 21.06 19.25 24.31 0.93 0.43 0.33 0.33 68.90 2008-01-14—2008-11-04 1 Last 12 months 2 Based on monthly net returns data 3 Based on ICE LIBOR 1M China A shares are quoted in local currency (Renminbi). -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

Bank of Ningbo China

Bank of Ningbo China On record This profile is no longer actively maintained, with the information now possibly out of date Send feedback on this profile By: BankTrack Created before Nov 2016 Last update: May 24 2016 Contact: Yu Xiaogang, Founder of Green Watershed About Bank of Ningbo Bank of Ningbo is a shareholding commercial bank that was established in April 1997. In July 2007 it was listed on the Shenzhen Stock Exchange. By September 2011 the bank owned 8 branches and had 126 sub-branches, operating in cities such as Shanghai, Nanjing, Hangzhou, Shenzhen, Suzhou, Wenzhou, Beijing, and Wuxi. The bank offers a variety of services to individuals, corporate, and small business clients. Services include the following: loans; deposits; trade financing; financing services for small companies; personal savings; foreign exchange trading; bond business; and credit card services. Website http://www.nbcb.cn/ywb/index.shtml Headquarters No. 294, Zhongshan East Road Ningbo, Zhejiang China CEO/chair Mr. Lu Huayu Chairman Supervisor China Banking and Investment Regulatory Commission (CBIRC) Annual report Annual Report 2013 Ownership listed on Shenzhen Stock Exchange Complaints and grievances Sustainability Voluntary initiatives Bank of Ningbo has committed itself to the following voluntary standards: Investment policies 2008 - None 2009 - None 2010 - None 2011 - None 2012 Official announcement of the "2012 Bank of Ningbo Credit Policy," which requires the restriction of credit extensions to "Two Highs" industries, and according to the principles of "total control, choose the superior and limit the inferior, and advance and retreat", and through a thorough search of credit business, to methodically establish a list of companies with excess capacity to be limited and supervised, and to endorse the gradual limitation of authority of the entire credit industry. -

Commercial Bank Ownership Structure and Risk Preference

Journal of Mathematical Finance, 2017, 7, 437-444 http://www.scirp.org/journal/jmf ISSN Online: 2162-2442 ISSN Print: 2162-2434 Commercial Bank Ownership Structure and Risk Preference Haoxuan Zhong Department of Economics, School of Economics, Jinan University, Guangzhou, China How to cite this paper: Zhong, H.X. Abstract (2017) Commercial Bank Ownership Struc- ture and Risk Preference. Journal of Ma- Company’s risk-taking behavior has a significant impact on corporate earn- thematical Finance, 7, 437-444. ings’ growth and the social economic development, and different ownership https://doi.org/10.4236/jmf.2017.72023 structure will affect the company’s risk preference. In this paper, with the 25 Received: April 21, 2017 Chinese listed banks, the empirical tests the effect of ownership structure on Accepted: May 24, 2017 bank’s risk preference. The result showed that the correlation between own- Published: May 27, 2017 ership concentration and the bank’s risk preference is positive; the bank’s risk preference and shareholding separation have inverted u-shaped relation; the Copyright © 2017 by author and Scientific Research Publishing Inc. correlation between bank’s equity balance and the bank’s risk preference is This work is licensed under the Creative negative; the correlation between bank’s cash flow rights and voting rights di- Commons Attribution International vergence and the bank’s risk preference is in inverted u-shaped. License (CC BY 4.0). http://creativecommons.org/licenses/by/4.0/ Keywords Open Access The Corporate Governance Structure, Ownership Structure, Risk Preference 1. Introduction From a broad perspective, risk preference refers to the amount of risk that an enterprise is willing to accept in the process of achieving its objectives.