View These Patents As Valuable Assets but We Do Not View Any Single Patent As Critical to Our Success

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1H2018 M&A Update

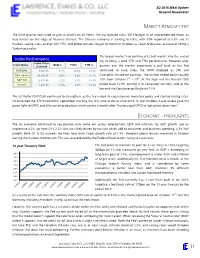

3Q 2018 M&A Update General Newsletter MARKET ATMOSPHERE The third quarter continued to give us drama on all fronts. The EU rejected Italy’s 2019 budget in an unprecedented move, as Italy teeters on the edge of financial distress. The Chinese economy is starting to falter, with GDP reported at 6.5% and its markets seeing a loss of over 20% YTD. And global tensions began to mount in October as Saudi Arabia was accused of killing a Turkish journalist. The broad market had continued its bull market into the end of Index Performance Q3, marking a solid YTD and TTM performance. However after Index Price Index Name QoQ % YTD% TTM % 9/28/2018 quarter end the market experience a pull back as the Fed NASDAQ 8,046.35 7.1% 14.8% 23.9% continued to raise rates, the DOW dropped as 3M, and Dow Jones 26,458.31 9.0% 6.6% 18.1% Caterpillar missed on earnings. The market ended down roughly st th S&P 500 2,913.98 7.2% 8.1% 15.7% 10% from October 1 – 29 . At the high end the Russell 2000 Russell 1,696.57 3.3% 9.5% 13.8% pulled back 12.9%, putting it in correction territory, and at the low end the Dow Jones pulling back 7.6%. The US Dollar (DXY:CUR) continued to strengthen, as the fed ended its expansionary monetary policy and started raising rates. Oil breached the $70 threshold in September marking the first time to do so since 2014. In late October, Saudi Arabia gave the green light to OPEC and allies on oil production, which comes a month after Trump urged OPEC to “get prices down now.” ECONOMIC - HIGHLIGHTS The US economy continued to see positive data come out across employment, GDP and inflation. -

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

400 Refreshing Punch Recipes

TABLE OF CONTENTS 1. Yellow Fruit Punch 2. Zesty Punch Sipper 3. Wassail Punch 4. Watermelon Punch 5. What Hit Me Punch 6. Whisky Punch 7. White Grape~ Tangerine~ & Asti-Spumante Punch 8. White House Pink Fruit Punch (En) 9. White Sangria Punch (Nonalcholic) 10. "No Punch" Champagne 11. "Sting-Like-A-Bee" Punch 12. 1, 2, 3, Punch 13. 4-Fruit Wedding Punch 14. 7-Up Punch 15. Alkoholfreier Planter`s Punch 16. Aloha Fruit Punch 17. Amber Cider Punch 18. Amelia Island Punch 19. Angelfrost Punch 20. Annie's Rosemary Fruit Punch 21. Apple Orchard Punch 22. Apple Slush Punch 23. Apricot Punch 24. Apricot Mist Punch 25. Artillery Punch 26. Artillerymen's Punch 27. Atlanta Coffee Ice Cream Punch 28. Aunt Cindy's Punch 29. Aunt Louise's Wassail Punch 30. Autumn Apple Punch 31. Autumn Punch 32. Aztec Punch 33. Banana Punch 34. Banana-Orange-Pineapple Punch 35. Becky's Wedding Punch 36. Bernice's Holiday Punch 37. Berry Colada Punch 38. Billy Clude Punch 39. Brandy Milk Punch 40. Bridal Fruit Punch (Non-Alcholic) 41. Bridal Sweet Punch 42. Brides Lunch Punch 43. Brown Cow Punch 44. Bubbling Jade Punch 45. Canadian Punch 46. Caribbean Guava Punch 47. Champagne Fruit Punch 48. Champagne Punch 49. Chatham Artillery Punch 50. Cheery Cherry Punch 51. Cherry Tea Punch 52. Chocolate Punch 53. Christmas Cherry Berry Punch 54. Christmas Cranberry Punch 55. Christmas Party Punch 56. Christmas Rum Punch 57. Christmas Snow Punch 58. Cider And Brandy Punch 59. Cider Fruit Punch A La Normande 60. Cider Punch 61. -

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

Fund Holdings As of 6/30/2021 Massmutual Balanced Fund Invesco Prior to 5/1/2021, the Fund Name Was Massmutual Premier Balanced Fund

Fund Holdings As of 6/30/2021 MassMutual Balanced Fund Invesco Prior to 5/1/2021, the Fund name was MassMutual Premier Balanced Fund. Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting % Amount Value Apple Inc AAPL 037833100 3.91 48,433 6,633,384 Microsoft Corp MSFT 594918104 3.45 21,552 5,838,437 USTREAS T-Bill Auction Ave 3 Mon 1.69 2,862,977 JPMorgan Chase & Co JPM 46625H100 1.56 16,948 2,636,092 Verizon Communications Inc VZ 92343V104 1.45 43,768 2,452,321 The Home Depot Inc HD 437076102 1.42 7,556 2,409,533 Intel Corp INTC 458140100 1.29 38,961 2,187,271 Procter & Gamble Co PG 742718109 1.04 13,105 1,768,258 Cisco Systems Inc CSCO 17275R102 1.03 32,830 1,739,990 UnitedHealth Group Inc UNH 91324P102 1.00 4,215 1,687,855 Comcast Corp Class A CMCSA 20030N101 0.94 28,021 1,597,757 AT&T Inc T 00206R102 0.91 53,587 1,542,234 Oracle Corp ORCL 68389X105 0.83 18,031 1,403,533 Deere & Co DE 244199105 0.76 3,635 1,282,101 Accenture PLC Class A ACN G1151C101 0.74 4,237 1,249,025 Johnson Controls International PLC JCI G51502105 0.74 18,185 1,248,037 Visa Inc Class A V 92826C839 0.71 5,152 1,204,641 Texas Instruments Inc TXN 882508104 0.70 6,128 1,178,414 Costco Wholesale Corp COST 22160K105 0.67 2,850 1,127,660 Bank of America Corp BAC 060505104 0.64 26,192 1,079,896 Broadcom Inc AVGO 11135F101 0.63 2,223 1,060,015 Abbott Laboratories ABT 002824100 0.57 8,348 967,784 Target Corp TGT 87612E106 0.56 3,949 954,631 Honeywell International Inc HON 438516106 0.56 4,324 948,469 Goldman Sachs Group Inc GS 38141G104 0.53 2,374 901,004 -

2011-2012 Sustainability Report

2011-2012 Sustainability Report Revised September 19, 2012 to correct tables on page 32 On the cover: Nature and its resources are critical to our business. Lake Tahoe, one of the world’s most pristine crystal blue alpine lakes, is just 15 minutes from The Ritz-Carlton®, Lake Tahoe (California), a LEED® Silver certified hotel (shown here). Contents Executive Letter 1 Marriott Business Values 12 Marriott and the Environment 30 About This Report 2 Workforce 13 Energy/Water/Waste/Carbon 32 Determining Materiality 2 Global Diversity and Inclusion 18 Supply Chain 37 Stakeholders 2 Human Rights 21 Green Buildings 40 Areas of Stakeholder Collaboration 3 Guest Satisfaction 22 Educating and Inspiring Associates and Guests 41 The Way We Do Business 6 Marriott Economic Hotel Development 23 Innovative Conservation Initiatives 43 Our Company 7 Marriott and Society 24 Awards and Recognition 45 Our Business Model 7 Shelter and Food/Poverty Alleviation 26 GRI Report Parameters 46 Global Growth 8 Vitality of Children 27 GRI Content Index 47 Governance 10 Readiness for Hotel Careers 28 Ethics 10 MARPAC Disbursements 11 1 To Our Stakeholders We are investing in sustainable development and innovative conservation initiatives, such as the following, that will provide long-term solutions to critical social and environmental issues. z In 2011, we announced our plan to open our first hotel in Port-au-Prince, Haiti, an area devastated by the 2010 earthquake. The tireless fundraising and volunteerism of our associates, hundreds with family connections in Haiti, inspired us personally to consider ways to help tourism return to the country. The hotel is scheduled to open in 2014, creating jobs and much-needed hotel and meeting space as Haiti recovers. -

PDF Product Guide

05/24/21 To Place an Order, Call (207)947-0321 Fax: (207)947-0323 ITEM # DESCRIPTION PACK ITEM # DESCRIPTION PACK COCKTAIL MIXES COFFEE FLAVORED 14678 ROLAND OLIVE JUICE DIRTY*MARTIN 12/25.4OZ 10927 MAINE'S BEST COFFEE JAMAICAN ME CRAZY 2 24/2.25OZ 2008 OCEAN SPRAY DRINK MIX BLOODY MARY 12/32 OZ 11282 MAINE'S BEST COFFEE VACATIONLND VANILLA 24/2.25OZ 26628 MAYSON'S MARGARITA MIX ON THE ROCKS 4/1 GAL 11516 MAINE'S BEST COFFEE HARBORSIDE HAZELNUT 24/2.25OZ 26633 MAYSON'S MARGARITA MIX FOR FROZEN 4/1 GAL 83931 NewEngland COFFEE REG FRNCH VAN CRAZE 24/2.5OZ 26634 MAYSON'S MARGARITA STRAWBERRY PUREE 4/1 GAL 83933 NewEngland COFFEE REG HAZELNUT CRAZE 24/2.5OZ 26637 MAYSON'S MARGARITA RASPBERRY PUREE 4/1 GAL 83939 NewEngland COFFEE REG PUMPKIN SPICE 24/2.5OZ 26639 MAYSON'S MARGARITA PEACH PUREE 4/1 GAL 83940 NewEngland COFFEE REG CINNAMON STICKY B 24/2.5OZ 26640 MAYSON'S MARGARITA WATERMELON PUREE 4/1 GAL 26724 MAYSON'S MARGARITA MANGO PUREE 4/1 GAL 83831 Packer DRINK MIX LEMON POWDER 12/1GAL COFFEE REGULAR 83890 COCO LOPEZ DRINK MIX CREAM COCONUT 24/15oz 10444 MAXWELL HOUSE COFFEE HOTEL & REST 112/1.6OZ 84011 Rose's SYRUP GRENADINE 12/1LTR 10479 Folgers COFFEE LIQ 100% COLOMBIAN 2/1.25L 10923 MAINE'S BEST COFFEE REG ACADIA BLEND 2O 42/2OZ 10924 MAINE'S BEST COFFEE REG COUNTY BLEND 1. 42/1.5OZ CAPPUCCINO 10930 MAINE'S BEST COFFEE REG DWNEAST DARK 2. 24/2.25OZ 90343 Int Coffee CAPPUCCINO FRENCH VAN 6/2LB 1410 Maxwellhse COFFEE REGULAR MASTERBLEND 64/3.75 OZ 23529 MAINE'S BEST COFFEE SEBAGO BLEND 42/2.25OZ 23531 NEW ENGLAND COFFEE EXTREME KAFFEINE -

Keurig Dr Pepper Relocating Texas Headquarters to Frisco New Dual Headquarters Location Will Provide a Vibrant, Collaborative and Connected Workplace

FOR IMMEDIATE RELEASE February 21, 2019 MEDIA CONTACTS Keurig Dr Pepper: Frisco EDC: Dallas Cowboys Football Club: Katie Gilroy, 617-820-8971 Leigh Lyons, 972-292-5155 Joe Trahan, 972-497-4552 [email protected] [email protected] [email protected] Keurig Dr Pepper Relocating Texas Headquarters to Frisco New dual headquarters location will provide a vibrant, collaborative and connected workplace PLANO, Texas and BURLINGTON, Mass. – Keurig Dr Pepper (NYSE: KDP) today announced that the company will move its Texas headquarters from Plano to a new, 350,000 sq. ft. build-to-suit, leased facility at The Star in Frisco, Texas. The new location will be ready in 2021 and serve as one of the company’s two headquarters, with the other located in Burlington, Massachusetts. “We are excited to upgrade our Texas co-headquarters location to support the needs of our vibrant business, including enhanced technology capabilities and space to increase collaboration,” said Bob Gamgort, Chairman and CEO of Keurig Dr Pepper. “The new location at The Star in Frisco will provide a state-of the-art work environment and exciting amenities that will energize our employees and enable us to attract top talent in the area.“ The announcement follows a vote by the Frisco Economic Development Corporation Board of Directors approving an incentive package tied to certain performance criteria. Approximately 1,100 employees work in the company’s current location in Plano, which it has occupied since 1998. “This is an exciting day for the City of Frisco,” said Frisco Mayor Jeff Cheney. “Having this Fortune 500 company located in Frisco will continue to strengthen the city’s position as one of the top corporate relocation destinations in the United States. -

Product Differentiation and Mergers in the Carbonated Soft Drink Industry

Product Differentiation and Mergers in the Carbonated Soft Drink Industry JEAN-PIERRE DUBE´ University of Chicago Graduate School of Business Chicago, IL 60637 [email protected] I simulate the competitive impact of several soft drink mergers from the 1980s on equilibrium prices and quantities. An unusual feature of soft drink demand is that, at the individual purchase level, households regularly select a variety of soft drink products. Specifically, on a given trip households may select multiple soft drink products and multiple units of each. A concern is that using a standard discrete choice model that assumes single unit purchases may understate the price elasticity of demand. Tomodel the sophisticated choice behavior generating this multiple discreteness,Iuse a household-level scanner data set. Market demand is then computed by aggregating the household estimates. Combining the aggregate demand estimates with a model of static oligopoly, I then run the merger simulations. Despite moderate price increases, I find substantial welfare losses from the proposed merger between Coca-Cola and Dr. Pepper. I also find large price increases and corresponding welfare losses from the proposed merger between Pepsi and 7 UP and, more notably, between Coca-Cola and Pepsi. 1. Introduction With the advent of aggregate brand-level data collected at supermarket checkout scanners, researchers have begun to use structural econo- metric models for policy analysis. The rich content of scanner data enables the estimation of demand systems and their corresponding cross-price elasticities. The areas of merger and antitrust policy have been strong beneficiaries of these improved data. Recent advances in structural approaches to empirical merger analysis consist of combining Iamvery grateful to my thesis committee: David Besanko, Tim Conley, Sachin Gupta, and Rob Porter. -

Carbonated Soft Drinks in the US Through 2025

Carbonated Soft Drinks in the U.S. through 2025: Market Essentials 2021 Edition (To be published September 2021. Data through 2020. Market projections through 2025.) More than 120 Excel tables plus an executive summary detailing trends and comprehensive profiles of leading companies, their brands and their strategies. his comprehensive market research report on the number-two T beverage category examines trends and top companies' For A Full strategies. It provides up-to-date statistics on leading brands, Catalog of packaging, quarterly growth and channels of distribution. It also Reports and offers data on regional markets, pricing, demographics, Databases, advertising, five-year growth projections and more. Go To The report presents the data in Excel spreadsheets, which it supplements with a concise executive summary highlighting key bmcreports.com developments including the impact of the coronavirus pandemic as well as a detailed discussion of the leading carbonated soft drink (CSD) companies. INSIDE: REPORT OVERVIEW A brief discussion of key AVAILABLE FORMAT & features of this report. 2 PRICING TABLE OF CONTENTS Direct Download A detailed outline of this Excel sheets, PDF, PowerPoint & Word report’s contents and data tables. 7 $4,395 To learn more, to place an advance order or to inquire about SAMPLE TEXT AND additional user licenses call: Charlene Harvey +1 212.688.7640 INFOGRAPHICS ext. 1962 [email protected] A few examples of this report’s text, data content layout and style. 13 HAVE Contact Charlene Harvey: 212-688-7640 x 1962 QUESTIONS? [email protected] Beverage Marketing Corporation 850 Third Avenue, 13th Floor, New York, NY 10022 Tel: 212-688-7640 Fax: 212-826-1255 The answers you need Carbonated Soft Drinks in the U.S. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Strategic Analysis of the Coca-Cola Company

STRATEGIC ANALYSIS OF THE COCA-COLA COMPANY Dinesh Puravankara B Sc (Dairy Technology) Gujarat Agricultural UniversityJ 991 M Sc (Dairy Chemistry) Gujarat Agricultural University, 1994 PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration Executive MBA O Dinesh Puravankara 2007 SIMON FRASER UNIVERSITY Summer 2007 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author APPROVAL Name: Dinesh Puravankara Degree: Master of Business Administration Title of Project: Strategic Analysis of The Coca-Cola Company. Supervisory Committee: Mark Wexler Senior Supervisor Professor Neil R. Abramson Supervisor Associate Professor Date Approved: SIMON FRASER UNIVEliSITY LIBRARY Declaration of Partial Copyright Licence The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection (currently available to the public at the "lnstitutional Repository" link of the SFU Library website <www.lib.sfu.ca> at: ~http:llir.lib.sfu.calhandle/l8921112>)and, without changing the content, to translate the thesislproject or extended essays, if technically possible, to any medium or format for the purpose of preservation of the digital work.