The Confident Car Buyer Presentation Outline

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Two-Point Vehicle Classification System

178 TRANSPORTATION RESEARCH RECORD 1215 A Two-Point Vehicle Classification System BERNARD C. McCULLOUGH, JR., SrAMAK A. ARDEKANI, AND LI-REN HUANG The counting and classification of vehicles is an important part hours required, however, the cost of such a count was often of transportation engineering. In the past 20 years many auto high. To offset such costs, many techniques for the automatic mated systems have been developed to accomplish that labor counting, length determination, and classification of vehicles intensive task. Unfortunately, most of those systems are char have been developed within the past decade. One popular acterized by inaccurate detection systems and/or classification method, especially in Europe, is the Automatic Length Indi methods that result in many classification errors, thus limiting cation and Classification Equipment method, known as the accuracy of the system. This report describes the devel "ALICE," which was introduced by D. D. Nash in 1976 (1). opment of a new vehicle classification database and computer This report covers a simpler, more accurate system of vehicle program, originally designed for use in the Two-Point-Time counting and classification and details the development of the Ratio method of vehicle classification, which greatly improves classification software that will enable it to surpass previous the accuracy of automated classification systems. The program utilizes information provided by either vehicle detection sen systems in accuracy. sors or the program user to determine the velocity, number Although many articles on vehicle classification methods of axles, and axle spacings of a passing vehicle. It then matches have appeared in transportation journals within the past dec the axle numbers and spacings with one of thirty-one possible ade, most have dealt solely with new types, or applications, vehicle classifications and prints the vehicle class, speed, and of vehicle detection systems. -

Revisiting the Compcars Dataset for Hierarchical Car Classification

sensors Article Revisiting the CompCars Dataset for Hierarchical Car Classification: New Annotations, Experiments, and Results Marco Buzzelli * and Luca Segantin Department of Informatics Systems and Communication, University of Milano-Bicocca, 20126 Milano, Italy; [email protected] * Correspondence: [email protected] Abstract: We address the task of classifying car images at multiple levels of detail, ranging from the top-level car type, down to the specific car make, model, and year. We analyze existing datasets for car classification, and identify the CompCars as an excellent starting point for our task. We show that convolutional neural networks achieve an accuracy above 90% on the finest-level classification task. This high performance, however, is scarcely representative of real-world situations, as it is evaluated on a biased training/test split. In this work, we revisit the CompCars dataset by first defining a new training/test split, which better represents real-world scenarios by setting a more realistic baseline at 61% accuracy on the new test set. We also propagate the existing (but limited) type-level annotation to the entire dataset, and we finally provide a car-tight bounding box for each image, automatically defined through an ad hoc car detector. To evaluate this revisited dataset, we design and implement three different approaches to car classification, two of which exploit the hierarchical nature of car annotations. Our experiments show that higher-level classification in terms of car type positively impacts classification at a finer grain, now reaching 70% accuracy. The achieved performance constitutes a baseline benchmark for future research, and our enriched set of annotations is made available for public download. -

Modelling of Emissions and Energy Use from Biofuel Fuelled Vehicles at Urban Scale

sustainability Article Modelling of Emissions and Energy Use from Biofuel Fuelled Vehicles at Urban Scale Daniela Dias, António Pais Antunes and Oxana Tchepel * CITTA, Department of Civil Engineering, University of Coimbra, Polo II, 3030-788 Coimbra, Portugal; [email protected] (D.D.); [email protected] (A.P.A.) * Correspondence: [email protected] Received: 29 March 2019; Accepted: 13 May 2019; Published: 22 May 2019 Abstract: Biofuels have been considered to be sustainable energy source and one of the major alternatives to petroleum-based road transport fuels due to a reduction of greenhouse gases emissions. However, their effects on urban air pollution are not straightforward. The main objective of this work is to estimate the emissions and energy use from bio-fuelled vehicles by using an integrated and flexible modelling approach at the urban scale in order to contribute to the understanding of introducing biofuels as an alternative transport fuel. For this purpose, the new Traffic Emission and Energy Consumption Model (QTraffic) was applied for complex urban road network when considering two biofuels demand scenarios with different blends of bioethanol and biodiesel in comparison to the reference situation over the city of Coimbra (Portugal). The results of this study indicate that the increase of biofuels blends would have a beneficial effect on particulate matter (PM ) emissions reduction for the entire road network ( 3.1% [ 3.8% to 2.1%] by kg). In contrast, 2.5 − − − an overall negative effect on nitrogen oxides (NOx) emissions at urban scale is expected, mainly due to the increase in bioethanol uptake. Moreover, the results indicate that, while there is no noticeable variation observed in energy use, fuel consumption is increased by over 2.4% due to the introduction of the selected biofuels blends. -

Making Markets for Hydrogen Vehicles: Lessons from LPG

Making Markets for Hydrogen Vehicles: Lessons from LPG Helen Hu and Richard Green Department of Economics and Institute for Energy Research and Policy University of Birmingham Birmingham B15 2TT United Kingdom Hu: [email protected] Green: [email protected] +44 121 415 8216 (corresponding author) Abstract The adoption of liquefied petroleum gas vehicles is strongly linked to the break-even distance at which they have the same costs as conventional cars, with very limited market penetration at break-even distances above 40,000 km. Hydrogen vehicles are predicted to have costs by 2030 that should give them a break-even distance of less than this critical level. It will be necessary to ensure that there are sufficient refuelling stations for hydrogen to be a convenient choice for drivers. While additional LPG stations have led to increases in vehicle numbers, and increases in vehicles have been followed by greater numbers of refuelling stations, these effects are too small to give self-sustaining growth. Supportive policies for both vehicles and refuelling stations will be required. 1. Introduction While hydrogen offers many advantages as an energy vector within a low-carbon energy system [1, 2, 3], developing markets for hydrogen vehicles is likely to be a challenge. Put bluntly, there is no point in buying a vehicle powered by hydrogen, unless there are sufficient convenient places to re-fuel it. Nor is there any point in providing a hydrogen refuelling station unless there are vehicles that will use the facility. What is the most effective way to get round this “chicken and egg” problem? Data from trials of hydrogen vehicles can provide information on driver behaviour and charging patterns, but extrapolating this to the development of a mass market may be difficult. -

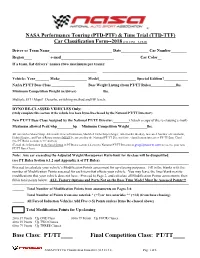

PT & TT Car Classification Form

® NASA Performance Touring (PTD-PTF) & Time Trial (TTD-TTF) Car Classification Form--2018 (v13.1/15.1—1-15-18) Driver or Team Name________________________________ Date______________ Car Number________ Region_____________ e-mail________________________________________ Car Color_______________ If a team, list drivers’ names (two maximum per team): ___________________________________________ ___________________________________________ Vehicle: Year_______ Make______________ Model___________________ Special Edition?____________ NASA PT/TT Base Class _____________ Base Weight Listing (from PT/TT Rules)______________lbs. Minimum Competition Weight (w/driver)_______________lbs. Multiple ECU Maps? Describe switching method and HP levels:_____________________________________________ DYNO RE-CLASSED VEHICLES Only: (Only complete this section if the vehicle has been Dyno Re-classed by the National PT/TT Director!) New PT/TT Base Class Assigned by the National PT/TT Director:_________(Attach a copy of the re-classing e-mail) Maximum allowed Peak whp_________hp Minimum Competition Weight__________lbs. All cars with a Motor Swap, Aftermarket Forced Induction, Modified Turbo/Supercharger, Aftermarket Head(s), Increased Number of Camshafts, Hybrid Engine, and Ported Rotary motors MUST be assessed by the National PT/TT Director for re-classification into a new PT/TT Base Class! (See PT Rules sections 6.3.C and 6.4) (E-mail the information in the listed format in PT Rules section 6.4.2 to the National PT/TT Director at [email protected] to receive your new PT/TT Base Class) Note: Any car exceeding the Adjusted Weight/Horsepower Ratio limit for its class will be disqualified. (see PT Rules Section 6.1.2 and Appendix A of PT Rules). Proceed to calculate your vehicle’s Modification Points assessment for up-classing purposes. -

Form HSMV 83045

FLORIDA DEPARTMENT OF HIGHWAY SAFETY AND MOTOR VEHICLES Application for Registration of a Street Rod, Custom Vehicle, Horseless Carriage or Antique (Permanent) INSTRUCTIONS: COMPLETE APPLICATION AND CHECK APPLICABLE BOX 1 APPLICANT INFORMATION Name of Applicant Applicant’s Email Address Street Address City _ State Zip Telephone Number _ Sex Date of Birth Florida Driver License Number or FEID Number 2 VEHICLE INFORMATION YEAR MAKE BODY TYPE WEIGHT OF VEHICLE COLOR ENGINE OR ID# TITLE# _ PREVIOUS LICENSE PLATE# _ 3 CERTIFICATION (Check Applicable Box) The vehicle described in section 2 is a “Street Rod” which is a modified motor vehicle manufactured prior to 1949. The vehicle meets state equipment and safety requirements that were in effect in this state as a condition of sale in the year listed as the model year on the certificate of title. The vehicle will only be used for exhibition and not for general transportation. A vehicle inspection must be done at a FLHSMV Regional office and the title branded as “Street Rod” prior to the issuance of the Street Rod license plate. The vehicle described in section 2 is a “Custom Vehicle” which is a modified motor vehicle manufactured after 1948 and is 25 years old or older and has been altered from the manufacturer’s original design or has a body constructed from non-original materials. The vehicle meets state equipment and safety requirements that were in effect in this state as a condition of sale in the year listed as the model year on the certificate of title. The vehicle will only be used for exhibition and not for general transportation. -

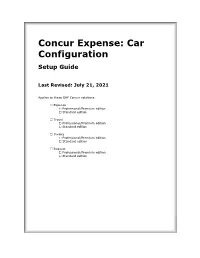

Car Configuration Setup Guide

Concur Expense: Car Configuration Setup Guide Last Revised: July 21, 2021 Applies to these SAP Concur solutions: Expense Professional/Premium edition Standard edition Travel Professional/Premium edition Standard edition Invoice Professional/Premium edition Standard edition Request Professional/Premium edition Standard edition Table of Contents Section 1: Permissions ................................................................................................ 1 Section 2: Two User Interfaces for Concur Expense End Users .................................... 2 This Guide – What the User Sees ............................................................................ 2 Transition Guide for End Users ................................................................................ 3 Section 3: Overview .................................................................................................... 3 Criteria ..................................................................................................................... 4 Examples of Car Configurations .................................................................................... 4 Dependencies ............................................................................................................ 5 Calculations and Amounts ........................................................................................... 5 Company Car - Variable Rates ................................................................................ 5 Personal Car ........................................................................................................ -

Louisville's Labor Day Drive Thru Car Show Participant Information

Louisville’s Labor Day Drive Thru Car Show Participant Information COVID-19 Health and Safety Information • Please stay home if you are sick or exhibiting COVID-19 symptoms or if you have been in close contact with a person suspected or confirmed to have COVID-19. • Face Masks: Masks must be worn properly covering the nose and mouth during check-in, when walking around the event, and when talking with car show attendees or other participants. You may remove your mask only when stationed at your vehicle. • Social Distancing: Please maintain a distance of 6’ or greater from event staff, volunteers, attendees, and other participants not from your household during the event. • A list of event participants, staff, and volunteers will be kept on file. Should you receive a positive or suspected COVID-19 diagnosis within 2 weeks following the event, please inform the event organizer. Contact tracing is generally implemented in situations where individuals have had close contact with a person suspected or confirmed to have COVID-19 (generally within 6 feet for at least 15 minutes, depending on level of exposure). General Information and Check-in Details Date and Times: Monday, September 7, 2020 • Participant check-in: 8:30-9:30am o If attendees are lined up and waiting to come through the show, we will begin letting attendees view the show as early as 9:45. • Car Show Hours: 10am-noon o Last attendee will enter the show at 12pm. Participating vehicles should plan to stay until 12:30. Check-in Location—See Attached Map • Ascent Community Church Parking Lot (aka, the “Old Sam’s Club”), 550 McCaslin Blvd, Louisville o Enter near Post Office; Check-in tent is on the north side of parking lot, near Safeway • Cars will generally be parked in the order in which you arrive. -

Limousine New York

SGB LIMOUSINE NEW YORK SGB LIMOUSINES OF NEW YORK | OFFICE (516) 223-5555 | FAX (516) 688-3914 | WEB SGBLIMOUSINE.COM SGB New York LIMOUSINE 24 HOUR LIMO &TO WN CAR SERVICE Your Car is Waiting New York SGB LIMOUSINE 24 HOUR LIMO &TO WN CAR SERVICE AFFILIATE DOCUMENT TABLE OF CONTENTS PAGE 4 WELCOME LETTER PAGE 5 ABOUT SGB PAGE 7 BILLING & CONFIRMATION PAGE 8 OUR FLEET PAGE 10 AIRPORT PROCEDURES PAGE 12 AFFILIATE LOCATIONS New York SGB LIMOUSINE 24 HOUR LIMO &TO WN CAR SERVICE WELCOME TO SGB LIMOUSINE OF NEW YORK On behalf of SGB Limousine, I would like to welcome you as a new affiliate partner. Our team looks forward to serving your needs in the New York Tri State area with the same pride and dedication that we currently provide our loyal customers. Warm Regards, Steven Berry President SGB LIMOUSINE New York SGB LIMOUSINE 24 HOUR LIMO &TO WN CAR SERVICE We are a team of SGB Limousine remains ABOUT professionals whose committed to the idea mission is to provide that every customer, superior chauffeured whether corporate or SGB LIMOUSINES car services that stand individual, is the one above the rest. that matters most. “Your Car is Waiting” 5 New York SGB LIMOUSINE 24 HOUR LIMO &TO WN CAR SERVICE YOU DESERVE THE BEST 24/7 Call Center We are committed to serving your clients around the clock. Experienced Corporate Agents Our agents are always professional and curtious. Professionally Trained Chauffeurs Our chauffeurs are prompt, curtious and professional. We hire only the best. Fleet of Executive Luxury Sedans We have a large fleet of meticulously maintained Chrysler 300Cs. -

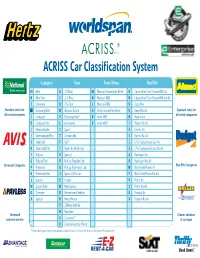

ACRISS Car Classification System

4WS 968 Car Industry Letter 6/12/06 09:15 Page 1 ACRISS Car Classification System Category Type Trans/Drive Fuel/Air M Mini B 2-3 Door M Manual Unspecified Drive R Unspecified Fuel/Power With Air N Mini Elite C 2/4 Door N Manual 4WD N Unspecified Fuel/Power Without Air E Economy D 4-5 Door C Manual AWD D Diesel Air Standard codes for H Economy Elite W Wagon/Estate A Auto Unspecified Drive Q Diesel No Air Standard codes for all rental companies all rental companies C Compact V PassengerVan* B Auto 4WD H Hybrid Air D Compact Elite L Limousine D Auto AWD I Hybrid No Air I Intermediate S Sport E Electric Air J Intermediate Elite T Convertible C Electric No Air S Standard F SUV* L LPG/Compressed Gas Air R Standard Elite J Open Air All Terrain S LPG/Compressed Gas No Air F Fullsize X Special A Hydrogen Air G Fullsize Elite P Pick up Regular Cab B Hydrogen No Air Increased Categories New Elite Categories P Premium Q Pick up Extended Cab M Multi Fuel/Power Air U Premium Elite Z Special Offer Car F Multi Fuel/Power No Air L Luxury E Coupe V Petrol Air W Luxury Elite M Monospace Z Petrol No Air O Oversize R Recreational Vehicle U Ethanol Air X Special H Motor Home X Ethanol No Air Y 2 Wheel Vehicle N Roadster Increased Greater selection customer service G Crossover* of car types K Commercial Van/Truck *These vehicle types require new booking codes which are listed in the chart on the back of this document. -

Product Overview THROTTLE POSITION SENSORS

Product Overview THROTTLE POSITION SENSORS Holstein Parts Throttle Position Sensors offer superior coverage for Import / Domestic applications Holstein Parts uses only the highest quality materials, manufactured to exacting standards to provide long- term function and performance Sealed Anti-Static Protective Packaging ensures that electrical components are not damaged during shipping OVERVIEW The Throttle Position Sensor (TPS) is used to Holstein Parts uses only the highest monitor how far the throttle valve (or blade) is open, quality materials and engineering for parts that are truly built to match or which is determined by how far down the exceed the OE part accelerator pedal has been pressed. This information is relayed to the vehicle's engine control Holstein Parts Throttle Position Sensors unit (ECU) and determines how much air and fuel is offer superior coverage for Import / entering the engine, which guarantees a smooth- Domestic applications running engine. When a TPS goes bad, the car's 3 Year / 36,000 Mile Warranty throttle body won't function properly. It could either stay shut or it won't close properly, which is a severe issue. If it stays shut, then your engine is not going to receive air, and it won't start. A worst-case scenario is when the throttle body won't close properly, causing unwanted acceleration or uncontrolled speed. HOLSTEINPARTS.COM Phone: 1.800.893.8299 Fax: 850.610.7433 Program Overview THROTTLE POSITION SENSORS What does the Throttle Position Sensor do? The Throttle Position Sensor monitors how far the throttle valve (or blade) is open, which is determined by how far down the accelerator pedal has been pressed down. -

COVID-19 Guidance for Rideshare, Taxi, and Car Service Workers

COVID-19 Guidance for Rideshare, Taxi, and Car Service Workers OSHA is committed to protecting the health and safety of America’s workers and workplaces during the COVID-19 pandemic. The agency is issuing a series of industry-specific alerts designed to help keep workers safe. Take the following steps to reduce risk of exposure to the coronavirus for workers in the rideshare, taxi, and car services industry. Instruct sick drivers to stay home. Ensure vehicle door handles and inside surfaces are routinely cleaned and disinfected. Provide drivers with disinfectants and cleaning supplies. Advise drivers to lower vehicle windows to increase airflow. Provide and have all workers wear face coverings (i.e., cloth face coverings or surgical masks) that have at least two layers of tightly woven breathable fabric. Face coverings should be provided at no cost to workers. Require all vehicle occupants and customers to wear face coverings and follow CDC requirements for face coverings on public transit. Provide alcohol-based hand sanitizers containing at least 60 percent ethanol and 70% isopropanol for both drivers and customers. Limit the number of passengers drivers can transport at a single time, and install plexiglass partitions between driver and passenger compartments. Ensure policies encourage drivers to report any safety and health concerns. For the latest guidance and other resources on protecting workers from coronavirus, visit OSHA’s Protecting Workers Guidance. OSHA issues alerts to draw attention to worker safety and health issues and solutions. 3R 2021 0 - 4021 • osha.gov/coronavirus • 1-800-321-OSHA (6742) • @OSHA_DOL OSHA OSHA .