For Personal Use Only Use Personal for Shares Pursuant to This Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary and Recommended Investment Strategy. Investment

Thirty Four Years of Independent Information and Unbiased Advice on the Australian and NZ Stockmarkets Market Analysis Issue No. 524 www.stockmarket.co.nz February 8, 2016 Inside Market Analysis Smiths City Group buys Auckland business Prophecy International reports strong growth as base for expansion ............................................... 2 (but numbers don't add up!)....................................... 8 Finbar Group announces two new developments .... 5, 6 New ASX and NZX Settlement Dates .................... 8, 9 Programmed Group's share price falls on Australian Warrant / Option Analysis ................. 10, 11 weak Resources sector result ............................... 7, 8 Founder: James R Cornell (B.Com.) Summary and Recommended Investment Strategy. The Resources sector remains firmly out-of-favour with the media and the stockmarket, but things are actually getting better. Or, at least, less worse. With the sector at a “point of maximum pessimism” - and some improvement in commodity prices - this could be the time to start adding to our positions in depressed Resource “tainted” shares! Investment Outlook.Stockmarket Forecasts The price of Crude Oil has recovered about 20% since One-Month One-Year its lows in mid-January. With over-production, record Australia: 61% (Bullish ) 40% (Neutral) high oil stocks and low demand, that price recovery may New Zealand: 51% (Neutral) 47% (Neutral) not last. Copper, Tin and Zinc prices are also up from mid-January lows. Aluminium, Lead and Thermal Coal prices have continued to rise from their recent lows in November 2015. Gold and Silver are up from lows in December. Iron Ore is the only major commodity to remain near its lows at US$42/tonne (although up $1 since December). -

Tax Companion

Stockbroking | Wealth Management | Corporate Advice Tax Companion 2020-2021 Stockbroking | Wealth Management | Corporate Advice Would you like access to IPOs? The Morgans Corporate Finance team is a market leader in capital raisings and corporate advisory solutions. Since the early 1990s, the team has structured and raised more than $40 billion in new capital for clients in over 2,000 transactions for ASX-listed businesses. Our clients have been able to invest in many ASX-listed success stories such as Airtasker, BlueBet, Booktopia Limited, Universal Holdings, Peter Warren Automotive, Domino’s Australia, Corporate Travel Management, Volpara Health Technologies and more. IPOs offered to Morgans clients For more information: morgans.com.au 1800 777 946 Contact your Morgans Adviser Contents Closing Prices 4 Dividends Ordinary 22 Dividends Trust 34 Bonus Issues 55 Rights Issues 56 Entitlement Issues 57 Reconstructions 61 Capital Returns 63 Takeovers and Mergers 64 Demergers 65 Delistings 67 New Listings 69 Company Name Changes 72 Disclaimer© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf. -

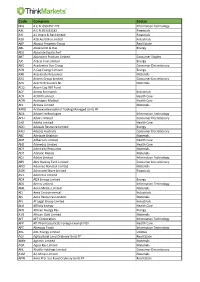

Australian Stock Exchange(ASX)

Security Code Description Margin % Allow Short AllowBuy Lot Size Currency 14D.ASX 1414 Degrees Limited 80 N Y 1 AUD 1AD.ASX Adalta Limited 100 N Y 1 AUD 1AG.ASX Alterra Limited 70 N Y 1 AUD 1ST.ASX 1St Group Ltd 100 N Y 1 AUD 2BE.ASX Tubi Limited 100 N Y 1 AUD 360.ASX Life360 Inc. 100 N Y 1 AUD 3DA.ASX Amaero International 60 N Y 1 AUD 3DP.ASX Pointerra Limited 100 N Y 1 AUD 3PL.ASX 3P Learning Ltd 60 N Y 1 AUD 4CE.ASX Force Com Ltd 100 N Y 1 AUD 4DS.ASX 4Ds Memory Limited 100 N Y 1 AUD 4DX.ASX 4Dmedical Limited 100 N Y 1 AUD 5GG.ASX Pentanet 100 N Y 1 AUD 5GN.ASX 5G Networks Limited 80 N Y 1 AUD 88E.ASX 88 Energy Ltd 70 N Y 1 AUD 8CO.ASX 8Common Limited 80 N Y 1 AUD 8EC.ASX 8Ip Emerg Co Ltd 100 N Y 1 AUD 8IH.ASX 8I Holdings Ltd 70 N Y 1 AUD 8VI.ASX 8Vi Holdings Limited 70 N Y 1 AUD 9SP.ASX 9 Spokes Int Limited 80 N Y 1 AUD A1C.ASX Aic Resources 100 N Y 1 AUD A1G.ASX African Gold Ltd. 100 N Y 1 AUD A1M.ASX Aic Mines Ltd 60 N Y 1 AUD A2B.ASX A2B Australia Ltd 60 Y Y 1 AUD A2M.ASX The A2 Milk Company 10 Y Y 1 AUD A3D.ASX Aurora Labs Limited 100 N Y 1 AUD A40.ASX Alitares 100 N Y 1 AUD A4N.ASX Alpha Hpa Ltd 50 N Y 1 AUD AAC.ASX Australian Agricult. -

Annual R Eport 20 18

Annual Report 2018 CIMIC Group is an engineering-led construction, mining, services and public private partnerships leader with a history dating back to 1899. Peak Downs Coal Mine Thiess, Queensland, Australia CIMIC Group I Annual Report 2018 1 CIMIC Group I Annual Report 2018 2 Maintenance Docking of HMAS Toowoomba, Henderson Common User Facility UGL, Western Australia CIMIC Group I Annual Report 2018 3 Executive Chairman’s review CIMIC is in a strong position, with a high level of demand for our operations. Dear shareholders, This kind of proactive collaboration, as And CIMIC is at the forefront, leveraging a committed part of our culture, is at our world of experience and expertise, CIMIC Group has a unique the heart of our competitive advantage, using our culture of innovation, and position in our markets equipping us to win and execute the further building our capabilities and most sought after projects. skills, to lead the digital transformation in globally. A family of industry our industries. leaders, our businesses offer Our Principles – integrity, accountability, innovation and delivery, underpinned by For CIMIC Group, digital transformation integrated, engineering-led safety – are essential to this and were is not about technology adoption for the strength in construction, evident throughout the year. sake of it. It’s about changing the way we work so we’re adding more value to our mining, services and public Also crucial to our culture is our clients, stakeholders and communities. private partnerships (PPPs). commitment to continue to build a truly diverse global team, keeping them safe It is about turning insights into solutions In 2018, we focused on enhancing this and prioritising health and wellbeing in by producing results that are grounded collective capability, to provide our all that we do. -

Tax Companion

Wealth Management | Superannuation Advice | Financial Planning Hobart Tax Companion 2020-2021 Wealth Management | Superannuation Advice | Financial Planning Hobart Are you looking for financial advice? As a leading provider of financial advice to Australians, Morgans is focused on your financial future. Our experienced advisers can help you nurture, grow and protect your wealth by developing personalised investment strategies, tailored to your needs and objectives. Our services • Wealth Management • Self-Managed Super Funds • Financial Planning • Stockbroking • Superannuation Advice • Retirement and Estate Planning Get in touch: morgans.com.au/hobart (03) 6236 9000 Contents Closing Prices 4 Dividends Ordinary 22 Dividends Trust 34 Bonus Issues 55 Rights Issues 56 Entitlement Issues 57 Reconstructions 61 Capital Returns 63 Takeovers and Mergers 64 Demergers 65 Delistings 67 New Listings 69 Company Name Changes 72 Disclaimer© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. -

Code Company Sector MIG A.C.N

Code Company Sector MIG A.C.N. 059 457 279 Information Technology AXL A.C.N.603323182 Financials AYI A1 Invest & Res Limited Financials A2B A2B Australia Limited Industrials ABP Abacus Property Group Real Estate ABL Abilene Oil & Gas Energy AEG Absolute Equity Perf ABT Abundant Produce Limited Consumer Staples AJC Acacia Coal Limited Energy AKG Academies Aus Group Consumer Discretionary ACB A-Cap Energy Limited Energy AX8 Accelerate Resources Materials AX1 Accent Group Limited Consumer Discretionary ACS Accent Resources NL Materials ACQ Acorn Cap INV Fund ACF Acrow Formwork Industrials ACR ACRUX Limited Health Care ACW Actinogen Medical Health Care AIV Activex Limited Materials XARO Activexardearealbnd Trading Managed Units FP ADA Adacel Technologies Information Technology ADH Adairs Limited Consumer Discretionary 1AD Adalta Limited Health Care ADD Adavale Resource Limited Energy AAU Adcorp Australia Consumer Discretionary ABC Adelaide Brighton Materials ADR Adherium Limited Health Care AHZ Admedus Limited Health Care ADY Admiralty Resources Materials ADT Adriatic Metals Materials ADJ Adslot Limited Information Technology ABV ADV Braking Tech Limited Consumer Discretionary ANO Advance Nanotek Limited Materials ASW Advanced Share Limited Financials AV1 Adveritas Limited ADX ADX Energy Limited Energy AER Aeeris Limited Information Technology AML Aeon Metals Limited Materials AEI Aeris Environmental Industrials AIS Aeris Resources Limited Materials AFL Af Legal Group Limited Industrials AEB Affinity Energy Health Care AFR African Energy Res -

Tax Companion

Wealth Management | Stockbroking | Financial Planning Brighton Tax Companion 2020-2021 Wealth Management | Stockbroking | Financial Planning Brighton Are you looking for financial advice? As a leading provider of financial advice to Australians, Morgans is focused on your financial future. Our experienced advisers can help you nurture, grow and protect your wealth by developing personalised investment strategies, tailored to your needs and objectives. Our services • Wealth Management • Self-Managed Super Funds • Stockbroking • Portfolio Administration • Financial Planning • Retirement and Estate Planning Get in touch: morgans.com.au/brighton (03) 9519 3555 Contents Closing Prices 4 Dividends Ordinary 22 Dividends Trust 34 Bonus Issues 55 Rights Issues 56 Entitlement Issues 57 Reconstructions 61 Capital Returns 63 Takeovers and Mergers 64 Demergers 65 Delistings 67 New Listings 69 Company Name Changes 72 Disclaimer© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. -

Pushing for Development

THEAUSTLIAN M R A product of PP100007123 ININAG EVIEW Incorporating THE USTLIAN Publications & E R Exhibitions Australia Pty Ltd OIL – GAS – ELECTRICIT Y – RENEWABLES ISSUE 113, JUNE 2017 NEWS: TECHNOLOGY & INNOVATION P10 MINING IN SOUTH AUSTRALIA P24 RECRUITMENT P75 Image: Bruce Peebles. © State of Queensland 2017. ADANI: Pushing for development When Adani spectacularly deferred it’s highly anticipated final investment decision announcement – just days before it was due – the future of its $16.5 billion Carmichael project was cast into doubt. The story continues to evolve, but if the kinks associated with State royalty agreements and Federal NAIF loans can be ironed out, then this mega-project could be an economic windfall for the North Queensland region for decades to come. FEATURE: p20 JUNE 2017 2 CONTENTS THE AUSTLIAN MINING REVIEW PUBLISHED BY ABN 28 112 572 433 A product of Publications & Exhibitions Australia Pty Ltd GENERAL MANAGER Brad Francis MANAGING EDITOR Reuben Adams COMMODITY FOCUS: DIAMONDS JOURNALISTS Cameron Drummond, Elizabeth Fabri GRAPHIC DESIGNER featurenews pp1918 Charlotte Lufino SALES EXECUTIVES NEWS 1 Beej Francis, John Carter, Chris Foley, Kelly Thompson Technology & Innovation 10 PRINTER Rural Press International 14 CONTACT US P: (08) 6314 0300 Commodity Focus: Diamonds 18 F: (08) 9481 7322 160 Beaufort Street, Perth, WA 6000. PO Box 8023, Perth BC, WA 6849. SPECIAL Profiles E-mail the editor at [email protected] Adani: Carmichael 20 For all other emails to staff, the standard convention is, first name (only) @miningoilgas. com.au Mining in South Australia 24 The Australian Mining Review is a free publication to all mine sites and mining companies in AIMEX 2017 30 Australia. -

Weeklycomm 8 July 2017 .Pages

FAR EAST CAPITAL LIMITED ! Suite 24, Level 6, 259 Clarence Street SYDNEY NSW AUSTRALIA 2000 Weekly Tel : +61-2-9230 1930 Mob: +61 417 863187 Email : [email protected] Commentary AFS Licence No. 253003 ACN 068 838 193 The Mining Investment Experts! 8 July 2017 On Friday’s Close Analyst : Warwick Grigor A week of gently improving sentiment Reading the AFR on Friday morning, I saw a headline required. It could be a sovereign nation account where saying that the eight year bull market in equities is set to there is a fundamental desire to build gold reserves. There continue. The journalist must be talking about something might even be events whereby the shorters are all forced to different to the market we have been observing over the close out their shorts at one time, causing a scramble for past 12 months, in mining equities. gold as everyone covers, but this would most likely be a However, we have started to see some improvement over short term event. the past week. The Metals and Mining Index has pushed The gold price is likely to stay range-bound for the through the downtrend line. While that doesn’t mean clear foreseeable future, between US$1,200 and US$1,300/oz. sailing from here, it does suggest that the weight of selling Gold producers will continue to make good profits on many seen over the last couple of months is being lifted. Unless mines but there will always be marginal mines that fail for there is a shot from left field to cause another round of both geological and management reasons. -

To Be Renamed "Pure Minerals Limited") ACN 125 368 658

Eagle Nickel Limited (to be renamed "Pure Minerals Limited") ACN 125 368 658 PROSPECTUS For an offer of 225,000,000 Shares (on a post-Consolidation basis) at an issue price of $0.02 each to raise $4,500,000 (before costs) (Public Offer). The minimum subscription under the Public Offer is $4,500,000. This Prospectus also contains the following Secondary Offers: 1. An offer of 17,500,000 Shares (on a post-Consolidation basis) to the vendors of Pure Manganese Pty Ltd (Pure Manganese) and the vendor of Minerals Development Pty Ltd (MDV) (or their respective nominees) for the acquisition of all of the shares in Pure Manganese by the Company and the acquisition of 80% of the shares in MDV by Pure Manganese (Consideration Offer). 2. An offer of 5,000,000 Shares (on a post-Consolidation basis) to the Lead Manager (or its nominees) in part consideration for corporate advisory services provided to the Company (Facilitation Offer). (Together, the Offers). Re-compliance with Chapters 1 and 2 In addition to the purpose of raising funds under the Public Offer, this Prospectus is issued for the purpose of re-complying with the admission requirements under Chapters 1 and 2 of the Listing Rules following a change to the scale of the Company's activities. Conditional Offers The Offers are conditional upon certain events occurring. Please refer to Section 2.3 for further information. The Offers are not underwritten. Important notice This is an important document and investors should read the document in its entirety and are advised to consult with their professional advisers before deciding whether to apply for Shares pursuant to this Prospectus. -

Tax Companion

Stockbroking | Wealth Management | Portfolio Administration Spring Hill Tax Companion 2020-2021 Stockbroking | Wealth Management | Portfolio Administration Spring Hill Are you looking for financial advice? As a leading provider of financial advice to Australians, Morgans is focused on your financial future. Our experienced advisers can help you nurture, grow and protect your wealth by developing personalised investment strategies, tailored to your needs and objectives. Our services • Stockbroking • Superannuation Advice • Wealth Management • Fixed Interest and Cash • Portfolio Administration Management Get in touch: morgans.com.au/springhill (07) 3833 9333 Contents Closing Prices 4 Dividends Ordinary 22 Dividends Trust 34 Bonus Issues 55 Rights Issues 56 Entitlement Issues 57 Reconstructions 61 Capital Returns 63 Takeovers and Mergers 64 Demergers 65 Delistings 67 New Listings 69 Company Name Changes 72 Disclaimer© 2021 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. -

Summary and Recommended Investment Strategy. Investment

Thirty Five Years of Independent Information and Unbiased Advice on the Australian and NZ Stockmarkets Market Analysis Issue No. 527 www.stockmarket.co.nz May 9, 2016 Inside Market Analysis SELL Nuplex Industries ............................................. 7 OZ Minerals expands Carrapateena project .......... 5, 6 Michael Hill International to restructure under an Australian Warrant /Option Analysis .................. 10, 12 Australian based parent company ............................. 2 NEW ISSUE: Tegel Group ...................................... 12 Ausenco Ltd receives (undisclosed) takeover proposal .................................................. 3, 4 Founder: James R Cornell (B.Com.) Summary and Recommended Investment Strategy. Share prices are determined by expectations about the future. Those expectations are uncertain, so prices are volatile. But the stockmarket usually offers interesting investment opportunities which can be rewarding over the longer term. Remain fully invested. Investment Outlook. Commodity prices will always be volatile, but are Stockmarket Forecasts generally continuing to slowly recover from lows reached One-Month One-Year in December 2015 or January 2016. That suggests Australia: 73% (Bullish) 77% (Bullish) depressed Resource shares and Resource related shares New Zealand: 75% (Bullish) 67% (Bullish) could be near cyclical lows, with the potential for strong profit and share price recovery over the next few years. This situation would also explain why a Private Equity fund is interested in acquiring 100% ownership of Ausenco Ltd - and why existing shareholders should not be wanting to sell at this cyclical low. Iron ore prices are up 49% since their low in December 2015, yet the shares of debt-free Mt Gibson Iron continue to trade at a 37% discount to cash in the bank! New Zealand All stockmarket investments involve some risk, but NZX 50 Index some out-of-favour, depressed shares become “lucky” investments that appreciate many-fold in value.