Morningstar® Exponential Technology Indexsm 20 December 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Bekanntmachung Auf Keyinvest Bezugsrechtsemission AMS AG

Bekanntmachung auf KeyInvest Bezugsrechtsemission AMS AG Rights issue AMS AG Im Zusammenhang mit der Kapitalerhöhung der AMS AG (Bloomberg Code: AMS SE) durch Bezugsrechtsemission wurden die Bedingungen der unten genannten Produkte der UBS AG, per 16. März 2020 angepasst. Die detaillierten Informationen befinden sich in der entsprechenden Produktedokumentation (Termsheets). With regard to the rights issue of AMS AG (Bloomberg Code: AMS SE), UBS AG will adjust the terms of the following products as of 16th March 2020. Detailed information can be found in the respective product documentation (Termsheets). ISIN Name CH0406766680 PERLES Plus on AMS AG CH0434739725 Kick-In Certificate on AMS AG / U-Blox / ABB CH0434739717 Kick-In Certificate on AMS AG / U-Blox / ABB CH0524660716 8.40% p.a. Callable Kick-In GOAL on AMS AG / Logitech / Temenos CH0391676241 PERLES Plus on AMS AG CH0405218907 PERLES Plus on AMS AG CH0428536335 9.00% p.a. ER Worst of Kick-In GOAL on AMS AG / Temenos / OC Oerlikon CH0437181537 Kick-In Certificate on AMS AG / Autoneum Holding AG / Dufry AG CH0524663124 10.20% p.a. ER Kick-In GOAL on AMS AG CH0522755518 6.00% p.a. Callable Kick-In GOAL on AMS AG / Kühne + Nagel / Swatch I / Richemont / LafargeHolcim CH0509384506 6.496023402505% p.a. Kick-In GOAL on AMS AG / Credit Suisse / Swiss Re CH0512543437 FACTOR CERTIFICATE ON AMS AG CH0512543445 FACTOR CERTIFICATE ON AMS AG CH0512547974 FACTOR CERTIFICATE ON AMS AG CH0527058983 FACTOR CERTIFICATE ON AMS AG CH0453246909 CHF MINI-FUTURE ON AMS AG CH0521942109 CHF EQUITY-WARRANT -

Electronics System Coordinator

Electronics System Coordinator RYOSAN CO., LTD. CORPORATE PROFILE 2020 Since its founding, Ryosan has conducted corporate activities based on the strong conviction that “a corporation is a public institution.” This phrase means that corporations are founded in order to benefit society in both the present and the future. Corporations are allowed to exist only if they are needed by society. In other words, corporations lose their meaning when they are no longer needed by society. Ryosan will continue its corporate activities with this strong conviction and firm resolution. “A corporation is a public institution.” Ryosan keeps this phrase firmly in its heart as the Company moves forward into the future. Ryosan History ~1960 1970 1980 1990 2000 2010~ 1953 1974 1981 1996 2000 2012 Ryosan Denki Co., Ltd. is established Hong Kong Ryosan Limited is The company name is changed to Ryosan Technologies USA Inc. The head office is moved to the current Ryosan Europe GmbH is established. in Kanda-Suehirocho, Chiyoda-ku, established. Ryosan Co., Ltd. is established. Head Office Building. Tokyo. Consolidated net sales exceed 300 2014 1976 1982 1997 billion yen. Ryosan India Pvt. Ltd. is established. 1957 Singapore Ryosan Private Limited Consolidated net sales exceed Zhong Ling International Trading The Company is reorganized as is established. 100 billion yen. (Shanghai) Co.,Ltd. is established. 2001 2016 a stock company as Korea Ryosan Corporation and Ryosan Engineering Headquarters obtain Ryosan Denki Co., Ltd. 1979 1983 1999 (Thailand) Co.,Ltd. are established. ISO9001 certification. Ryotai Corporation is established. Stock is listed on the Second Section Kawasaki Comprehensive Business 1963 of the Tokyo Stock Exchange. -

News Release

NEWS RELEASE Jun 11, 2020 R&I View: Electronic Components Companies Struggle with Automotive Businesses Eyes on investments in advanced fields Demand for automotive electronic components has plunged in the wake of the novel coronavirus outbreak. In the January-March 2020 period, TDK Corp. (Sec. Code: 6762, Issuer Rating: A+) and Taiyo Yuden Co., Ltd. (Sec. Code: 6976, Issuer Rating: A) posted net losses due primarily to impairment losses on assets associated with automotive businesses, combined with a seasonal decline in smartphone-related demand. Alps Alpine Co., Ltd. (Sec. Code: 6770, Issuer Rating: A-), which derives around 70% of consolidated sales from automotive products and components, including car navigation systems, fell into an operating loss. As growth in unit sales of smartphones and other digital devices became difficult to envisage, many electronic components companies have been actively investing in expanding automotive businesses as the core of their growth strategies. If automobile production and sales continue to be stagnant for a protracted period of time due, for example, to the slow containment of the coronavirus or the emergence of a serious second wave, the earnings impact will be amplified. Should development plans for next-generation vehicles be disturbed, the risk of impairment of related facilities and goodwill will also warrant attention. R&I will keep an eye on the earnings of Nidec Corp. (Sec. Code: 6594, Issuer Rating: AA-) and MinebeaMitsumi Inc. (Sec. Code: 6479, Issuer Rating: A), which have made aggressive investments in the growth of their automotive businesses in recent years. Demand is rising for products such as notebook and tablet computers and game consoles, reflecting changes in the way people live, as exemplified by the wider adoption of teleworking and consumption at home driven by restrictions on going out. -

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 May 2021 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 • Naohiko Saida based in Tokyo at Milestone Asset Management provides a dedicated research service to the team at ACIM, Naohiko and James have worked together for the last twenty years Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares 2.81 9.51 21.63 15.06 49.05 46.77 152.42 14.20 I GBP C shares 0.31 4.48 9.45 4.30 27.48 36.66 - - I EUR Hedged C shares 2.77 9.47 21.58 15.14 48.54 42.72 - - I JPY C shares 3.03 9.87 22.53 15.91 50.20 47.62 - - I EUR C shares 1.48 5.93 14.41 9.75 33.73 - - - I EUR D shares -0.67 3.66 11.95 7.37 30.79 - - - I USD Hedged C shares 2.89 9.57 22.14 15.51 49.89 53.06 163.50 14.91 Topix (TR) 1.38 4.12 10.81 7.62 25.61 18.17 80.92 8.88 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

TAIYO YUDEN Lithium Ion Capacitors: an Effective EDLC Replacement

Whitepaper TAIYO YUDEN Lithium Ion Capacitors: An Effective EDLC Replacement Lithium Ion Capacitors overcome the pitfalls of EDLCs, providing superior self-discharge characteristics, high-energy density, reliability, longevity and safety. Atsuya Sato Field Application Engineering Supervisor TAIYO YUDEN TAIYO YUDEN Lithium Ion Capacitors: The Ultimate EDLC Replacement Background An accepted energy solution, conventional Electrical Double Layer Capacitors (EDLC) have many notable drawbacks relating to self-discharge characteristics, energy density, reliability, longevity and thermal design. TAIYO YUDEN Lithium Ion Capacitors overcome these issues and are an effective replacement for EDLCs. Lithium Ion Capacitors are hybrid capacitors, featuring the best characteristics of both EDLC and Lithium Ion Secondary Batteries (LIB). EDLCs were first created in Japan in the 1970s and began appearing in various home appliances in the 1990s. Since the 2000s, they have been used in mobile phones and digital cameras. EDLCs are typically used to protect against sudden momentary drops or sudden interruptions in power. They can instantaneously output large amounts of power, while a battery cannot. They are frequently used as backup power sources in servers and storage devices for integrated circuits, processors, memory and more. While EDLCs are intended to be backup power sources, conventional EDLCs suffer from a phenomenon known as self-discharge, where the capacitor will gradually lose its charge over time. Self-discharge can occur more rapidly during exposure to high temperature environments. The extremely low self-discharge of an Lithium Ion Capacitor, even in high heat environments, ensures a long-lasting charge. Furthermore, Lithium Ion Capacitors have no risk of thermal runaway. No additional thermal design considerations, space or components are necessary when designing with an Lithium Ion Capacitor. -

Proposal of a Data Processing Guideline for Realizing Automatic Measurement Process with General Geometrical Tolerances and Contactless Laser Scanning

Proposal of a data processing guideline for realizing automatic measurement process with general geometrical tolerances and contactless laser scanning 2018/4/4 Atsuto Soma Hiromasa Suzuki Toshiaki Takahashi Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 1 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for point cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 2 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for Point Cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 3 Introduction of JEITA What is JEITA? The objective of the Japan Electronics and Information Technology Industries Association (JEITA) is to promote healthy manufacturing, international trade and consumption of electronics products and components in order to contribute to the overall development of the electronics and information technology (IT) industries, and thereby to promote further Japan's economic development and cultural prosperity. JEITA’s Policy and Strategy Board > Number of full members: 279> Number of associate members: 117(as of May 13, 2014) - Director companies and chair/subchair companies - Policy director companies (alphabetical) Fujitsu Limited (chairman Masami Yamamoto) Asahi Glass Co., Ltd. Nichicon Corporation Sharp Corporation Azbil Corporation IBM Japan, Ltd. Hitachi, Ltd. Advantest Corporation Nippon Chemi-Con Corporation Panasonic Corporation Ikegami Tsushinki Co., Ltd. Japan Aviation Electronics Industry, Ltd. SMK Corporation Mitsubishi Electric Corporation Nihon Kohden Corporation Omron Corporation NEC Corporation JRC Nihon Musen Kyocera Corporation Sony Corporation Hitachi Metals, Ltd KOA Corporation Fuji Xerox Co., Ltd. -

MAX1917 Evaluation Kit

19-2491; Rev 0; 7/02 MAX1917 Evaluation Kit General Description Features Evaluates: MAX1917 The MAX1917 evaluation kit (EV kit) demonstrates the ♦ Automatically Sets VTT and VTTR to 1/2 VDDR MAX1917’s standard 7A application circuit. This DC-DC ♦ ±1% Output Voltage Accuracy converter provides a complete power-management solu- tion for DDR memory. This EV kit is a fully assembled ♦ 2.5V to 14V Input Voltage Range and tested circuit board. The MAX1917 EV kit generates ♦ 7A Output Current Capability a regulated voltage for VTT and VTTR that is half the ♦ voltage at the DDR input. The input voltage range is Sourcing and Sinking Current 2.5V to 14V. The circuit is configured to deliver 7A of ♦ 550kHz Switching Frequency output current. The DC-DC converter uses buck topology ♦ 16-Pin QSOP Package with synchronous rectification to achieve low output voltage with greater than 90% efficiency. The converter ♦ Low-Profile Components output is capable of sourcing and sinking current. Sink ♦ Fully Assembled and Tested capabilities at low voltage arise from the use of a syn- chronous rectifier, which allows the inductor current to Ordering Information reverse. The EV kit operates at 550kHz switching fre- quency and has superior load-transient response that PART TEMP RANGE IC PACKAGE meets JEDEC specifications for DDR memory. MAX1917EVKIT 0°C to +70°C 16 QSOP Component List DESIGNATION QTY DESCRIPTION DESIGNATION QTY DESCRIPTION 10µF, 25V X5R ceramic capacitors JU2, JU3 2 2-pin headers (1812) C1, C2, C3 3 JU4 1 Not installed Taiyo Yuden TMK432BJ106KM -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

CIAJ Profile 2019-2020

CIAJ PROFILE Communications and Information Network Association of Japan 2019-2020 ADDRESS: 6th Fl., Kabutocho Uni-square, 21-7 Kabutocho, Nihonbashi, Chuo-ku, Tokyo 103-0026 PHONE: +81 3 5962-3454 COMMU N ICATIONS FAX: +81 3 5962-3455 E-mail: [email protected] URL: https://www.ciaj.or.jp/en/ AND INFORM ATION NETW ORK ASSOCIATION O F JA P A N Who we are CIAJ Management Team (As of September, 2019) Board of Directors Senior Steering Committee Members The Communications and Information Network Association of Japan promotes the further use and advancement of info-communication technologies (ICT), aiming for the robust growth of all industries that provides and/or uses info-communication networks by bringing together diverse industries and Chairman Director Director Nobuhiro Endo Tatsuya Tanaka sharing insights. Through such initiatives, CIAJ has Nobuhiro Endo Koichi Hamada Ryota Kitamura Chairman, Chairman, Chairman, President, Telecommunications NEC Corporation Fujitsu Limited NEC Corporation Anritsu Corporation Carriers the mission of contributing to solving social issues Association (NTT) and realizing an enriching society in Japan as well as a sustainable global community. CIAJ was established in 1948 as a voluntary industry association composed mainly of telecom terminal Director Director Director manufacturers and network infrastructure vendors. In Hideichi Kawasaki Toshiaki Higashihara Kaichiro Sakuma Shuji Nakamura Kunihiko Satoh Chairman, President, October 2009, CIAJ embarked on a new page in its President, Executive Officer, Corporate Adviser, OKI Electric Industry Hitachi, Ltd. Hitachi Kokusai Mitsubishi Research Ricoh Co., Ltd. Co., Ltd. history by becoming a general incorporated Electric Inc. Institute, Inc. association. CIAJ’s diverse regular members include communication network and equipment vendors, telecommunication carriers, service providers and user companies. -

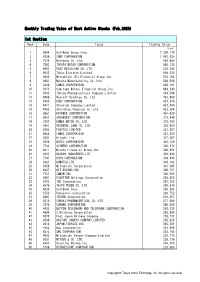

Monthly Trading Value of Most Active Stocks (Feb.2020) 1St Section

Monthly Trading Value of Most Active Stocks (Feb.2020) 1st Section Rank Code Issue Trading Value \ mil. 1 9984 SoftBank Group Corp. 2,359,179 2 6758 SONY CORPORATION 1,081,626 3 7974 Nintendo Co.,Ltd. 895,803 4 7203 TOYOTA MOTOR CORPORATION 884,133 5 9983 FAST RETAILING CO.,LTD. 830,642 6 8035 Tokyo Electron Limited 694,635 7 8306 Mitsubishi UFJ Financial Group,Inc. 576,156 8 6981 Murata Manufacturing Co.,Ltd. 508,566 9 3436 SUMCO CORPORATION 458,161 10 8316 Sumitomo Mitsui Financial Group,Inc. 444,343 11 4502 Takeda Pharmaceutical Company Limited 434,504 12 6098 Recruit Holdings Co.,Ltd. 432,993 13 9433 KDDI CORPORATION 427,810 14 4911 Shiseido Company,Limited 427,490 15 4063 Shin-Etsu Chemical Co.,Ltd. 423,264 16 6861 KEYENCE CORPORATION 401,020 17 6857 ADVANTEST CORPORATION 372,949 18 7267 HONDA MOTOR CO.,LTD. 370,595 19 4661 ORIENTAL LAND CO.,LTD. 336,860 20 6702 FUJITSU LIMITED 331,957 21 6954 FANUC CORPORATION 331,423 22 6501 Hitachi,Ltd. 322,402 23 6594 NIDEC CORPORATION 322,160 24 7733 OLYMPUS CORPORATION 320,972 25 8411 Mizuho Financial Group,Inc. 306,962 26 6367 DAIKIN INDUSTRIES,LTD. 304,946 27 7741 HOYA CORPORATION 304,899 28 6301 KOMATSU LTD. 303,182 29 8058 Mitsubishi Corporation 301,645 30 9437 NTT DOCOMO,INC. 300,727 31 7751 CANON INC. 296,096 32 4901 FUJIFILM Holdings Corporation 293,923 33 6762 TDK Corporation 292,358 34 6976 TAIYO YUDEN CO.,LTD. 290,670 35 9434 SoftBank Corp. -

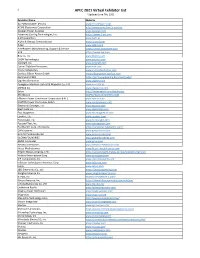

APEC 2021 Virtual Exhibitor List *Updated June 7Th, 2021

1 APEC 2021 Virtual Exhibitor List *Updated June 7th, 2021 Exhibitor Name Website AC POWER CORP. (Preen) www.PreenPower.com ACME Electronics Corporation http://www.acme-ferrite.com.tw Acopian Power Supplies www.acopian.com Advanced Cooling Technologies, Inc. https://www.1-act.com AiSHi Capacitors www.aishi.us Alpha & Omega Semiconductor www.aosmd.com Altair www.altair.com AmePower I Manufacturing, Support & Service https://www.amepower.com AVX https://www.avx.com Bourns, Inc. www.bourns.com CAEN Technologies www.caenels.com Coilcraft, Inc. www.coilcraft.com Cornell Dubilier Electronics www.cde.com Cramer Magnetics www.cramermagnetics.com Danfoss Silicon Power GmbH www.siliconpower.danfoss.com Dartmouth PMIC https://pmic.engineering.dartmouth.edu/ Digi-Key Electronics www.digikey.com Dongguan Mentech Optical & Magnetic Co., Ltd. www.mnc-tek.us dSPACE Inc. www.dspaceinc.com Eaton http://www.eaton.com/electronics EFC/Wesco WWW.FILMCAPACITORS.COM Efficient Power Conversion Corporation (EPC) www.epc-co.com EGSTON Power Electronics Gmbh www.egstonpower.com Electronic Concepts, Inc. www.ecicaps.com Elektrisola Inc. www.elektrisola.com Elna Magnetics www.elnamagnetics.com Epoxies, Etc. www.epoxies.com Ferroxcube, Inc. www.ferroxcube.com Focused Test, Inc. www.focusedtest.com Fuji Electric Corp. of America https://americas.fujielectric.com/ GAN Systems www.gansystems.com GeneSiC Semiconductor www.genesicsemi.com GLOBALFOUNDRIES www.globalfoundries.com GMW Associates www.gmw.com Heraeus Electronics www.heraeus-electronics.com Hesse Mechatronics www.hesse-mechatronics.com Hitachi Metals America, LTD. https://www.hitachi-metals.co.jp/e/products/item/sm Hotland International Corp www.sz-hotland.com ICE Components, Inc. www.icecomponents.com Infineon Technologies Americas Corp www.infineon.com Iptest www.iptest.com J&D Electronics Co., Ltd https://www.hqsensing.com Jianghai America Inc www.jianghai-america.com KEPCO, Inc.