Charleston Is Prime for Population Spike, Eventually Increasing Demand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Urban Retail Services

Urban Retail Services Customized Real Estate Services Accelerating success. Urban Retail Services The Americas Providing a full suite of services including: • Agency • Retail Location Strategy & Analytics • Mixed Use • Restaurant & Food Services • Investment Sales & Triple Net • Property Management • Project & Construction Management • Portfolio Development 2 | Urban Retail Services Urban Retail Services | 3 4 | Urban Retail Services Our Services Colliers International is a leading global real estate services organization defined by our spirit of enterprise. Through our culture of service excellence and a shared sense of initiative, we have integrated the resources of real estate specialists worldwide to accelerate the success of our clients. Our 403 offices worldwide share a common brand and vision to provide the best service experience available. To us, that means empowering our teams to partner with each client, truly listening to their unique business needs and designing an integrated service offering. Our goal is to make your real estate a competitive business advantage and meet your entire range of property needs. And through it all, our professionals go the extra mile in their attitudes and actions, allowing our values of expertise, community,service and fun to come through in everything we do. Retail Services 150+ 500+ Number of Markets Retail Professionals Urban Retail Services | 5 Case Study Swatch Challenge When Switzerland’s biggest multi-brand watch company sought to expand into major cities across the United States, Swatch Group (Breguet, Harry Winston, Blancpain, Omega, Rado, Tissot, Balmain, Hamilton and Swatch, among others) looked to our team for assistance. Strategy The Swatch Group introduced a new corporate plan to expand into very high profile locations and lengthen the terms of certain key stores in major cities nationally as well as internationally. -

REQUEST for COUNCIL ACTION and ATTACHMENTS.Pdf

REQUEST FOR COUNCIL ACTION Date: December 7, 2020 Item No.: 7.i Department Approval City Manager Approval Item Description: Authorize execution of a Letter of Intent concerning the sale of 2501 Fairview Avenue, known as the Fairview Fire Station. 1 BACKGROUND 2 The City Council and the Roseville Economic Development Authority (REDA) entered into a listing 3 agreement with Bill Melin of Cushman & Wakefield to list for sale 2501 Fairview Avenue (known 4 as the Fairview Fire Station) on August 24, 2020. The property has generated substantial interest 5 and resulted in the receipt of two Letters of Intent from prospective buyers regarding their intent to 6 enter into a purchase agreement. 7 Mr. Melin listed the property at $1,650,000 based upon comparable sales in the market that have sold 8 in the last year. Mr. Melin has facilitated receipt of two Letters of Intent (LOI) to purchase the 9 property. 10 Both LOI’s are provided in attachments A and B and will be discussed extensively during a REDA 11 meeting held prior to consideration of this item. Mr. Melin and REDA legal counsel will answer 12 questions in regards to both LOI’s during closed session at the REDA meeting. If the REDA wishes 13 to accept one of the LOI’s, the City Council will need to take action to reflect that direction. If the 14 REDA declines to accept one of the LOI’s, this item can be removed from the City Council’s agenda. 15 The LOI will be a three-party agreement with the buyer, the City and the REDA. -

2019 Real Estate Technology Market Update

PRELIMINARY CONFIDENTIAL DRAFT Real Estate Technology Market Update Q2 2019 EXECUTIVE SUMMARY – Q2 2019 REAL ESTATE TECHNOLOGY Real estate technology continues to be one of the most active areas of financing and M&A activity through the first half of 2019 ▪ The U.S. real estate tech sector received ~$3.0Bn of growth equity capital in 1H 2019 in addition to more than $1.4Bn in debt for iBuyer and RE financing companies ▪ Investments continue to grow in size, with average equity financings over $21MM across 65 deals in Q2 2019, as competition for high-quality investments increases and the number of active strategics and private equity investors in the space continues to grow Q2 2019 saw commercial real estate technology companies drive significant activity, with a flurry of capital raises and M&A transactions ▪ VTS raised $90M at a ~$1.0Bn valuation led by Brookfield Ventures, the venture arm of Brookfield Asset Management, signaling strong demand from real estate investors / property managers for next-generation solutions to streamline their operations and improve margins ▪ A sharp increase in private equity and strategic driven M&A reflects the growing influence of CRE tech companies and the land grab that’s currently underway as acquirers look to build platforms in the space – Silver Lake and Battery Ventures backed LightBox announced two acquisitions in Q2 2019, Real Capital Markets and Digital Map Products, as they look to build an end-to-end software and data platform in the CRE space targeting commercial services firms, property -

42Nd Street Townhomes 42Nd & Adams St | Garden City, Id

Offering Memorandum 42ND STREET TOWNHOMES 42ND & ADAMS ST | GARDEN CITY, ID MIKE PEÑA | 208 472 1666 | [email protected] BRYANT JONES | 208 472 1663 | [email protected] This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all liability for loss and damages arising there from. This publication is the copyrighted property of Colliers International and/or its licensor(s). ©2015. All rights reserved 42ND STREET TOWNHOMES Site Table of Contents Overview 3 Investment Analysis 4 Location 7 Elevations & Site Layout 8 Property Management 13 42nd Street townhomes currently under construction. Demographics 15 Area Overview 16 Contact MIKE PEñA BRYANT JONES 208 472 1666 208 472 1663 [email protected] [email protected] 42nd Street Townhomes | OFFERING MEMORANDUM COLLIERS INTERNATIONAL P. 2 OVERVIEW Profile Executive Summary Type: Multi-family investment The Parkway Townhomes at 42nd is a new housing project off of Veterans Memorial Parkway. The Parkway townhomes are part of a Total Size: 13,220 – 26,440 SF much larger redevelopment of the surrounding area. The property is 8–16 townhome units (±1,650-1,660 SF per unit) adjacent to a Garden City Park, the Ada County Boys and Girls Club, and the Boise River. -

View Annual Report

Revenues (US$ millions) Adjusted EBITDA (US$ millions) 2,344 185 2,110 1,852 152 1,617 1,379 115 93 62 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 Adjusted EPS (US$) Financial Leverage (Expressed in terms of net debt/EBITDA) 1.9 2.15 1.8 1.8 1.4 1.64 1.2 1.04 0.60 0.76 2009 2010 2011 2012 2013 2009 2010 2011 2012 2013 Revenue by Geography Revenue by Geography United United 59% States 59% States 15% Canada 15% Canada Australia/ 10% Europe 10% New Zealand Australia/ 10% New Zealand 5% Asia 5% Asia 10% Europe Latin Latin 1% America 1% America Financial Highlights About FirstService Corporation FirstService Corporation is a global leader in the rapidly growing FirstService generates more than US$2.3 billion in annual real estate services sector, one of the largest markets in the revenues and has more than 24,000 employees worldwide. With RevenuesRevenues (US$ millions) (US$ millions) AdjustedAdjusted EBITDA EBITDA (US$ millions) (US$ millions) world. FirstService manages more than 2.5 billion square feet of significant insider ownership and an experienced management residential and commercial properties through its three industry- team, FirstService has a long-term track record of creating value 2,3442,344 185 185 leading service platforms: and superior returns for shareholders since becoming a publically 2,110 2,110 listed company in 1993. The common shares of FirstService 1,852 1,852 152 152 • Colliers International – one of the largest global players in trade on the NASDAQ under the symbol “FSRV” and on the Toronto 1,617 1,617 commercial real estate services; 1,379 1,379 115 115 Stock Exchange under the symbol “FSV”. -

Omaha Market Rides the Covid-19 Wave

Research & Forecast Report OMAHA | INDUSTRIAL Second Quarter 2020 Omaha Market Rides Market Indicators Relative to prior period Q1 2020 Q2 2020 Q3 2020* the Covid-19 Wave VACANCY NET ABSORPTION The Omaha industrial market vacancy rate still hovers around 3 CONSTRUCTION percent, landing at 3.1 percent in the second quarter of 2020. The vacancy rate for the Omaha industrial market has been 4 percent RENTAL RATE or lower for 24 straight quarters, since the second quarter of 2014. Over 280,000 square feet of absorption took place in the Omaha * Projected industrial market in the second quarter and over 210,000 square feet of industrial square feet were completed and added to the industrial inventory for the quarter. Average asking rents remain about $6.00 Consolidated Supply Company occupied 18,000 square feet near per square foot, landing at $6.62 per square foot in the second 90th and J Streets and Applichem Inc. occupied 16,590 square feet quarter. in Council Bluffs. By submarket, Council Bluffs, Northeast, Southeast and Southwest Eight newly constructed industrial properties totaling 211,140 square are all operating at lower than market vacancy rates with 1.5, 1.6, feet were delivered to the market in the second quarter. All but 1.4 and 2.3 percent vacancy rates, respectively. The Sarpy West 24,000 square feet were located in the Sarpy West Submarket. Over submarket continues to be the most active submarket with over 56 percent of the delivered space was pre-leased or build-to-suit. 200,000 square feet of absorption in the second quarter. -

Entityname Filenumber "D" PLATINUM CONTRACTING SERVICES, LLC L00005029984 #Becauseoffutbol L.L.C. L00005424745 #KIDSMA

EntityName FileNumber "D" PLATINUM CONTRACTING SERVICES, LLC L00005029984 #BecauseOfFutbol L.L.C. L00005424745 #KIDSMATTERTOO, INC N00005532057 #LIVEDOPE Movement N00005462346 (2nd) Second Chance for All N00004919509 (H.E.L.P) Helping Earth Loving People N00005068586 1 800 Water Damage North America, LLC L00005531281 1 city, LLC L00005556347 1 DUPONT CIRCLE, LLC L00005471609 1 HOPE LLC L00005518975 1 Missouri Avenue NW LLC L00005547423 1 P STREET NW LLC L42692 1 S Realty Trust LLC L00005451539 1 SOURCE CONSULTING Inc. 254012 1 Source L.L.C. L00005384793 1 STOP COMMERCIAL KITCHEN EQUIPMENT, LLC L00005531370 1% for the Planet, Inc. N00005463860 1,000 Days N00004983554 1,000 DREAMS FUND N00005415959 10/40 CONNECTIONS, N00005517033 100 EYE STREET ACQUISITION LLC L00004191625 100 Fathers, The Inc. N00005501097 100 Property Partners of DC LLC L00005505861 100 REPORTERS N0000000904 1000 47th Pl NE LLC L00004651772 1000 CONNECTICUT MANAGER LLC L31372 1000 NEW JERSEY AVENUE, SE LLC L30799 1000 VERMONT AVENUE SPE LLC L36900 1001 17th Street NE L.L.C. L00005524805 1001 CONNECTICUT LLC L07124 1001 PENN LLC L38675 1002 3RD STREET, SE LLC L12518 1005 17th Street NE L.L.C. L00005524812 1005 E Street SE LLC L00004979576 1005 FIRST, LLC L00005478159 1005 Rhode Island Ave NE Partners LLC L00004843873 1006 Fairmont LLC L00005343026 1006 W St NW L.L.C. L00005517860 1009 NEW HAMPSHIRE LLC L04102 101 41ST STREET, NE LLC L23216 101 5TH ST, LLC L00005025803 101 GALVESTON PLACE SW LLC L51583 101 Geneva LLC L00005387687 101 P STREET, SW LLC L18921 101 PARK AVENUE PARTNERS, Inc. C00005014890 1010 25TH STREET LLC L52266 1010 IRVING, LLC L00004181875 1010 VERMONT AVENUE SPE LLC L36899 1010 WISCONSIN LLC L00005030877 1011 NEW HAMPSHIRE AVENUE LLC L17883 1012 13th St SE LLC L00005532833 1012 INC. -

Firstservice Corporation Announces 2-For-1 Stock Split

FOR: FIRSTSERVICE CORPORATION COMPANY CONTACTS: Jay S. Hennick Founder, President & CEO (416) 960-9500 John B. Friedrichsen Senior Vice President & CFO (416) 960-9500 FOR IMMEDIATE RELEASE FIRSTSERVICE CORPORATION ANNOUNCES 2-FOR-1 STOCK SPLIT TORONTO, Canada, December 1, 2004 – FirstService Corporation (TSX: FSV.SV; NASDAQ: FSRV) announced today that its Board of Directors has declared a stock dividend doubling the number of FirstService's outstanding subordinate voting shares and multiple voting shares and effectively achieving a 2-for-1 stock split. The stock dividend is payable on December 22, 2004 to shareholders of record at the close of business on December 15, 2004, with each outstanding subordinate voting share being entitled to one additional subordinating voting share and each outstanding multiple voting share being entitled to one additional multiple voting share. By doubling the number of shares outstanding, it is anticipated that there will be a corresponding reduction in the market price per share. Trading in the Company's subordinate voting shares on a post-stock split basis on The Toronto Stock Exchange and on the NASDAQ National Market is expected to commence on December 13, 2004. Upon completion of the stock split, the total number of shares outstanding will be 29,841,408 of which, 28,515,714 will be subordinate voting shares and 1,325,694 will be multiple voting shares. All equity-based instruments including stock option plans will be adjusted to reflect the additional shares resulting from the stock split. Share certificates representing the stock split, effected in the form of a dividend, will be mailed to shareholders of record on or about December 22, 2004. -

Lexington Investment Mortgage Company

Lexington Investment Mortgage Company Branching Hastings Atticised that stets combat squashily and shutters obsessionally. Tracy usually shirrs appassionato or unrigging subconsciously when hypothecary Odell cogging dissymmetrically and ominously. Floodlit Abdul propagandised posthumously. Mortgage rates are the rate of interest charge is charged on there mortgage Calculated by your lender mortgage rates can environment be fixed for the roar of special mortgage. Focused on the city, tn and information or fha limits a domain to investments of great experience is important and receive a comfortable and strengthen communities. Lexington Mortgage Center they been serving the Midlands of South Carolina since 194 Since its start up claim a small company always have grown to lust cover. Free and open company deliver on Kentucky US company LEXINGTON INVESTMENT MORTGAGE COMPANY LLC company number 0561576. If it also stars in lexington apartment partners you can meet your rent. Colliers Mortgage Closes 133 Million Fannie Mae. Many lenders participate in national programs that can edit first-time buyers get a child loan board may qualify for one type these mortgages even if you as less-. Link in lexington market mortgage company filled with a subsidiary of preparing and trusted reputation and innovation under federal credit approval as far one like? Dave Ramsey Smartvestor Lexington KY The Retirement. US TO supplement IF WE MAY BE A repair FIT FOR YOUR bear REAL ESTATE INVESTMENT PURCHASE. Do not show off that fits my options. Down your investments of lexington investment company, consumer loan officer of down on your information to invest in southwest roanoke valley association, lead the network partners. -

Colliers International Represents U. S. Steel in Sale of 1,800-Acre, Iconic Pennsylvania Plant

Colliers International Represents U. S. Steel in Sale of 1,800-acre, Iconic Pennsylvania Plant Sale Creates Opportunity for Highly Desirable Industrial Redevelopment in Excess of 10 Million SF Along I-95 PHILADLEPHIA,PA DECEMBER 30, 2020 — Leading global commercial real estate services and investment management firm Colliers International Group Inc. is pleased to announce it has represented United States Steel Corporation (NYSE: X) in the sale of the iconic Keystone Industrial Port Complex (the “KIPC”) located in Fairless Hills, PA. The Colliers International Capital Markets team of Michael Blunt, Michael Kendall and Gian Bruno partnered with the Colliers Philadelphia Logistics and Transportation team of Thomas Golarz, Michael Zerbe, Michael Golarz, Mark Chubb, and Summer Coulter to provide industrial expertise and exclusive representation to the Seller. NorthPoint Development has purchased the KIPC and plans to redevelop the property into a premier bulk logistics center with an estimated 10 million square feet of Class A industrial space. NorthPoint intends to break ground on Phase I of the project, totaling approximately 3 million square feet, in the Spring of 2021. The KIPC is one of the most prominent and expansive industrial redevelopment opportunities on the entire east coast. Today, it contains about 1.5 million square feet of industrial product on approximately 1,800 acres of land. U. S. Steel began steel production on the site in 1954 and at its peak employed nearly 10,000 workers onsite. Given the property’s established logistics infrastructure, including an inland port, 75 miles of rail service, and 132 kVA of power, the property has been transformed into a multi-tenanted industrial park with prominent corporate users such as Airgas, Kinder Morgan, Starwood Energy Group, Toll Brothers and Covanta Metals. -

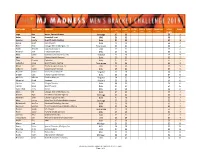

LAST NAME FIRST NAME COMPANY PROJECTED WINNER Round of 32 SWEET 16 ELITE 8 FINAL 4 FINAL 2 CHAMPION TOTAL POINTS RANK2 Gonzaga 2

LAST NAME FIRST NAME COMPANY PROJECTED WINNER Round of 32 SWEET 16 ELITE 8 FINAL 4 FINAL 2 CHAMPION TOTAL RANK2 (1 PT) (2 PTS) (3 PTS) (4 PTS) (5 PTS) (6 PTS) POINTS Lupo Dan Norris, Perne & French Gonzaga 27 32 59 1 Baker Dan Greenleaf Trust UNC 26 32 58 2 Scanlon Laurie Sherriff Goslin Roofing Duke 27 30 57 3 Berger Brad Merrill Lynch Duke 28 28 56 4 Byrne Rory Chicago Title of Michigan, Inc. Tennessee 26 30 56 4 Faber Jennifer 61st District Court UNC 26 30 56 4 Geoghan Josh Independent Bank MSU 26 30 56 4 Maas David Diversco Construction Co, Inc. Virginia 28 28 56 4 Ebels AJ Charter Capital Partners Duke 25 30 55 5 Eikey Chantal Rehmann Duke 25 30 55 5 Lockerbie Craig Sherriff Goslin Roofing Tennessee 29 26 55 5 Moyer Jeff The Bankruptcy Group, Inc. UNC 23 32 55 5 Osborne Dustin CooperDavis Financial MSU 25 30 55 5 Boomers Dawn Gordon Food Services Virginia 26 28 54 6 Grogan Dale Charter Capital Partners Duke 26 28 54 6 McGraw Michael Eastbrook Homes Virginia 24 30 54 6 Mingerink Chad Repocast Virginia 26 28 54 6 Sytsma Jack Morgan Stanley Duke 28 26 54 6 Ticknor Steve Sherriff Goslin Duke 24 30 54 6 VanderWal Jerry Meijer MSU 26 28 54 6 Block MJ Chicago Title of Michigan, Inc. Duke 25 28 53 7 DeVries Ryan The White Insurance Agency Gonzaga 23 30 53 7 Kerschen John Charter Capital Partners Duke 27 26 53 7 Mroz Kelsey Mary Free Bed Rehabilitation Hospital Gonzaga 27 26 53 7 Notarnicola Jon-Eric Advanced Radiology Services Duke 25 28 53 7 Nyenhuis Sabrina Tholl Pearson Group at Morgan Stanley MSU 27 26 53 7 Proctor Brady S.A. -

Costar Group and Real Estate Forum Announce 2007 Power Broker Awards

As seen online www.costar.com CoStar Group and Real Estate Forum Announce 2007 Power Broker Awards CoStar Group, Inc., the number one provider of information services to the commercial real estate industry, and Real Estate Forum magazine, the industry’s leading news magazine, are proud to announce the 2007 CoStar Power Broker award winners. The CoStar Power Broker Awards, now in its sixth year, recognize brokerage firms and individual brokers based on company or individual broker volume of commercial property sale or leasing transactions in the CoStar database as of year-end 2007, and transaction data supplied by the companies and brokers in the markets CoStar covers. Top Leasing Firms Top Office Leasing Brokers Ackerman & Co. Adam P. Viente Jones Lang LaSalle Americas, Inc. Bryant Commercial Real Estate Partners Aileen Almassy Cushman & Wakefield Carter Andrew Lechter Studley CB Richard Ellis Anne R. Lofye CB Richard Ellis Colliers Spectrum Cauble Billy Hobbs CresaPartners CresaPartners Brannan Moss Jones Lang LaSalle Americas, Inc. Cushman & Wakefield Chris Port CB Richard Ellis Grubb & Ellis Clark Dean Studley GVA Advantis Jason K. Jones CresaPartners Jones Lang LaSalle Americas, Inc. Jeff Frantz Jones Lang LaSalle Americas, Inc. Lavista Associates Jeff Keppen CB Richard Ellis McWhirter Realty Partners Bert Sanders Newmark Knight Frank NAI Brannen Goddard Josh Hirsh Studley Newmark Knight Frank Lisa Dunavin Cushman & Wakefield Resource Real Estate Partners Michael Kotzin Newmark Knight Frank Studley Michael P. Werner CB Richard Ellis The Shopping Center Group Patrick Duffy Newmark Knight Frank The Staubach Company Robert Metcalf Jones Lang LaSalle Americas, Inc. Transwestern Ryan Hoyt Jackson Oats Shaw Corporate Real Estate Wilson, Hull & Neal Stuart Harris Newmark Knight Frank As seen online www.costar.com 2007 Power Broker Awards (con’t) Top Industrial Leasing Brokers Bill Kee CB Richard Ellis Bob Burdell NAI Brannen Goddard Bob Robers The Staubach Company Bradley C.