Oct. 9, 2021 Constitutional Amendment Summaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

October 9, 2020 Emergency Order Under MCL 333.2253 – Gathering

STATE OF M ICHIGAN GRETCHEN WHITMER DEPARTMENT OF HEALTH AND HUMAN SERVICES ROBERT GORDON GOVERNOR LANSING DIRECTOR October 9, 2020 Emergency Order Under MCL 333.2253 – Gathering Prohibition and Face Covering Order The novel coronavirus (COVID-19) is a respiratory disease that can result in serious illness or death. It is caused by a new strain of coronavirus not previously identified in humans and easily spread from person to person. There is currently no approved vaccine for this disease. COVID-19 spreads through close human contact, even from individuals who may be asymptomatic. On March 10, 2020, the Michigan Department of Health and Human Services (“MDHHS”) identified the first two presumptive-positive cases of COVID-19 in Michigan. Throughout the pandemic, Michigan has used a range of public health tools and guidance to contain the spread of COVID-19 and protect the public health, including via the Governor’s authority under the Emergency Management Act and the Emergency Powers of Governor Act. On Friday, October 2, 2020, the Michigan Supreme Court concluded that the Governor was not authorized to issue executive orders addressing COVID-19 after April 30, 2020. Michigan was one of the states most heavily impacted by COVID-19 early in the pandemic, with new cases peaking at nearly 2,000 per day in late March. Strict preventative measures and the cooperation of Michiganders drove those numbers down dramatically, greatly reducing the loss of life. Although fewer than 100 new cases per day were reported in mid-June, cases have increased since that time, and recently nearly 1,000 new cases have been reported per day. -

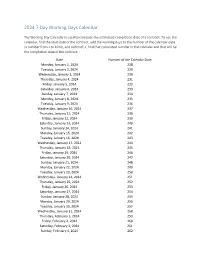

2024 7 Day Working Days Calendar

2024 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Monday, January 1, 2024 228 Tuesday, January 2, 2024 229 Wednesday, January 3, 2024 230 Thursday, January 4, 2024 231 Friday, January 5, 2024 232 Saturday, January 6, 2024 233 Sunday, January 7, 2024 234 Monday, January 8, 2024 235 Tuesday, January 9, 2024 236 Wednesday, January 10, 2024 237 Thursday, January 11, 2024 238 Friday, January 12, 2024 239 Saturday, January 13, 2024 240 Sunday, January 14, 2024 241 Monday, January 15, 2024 242 Tuesday, January 16, 2024 243 Wednesday, January 17, 2024 244 Thursday, January 18, 2024 245 Friday, January 19, 2024 246 Saturday, January 20, 2024 247 Sunday, January 21, 2024 248 Monday, January 22, 2024 249 Tuesday, January 23, 2024 250 Wednesday, January 24, 2024 251 Thursday, January 25, 2024 252 Friday, January 26, 2024 253 Saturday, January 27, 2024 254 Sunday, January 28, 2024 255 Monday, January 29, 2024 256 Tuesday, January 30, 2024 257 Wednesday, January 31, 2024 258 Thursday, February 1, 2024 259 Friday, February 2, 2024 260 Saturday, February 3, 2024 261 Sunday, February 4, 2024 262 Date Number of the Calendar Date Monday, February 5, 2024 263 Tuesday, February 6, 2024 264 Wednesday, February -

Early Dance Division Calendar 17-18

Early Dance Division 2017-2018 Session 1 September 9 – November 3 Monday Classes Tuesday Classes September 11 Class September 12 Class September 18 Class September 19 Class September 25 Class September 26 Class October 2 Class October 3 Class October 9 Class October 10 Class October 16 Class October 17 Class October 23 Class October 24 Class October 30 Last Class October 31 Last Class Wednesday Classes Thursday Classes September 13 Class September 14 Class September 20 Class September 21* Class September 27 Class September 28 Class October 4 Class October 5 Class October 11 Class October 12 Class October 18 Class October 19 Class October 25 Class October 26 Class November 1 Last Class November 2 Last Class Saturday Classes Sunday Classes September 9 Class September 10 Class September 16 Class September 17 Class September 23 Class September 24 Class September 30* Class October 1 Class October 7 Class October 8 Class October 14 Class October 15 Class October 21 Class October 22 Class October 28 Last Class October 29 Last Class *Absences due to the holiday will be granted an additional make-up class. Early Dance Division 2017-2018 Session 2 November 4 – January 22 Monday Classes Tuesday Classes November 6 Class November 7 Class November 13 Class November 14 Class November 20 No Class November 21 No Class November 27 Class November 28 Class December 4 Class December 5 Class December 11 Class December 12 Class December 18 Class December 19 Class December 25 No Class December 26 No Class January 1 No Class January 2 No Class January 8 Class -

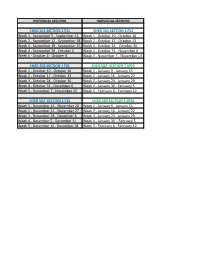

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

Salary Payroll Schedule - 2021 Fiscal Pay Salary Overtime &Retro Leave Semester Pay Period HR Transaction Deadline Payday Days Year Number Entry (PHAHOUR) Periods

Salary Payroll Schedule - 2021 Fiscal Pay Salary Overtime &Retro Leave Semester Pay Period HR Transaction deadline Payday Days Year Number Entry (PHAHOUR) Periods December 25 – January 9 1 Monday, January 4, 2021 Wednesday, January 6, 2021 Friday, January 15, 2021 11 12 January 10 – January 24 2 Tuesday, January 19, 2021 Thursday, January 21, 2021 Monday, February 1, 2021 10 1 January 25 – February 9 3 Tuesday, February 2, 2021 Thursday, February 4, 2021 Tuesday, February 16, 2021 12 February 10 – February 24 4 Tuesday, February 16, 2021 Thursday, February 18, 2021 Monday, March 1, 2021 11 Spring Semester 2 Classes Begin February 25 – March 9 5 Wednesday, March 3, 2021 Friday, March 5, 2021 Tuesday, March 16, 2021 9 1/19/21 Exams End 5/13/21 21 March 10 – March 24 6 Thursday, March 18, 2021 Monday, March 22, 2021 Wednesday, March 31, 2021 11 3 March 25 – April 9 7 Monday, April 5, 2021 Wednesday, April 7, 2021 Friday, April 16, 2021 12 April 10 – April 24 8 Monday, April 19, 2021 Wednesday, April 21, 2021 Friday, April 30, 2021 10 4 April 25 – May 9 9 Monday, May 3, 2021 Wednesday, May 5, 2021 Friday, May 14, 2021 10 May 10 – May 24 10 Tuesday, May 18, 2021 Thursday, May 20, 2021 Tuesday, June 1, 2021 11 Summer I 5 Classes Begin May 25 – June 9 11 Thursday, June 3, 2021 Monday, June 7, 2021 Wednesday, June 16, 2021 12 5/24/21 (Paid 7/1/21) June 10 – June 24 12 Friday, June 18, 2021 Tuesday, June 22, 2021 Thursday, July 1, 2021 11 6 June 25 – July 9 13 Friday, July 2, 2021 Wednesday, July 7, 2021 Friday, July 16, 2021 11 Summer II Classes -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

2021 Calendar Campaign

One Tail at a Time 2021 Calendar Pets Date Status Date Status Date Status Date Status Date Status Date Status Date Status Date Status Friday, January 1 Not Available Saturday, February 20 Not Available Sunday, April 11 Available Monday, May 31 Not Available Tuesday, July 20 Available Wednesday, September 8 Not Available Thursday, October 28 Available Thursday, December 16 Available Saturday, January 2 Available Sunday, February 21 Available Monday, April 12 Not Available Tuesday, June 1 Available Wednesday, July 21 Not Available Thursday, September 9 Available Friday, October 29 Available Friday, December 17 Available Sunday, January 3 Available Monday, February 22 Available Tuesday, April 13 Available Wednesday, June 2 Available Thursday, July 22 Not Available Friday, September 10 Available Saturday, October 30 Available Saturday, December 18 Not Available Monday, January 4 Available Tuesday, February 23 Available Wednesday, April 14 Available Thursday, June 3 Available Friday, July 23 Available Saturday, September 11 Available Sunday, October 31 Not Available Sunday, December 19 Available Tuesday, January 5 Available Wednesday, February 24 Available Thursday, April 15 Not Available Friday, June 4 Available Saturday, July 24 Available Sunday, September 12 Available Monday, November 1 Available Monday, December 20 Available Wednesday, January 6 Available Thursday, February 25 Available Friday, April 16 Not Available Saturday, June 5 Available Sunday, July 25 Available Monday, September 13 Available Tuesday, November 2 Available Tuesday, -

2021 Park Hours

Holiday World & Splashin' Safari 2021 Operating Calendar May, 2021 Holiday World Hours Splashin' Safari Hours Special Events Saturday, May 1 Holiday World & Splashin' Safari are closed Sunday, May 2 Holiday World & Splashin' Safari are closed Monday, May 3 Holiday World & Splashin' Safari are closed Tuesday, May 4 Holiday World & Splashin' Safari are closed Wednesday, May 5 Holiday World & Splashin' Safari are closed Thursday, May 6 Holiday World & Splashin' Safari are closed Friday, May 7 Holiday World & Splashin' Safari are closed Saturday, May 8 Platinum Season Pass Preview Day: Holiday World is open from 10 AM until 6 PM Splashin' Safari is Closed Platinum Season Passholder Party Sunday, May 9 Passholder Preview Day: Holiday World is open from 10 AM until 6 PM Splashin' Safari is Closed Monday, May 10 Holiday World & Splashin' Safari are closed Tuesday, May 11 Holiday World & Splashin' Safari are closed Wednesday, May 12 Holiday World & Splashin' Safari are closed Thursday, May 13 Holiday World & Splashin' Safari are closed Friday, May 14 Holiday World & Splashin' Safari are closed for a private outing Saturday, May 15 Holiday World is open from 10 AM until 4 PM Splashin' Safari is Closed Sunday, May 16 Holiday World is open from 10 AM until 4 PM Splashin' Safari is Closed Monday, May 17 Holiday World & Splashin' Safari are closed Tuesday, May 18 Holiday World & Splashin' Safari are closed Wednesday, May 19 Holiday World & Splashin' Safari are closed Thursday, May 20 Holiday World & Splashin' Safari are closed Friday, May 21 Holiday -

CHED 501-SECTION 1 F21 CHED 501 SECTION 2 F21 Week 1

INDIVIDUAL SESSIONS INDIVIDUAL SESSIONS CHED 501-SECTION 1 F21 CHED 501 SECTION 2 F21 Week 1 - September 5 - September 11 Week 1 - October 10 - October 16 Week 2 - September 12 - September 18 Week 2 - October 17 - October 23 Week 3 - September 19 - September 25 Week 3 - October 24 - October 30 Week 4 - September 26 - October 2 Week 4 - October 31 - November 6 Week 5 - October 3 - October 9 Week 5 - November 7 - November 13 CHED 502 SECTION 1 F21 CHED 502 -SECTION 1 SP22 Week 1 - October 10 - October 16 Week 1 - January 9 - January 15 Week 2 - October 17 - October 23 Week 2 - January 16 - January 22 Week 3 - October 24 - October 30 Week 3 - January 23 - January 29 Week 4 - October 31 - November 6 Week 4 - January 30 - February 5 Week 5 - November 7 - November 13 Week 5 - February 6 - February 12 CHED 503 SECTION 1 F21 CHED 503 SECTION 1 SP22 Week 1 - November 14 - November 20 Week 1 - January 9 - January 15 Week 2 - November 21 - November 27 Week 2 - January 16 - January 22 Week 3 - November 28 - December 4 Week 3 - January 23 - January 29 Week 4 - December 5 - December 11 Week 4 - January 30 - February 5 Week 5 - December 12 - December 18 Week 5 - February 6 - February 12 INDIVIDUAL SESSIONS INDIVIDUAL SESSIONS INDIVIDUAL SESSIONS CHED 501 SECTION 1 SP22 CHED 501 SECTION 2 SP22 Week 1 - January 9 - Janaury 15 Week 1 - April 3 - April 9 Week 2 - January 16 - January 22 Week 2 - April 10 - April 16 Week 3 - January 23 - January 29 Week 3 - April 17 - April 23 Week 4 - January 30 - February 5 Week 4 - April 24 - April 30 Week 5 - February -

2021 Working Day Calendar-5 Day-Alternative Format

2021 Working Days Calendar – 5 day The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 Non-working Day Saturday, January 2, 2021 Non-working Day Sunday, January 3, 2021 Non-working Day Monday, January 4, 2021 938 Tuesday, January 5, 2021 939 Wednesday, January 6, 2021 940 Thursday, January 7, 2021 941 Friday, January 8, 2021 942 Saturday, January 9, 2021 Non-working Day Sunday, January 10, 2021 Non-working Day Monday, January 11, 2021 943 Tuesday, January 12, 2021 944 Wednesday, January 13, 2021 945 Thursday, January 14, 2021 946 Friday, January 15, 2021 947 Saturday, January 16, 2021 Non-working Day Sunday, January 17, 2021 Non-working Day Monday, January 18, 2021 Non-working Day Tuesday, January 19, 2021 948 Wednesday, January 20, 2021 949 Thursday, January 21, 2021 950 Friday, January 22, 2021 951 Saturday, January 23, 2021 Non-working Day Sunday, January 24, 2021 Non-working Day Monday, January 25, 2021 952 Tuesday, January 26, 2021 953 Wednesday, January 27, 2021 954 Thursday, January 28, 2021 955 Friday, January 29, 2021 956 Saturday, January 30, 2021 Non-working Day Sunday, January 31, 2021 Non-working Day Monday, February 1, 2021 957 Tuesday, February 2, 2021 958 Wednesday, February 3, -

CSWE and Commission on Accreditation Statement Update October 9, 2020, Alexandria, Va

CSWE and Commission on Accreditation Statement Update October 9, 2020, Alexandria, Va. The safety of students, educators, social workers, and their clients and communities are paramount to the Council on Social Work Education (CSWE) and its Commission on Accreditation. In response to the continuing impact of the COVID-19 pandemic, the Commission on Accreditation offers this update to social work education programs as follows: 1. Reduction in field hours: Deadline extended from May 31, 2021 to May 31, 2022. Under AS 2.2.5, field education programs provide a minimum of 400 hours of field education for baccalaureate programs and a minimum of 900 hours for master’s programs. Due to the disruption caused by the COVID-19 pandemic, students who have completed 85% of the required placement hours (i.e., equivalent to 340 hours for baccalaureate programs and 765 hours for master’s programs) to a satisfactory level may, at program discretion, be evaluated as having met the field placement requirement. This reduction in field hours may be applied to field placement courses that are fully or partially completed by May 31, 2022. Field placement courses that are partially completed by May 31, 2022 may continue to apply the 15% reduction in hours until the specific field course is completed, even if the completion date is after May 31, 2022. New field placement courses that begin after May 31, 2022 will return to the full hours requirement. Remote field activity, as well as field supervision and field seminar hours, may be counted toward the accrual of field hours. 2. -

WIAA Calendar Official for 2021-2022; Tentative for 2022-2023 and 2023-24 (See Page 11 for Equivalent Dates in Future Years)

WIAA Calendar Official for 2021-2022; Tentative for 2022-2023 and 2023-24 (See Page 11 for Equivalent Dates in Future Years) Area Meetings __________________________________________________________________________________________________________2021-22 2022-23 2023-24 Fox Valley Lutheran .................................................................... September 13 Greenfield ................................................................................... September 14 THESE THESE Mauston ...................................................................................... September 15 DATES DATES Oconomowoc ............................................................................. September 20 WILL BE WILL BE Rice Lake..................................................................................... September 21 ANNOUNCED ANNOUNCED Antigo ......................................................................................... September 22 LATER LATER Mount Horeb .............................................................................. September 27 Special Dates ____________________________________________________________________________________________________________ Labor Day ................................................................................... September 6 September 5 September 4 *Rosh Hashanah.......................................................................... September 7-8 Sepember 26-27 September 16-17 *Yom Kippur...............................................................................