Case 1:12-Cv-20717-MGC Document 240 Entered on FLSD Docket 04/20/15 15:31:54 Page 1 of 8

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tavernier House

FILM REVIEW Eat, drink and be merry Winterbottom’s 2005’s This British “Tristram Shandy: A Cock import is wit and Bull Story.” Coogan is probably writ large most recognizable in the KEY WEST U.S. from his role as ‘The Trip’, 107 minutes, Octavius in the two “Night Unrated, opens Friday, Aug. At The Museum” films. 26, Tropic Cinema, Key “The Trip” reunites the trio West in a very funny movie Beer masters compete about, well, basically about Two British guys go on nothing. While the movie a road trip through a pretty only lightly touches on the KEYS but purpose of the trip, the for bragging rights FILM rainy director wisely concentrates country- on the repartee between the economies. side, two main characters. The Brewfest touts “Recently, China has eat at In L’Attitudes end result is an enjoyable overtaken the U.S. as the several film. 140 beers for largest beer economy,” con- restau- “The Trip” started as a Sept. 1-5 event cluded economists Liesbeth rants, TV series in the UK and Colen and Johan Swinnen of talk and Winterbottom has woven L’Attitudes Staff the University of Leuven, talk some of those episodes into writing in the American some a 107-minute film. The Picture 12 dozen differ- trade industry’s magazine. more, do premise is that Coogan is ent beers on tap or chilled in Lest we allow China to impres- hired by a London newspa- bottles waiting to quench usurp our longstanding beer Craig Wanous sions of per to write about fine your thirst. -

Florida Keys Vessel Pumpout Facilities Marine Sanitation Device

Marine Sanitation Device Discharge Regulations Effective: December 27, 2010 Activities prohibited Sanctuary-Wide: q Discharge of sewage incidental to vessel use and generated by a marine sanitation device in accordance with the Federal Water Pollution Control Act (also called the Clean Water Act). q Having a marine sanitation device that is not secured in a manner that prevents discharges or deposits of treated and untreated sewage. Acceptable methods include, but are not limited to, all methods that have been approved by the U.S. Coast Guard. Pumpout facilities are located throughout the Keys to assist boat operators in complying with this rule. For a list of pumpout facilities, visit http://www.dep.state.fl.us/cleanmarina/about.htm. Florida Keys Vessel Pumpout Facilities * Designated Clean Marina Facility Key West Duck Key Mobile Pumpout Services • A & B Marina • Hawk’s Cay Resort Marina Free pumpout services for vessels • Conch Harbor Marina* anchored within unincorporated Long Key • City Marina at Garrison Bight* Monroe County (Key Largo, • Key West Bight Marina* • Fiesta Key KOA Tavernier, Cudjoe, Big Pine, Stock Stock Island Upper Matecumbe Key Island, etc.) and the Village of • Stock Island Marina Village • Bayside Marina- World Wide Sportsman* Islamorada. • Sunset Marina • Coral Bay Marina • Pumpout USA at 305-900-0263 or visit www.po-keys.com. Lower Keys Plantation Key • Plantation Yacht Harbor* • Bahia Honda State Park* • City of Key West 305-292-8167 • Sunshine Key RV Resort & Marina • Treasure Harbor Marine* • Stock Island, Mark LPS 305-587-2787 Marathon Tavernier • City of Marathon 305-289-8877 • Boot Key Harbor City Marina • Mangrove Marina • Key Colony Beach 305-289-1310 • Burdines Waterfront • Marathon Yacht Club Key Largo • Panchos Fuel Dock & Marina • All Keys Portalet Tips: • Sombrero Marina Dockside* • John Pennekamp Coral Reef State Park* • Check with marina ahead of time on • Manatee Bay Marina status of pumpout equipment. -

Collier Miami-Dade Palm Beach Hendry Broward Glades St

Florida Fish and Wildlife Conservation Commission F L O R ID A 'S T U R N P IK E er iv R ee m Lakewood Park m !( si is O K L D INDRIO ROAD INDRIO RD D H I N COUNTY BCHS Y X I L A I E O W L H H O W G Y R I D H UCIE BLVD ST L / S FT PRCE ILT SRA N [h G Fort Pierce Inlet E 4 F N [h I 8 F AVE "Q" [h [h A K A V R PELICAN YACHT CLUB D E . FORT PIERCE CITY MARINA [h NGE AVE . OKEECHOBEE RA D O KISSIMMEE RIVER PUA NE 224 ST / CR 68 D R !( A D Fort Pierce E RD. OS O H PIC R V R T I L A N N A M T E W S H N T A E 3 O 9 K C A R-6 A 8 O / 1 N K 0 N C 6 W C W R 6 - HICKORY HAMMOCK WMA - K O R S 1 R L S 6 R N A E 0 E Lake T B P U Y H D A K D R is R /NW 160TH E si 68 ST. O m R H C A me MIDWAY RD. e D Ri Jernigans Pond Palm Lake FMA ver HUTCHINSON ISL . O VE S A t C . T I IA EASY S N E N L I u D A N.E. 120 ST G c I N R i A I e D South N U R V R S R iv I 9 I V 8 FLOR e V ESTA DR r E ST. -

Education, Outreach, and Media Activities and Products

Marine Zoning and Regulatory Review -Education, Outreach, and Media Activities and Products Mary Tagliareni Deputy Superintendent for Operations and Education Goals of this Presentation • Review FKNMS Education and Outreach Goals and Objectives • Review FKNMS Education and Outreach Action Plan • Review FKNMS Education and Outreach Programs and Activities • Discussion on Possible Action Items for Marine Zoning and Regulatory Review What is education and outreach? A tool… for managing resources and more importantly, reaching people that impact those resources. Who is our audience? • 3.5 Million Visitors (13.3 Million Visitor Days) • 8,300 School-Aged Children • 75,000 Permanent Residents (130,000 during season) Who is our audience? 2007 – 2008 data Fishing • 400,000 visitors and residents • 2 million person days Diving • 739,000 visitors and residents • 2.8 million person days Who is our audience? Some Challenges We Face • No single point of entry • 26,461 registered vessels (2012) • Diverse audiences – Residential/Tourist – Broad Geographic Audience • Resource damage – Direct impacts – Indirect impacts • Lack of Awareness Education/Outreach Action Plan Goals • Promote protection and sustainable use of Sanctuary resources; • Promote public understanding of marine resources, and related watersheds; • Promote public understanding of the national marine sanctuaries; and, • Empower citizens with the necessary knowledge to make informed decisions that lead to the responsible stewardship of aquatic ecosystems. Education/Outreach Action Plan 1997 -

Appendix C - Monroe County

2016 Supplemental Summary Statewide Regional Evacuation Study APPENDIX C - MONROE COUNTY This document contains summaries (updated in 2016) of the following chapters of the 2010 Volume 1-11 Technical Data Report: Chapter 1: Regional Demographics Chapter 2: Regional Hazards Analysis Chapter 4: Regional Vulnerability and Population Analysis Funding provided by the Florida Work completed by the Division of Emergency Management South Florida Regional Council STATEWIDE REGIONAL EVACUATION STUDY – SOUTH FLORIDA APPENDIX C – MONROE COUNTY This page intentionally left blank. STATEWIDE REGIONAL EVACUATION STUDY – SOUTH FLORIDA APPENDIX C – MONROE COUNTY TABLE OF CONTENTS APPENDIX C – MONROE COUNTY Page A. Introduction ................................................................................................... 1 B. Small Area Data ............................................................................................. 1 C. Demographic Trends ...................................................................................... 4 D. Census Maps .................................................................................................. 9 E. Hazard Maps .................................................................................................15 F. Critical Facilities Vulnerability Analysis .............................................................23 List of Tables Table 1 Small Area Data ............................................................................................. 1 Table 2 Health Care Facilities Vulnerability -

Keys Sanctuary 25 Years of Marine Preservation National Parks Turn 100 Offbeat Keys Names Florida Keys Sunsets

Keys TravelerThe Magazine Keys Sanctuary 25 Years of Marine Preservation National Parks Turn 100 Offbeat Keys Names Florida Keys Sunsets fla-keys.com Decompresssing at Bahia Honda State Park near Big Pine Key in the Lower Florida Keys. ANDY NEWMAN MARIA NEWMAN Keys Traveler 12 The Magazine Editor Andy Newman Managing Editor 8 4 Carol Shaughnessy ROB O’NEAL ROB Copy Editor Buck Banks Writers Julie Botteri We do! Briana Ciraulo Chloe Lykes TIM GROLLIMUND “Keys Traveler” is published by the Monroe County Tourist Development Contents Council, the official visitor marketing agency for the Florida Keys & Key West. 4 Sanctuary Protects Keys Marine Resources Director 8 Outdoor Art Enriches the Florida Keys Harold Wheeler 9 Epic Keys: Kiteboarding and Wakeboarding Director of Sales Stacey Mitchell 10 That Florida Keys Sunset! Florida Keys & Key West 12 Keys National Parks Join Centennial Celebration Visitor Information www.fla-keys.com 14 Florida Bay is a Must-Do Angling Experience www.fla-keys.co.uk 16 Race Over Water During Key Largo Bridge Run www.fla-keys.de www.fla-keys.it 17 What’s in a Name? In Marathon, Plenty! www.fla-keys.ie 18 Visit Indian and Lignumvitae Keys Splash or Relax at Keys Beaches www.fla-keys.fr New Arts District Enlivens Key West ach of the Florida Keys’ regions, from Key Largo Bahia Honda State Park, located in the Lower Keys www.fla-keys.nl www.fla-keys.be Stroll Back in Time at Crane Point to Key West, features sandy beaches for relaxing, between MMs 36 and 37. The beaches of Bahia Honda Toll-Free in the U.S. -

Meeting Space Guide

KEY LARGO BAY MARRIOTT BEACH RESORT YOUR KEY TO PARADISE Key Largo Bay Marriott® Beach Resort is your key to a relaxing and enjoyable experience in the Florida Keys. 17 lush tropical acres located just 55 miles south of Miami welcome you to our waterfront resort. Our comfortable guest rooms provide ample space to spread out with private balcony views. Dine al fresco at one of our casual on-site restaurants while watching a spectacular sunset. Retreat to our newly redesigned spa for a relaxing experience for the senses or stay focused on your fitness routine in our spacious fitness center. Our prime Key Largo location is the ultimate playground for water adventures and relaxation with an on-site dive shop and basin providing easy access to the waters of the Gulf and the Atlantic Ocean. WATERFRONT ACCOMMODATIONS MEETING ROOM CAPACITY CHARTS WITH STUNNING VIEWS Our waterfront resort is your key to comfort and ease MEETING ROOM LxWxH (Ft.) Sq. Ft. Theater Schoolroom Conference U-Shape Reception Banquet featuring 153 oversized rooms, including 20 spacious Upper Gus 30x100 3,000 75 20 20 150 100 suites each boasting approximately 980 sq. ft. of space. Complimentary high speed Wi-Fi is available Gus Patio 48x108 3,773 30 30 200 150 throughout the resort providing fast connections for Gus Beach 35x216 6,325 200 150 engaged co-workers and families. Private balconies Upper Breezers 24x30 720 25 25 20 30 30 are featured in most rooms with stunning views of our tropical resort. Breezers Beach 128x128 16,384 250 250 French Reef 28x39 1,092 60 40 25 25 50 60 DINE WITH IMPECCABLE VIEWS Molasses Reef 28x39 1,092 60 40 25 25 50 60 Lay poolside and catch some rays or try the tantalizing fare with the freshest Florida cuisine and endless Carysfort Reef 19x26 494 30 20 12 12 30 30 handcrafted cocktails at Flipper’s Poolside Tiki Bar. -

Monroe County Stormwater Management Master Plan

Monroe County Monroe County Stormwater Management Master Plan Prepared for Monroe County by Camp Dresser & McKee, Inc. August 2001 file:///F|/GSG/PDF Files/Stormwater/SMMPCover.htm [12/31/2001 3:10:29 PM] Monroe County Stormwater Management Master Plan Acknowledgements Monroe County Commissioners Dixie Spehar (District 1) George Neugent, Mayor (District 2) Charles "Sonny" McCoy (District 3) Nora Williams, Mayor Pro Tem (District 4) Murray Nelson (District 5) Monroe County Staff Tim McGarry, Director, Growth Management Division George Garrett, Director, Marine Resources Department Dave Koppel, Director, Engineering Department Stormwater Technical Advisory Committee Richard Alleman, Planning Department, South Florida WMD Paul Linton, Planning Department, South Florida WMD Murray Miller, Planning Department, South Florida WMD Dave Fernandez, Director of Utilities, City of Key West Roland Flowers, City of Key West Richard Harvey, South Florida Office U.S. Environmental Protection Agency Ann Lazar, Department of Community Affairs Erik Orsak, Environmental Contaminants, U.S. Fish and Wildlife Service Gus Rios, Dept. of Environmental Protection Debbie Peterson, Planning Department, U.S. Army Corps of Engineers Teresa Tinker, Office of Planning and Budgeting, Executive Office of the Governor Eric Livingston, Bureau Chief, Watershed Mgmt, Dept. of Environmental Protection AB i C:\Documents and Settings\mcclellandsi\My Documents\Projects\SIM Projects\Monroe County SMMP\Volume 1 Data & Objectives Report\Task I Report\Acknowledgements.doc Monroe County Stormwater Management Master Plan Stormwater Technical Advisory Committee (continued) Charles Baldwin, Islamorada, Village of Islands Greg Tindle, Islamorada, Village of Islands Zulie Williams, Islamorada, Village of Islands Ricardo Salazar, Department of Transportation Cathy Owen, Dept. of Transportation Bill Botten, Mayor, Key Colony Beach Carlos de Rojas, Regulation Department, South Florida WMD Tony Waterhouse, Regulation Department, South Florida WMD Robert Brock, Everglades National Park, S. -

Media Kit 19 Keys R1

Distribution Great Locations® is everywhere the tourist goes! Distributed annually from over 400 locations, including over 160 resorts, hotels, motels, inns, guest houses and condominiums... Locations Caribbean Club Playa Largo Caribbean Resort Sands of Islamorada Circle K - 102525 Overseas Hwy Port Largo Villas Cheeca Lodge Smuggler’s Cove Marina throughout the Circle K - 106501 Overseas Hwy Rock Reef Resort Chesapeake Resort Sunset Motel Florida Keys Circle K - 99810 Overseas Hwy Seafarer Resort City Hall Cafe Tropical Optical Courtyard Marriott Senor Frijoles GATEWAY Coral Bay Resort Wahoo’s Restaurant Denny’s Snapper’s Restaurant Budget Host Inn Dion’s White Gate Resort Denny’s Latin Cafe - Outdoor Sunset Cove Resort Dade Corner - Indoor & Outdoor Doc’s Diner - Outdoor Drop Anchor Resort Motel Ziggie & Mad Dogs Tower of Pizza - Outdoor Dove Creek Lodge Fishers Inn Dion’s - Florida City Valero LONG KEY Dunkin’ Donuts Florida High Adventure Sea Base Dion’s - Homestead Wells Fargo - Outdoor Edgewater Lodge Florida Bay Club Florida Keys Brewing Co. Econolodge Wendy’s Fiesta Key of America RV Resort Florida City RV Camp & Park Gilbert’s Resort Motel Green Turtle - Outdoor Hampton Inn Lime Tree Bay Resort Floridian Hotel of Homestead TAVERNIER History of Diving Museum Harriet’s Restaurant - Outdoor Outdoor Resorts Golden Corral Atlantic Bay Resort Hungry Tarpon @ Robbies - Outdoor Hidden Out Restaurant Caloosa Cove Resort Holiday Inn Islamorada Chamber of Commerce CONCH KEY Holiday Inn Capt. Slates Dive Center Homestead Visitor Center Islamorada -

305.293.6217 Casamarinaresort.Com CASA MARINA THROUGH the YEARS at OUR “HOUSE by the SEA”

1500 Reynolds Street, Key West, FL 33040 | Tel: 305.293.6217 casamarinaresort.com CASA MARINA THROUGH THE YEARS AT OUR “HOUSE BY THE SEA” 1904 Henry M. Flagler commits to building his Overseas Railway linking Key West to the US mainland 1912 Henry M. Flagler, upon completion of the railway, promises the town a luxury resort hotel 1913 Henry M. Flagler passes at the age of 83 1918 Construction begins under the guidance of a trusted Flagler aid, Louis P. Schutt, who became the resort’s manager until his passing in 1933. Designed by experts in Spanish Architecture, Thomas Hastings and John M. Carrere of New York, as a monument to Henry M. Flagler. 1920 Casa Marina welcomes our first guests on New Year’s Eve and operated as a seasonal resort January through March for the first 10 years. 1935 Casa Marina survives The Great Hurricane of 1935 with no serious damage. 1942 The US Navy, by law of eminent domain, buys Casa Marina and converts it to officers’ quarters. It would remain as quarters until 1946. 1946 The resort was purchased from the government and operated under several owners through 1962. 1962 US military commandeered the resort during the Cuban Missile Crisis; installed missiles directed at Cuba and surrounded the property in barbed wire. The US Military briefly considered using Casa Marina as their permanent headquarters 1966 Purchased by Senator Spottswood, a 5th generation Key Wester who assisted his mother working the newsstand as a small boy. He leased the resort to the Westinghouse Corporation for training of 300 volunteers for the new Peace Corp. -

FL Keys Application Map 11X17.Ai

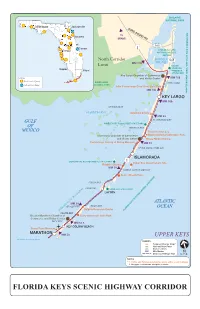

BISCAYNE NATIONAL PARK Tallahassee Jacksonville CARD SOUND RD To Daytona MIAMI Orlando 905 Cocoa 1 Tampa CROCODILE LAKE NATIONAL WILDLIFE REFUGE North Corridor BARNES 905 MM 110 SOUND Limit DAGNY Naples JOHNSON Miami HAMMOCK STATE PARK Key Largo Chamber of Commerce LEGEND and Visitor Center MM 106 Florida Scenic Highway EVERGLADES KEY LARGO National Scenic Byway NATIONAL PARK John Pennekamp Coral Reef State Park MM 102 JOHN PENNEKAMP CORAL REEF STATE PARK (UNDERWATER) KEY LARGO MM 100 OYSTER KEYS FLORIDA BAY Wild Bird Center MM 93 GULF PLANTATION KEY WINDLEY KEY FOSSIL REEF STATE PARK OF WINDLEY KEY MEXICO Theater of the Sea Islamorada Chamber of Commerce Marine Mammal Adventure Park and Visitor Center Whale Harbor Marina Florida Keys History of Diving Museum MM 83 UPPER MATECUMBE KEY ISLAMORADA LIGNUMVITAE KEY BOTANICAL STATE PARK 1 Indian Key State Historic Site Robbie’s Marina MM 78 LOWER MATECUMBE KEY Anne’s Beach Park ARY FIESTA KEY LONG KEY LONG KEY STATE PARK LAYTON ATLANTIC MM 59 GRASSY KEY DUCK KEY OCEAN Dolphin Research Center INTRACOASTAL WATERWAY FLORIDA KEYS NATIONAL MARINE SANCTU CRAWL KEY Greater Marathon Chamber of Curry Hammock State Park Commerce and Visitor Center VACA KEY MM 53.5 KEY COLONY BEACH Crane Point Museum MARATHON MM 50 UPPER KEYS continued on next page LEGEND xxx Features/Itinerary Stops* xxx National/State Parks xxx Visitor Centers MM Mile Marker Overseas Heritage Trail NOTES * 1. Diving and Fishing opportunities along entire scenic highway. 2. No gaps or intrusions along the corridor. FLORIDA KEYS SCENIC -

Demolition Siteworkhauling Dumpsters

DIVING SPORTS Irma impacted Canes look to popular Keys shakeoff close wreck, 1B loss, 1B VOLUME 51-NO. 3 STAY CONNECTED /KEYSINFONET NEWSAll DAY. YOUR WAY. WWW.FLKEYSNEWS.COM FACEBOOK.COM FRIDAY JANUARY19,2018 50 cents CRIME ON THE WATER CRIME &COURTS Condo Guard camera seizes captures shrimp in Keys marine burglary protected area Three construction workers charged after video shows them The 6,000 pounds were found searching Tavernier apartment. aboardaboatinthe protected Tortugas. BY KEVIN WADLOW [email protected] KEYNOTER STAFF Owners of aTavernier condomi- The U.S. Coast Guard and the nium watched alive burglary in National Oceanic and Atmospheric progress on their residence’s securi- credit Administration seized about 6,000 ty video Tuesday, the Monroe RobertSchminky, chargedwith attempted first-degree murder aftera2015 shootout with police. pounds of shrimp from the 68-foot County Sheriff’s fishingvessel Ronald E.nearthe Office reports. Dry TortugasShrimp Sanctuary Three men, all PreservationArea Jan. 12, the Guard employed by a said. Homestead company Keys cops still impacted Crews aboard the Coast Guard doing work at the cutter Raymond Evans and aNOAA Ocean Pointe com- joint boardingteam saw the crew of plex on Burton the Ronald E. fishing inside the Chavez Drive, were each by 2015 rollingshootout marine sanctuaryand was boarded. arrested on acount The vessel’screw was citedfor of felony burglary Trial began this week three yearsafter KeyLargo man illegally fishing inside anational and misdemeanor engaged police in amiles-long gun battle,wounding one marine sanctuaryand for safety theft. deputy and shooting up an FHP trooper’s patrol car. violations. The unit owners Fishing within federally protected told Deputy Matt through several Key Largo YOUKNOWWHEN waters is illegal.