96-3-091 John Gillespie

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

30Th September 2018 Tel: 074 95 42935 - Email: [email protected] - Kincasslagh Parish - Web: - SVP 087 050 7895

Kincasslagh Parish Newsletter, 30th September 2018 Tel: 074 95 42935 - Email: [email protected] - Kincasslagh Parish - Web: www.kincasslagh.ie - SVP 087 050 7895 Schedule of Masses Facebook (Rosses NYP - Foroige) for more required. Permission from dead persons Training will be provided. If you’d like more St. Mary’s Church, Kincasslagh details for registrations TXT 086 828 0149 relatives will be required. If a dead person information on becoming a volunteer please Next Weekend has no living relatives left then their names contact; Saturday @ 6.30 p.m. Do this In Memory will be allowed to be included. Deirdre Murphy, Irish Cancer Society Tel: 01 Sunday @ 10.00 a.m. There will be a meeting for parents of first Hugh Rodgers: 087 767 8206 Arranmore 231 0564 or [email protected] Next Week Communion Classes in the Community Tommy Gallagher : 0044 776 853 3991 Tuesday @ 1.00 p.m. in Keadue School. Centre next Thursday at 7.00 p.m. to outline Killybegs, Kilcar, Dunkineely, Donegal Town, Rosary on the Coast for Life and Faith Wednesday @ 7.00 p.m. the programme, give the necessary books to Mountcharles, Ardara A gathering will take place on Sunday Friday @ 7.00 p.m. parents and to receive the timetable and Conal Frances Gallagher : 087 230 3610 October 7th at 2.30 p.m. at Belcruit St. Columba’s Church, Acres the jobs that go along with the programme. Dungloe, Meenacross, Lettermacaward, Graveyard Car Park to join tens of thousands Next Weekend Next Saturday evening in St. Mary’s will be Glenties, Portnoo, Glenfinn of faithful along the coast of Ireland and in Sunday @ 11.30 a.m. -

AN INTRODUCTION to the ARCHITECTURAL HERITAGE of COUNTY DONEGAL

AN INTRODUCTION TO THE ARCHITECTURAL HERITAGE of COUNTY DONEGAL AN INTRODUCTION TO THE ARCHITECTURAL HERITAGE of COUNTY DONEGAL COUNTY DONEGAL Mount Errigal viewed from Dunlewey. Foreword County Donegal has a rich architectural seventeenth-century Plantation of Ulster that heritage that covers a wide range of structures became a model of town planning throughout from country houses, churches and public the north of Ireland. Donegal’s legacy of buildings to vernacular houses and farm religious buildings is also of particular buildings. While impressive buildings are significance, which ranges from numerous readily appreciated for their architectural and early ecclesiastical sites, such as the important historical value, more modest structures are place of pilgrimage at Lough Derg, to the often overlooked and potentially lost without striking modern churches designed by Liam record. In the course of making the National McCormick. Inventory of Architectural Heritage (NIAH) The NIAH survey was carried out in phases survey of County Donegal, a large variety of between 2008 and 2011 and includes more building types has been identified and than 3,000 individual structures. The purpose recorded. In rural areas these include structures of the survey is to identify a representative as diverse as bridges, mills, thatched houses, selection of the architectural heritage of barns and outbuildings, gate piers and water Donegal, of which this Introduction highlights pumps; while in towns there are houses, only a small portion. The Inventory should not shopfronts and street furniture. be regarded as exhaustive and, over time, other A maritime county, Donegal also has a rich buildings and structures of merit may come to built heritage relating to the coast: piers, light. -

Killybegs Harbour Centre & South West Donegal, Ireland Access To

Killybegs Harbour Centre & South West Donegal, Ireland Area Information Killybegs is situated on the North West Coast of Ireland with the newest harbour facility in the country which opened in 2004. The area around the deep fjord-like inlet of Killybegs has been inhabited since prehistoric times. The town was named in early Christian times, the Gaelic name Na Cealla Beaga referring to a group of monastic cells. Interestingly, and perhaps surprisingly in a region not short of native saints, the town’s patron saint is St. Catherine of Alexandria. St. Catherine is the patron of seafarers and the association with Killybegs is thought to be from the 15th Century which confirms that Killybeg’s tradition of seafaring is very old indeed. The area is rich in cultural & historical history having a long association with marine history dating back to the Spanish Armada. Donegal is renowned for the friendliness & hospitality of its people and that renowned ‘Donegal Welcome’ awaits cruise passengers & crew to the area from where a pleasant travel distance through amazing sea & mountain scenery of traditional picturesque villages with thatched cottages takes you to visit spectacular castles and national parks. Enjoy the slow pace of life for a day while having all the modern facilities of city life. Access to the area Air access Regular flights are available from UK airports and many European destinations to Donegal Airport which is approx an hour’s drive from Killybegs City of Derry Airport approx 1 hour 20 mins drive from Kilybegs International flights available to and from Knock International Airport 2 hours and 20 minutes drive with public transport connections. -

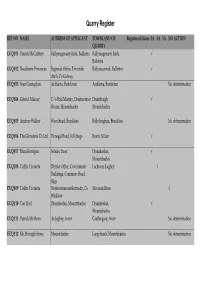

Quarry Register

Quarry Register REF NO NAME ADDRESS OF APPLICANT TOWNLAND OF Registered Status 3A 4A 5A NO ACTION QUARRY EUQY01 Patrick McCafferty Ballymagroarty Irish, Ballintra Ballymagroarty Irish, √ Ballintra EUQY02 Roadstone Provinces Regional Office, Two mile Ballynacarrick, Ballintra √ ditch, Co Galway EUQY03 Sean Granaghan Ardfarna, Bundoran Ardfarna, Bundoran No determination EUQY04 Gabriel Murray C/o Brid Murray, Drumconnor Drumbeagh, √ House, Mountcharles Mountcharles EUQY05 Andrew Walker Woodhead, Bruckless Ballyloughan, Bruckless No determination EUQY06 The Glenstone Co Ltd Donegal Road, Killybegs Bavin, Kilcar √ EUQY07 Brian Kerrigan Selacis, Inver Drumkeelan, √ Mountcharles EUQY08 Coillte Teoranta District Office, Government Lackrom, Laghey √ Buildings, Cranmore Road, Sligo EUQY09 Coillte Teoranta Newtownmountkennedy, Co Meenanellison √ Wicklow EUQY10 Con Friel Drumkeelan, Mountcharles Drumkeelan, √ Mountcharles EUQY11 Patrick Mulhern Ardaghey, Inver Castleogary, Inver No determination EUQY12 Mc Monagle Stone Mountcharles Largybrack, Mountcharles No determination Quarry Register REF NO NAME ADDRESS OF APPLICANT TOWNLAND OF Registered Status 3A 4A 5A NO ACTION QUARRY EUQY14 McMonagle Stone Mountcharles Turrishill, Mountcharles √ EUQY15 McMonagle Stone Mountcharles Alteogh, Mountcharles √ EUQY17 McMonagle Stone Mountcharles Glencoagh, Mountcharles √ EUQY18 McMonagle Stone Mountch arles Turrishill, Mountcharles √ EUQY19 Reginald Adair Bruckless Tullycullion, Bruckless √ EUQY21 Readymix (ROI) Ltd 5/23 East Wall Road, Dublin 3 Laghey √ EUQY22 -

Donegal Heritage Collection

Irish Life and Lore Series Donegal Heritage Collection IRISH LIFE AND LORE SERIES DONEGAL HERITAGE COLLECTION _____________ CATALOGUE OF 64 RECORDINGS www.irishlifeandlore.com Page: 1 / 34 © 2010 Maurice O'Keeffe Irish Life and Lore Series Donegal Heritage Collection Irish Life and Lore Series Maurice and Jane O’Keeffe, Ballyroe, Tralee, County Kerry E-mail: [email protected] Website: www.irishlifeandlore.com Telephone: + 353 (66) 7121991/ + 353 87 2998167 Recordings compiled by : Maurice O’Keeffe Catalogue Editor : Jane O’Keeffe Secretarial work by : NB Secretarial Services, Tralee Recordings mastered by : Media Duplication Privately published by : Maurice and Jane O’Keeffe, Tralee The Donegal Heritage ‘Life & Lore’ Collection was commissioned by the County Donegal Heritage Office, Donegal County Council, the County Donegal Heritage Forum and The Heritage Council under the County Donegal Heritage Plan (2007- 2011). An Action of the County Donegal Heritage Plan (2007-2011) Page: 2 / 34 © 2010 Maurice O'Keeffe Irish Life and Lore Series Donegal Heritage Collection NAME: MATTHEW GRAHAM, BORN 1939, ST. JOHNSTON, ARDAGH (Part 1) Title: Irish Life and Lore Donegal Heritage Collection CD 1 Subject: Changing landscapes Recorded by: Maurice O’Keeffe Date: 2010 Time: 56:08 Description: Matthew Graham’s grandfather originally arrived in St. Johnston in 1888 and he farmed fifty acres there. Matthew’s father also farmed there and Matthew discusses the arrival of the first tractor at the farm in 1957, butter-making and the arrival of electricity, the growing of flax for thatching and also wheat straw, rye straw and rushes. He recalls the McGlincheys of the Green who were flax millers, and some of the other milling families. -

The Letterkenny & Burtonport Extension

L.6. 3 < m \J . 3 - 53 PP NUI MAYNOOTH OlltcisiE na r.£ir55n,i m & ft uac THE LETTERKENNY & BURTONPORT EXTENSION RAILWAY 1903-47: ITS SOCIAL CONTEXT AND ENVIRONMENT by FRANK SW EENEY THESES FOR THE DEGREE OF PH. D. DEPARTMENT OF MODERN HISTORY NATIONAL UNIVERSITY OF IRELAND MAYNOOTH HEAD OF DEPARTMENT: Professor R. V. Comerford Supervisor of research: Professor R.V. Comerford October 2004 Volume 2 VOLUME 2 Chapter 7 In the shadow of the great war 1 Chapter 8 The War of Independence 60 Chapter 9 The Civil War 110 Chapter 10 Struggling under native rule 161 Chapter 11 Fighting decline and closure 222 Epilogue 281 Bibliography 286 Appendices 301 iv ILLUSTRATIONS VOLUME 2 Fig. 41 Special trains to and from the Letterkenny Hiring Fair 10 Fig. 42 School attendance in Gweedore and Cloughaneely 1918 12 Fig. 43 New fares Derry-Burtonport 1916 17 Fig. 44 Delays on Burtonport Extension 42 Fig. 45 Indictable offences committed in July 1920 in Co. Donegal 77 Fig. 46 Proposed wages and grades 114 Fig. 47 Irregular strongholds in Donegal 1922 127 Fig. 48 First count in Donegal General Election 1923 163 Fig. 49 Population trends 1911-1926 193 Fig. 50 Comparison of votes between 1923 and 1927 elections 204 Fig. 51 L&LSR receipts and expenses plus governments grants in 1920s 219 Fig. 52 New L&LSR timetable introduced in 1922 220 Fig. 53 Special trains to Dr McNeely’s consecration 1923 221 Fig. 54 Bus routes in the Rosses 1931 230 Fig. 55 Persons paid unemployment assistance 247 Fig. -

Minutes of Meeting of Glenties Municipal District Committee

MINUTES OF MEETING OF GLENTIES MUNICIPAL DISTRICT COMMITTEE HELD ON 18th SEPTEMBER 2018 IN DUNGLOE PUBLIC SERVICE CENTRE _______________________________________________ MEMBERS PRESENT: Cllr. John Sheamais Ó Fearraigh Cllr. Seamus Ó Domhnaill Cllr.Michéal Choilm Mac Giolla Easbuig Cllr. Terence Slowey Cllr. Enda Bonner Cllr. Marie Therese Gallagher OFFICIALS PRESENT: Michael McGarvey, A/Director Water & Environment Brendan McFadden – S.E.E. Area Manager, Roads & Transportation Fergus Towey – SEE, NRDO Eamonn Brown – A/Area Manager, Housing & Corporate Collette Beattie – Assistant Planner David Friel – Coastal Officer Charles Sweeney – Area Manager, Community Development Michael Rowsome, S.S.O. Motor Tax/Corporate GMD 66/18 BEREAVEMENT A minutes silence was observed by the Committee in memory of the late Dom Bonner, father of Cllr. Bonner. GMD 67/18 MINUTES OF MEETING OF GLENTIES MD HELD ON 12TH JULY 2018 On the proposal of Cllr. Slowey, seconded by Cllr. Gallagher, the minutes of the meeting of the Glenties Municipal District Committee held on the 12th July 2018 were confirmed. GMD 68/18 REPORT FROM WORKSHOP The Committee noted the reports from the workshops held on; (i) 12th July, (a) Community Involvement Schemes 2019 (b) Local Improvement Scheme 2018 (c) Local Area Plans (ii) 2nd August, (a) Funding calls under the National Development Plan (2018-2027) GMD 69/18 BUDGET WORKSHOP On the proposal of Cllr. Slowey, seconded by Cllr. Gallagher the Committee agreed to schedule a budget workshop on the 4th of October 2018 at 10:00 am in the Dungloe PSC. GMD 70/18 BUDGET MEETING On the proposal of Cllr. Slowey, seconded by Cllr. Gallagher the Committee agreed to schedule a budget meeting on the 25th of October at 10:00 am in the Dungloe PSC. -

LOCH CHONAILL RAILWAY WALK and the Route Went from Derry City to Burtonport

The Railway It was constructed by the Lough Swilly Railway Company LOCH CHONAILL RAILWAY WALK and the route went from Derry City to Burtonport. The construction of the railway brought hope to many following years of hardship. The terrain to construct a Railway on was difficult to say the least, negotiating Granite rocks, hills, valleys and bogland. End This route was the second largest narrow gauge Railway ever constructed. The entire building materials were sourced locally i.e. the timber from locally grown trees, the lime, sand and the stone was quarried at the top of the hill. The stone from the quarry at the Mullach Bhan was also used for road building and constructing the rail track. It is now to be used as an overflow car park for the walkway. Loch Chonaill N56 The Train You are here Locally the train was called the Mhuc Dhubh (the black Start pig) as it chugged its way through the landscape. The train first came to this area in 1903 and stopped running in 1940. It was innovative of its time and its Rd to Crolly primary function was to take fish out of Burtonport and Station house transport goods and people in and out of North West Donegal. Burtonport and the offshore islands especially N56 Inis Mhic an Doirn (Rutland) were a hive of activity at this time. The ruins of the factories are still visible today. The train ceased to run as lorries were being used to transport fish and goods much faster than the train. The route of the train did not go through populated areas Rd to Annagry so it was of little benefit for transporting people. -

Kincasslagh Parish Newsletter, 5Th January 2020

Kincasslagh Parish Newsletter, 5th January 2020 Tel: 074 954 2006 – 086 230 0620 - Email: [email protected] - Kincasslagh Parish - Web: www.kincasslagh.ie - SVP 087 050 7895 Schedule of Masses The theme this year is ‘Unusual Kindness’. 4. In Prague, a Three Kings swim “Every day now is Christmas” is a saying that St. Mary’s Church, Kincasslagh commemorates Epiphany Day at the refers to the frugality of the past rather than Next Weekend Keadue Rovers Vltava River to the luxury of the present. Sunday @ 10.00 a.m. Keadue Rovers Bingo Results 27/12/19: 5. In New York, El Museo del Barrio has Christmas comes early, because transport Next Week Winners of the €100 house jackpots were celebrated and promoted Three Kings' Day may be delayed by rough weather, the Monday @ 10.00 a.m. Epiphany Laura Kessack Keadue/Margaret Hanlon annual parades for over thirty years shopkeepers must stock in weeks before their Wednesday @ 7.00 p.m. Calhame (Shared) & Breedge McDevitt mainland colleagues. Likewise, we all must Friday @ 7.00 p.m. Annagry. No winner of the Snowball and it Ards Retreat Centre be unusually careful to post early for St. Columba’s Church, Acres now stands at €6,650 Friday 3/1/20. Weekend retreat facilitated by Philip Christmas. Next Weekend Club Lotto will also be drawn Friday 3/1/20 McParland. “Have a drink”, an islander invited me at the Saturday @ 6.30 p.m. for €1,100. Learning to Meditate. end of November. I declined. “But, man, it’s Sunday @ 11.30 a.m. -

BMH.WS1328.Pdf

ROINN COSANTA. BUREAU OF MILITARY HISTORY, 1913-21. STATEMENT BY WITNESS. DOCUMENT NO. W.S. 1,328 Witness Philip Boyle, Marameelin, Dungloe, Co. Donegal. Identity. 0/C. 'A' (Dungloe) Company, 1st Battalion, 1st Northern Division. 1st 0/C. Battalion, 1st Brigade, 1st Northern Division. Subject. Dungloe Company Irish Volunteers, Co. Donegal, 1918-1921. Conditions,if any, Stipulated by Witness. Nil File No. S.2644 Form B.S.M.2 STATEMENT BY PHILIP BOYLE, Marameelan, Dungloe, Co. Donegal. I joined the Irish Volunteers in November, 1918. At that time a company was organised in my area. It was known as C. Company, 1st Battalion, West Donegal Brigade. Ernie O'Malley came to the area as organiser. The first Captain of the Company was Joe Carr. He was an ex soldier of the British army. Carr remained as Captain until January, 1919. When orders were received from the Brigade to enforce a boycott of the R.I.C. and their friends, Carr was not prepared to go through with it and he was released from his post. was appointed Captain to replace Carr. The Company strength at that time was twenty-four. Late In 1920 - it may have been August - our Company collected any shotguns held by civilians in the area. At the time, the Ancient Order of Hibernians was fairly strong, and they resisted the taking up of guns, but we had not to use force when they realised that we were determined to get the guns. The main work of the Volunteers in our area in 1918, 1919 and early 1920 was concerned with drilling and training. -

Riding with the Wind in Donegal, Ireland by Cara Coolbaugh

Riding with the Wind in Donegal, Ireland Lush green countryside, miles of quiet rural lanes, and a lively culture have long attracted bicycle travelers to Ireland. Although most cyclists head straight for the southern counties of Kerry and Cork, a post- card dropped through our letterbox drew our attention elsewhere. Story by Cara Coolbaugh Photos by Cass Gilbert the image on the front was of Five Fingers but impressive peaks, quaint villages, and — “Yeats’ country,” he said. The next we figured we were in for mixed weath- Strand, and it showed an unspoiled empty a wealth of history. My partner Cass and morning, we hopped on the train to Sligo. er, but what we hadn’t anticipated was beach, long swaths of white sand, softly I were inspired to explore the windswept As we pulled into the station, my eyes the brilliant sunshine and spring heat breaking waves under steep sea cliffs, and region, following the coast as closely as pos- caught sight of an enormous flat-topped wave. The road was smooth, and we emerald grassy hills in the distance. The sible for a week-long tour in early spring. pyramid projecting straight up from the flew along, ticking off miles in handfuls. card said this would be found in Donegal, Our Dubliner-friend Philip invited us for seafront and arching out like a crashing It was a shame Phil had to turn around the northwesternmost county in Ireland, a visit in the capital before heading north. wave. Mounting our steeds, we pedaled and head home soon after we reached best known for its wild weather and great We wasted no time in finding a traditional, toward it and came across Drumcliffe the fifteenth-century centerpiece castle in surf. -

964 Bus Time Schedule & Line Route

964 bus time schedule & line map 964 Paddy Og's Pub, Crolly - Doughiska, Ballybane View In Website Mode Road The 964 bus line (Paddy Og's Pub, Crolly - Doughiska, Ballybane Road) has 11 routes. For regular weekdays, their operation hours are: (1) Annagry →Garda Station, Donegal Town: 2:20 PM (2) Clarion Road (Clarion Village) →Galway Cathedral: 1:00 PM (3) Eyre Square Galway →Paddy Og's Pub, Crolly: 8:00 PM (4) Galway Cathedral →Letterkenny, Ramelton Road: 1:30 PM - 4:00 PM (5) Galway Cathedral →Paddy Og's Pub, Crolly: 9:00 AM - 4:00 PM (6) Garda Station, Donegal Town →Annagry: 4:30 PM - 8:50 PM (7) Main Street →Garda Station, Donegal Town: 6:40 PM (8) Monivee (Galway City), Galway Mayo Institute Of Technology →Paddy Og's Pub, Crolly: 1:00 PM (9) Paddy Og's Pub, Crolly →Doughiska, Ballybane Road: 5:30 PM (10) Paddy Og's Pub, Crolly →Galway Cathedral: 7:20 AM - 2:45 PM (11) The Diamond Carndonagh →Just Inn Cafe, Ballybofey: 6:00 PM Use the Moovit App to ƒnd the closest 964 bus station near you and ƒnd out when is the next 964 bus arriving. Direction: Annagry →Garda Station, Donegal Town 964 bus Time Schedule 6 stops Annagry →Garda Station, Donegal Town Route VIEW LINE SCHEDULE Timetable: Sunday 2:20 PM Annagry Monday 7:50 AM Main Street Tuesday Not Operational Main Street,Glenties Wednesday Not Operational Thursday Not Operational Main Street, Ardara The Diamond, Ardara Friday Not Operational Main Street Saturday Not Operational Garda Station, Donegal Town 964 bus Info Direction: Annagry →Garda Station, Donegal Town Stops: 6 Trip Duration: