2007- 30-33 2008 No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Direction and Condition of Modern Education in Bihar Niraj

ISSN: 2456–4397 RNI No.UPBIL/2016/68067 Vol-5* Issue-6* September-2020 Anthology : The Research The Direction and Condition of Modern Education in Bihar Paper Submission: 15/09/2020, Date of Acceptance: 26/09/2020, Date of Publication: 27/09/2020 Abstract The State of Bihar is one of the major hubs of learning in the country of India. Since long back, this state has been a centre of education. Presently, a huge gap got created in between the demand of education and supply. This gap between the school education and higher education has brought the literacy rate of the state a bit down. This signifies the importance of establishment of more schools in the field of modern education. This craving for higher education among the general population of Bihar has led to a migration of the student community from the state. This has led to a flooding of students to seek educational opportunities in other state, even for graduation level college education. Patna has become an educational hub for the Eastern India. It is an important centre for preparation of exam like IIT, IAS, Engineering and Medical entrance. The quality education of schools is better in Patna than New Delhi. But Bihar still lacks behind in Higher Education. We need an initiative from educational ministry of Bihar to take proper step in opening technical institutes for students of Bihar which will help them to stay in their state and also attracts students from different states. If we all work toward these steps, we will see a rise in education system of Bihar which will be very fruitful for betterment of Bihar and its people. -

Afu Srd Qoffir

qeio-ftocogofroelo/ lRMs- 10/2020, qi"...1.?.... fe-ax tcnffft-o gan frvn ffi (qrqrq s$rsq frqrrr) nso', sfi{r ts{ fu€r. frts o,d c-{ffi. ftErq crrfifto gun frvr ffi qe-+t ftr n, ftrm q-flDorfr. qfiIt qr.n. ftci--...a >ll.g.l.l..t:^ ftqq:- qrc-q ssrEFr c-{'Er{ c"nd (HRMS) clMn t-{r gkorot ovn rgqtqun-sqa iD't Scanning d tidq { t q{frl:- fr{H qr qiw-''titz. fr{ifr-1s.io.2o1s aefl q{i6-gol. fr{is- 29.05.2020 IT6ITq, sqEffi frqq-o' crciFro q'it d snr enc si-{q-d t fu rrq ofid oI \1otq-d srcrn{ d-fi oa qFit qa or eR-o G crrflff $ffiq-qf, qr+q \4qErt !-qtrr cqrfr (HRMs) ffi( o-{i d mq d fu S*Zo* qms q'r Digitisation aeTI e-tar gw ot ffiu fu sqcIcr qtrqr"qt (legacy oata) fr Data capture Format (DCFIi cfre o'-{i or ord srt i t 2. -cniFro' c=jl n +sI gRilor. ridl= 3IRs st 6ffi{it ErqI sqnrq orri rrc Efrqw q, ol Scanning 6{i d €dtl I arerrl i] oTd-6q +1 qaw frn qri ot s-de fu-ql .rqr t t q-c-{ o. tfl Sfu"ol r{ €dcun qr d scanning t-E ftrd d orufa-q-qR aTtroq frt q.ff *ia.{ tr (3r-flff-r) 4- Scanning 61 o,rd qqF-( 1'Ss lvs CBSL eRI ffiqr .rfi. f,a, 3Tq{ qfoq. .rfi Fmfur fuTFr d ory S qmi srd o.rt it ftcio-oa.o'r.zoz'r d qrtqt"-gef ro:oo ad t 3rq{rfl 6:00 cd ao ria.c o'd-6'q F-5{ff-r) o r5wn fu-qI qrvqrt 5. -

Chausa Block , Madhepura, District

CHAUSA BLOCK , MADHEPURA, DISTRICT BASEITH KALIASTHAN RAMNAGAR TOLA DHARHARA . SHARMA TOLA RASULPURDHURIYA RASALPUR DHURIA Rasulpur Dhuria DIMHA TOLA DIMHA PARBATTA Govind Ram Kumedan Jagir PAHARPUR TILLARAHI (TERASI) BIHPUR BASA Jamman kumedan Jagir GHOSAI GHOSAI MAHTO BASA DAUBHATA BASA BARI BADHOUNA Ghosai Niamatullah Sipahi Jagir* Hasan Sharif Jamadar Jag* Khan Kumedan Jagir Din Mohammad Subedar Jag* DHURIA GORCHARI Chamru Hawaldar Jagir (U* TETRI BASA Mohammad Jafar Subedar J* English Ghosai (Uninhabi* English Ghosai (Uninhabi* GHOSAI Kewat Ram Subedar Jagir BUDDHU TOLA PAINA ARSANDI BAKHRI TOLA Subhani Subedar Jagir Paina SUKHAI TOLA BARI BADHOUNA DIYARA TOLA TILARAHI TOLA DABRU TOLA Ramakant Subedar Jagir MD HANIF KHAN JAHAGIR BIRBAL TOLA GHANAUL BHAGWANPUR BASA TULSIPUR TOLA Bhola Singh Jamadar Pahari Subedar Jagir (Un* Pahari Subedar Jagir (Un* Chausa Amanat Sarkar (Un* Chausa DHANESHPUR Amanat Hedaetullah Subed* Etwari Jamadar Jagir (Un* M TOLA WEST Hidaetullah Jamadar Jagi* Chausa MUSLIM TOLA Ramakant Subedar Jagir PASWAN TOLA Amanat Manullah Jamadar * M TOLA EAST YADAV TOL!A DHANESHPUR WEST CHAUSA AMYA TOLA Khan Kumedan Jagir PASWAN TOLA CHOUSA EAST DHITA TOLA CHIRAURI Amanat Manullah Subedar * CHOUSA WEST Mohammad Jafar Subedar J* Bhola Singh Jamadar BASAITHA MANOHARPUR SIRHA TOLADhanseshpur PUNAMA BASA ARAJPUR CHOUDHARI TOLA Manullah Subedar Jagir (* BAKIL TOLAJamman kumedan Jagir BASAITHA HEMKUNJ TOLA MALA BASA YADAV TOLA BHIKHA TOLA TIUTAUGA TOLA SAPNI MUSAHRI TOLA PHULKIA TOLA LADU BASA SAHAURA (SHABAWA TOLA) TERASI CATCHIRA -

Chapter-Iii Performance Audit Human Resources Development Department

CHAPTER-III PERFORMANCE AUDIT HUMAN RESOURCES DEVELOPMENT DEPARTMENT 3.1 NUTRITIONAL SUPPORT TO PRIMARY EDUCATION (Mid-day Meal Scheme) Highlights Nutritional Support to Primary Education (NSPE), a Centrally sponsored Scheme, popularly known as Mid-day Meal Scheme (MDM) was launched in August 1995 with the objective of boosting universalisation of primary education by increasing enrolment, retention, attendance and simultaneous improvement in the nutritional status of students. In Bihar, the scheme was extended to all primary schools in January 2005; it is yet to cover all schools. There was increase in enrolment and retention of students in urban as well as rural school which was a positive indication of the Scheme. However, the scheme was suffering from inadequate food grain management and fund transfer mechanism resulting into unsatisfactory implementation of the scheme. There was complete absence of the internal controls, regular monitoring and evaluation of the Scheme as per the guidelines The expenditure was reported by the implementing agencies on the basis of funds transferred instead of utilisation. (Paragraph 3.1.6.1) There was increase in enrolment and retention of students in urban as well as rural school which was a positive indication of the Scheme. (Paragraph 3.1.7.1 and 3.1.7.3) 563.75 MT of rice valuing Rs 90.20 lakh rotted due to poor storage and 50.96 MT of uncooked rice grains (valued at Rs 3.02 lakh) were distributed instead of cooked meals. (Paragraph 3.1.8.1) The average number of days on which cooked meal was served ranged between 92 to 108 days and 94 to 106 days in Urban and Rural schools respectively against 200/ 220 days prescribed in the scheme. -

AKU - Aryabhatta Knowledge University

AKU - Aryabhatta Knowledge University Patna An exclusive Guide by AKU - Aryabhatta Knowledge University Courses & Fees 2021 Showing 229 Courses Get fees, placement reviews, exams required, cutoff & eligibility for all courses. Bachelor of Computer Application (BCA) (3 years) Offered by CIMAGE College No. of Seats Exams ─ ─ Total Fees Median Salary ─ ─ Course Rating Ranked 4.6 20 ─ Bachelor of Pharmacy (B.Pharma.) (4 years) Offered by Government Pharmacy Institute, Gulzarbagh Disclaimer: This PDF is auto-generated based on the information available on Shiksha as on 21-Sep-2021. No. of Seats Exams 60 ─ Total Fees Median Salary 3.92 L ─ Course Rating Ranked 4.1 6 ─ B.Tech. in Computer Science and Engineering (4 years) Offered by Netaji Subhas Institute of Technology No. of Seats Exams 60 ─ Total Fees Median Salary 5.13 L ─ Course Rating Ranked 3.7 3 ─ B.Sc. in Nursing (4 years) Disclaimer: This PDF is auto-generated based on the information available on Shiksha as on 21-Sep-2021. Offered by College of Nursing, Kurji Holy Family Hospital No. of Seats Exams 40 ─ Total Fees Median Salary ─ ─ Course Rating Ranked ─ ─ Bachelor of Business Administration (BBA) (3 years) Offered by CIMAGE College No. of Seats Exams ─ ─ Total Fees Median Salary ─ ─ Course Rating Ranked 4.0 16 ─ Disclaimer: This PDF is auto-generated based on the information available on Shiksha as on 21-Sep-2021. Bachelor of Computer Application (BCA) (3 years) Offered by St. Xavier's College of Management and Technology No. of Seats Exams 60 ─ Total Fees Median Salary 2.04 L ─ Course Rating Ranked 4.6 4 ─ BAMS - Bachelor of Ayurvedic Medicine and Surgery (66 months) Offered by Government Ayurvedic College, Patna No. -

2006- 28-31 2007 No

TABLE OF CONTENTS Certificate of the Comptroller and Auditor General of India iii Introductory 1-3 PART I-SUMMARISED STATEMENTS Statement- No. 1- Summary of transactions 6-27 No. 2- Capital Outlay-Progressive Capital Outlay to the end of the year 2006- 28-31 2007 No. 3- Financial results of irrigation works 32-33 No. 4- Debt position- 34-37 (i) Statement of borrowings (ii) Other obligations (iii) Service of debt No. 5- Loans and Advances by the State Government - 38-41 (i) Statement of loans and advances (ii) Recoveries in arrears No. 6- Guarantees given by Government for repayment of loans etc. raised by 42-45 Statutory Corporations, Government Companies, Local Bodies and other institutions No. 7- Cash balances and investments of cash balances 46-47 No. 8- Summary of balances under Consolidated Fund, Contingency Fund and 48-49 Public Account PART II-DETAILED ACCOUNTS AND OTHER STATEMENTS A. REVENUE AND EXPENDITURE No. 9- Statement of Revenue and Expenditure under different heads for the 50-53 year 2006-2007 expressed as a percentage of total Revenue/total Expenditure No. 10- Statement showing the distribution between Charged and Voted 54 Expenditure No. 11- Detailed account of revenue by minor heads 55-75 No. 12- Detailed account of expenditure by minor heads 76-117 No. 13- Detailed statement of Capital Expenditure during and to end of the year 118-211 2006-2007 No. 14- Statement showing details of investments of Government in statutory 212-227 corporations, Government companies, other joint stock companies, co- operative banks and societies etc. to the end of 2006-2007 i B. -

World Bank Document

MINISTRY OF ROAD TRANSPORT & HIGHWAY GOVERNMENT OF INDIA Public Disclosure Authorized CONSULTANCY SERVICES FOR DETAILED PROJECT REPORT FOR REHABILITATION AND UPGRADING TO 2 LANE/2 LANE WITH PAVED SHOULDER OF BIRPUR TO BIHPUR SECTION OF NH-106 (KM 0. 000 TO KM 136.00) (BIHAR) Package I SOCIAL IMPACT ASSESSMENT& RAP REPORT Public Disclosure Authorized Public Disclosure Authorized February – 2014 Public Disclosure Authorized Up gradation of Birpur- Bihpur Section of NH 106 in the State of Bihar Social Impact Assessment & RAP Social Impact Assessment & RAP Report (FINAL) TABLE OF CONTENTS S. Description Page No ABBREVIATIONS Executive Summary ES 1-7 1. PROJECT BACKGROUND AND INTRODUCTION 1-1 to 1-4 1.1 Project Background 1-1 1.2 Project Description 1-1 1.3 Approach and Methodology 1-3 2. SOCIO-ECONOMIC PROFILE OF THE PROJECT INFLUENCE ZONE 2-1 to 2-5 2.1 Introduction 2-1 2.2 Socio- Economic Status of Project influence District 2-1 2.2.1 Supaul District 2-1 2.2.2 Madhepura District 2-1 2.2.3 Saharsa District 2-2 2.3 Direct Impact Zone 2-2 2.4 Socio-Economic Profiling 2-3 2.5 Existing Public Amenities 2-4 2.5.1 Educational Service 2-4 2.5.2 Health CARE Service 2-4 2.5.3 Market Facility 2-4 2.5.4 Transport Facilities 2-4 3. ANALYSIS OF ALTERNATIVES & PROPOSED IMPROVEMENT 3-1 to 3-3 PLAN 3.1 Introduction 3-1 3.2 Design Considerations 3-1 3.3 Considerations of Alternatives 3-2 3.3.1 Proposed Realignments 3-2 Client : MoRT&H Up gradation of Birpur- Bihpur Section of NH 106 in the State of Bihar Social Impact Assessment & RAP 4. -

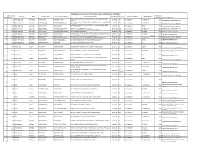

Madhepura District:List of Not Shortlisted Candidates for Uddeepika

Madhepura District:List of Not Shortlisted Candidates for Uddeepika Application Percentage Panchayat Block Candidate Name Father's/ Husband Name Correspondence Address Date Of Birth Ctageory Permanent Address DD/IPO Number S .No. Number Of Marks Reasons of Rejection VILL+PO+PS- ALAMNAGAR PURVI PANCHAYAT, WARD NO-02, PINCODE- 736 Alamnagar East Alamnagar PINKI KUMARI ABADHESH PANDIT 27-Sep-91 EBC Same as above 74G 853587-88 46.00 1 852219 Intermediate marks is less than 55% VILL- PANSALWA, P.O- BAJRAHA, VILL- ALAMNAGAR EAST, P.S- ALAMNAGAR, 440 Alamnagar East Alamnagar PUSHPA KUMARI RITESH KUMAR MANDAL 25-Jul-88 EBC Same as above 71G 930793-92 47.00 2 PIN- 852119 Intermediate marks is less than 55% C/O-SANJAY KUMAR KAVI (MOHAN TOLA), VILL+PO-ALAMNAGAR, WARD 1890 Alamnagar East Alamnagar NUTAN KUMARI SANJAY KUMAR 24-Jul-78 BC Same as above 659690 49.00 3 NO:-2, PIN-852219 Intermediate marks is less than 55% 4 2023 Alamnagar East Alamnagar MINU KUMARI KALICHARAN CHAUDHARY VILL+P.O+P.S- ALAMNAGAR, PIN- 852219 05-Aug-86 GEN Same as above 18F 306621-30 54.00 Intermediate marks is less than 55% 5 1902 Alamnagar East Alamnagar ARPANA KUMARI UDAY NATH MISHRA VILL+P.O- ALAMNAGAR, P.S- ALAMNAGAR, PIN- 852219 01-Feb-92 GEN Same as above 8H 105223 58.00 Age less than prescribed limit 6 2493 Alamnagar East Alamnagar SWATI KUMARI PRASHANT KUMAR MISHRA VILL+PO-ALAMNAGAR-852219 20-May-76 GEN Same as above 9h 610885 63.00 Age more than prescribed limit 513 Alamnagar East Alamnagar MANJAN KUMARI RUPESH MISHRA VILL- ALAMNGAR, PO- ALAMNGAR, PS- ALAMNAGAR, -

Bihar Flood 2008 Emmanuel Hospital Association, New Delhi Situation Report -1 Date: August 27, 2008

Bihar Flood 2008 Emmanuel Hospital Association, New Delhi Situation Report -1 Date: August 27, 2008 Background The flood situation resulting from the breach in the eastern Koshi embankment in neighboring Nepal has worsened in the fourth day as flood water entered into new areas of Supaul, Araria and Madhepura districts in the state of Bihar. These three districts were the worst affected locations. Flood waters have also disrupted the lives of many in Narpatganj, Farbesgunj and Bhargama blocks of Araria district and Kumarkhand and Sankarpur blocks of Madhepura district. Over 20 lakh people are bearing the brunt of floods as the turbulent waters of the Kosi submerged fresh areas in the three districts. So far, 42 people have died in the floods in Bihar, official sources said. Situation in Madhepura The Madhepura Christian Hospital, a unit of Emmanuel Hospital Association (EHA) is presently conducting an assessment and ha started the early relief operations. Madhepura Christian Hospital is a 25 bedded hospital located at about 4 kms from Madhepura Town, and is the only voluntary hospital for three adjoining districts. The hospital is located in the Madhepura block in Madhepura district which is today one of the worst affected location. It is officially reported that over 7 blocks are affected, of which 150 villages with more than 150000 population are severely affected by the flood. All communications and network are difficult as all the major lines are been cut off. Impact of Flood in Madhepura district Madhepura District is located in the northeastern part of the state of Bihar. Madhepura district is surrounded by Araria and Supaul districts in the north, Khagaria and Bhagalpur districts in the south, Purnia district in the east and Saharsa district in the west. -

Medical Admission Counselling Book

Excelling in IIT-JEE Since 2001... Exclusivity EXPERIENCE Expertise Growing in Pre-Medical Since 2011... Table for BDS WITH US PRE-MEDICAL DIVISION (Sorted by descending order in General Category) Excellence ResoMAC-BOOK MEDICAL ADMISSION COUNSELLING BOOK For Admission in MBBS & BDS Courses in Academic Session: 2019-20 Excelling in IIT-JEE Since 2001... ResoMAC-BOOK: MEDICAL ADMISSION COUNSELLING BOOK Growing in Pre-Medical Since 2011... TABLE OF CONTENT Sr. Particular Page No. 1. NEET-2018: All India Closing Rank After Round-2 for MBBS Course 1 2. NEET-2018: All India Closing Rank After Round-2 for BDS Course 9 3. NEET-2018: State Counselling (85%) Seats Closing Rank 11 4. AIIMS & JIPMER-2018 Closing Rank 14 5. State Medical Education Directorates & Ofces Details 14 6. NEET-2018: Resonance Kota’s Classroom Achievers 17 Resonance Pre-Medical Division Campus, Kota Excelling in IIT-JEE Since 2001... ResoMAC-BOOK: MEDICAL ADMISSION COUNSELLING BOOK Growing in Pre-Medical Since 2011... NEET-2018: All India Closing Rank After Round-2 for MBBS Course (TABLE IS SORTED BY DESCENDING ORDER IN GENERAL CATEGORY) ALLOTTED ANNUAL S NO Quota ALLOTTED INSTITUTE COURSE GEN. OBC SC ST STATE FEE HOSTEL 1 AIQ MAULANA AZAD MEDICAL COLLEGE, NEW DELHI MBBS 62 210 3103 1792 DELHI (NCT) 2445 500 2 AIQ VMMC AND SAFDARJUNG HOSPITAL, NEW DELHI MBBS 116 417 5381 6372 DELHI (NCT) 36000 500 3 AIQ UNIVERSITY COLLEGE OF MEDICAL SCIENCES, NEW DELHI MBBS 183 402 4153 13807 DELHI (NCT) 5295 295 4 AIQ GOVERNMENT MEDICAL COLLEGE AND HOSPITAL, CHANDIGARH MBBS 289 0 5651 26447 CHANDIGARH (UT) 25000 975 5 AIQ SETH G.S. -

Ga-10.06 Khagaria Saharsa and Madhepura

86°20'0"E 86°30'0"E 86°40'0"E 86°50'0"E 87°0'0"E 87°10'0"E GEOGRAPHICAL AREA Babhani Bholwa KHAGARIA, SAHARSA AND ! Maura MADHEPURA DISTRICTS ! Piprahi (Part in Gamharia) Aurahi ! ! Bishunpur Sundar ± Gidha ! ! ! Puraini CA-22 ! Parmanandpur CA-20 SHANKARPUR Ramnagar Mahesh ! ! KEY MAP GAMHARIYA Bakaunia Lalpur ! Rupauli (Part in Singheshwar) ! ! Jirwa CA-21 ! Chitti Chikni Mangarwara Purikh ! ! ! Lachhmipur Bhagwati N ! Rakeapatti SINGHESHWAR ! N " ! " 0 Darhar Siripur 0 ' ! Nauhatta ! Raibhir ! CA-23 ' 0 ! Rupauli (Part in Gamharia)* Rampatti ! 0 ° ! ! ! ° 6 CA-11 6 2 KUMARKHAND 2 Bijalpur Patori Israin Kalan NAUHATTA ! Bhatranha Sirinagar Jiwachhpur ! Padumpur ! ! ! (! Sukhasan ! Singhesar Asthan ! ! Ghailarh Maheswa ! ! £91 Pachgachhia Sukhasan! Gauripur ¤ Kharhatelwa Patori ! Sattar ! ! Belari ! ! Barahi Gohumani ! Á! CA-19 Ratanpura ! Bishunpur Korlahi ! Majarhat Dhorgaon ! ! Belsarh Gangaura Behra ! ! ! ! Got Bardaha GHELADH Israin Khurd Aunira Ramauli ! Chandrain ! Sihaul ! ! ! Jhitkia Tamautparsa Lachhmipur Chandi Asthan Murajpur ! Bhelwa ! Sataur ! Ukahi ! ! ! CA-12 Bhadaul ! Rahta Bara Sahugarh ! ! SATTAR ! Bhawantikthi CA-18 KATAIYA Khajuri ! ! Bhatkhori B I H A R ¤£66 ! .!( ! Jorgawan Birgaon MADHEPURA ! ! Gamhariya ! ! ! Manikpur Parwa ! Bhelahi Kalan Khurd Á! MaÁdhipura ! ! ! Á! Á Murho Á! Baijnathpur Tiri Madanpur ! ! (! Murliganj Nariar ! ! ! Rampur Á Jalai ! ! ! .!(! Saharsa ! Madhuban ! Patuwaha Jitapur Telwa ! ! CA-24 Dighi ! Bangaon ! Ara ! Manaur ! Belo MURLIGANJ ! CA-13 Á Sahuria ! ! ! Harpur CA-10 Mahisi ! Pokhram -

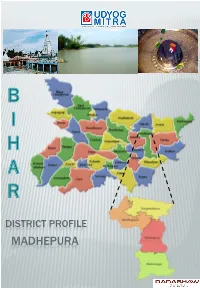

Madhepura Introduction

DISTRICT PROFILE MADHEPURA INTRODUCTION Madhepura district is one of the thirty-eight districts of the State of Bihar. It was formed in 1981, separated from Saharsa district. Madhepura district is surrounded by Araria and Supaul districts in the north, Khagaria and Bhagalpur districts in the south, Purnia district in the east and Saharsa district in the West. Madhepura district is situated in the Plains of River Koshi and located in the Northeastern part of Bihar. HISTORICAL BACKGROUND Madhepura stands at the centre of Kosi ravine, it was called Madhyapura- a place centrally situated which was subsequently transformed as Madhipura into present Madhepura. Madhepura is known to be the meditation ground for Lord Shiva and other Gods. Madhepura finds reference in the Indian epics Ramayan and Mahabharat. Kushan dynasty has also resided in Madhepura. Bhant Community, the decedents of Kushan dynasty . In ancient times Madhepura was governed by Anga Desh. It was also governed by Maurya, Sunga, Kanva and Kushan dynasties. During Mughal period Madhepura remained under Sarkar Tirhut. A mosque of the time of Akbar is still present in Sarsandi village under Uda-Kishunganj. ADMINISTRATIVE Madhepura city is the district headquarters. Madhepura district is divide into 2 sub-divisions, Madhepura Uda Krishanganj Madhepura district has been divided into 13 municipal blocks: o Madhepura o Shankarpur o Alamnagar o Singheshwar o Chousa o Murliganj o Purani o Gamhariya o Gwalpara o Ghelardh o Bihariganj o Kumarkhand o Uda Krishanganj Total number of Panchayats in Madhepura district 170. Madhepura district has 449 number of revenue villages. ECONOMIC PROFILE Having its background in agriculture, wood and wooden based furniture and steel fabrication units.