Integrating with Google Pay API for Mobile Payments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Google Apps Premier Edition: Easy, Collaborative Workgroup Communication with Gmail and Google Calendar

Google Apps Premier Edition: easy, collaborative workgroup communication with Gmail and Google Calendar Messaging overview Google Apps Premier Edition messaging tools include email, calendar and instant messaging solutions that help employees communicate and stay connected, wherever and whenever they work. These web-based services can be securely accessed from any browser, work on mobile devices like BlackBerry and iPhone, and integrate with other popular email systems like Microsoft Outlook, Apple Mail, and more. What’s more, Google Apps’ SAML-based Single Sign-On (SSO) capability integrates seamlessly with existing enterprise security and authentication services. Google Apps deliver productivity and reduce IT workload with a hosted, 99.9% uptime solution that gets teams working together fast. Gmail Get control of spam Advanced filters keep spam from employees’ inboxes so they can focus on messages that matter, and IT admins can focus on other initiatives. Keep all your email 25 GB of storage per user means that inbox quotas and deletion schedules are a thing of the past. Integrated instant messaging Connect with contacts instantly without launching a separate application or leaving your inbox. No software required. Built-in voice and video chat Voice and video conversations, integrated into Gmail, make it easy to connect face-to-face with co-workers around the world. Find messages instantly Powerful Google search technology is built into Gmail, turning your inbox into your own private and secure Google search engine for email. Protect and secure sensitive information Additional spam filtering from Postini provides employees with an additional layer of protection and policy-enforced encryption between domains using standard TLS protocols. -

Google Apps: an Introduction to Docs, Scholar, and Maps

[Not for Circulation] Google Apps: An Introduction to Docs, Scholar, and Maps This document provides an introduction to using three Google Applications: Google Docs, Google Scholar, and Google Maps. Each application is free to use, some just simply require the creation of a Google Account, also at no charge. Creating a Google Account To create a Google Account, 1. Go to http://www.google.com/. 2. At the top of the screen, select “Gmail”. 3. On the Gmail homepage, click on the right of the screen on the button that is labeled “Create an account”. 4. In order to create an account, you will be asked to fill out information, including choosing a Login name which will serve as your [email protected], as well as a password. After completing all the information, click “I accept. Create my account.” at the bottom of the page. 5. After you successfully fill out all required information, your account will be created. Click on the “Show me my account” button which will direct you to your Gmail homepage. Google Docs Now that you have an account created with Google, you are able to begin working with Google Docs. Google Docs is an application that allows the creation and sharing of documents, spreadsheets, presentations, forms, and drawings online. Users can collaborate with others to make changes to the same document. 1. Type in the address www.docs.google.com, or go to Google’s homepage, http://www. google.com, click the more drop down tab at the top, and then click Documents. Information Technology Services, UIS 1 [Not for Circulation] 2. -

Google Earth User Guide

Google Earth User Guide ● Table of Contents Introduction ● Introduction This user guide describes Google Earth Version 4 and later. ❍ Getting to Know Google Welcome to Google Earth! Once you download and install Google Earth, your Earth computer becomes a window to anywhere on the planet, allowing you to view high- ❍ Five Cool, Easy Things resolution aerial and satellite imagery, elevation terrain, road and street labels, You Can Do in Google business listings, and more. See Five Cool, Easy Things You Can Do in Google Earth Earth. ❍ New Features in Version 4.0 ❍ Installing Google Earth Use the following topics to For other topics in this documentation, ❍ System Requirements learn Google Earth basics - see the table of contents (left) or check ❍ Changing Languages navigating the globe, out these important topics: ❍ Additional Support searching, printing, and more: ● Making movies with Google ❍ Selecting a Server Earth ❍ Deactivating Google ● Getting to know Earth Plus, Pro or EC ● Using layers Google Earth ❍ Navigating in Google ● Using places Earth ● New features in Version 4.0 ● Managing search results ■ Using a Mouse ● Navigating in Google ● Measuring distances and areas ■ Using the Earth Navigation Controls ● Drawing paths and polygons ● ■ Finding places and Tilting and Viewing ● Using image overlays Hilly Terrain directions ● Using GPS devices with Google ■ Resetting the ● Marking places on Earth Default View the earth ■ Setting the Start ● Location Showing or hiding points of interest ● Finding Places and ● Directions Tilting and -

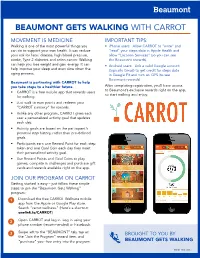

Beaumont Gets Walking with Carrot

BEAUMONT GETS WALKING WITH CARROT MOVEMENT IS MEDICINE IMPORTANT TIPS: Walking is one of the most powerful things you • iPhone users: Allow CARROT to “write” and can do to support your own health. It can reduce “read” your steps data in Apple Health and your risk for heart disease, high blood pressure, allow “Location Services” (so you can see stroke, Type 2 diabetes and colon cancer. Walking the Beaumont rewards). can help you lose weight and gain energy. It can • Android users: Link a valid Google account help improve your sleep and even slow down the (typically Gmail) to get credit for steps data aging process. in Google Fit and turn on GPS (to see Beaumont rewards). Beaumont is partnering with CARROT to help you take steps to a healthier future. After completing registration, you’ll have access to Beaumont’s exclusive rewards right on the app, • CARROT is a free mobile app that rewards users so start walking and enjoy. for walking. • Just walk to earn points and redeem your “CARROT currency” for rewards. • Unlike any other program, CARROT gives each user a personalized activity goal that updates each day. • Activity goals are based on the participant’s personal step history, rather than pre-defined goals. • Participants earn one Reward Point for each step taken and one Goal Coin each day they meet their personalized activity goal. Beaumont Beaumont • Use Reward Points and Goal Coins to play games, compete in challenges and purchase gift cards and rewards available right on the app. JOIN OUR PROGRAM ON CARROT Getting started is easy – just follow these simple steps to join the “Beaumont Gets Walking” program: 1 Download the free CARROT Wellness mobile app from the Apple or Google Play store. -

Tutorial: Setup for Android Development

Tutorial: Setup for Android Development Adam C. Champion, Ph.D. CSE 5236: Mobile Application Development Autumn 2019 Based on material from C. Horstmann [1], J. Bloch [2], C. Collins et al. [4], M.L. Sichitiu (NCSU), V. Janjic (Imperial College London), CSE 2221 (OSU), and other sources 1 Outline • Getting Started • Android Programming 2 Getting Started (1) • Need to install Java Development Kit (JDK) (not Java Runtime Environment (JRE)) to write Android programs • Download JDK for your OS: https://adoptopenjdk.net/ * • Alternatively, for OS X, Linux: – OS X: Install Homebrew (http://brew.sh) via Terminal, – Linux: • Debian/Ubuntu: sudo apt install openjdk-8-jdk • Fedora/CentOS: yum install java-1.8.0-openjdk-devel * Why OpenJDK 8? Oracle changed Java licensing (commercial use costs $$$); Android SDK tools require version 8. 3 Getting Started (2) • After installing JDK, download Android SDK from http://developer.android.com • Simplest: download and install Android Studio bundle (including Android SDK) for your OS • Alternative: brew cask install android- studio (Mac/Homebrew) • We’ll use Android Studio with SDK included (easiest) 4 Install! 5 Getting Started (3) • Install Android Studio directly (Windows, Mac); unzip to directory android-studio, then run ./android-studio/bin/studio64.sh (Linux) 6 Getting Started (4) • Strongly recommend testing Android Studio menu → Preferences… or with real Android device File → Settings… – Android emulator: slow – Faster emulator: Genymotion [14], [15] – Install USB drivers for your Android device! • Bring up Android SDK Manager – Install Android 5.x–8.x APIs, Google support repository, Google Play services – Don’t worry about non-x86 Now you’re ready for Android development! system images 7 Outline • Getting Started • Android Programming 8 Introduction to Android • Popular mobile device Mobile OS Market Share OS: 73% of worldwide Worldwide (Jul. -

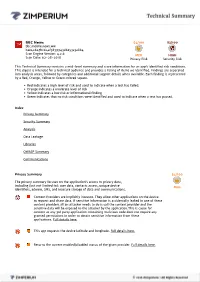

Android App Detailed Report

BBC News 54/100 83/100 bbc.mobile.news.ww bae42647bc64af3839943d6e53a3a8b4 Scan Engine Version: 4.2.6 MED HIGH Scan Date: 02-28-2018 Privacy Risk Security Risk This Technical Summary contains a mid-level summary and score information for an app’s identified risk conditions. This digest is intended for a technical audience and provides a listing of items we identified. Findings are separated into analysis areas, followed by categories and additional support details when available. Each finding is represented by a Red, Orange, Yellow or Green colored square. Red indicates a high level of risk and used to indicate when a test has failed. Orange indicates a moderate level of risk Yellow indicates a low risk or informational finding Green indicates that no risk conditions were identified and used to indicate when a test has passed. Index Privacy Summary Security Summary Analysis Data Leakage Libraries OWASP Summary Communications Privacy Summary 54/100 The privacy summary focuses on the application’s access to privacy data, including (but not limited to): user data, contacts access, unique device MED identifiers, adware, SMS, and insecure storage of data and communications. Content Providers are implicitly insecure. They allow other applications on the device to request and share data. If sensitive information is accidentally leaked in one of these content providers all an attacker needs to do is call the content provider and the sensitive data will be exposed to the attacker by the application.This is cause for concern as any 3rd party application containing malicious code does not require any granted permissions in order to obtain sensitive information from these applications. -

Android Support for Microsoft Exchange in Pure Google Devices

Android support for Microsoft Exchange in pure Google devices Note: The information presented here is intended for Microsoft Exchange administrators who are planning and implementing support for any of these pure Google devices running Android. Android support by version and device The following AndroidTM versions support Microsoft Exchange information services and security policies: ● Android 4.0.4 (Ice Cream Sandwich) ● Android 4.1 and later (Jelly Bean) The following “pure Google” devices support the Microsoft Exchange services and policies: ● Galaxy Nexus phones running Android ● Nexus S phones running Android ● Motorola Xoom tablets running Android ● Nexus 4 phones running Android ● Nexus 7 tablets running Android ● Nexus 10 tablets running Android Requirements To support Android 4.0 running on pure Google devices, you must be running one of the following versions of Microsoft Exchange: ● Exchange Server 2010 SP1 with Exchange ActiveSync 14.1 ● Exchange Server 2010 with Exchange ActiveSync 14.0 ● Exchange Server 2007 SP1 with Exchange ActiveSync 12.1 ● Exchange Server 2007 with Exchange ActiveSync 12.0 ● Exchange Server 2003 SP2 with Exchange ActiveSync 2.5 The following information applies to the Android platform, including the Settings, Email, Calendar, People, and related apps as built by Google. If a device manufacturer has modified these apps on its own devices, contact the manufacturer for information about support for Exchange features. Supported information services Users can add Microsoft Exchange accounts to their pure Google devices by using the Account & Sync settings available from the Settings or Email app. Android supports the following Exchange information services: ● Adding Exchange user accounts (via an ActiveSync server), and enforcement of some mailbox policies (as described in “Supported security policies,” next). -

Roboto Italic It Is a Google Font, Universally Accessible and Optimized for All Print and Digital Needs

Identity Guidelines 1. Logos 2. Palettes + Swatches 3. Fonts 4. Amplify 5. Programs V2-Jan 2019 1. The Logos PRIMARY LOGO Logos The Primary Logo for ILHIGH is the version with White Type and Bright Teal “bubble”. While there are many color versions of the logo available, this version is the Primary Logo and the representational mark for ILHIGH as a whole. For Black and White, the logo version with White Type and Black bubble is the primary logo. Bright Teal Pantone 7716 C Pantone 7716 U CMYK 85, 17, 40, 0 RGB 7, 157, 161 HEX 079DA1 1. The Logos BRAND NAME Logos • When referring to the brand name it must always be: I Live Here I Give Here • Ever word has an initial capitalization and there is no comma after “Here” • After writing out I Live Here I Give Here, the brand name can subsequently be shortened to ILHIGH • Incorrect versions are: I LIVE HERE I GIVE HERE I Live Here, I Give Here 1. The Logos Logos LOGO VARIATIONS Solid The ILHIGH logo is intended to be playful and have personality, so a combination of any of the three brand colors (Bright Teal, Dark Teal, Amplify Green) and White is encouraged. This includes “reversed out” versions (White or light bubble on darker background), and Bubble outline options. Reversed Outline + Reversed Outline 1. The Logos LOGO VARIATIONS Logos Black and White Variations of the logo. 1. The Logos LOGO “BUG” Logos The Logo Bug is a truncated, simplified version of the ILHIGH logo. This is intended only for use in small spaces when the regular, full version of the logo will lose its legibility. -

Paper #5: Google Mobile

Yale University Thurmantap Arnold Project Digital Platform Theories of Harm Paper Series: 5 Google’s Anticompetitive Practices in Mobile: Creating Monopolies to Sustain a Monopoly May 2020 David Bassali Adam Kinkley Katie Ning Jackson Skeen Table of Contents I. Introduction 3 II. The Vicious Circle: Google’s Creation and Maintenance of its Android Monopoly 5 A. The Relationship Between Android and Google Search 7 B. Contractual Restrictions to Android Usage 8 1. Anti-Fragmentation Agreements 8 2. Mobile Application Distribution Agreements 9 C. Google’s AFAs and MADAs Stifle Competition by Foreclosing Rivals 12 1. Tying Google Apps to GMS Android 14 2. Tying GMS Android and Google Apps to Google Search 18 3. Tying GMS Apps Together 20 III. Google Further Entrenches its Mobile Search Monopoly Through Exclusive Dealing22 A. Google’s Exclusive Dealing is Anticompetitive 25 IV. Google’s Acquisition of Waze Further Forecloses Competition 26 A. Google’s Acquisition of Waze is Anticompetitive 29 V. Google’s Anticompetitive Actions Harm Consumers 31 VI. Google’s Counterarguments are Inadequate 37 A. Google Android 37 B. Google’s Exclusive Contracts 39 C. Google’s Acquisition of Waze 40 VII. Legal Analysis 41 A. Google Android 41 1. Possession of Monopoly Power in a Relevant Market 42 2. Willful Acquisition or Maintenance of Monopoly Power 43 a) Tying 44 b) Bundling 46 B. Google’s Exclusive Dealing 46 1. Market Definition 47 2. Foreclosure of Competition 48 3. Duration and Terminability of the Agreement 49 4. Evidence of Anticompetitive Intent 50 5. Offsetting Procompetitive Justifications 51 C. Google’s Acquisition of Waze 52 1. -

A Framework for Developing Context-Aware Mobile Applications

Magni - A Framework for Developing Context-aware Mobile Applications Ricardo Queir´os1, Filipe Portela2, and Jos´eMachado2 1 ESMAD, Polytechnic of Porto, Portugal 2 Algoritmi Research Centre, University of Minho, Portugal. Abstract. The advent of Internet and ubiquitous technologies has been fostering the appearance of intelligent mobile applications aware of their environment and the objects nearby. Despite its popularity, mobile de- velopers are often required to write large and disorganized amounts of code, mixing UI with business logic and interact, in a ad-hoc fashion, with sensor devices and services. These habits hinder the code maintenance, refactoring and testing, while negatively influencing the consistency and performance of mobile applications. In this paper we present Magni as an abstract framework for the design and implementation of personalized and context-aware mobile applications. The corner stone of the frame- work is its architectural pattern based on the Model-View-Presenter pat- tern in the UI layer relying in REST services the majority of the app features. This paradigm fosters the modular design, implementing the separation of concerns concept and allowing an easier implementation of unit tests. In order to validate the framework, we present a prototype for an healthcare automotive app. The main goal of the app is to facilitate the access to health related points of interest such as hospitals, clinics and pharmacies. Keywords: Web services, Design patterns, Mobile frameworks, Geolo- calization, Interoperability, Mobile healthcare, Automotive apps 1 Introduction The increased use of mobile devices and their ubiquitous facet, fostered the design of context-aware applications that make use of data collected from the sensors' device and location services. -

Tug of Perspectives: Mobile App Users Vs Developers

Tug of Perspectives: Mobile App Users vs Developers Sandeep Kaur Kuttal #1, Yiting Bai #2, Ezequiel Scott ∗3, Rajesh Sharma ∗4 # Tandy School of Computer Science, University of Tulsa USA 1 [email protected] 2 [email protected] ∗ University of Tartu Estonia 3 [email protected] 4 [email protected] Abstract—Billions of apps are published each year in the expressed in app reviews, and team structures can impact mobile application distribution market. However, a large number app popularity. To fill this gap, we investigated the influence of these apps are unsuccessful due to poor user attention of these factors on the user experience to assist struggling and satisfaction as reflected by low ratings on the distribution markets. Recent studies have investigated the app popularity developers. from users’ perspectives, but none of the studies have compared To analyze and understand software engineering paradigm it from a developer’s perspective. To fill this gap, we analyzed of app development, we collected two types of information the user ratings and reviews with the software characteristics: - users ratings and reviews from the Apple App Store and ratings, issue report contents, number of bugs and enhancements, project related information (e.g. issue reports, developers in- and developers’ team structure. In order to do this, we examined 274 apps on the Apple App Store that also had their source volved) from GitHub. These provided us with a rich and inter- code available on GitHub. We collected 19,655 app reviews related set of data. and 13,193 issue reports from both platforms. -

Google Pay-FAQ

Frequently Asked Questions 1. What is Google Pay? You can also open the Google Pay app, swipe left at the top to find the card you want to make default, then tap Pay Google Pay is a mobile payments app that can store your credit, debit, prepaid, loyalty Cards, etc. It is the fastest, simplest with this card 19. Can I continue to use Google Pay if my physical Credit / Debit / Prepaid card is due to expire? way to pay in millions of places – online, in stores. It brings together everything you need at checkout and protects your You can continue to use Google Pay till your card expiry date. Once you receive and activate your renewed card, you payment info with multiple layers of security. 9. Is Google Pay secure? will need to add it into Google Pay. Yes. Google Pay is secure because it processes transactions through a tokenisation service. This service replaces a 2. How do I set up Google Pay? Card’s primary account number with a random numerical sequence unique to a specific device, merchant, transaction 20. Will the card image in Google Pay match my physical card? •It only takes a few minutes to get up and running with Google Pay. type or channel. Actual account numbers are not stored on the device, or on mobile servers, and cashiers will no The card image may not be an exact match. Keep in mind this doesn't affect how your cards work with Google Pay. •Download the app on Google Play or the App Store, or visit pay.google.com.