Annual Report 2017 Connecting Lives Building Futures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interchange from NWFB and Citybus to Turbojet Save Ferry Fare up to $30 and Enjoy an Exclusive Seat Class Upgrade with $50

Interchange from NWFB and Citybus to TurboJET Save Ferry Fare Up to $30 and Enjoy an Exclusive Seat Class Upgrade with $50 (17 May 2019, Hong Kong) New World First Bus (“NWFB”) and Citybus announced a collaboration with TurboJET today to launch “One tap to board with Octopus” interchange discount scheme. From now to 31 December 2019, Octopus paying passengers of NWFB and Citybus routes can enjoy an interchange discount equivalent to bus fare of the last single trip, when using the “One Tap to Board with Octopus” service to pay their ferry fare at the first gate of ferry terminal to Macau at Hong Kong Macau Ferry Terminal in Sheung Wan, Tuen Mun Ferry Terminal and China Hong Kong City Ferry Terminal. The maximum discount is $30. In addition, passengers of NWFB and Citybus can at the same time enjoy an exclusive offer by TurboJET for seat class upgrade with $50 using “One Tap to Board with Octopus” service. Please visit http://www.turbojet.com.hk/en/promotions/octopus-tj-discount.aspx for *terms and conditions. – END – *Terms and conditions 1. The offer is valid from now until 31 December 2019, provided by TurboJET. 2. Interchange must take place within 120 minutes after the bus fare payment and the use of “One Tap to Board with Octopus” service at designated Ferry Terminals; same Octopus has to be used in order to enjoy the offer. 3. The interchange discount is equivalent to the bus fare of the last paid trip, to be directly deducted from the ferry fare during the use of “One Tap to Board with Octopus” service. -

Annual Report 2009

NWS HOLDINGS LIMITED NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPORT 2009 ANNUAL REPORT 28/F New World Tower 18 Queen’s Road Central Hong Kong Tel: (852) 2131 0600 Fax: (852) 2131 0611 E-mail: [email protected] Sustaining Growth www.nws.com.hk Striving for Excellence NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. NWS HOLDINGS LIMITED This annual report is printed on FSC certified paper using vegetable oil-based inks. Pulps used are elemental chlorine-free. ANNUAL REPORT 2009 The FSC logo identifies product group from well-managed forests and other controlled sources in accordance with the rules of the Forest Stewardship Council. STOCK CODE: 659 VISION To build a dynamic and premier group of infrastructure and service management companies driven by a shared passion for customer value and care MISSION Synergize and develop business units that: • Nurture total integrity • Attain total customer satisfaction • Foster learning culture and employee pride • Build a world-class service provider brand • Maximize financial returns CORE VALUES • Reputable customer care • Pride and teamwork • Innovation • Community contributions and environmental awareness • Stakeholders’ interest CONTENTS 2 CORPORATE PROFILE 4 MILESTONES 6 FINANCIAL HIGHLIGHTS 8 CHAIRMAN’S STATEMENT 10 BOARD OF DIRECTORS 14 CORPORATE GOVERNANCE REPORT 26 KEY INFORMATION FOR SHAREHOLDERS 30 HUMAN CAPITAL 32 COMMUNITY CARE 34 ENVIRONMENTAL FRIENDLINESS 36 MANAGEMENT DISCUSSION AND ANALYSIS 48 REPORTS AND FINANCIAL STATEMENTS 150 FIVE-YEAR FINANCIAL SUMMARY 152 PROJECT KEY FACTS AND FIGURES 164 GLOSSARY OF TERMS 166 CORPORATE INFORMATION CORPORATE PROFILE About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). -

Annual Report 2018 Connecting Lives Building Futures

NWS HOLDINGS LIMITED NWS HOLDINGS LIMITED STOCK CODE: 659 NWS Holdings Limited (incorporated in Bermuda with limited liability) ANNUAL REPO 28/F New World Tower 18 Queen’s Road Central Central, Hong Kong Tel : (852) 2131 0600 Fax : (852) 2131 0611 E-mail : [email protected] R T www.nws.com.hk 2018 Annual Report 2018 Connecting Lives Building Futures NWS Holdings Limited takes every practicable measure to conserve resources and minimize waste. ™ This annual report is printed on FSC certified paper and other controlled material using chemistry free plate system and soy ink. The FSC™ logo identifies product group from responsible forestry in accordance with the rules of the Forest Stewardship Council®. About NWS Holdings NWS Holdings Limited (Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). Listed on the Hong Kong Stock Exchange, NWS Holdings embraces a range of businesses predominately in Hong Kong and Mainland China. With a workforce of approximately 30,000 people, NWS Holdings is committed to achieving sustainable growth in its two core business areas of infrastructure and services. VISION MISSION CORE VALUES To build a dynamic and Synergize and develop • Reputable customer care premier group of business units that: • Pride and teamwork infrastructure and service • Nurture total integrity • Innovation management companies • Attain total customer driven by a shared • Community contributions satisfaction passion for customer value and environmental and care • Foster learning culture awareness and employee pride • Stakeholders’ interest • Build a world-class service provider brand • Maximize financial returns CONNECTING LIVES • BUILDING FUTURES NWS HOLDINGS LIMITED This year’s annual report features a brightly coloured bird, its vibrancy NWS HOLDINGS LIMITED STOCK CODE: 659 representing the Group’s diverse and flourishing business segments. -

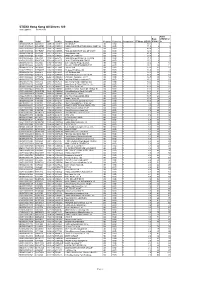

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

ANE (Cayman) Inc. (The “Company”) (A Company Incorporated in the Cayman Islands with Limited Liability)

The Stock Exchange of Hong Kong Limited and the Securities and Futures Commission take no responsibility for the contents of this Application Proof, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Application Proof. Application Proof of ANE (Cayman) Inc. (the “Company”) (A company incorporated in the Cayman Islands with limited liability) WARNING The publication of this Application Proof is required by The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and the Securities and Futures Commission (the “Commission”) solely for the purpose of providing information to the public in Hong Kong. This Application Proof is in draft form. The information contained in it is incomplete and is subject to change which can be material. By viewing this document, you acknowledge, accept and agree with the Company, its sponsors, advisers or members of the underwriting syndicate that: (a) this document is only for the purpose of providing information about the Company to the public in Hong Kong and not for any other purposes. No investment decision should be based on the information contained in this document; (b) the publication of this document or supplemental, revised or replacement pages on the Stock Exchange’s website does not give rise to any obligation of the Company, its sponsors, advisers or members of the underwriting syndicate to proceed with an offering in Hong Kong or any other -

About NWS Holdings Infrastructure

CORPORATE PROFILE About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 17). Listed on the Hong Kong Stock Exchange, NWS Holdings has built up a diversified business portfolio across Hong Kong, Mainland China and Macau. Infrastructure As one of the major infrastructure investors in Mainland China, NWS Holdings has established a strong foundation with 62 projects in the four segments of Roads, Energy, Water as well as Ports & Logistics. Roads Water NWS Holdings operates 20 road and related NWS Holdings has invested in the vast water markets of Mainland China projects in Hong Kong and Mainland China’s and Macau via its joint venture company, Sino-French Holdings (Hong Kong) strategic locations, for example, Guangdong and Limited for over 20 years. The Group operates 25 water treatment and waste Tianjin, covering approximately 578 km in length. treatment projects etc, treating up to 6.62 million cubic metres of water and waste water per day, 540 tonnes of sludge per day and 60,000 tonnes of waste per year. Also, the Group holds stake in a 61-hectare landfill in Hong Kong. Energy Ports & Logistics The Energy portfolio comprises five power plants NWS Holdings has seven port projects in the major coastal cities of Mainland in Guangdong, Sichuan and Macau with a total China such as Xiamen and Tianjin, with a container handling capacity of installed capacity of approximately 3,742 MW 7.1 million TEUs per year. -

About NWS Holdings

Corporate Profile NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong About stock code: 0659) is the infrastructure and service flagship of New World Development Company Limited (Hong NWS Kong stock code: 0017). Listed on the Hong Kong Stock Exchange in January 2003, the Group is a Holdings constituent stock of the Hang Seng Hong Kong Mid-cap Index and FTSE Asia Pacific (ex-Japan) Index. Embracing a diversified range of businesses in Hong Kong, Mainland China and Macau, NWS Holdings’ Infrastructure portfolio encompasses Energy, Water, Roads and Ports projects while its Service & Rental businesses comprise Facilities Rental, Contracting, Transport, etc. Drawing on a wealth of strategic vision, NWS Holdings aspires to build a dynamic and premier group of infrastructure and service management companies in the region. NWS Holdings Limited 02 03 Service & Rental Infrastructure As a major infrastructure investor with a strong foothold in China, NWS Holdings operates 51 projects in Energy, Water, Roads and Ports segments. Energy The three power plants in Guangdong and Macau have a total installed capacity of approximately 1,688MW. Water Through its 20-year-old joint venture company Sino-French Holdings (Hong Kong) Limited, NWS Holdings enjoys a first-mover As a leading service management group in Hong Kong, advantage in the water markets of NWS Holdings has the experience to capture the Mainland China and Macau where tremendous potential across the border. its 19 water treatment plants can Hong Kong Convention and treat up to 4.38 million m3 of fresh Facilities Exhibition Centre and ATL Logistics water and wastewater per day. -

NWS Holdings Disposes of Its Interest in Macau Power

For immediate release NWS Holdings disposes of its interest in Macau Power (16 May 2014, Hong Kong) NWS Holdings Limited (“NWS Holdings” or the “Group”; Hong Kong stock code: 659) announced that its joint venture Sino-French Holdings (Hong Kong) Limited (“SFH”) has entered into a conditional share purchase agreement with Nam Kwong Development (H.K.) Limited to sell 90% of the issued share capital in Sino-French Energy Development Company Limited (“SFED”) and the shareholder loan owed by SFED, at the aggregate cash consideration of US$612 million (equivalent to HK$4,755.24 million). SFED directly holds approximately 42.2% shareholding in Companhia de Electricidade de Macau – CEM, S.A. (“Macau Power”). In connection with the disposal, SFH entered into a put option agreement with King Class Limited (“KCL”) to grant KCL a put option to require SFH to purchase its 9% effective shareholding in SFED, so that KCL may opt to participate in this transaction. Under the existing shareholding structure, SFH, a 50/50 joint venture between NWS Holdings and Suez Environnement, holds 90% effective interest in SFED, and the remainder 10% is held by KCL. Accordingly, NWS Holdings holds approximately 19% effective interest in Macau Power. Upon completion of the disposal and in the event of the put option being exercised, SFH will have disposed of its 81% interest in SFED and will continue to hold effectively 9% interest in SFED through a special purpose vehicle. NWS Holdings expects to share a gain of HK$1.5 billion from the disposal of approximately 17% effective interest in Macau Power, assuming the transactions have taken place on 30 April 2014. -

“We Are a Big Family!

Corporate Profile We are a Big“ Family! At NWS Holdings, we cherish our people because they always have and always will be the cornerstone on which our success is built.” Infrastructure With 55 major Roads, Energy, Water and Ports projects, NWS Holdings has built a strong track record in managing and operating infrastructure assets across Mainland China. Roads 20 years. In conjunction with its The Group owns interests in 20 key joint venture company, Sino-French road and bridge projects covering Holdings (Hong Kong) Limited, approximately 671 km in strategically the Group now operates 21 water located Mainland China’s transport plants and one waste incineration 3 hubs such as Guangdong and Tianjin. plant, treating up to 5.68 million m of water and wastewater daily and 60,000 tonnes of waste per year. Energy The Group also holds stake in a Offering a total installed capacity 61-hectare landfill in Hong Kong. of approximately 3,142MW, NWS Holdings’ interest in five power plants in Guangdong, Sichuan and Macau Ports ensure a reliable energy supply. NWS Holdings operates seven Ports projects with a total handling capacity of approximately 6.12 Water million TEUs annually in strategically The Group has been investing in important Mainland Chinese coastal Mainland China’s and Macau’s cities such as Xiamen and Tianjin. vast water markets for more than 2 About NWS Holdings NWS Holdings Limited (“NWS Holdings” or the “Group”, Hong Kong stock code: 0659) is the infrastructure and service flagship of New World Development Company Limited (Hong Kong stock code: 0017). Over the years, NWS Holdings has built up a diversified business portfolio covering Hong Kong, Mainland China and Macau. -

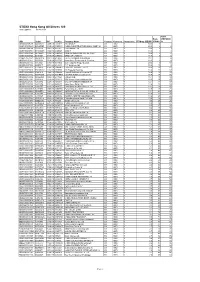

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2017

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 2 2 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 3 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 4 4 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 5 7 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 6 5 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 9 10 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 10 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 11 11 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 12 12 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 13 13 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 14 16 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd.