Mix Telematics Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

South Africa

PUBLIC VERSION DOC Investigation No. A-791-825 ITC Investigation Nos. 701-TA-___-___ and 731-TA- ___-___ Total No. of Pages: 370 AD/CVD Operations Petitioners’ Business Proprietary Information for Which Proprietary Treatment Has Been Requested Deleted at Exhibits AD-ZA-1 (Atts. 1, 2, 5, 7,), AD-ZA- 2, AD-ZA-4, and AD-ZA-5 PUBLIC VERSION BEFORE THE INTERNATIONAL TRADE ADMINISTRATION OF THE U.S. DEPARTMENT OF COMMERCE AND THE U.S. INTERNATIONAL TRADE COMMISSION ANTIDUMPING DUTY PETITION VOLUME XVI SOUTH AFRICA COMMON ALLOY ALUMINUM SHEET FROM BAHRAIN, BRAZIL, CROATIA, EGYPT, GERMANY, GREECE, INDIA, INDONESIA, ITALY, KOREA, OMAN, ROMANIA, SERBIA, SLOVENIA, SOUTH AFRICA, SPAIN, TAIWAN, AND TURKEY PETITIONERS: THE ALUMINUM ASSOCIATION COMMON ALLOY ALUMINUM SHEET TRADE ENFORCEMENT WORKING GROUP AND ITS INDIVIDUAL MEMBERS W. BRAD HUDGENS JOHN M. HERRMANN DAVID C. SMITH WILLIAM H. CROW II PAUL C. ROSENTHAL GRACE W. KIM EMILY R. MALOOF KATHLEEN W. CANNON MELISSA M. BREWER NEREUS JOUBERT R. ALAN LUBERDA JOSHUA R. MOREY VLADIMIR VARBANOV BROOKE M. RINGEL MATTHEW G. PEREIRA GEORGETOWN ECONOMIC KELLEY DRYE & WARREN LLP SERVICES, LLC 3050 K Street, N.W., Suite 400 3050 K Street, N.W. Washington, DC 20007 Washington, D.C. 20007 (202) 342-8400 (202) 945-6660 Counsel to Petitioners March 9, 2020 PUBLIC VERSION Table of Contents Page I COMMON ALLOY ALUMINUM SHEET FROM SOUTH AFRICA IS BEING SOLD OR OFFERED FOR SALE AT LESS THAN FAIR VALUE .......,.1 A. Introduction............... 1 B. Producers in South Africa."..'. ,2 C. Export Price or Constructed Export Price' .4 D. Normal Value........ 5 E. -

Report on Consultative Hearings Into the State of Shelters in South Africa

REPORT ON CONSULTATIVE HEARINGS INTO THE STATE OF SHELTERS IN SOUTH AFRICA REPORT ON CONSULTATIVE HEARINGS INTO THE STATE OF SHELTERS IN SOUTH AFRICA Copyright: 2020 Commission on Gender Equality. All rights reserved. No part of this publication may be reproduced, photocopied or transmitted in any form nor part thereof be distributed for profit-making purposes without prior written consent of the Commission for Gender Equality. Publisher: Commission for Gender Equality ISBN: 978-1-920308-86-5 Copy Editor: Proof Africa Design: Layout & Printing: JKMN Consulting REPORT ON CONSULTATIVE HEARINGS INTO THE STATE OF SHELTERS IN SOUTH AFRICA Content Acronyms 3 1. Introduction 5 2. Objectives 9 3. National Department of Social Development 11 4. Department of Social Development - Gauteng 22 5. Department of Social Development - North West 28 6. Department of Social Development - Mpumalanga 38 7. Gauteng Community Safety 42 8. Department of Social Development - Free State 49 9. Department of Social Development - Western Cape 60 10. Department of Social Development - Northern Cape 78 11. Department of Social Development - Eastern Cape 83 12. Department of Social Development - KwaZulu-Natal 99 13. Department of Social Development - Limpopo 102 14. South African Police Service 109 15. National Department of Labour 115 16. Department of National Treasury 116 17. Department of Women, Youth and Persons with Disabilities 129 18. Department of Human Settlements 134 19. National Department of Health (NDOH) 142 20. Department of Public Works and Infrastructure 155 21. Overall findings 157 22. Overall Recommendations 158 List of Tables Table 1: Gauteng overview 11 Table 2: Western Cape funding for shelters 13 Table 3: Shelters for Free State and budget allocations 14 Table 4: Number of shelters funded in South Africa 15 Table 5: Number of white door centres across provinces 15 Table 6. -

Coaxial Connectors Navigator the ABC’S of Ordering from Radiall A

Coaxial Connectors Navigator The ABC’s of Ordering From Radiall A. Series P/N Series Prefix Radiall and Radiall AEP Orientation Gender Connector Catalog P/N & Part Number Series 3 digits correspond to series Radiall AEP Part 4 digits correspond to series (SMA, BNC, SMB, etc; refer to (SMA, BNC, SMB, etc.; refer to Section Number Straight Male Prefix Radiall System Number System Interface finder guide for series) finder guide for series) Name R XXX XXX XXX 3 digits correspond to function 9000-XXXX-XXX 4 digits correspond to function (Plating, captivation, attachment (Interface, geometry, panel Body mounting, etc.) and materials) Right angle Female 3 digits correspond to variant 3 digits correspond to variant Size (Variation) (Dimension, finish, packaging, etc.) Attachment B. Style C. Electrical Options Coupling System Main Cable Types SMA, SMC, TNC, N, UMP, MMS, MMT, BMA, SMP QMA, QN, SMB "Fakra Ω UHF, DIN 7/16, etc. MC-Card, SMB, MCX "smooth bore" BNC, C and USCar,"SMZ type 43 IMP, UMP Performance: Performance: Performance: Performance: Performance: Performance: Excellent Average Excellent Average Average Average Connection time: Connection time: Connection time: Connection time: Lock Connection time: Connection time: Bayonet Snap-On Slide-On Long Very fast Very fast Fast Very fast Press-On Very fast Screw-On Minimum Frequency Needs space Space saving Space saving Needs space Space saving Space saving Mating Cycles Measured in GHz: current Perfect for Outer latching Secured mating Perfect for Durability range is DC-40 GHz (Max) miniaturization -

Intelligent Insurance

Intelligent Insurance Financial Services The South African Insurance Industry Survey 2017 August 2017 kpmg.co.za Intelligent Insurance Today’s leading financial services companies are operating in a new and more complex environment; one where the fundamental definition of how customers experience and interact with an insurer is being challenged and redefined. This is further complicated by millennials’ dramatically different buying patterns, alternate channels and changing expectations for consumer and digital experiences. This new consumer driven/ customer centric business model is one that many insurers recognise and are striving to adopt in order to win and retain customers. The South African Insurance Industry Survey 2017 Introduction 1 King Hammurabi had the coolest beard 3 Behavioural Economics Perception is King to reality's court Jester 9 The role of financial services in society 19 IFRS17 - Left out in the cold before it even gets a foot in the door? 27 Enhancing the strategic value of Internal audit 31 Will the surge of Millenials challenge traditional insurance? 37 Y Robot? Insurance on Demand, Virtual Agent's and Telematics . 43 Insurance evolved in the Digital Age 49 Changes to VAT compliance rules 53 Expense allocation – changes to Life Insurance Tax 57 ORSA A continuous improvement cycle 61 Microinsurance in Africa 67 Incremental Implementation towards a Market Conduct Framework 73 Short-term Insurance Industry results 79 Long-term Insurance Industry results 105 Reinsurance Industry results 121 We cannot wait until there are massive dislocations in our society to prepare for the fourth industrial revolution. Robert J.Shiller The South African Insurance Industry Survey 2017 | 1 Antoinette Malherbe Partner, Insurance Survey 2017 Financial Services Tel: +27 83 458 8484 Email: [email protected] If there is something to be learned from the year 2017, evolved and we look at the progress the market has made it is that change is inevitable. -

National Road N12 Section 6: Victoria West to Britstown

STAATSKOERANT, 15 OKTOBER 2010 NO.33630 3 GOVERNMENT NOTICE DEPARTMENT OF TRANSPORT No. 904 15 October 2010 THE SOUTH AFRICAN NATIONAL ROADS AGENCY LIMITED Registration No: 98109584106 DECLARATION AMENDMENT OF NATIONAL ROAD N12 SECTION 6 AMENDMENT OF DECLARATION No. 631 OF 2005 By virtue of section 40(1)(b) of the South African National Roads Agency Limited and the National Roads Act, 1998 (Act NO.7 of 1998), I hereby amend Declaration No. 631 of 2005, by substituting the descriptive section of the route from Victoria West up to Britstown, with the subjoined sheets 1 to 27 of Plan No. P727/08. (National Road N12 Section 6: Victoria West - Britstown) VI ~/ o8 ~I ~ ~ ... ... CD +' +' f->< >< >< lli.S..E..I VICTORIA WEST / Ul ~ '-l Ul ;Ii; o o -// m y 250 »JJ z _-i ERF 2614 U1 iii,..:.. "- \D o lL. C\J a Q:: lL. _<n lLJ ~ Q:: OJ olLJ lL. m ~ Q:: Q) lLJ JJ N12/5 lL. ~ fj- Q:: ~ I\J a DECLARATION VICTORIA lLJ ... ... .... PLAN No. P745/09 +' a REM 550 +' :£ >< y -/7 0 >< WEST >< 25 Vel von stel die podreserwe voor von 'n gedeelte Z Die Suid Afrikoonse Nosionole Podogentskop 8eperk Die figuur getoon Sheet 1 of 27 a represents the rood reserve of 0 portion ~:~:~:~: ~ :~: ~:~:~:~:~:~ The figure shown w The South African Notional Roods Agency Limited ........... von Nosionole Roete Seksie 6 Plan w :.:-:-:-:.:.:-:.:-:-:.: N12 OJ of Notional Route Section P727108 w a D.O.9.A • U1 01 o II') g 01' ICTORIA0' z " o o (i: WEST \V II> ..... REM ERF 9~5 II') w ... -

National Liquor Authority Register

National Liquor Register Q1 2021 2022 Registration/Refer Registered Person Trading Name Activities Registered Person's Principal Place Of Business Province Date of Registration Transfer & (or) Date of ence Number Permitted Relocations or Cancellation alterations Ref 10 Aphamo (PTY) LTD Aphamo liquor distributor D 00 Mabopane X ,Pretoria GP 2016-09-05 N/A N/A Ref 12 Michael Material Mabasa Material Investments [Pty] Limited D 729 Matumi Street, Montana Tuine Ext 9, Gauteng GP 2016-07-04 N/A N/A Ref 14 Megaphase Trading 256 Megaphase Trading 256 D Erf 142 Parkmore, Johannesburg, GP 2016-07-04 N/A N/A Ref 22 Emosoul (Pty) Ltd Emosoul D Erf 842, 845 Johnnic Boulevard, Halfway House GP 2016-10-07 N/A N/A Ref 24 Fanas Group Msavu Liquor Distribution D 12, Mthuli, Mthuli, Durban KZN 2018-03-01 N/A 2020-10-04 Ref 29 Golden Pond Trading 476 (Pty) Ltd Golden Pond Trading 476 (Pty) Ltd D Erf 19, Vintonia, Nelspruit MP 2017-01-23 N/A N/A Ref 33 Matisa Trading (Pty) Ltd Matisa Trading (Pty) Ltd D 117 Foresthill, Burgersfort LMP 2016-09-05 N/A N/A Ref 34 Media Active cc Media Active cc D Erf 422, 195 Flamming Rock, Northriding GP 2016-09-05 N/A N/A Ref 52 Ocean Traders International Africa Ocean Traders D Erf 3, 10608, Durban KZN 2016-10-28 N/A N/A Ref 69 Patrick Tshabalala D Bos Joint (PTY) LTD D Erf 7909, 10 Comorant Road, Ivory Park GP 2016-07-04 N/A N/A Ref 75 Thela Management PTY LTD Thela Management PTY LTD D 538, Glen Austin, Midrand, Johannesburg GP 2016-04-06 N/A 2020-09-04 Ref 78 Kp2m Enterprise (Pty) Ltd Kp2m Enterprise D Erf 3, Cordell -

Affordability and Subsidies in Urban Public Transport: Assessing the Impact of Public Transport Affordability on Subsidy Allocation in Cape Town

Affordability and Subsidies in Urban Public Transport: Assessing the impact of public transport affordability on subsidy allocation in Cape Town by Jaco Piek Thesis presented in partial fulfilment of the requirements for the degree of MCom (Transport Economics) in the Faculty of Economic and Management Sciences at Stellenbosch University Supervisor: Mr. JA Van Rensburg December 2017 The financial assistance of the National Research Foundation (NRF) towards this research is hereby acknowledged. Opinions expressed and conclusions arrived at, are those of the author and are not necessarily to be attributed to the NRF Stellenbosch University https://scholar.sun.ac.za Declaration By submitting this thesis/dissertation electronically, I declare that the entirety of the work contained therein is my own, original work, that I am the sole author thereof (save to the extent explicitly otherwise stated), that reproduction and publication thereof by Stellenbosch University will not infringe any third party rights and that I have not previously in its entirety or in part submitted it for obtaining any qualification. Date: December 2017 Copyright © 2017 Stellenbosch University All rights reserved i Stellenbosch University https://scholar.sun.ac.za ABSTRACT Cape Town is characterised by high commuting costs and high travel times due to a spatial mismatch between housing and jobs, as a result of apartheid planning policies. This dissertation investigated the use of an Intra-City Affordability Index to better understand this mismatch by analysing transport expenditure and potential travel patterns of public transport commuters in Cape Town. The results from the constructed affordability index analysed public transport affordability within this context. -

Republic of South Africa

REPUBLIC OF SOUTH AFRICA, REPUBLIC OF SOUTH AFRICA, REPORT OF THE COMMISSION OF INQUIRY INTO SOUTH AFRICAN COUNCIL OF CHURCHES TO THE STATE PRESIDENT OF THE REPUBLIC OF SOUTH AFRICA, MR M VILJOEN May it please you: We, the undersigned, who were appointed under your hand as Chairman and members of the Commission, C.F. Elff Chairman Member Member /P. Oosthuiz F.G. Barr'e S.A. Patterson have the honour to report as follows:- Member Member TABLE OF CONTENTS Page Paragraph PART I INTRODUCTION Appointment, terms of reference and composition 1 1 Background to the appointment of the Commission 1 2 Appointments 13 3 Modus Operandi 14 4 Scheme of the Report 21 5 Acknowledgements 25 6 PART II CHAPTER 1 THE CONSTITUTIONAL AIMS AND STRUCTURES OF THE SACC AND ITS PRINCIPAL PROGRAMMES Nature of the SACC 26 1.1 Aims 26 1.2 Organisation of the SACC 27 1.3 SACC Office-bearers 29 1.4 Membership 29 1.5 Key officials of the SACC 30 1.6 Departmental structures 31 1.7 Church and Mission 34 1.8 Development and Service 37 1.9 Justice and Society 40 1.10 CHAPTER 2 THE INCEPTION AND DEVELOPMENT OF THE SOUTH AFRICAN COUNCIL OF CHURCHES Introductory 55 2.1 The General Missionary Conference 56 2.2 Ecumenism 58 2.5 Cottesloe Consultation 59 2.6 "A Message to the People" 60 2.7 SPROCAS 61 2.8 CHAPTER 2 (cont.) Growing Black participation 65 2.9 The Programme to Combat Racism (PCR) 66 2.10 The Rees era 70 2.11 Relations between the SACC and SPROCAS 73 2.14 Factors affecting change 74 2.15 Establishment of the Division of Justice and Reconciliation 75 2.16 Establishment of Division of Theological Training 76 2.17 Christian Institute 77 2.18 The Wilgespruit Episode 81 2.19 Violence and Non-Violence 82 2.20 Black Consciousness 83 2.21 Hammanskraal 1974 84 2.23 SACC and the Dutch Reformed Churches 86 2.24 The first socio-political blueprint 87 2.25 The problem of limited support 88 2.26 Dr W. -

Contract RT57-2019 Contract Circular - Pricing for the Period 1 August 2020 to 30 November 2020 Date 14-Aug-20

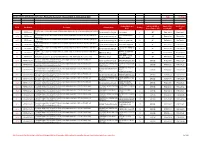

Contract RT57-2019 Contract Circular - Pricing for the period 1 August 2020 to 30 November 2020 Date 14-Aug-20 Combined Make and Subsidised(SUB) or Awarded Price New Price Incl. Ref # Item Number Description Company Name Ranking Model General Purpose (GP) IncludingVAT VAT Four/Five seater sedan 4 door or hatch 3/5 doors-piston displacement up to 1900cm3, Hybrid (pool vehicles 3352 RT57-00-01 Toyota South Africa (Pty) Ltd Prius 1.8 42G 1 GP R446,144.00 R446,144.00 only) Four/Five seater sedan 4 door or hatch 3/5 doors - piston displacement 1901cm³ to 3000cm³, Hybrid(Pool Lexus IS300H HYBRID 3354 RT57-00-02 Toyota South Africa (Pty) Ltd 1 GP R632,285.00 R632,285.00 vehicles only) 39M Four/Five seater sedan 4 door or hatch 3/5 doors - piston displacement 1901cm³ to 3000cm³, Hybrid(Pool 3357 RT57-00-02 Toyota South Africa (Pty) Ltd UX 250 SE Hybrid 68C 2 GP R637,424.00 R637,424.00 vehicles only) Four/Five seater sedan 4 door or hatch 3/5 doors - piston displacement 1901cm³ to 3000cm³, Hybrid(Pool 3355 RT57-00-02 Toyota South Africa (Pty) Ltd Lexus NX300 Hybrid 23T 3 GP R721,001.00 R721,001.00 vehicles only) Four/Five seater sedan 4 door or hatch 3/5 doors - piston displacement 1901cm³ to 3000cm³, Hybrid(Pool Lexus ES 300 HYBRID SE 3353 RT57-00-02 Toyota South Africa (Pty) Ltd 4 GP R765,485.00 R765,485.00 vehicles only) 21J Four/Five seater sedan 4 door or hatch 3/5 doors - piston displacement 1901cm³ to 3000cm³, Hybrid(Pool BMW 7 Series BMW 740e 363 RT57-00-02 BMW (South Africa) 5 GP R1,067,000.00 R1,067,000.00 vehicles only) Sedan (G11) BMW i BMW i3 (120Ah 364 RT57-00-07 Any Fully Electrical Vehicle (Sedan/Hatch/SUV/MPV) 4x2 or 4x4, NON-Hybrid (Pool vehicles only) BMW (South Africa) 1 GP R589,500.00 R589,500.00 BEV) Hatch (BMW i) Four seater sedan 4 door or hatch 3-5 doors ,piston displacement up to 1250 cm (Petrol/Diesel) 2630 RT57-01-12-01 Nissan South Africa (Pty) Ltd. -

Flower Route Map 2017

K o n k i e p en w R31 Lö Narubis Vredeshoop Gawachub R360 Grünau Karasburg Rosh Pinah R360 Ariamsvlei R32 e N14 ng Ora N10 Upington N10 IAi-IAis/Richtersveld Transfrontier Park Augrabies N14 e g Keimoes Kuboes n a Oranjemund r Flower Hotlines O H a ib R359 Holgat Kakamas Alexander Bay Nababeep N14 Nature Reserve R358 Groblershoop N8 N8 Or a For up-to-date information on where to see the Vioolsdrif nge H R27 VIEWING TIPS best owers, please call: Eksteenfontein a r t e b e e Namakwa +27 (0)72 760 6019 N7 i s Pella t Lekkersing t Brak u Weskus +27 (0)63 724 6203 o N10 Pofadder S R383 R383 Aggeneys Flower Hour i R382 Kenhardt To view the owers at their best, choose the hottest Steinkopf R363 Port Nolloth N14 Marydale time of the day, which is from 11h00 to 15h00. It’s the s in extended ower power hour. Respect the ower Tu McDougall’s Bay paradise: Walk with care and don’t trample plants R358 unnecessarily. Please don’t pick any buds, bulbs or N10 specimens, nor disturb any sensitive dune areas. Concordia R361 R355 Nababeep Okiep DISTANCE TABLE Prieska Goegap Nature Reserve Sun Run fels Molyneux Buf R355 Springbok R27 The owers always face the sun. Try and drive towards Nature Reserve Grootmis R355 the sun to enjoy nature’s dazzling display. When viewing Kleinzee Naries i R357 i owers on foot, stand with the sun behind your back. R361 Copperton Certain owers don’t open when it’s overcast. -

Monitoring Fish Eagles Along the Breede River

How green is the valley? MONITORING FISH EAGLES ALONG THE BREEDE RIVER The African Fish Eagle is perhaps the conti- nent’s most iconic bird species – to most people, its bold presence and haunting cry symbolise ‘wild Africa’. But inevitably there is interaction between man and these large raptors as each seeks out ‘territory’. Researchers Adam Welz and Andrew Jenkins are studying the possible effects of agricultural pesticides on the fish eagle along one of the major rivers in the south-western Cape to assess whether intensive farming practices are impacting on this species and, if so, to what degree. TEXT & PHOTOGRAPHS BY ADAM WELZ & ANDREW JENKINS or centuries much of the south-western part of South Africa’s Western Cape Province has been intensively farmed. The region’s wines are internationally renowned F and its deciduous fruit crops, exported worldwide, earn South Africa millions in foreign exchange annually. One of the prime agricultural areas, supporting thousands of hectares of vineyards and orchards, is the Breede River Valley, which lies about a hundred kilometres inland from Cape Town. Most people define the Breede River Valley as the area along the river between Michell’s Pass (just outside Ceres) and Bonnievale, about 140 kilometres downstream. The Breede itself continues for quite some distance to its mouth at Witsand, near Cape Infanta. The Breede River (‘wide’ river in Afrikaans) was so named because it spreads over a large floodplain during the area’s winter rains. Very little natural vegetation remains within the valley, but this Late on a summer evening, a farm doesn’t stop large populations of various raptor species from thriv- worker sprays pesticide on a vine- ing there. -

Printing, Where It Is Impossible to Obtain a Margin with the Said Dimensions

HIGH COURT RULES OF COURT SUPREME COURT ACT 59 OF 1959 UNIFORM RULES OF COURT RULES REGULATING THE CONDUCT OF THE PROCEEDINGS OF THE SEVERAL PROVINCIAL AND LOCAL DIVISIONS OF THE HIGH COURT OF SOUTH AFRICA Published under GN R48 of 12 January 1965 as amended by GN R235 of 18 February 1966 GN R2004 of 15 December 1967 GN R33553 of 17 October 1969 GN R2021 of 5 November 1971 GN R1985 of 3 November 1972 GN R480 of 30 March 1973 GN R639 of 4 April 1975 GN R1816 of 8 October 1976 GN R1975 of 29 October 1976 GN R2477 o f 17 December 1976 GN R2365 of 18 November 1977 GN R1546 of 28 July 1978 GN R1577 of 20 July 1979 GN R1535 of 25 July 1980 GN R2527 of 5 December 1980 GN R500 of 12 March 1982 GN R773 of 23 April 1982 GN R775 of 23 April 1982 GN R1873 of 3 September 1982 GN R2171 of 6 October 1982 GN R645 of 25 March 1983 GN R841 of 22 April 1983 GN R1077 of 20 May 1983 GN R1996 of 7 September 1984 GN R2094 of 13 September 1985 GN R810 of 2 May 1986 GN R2164 of 2 October 1987 GN R2642 of 27 November 1987 GN R1421 of 15 July 1988 GN R210 of 10 February 1989 GN R608 of 31 March 1989 GN R2628 of 1 December 1989 GN R185 of 2 February 1990 GN R1929 of 10 August 1990 GN R1262 of 30 May 1991 GN R2410 of 30 September 1991 GN R2845 of 29 November 1991 Copyright Juta and Company (Pty) Ltd GN R406 of 7 February 1992 GN R1 883 of 3 July 1992 GN R109 of 22 January 1993 GN R960 of 28 May 1993 GN R974 of 1 June 1993 GN R1356 of 30 July 1993 GN R1843 of 1 October 1993 GN R2365 of 10 December 1993 GN R2529 of 31 December 1993 GN R181 of 28 January 1994 GN R411