Notification of Intended Decision on the Other Systemically Important Institutions (O- Siis) in Greece

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Bank of Greece (NBG) Memo Name: James Zhang Phone #: (757) 788-9962 College/School: CLAS Year: Class of 2017

National Bank of Greece (NBG) Memo Name: James Zhang Phone #: (757) 788-9962 College/School: CLAS Year: Class of 2017 Company Description [NYSE; NGB] is a Greek bank and financial services company that primarily operates in commercial banking, but also has business in retail banking, investment banking, asset management, and insurance. The National Bank of Greece SA previously wrote off huge losses on its balance sheet during the Eurozone debt crisis, it has been on a steady path to recovery since the second half of 2013, and has been expanding its business in various sectors throughout Europe. Specifically, the rise in Greek lending and home loans, diversification by way of improved operations in Turkey and emerging markets, and the general recovery of the Greek economy will propel NGB to huge growth in the long term. Most notably, recent actions by Mario Draghi and the European Central Bank will create a healthy, stable environment for the National Bank of Greece to achieve its upside potential over time. Thesis / Key Points Rise in lending and specific developments in the banking sector in Greece will play to NBG’s advantage As Greece’s largest lender, NBG has acted swiftly in the past year to boost its position financially by increasing loans and retailing banking, as well as increasing capitalization from outside investors and generating domestic confidence. o Its nonperforming loans (NLP) have receded drastically and will contribute to its profitability when compared with its 3 closest rivals, Piraeus Bank, Alpha Bank, and EuroBank, who have all booked operating losses in this field. In addition, NGB now controls a quarter of commercial banking in Greece and 25% of total consumer deposits, and has also proceeded to raise around €2.5 billion in capital to reduce the Greece government’s holding stake in the bank. -

O-SII Notification

Notification template for Article 131 CRD – Other Systemically Important Institutions (O-SII) Please send this template to • [email protected] when notifying the ESRB; • [email protected] when notifying the ECB; • [email protected] when notifying the EBA. Emailing this template to the above-mentioned addresses constitutes an official notification, no further official letter is required. In order to facilitate the work of the notified authorities, please send the notification template in a format that allows electronically copying the information. 1. Notifying national authority 1.1 Name of the notifying National Committee for Macroprudential Oversight authority 2. Description of the measure Based on data available as of 31 March 2017, 9 credit institutions Romanian legal entities obtained a score higher than the threshold set for automatic designation of systemically important institutions (275 basis points). The re-evaluation based on June 2017 available data generated the same results. The name and LEI code of the systemically important institutions identified in Romania are provided below. Banca Comercială Română S.A. – LEI code 549300ORLU6LN5YD8X90 BRD - Groupe Societe Generale S.A. – LEI code 5493008QRHH0XCLJ4238 2.1 Concerned institution UniCredit Bank S.A. – LEI code 5493003BDYD5VPGUQS04 or group of institutions Raiffeisen Bank S.A. – LEI code 549300RFKNCOX56F8591 Banca Transilvania S.A. – LEI code 549300RG3H390KEL8896 Alpha Bank România S.A. – LEI code 529900TKT32Z5LP7XF90 CEC Bank S.A. – LEI code 2138008AVF4W7FMW8W87 Bancpost S.A. – LEI code 549300GM6AMB2XDWNC96 Garanti Bank S.A. – LEI code 549300UZRCTIM0HREY46 An O-SII buffer applicable in 2018 is set for the systemically important institutions which are Romanian legal entities. -

CAYMAN ISLANDS) LIMITED (Incorporated with Limited Liability in the Cayman Islands) As Issuer and EFG EUROBANK ERGASIAS S.A

– 6:46 pm – mac5 – 3485 Intro : 3485 Intro Prospectus EFG HELLAS PLC (incorporated with limited liability in England and Wales) as Issuer and EFG HELLAS (CAYMAN ISLANDS) LIMITED (incorporated with limited liability in the Cayman Islands) as Issuer and EFG EUROBANK ERGASIAS S.A. (incorporated with limited liability in the Hellenic Republic) as Guarantor €15,000,000,000 Programme for the Issuance of Debt Instruments Under this €15,000,000,000 Programme for the Issuance of Debt Instruments (the “Programme”), each of EFG Hellas PLC and EFG Hellas (Cayman Islands) Limited (each an “Issuer” and, together, the “Issuers”) may from time to time issue debt instruments (“Instruments”) guaranteed by EFG Eurobank Ergasias S.A. (the “Guarantor” or the “Bank”) and denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined herein). Application has been made to the Commission de Surveillance du Secteur Financier (the “CSSF”) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 on prospectuses for securities to approve this document as a base prospectus. Application has also been made to the Luxembourg Stock Exchange for Instruments issued under the Programme to be admitted to trading on the Luxembourg Stock Exchange's regulated market and to be listed on the Official List of the Luxembourg Stock Exchange. References in this Prospectus to Instruments which are intended to be “listed” (and all related references) on the Luxembourg Stock Exchange shall mean that such Instruments have been admitted to trading on the Luxembourg Stock Exchange’s regulated market and have been listed on the Official List of the Luxembourg Stock Exchange. -

Discussion Paper Series

DISCUSSION PAPER SERIES No. 2791 GREEK BANKING AT THE DAWN OF THE NEW MILLENNIUM Barry Eichengreen and Heather D Gibson INTERNATIONAL MACROECONOMICS ZZZFHSURUJ Available online at: www.cepr.org/pubs/dps/DP2791.asp www.ssrn.com/xxx/xxx/xxx ISSN 0265-8003 GREEK BANKING AT THE DAWN OF THE NEW MILLENNIUM Barry Eichengreen, University of California Berkeley and CEPR Heather D Gibson, Bank of Greece Discussion Paper No. 2791 May 2001 Centre for Economic Policy Research 90–98 Goswell Rd, London EC1V 7RR, UK Tel: (44 20) 7878 2900, Fax: (44 20) 7878 2999 Email: [email protected], Website: www.cepr.org This Discussion Paper is issued under the auspices of the Centre’s research programme in International Macroeconomics. Any opinions expressed here are those of the author(s) and not those of the Centre for Economic Policy Research. Research disseminated by CEPR may include views on policy, but the Centre itself takes no institutional policy positions. The Centre for Economic Policy Research was established in 1983 as a private educational charity, to promote independent analysis and public discussion of open economies and the relations among them. It is pluralist and non-partisan, bringing economic research to bear on the analysis of medium- and long-run policy questions. Institutional (core) finance for the Centre has been provided through major grants from the Economic and Social Research Council, under which an ESRC Resource Centre operates within CEPR; the Esmée Fairbairn Charitable Trust; and the Bank of England. These organizations do not give prior review to the Centre’s publications, nor do they necessarily endorse the views expressed therein. -

Name Address Postal City Mfi Id Head Office Res* Greece

MFI ID NAME ADDRESS POSTAL CITY HEAD OFFICE RES* GREECE Central Banks GR010 Bank of Greece, S.A. 21, Panepistimiou Str. 102 50 Athens No Total number of Central Banks : 1 Credit Institutions GR060 ABN Amro Bank 348, Syngrou Avenue 176 74 Athens NL ABN AMRO Bank N.V. Yes GR077 Achaiki Co-operative Bank, L.L.C. 66, Michalakopoulou Str. 262 21 Patra Yes GR056 Aegean Baltic Bank S.A. 28, Diligianni Str. 145 62 Athens Yes GR014 Alpha Bank, S.A. 40, Stadiou Str. 102 52 Athens Yes GR100 American Bank of Albania Greek Branch 14, E. Benaki Str. 106 78 Athens AL American Bank of Albania Yes GR080 American Express Bank 280, Kifissias Avenue 152 32 Athens US American Express Yes Company GR047 Aspis Bank S.A. 4, Othonos Str. 105 57 Athens Yes GR043 ATE Bank, S.A. 23, Panepistimiou Str. 105 64 Athens Yes GR016 Attica Bank, S.A. 23, Omirou Str. 106 72 Athens Yes GR081 Bank of America N.A. 35, Panepistimiou Str. 102 27 Athens US Bank of America Yes Corporation GR073 Bank of Cyprus Limited 170, Alexandras Avenue 115 21 Athens CY Bank of Cyprus Public Yes Company Ltd GR050 Bank Saderat Iran 25, Panepistimiou Str. 105 64 Athens IR Bank Saderat Iran Yes GR072 Bayerische Hypo und Vereinsbank A.G. 7, Irakleitou Str. 106 73 Athens DE Bayerische Hypo- und Yes Vereinsbank AG GR105 BMW Austria Bank GmbH Zeppou 33 166 57 Athens AT BMW Austria Bank GmbH Yes GR070 BNP Paribas 94, Vas. Sofias Avenue 115 28 Athens FR Bnp paribas Yes GR039 BNP Paribas Securities Services 94, Vas. -

The Competition Council Has Authorized the Merger Between ALPHA BANK AE and EFG EFG EUROBANK ERGASIAS SA

The Competition Council has authorized the merger between ALPHA BANK AE and EFG EFG EUROBANK ERGASIAS SA The Competition Council has authorized the economic concentration consisting in merger by absorbtion of EFG Eurobank Ergasias SA by Alpha Bank AE. The analysis of the competition authority found that the notified economic concentration does not raise significant obstacles to effective competition on the Romanian market, respectively does not lead to the creation or strengthening of a dominant position of the merged company to have as effect restriction, prevention or significant distortion of competition on the Romanian market or on a part of it. Since both Alpha Bank AE and EFG Eurobank Ergasias SA hold in Greece more than 2/3 of turnover at European level, there is no obligation this merger to be notified to the European Commission. Community legislation provides that where each of the companies involved achieves more than 2/3 of total turnover in one of member states, the operation is analyzed by the competition authority of respective state as well as by each of the states where the involved parties activate. The merged company shall be called Alpha Eurobank SA. Alpha Bank AE is a company that is part of Alpha group, one of the most important banking and financial services groups in Greece. Alpha Group offers a wide range of services including retail banking, corporate banking, asset management, private sector banking, distribution of insurance products, investment banking, leasing, factoring, management of brokerage services and of estate assets, and brokerage services. In Romania, Alpha group holds control over Alpha Bank Romania S.A., Alpha Leasing Romania IFN S.A., SSIF Alpha Finance Romania S.A., Alpha Insurance Brokers S.R.L., Alpha Astika Akinita Romania S.R.L. -

Finance & Photography

bulletin Finance & Photography 2021 eabh (The European Association for Banking and Financial History e.V.) Photograph: A projector with its lens from the Department of Polytheama and Photographic Mediums’ equipment. © National Bank of Greece UNICREDIT UniCredit’s photographic archives Francesca Malvezzi The photographic archive of UniCredit in Italy consti- notes. For photo albums, in addition to the elements just tutes a rich and varied source of information about the mentioned, it was considered appropriate to highlight, bank’s history. where available, the captions accompanying the indivi- eabh dual images. The UniCredit Historical Archives, established in The photographic section is estimated to com- bulletin 1951 in order to preserve documents acquired since the company’s foundation in 1870 (Banca di Genova, renamed prise 600 photo albums, 130,000 positives, 28,000 prints, Credito Italiano in 1895), are one of the most important matrices and negatives. They date from the early 1900s to business archival collections in Italy. The archives contain the 2000s. These are complemented, for the last period of the historical records of UniCredit/Credito Italiano, as well the 20th century, by the photographic archive of Giuseppe as many of the Italian banks which have been acquired by Rampolla, photographer already in service of Banca di the Group. Many of these had Roma SpA, with about 12,000 roots in the late Mediaeval pieces (negatives, slides, pos- period or early Modern such itives and CD-ROMs) and as: Rolo Banca 1473, Cassa di The subject matter extends Ferruccio Torboli, photogra- Risparmio di Verona Vicenza beyond the business of the bank, pher already in service of the Belluno e Ancona, Cassamarca, though that in itself encompasses Credito Italiano Audiovisual Cassa di Risparmio di Torino, an extensive range of material, Centre, with about 40,000 Cassa di Risparmio di Trento e pieces (negatives, slides, Rovereto, Cassa di Risparmio covering education, employment positives and CD-ROMs). -

Capital Link Invest in Greece Forum Monday, December 11, 2017 - New York City

19thAnnual Capital Link Invest in Greece Forum Monday, December 11, 2017 - New York City Conference Notes In Cooperation with Lead Sponsors Press Release An International Summit on Greece in New York Featuring Top US Investors, Global Investment Banks & Institutions, the Greek Government & Business Leaders CONFERENCE MATERIALS AND PROGRAMME AGENDA ARE AVAILABLE AT http://forums.capitallink.com/greece/2017/index.html The 19th Annual Capital Link Invest in Greece The Forum offered a unique combination of Forum was organized at the Metropolitan Club in New information, marketing and networking opportunities. York City on Monday, December 11, 2017 with huge The participants this year had the opportunity to be success attracting more than 1350 participants. This is informed about Greece from: an International Summit about Greece in New York • 87 high - level speakers who addressed organized in cooperation with the New York Stock • 1350 delegates who attended the forum Exchange and major global investment banks. • 153 one-to-one meetings with listed and non- listed companies The Forum featured government and business leaders • Separate meetings for the Greek Economy from Greece, Europe and the United States, and top Ministers with Group of Institutional investors executives from the investment, financial and business (funds) which are interested in investing in Greece communities. The forum attracts the elite of Wall Street • Separate meetings with representatives of and this year took place in a crucial time for Greece. foreign media After years of recession, Greece is slowly returning to • At the same time all the attendees had the a period of economic growth and aims to position itself opportunity for networking while various parallel as an attractive investment and business destination. -

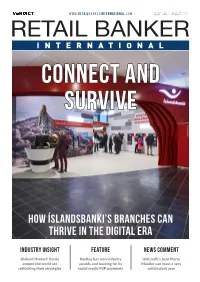

How Íslandsbanki's Branches Can Thrive in the Digital

www.retailbankerinternational.com Issue 740 / AUGUST 2017 CONNECT AND SURVIVE HOW ÍSLANDSBANKI’S BRANCHES CAN THRIVE IN THE DIGITAL ERA INDUSTRY INSIGHT FEATURE NEWS COMMENT Diebold Nixdorf: Banks PayKey has won industry UniCredit’s Jean Pierre around the world are awards and backing for its Mustier can toast a very rethinking their strategies social media P2P payments satisfactory year RBI August 740.indd 1 18/08/2017 16:23:45 contents this month NEWS COVER STORY 05 / EDITOR’S LETTER ÍSLANDSBANKI IN 18 / DIGEST • CBA to refund $8m for unsuitable CCI • CBA CEO to retire • ADGM, UAE Exchange sign agreement THE DIGITAL ERA • Barclays names new Barclaycard CEO • PayPal to acquire Swift Financial • Banco Popular acquisition approved • ThinCats gains full FCA authorisation • UK branch closures top 4,000 • Tandem to buy Harrods Bank • PwC, Featurespace collaborate • DBS closes migration of ANZ businesses • Tesco Bank adds card block feature • BoA Merrill launches in China • Fiserv launches analytics solution • China creates new clearing house 12 Editor: Douglas Blakey Group Editorial Director: Head of Subscriptions: +44 (0)20 7406 6523 Ana Gyorkos Alex Aubrey [email protected] +44 (0)20 7406 6707 +44 (0)20 3096 2603 [email protected] [email protected] Deputy Editor: Anna Milne +44 (0)20 7406 6701 Sub-editor: Nick Midgley Director of Events: Ray Giddings [email protected] +44 (0)161 359 5829 +44 (0)20 3096 2585 [email protected] [email protected] Senior Reporter: Patrick Brusnahan +44 (0)20 7406 6526 [email protected] Customer Services: +44 (0)20 3096 2603 or +44 (0)20 3096 2636, [email protected] Financial News Publishing, 2012. -

Annual Report 2015

ANNUAL REPORT 2015 www.eurobank.gr/annualreport2015_en The people of Eurobank stand by our signature. We commit to give… priority to you. CONTENTS Historical Milestones 6 Group Financial Figures 8 Letter to Shareholders 10 Share Capital Increase – Capital Adequacy 22 Financial Review 24 Strategic Transformation Programme 26 Corporate Governance 28 Risk Management 40 Piority to Our Customers 54 Retail Banking 54 Group Corporate & Investment Banking 64 Troubled Assets Management 72 Wealth Management 74 International Capital Markets & Treasury 78 Equities Brokerage 80 Insurance Operations 81 Other Activities 82 International Presence 84 Romania 85 Bulgaria 85 Serbia 87 Cyprus 88 Luxembourg 88 Ukraine 89 Corporate Responsibility 92 Priority to our People 94 Priority to Society 102 Priority to Innovation and Youth Entrepreneurship 110 Priority to Communicating with Customers 116 Relations with Suppliers 119 Priority to the Environment and Sustainable Development 120 Management Systems and Certifications 126 Memberships in Associations & Organisations 128 Awards 2015 130 Appendix 132 Financial Data for the Year ANNUAL REPORT 2015 | HISTORICAL MILESTONES HISTORICAL MILESTONES 2007 2013 1997 2015 Launch of greenfield 2000 2003 2004 operation in Cyprus. Eurobank is recapitalised 1990 Eurobank-Interbank Acquisition of 70% by the HFSF Acquisition of the operations of merger. of Tekfenbank Turkey, Alpha Bank’s Bulgarian Branch by EFG Eurobank – Acquisition of a 90.8% Acquisition which is renamed to The Group grows Eurobank’s subsidiary in Bulgaria, Acquisition of the Ergobank merger; stake in Postbanka of Intertrust Eurobank Tekfen. further, through the Eurobank Bulgaria AD (“Postbank”). Establishment branch network of the new bank is AD Serbia, which M.F.M.C. -

Katerina Gini

Katerina Gini Katerina Gini is a senior associate within our Banking & Finance and Capital Markets teams. She advises both domestic and international clients on a wide range of issues relating to banking, international business, trade and finance law, as well as commercial and corporate law. Alongside her advisory work, Katerina has been a member of the Athens Bar Association since 2009. She has handled numerous judicial and extrajudicial disputes in private law, including cases of violation of commercial and banking contracts, consumer and data protection law, pursuit of financial claims, fraudulent transactions, loans with currency clauses, real estate-related transactions and insolvency proceedings. She has extensive experience in drafting the relevant documentation for extrajudicial statements, lawsuits, applications for interim measures, appeals and oppositions, and of representing clients before the courts of first and second instance. Banking & Finance Katerina has extensive experience in banking and finance-related matters including project finance, the management and acquisition of large NPE and NPL portfolios, and corporate lending covering all kinds of bond and loan financing. She also provides lenders’ counsel services to a number of our clients, including Alpha Bank and EBRD. Katerina has worked with clients on a wide range of matters relating to real estate acquisition finance, and debt restructuring and securitization. She is also experienced in all aspects of the establishment and operation, insolvency and special liquidation procedures of companies, and credit and financial institutions. Notable Banking & Finance cases Advising EBRD in the financing of Papoutsanis, a leading cosmetics maker in Greece. Advising Alpha Bank in financing Hines for the development of Academy Gardens, a greenfield project in the Athens Metro Area. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P.