Profit Leaders Fp500

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainability from the Ground up Eldorado Gold

Eldorado Gold 2020 Sustainability Report Sustainability from the Ground Up Eldorado Gold About 2020 Sustainability Report This 2020 Sustainability Report (the “Report”) has been produced Other In-Country Sustainability Reporting in accordance with the requirements of the core Global Reporting In addition to this report, our Greek subsidiary, Hellas Gold S.A., Initiatives (“GRI”) standards, and includes data on Eldorado Gold publishes a GRI-aligned Corporate Social Responsibility report, and Corporation’s (“Eldorado” or the “Company”) five producing mines our Turkish subsidiary, Tüprag Metal Madencilik Sanayive Ticaret A.S., in 2020 as well as construction, development and exploration publishes a biannual magazine called Altin Sayfa (Golden Pages) projects. However, the performance data focuses on our producing that includes articles, case studies and news relevant to our Turkish assets – Kışladağ, Lamaque, Efemçukuru, Olympias and Stratoni. Data mines’ social and environmental performance during the period. represents the full 2020 calendar year and, unless otherwise noted, Our Lamaque project, Eldorado Gold Québec, produces a biannual all costs are reported in US dollars. Although the Sustainability Report information bulletin that discusses the project’s health and safety, and is not externally verified, all data and content have been prepared and environmental and social performance and programs. The bulletin is reviewed internally by our management teams and the Sustainability distributed by mail to residents of the Abitibi-Témiscamingue region of Committee of the Board of Directors. Québec, Canada. Please note that, where applicable, restatements of prior year data have been highlighted throughout the Report. Restatements occur as a result of updated or more accurate data becoming available after the publication of our previous Sustainability Report on June 25, 2020. -

Financial Review

Financial Review Management’s Discussion and Analysis of Financial Condition 29 and Results of Operations Management’s Responsibility for Financial Reporting 55 Independent Auditors’ Report of Registered Public Accounting Firm 56 Report of Independent Registered Public Accounting Firm 57 Consolidated Balance Sheets 58 Consolidated Income Statements 59 Consolidated Statements of Comprehensive Income 60 Consolidated Statements of Cash Flows 61 Consolidated Statements of Changes in Equity 62 Notes to the Consolidated Financial Statements 63 Board of Directors, Officers and Senior Management Team 99 Mineral Reserves 100 Mineral Resources 101 Shareholder Information 102 Corporate Information 103 Cautionary Note About Forward-Looking Statements and Information 104 28 Eldorado gold Annual Report 2014 MANAGEMENT’S DISCUSSION and ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (MD&A) for the year ended December 31, 2014 Throughout this MD&A, Eldorado, we, us, our and the Company mean Eldorado Gold Corporation. This year means 2014. All dollar amounts are in US dollars unless stated otherwise. The information in this MD&A is as of February 19, 2015. You should also read our audited consolidated financial statements for the year ended December 31, 2014. We prepare our consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). We file them with appropriate regulatory authorities in Canada and the United States. You can find more information about Eldorado, including our Annual Information Form, on SEDAR at www.sedar.com. About Eldorado Based in Vancouver, Canada, Eldorado owns and operates mines around the world. Its activities involve all facets of the mining industry including exploration, development, production and reclamation. -

Corporate Donations Program

Corporate Donations Program Issuers supporting the advancement of the investor relations profession in Canada Canadian Investor Relations Institute 601, 67 Yonge St. Toronto, ON M5E 1J8 CIRI.org To learn more, contact Yvette Lokker at 416-364-8200. The Canadian Investor Relations Institute’s (CIRI) mandate is to contribute to the transparency and integrity of the Canadian capital market by advancing the practice of investor relations, the professional competency of its members and the stature of the profession. OUR FOCUS Financial support through the CDP Since CIRI began in the early 1990s, we have provided ensures that CIRI can continue its professional development; resources; and issues advocacy and efforts to enhance the integrity of education to our 500 members across Canada. CIRI has been the Canadian capital markets instrumental in evolving the IR role in Canada from a tactical through research, advocacy and communications function to a strategic multi-disciplinary education of investor relations profession. professionals throughout Canada. WHY ISSUERS CONTRIBUTE At ARC we believe this is an important service to Canadian As a Corporate Donations Program (CDP) participant, your companies and institutional and company will be contributing to the advancement of the retail shareholders. investor relations profession in Canada. Your donation will be used to support the three key pillars for the advancement of IR David Carey in Canada: professional development; resources; and issues Past SVP, Capital Markets, ARC Resources advocacy and education, areas where CIRI invests more than CDP Participant Since 2009 $500,000 annually. CDP PARTICIPANTS The following issuers are committed to HOW YOU CAN MAKE A DIFFERENCE advancing the investor relations profession in Canada: Whether through a multi-year commitment or a one-time donation, your company will be recognized as a CDP Visionary participant and will be assisting CIRI in fulfilling its mandate. -

United States Securities and Exchange Commission Form S-4 Newmont Goldcorp Corporation Newmont Usa Limited

Table of Contents As filed with the Securities and Exchange Commission on June 28, 2019 Registration No. 333- UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM S-4 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 NEWMONT GOLDCORP CORPORATION NEWMONT USA LIMITED (Exact name of Registrant as specified in its charter) (Exact name of Registrant as specified in its charter) Delaware Delaware (State or other jurisdiction of incorporation or organization) (State or other jurisdiction of incorporation or organization) 1040 1040 (Primary Standard Industrial Classification Code Number) (Primary Standard Industrial Classification Code Number) 84-1611629 13-2526632 (I.R.S. Employer Identification No.) (I.R.S. Employer Identification No.) 6363 South Fiddler’s Green Circle 6363 South Fiddler’s Green Circle Greenwood Village, Colorado 80111 Greenwood Village, Colorado 80111 (303) 863-7414 (303) 863-7414 (Address, including zip code, and telephone number, including (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) area code, of Registrant’s principal executive offices) Nancy Lipson Executive Vice President and General Counsel Newmont Goldcorp Corporation 6363 South Fiddler’s Green Circle Greenwood Village, Colorado 80111 (303) 863-7414 (Name, address, including zip code and telephone number, including area code, of agent for service) With copies to: Laura M. Sizemore David M. Johansen White & Case LLP 1221 Avenue of the Americas New York, New York 10020 (212) 819-8200 Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable following the effective date of this registration statement. If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. -

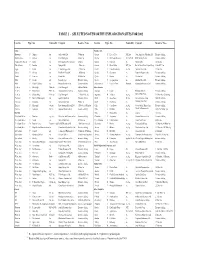

Selected Noteworthy Exploration Sites for 2002

TABLE 2 - SELECTED NOTEWORTHY EXPLORATION SITES FOR 2002 Location Type1 Site Commodity Company Resource2 Notes Location Type1 Site Commodity Company Resource2 Notes Africa Canada, cont. Botswana F Mupane Au Gallery Gold Ltd. 795koz Au Ontario P Lac des Iles PGE, Au North American Palladium Ltd. Extensive drilling Burkina Faso F Kalkasa Au Cluff Mining plc 470koz Au Ontario E McCreedy West area Ni, Cu, PGE FNX Mining Co. Inc. Extensive drilling Congo, Dem. Rep. of P Lonshi Cu First Quantum Minerals Ltd. 356kt Cu Ontario P Red Lake Au Goldcorp Inc. 5.2Moz Au Côte d’Ivoire E Bonikro Au Equigold NL 1.3Moz Au Ontario E River Valley PGE, Au Pacific North West Capital Corp. 1Moz PGE+Au Egypt F Sukari Au Centamin Egypt Ltd. 1.74Moz Au Quebec F Casa Berardi West Au, Cu Aurizon Mines Ltd. 1.4Moz Au Ghana F Chirano Au Red Back Mining NL 1.06Moz Au Quebec E Clearwater Au Eastmain Resources Inc. Extensive drilling Guinea P Lero area Au Kenor ASA 2.94Moz Au Quebec P Doyon Au Cambior Inc. Extensive drilling Mali P Sadiola Au Iamgold Corp. Extensive drilling Quebec P Sleeping Giant Au Aurizon Mines Ltd. Extensive drilling Mali F Segala/Takakoto Au Nevsun Resources Ltd. Extensive drilling Saskatchewan F Fort à la Corne Diamond Kensington Resources Ltd. Extensive drilling S. Africa F Blue Ridge PGE, Au Cluff Mining plc 4.6Moz PGE+Au Latin America S. Africa P Platreef area PGE, Au Anooraq Resources Corp. Extensive drilling Argentina F Esquel Au Meridian Gold Inc. Extensive drilling S. Africa E Sheba's Ridge PGE, Au Cluff Mining plc 17.4Moz PGE+Au Argentina D Veladero Au, Ag Barrick Gold Corp. -

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited)

AI Powered International Equity ETF Schedule of Investments August 31, 2020 (Unaudited) Shares Security Description Value COMMON STOCKS - 99.4% Argentina - 1.1% 360 Globant SA (a) $ 63,929 Australia - 3.3% 512 Atlassian Corporation plc - Class A (a) 98,182 700 Australia & New Zealand Banking Group, Ltd. - ADR 9,463 3,684 Mesoblast, Ltd. - ADR (a) 71,323 1,568 National Australia Bank, Ltd. - ADR 10,396 189,364 Belgium - 1.5% 233 Galapagos NV - ADR (a) 31,026 1,375 Materialise NV - ADR (a) 55,908 86,934 Canada - 38.0% 7,200 Alexco Resource Corporation (a) 22,248 1,089 Algonquin Power & Utilities Corporation 15,061 914 Aurinia Pharmaceuticals, Inc. (a) 13,555 12,605 Auryn Resources, Inc. (a) 24,580 1,140 B2Gold Corporation 7,684 2,052 Ballard Power Systems, Inc. (a) 34,063 1,650 Barrick Gold Corporation 48,923 132 BCE, Inc. 5,677 4,774 BlackBerry, Ltd. (a) 24,920 748 Brookfield Asset Management, Inc. - Class A 25,238 1,049 CAE, Inc. (a) 16,585 376 Canada Goose Holdings, Inc. (a) 9,208 462 Canadian National Railway Company 48,316 1,963 Canadian Natural Resources, Ltd. 38,612 146 Canadian Pacific Railway, Ltd. 43,169 1,491 Canadian Solar, Inc. (a) 48,443 1,635 Canopy Growth Corporation (a) 26,963 840 Canopy Growth Corporation (a) 13,877 2,220 Cascades, Inc. 23,607 2,744 Celestica, Inc. (a) 21,815 11 Constellation Software, Inc. 12,734 1,064 Descartes Systems Group, Inc. (a) 64,851 2,039 Dollarama, Inc. 79,600 1,597 Eldorado Gold Corporation (a) 18,238 13,136 EMX Royalty Corporation (a) 38,357 17,174 Enerplus Corporation 45,511 1,337 Fortis, Inc. -

Mid-Year 2020 Metro Vancouver Office Market Report

Mid-Year 2020 Office Market Report Metro Vancouver, BC metro Vancouver Pandemic impact fails to materialize as downtown vacancy & absorption trends Vacancy Rate remains tight amid record-low suburban vacancy 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% redictions that the impacts from a global mid-year 2019, but was still less than the 5.1% 366,304 Ppandemic would fundamentally alter recorded just 24 months ago. Regional vacancy 2020F 4% the dynamics of Metro Vancouver’s office is forecasted to decline to 4% by year-end market failed to materialize at mid-year 2020 2020 due to a profound lack of new supply -26,019 as vacancy in the suburbs reached record both downtown and in the suburbs as well Mid-2020 4.7% 7.3% lows and downtown Vancouver continued to as a strong track record of preleasing. The post one of the tightest office vacancy rates latter helps insulate against notable spikes in 478,555 vacancy when new supply is added and force 2019 4.4% in North America despite an initial wave of sublease vacancy. New office development many existing businesses to consider existing activity throughout the region remained on head lease space or, at least in the case of 2018 5.1% 1,802,623 schedule with only minor delays due in large downtown Vancouver, the rising availability of part to the provincial government designating sublease opportunities. Downtown Vancouver construction as an essential service in its and, to a lesser extent, the suburbs, were 2017 8% 1,223,656 initial response to COVID-19 in March 2020. -

Manica Gautam Moved to Vancouver to Launch a Venture Capital Fund

FINANCIAL STAKES Manica Gautam moved to Vancouver to launch a venture capital fund. Now she helps run the Houssian family's investment firm B.C.’S MOST INFLUENTIALmoney WOMEN on the To mark our fifth annual tribute to female leaders making a difference, we celebrate women in finance or Kai Li, a finance professor atUBC Sauder School of Business, it’s become a familiar sight. In a typical year, about 50 percent of the school’s commerce undergraduates are female. But as third- year specialization approaches, relatively few women choose finance. Li, who teaches a course that readies students for Fthe investment banking industry, thinks there’s both a supply and a demand problem. “People who I invite as guest speakers, there are very few female role models, unfortunately,” she says. At the same time, investment banking’s long hours may not appeal to women seeking work-life balance. Despite such challenges, this province is home to a remarkable group of women working in financial roles. For our fifth annual B.C.’s Most Influential Women fea- ture, we again sought the advice of an expert panel (see p.47)—three of whose five members are women mak- ing their mark in finance—to identify names worthy of recognition. We defined finance broadly, to encompass every- one from CFOs and entrepreneurs to bank executives and money managers. As usual, our list is representa- tive, not exhaustive or definitive. The goal is to celebrate the achievements of female leaders at different career >>> BY NATHAN CADDELL, NICK ROCKEL + FELICITY STONE <<< 28 BCBUSINESS MARCH 2019 LINDSAY SIU ON LOCATION AT INTERNATIONAL PRIVATE VAULTS › MARCH 2019 BCBUSINESS 29 stages, hear some of their stories and show how big an 28 stocks tracked. -

Fools Gold Eldorado Gold

SO M O Fool’s Gold How Canadian firm Eldorado Gold destroys the Greek environment and dodges tax through Dutch mailbox companies SOMO March 2015 Fool’s gold | noun [U] UK 1. a yellow metal that looks like gold 2. something that you are very attracted to that you later find is not worth very much Colophon Fool’s Gold How Canadian firm Eldorado Gold destroys the Greek environment and dodges tax through Dutch mailbox companies March 2015 Authors: Ilona Hartlief, Katrin McGauran, Roos van Os, Indra Römgens Copy editor: Vicky Anning Layout: Frans Schupp Photo: Giannis Papanikos (www.demotix.com) ISBN: 978-94-6207-056-1 This publication was made possible through the financial support of the Halifax Initiative (Canada), InterPares (Canada), Mining Watch Canada and the Sigrid Rausing Trust (UK). SOMO would particularly like to thank individual supporters of this research who responded to a crowdfunding campaign. Besides a number of SOMO staff members, these are Jasper Blom, Tineke Egyedi, Rob Geurtsen, Mariska de Gooijer, Hugo Hoes, Marianne van Kalmthout, Gijsbert Koren, Lieke Ruijmschoot, Bahar Sakizlioglu, Georgios Smaragdos, David Sogge and Gemma Toppen. The content of this publication is the sole responsibility of SOMO. The authors would like to thank the following people for their substantial contributions to this report: Marica Frangakis (freelancer), Kees Hudig (freelancer), Maria Kadoglou (Hellenic Mining Watch), Karyn Keenan (Halifax Initiative), Jamie Kneen (MiningWatch Canada), Matti Kohonen (freelancer) and Theodora Oikonomides (freelancer). The following people reviewed specific sections of the report; their comments and additions were also invaluable: David Bruer (InterPares), George Chasiotis (WWF Greece), Roberta Cowen (SOMO), Rodrigo Fernandez (SOMO/University of Leuven), Christina Laskaridis (Corporate Watch), Patrick Kryticous Nshindano (ActionAid Zambia), Sol Picciotto (Lancaster University), Gerhard Schuil (SOMO) and Francis Weyzig (Oxfam Novib). -

Technical Report Lamaque Project Québec, Canada

Technical Report Lamaque Project Québec, Canada Project Location: Bourlamaque Township, Province of Québec, Canada (NTS: 32C/04) (UTM: 293960E, 5329260N) (NAD 83, Zone 18) Effective Date: March 21st, 2018 Signature Date: March 29th, 2018 Qualified Person Company Mr. Colm Keogh, P.Eng. Eldorado Gold Corporation Mr. Jacques Simoneau, P.Geo. Eldorado Gold Corporation Dr. Stephen Juras, Ph.D., P.Geo. Eldorado Gold Corporation Ms. Marianne Utiger, P.Eng. WSP Canada inc. Mr. François Chabot, P.Eng. Eldorado Gold Corporation. L AMAQUE P ROJECT, Q UÉBEC, C ANADA T ECHNICAL R EPORT TABLE OF CONTENTS SECTION • 1 EXECUTIVE SUMMARY ......................................................................................... 1-13 Introduction ................................................................................................. 1-13 Contributors and Qualified Persons ........................................................... 1-13 Property Description and Ownership .......................................................... 1-14 Accessibility, Climate, Local Resources, Infrastructure and Physiography .............................................................................................. 1-15 Geology and Mineralization ........................................................................ 1-15 Drilling, Sampling Method, Approach and Analyses .................................. 1-16 Metallurgical Testing ................................................................................... 1-17 Mineral Resource Estimates...................................................................... -

Eldorado Gold Year in Review 2017 About “Tomorrow, Together”

1 ELDORADO GOLD Tomorrow, Together Eldorado Gold Year in Review 2017 About “Tomorrow, Together” “Tomorrow, Together” is a reflection of our belief that in mining the hard work of taking a project from exploration to reclamation can only be done with support from, and in partnership with, our employees, local communities and host governments. Our goal is to work with our stakeholders to build a stronger future. This 2017 Year in Review report (the “Report”) has been produced Table of Contents in accordance with the requirements of the “Core” Global Reporting Initiative (GRI) fourth generation (G4) Sustainability Reporting Guidelines, Eldorado Gold at a Glance ..................................................................1 and includes data on Eldorado Gold Corporation’s (“Eldorado” or “the Letter from the President & CEO ........................................................ 2 Company”) four producing mines in 2017, as well as its construction and development projects. However, the performance data focuses on our Our Business ................................................................................ 4 producing assets – Kışladağ, Efemçukuru, Olympias and Stratoni. As our 2017 Key Outcomes ....................................................................... 5 Lamaque site was acquired part way through 2017, its operations are not Creating Value Throughout the Mining Life Cycle ........................... 6 included in this Report unless otherwise noted. Data represents the full Our Products ............................................................................... -

Weekly Trends

Weekly Trends Larbi Moumni, CFA June 21, 2019 Notes from the PCS Desk Equity Market YTD Returns (%) We receive many questions on the PCS desk about a variety of topics. This week we share some of the top questions we have received recently. S&P 500 17.7 . How much should we allocate to Canada versus the US? Russell 2000 15.2 . What do you think about the Canadian REIT sector? MSCI World 15.9 . What are rare earth metals? (On China’s rare earth metals ban) S&P/TSX Comp 15.7 . What do we do with energy right now? MSCI Europe 14.0 . What is the possibility of Vermilion Energy (VET-T) cutting its dividend? MSCI EAFE 11.5 . What is your take on FANG stocks in light of the Department of Justice S&P/TSX Small Cap 9.9 (DoJ)/Federal Trade Commission (FTC) investigations? MSCI EM 9.1 . What are the team’s thoughts on TELUS amid the possibility of a Huawei 5G equipment ban? 0 10 20 . What are a few ways to play lithium? Canadian Sectors Weight Recommendation Consumer Discretionary 4.2 Underweight Consumer Staples 4.0 Overweight Energy 17.1 Underweight Financials 32.0 Market weight Health Care 2.0 Underweight Industrials 11.4 Market weight Technology 5.2 Market weight Materials 10.9 Market weight Communications 5.6 Overweight Utilities 4.3 Market weight Real Estate 3.4 Overweight Technical Considerations Level YE Target S&P/TSX Composite 16,575 15,600 17,000 S&P/TSX Top 5 Gainers/Laggards* S&P/TSX Market Internals S&P/TSX Comp 50-Day MA ELDORADO GOLD 18% Weekly Advance 154 61% 16,000 200-Day MA Weekly Decline 85 34% YAMANA GOLD INC 18% Advance-Decline 69 15,000 CRESCENT POINT 15% FORTUNA SILVER 15% New 52 wk high 26 11% 14,000 IVANHOE MINES LT 14% New 52 wk low 0 0% 13,000 NEW GOLD INC -3% No.