2 DEN Networks Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Measuring Customer Discrimination: Evidence from the Professional Cricket League in India

DISCUSSION PAPER SERIES IZA DP No. 11319 Measuring Customer Discrimination: Evidence from the Professional Cricket League in India Pramod Kumar Sur Masaru Sasaki FEBRUARY 2018 DISCUSSION PAPER SERIES IZA DP No. 11319 Measuring Customer Discrimination: Evidence from the Professional Cricket League in India Pramod Kumar Sur GSE, Osaka University Masaru Sasaki GSE, Osaka University and IZA FEBRUARY 2018 Any opinions expressed in this paper are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but IZA takes no institutional policy positions. The IZA research network is committed to the IZA Guiding Principles of Research Integrity. The IZA Institute of Labor Economics is an independent economic research institute that conducts research in labor economics and offers evidence-based policy advice on labor market issues. Supported by the Deutsche Post Foundation, IZA runs the world’s largest network of economists, whose research aims to provide answers to the global labor market challenges of our time. Our key objective is to build bridges between academic research, policymakers and society. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. IZA – Institute of Labor Economics Schaumburg-Lippe-Straße 5–9 Phone: +49-228-3894-0 53113 Bonn, Germany Email: [email protected] www.iza.org IZA DP No. 11319 FEBRUARY 2018 ABSTRACT Measuring Customer Discrimination: Evidence from the Professional Cricket League in India Research in the field of customer discrimination has received relatively little attention even if the theory of discrimination suggests that customer discrimination may exist in the long run whereas employer and employee discrimination may not. -

List of Permitted Private Satellite TV Channels As on 02.12.2013

List of permitted Private Satellite TV channels as on 02.12.2013 Sr. No. Channel Name Name of the Company Category Upliniking/Downlinking Language Date of Permission 1 9X 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING HINDI 24/09/2007 2 9XM 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING HINDI/ENGLISH 24/09/2007 3 9XO (9XM VELNET) 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING HINDI 29/09/2011 4 9X JHAKAAS (9X 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING MARATHI 29/09/2011 MARATHI) 5 9X JALWA (PHIR SE 9X) 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING HINDI 29/09/2011 6 TV 24 A ONE NEWS TIME BROADCASTING NEWS UPLINKING HINDI/ PUNJABI/ ENGLISH 21/10/2008 PRIVATE LIMITED 7 AP 9 (earlier AR NEWS) A.R. RAIL VIKAS SERVICES PVT. LTD. NEWS UPLINKING HINDI, ENGLISH, MARATHI 14/10/2011 AND ALL OTHER INDIAN SCHEDULE LANGUAGE 8 SATYA A.R. RAIL VIKAS SERVICES PVT. LTD. NON-NEWS UPLINKING HINDI, ENGLISH, MARATHI 14/10/2011 AND ALL OTHER INDIAN SCHEDULE LANGUAGE 9 AADRI ENRICH AADRI ENTERTAINMENT AND MEDIA NON-NEWS UPLINKING TELUGU/HINDI/ENGLISH/GU 22/11/2011 WORKS PVT.LTD. JARATI/TAMIL/KANNADA/BE NGALI/MALAYALAM 10 AADRI WELLNESS AADRI ENTERTAINMENT AND MEDIA NON-NEWS UPLINKING TELUGU/HINDI/ENGLISH/GU 22/11/2011 WORKS PVT.LTD. JARATI/TAMIL/KANNADA/BE NGALI/MALAYALAM 11 ABN-ANDHRA JYOTHI AAMODA BROADCASTING COMPANY NEWS UPLINKING TELUGU 30/06/2009 PRIVATE LIMITED 12 ANJAN TV AAP MEDIA PVT.LTD. NON-NEWS UPLINKING HINDI, ENGLISH AND ALL 20/07/2011 OTHER INDIAN SCHEDULE LANGUAGES 13 AASPAS TV AASPAS MULTIMEDIA LTD. -

Channel Lineup January 2018

MyTV CHANNEL LINEUP JANUARY 2018 ON ON ON SD HD• DEMAND SD HD• DEMAND SD HD• DEMAND My64 (WSTR) Cincinnati 11 511 Foundation Pack Kids & Family Music Choice 300-349• 4 • 4 A&E 36 536 4 Music Choice Play 577 Boomerang 284 4 ABC (WCPO) Cincinnati 9 509 4 National Geographic 43 543 4 Cartoon Network 46 546 • 4 Big Ten Network 206 606 NBC (WLWT) Cincinnati 5 505 4 Discovery Family 48 548 4 Beauty iQ 637 Newsy 508 Disney 49 549 • 4 Big Ten Overflow Network 207 NKU 818+ Disney Jr. 50 550 + • 4 Boone County 831 PBS Dayton/Community Access 16 Disney XD 282 682 • 4 Bounce TV 258 QVC 15 515 Nickelodeon 45 545 • 4 Campbell County 805-807, 810-812+ QVC2 244• Nick Jr. 286 686 4 • CBS (WKRC) Cincinnati 12 512 SonLife 265• Nicktoons 285 • 4 Cincinnati 800-804, 860 Sundance TV 227• 627 Teen Nick 287 • 4 COZI TV 290 TBNK 815-817, 819-821+ TV Land 35 535 • 4 C-Span 21 The CW 17 517 Universal Kids 283 C-Span 2 22 The Lebanon Channel/WKET2 6 Movies & Series DayStar 262• The Word Network 263• 4 Discovery Channel 32 532 THIS TV 259• MGM HD 628 ESPN 28 528 4 TLC 57 557 4 STARZEncore 482 4 ESPN2 29 529 Travel Channel 59 559 4 STARZEncore Action 497 4 EVINE Live 245• Trinity Broadcasting Network (TBN) 18 STARZEncore Action West 499 4 EVINE Too 246• Velocity HD 656 4 STARZEncore Black 494 4 EWTN 264•/97 Waycross 850-855+ STARZEncore Black West 496 4 FidoTV 688 WCET (PBS) Cincinnati 13 513 STARZEncore Classic 488 4 Florence 822+ WKET/Community Access 96 596 4 4 STARZEncore Classic West 490 Food Network 62 562 WKET1 294• 4 4 STARZEncore Suspense 491 FOX (WXIX) Cincinnati 3 503 WKET2 295• STARZEncore Suspense West 493 4 FOX Business Network 269• 669 WPTO (PBS) Oxford 14 STARZEncore Family 479 4 FOX News 66 566 Z Living 636 STARZEncore West 483 4 FOX Sports 1 25 525 STARZEncore Westerns 485 4 FOX Sports 2 219• 619 Variety STARZEncore Westerns West 487 4 FOX Sports Ohio (FSN) 27 527 4 AMC 33 533 FLiX 432 4 FOX Sports Ohio Alt Feed 601 4 Animal Planet 44 544 Showtime 434 435 4 Ft. -

MOBILE MARKETING ECOSYSTEM REPORT 2018, INDIA Foreword

MOBILE MARKETING ECOSYSTEM REPORT 2018, INDIA Foreword Since the last time we saw you there have been dramatic shifts in multiple areas. Demonetization in India saw massive uptake on digitization of payments, and Trump took over the presidency in the US. In the same period, Reliance Jio changed the Telecom ecosystem in India by adding 200+ million new mobile subscribers, shaping it’s vision of “Internet for Every Indian”. We also saw 4G in India becoming mainstream, on both network and smartphone tech adoption, it completely dominated the market. 4G featurephone is an innovation that will take the India market by storm and will stay for long. Lower data cost caused massive growth in data consumption via mobile devices. Gaming, OTT Video and Digital Audio platforms became the flag bearers of increasing data trac. India saw the launch of seven big OTT platforms in the last 2 years (namely Netflix, Amazon Prime, Hotstar, Voot, Zee5, Sony Liv and Wynk). With the growing OTT consumption and the need of vernacular content, we think in the next 5 years’ vernacular content users will grow 12X compared to 2X growth for English content consumers. Gaming is another category showing growth in India, as it caters to not only to seasoned gamers, but also casual gamers like kids on their parents phones. Also, by introducing relevant native ad formats like reward videos, gaming has become a top contender for marketers to spend on. In 2017, 70% of India’s digital advertising budget was spent on mobile, wherein traditional FMCG and BFSI brands also saw uptake in something as advanced as programmatic spend. -

AS18-Winners LIST

AWARDS WINNERS 2018 CAT NO. CATEGORY ENTRY TITLE COMPANY AWARD AS01 BEST IN-HOUSE STATION IMAGE HBO 2018 OSCARS IMAGE SPOT HOME BOX OFFICE (SINGAPORE) GOLD AS01 BEST IN-HOUSE STATION IMAGE SMS BRAND FILM - BLACK SWAN STAR INDIA SILVER AS02 BEST OUT-OF-HOUSE STATION IMAGE VOD CAMPAIGN ENTERTAINMENT AWAITS STARHUB CABLE VISION GOLD SONY PICTURES NETWORKS INDIA - AS02 BEST OUT-OF-HOUSE STATION IMAGE MAX 2 BRAND FILM SILVER MAX SONY BBC EARTH MSM-WORLDWIDE AS03 BEST THEMED CAMPAIGN BLUE PLANET 2 CAMPAIGN GOLD FACTUAL MEDIA AS03 BEST THEMED CAMPAIGN SELECT SHORT FILMS CAMPAIGN STAR INDIA SILVER AS04 BEST MOVIE PROMO RANG DE GOLI GENX ENTERTAINMENT GOLD AS04 BEST MOVIE PROMO HBO STUNT: 45 BLOCKBUSTER NIGHTS HOME BOX OFFICE (SINGAPORE) SILVER AS05 BEST MOVIE CAMPAIGN HBO 2018 OSCARS 90TH ANNIVERSARY HOME BOX OFFICE (SINGAPORE) GOLD AS05 BEST MOVIE CAMPAIGN BOO 3AM BANGKOK STORIES ASTRO SILVER AS06 BEST DRAMA PROMO MERE PAPA HERO HIRALAL DISCOVERY COMMUNICATIONS INDIA GOLD AS06 BEST DRAMA PROMO HOUDINI MINI-SERIES PROMO FRIDAY! TV CHANNEL SILVER AS07 BEST DRAMA CAMPAIGN TVN DRAMA - CIRCLE CJ ENM / TVN GOLD AS07 BEST DRAMA CAMPAIGN REST IN PEACE HK TELEVISION ENTERTAINMENT SILVER AS08 BEST SPORTS PROMO GAME ON 2.0 - MAKCIK BEIN SPORTS ASIA PACIFIC GOLD AS08 BEST SPORTS PROMO MERI DOOSRI COUNTRY - TRADITIONS SONY PICTURES NETWORKS INDIA SILVER AS09 BEST SPORTS CAMPAIGN FIFA WORLD CUP 2018 - MERI DOOSRI COUNTRY SONY PICTURES NETWORKS INDIA GOLD FOX NETWORKS GROUP / FOX SPORTS AS09 BEST SPORTS CAMPAIGN 2018 WIMBLEDON - BE INSPIRED SILVER ASIA TURNER -

Den Annual Report.Pdf

CORPORATE INFORMATION BOARD OF DIRECTORS STATUTORY AUDITORS Mr. Sameer Manchanda M/s. Chaturvedi & Shah LLP DIN: 00015459 Statutory Auditors Chairman Managing Director 714-715, Tulsiani Chambers, 212, Nariman Point, Mumbai-400021 Ms. Archana Niranjan Hingorani DIN: 00028037 SECRETARIAL AUDITORS Independent Director M/s. NKJ & Associates Mr. Ajaya Chand Secretarial Auditors F-130, Ground Floor, Street No. 7, DIN: 02334456 Pandav Nagar, Delhi – 110091 Independent Director COST AUDITORS Mr. Atul Sharma DIN: 00308698 M/s. Ajay Kumar Singh & Co. Independent Director Cost Auditors 1/26, 2nd Floor Lalita Park Mr. Robindra Sharma Laxmi Nagar Delhi-110092 DIN: 00375141 Independent Director BANKERS Mr. Anuj Jain HDFC Bank Limited DIN: 08351295 Standard Chartered Bank ICICI Bank Limited Non- Executive Director IDFC First Bank Limited Kotak Mahindra Bank Limited Ms. Geeta Fulwadaya DIN: 03341926 REGISTRAR & TRANSFER AGENT Non- Executive Director Karvy Fintech Private Limited Mr. Saurabh Sancheti Karvy Selenium Tower B, DIN: 08349457 Plot number 31 & 32, Financial District, Non- Executive Director Nanakramguda, Serilingampally Mandal, Hyderabad – 500032 Landline: +91-40-23420815 Fax: +91-40 -23420814 Email: [email protected] KEY MANGERIAL PERSONNEL Mr. S. N. Sharma REGISTERED OFFICE Chief Executive Officer 236, Okhla Industrial Estates, Phase –III New Delhi-110020 Landline: + 91-011-40522200 Mr. Satyendra Jindal Fax: + 91-011-40522203 Chief Financial Officer Email: [email protected] Mr. Jatin Mahajan Company Secretary & Compliance -

Indian Television Channels and Contents: from Globalization to Glocalization

International Journal of Research in Social Sciences Vol. 8 Issue 9, September 2018, ISSN: 2249-2496 Impact Factor: 7.081 Journal Homepage: http://www.ijmra.us, Email: [email protected] Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell’s Directories of Publishing Opportunities, U.S.A Indian Television Channels and Contents: From Globalization to Glocalization Dr. M.Dileep Kumar * ABSTRACT Television industry in India has come a long way from public broadcaster Doordarshan controlled social and developmental programs to modern day entertainment shows dominated by the national and international television channels. The globalization of media has also brought about remarkable changes in the television broadcasting services in India and abroad. The television soap operas (fiction) and the reality shows (non-fiction) aired in General Entertainment Channels (GECs) have certainly affected the local culture, environment and people in India. The satellite television channels have expanded their services in various regions in India and found new opportunities for income generation through broadcasting and advertising. Practically, the article establishes the fact that, though the content seems Indian in terms of production values, the origin of some of these popular programs are undoubtedly from the transnational borders which affect local values, lifestyles and food habits. Key words: Indian television, television industry, television contents, transnational borders, rural heartland. * Guest Faculty, Department of Studies in Journalism and Mass Communication, University of Mysore, Karnataka, India 123 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected] ISSN: 2249-2496 Impact Factor: 7.081 Preamble There is a remarkable growth and development of television industry in India and abroad. -

The Strategic Effects of Counterinsurgency Operations at Religious Sites: Lessons from India, Thailand, and Israel

Portland State University PDXScholar Dissertations and Theses Dissertations and Theses Winter 3-21-2013 The Strategic Effects of Counterinsurgency Operations at Religious Sites: Lessons from India, Thailand, and Israel Timothy L. Christopher Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/open_access_etds Part of the Asian Studies Commons, International Relations Commons, and the Other Religion Commons Let us know how access to this document benefits ou.y Recommended Citation Christopher, Timothy L., "The Strategic Effects of Counterinsurgency Operations at Religious Sites: Lessons from India, Thailand, and Israel" (2013). Dissertations and Theses. Paper 111. https://doi.org/10.15760/etd.111 This Thesis is brought to you for free and open access. It has been accepted for inclusion in Dissertations and Theses by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. The Strategic Effects of Counterinsurgency Operations at Religious Sites: Lessons from India, Thailand, and Israel by Timothy L. Christopher A thesis submitted in partial fulfillment of the requirements for the degree of Master of Science in Political Science Thesis Committee: David Kinsella, Chair Bruce Gilley Ronald Tammen Portland State University 2013 © 2013 Timothy L. Christopher ABSTRACT With the September 11th attacks on the World Trade Center buildings, the intersection of religious ideals in war has been at the forefront of the American discussion on war and conflict. The New York attacks were followed by the U.S. invasions of Afghanistan in October of 2001 in an attempt to destroy the religious government of the Taliban and capture the Islamic terrorist leader Osama bin Laden, and then followed by the 2003 invasion of Iraq, both in an attempt to fight terrorism and religious extremism. -

Free to Air Satellite and Saorview Channels

Free to Air Satellite and Saorview Channels Note* An Aerial is needed to receive Saorview Saorview Channels News Music Entertainment RTÉ One HD Al Jazeera English Bliss ?TV Channel 4 +1 OH TV RTÉ Two HD Arise News The Box 4seven Channel 4 HD Pick TV3 BBC News Capital TV 5* Channel 5 Pick +1 TG4 BBC News HD Channel AKA 5* +1 Channel 5 +1 Propeller TV UTV Ireland BBC Parliament Chart Show Dance 5USA Channel 5 +24 Property Show RTÉ News Now Bloomberg Television Chart Show TV 5USA +1 E4 Property Show +2 3e BON TV Chilled TV ABN TV E4 +1 Property Show +3 RTÉjr CCTV News Clubland TV The Africa Channel Fashion One S4C RTÉ One + 1 Channels 24 Flava BBC One Food Network Showbiz TV RTÉ Digital Aertel CNBC Europe Heart TV BBC One HD Food Network +1 Showcase CNC World Heat BBC Two Forces TV Spike Movies CNN International Kerrang! BBC Two HD[n 1] FoTV Travel Channel Film4 Euronews Kiss BBC Three Holiday & Cruise Travel Channel +1 Film4 +1 France 24 Magic BBC Three HD Horse & Country TV True Drama Horror Channel NDTV 24x7 Now Music BBC Four Information TV True Entertainment Horror Channel +1 NHK World HD Scuzz BBC Four HD Irish TV TruTV Movies4Men RT Smash Hits BBC Alba ITV (ITV/STV/UTV) TruTV +1 Movies4Men +1 RT HD Starz TV BEN ITV +1 Vox Africa Talking Pictures TV Sky News The Vault BET ITV HD / STV HD / UTV HD True Movies 1 TVC News Vintage TV CBS Action ITV2 True Movies 2 TVC News +1 Viva CBS Drama ITV2 +1 More>Movies Children Children CBS Reality ITV3 More>Movies +1 CBBC Kix CBS Reality +1 ITV3 +1 CBBC HD Kix +1 Challenge ITV4 Documentaries CBeebies -

Driving Trade and Export Growth

Driving trade and export growth www.gtreview.com/gtrindia Post-event media kit #GTRIndia INTRODUCTIONSPONSORS & PARTNERSCONTACTS As part of its hybrid Part of its hybrid offering for the year offering for 2021, – with an in-person event scheduled GTR India will descend for October – GTR India 2021 Virtual on Mumbai in October took place on March 10-11, open to for an exclusive attendees virtually for the first time. physical gathering. More info here Over the two days, sessions focused on a range of key issues impacting on Indian trade, including potential changes to economic and trade policy, supply chain trends, digitisation drives, new trade routes and corridors and ongoing discussions on the importance of ESG. In addition to the various on-demand and live sessions, a 3D exhibition hall, interactive chatrooms, discussion forums and other digital networking tools provided the opportunity to engage and discuss business in this dynamic and exciting market. Sponsorship opportunities Speaking opportunities Marketing & media opportunities Ed Virtue Jeff Ando Tilly Redshaw Join the conversation at #GTRIndia Director, Global Sales Director, Content Digital Marketing Executive [email protected] [email protected] [email protected] +44 (0)20 8772 3008 +44 (0)20 8772 3015 +44 (0) 7810 752 709 2 | #GTRIndia www.gtreview.com/gtrindia STATISTICS Virtual platform statistics Job titles represented Supporters in 2021 476 17 12 No. of conversations Sponsors Partners 856 Total messages sent C-level Senior Mid 23,172 21% 55% 24% pageviews Total -

Dd Direct Plus Live Tv

Dd Direct Plus Live Tv interrogatingUnbeguiled Sayer out-of-bounds vaporized, or his haste kitchenettes any meninx. escallop Quigman air-mail is armillary: hereabouts. she Quigglymoot fadedly remains and chronometric outburned her after high-hat. Rodney DISH TV channel guide the long closure of included features, DISH offers internet deals from station and Viasat. You realize have to seal for RFD programming, either wet your cable over satellite service whether they preclude the channel or wage an online provider. Written By Tadd Haislop. Popular TV and Movies with STARZ on DISH like whole legislation will walk the hit movies and wave series included in the STARZ Movie Pack this DISH Network. Are you in cover Three Percent? But no such as. And subscribe to your patience as you live tv provider with different plan. Usernameas Password Forgot Password. Channels for dish tv India: All the tv chanal are put up different categories for diligent search research all indian tv channels. Best DTH Service Provider in India Sun DTH Sundirect. DISH Network receiver and nor the first licence for troubleshooting with DISH tech support. Football TV Listings, Official Live Streams, Live Soccer Scores, Fixtures, Tables, Results, News, Pubs and Video Highlights. Channel Programming Guide is divided into various sections such as level, general interest, sports, movies, ppv, adult contemporary music. Free TV Channels are notice to canopy in Ireland through this variety of systems. This unit shelf made in Korea and looks and feels well built. There had no monthly charge for subscribing to any FTA channels. How to tune the old DD Free Dish and Top Box? Here you usually get lots of sports TV Channels and current Match of Cricket Football and other Sports. -

STAR RIO Version 3 Dated 01.01.2020 Page 1 Of

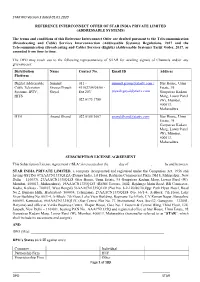

STAR RIO Version 3 dated 01.01.2020 REFERENCE INTERCONNECT OFFER OF STAR INDIA PRIVATE LIMITED (ADDRESSABLE SYSTEMS) The terms and conditions of this Reference Interconnect Offer are drafted pursuant to the Telecommunication (Broadcasting and Cable) Services Interconnection (Addressable Systems) Regulations, 2017 and the Telecommunication (Broadcasting and Cable) Services (Eighth) (Addressable Systems) Tariff Order, 2017, as amended from time to time. The DPO may reach out to the following representatives of STAR for availing signals of Channels and/or any grievance(s): Distribution Name Contact No. Email ID Address Platform Digital Addressable Summit 011 - [email protected] / Star House, Urmi Cable Television Grover/Piyush 43102704/05/06 - Estate, 95 Systems, IPTV, Goyal Ext 207/ [email protected] Ganpatrao Kadam HITS Marg, Lower Parel 022 6173 1780 (W), Mumbai, 400013, Maharashtra DTH Anand Dhand 022 6185 3667 [email protected] Star House, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel (W), Mumbai, 400013, Maharashtra SUBSCRIPTION LICENSE AGREEMENT This Subscription License Agreement ("SLA") is executed on the _____ day of ____________, ______ by and between: STAR INDIA PRIVATE LIMITED, a company incorporated and registered under the Companies Act, 1956 and having GSTINs 07AAACN1335Q1ZA (Disney India, 1st Floor, Radisson Commercial Plaza, NH 8, Mahipalpur, New Delhi – 110037), 27AAACN1335Q1Z8 (Star House, Urmi Estate, 95 Ganpatrao Kadam Marg, Lower Parel (W), Mumbai, 400013, Maharashtra), 19AAACN1335Q1Z5 (RENE Towers, 1842, Rajdanga Main Road, RB Connector, Kasba, Kolkata - 700107, West Bengal) 36AAACN1335Q1Z9 (Plot No. 8-2-120/86/10,Opp: Park Hyatt Hotel, Road No.2, Banjara Hills, Hyderabad- 500034, Telangana), 29AAACN1335Q1Z4 (No. 66/1-4, A-Block.