Emerging Markets Growth Portfolio-PM Commentary-2Q19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd

Page 1 of 4 Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd. - Class A 9,230 $ 120,977 Wens Foodstuffs Group Co Ltd. - Class A 4,660 15,857 136,834 Auto Manufacturers - 0.7% SAIC Motor Corp Ltd. - Class A 24,600 64,077 Banks - 23.7% Agricultural Bank of China Ltd. - Class H 352,300 163,039 Bank of China Ltd. - Class H 193,900 92,512 Bank of Communications Co Ltd. - Class A 184,100 125,556 China CITIC Bank Corp Ltd. - Class H 24,700 18,261 China Construction Bank Corp. - Class H 81,500 71,464 China Everbright Bank Co Ltd. - Class H 126,400 68,456 China Merchants Bank Co Ltd. - Class A 108,200 539,489 China Minsheng Banking Corp Ltd. - Class A 254,300 201,851 Industrial & Commercial Bank of China Ltd. - Class A 198,400 140,993 Industrial Bank Co Ltd. - Class A 127,400 285,849 Ping An Bank Co Ltd. - Class A 75,000 143,348 Shanghai Pudong Development Bank Co Ltd. - Class A 132,300 196,379 2,047,197 Beverages - 17.9% Jiangsu Yanghe Brewery Joint-Stock Co Ltd. - Class A 4,000 77,398 Kweichow Moutai Co Ltd. - Class A 4,000 961,777 Wuliangye Yibin Co Ltd. - Class A 16,200 504,835 1,544,010 Building Materials - 1.6% Anhui Conch Cement Co Ltd. - Class H 15,900 139,921 Coal - 0.5% China Shenhua Energy Co Ltd. -

Kweichow Moutai Growth Declines on Slow Deliveries

CHINA DAILY Tuesday, October 30, 2018 BUSINESS 17 Kweichow Moutai growth Execs optimistic on import expo By WANG YING in Shanghai products, their know-how, “Shanghai has become a [email protected] and how interesting they are vital center for advanced as a company,” said Brian technology leadership — for Top multinational corpora- Duperreault, president, CEO ABB and the world ... We will tions’ executives have and director of finance cor- make full use of the city’s declines on slow deliveries expressed their enthusiasm poration American Interna- existing advantages and for the first China Internation- tional Group Inc. make clear the main challen- al Import Expo set to launch According to Severin ges facing Shanghai, focus Share price of on Nov 5, as part of the nation’s Schwan, CEO of Roche Group, support policies on measures efforts to expand opening-up. the pharmaceuticals giant that can address the challen- liquor maker slips While attending the 30th will showcase its cutting-edge ges, and develop specific but consumption International Business Lead- technology at the import plans and solutions,” Spies- ers’ Advisory Council, held expo, covering early research shofer said, explaining the upgrades to buoy annually in Shanghai, busi- and development, integrated company’s rationale. ness leaders said they are diagnosis and treatment solu- “We are not only seeing future prospects optimistic about China’s tions, and personalised progress in Shanghai’s reform opening-up policy and new healthcare offerings. and opening-up, but we at By ZHU WENQIAN in Beijing opportunities. Roche are taking an active role and YANG JUN in Guiyang “The import expo is in the development of China’s unprecedented in China for biomedical industry. -

Jpmorgan Funds - China A-Share Opportunities Fund

Fund House of the Year Fund Selector Asia Awards - Singapore3) Singapore 2021 - Greater China/China Equity - Platinum4) FOR SINGAPORE INVESTORS ONLY SINGAPORE RECOGNISED SCHEME FACT SHEET | July 31, 2021 JPMorgan Funds - China A-Share Opportunities Fund INVESTMENT OBJECTIVE PERFORMANCE To provide long-term capital growth by investing primarily inCUMULATIVE PERFORMANCE (%) companies of the People's Republic of China (PRC). JPM China A-Share Opportunities A (acc) - USD CSI 300 (Net)1) EXPERTISE 300 200 Fund Manager Howard Wang, Rebecca Jiang 250 150 % CHANGE FUND INFORMATION (JPMorgan Funds - China A-Share Opportunities Fund) 200 100 Fund base currency Launch Date REBASED 150 50 CNH 11/09/15 Total fund size (m) Inception NAV 100 0 USD 8,051.8 USD 15.61 50 -50 ISIN code 08/15 08/16 08/17 08/18 08/19 08/20 08/21 LU1255011170 Since 11/09/15 Current charge Since 1 month 3months 1 year 3 years 5 years Initial : Up to 5.0% of NAV launch Redemption : Currently 0% (Up to 0.5% of NAV) A (acc) - USD (NAV to NAV) -7.9 -4.4 20.8 98.6 143.2 149.4 Management fee : 1.5% p.a. A (acc) - USD (Charges applied)* -12.3 -9.0 15.0 89.2 131.5 137.4 Subscription Channel Benchmark (in USD)1) -6.7 -4.9 12.3 52.4 69.1 59.2 Cash A (acc) - RMB (NAV to NAV) -8.0 -4.5 11.8 88.4 136.4 151.7 SRS(for platforms only) A (acc) - RMB (Charges applied)* -12.4 -9.0 6.4 79.4 125.1 139.7 RATINGS A (acc) - SGD (NAV to NAV) -7.3 -2.6 19.0 97.4 - 105.5 A (acc) - SGD (Charges applied)* -11.8 -7.2 13.3 88.0 - 95.7 Morningstar Analyst Rating Silver Morningstar Rating™ ★★★★★ ANNUALISED -

Premium China Funds Management

Premium China Fund Top 10 Portfolio Holdings as at 31 July 2020 Tencent (Media & Entertainment) Market Cap: USD 660.2 Billion • Tencent, a world leader in the internet-related services space, provides services across instant messaging, social media, email, web-portals, e-commerce, advertising, online payment as well as multiplayer games. • With offerings including QQ Instant Messenger and WeChat, Tencent is providing similar services to the likes of Facebook, Twitter and WhatsApp. By the end of Q2 2018, QQ had 803 million monthly active user accounts, whilst WeChat, since its launch in 2011, accommodates for over 1 Billion monthly active users. • In November 2017, Tencent's market value reached US$528 billion, surpassing Facebook’s market value at the time, which resulted in it being recognised as one of the world's top 5 most valuable public companies. Alibaba Group (Retailing) Market Cap: USD 681.2 Billion • Alibaba, an e-commerce giant, provides services ranging from web portals connecting businesses and consumers, electronic payment services and internet infrastructure. • Its flagship site Alibaba.com is the world’s largest online business-to-business trading platform for small businesses, handling sales between importers and exporters from over 240 countries. whilst its consumer-to-consumer portal—Taobao functions similar to eBay featuring nearly a billion products. Currently, it is amongst one of the 20 most visited websites globally on a consistent basis. • Global brands such as Nike, Uniqlo and Burberry, use Alibaba’s Tmall platform to market to an estimated 300 million shoppers. The companies online payment platform—Alipay is larger than PayPal and accounts for roughly half of all online payment transactions within China. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ • iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ • iShares MSCI Emerging Markets Min Vol Factor ETF | EEMV | Cboe BZX • iShares MSCI Emerging Markets Multifactor ETF | EMGF | Cboe BZX • iShares MSCI Global Min Vol Factor ETF | ACWV | Cboe BZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. -

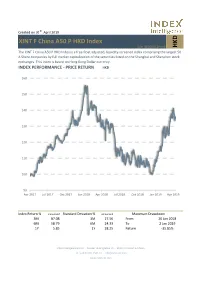

HKD XINT F China A50 P HKD Index

Created on 30th April 2019 XINT F China A50 P HKD Index ISIN: DE000A13PXH3 HKD The XINT F China A50 P HKD Index is a free-float adjusted, liquidity-screened index comprising the largest 50 A Share companies by full market capitalization of the securities listed on the Shanghai and Shenzhen stock exchanges. This index is based on Hong Kong Dollar currency. INDEX PERFORMANCE - PRICE RETURN HKD 160 150 140 130 120 110 100 90 Apr 2017 Jul 2017 Oct 2017 Jan 2018 Apr 2018 Jul 2018 Oct 2018 Jan 2019 Apr 2019 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M 87.08 3M 27.56 From 26 Jan 2018 6M 58.79 6M 24.33 To 2 Jan 2019 1Y 5.85 1Y 28.25 Return -35.85% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Ping An Insurance Group Co of China Ltd 14.01% 923,482 14.01% Insurance Kweichow Moutai Co Ltd 7.61% 501,542 7.61% Food & Beverage China Merchants Bank Co Ltd 7.16% 471,859 7.16% Banks Industrial Bank Co Ltd 4.88% 321,481 4.88% Banks Gree Electric Appliances Inc of Zhuhai 4.18% 275,446 4.18% Personal & Household Goods China Vanke Co Ltd 3.30% 217,531 3.30% Real Estate Wuliangye Yibin Co Ltd 3.18% 209,889 3.18% Food & Beverage Midea Group Co Ltd 3.18% 209,780 3.18% Personal & Household Goods CITIC Securities Co Ltd 3.16% 208,599 3.16% Financial Services China Minsheng Banking Corp Ltd 3.13% 206,157 3.13% Banks Total 3,545,766 53.79% This information has been prepared by Index Intelligence GmbH (“IIG”). -

Ishares Core CSI 300 ETF 82846/ As of 31/08/2021 9846

2846/ iShares Core CSI 300 ETF 82846/ As of 31/08/2021 9846 INVESTMENT OBJECTIVE FUND DETAILS The iShares Core CSI 300 Index ETF seeks to track the performance of an index Asset Class Equity composed of 300 large and mid-capitalization stocks traded on the Shanghai and Inception Date 12/11/2009 Shenzhen stock exchanges. Benchmark CSI 300 Index Number of Holdings 301 WHY 2846? Net Assets 244,617,181 CNY Management Fee (in 0.38 1 Exposure to the 300 largest stocks listed on Shanghai and Shenzhen stock %) exchanges Units Outstanding 7,750,000 2 Liquid trading vehicle for the China A-share market Domicile Hong Kong Base Currency RMB GROWTH OF 10,000 CNY SINCE INCEPTION Bloomberg CSIN0300 Benchmark Ticker TOP 10 HOLDINGS (%) KWEICHOW MOUTAI LTD A 4.97 CHINA MERCHANTS BANK LTD A 3.08 PING AN INSURANCE (GROUP) OF CHINA 2.74 WULIANGYE YIBIN LTD A 1.98 LONGI GREEN ENERGY Fund Benchmark TECHNOLOGY LTD 1.97 The chart shows change of investment amount based on a hypothetical investment in MIDEA GROUP LTD A 1.65 the Fund. INDUSTRIAL BANK LTD A 1.36 ANNUALIZED PERFORMANCE (%CNY) EAST MONEY INFORMATION LTD A 1.30 Cumulative Annualized BYD LTD A 1.28 1 Month 3 Month YTD 1 Year 3 Year 5 Year Since HANGZHOU HIKVISION DIGITAL Inception TECHNOL 1.22 Fund 0.09% -8.78% -6.68% 0.97% 14.46% 8.88% 2.83% Total 21.55 Benchmark 0.11% -8.69% -6.41% 1.40% 15.06% 9.64% 4.59% Holdings are subject to change. -

Foreign Bonds

Quarterly Portfolio Disclosure |March 31, 2020 CI ICBCCS S&P China 500 Index ETF (CHNA.B) Summary of Investment Portfolio Sector Breakdown† as at 3/31/20 Top 25 Holdings* as at 3/31/20 Sector________________________________ ___________________________% of Net Asset Value Description________________________________ ___________________________% of Net Asset Value Financials 21.4 % Alibaba Group Holding Ltd. 9.7 % Consumer Discretionary 19.3 % Tencent Holdings Ltd. 9.1 % Communication Services 12.3 % Ping An Insurance Group Co. of China Ltd. 4.6 % Industrials 9.0 % China Construction Bank Corp. 2.8 % Information Technology 8.2 % China Merchants Bank Co., Ltd. 2.6 % Consumer Staples 7.7 % Kweichow Moutai Co., Ltd. 2.6 % Materials 5.8 % Industrial & Commercial Bank of China Ltd. 2.3 % Health Care 5.8 % China Mobile Ltd. 1.4 % Real Estate 5.1 % Meituan Dianping 1.4 % Utilities 2.5 % Bank of China Ltd. 1.3 % Energy 2.4 % JD.com, Inc. 1.2 % Other Assets less Liabilities‡ 0.5 % Jiangsu Hengrui Medicine Co., Ltd. 1.1 % Total 100.0 % Industrial Bank Co., Ltd. 1.1 % † The ETF’s sector breakdown is expressed as a percentage of net Midea Group Co., Ltd. 1.0 % asset value and may change over time. In addition, a sector may be Gree Electric Appliances, Inc. of Zhuhai 1.0 % comprised of several industries. It does not include derivatives (if CITIC Securities Co., Ltd. 1.0 % any). China Minsheng Banking Corp., Ltd. 1.0 % ‡ Other assets include investment of cash collateral for securities on Wuliangye Yibin Co., Ltd. 1.0 % loan (if any). Anhui Conch Cement Co., Ltd. -

Annual Report DBX ETF Trust

May 31, 2021 Annual Report DBX ETF Trust Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF (ASHS) Xtrackers MSCI All China Equity ETF (CN) Xtrackers MSCI China A Inclusion Equity ETF (ASHX) DBX ETF Trust Table of Contents Page Shareholder Letter ....................................................................... 1 Management’s Discussion of Fund Performance ............................................. 3 Performance Summary Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 6 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 8 Xtrackers MSCI All China Equity ETF .................................................... 10 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 12 Fees and Expenses ....................................................................... 14 Schedule of Investments Xtrackers Harvest CSI 300 China A-Shares ETF ........................................... 15 Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF .................................. 20 Xtrackers MSCI All China Equity ETF .................................................... 28 Xtrackers MSCI China A Inclusion Equity ETF ............................................ 33 Statements of Assets and Liabilities ........................................................ 42 Statements of Operations ................................................................. 43 Statements of Changes in Net -

Baijiu Makers See Revenues Rise on Strong Middle-Class Demand

CHINA DAILY Monday, January 16, 2017 Markets | BUSINESS 17 Baijiu makers see revenues rise CSRC seen mulling easier rules on stock on strong middleclass demand futures trading Other higherend By LI XIANG daily staples see [email protected] robust sales on China’s securities regula rising incomes tor is reportedly considering relaxing the restrictions on The basic condi the trading of stock index By BLOOMBERG futures. Any such move tion for loosen would underscore its inten Drink a baijiu toast to the tion to gradually restore the ing the trading new year. China’s consumer market function that has staples stocks, led by makers of almost come to a halt since curbs on index the fiery Chinese liquor, are the market rout in 2015. futures is in helping drive stock gains this Relaxation measures will year as sales prospects get likely include reducing the place.” rosier. minimum margin require As China’s markets ment from 40 percent to 20 Xun Yugen, chief strategist endured a year of turmoil percent of the contract value at Haitong Securities Co Ltd amid concerns over the eco and increasing the maximum nomic outlook, consumer sta daily trading volume from 10 ples was the only sector on the contracts to 20 per investor, country’s key stocks Chinese media reported, cit exchanges with positive ing people familiar with the >90 returns last year. Those busi matter. nesses, which sell things for Chinese online media outlet percent daily use, surged with average thepaper.cn reported that the the yoy drop in trading vol revenue in fiscal 2017 forecast regulator is likely to announce ume of index futures in 2016 to grow three times as quickly the decision within this as their global peers. -

Kraneshares Bosera MSCI China a Share

Contact Us: +(1) 855 8KRANE8 [email protected] KBA Data as of 12/31/2017 KraneShares Bosera MSCI Fund Details As of 12/31/2017 China A Share ETF Primary Exchange NYSE Cusip 500767405 Investment Strategy: Total Annual Fund Operating Expense Gross: 0.84% Net: 0.64%* KBA is benchmarked to the MSCI China A Inclusion Index which is designed to track the progressive partial inclusion of A shares in the MSCI Emerging Inception Date 3/04/2014 Markets Index over time. The index is designed for global investors accessing Distribution Frequency Annually the A shares market using the Stock Connect framework and is calculated using China A Stock Connect listings based on the offshore RMB exchange rate Index Name MSCI China A Inclusion Index (CNH). Index Ticker Bloomberg: M1CNA Number of Holdings (ex Cash) 263 MSCI will include Mainland listed equities (China A shares) into their Global Standard Indexes beginning in May 2018 Underlying Exchanges Shanghai and Shenzhen With $1.5 trillion benchmarked to the MSCI Emerging Market Index1, full inclusion of Mainland Chinese equities could see significant Valuation Metrics (Data from Morningstar as of 12/31/2017) flows into the securities KBA owns today. Price-to-Earnings3 15.59 Price-to-Cash flow4 12.25 KBA Key differentiators Price-to-Sales5 1.50 • The Index adheres to MSCI’s Global Investable Market Index (GIMI) rules – Price-to-Book6 1.93 ensuring all holdings pass a transparent, rules-based inclusion criteria • MSCI provides comprehensive historical fundamental data on the Index 1. Data from MSCI as of 12/31/2016, as reported on 3/31/2017, retrieved 12/31/2017. -

Indicative March 2017 Review

Indicative March 2017 Review - FTSE China A50 Index Indicative data as at the close of trading on 17 March 2017 (Prior to Change) and at the open of trading 20 March 2017 (Post Change) *Analysis based on proposed changes to the FTSE China A50 Index Ground Rules - please contact FTSE Russell for further information* FTSE China A50 Indicative FTSE Index Prior to China A50 Index Change Post Change Cons Code SEDOL Local Code Constituent Name ICB Subsector Code ICB Subsector Name Wgt (%) Wgt (%) Difference (%) Notes 124375 B620Y41 601288 Agricultural Bank of China (A) 8355 Banks 3.10 3.07 -0.03 30814 B249NZ2 601169 Bank of Beijing (A) 8355 Banks 2.85 2.82 -0.03 16414 B180B49 601988 Bank of China (A) 8355 Banks 2.07 2.05 -0.02 26883 B1W9Z06 601328 Bank of Communications (A) 8355 Banks 3.32 3.29 -0.03 172586 BD5BP36 601229 Bank of Shanghai (A) 8355 Banks - 0.39 0.39 Addition at the March 2017 Review 132716 B466322 2594 BYD (A) 3353 Automobiles 0.72 0.72 -0.01 25125 B1VXHG9 601998 China Citic Bank (A) 8355 Banks 0.49 0.49 0.00 71500 B6Y7DS7 601800 China Communications Construction (A) 2357 Heavy Construction 0.67 0.66 -0.01 31804 B24G126 601939 China Construction Bank (A) 8355 Banks 1.44 1.42 -0.01 125390 B53SCQ5 601818 China Everbright Bank (A) 8355 Banks 1.55 1.53 -0.01 19302 B1LBS82 601628 China Life Insurance (A) 8575 Life Insurance 1.00 0.99 -0.01 73003 6518723 600036 China Merchants Bank (A) 8355 Banks 5.99 5.94 -0.06 71524 BYY36X7 1979 China Merchants Shekou Industrial Zone Holdings (A) 8633 Real Estate Holding & Development 0.98 0.97 -0.01