The Future of Grocery E-Commerce, Digital Technology and Changing Shopping Preferences Around the World

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mexican Supermarkets & Grocery Stores Industry Report

Mexican Supermarkets & Grocery Stores Industry Report July 2018 Food Retail Report Mexico 2018Washington, D.C. Mexico City Monterrey Overview of the Mexican Food Retail Industry • The Mexican food retail industry consists in the distribution and sale of products to third parties; it also generates income from developing and leasing the real estate where its stores are located • Stores are ranked according to size (e.g. megamarkets, hypermarkets, supermarkets, clubs, warehouses, and other) • According to ANTAD (National Association of Food Retail and Department Stores by its Spanish acronym), there are 34 supermarket chains with 5,567 stores and 15 million sq. mts. of sales floor in Mexico • Estimates industry size (as of 2017) of MXN$872 billion • Industry is expected to grow 8% during 2018 with an expected investment of US$3.1 billion • ANTAD members approximately invested US$2.6 billion and created 418,187 jobs in 2017 • 7 states account for 50% of supermarket stores: Estado de Mexico, Nuevo Leon, Mexico City, Jalisco, Baja California, Sonora and Sinaloa • Key players in the industry include, Wal-Mart de Mexico, Soriana, Chedraui and La Comer. Other regional competitors include, Casa Ley, Merza, Calimax, Alsuper, HEB and others • Wal-Mart de México has 5.8 million of m² of sales floor, Soriana 4.3 m², Chedraui 1.2 m² and La Cómer 0.2 m² • Wal-Mart de México has a sales CAGR (2013-2017) of 8.73%, Soriana 9.98% and Chedraui 9.26% • Wal-Mart de México has a stores growth CAGR (2013-2017) of 3.30%, Soriana 5.75% and Chedraui 5.82% Number -

Hypermarket Format: Any Future Or a Real Need to Be Changed? an Empirical Study of the French, Spanish and Italian Markets

Hypermarket Format: Any Future or a Real Need to Be Changed? An Empirical Study of the French, Spanish and Italian markets. Rozenn PERRIGOT ESC Rennes School of Business CREM UMR CNRS 6211 2, rue Robert d’Arbrissel CS 76522 35065 Rennes Cedex FRANCE [email protected] Gérard CLIQUET Institute of Management of Rennes (IGR-IAE) University of Rennes 1 CREM UMR CNRS 6211 11, rue Jean Macé CS 70803 35708 Rennes Cedex FRANCE [email protected] 5th International Marketing Trends Congress, Venice (ITALY), 20-21 of January 2006 Hypermarket Format: Any Future or a Real Need to Be Changed? An Empirical Study of the French, Spanish and Italian markets. Abstract: The hypermarket appeared first in France at the beginning of the sixties as a synthesis of the main features of modern retailing. But in France, the decline of this retail format seems to have begun and Spain could follow quickly. In the same time, the German hard-discounters continue their invasion. According to the retail life cycle theory, this paper displays curves to demonstrate the evolution of this retail concept in France, Spain and Italy and tries to evoke some managerial and strategic issues. The retail wheel seems to go on turning! Keywords: France, hypermarket, Italy, retail life cycle, Spain, wheel of retailing. 1. Introduction The history of modern retailing began more than 150 years ago. The first retailing formats began to outcompete the traditional small and independent shops. For instance, many department stores followed several decades later by variety stores appeared in Europe (France, UK, Germany and Italy) but also in the United States and Japan. -

Serving Customers in Diverse Ways Products Ecommerce

eCommerce Products Truffles Donckels brand from Belgium is available One of the reasons behind Walmart Brazil’s in both Sam’s Club and Walmart. Additionally, success is their ability to leverage scale and Walmart Brazil imports Hunts Tomato Sauce, expertise to be one of the top leaders among online Cheesecake Factory and Samuel Adams beer to retailers in market share and provide low, Sam’s Club stores. competitive prices. In addition, walmart.com.br is able to present a huge variety and assortment of Borges Olive Oil and McCain French Fries are part general merchandise, usually larger than brick and of the portfolio for Walmart Brazil. As of 2015, the Serving Customers mortar operations. Brazilian consumer can buy children’s clothing Child of Mine, developed by Carter’s in the United In Diverse Ways States, exclusively at Walmart. History “Orbit” chewing gum, Starburst and “5” gum, from Walmart Brazil began its Wrigley (Mars, Incorporated), was available to operations in 1995, with its Economic Impact Brazil in 2014, exclusively at Walmart stores in all headquarters located in Barueri, regions. São Paulo. Walmart Brazil Over the past 12 years, Walmart Brazil’s Producer’s operates across 18 states and the Club has grown to 9,221 households in 18 Brazilian Schwinn, a traditional bike brand in USA, now offers Federal District, serving 1 million states and the Federal District. It offers these Mountain, Dakota, Colorado and Eagle bike models customers each day with suppliers access to Walmart Brazil stores to sell in Brazil through Walmart hypermarket formats. hypermarkets, supermarkets, cash their products. -

Top 100 Retailers in Asia 2020

Top 100 Retailers in Asia 2020 DEEPIKA CHANDRASEKAR AND CLARE LEE Not to be distributed without permission. The data included in this document is accurate according to Passport, Euromonitor International’s market research database, at time of publication: May 2020 Top 100 Retailers in Asia 2020 DEEPIKA CHANDRASEKAR CLARE LEE CONNECT WITH US © 2020 Euromonitor International Contents 1 Asia Pacific as an Innovation Hub 2 The Asian Landscape: Top 100 Retailers in Asia Pacific 5 Key Retailing Categories 11 Regional Spotlight: Southeast Asia 14 Country Profiles 26 Coronavirus: Outlook of Asia Pacific’s Retailing Industry on the Back of the Pandemic 28 Definitions 33 About the Authors 34 How Can Euromonitor International Help? © Euromonitor International Asia Pacific as an Innovation Hub 2019 was another year of growth for the retailing industry in Asia Pacific. What set the region apart from other markets was the proliferation of new types of brick-and-mortar and e-commerce retailing formats and new brands experimenting with various innovations in order to win the local young, and increasingly tech-savvy, population. The rapid uptake of social media in Asia Pacific, thanks to consumer segments such as millennials and Generation Z, has been a major factor in the rise of social commerce. The Asia Pacific region offers businesses great growth opportunities and profitability, due to its large working-age population, a critical mass of highly-educated people, an expanding middle class and modernisation efforts, all of which are boosting consumer expenditure and increasing demand for online retailing and e-commerce. Demographic dividend and fast-paced digital connectivity are key differentiators allowing the region to surpass other countries by paving the way for more innovative accessible services, customised products and experiences as well as creating unique digital marketplaces in the region. -

D2492609215cd311123628ab69

Acknowledgements Publisher AN Cheongsook, Chairperson of KOFIC 206-46, Cheongnyangni-dong, Dongdaemun-gu. Seoul, Korea (130-010) Editor in Chief Daniel D. H. PARK, Director of International Promotion Department Editors KIM YeonSoo, Hyun-chang JUNG English Translators KIM YeonSoo, Darcy PAQUET Collaborators HUH Kyoung, KANG Byeong-woon, Darcy PAQUET Contributing Writer MOON Seok Cover and Book Design Design KongKam Film image and still photographs are provided by directors, producers, production & sales companies, JIFF (Jeonju International Film Festival), GIFF (Gwangju International Film Festival) and KIFV (The Association of Korean Independent Film & Video). Korean Film Council (KOFIC), December 2005 Korean Cinema 2005 Contents Foreword 04 A Review of Korean Cinema in 2005 06 Korean Film Council 12 Feature Films 20 Fiction 22 Animation 218 Documentary 224 Feature / Middle Length 226 Short 248 Short Films 258 Fiction 260 Animation 320 Films in Production 356 Appendix 386 Statistics 388 Index of 2005 Films 402 Addresses 412 Foreword The year 2005 saw the continued solid and sound prosperity of Korean films, both in terms of the domestic and international arenas, as well as industrial and artistic aspects. As of November, the market share for Korean films in the domestic market stood at 55 percent, which indicates that the yearly market share of Korean films will be over 50 percent for the third year in a row. In the international arena as well, Korean films were invited to major international film festivals including Cannes, Berlin, Venice, Locarno, and San Sebastian and received a warm reception from critics and audiences. It is often said that the current prosperity of Korean cinema is due to the strong commitment and policies introduced by the KIM Dae-joong government in 1999 to promote Korean films. -

Asian Cities Report Seoul Retail 2H 2017

Asian Cities Report | Seoul Retail Savills World Research2H 2017 Korea Asian Cities Report Seoul Retail 2H 2017 savills.com.hk/research savills.com.hk/research 01 Asian Cities Report | Seoul Retail 2H 2017 GRAPH 1 First floor retail rents continuing growth of e-commerce. First floor rental increases in major Seoul Based on the Korea Appraisal Supported by the Korea Sale Fiesta (a nationwide government-sponsored retail districts, 2014−2016 Board (KAB) data in June 2017, 1/F rents in the top five retail areas for bargain sales period) and other events, 2014 2015 2016 mid-size buildings have shown a the sales of large discount stores, 5% divergent performance. Retail rents including duty-free shops and outlets, in Myeongdong and Gangnamdaero rose by 9%. In 1H/2017, convenience 4% recorded steady growth from 2014 to store and non-store retail sales continued their double digit growth. 3% mid 2016, but have recorded slight downward movement since 2016. 2% Meanwhile retail rents for Hongdae- Non-store retail Hapjung increased due to new Non-store retail volumes rose by 16% 1% recreational facilities and improved year-on-year (YoY) in 2016 and 13% infrastructure. in 1H/2017. Sales increases in food, 0% electronics and apparel contributed Average contracted rents in to the growth. The sales volumes -1% Myeongdong Gangnamdaero Garosugil Hongdae- Itaewon Myeongdong at the end of June were of online shopping malls operated Hapjung the highest in the city, according to by offline based retailers such as Shinsegae and Lotte group grew far Source: Korea Appraisal Board (KAB) KAB. Myeongdong is an extremely popular foreign tourist destination more rapidly than pure online shopping and attracts significant foot traffic, malls. -

RSCI Pioneered the Hypermarket Concept in the Philippines Through Shopwise

Rustan Supercenters, Inc. (RSCI), a member of the Rustan Group of Companies, was founded in 1998 at the height of the Asian Economic Crisis. It was the first Rustan Company to take in outside investors. It was also the Rustan Group’s first major foray into the discount retailing segment through an adapted European style hypermarket. RSCI pioneered the hypermarket concept in the Philippines through Shopwise. Armed with the vision of providing Quality for All, the Company sought to make the renowned Rustan’s quality accessible to all, especially the middle and working class. Its mission is to create a chain of supercenters or hypermarkets which is the needs of the Filipino family. Rustan’s decision to diversify into hypermarkets was borne out of manifest opportunities brought about by fundamental changes that are taking place in the Philippine market: a burgeoning middle class; increasing value consciousness across various income levels; and new geographical market opportunities that are best served through discount retailing operations. RSCI developed and opened the first hypermarket in the country in November 29, 1998 in Alabang. From 40 employees, it now employs more than 6,000 employees The Company has attained much success since its inception. From 40 employees, it now employs more than 6,000 employees. From sales of zero, the Company registered sales of over P17B in fiscal year 2012-2013. From one hypermarket in Filinvest Alabang, it has now grown to 46 stores covering multiple retail formats, namely, hypermarkets, upscale supermarkets, and neighborhood grocery stores. November 2006 marked yet another milestone for RSCI when it has acquired the 21 Rustan’s stores and food services operations under an Asset Lease Agreement. -

2019 Philippines Food Retail Sectoral Report

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 7/8/2019 GAIN Report Number: 1913 Philippines Retail Foods 2019 Food Retail Sectoral Report Approved By: Ryan Bedford Prepared By: Joycelyn Claridades Rubio Report Highlights: The Philippine food retail sector continues to grow, providing opportunities for increased exports of U.S. high-value food and beverages. The food retail industry sold a record $47.4 billion in 2018, and Post forecasts sales in 2019 at nearly $50 billion. Driven by rising incomes, a growing population, and a strong preference for American brands, the Philippines imported $1.09 billion of U.S. consumer-oriented products in 2018. Post expects U.S. exports in this sector to grow further in 2019, reaching an all-time high of $1.2 billion. Market Fact Sheet: Philippines With a population of 105.9 million and decreasing farmlands, the Philippines is dependent on food imports. In 2018, Philippine imports of high-value food products from the United States reached $1.09 billion, making the United States the largest supplier for high-value, consumer-oriented food and beverage products. Post expects this to continue in 2019, with exports forecast to grow 10 percent to $1.2 billion. The Philippines continues to be one of the fastest-growing economies in Asia. With a growing middle class and a large, young population, the Philippine economy is rooted in strong consumer demand, boosted by rising incomes and overseas remittances. Per capita gross income and consumer expenditures saw strong gains from 2012 to 2018. -

Korea - Republic Of

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 8/16/2018 GAIN Report Number: KS1829 Korea - Republic of Retail Foods 2018 Approved By: Lynne Larrabee, ATO Director Prepared By: Sangyong Oh, Marketing Specialist Report Highlights: Strong consumer demand for value, quality, convenience, and diversity generates increased demand for imported agricultural products in the Korean retail sector. The United States remains the leading supplier of consumer-oriented agricultural products to the Korean retail sector. Korea’s imports of consumer-oriented agricultural products from the United States amounted to a record $4.3 billion in 2017. Post: Seoul ATO Market Fact Sheet: South Korea Executive Summary Quick Facts CY 2017 South Korea is the 11th largest economy in the world with a national GDP of Imports of Ag. Products from the World $1.53 trillion and a per capita GNI of almost $30,000 as of 2017. It is about - Basic Products US $4.9 billion the size of the state of Indiana and has a population of 51 million. Over - Intermediate Products US $7.9 billion 90% of Koreans live in urban areas. Korean consumers maintain strong - Consumer-Oriented Products US $12.8 billion demand for healthy diets, diversified choices, and new tastes. The country - Forest Products US $3.2 billion relies heavily on imports to fulfill total demand. Korea is the fifth largest - Seafood Products US $5.0 billion export market for American agriculture. The United States was the leading - Total US $33.8 billion supplier of imported agricultural products to Korea by accounting for $7.9 billion or 23.5% of Korea's total agricultural imports of $33.8 billion in Top 10 Consumer-Oriented Ag. -

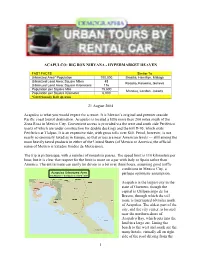

1 Acapulco: Big Box Nirvana

ACAPULCO: BIG BOX NIRVANA - HYPERMARKET HEAVEN FAST FACTS Similar To Urbanized Area* Population 700,000 Brasilia, Hamilton, Malaga Urbanized Land Area: Square Miles 45 Rosario, Kelowna, Geneva Urbanized Land Area: Square Kilometers 116 Population per Square Mile 15,600 Manaus, London, Jakarta Population per Square Kilometer 6,000 *Continuously built up area 21 August 2004 Acapulco is what you would expect for a resort. It is Mexico’s original and premier seaside Pacific coast tourist destination. Acapulco is located a little more than 200 miles south of the Zona Rosa in Mexico City. Convenient access is provided via the west and south side Periferico (parts of which are under construction for double decking) and the toll D-95, which exits Periferico at Tlalpan. It is an expensive ride, with gross tolls over $40. Petrol, however, is not nearly so onerously taxed as in Europe, so that prices are near American levels --- still among the most heavily taxed products in either of the United States (of Mexico or America, the official name of Mexico is Estados Unidos de Mexicanos). The trip is picturesque, with a number of mountain passes. The speed limit is 110 kilometers per hour, but it is clear that respect for the limit is more on a par with Italy or Spain rather than America. The entire route can easily be driven in a bit over three hours, assuming good traffic conditions in Mexico City, a Acapulco Urbanized Area perhaps optimistic assumption. MICROSOFT “STREETS & TRIPS” MAP Acapulco is the largest city in the state of Guerrero, though the capital is Chilpancingo de los Bravos, through which the toll route is interrupted 60 miles north of Acapulco. -

Hypermarket Lessons for New Zealand a Report to the Commerce Commission of New Zealand

Hypermarket lessons for New Zealand A report to the Commerce Commission of New Zealand September 2007 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. In market research it means understanding the big picture before you get into the details. PO BOX 10 202, Mt. Eden, Auckland 1030, New Zealand Tel: +64 9 623 1848; Fax: +64 9 353 1515; email: [email protected] www.coriolisresearch.com PROJECT BACKGROUND This project has the following background − In June of 2006, Coriolis research published a company newsletter (Chart Watch Q2 2006): − see http://www.coriolisresearch.com/newsletter/coriolis_chartwatch_2006Q2.html − This discussed the planned opening of the first The Warehouse Extra hypermarket in New Zealand; a follow up Part 2 was published following the opening of the store. This newsletter was targeted at our client base (FMCG manufacturers and retailers in New Zealand). -

Living in Korea

A Guide for International Scientists at the Institute for Basic Science Living in Korea A Guide for International Scientists at the Institute for Basic Science Contents ⅠOverview Chapter 1: IBS 1. The Institute for Basic Science 12 2. Centers and Affiliated Organizations 13 2.1 HQ Centers 13 2.1.1 Pioneer Research Centers 13 2.2 Campus Centers 13 2.3 Extramural Centers 13 2.4 Rare Isotope Science Project 13 2.5 National Institute for Mathematical Sciences 13 2.6 Location of IBS Centers 14 3. Career Path 15 4. Recruitment Procedure 16 Chapter 2: Visas and Immigration 1. Overview of Immigration 18 2. Visa Types 18 3. Applying for a Visa Outside of Korea 22 4. Alien Registration Card 23 5. Immigration Offices 27 5.1 Immigration Locations 27 Chapter 3: Korean Language 1. Historical Perspective 28 2. Hangul 28 2.1 Plain Consonants 29 2.2 Tense Consonants 30 2.3 Aspirated Consonants 30 2.4 Simple Vowels 30 2.5 Plus Y Vowels 30 2.6 Vowel Combinations 31 3. Romanizations 31 3.1 Vowels 32 3.2 Consonants 32 3.2.1 Special Phonetic Changes 33 3.3 Name Standards 34 4. Hanja 34 5. Konglish 35 6. Korean Language Classes 38 6.1 University Programs 38 6.2 Korean Immigration and Integration Program 39 6.3 Self-study 39 7. Certification 40 ⅡLiving in Korea Chapter 1: Housing 1. Measurement Standards 44 2. Types of Accommodations 45 2.1 Apartments/Flats 45 2.2 Officetels 46 2.3 Villas 46 2.4 Studio Apartments 46 2.5 Dormitories 47 2.6 Rooftop Room 47 3.