RSCI Pioneered the Hypermarket Concept in the Philippines Through Shopwise

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hypermarket Format: Any Future Or a Real Need to Be Changed? an Empirical Study of the French, Spanish and Italian Markets

Hypermarket Format: Any Future or a Real Need to Be Changed? An Empirical Study of the French, Spanish and Italian markets. Rozenn PERRIGOT ESC Rennes School of Business CREM UMR CNRS 6211 2, rue Robert d’Arbrissel CS 76522 35065 Rennes Cedex FRANCE [email protected] Gérard CLIQUET Institute of Management of Rennes (IGR-IAE) University of Rennes 1 CREM UMR CNRS 6211 11, rue Jean Macé CS 70803 35708 Rennes Cedex FRANCE [email protected] 5th International Marketing Trends Congress, Venice (ITALY), 20-21 of January 2006 Hypermarket Format: Any Future or a Real Need to Be Changed? An Empirical Study of the French, Spanish and Italian markets. Abstract: The hypermarket appeared first in France at the beginning of the sixties as a synthesis of the main features of modern retailing. But in France, the decline of this retail format seems to have begun and Spain could follow quickly. In the same time, the German hard-discounters continue their invasion. According to the retail life cycle theory, this paper displays curves to demonstrate the evolution of this retail concept in France, Spain and Italy and tries to evoke some managerial and strategic issues. The retail wheel seems to go on turning! Keywords: France, hypermarket, Italy, retail life cycle, Spain, wheel of retailing. 1. Introduction The history of modern retailing began more than 150 years ago. The first retailing formats began to outcompete the traditional small and independent shops. For instance, many department stores followed several decades later by variety stores appeared in Europe (France, UK, Germany and Italy) but also in the United States and Japan. -

Serving Customers in Diverse Ways Products Ecommerce

eCommerce Products Truffles Donckels brand from Belgium is available One of the reasons behind Walmart Brazil’s in both Sam’s Club and Walmart. Additionally, success is their ability to leverage scale and Walmart Brazil imports Hunts Tomato Sauce, expertise to be one of the top leaders among online Cheesecake Factory and Samuel Adams beer to retailers in market share and provide low, Sam’s Club stores. competitive prices. In addition, walmart.com.br is able to present a huge variety and assortment of Borges Olive Oil and McCain French Fries are part general merchandise, usually larger than brick and of the portfolio for Walmart Brazil. As of 2015, the Serving Customers mortar operations. Brazilian consumer can buy children’s clothing Child of Mine, developed by Carter’s in the United In Diverse Ways States, exclusively at Walmart. History “Orbit” chewing gum, Starburst and “5” gum, from Walmart Brazil began its Wrigley (Mars, Incorporated), was available to operations in 1995, with its Economic Impact Brazil in 2014, exclusively at Walmart stores in all headquarters located in Barueri, regions. São Paulo. Walmart Brazil Over the past 12 years, Walmart Brazil’s Producer’s operates across 18 states and the Club has grown to 9,221 households in 18 Brazilian Schwinn, a traditional bike brand in USA, now offers Federal District, serving 1 million states and the Federal District. It offers these Mountain, Dakota, Colorado and Eagle bike models customers each day with suppliers access to Walmart Brazil stores to sell in Brazil through Walmart hypermarket formats. hypermarkets, supermarkets, cash their products. -

2017 Food Retail Sectoral Report Retail Foods Philippines

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: GAIN Report Number: 1724 Philippines Retail Foods 2017 Food Retail Sectoral Report Approved By: Ralph Bean Prepared By: Joycelyn Claridades-Rubio Report Highlights: The growing expansion and increase in sales of food retailers in the Philippines creates opportunities for more exports of U.S. high-value, consumer-oriented food and beverage products. Driven by a growing population, strong domestic consumption, and a buoyant economy, the food retail sector reached a growth of $45.3B in sales in 2016, a 4% increase from $43.5 in 2015. Post: Manila General Information: I. Overview of the Philippine Market The Philippines is the largest market in Southeast Asia for U.S. consumer-oriented food and beverage (f&b) products and one of the fastest growing markets in the world, importing $923.4 billion in U.S. f&b products in 2016. A mature market with growing demand for consumer-oriented products, the United States remains the Philippines’ largest supplier for food, beverage and ingredient products. Ranked as the 11th largest export market for U.S. high-value, consumer-oriented products, the Philippines imported $716.1 million from January through September 2017. Based on the chart below, the United States remains the largest supplier with fifteen percent (15%) market share, followed by China (9%), Indonesia and New Zealand (10%), and Thailand (8%). Total imports of consumer-oriented food grew annually by an average of 10%. Chart 1 – Market Share of Consumer-Oriented Products in the Philippines Per Country The Philippines has a strong preference for U.S. -

Hang Seng Enjoy Card Designated Merchants Enjoy Card Designated Merchants Include

Hang Seng enJoy Card Designated Merchants enJoy Card Designated Merchants include: 7-Eleven Market Place by Jasons IKEA Oliver’s The Delicatessen Mannings "Wellcome Delivers" Newly Mannings Plus Market Place by Jasons e-supermarket Joined Newly Mannings Baby Joined Arome Bakery GNC Genki Sushi Maxim’s Group(1) sen-ryo Pizza Hut DONDONYA (Honten) Wellcome DONDONYA Shokudo ThreeSixty The Excelsior, Hong Kong(2) (1) Designated outlets of Maxim’s Group include: • Maxim's Chinese Cuisine •m.a.x. concepts Maxim's Palace Pearl on the Peak Maxim's Chinese Restaurants Lawry's The Prime Rib Maxim's Chinese Restaurant (Chek Lap Kok) Café Landmark Serenade Chinese Restaurant Kiku 8 Happiness Miso Jade Garden rice paper The Square Thai Basil Shanghai Jade City Hall Maxim's Café Jasmine Place Café Muse Hoi Yat Heen EXP Jasmine Garden deck n beer Jasmine simplylife BREAD AND WINE* House of Jasmine simplylife BAKERY CAFÉ* Xi Yue simplylife THE EAST THE WEST* Chiuchow Garden Restaurants • Maxim's MX China Fragrance • Maxim's Cakes Chiuchow Garden •can.teen Peking Garden Restaurant • Maxim's Food2 House of Beijing Oriental Lily Shanghai Garden Festive China * Not valid for purchase from the semi-self service area. (2) Restaurants of The Excelsior, Hong Kong include: Yee Tung Heen, Cammino, Café on the 1st, Dickens Bar, ToTT's and Roof Terrace and EXpresso Notes: – “Maxim's” and any name, logo or trademark of Maxim's restaurants referred to herein belong to Maxim's Caterers Limited, a company operating in Hong Kong. – The list of enJoy Card Designated Merchants is subject to change from time to time without prior notice. -

2019 Philippines Food Retail Sectoral Report

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 7/8/2019 GAIN Report Number: 1913 Philippines Retail Foods 2019 Food Retail Sectoral Report Approved By: Ryan Bedford Prepared By: Joycelyn Claridades Rubio Report Highlights: The Philippine food retail sector continues to grow, providing opportunities for increased exports of U.S. high-value food and beverages. The food retail industry sold a record $47.4 billion in 2018, and Post forecasts sales in 2019 at nearly $50 billion. Driven by rising incomes, a growing population, and a strong preference for American brands, the Philippines imported $1.09 billion of U.S. consumer-oriented products in 2018. Post expects U.S. exports in this sector to grow further in 2019, reaching an all-time high of $1.2 billion. Market Fact Sheet: Philippines With a population of 105.9 million and decreasing farmlands, the Philippines is dependent on food imports. In 2018, Philippine imports of high-value food products from the United States reached $1.09 billion, making the United States the largest supplier for high-value, consumer-oriented food and beverage products. Post expects this to continue in 2019, with exports forecast to grow 10 percent to $1.2 billion. The Philippines continues to be one of the fastest-growing economies in Asia. With a growing middle class and a large, young population, the Philippine economy is rooted in strong consumer demand, boosted by rising incomes and overseas remittances. Per capita gross income and consumer expenditures saw strong gains from 2012 to 2018. -

Annual Report 2019 Our Goal: “ to Give Our Customers Across Asia a Store They TRUST, Delivering QUALITY, SERVICE and VALUE.”

Annual Report 2019 Our Goal: “ To give our customers across Asia a store they TRUST, delivering QUALITY, SERVICE and VALUE.” Dairy Farm International Holdings Limited is incorporated in Bermuda and has a standard listing on the London Stock Exchange, with secondary listings in Bermuda and Singapore. The Group’s businesses are managed from Hong Kong by Dairy Farm Management Services Limited through its regional offices. Dairy Farm is a member of the Jardine Matheson Group. A member of the Jardine Matheson Group Annual Report 2019 1 Contents 2 Corporate Information 36 Financial Review 3 Dairy Farm At-a-Glance 39 Directors’ Profiles 4 Highlights 41 Our Leadership 6 Chairman’s Statement 44 Financial Statements 10 Group Chief Executive’s Review 116 Independent Auditors’ Report 14 Sustainable Transformation at Dairy Farm 124 Five Year Summary 18 Business Review 125 Responsibility Statement 18 Food 126 Corporate Governance 22 Health and Beauty 133 Principal Risks and Uncertainties 26 Home Furnishings 135 Shareholder Information 30 Restaurants 136 Retail Outlets Summary 34 Other Associates 137 Management and Offices 2 Dairy Farm International Holdings Limited Corporate Information Directors Dairy Farm Management Services Limited Ben Keswick Chairman and Managing Director Ian McLeod Directors Group Chief Executive Ben Keswick Clem Constantine Chairman (joined the Board on 11th November 2019) Ian McLeod Neil Galloway Group Chief Executive (stepped down on 31st March 2019) Clem Constantine Mark Greenberg Chief Financial Officer (joined the board on 19th November 2019) George J. Ho Neil Galloway Adam Keswick Group Finance & IKEA Director (stepped down on 31st March 2019) Simon Keswick (stepped down on 1st January 2020) Choo Peng Chee Chief Executive Officer – North Asia Michael Kok & Group Convenience (stepped down on 8th May 2019) Sam Kim Dr Delman Lee Chief Executive Officer – Health & Beauty and Chief Marketing & Business Development Officer Anthony Nightingale Martin Lindström Y.K. -

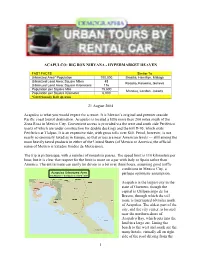

1 Acapulco: Big Box Nirvana

ACAPULCO: BIG BOX NIRVANA - HYPERMARKET HEAVEN FAST FACTS Similar To Urbanized Area* Population 700,000 Brasilia, Hamilton, Malaga Urbanized Land Area: Square Miles 45 Rosario, Kelowna, Geneva Urbanized Land Area: Square Kilometers 116 Population per Square Mile 15,600 Manaus, London, Jakarta Population per Square Kilometer 6,000 *Continuously built up area 21 August 2004 Acapulco is what you would expect for a resort. It is Mexico’s original and premier seaside Pacific coast tourist destination. Acapulco is located a little more than 200 miles south of the Zona Rosa in Mexico City. Convenient access is provided via the west and south side Periferico (parts of which are under construction for double decking) and the toll D-95, which exits Periferico at Tlalpan. It is an expensive ride, with gross tolls over $40. Petrol, however, is not nearly so onerously taxed as in Europe, so that prices are near American levels --- still among the most heavily taxed products in either of the United States (of Mexico or America, the official name of Mexico is Estados Unidos de Mexicanos). The trip is picturesque, with a number of mountain passes. The speed limit is 110 kilometers per hour, but it is clear that respect for the limit is more on a par with Italy or Spain rather than America. The entire route can easily be driven in a bit over three hours, assuming good traffic conditions in Mexico City, a Acapulco Urbanized Area perhaps optimistic assumption. MICROSOFT “STREETS & TRIPS” MAP Acapulco is the largest city in the state of Guerrero, though the capital is Chilpancingo de los Bravos, through which the toll route is interrupted 60 miles north of Acapulco. -

RISKS of SOURCING SEAFOOD in HONG KONG SUPERMARKETS 2019 Every Retailer in the City Must Take a Lead to Help Transform Hong Kong Into Asia’S Most Sustainable City

RISKS OF SOURCING SEAFOOD IN HONG KONG SUPERMARKETS 2019 Every retailer in the city must take a lead to help transform Hong Kong into Asia’s most sustainable city The United Nations’ recent global assessment on biodiversity and ecosystem services sounded a warning that around one million species already face extinction, many within decades, unless action is taken to reduce the intensity of drivers of biodiversity loss. More than a third of all marine mammals are currently threatened. Without proper management of fishing practices and transparent seafood supply chains, there will be degradation of natural habitats and a drop in food security levels in seafood. Ultimately, it will affect the profitability of all businesses that rely on seafood. Hong Kong is the second largest per capita consumer of seafood in Asia. We import over 90% of our seafood from over 170 countries and territories around the world. Our seafood choices affect marine fisheries resources worldwide. As Hong Kong supermarkets play an increasingly important role in supplying seafood to consumers, they can also be crucial in making sustainable seafood more publicly accessible. In October 2016, WWF-Hong Kong published the first report detailing how local supermarket giants were selling globally threatened species and seafood products associated with environmental, social and legal problems. By documenting their existing practices and educating supermarkets about the impacts of their seafood sales on marine resources and our oceans, we sought to raise public awareness and collectively encourage them to set up a comprehensive sustainable seafood procurement policy. There are 29 chain supermarket brands in Hong Kong owned by a total of nine groups or companies comprising over 70% market share in the city’s food retail sector. -

Dairy Farm 2018 Interim Results

2018 Interim Results 27 July 2018 Disclaimer This Document (the “Document”) is for information purposes only. This Document is not intended to form the basis of any investment decision nor does it constitute a recommendation or advice as to how the reader should act on any matter. The information in this Document is an overview only and does not contain or purport to contain information necessary for investment decisions. In making any investment decision, investors should rely on their own examination of Dairy Farm and consult with their own legal, tax, business and/or financial advisors in connection with any acquisition of securities. The information contained in this Document has been prepared in good faith by Dairy Farm and it may contain forward looking statements including statements regarding our intent, belief or current expectations with respect to Dairy Farm’s businesses and operations, market conditions, results of operational and financial conditions, capital adequacy, specific provisions and risk management practices. Readers are cautioned not to rely on these forward looking statements. Dairy Farm does not undertake any obligation to publicly release the result of any revisions to these forward looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Dairy Farm’s control. Past performance is not a reliable indication of future performance. This Document does not constitute or contain an offer for purchase or invitation to purchase any securities and neither this Document nor anything contained herein shall form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. -

Hypermarket Lessons for New Zealand a Report to the Commerce Commission of New Zealand

Hypermarket lessons for New Zealand A report to the Commerce Commission of New Zealand September 2007 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. In market research it means understanding the big picture before you get into the details. PO BOX 10 202, Mt. Eden, Auckland 1030, New Zealand Tel: +64 9 623 1848; Fax: +64 9 353 1515; email: [email protected] www.coriolisresearch.com PROJECT BACKGROUND This project has the following background − In June of 2006, Coriolis research published a company newsletter (Chart Watch Q2 2006): − see http://www.coriolisresearch.com/newsletter/coriolis_chartwatch_2006Q2.html − This discussed the planned opening of the first The Warehouse Extra hypermarket in New Zealand; a follow up Part 2 was published following the opening of the store. This newsletter was targeted at our client base (FMCG manufacturers and retailers in New Zealand). -

Understanding the Beauty and Health Retailers in Hong Kong

UNDERSTANDING THE BEAUTY AND HEALTH RETAILERS IN HONG KONG CONTENTS Overview of Distribution Channels Online Retailer in Hong Kong and Macau 04 1. Hong Kong Retailers’ Own Website 22 Brick-and-mortar Retail Stores in Hong Kong 2. E-commerce Platform in Hong Kong 23 1. Department Stores 06 3. Cross-border E-commerce Platform in China 23 2. Beauty Specialty Stores 10 3. Pharmacy Stores 13 Hong Kong Beauty and Health Trade Events 26 4. Supermarkets 14 Austrade Contacts 27 5. Multi-brand Shops 16 6. Health and Organic Stores 19 7. Australian Brand Stores 21 Disclaimer Copyright © Commonwealth of Australia 2019 This report has been prepared by the Commonwealth of Australia represented by the Australian Trade and Investment Commission (Austrade). The report is a general overview and is not intended to The material in this document is licensed under a Creative Commons provide exhaustive coverage of the topic. The information is made Attribution – 4.0 International licence, with the exception of: available on the understanding that the Commonwealth of Australia is • the Commonwealth Coat of Arms not providing professional advice. • the Australian Trade and Investment Commission’s logo While care has been taken to ensure the information in this report • any third party material is accurate, the Commonwealth does not accept any liability for any • any material protected by a trade mark loss arising from reliance on the information, or from any error or • any images and photographs. omission, in the report. More information on this CC BY licence is set out at the creative Any person relying on this information does so at their own risk. -

Codeswitching in Print Advertisements in Hong Kong and Sweden

Department of Linguistics and Phonetics Supervisor: Gisela Håkansson Masters thesis in General Linguistics Spring Term 2006 Carrie Leung Codeswitching in print advertisements in Hong Kong and Sweden Table of contents Abstract 1. Introduction 1. 1. A brief account and comparison of language situation in Hong Kong and Sweden 1. 1. 1. Table. 1. Education mapping 1. 1. 2. Bilingualism in HK 1. 1. 3. Bilingualism in Sweden 1. 2. The role of English in Hong Kong and Sweden 2. Background literature 2. 1. What is codeswitching? 2. 1. 1. Codeswitching as a research topic 2. 2. Motivations for codeswitching 2. 2. 1. Political and cultural aspects 2. 2. 2. Social and psychological aspects 2. 2. 3. Travellers and tourists 2. 2. 4. Bilingual punning 2. 2. 5. A gap in the register and principle of economy 2. 2. 6. “Limited access to terms theory” 2. 2. 7. Attitude: English is a threat? Chinglish vs. Svengelska 2. 3. Codeswitching vs. borrowing 2. 4. Loanwords from English in Cantonese and Swedish 2. 5. Structural aspect of codeswitching 2. 6. Anglicized advertising discourse 3. Methodology 3. 1. The aim of the present study and hypotheses 3. 1. 1. Ideological functions of advertising 3. 1. 2. Constraints on the use of English 3. 1. 3. Areas in which English is most used 3. 1. 4. Hypotheses A, B 3. 2. Materials and experimental design 3. 3. Data analysis 3. 3. 1. Hong Kong data 3. 3. 2. Swedish data 2 4. Results 4. 1. An overview of Hong Kong and Swedish data Tables 2, 3, 4 4.