Soft Drinks Industry 2001

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Weigao Reducer Success Case (Large Enterprise Version) Serial Company Name Serial Company Name

China Weigao reducer success case (large enterprise version) serial Company Name serial Company Name 1 Shanghai Automobile Group Co., Ltd. 231 Chongqing Textile Holding (Group) Company 2 Dongfeng Motor Corporation 232 Aoyang Group Co., Ltd. 3 Huawei Investment Holdings Co., Ltd. 233 Guangxi Shenglong Metallurgy Co., Ltd. 4 China Ordnance Equipment Group Corporation 234 Lingyuan Iron and Steel Group Co., Ltd. 5 China Minmetals Corporation 235 Futong Group Co., Ltd. 6 China FAW Group Corporation 236 Yongfeng Group Co., Ltd. 7 China Ordnance Industry Corporation 237 Shandong Taishan Iron and Steel Group Co., Ltd. 8 Beijing Automobile Group Co., Ltd. 238 Xinjiang Zhongtai (Group) Co., Ltd. 9 Shandong Weiqiao Venture Group Co., Ltd. 239 Guangdong Haida Group Co., Ltd. 10 China Aviation Industry Corporation 240 Jiangsu Yangzijiang Shipbuilding Group Corporation 11 Zhengwei International Group Co., Ltd. 241 Shenzhen Oufeiguang Technology Co., Ltd. 12 China Baowu Iron and Steel Group Co., Ltd. 242 Dongchen Holding Group Co., Ltd. 13 Lenovo Holdings Co., Ltd. 243 Xinjiang Goldwind Technology Co., Ltd. 14 China National Chemical Corporation 244 Wanji Holding Group Co., Ltd. 15 Hegang Group Co., Ltd. 245 Tsingtao Brewery Co., Ltd. 16 China Shipbuilding Industry Corporation 246 Tasly Holding Group Co., Ltd. 17 Guangzhou Automobile Industry Group Co., Ltd. 247 Wanfeng Auto Holding Group Co., Ltd. 18 Aluminum Corporation of China 248 Wuhan Institute of Posts and Telecommunications 19 China National Building Material Group Co., Ltd. 249 Red Lion Holdings Group Co., Ltd. 20 Hengli Group Co., Ltd. 250 Xinjiang Tianye (Group) Co., Ltd. 21 CRRC Corporation Limited 251 Juhua Group Company 22 Xinxing Jihua Group Co., Ltd. -

Main Brazilian Products Imported by China in 2006 (Source: China Customs)

MAIN BRAZILIAN PRODUCTS IMPORTED BY CHINA IN 2006 (SOURCE: CHINA CUSTOMS) HS CODE PRODUCT NAME IMPORTER Guangdong Commence Imp/Exp Co. Guangdong Youhe Imp/Exp Co. Guangzhou Nanying Foreign Trade Co. Huidong County Port Imp/Exp Co. Wings of fowls of the species Nanning Xinxing Kenong Food Co. 02071421 Gallus domesticus, frozen Ningbo Doctor Kai Food Co. Ningbo Today Food Co. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dajiang (Group) Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. Guangdong Commence Imp/Exp Co. Guangdong Youhe Taiwan Trading Co. Guangzhou Nanying Foreign Trade Co. Nanning Xinxing Kenong Food Co. Ningbo Chengji Food Co. 02071422 Other offal of fowls, frozen Ningbo Doctor Kai Food Co. Ningbo Today Food Co. Qingdao Kaiyuan Products Co., Ltd. Shanghai Dajiang (Group) Co., Ltd. Shanghai Food Stuffs Imp/Exp. Co., Ltd. China Grains and Oils Group Corporation China Textiles Grain and Oil Import & Export Co., Ltd. Dahai Grain and Oil Industry Fangcheng Co.,Ltd. Dalian Huanong Bean Group Limited East Sea Grain and Oil Zhangjiagang Co., Ltd 12010091 Yellow soybeans Huanghai Grain and Oil Industrial Co.,Ltd.(Shandong) Qinhuangdao Jinhai Grain and Oil Industrial Co.,Ltd. Quanzhou Fuhai Cereals and Oil Industrial Co., Ltd. Shandong Sanwei Oil & Fat Group Co., Ltd. Yihai (Lianyungang) Grain and Oil Co., Ltd. Yihai (Yantai) Grain and Oil Co., Ltd. China Grains and Oils Group Corporation China plant Oil Co.,Ltd. Dongma Oil and Fat(Guangzhou Bonded Area)Co., Ltd. East Sea Grain and Oil Zhangjiagang Co., Ltd Shanghai Jintai International Grain & Oil Trading Co., Ltd. Crude oil whether or Not 15071000 degummed Shanghai Liangyou Group Co., Ltd. -

Discussion Materials

BMO Financial Group China’s Role in the Global Food Economy A Look Forward BMO Financial Group in China - Timeline 1818 1961 1996 2003 2004 BMO undertakes first BMO is one of the first BMO is the first BMO becomes a 16.7% BMO is the first FX transaction in western banks to Canadian bank owner of Fullgoal Fund Canadian bank to be support of trade with establish direct licensed for a full- Management, China’s 2nd- licensed by the China China business ties with the service branch in largest mutual fund Banking Regulatory Bank of China Beijing company (increased to Commission to sell 28% in 2004) derivatives in China BMO China Timeline 2005 2005 2006 2008 2010 BMO is the first BMO selected to work BMO opens Shanghai branch officially BMO is the first Canadian bank licensed alongside the BOC, the Investment Banking begins operations Canadian bank to to provide RMB local CITIC and the ICBC as a representative office in incorporate in China currency services to market maker for the new Beijing foreign and local FX trading platform companies in China BMO Financial Group in China – Market Presence Bank of Montreal (China) Co. Ltd. -Office presence since 1983 Beijing -4 Greater China branches and 200 staff ▪ -FX pioneer and government-appointed FX market maker -USD & CNY licenses with national coverage -Active in trade finance -Close relationships with top Chinese banks -Expanded product range with 2010 local incorporation ▪ Shanghai Guangzhou ▪ ▪ Hong Kong Bank of Montreal (China) Co. Ltd is a wholly-owned subsidiary of BMO Financial Group Observations The food industry continues to be one of China’s largest, fastest growing and most important sectors. -

Beyond Ownership: State Capitalism and the Chinese Firm Curtis J

University of Florida Levin College of Law UF Law Scholarship Repository UF Law Faculty Publications Faculty Scholarship 3-2015 Beyond Ownership: State Capitalism and the Chinese Firm Curtis J. Milhaupt Wentong Zheng University of Florida Levin College of Law, [email protected] Follow this and additional works at: http://scholarship.law.ufl.edu/facultypub Part of the Corporation and Enterprise Law Commons, and the Foreign Law Commons Recommended Citation Curtis J. Milhaupt & Wentong Zheng, Beyond Ownership: State Capitalism and the Chinese Firm, 103 Geo. L.J. 665 (2015), available at http://scholarship.law.ufl.edu/facultypub/696 This Article is brought to you for free and open access by the Faculty Scholarship at UF Law Scholarship Repository. It has been accepted for inclusion in UF Law Faculty Publications by an authorized administrator of UF Law Scholarship Repository. For more information, please contact [email protected]. Beyond Ownership: State Capitalism and the Chinese Firm CURTIS J. MILHAUPT*&WENTONG ZHENG** Chinese state capitalism has been treated as essentially synonymous with state- owned enterprises (SOEs). But drawing a stark distinction between SOEs and privately owned enterprises (POEs) misperceives the reality of China’s institutional environment and its impact on the formation and operation of large enterprises of all types. We challenge the “ownership bias” of prevailing analyses of Chinese firms by exploring the blurred boundary between SOEs and POEs in China. We argue that the Chinese state has less control over SOEs and more control over POEs than its ownership interest in the firms suggests. Our analysis indicates that Chinese state capitalism can be better explained by capture of the state than by ownership of enterprise. -

Chinese Companies in the 21St Century

CHINESE COMPANIES IN THE 21ST CENTURY A SURVEY BY WWF’S TRADE AND INVESTMENT PROGRAMME - - PENG LEI, - BAIJIN LONG AND DENNIS PAMLIN APRIL 2005 CHINESE COMPANIES IN THE 21ST CENTURY HELPING OR DESTROYING THE PLANET? CORPORATE SOCIAL RESPONSIBILITY AND BEYOND A SURVEY BY WWF’S TRADE AND INVESTMENT PROGRAMME - - PENG LEI, - BAIJIN LONG AND DENNIS PAMLIN APRIL 2005 CHINESE COMPANIES IN THE 21ST CENTURY 3 CONTENTS EXECUTIVE SUMMARY 7 RESULTS 8 POSSIBLE STEPS FORWARD 9 INTRODUCTION 11 SUSTAINABLE DEVELOPMENT AND THE ENVIRONMENT IN CHINA 17 THE EVOLUTION OF CHINESE COMPANIES 18 THE MAJOR COMPANIES IN CHINA 19 AN OVERVIEW OF CSR ACTIVITIES IN CHINA 20 FROM MARGINAL IMPROVEMENTS TO NEW SOLUTIONS 21 THE WWF STUDY : CHINESE COMPANIES AND SUSTAINABLE DEVELOPMENT 23 THE PROCESS 24 THE RESULTS 25 WWF’S RESPONSE 31 APPENDIX AND FOOTNOTES 34 APPENDIX 1 - COMPANIES APPROACHED 36 APPENDIX 2 - LETTER, QUESTIONNAIRE AND REPLIES 38 FOOTNOTES 43 This report is the first of a series of studies by WWF’s Trade and Investment Pro- gramme. The project of which it is a part aims to identify and work with actors in key emerging economies (China, Brazil, India, Russia and South Africa) to champion international sustainable trade and investment. The project examines the scope for these countries to become leading exporters of, and investors in, sustainable goods and services, whilst emerging as key actors in promoting a proactive inter- national sustainable development agenda. For more information see: www.panda.org/investment or email: trade@wwfint.org EXECUTIVE SUMMARY This report is based on a survey of 182 of the largest and most important Chinese companies. -

Huiyuan Juice from Wikipedia, the Free Encyclopedia

Create account Log in Article Talk Read Edit Search Huiyuan Juice From Wikipedia, the free encyclopedia China Huiyuan Juice Group Limit ed (Chinese: ; pinyin: China Huiyuan Juice Group Navigation Zhōngguó Huìyuán Guǒzhī Jítuán Yǒuxiàn Gōngsī ) (SEHK: 1886 ), Limited Main page established in 1992 and headquartered in Beijing, is the largest privately Contents owned juice producer in China.[1] It is engaged in the manufacture and Featured content sales of juice and other beverage products. Its products include fruit juice Current events and vegetable juice, nectars, bottled water, tea, and dairy drinks.[2] Random article Donate to Wikipedia Contents [hide] 1 Hong Kong Listing Type Listed company 2 Coca Cola buy-out attempt Interaction Indust ry Juice production 3 References Fo unded 1992 Help 4 External links About Wikipedia Fo under(s) Mr. Zhu Xinli Community portal Hong Kong Listing [edit] Headquart ers Beijing, People's Recent changes Republic of China Contact page It was listed on the Hong Kong Stock Exchange in February 2007. Prior to Area served People's Republic of its listing, Groupe Danone and Warburg Pincus became cornerstone China Toolbox investors in the company. Warburg Pincus sold its stake into the public Key peo ple Chairman: Mr. Zhu Xinli market in 2009; Danone sold its 23 percent stake Huiyuan for €200m Websit e China Huiyuan Juice What links here ($260m) in 2010 to Hong Kong private equity group, SAIF.[3] Group Limited Related changes Upload file Coca Cola buy-out attempt [edit] Special pages Permanent link In 3 September 2008, Atlantic Industries, a wholly owned subsidiary of The Coca-Cola Company, agreed to buy Page information China Huiyuan Juice for HK$17.9 billion at HK$12.20 per share, three times more than its closing price of HK$4.14 Data item on the previous day. -

Made in China 2025 Plan

MADE IN CHINA 2025 China Manufacturing in the 21st Century - Opportunities for UK-China Partnership www.cbbc.org www.ukti.gov.uk Contents Forewords 02 Executive Summary 04 Background to Made in China 2025 06 The State Council’s Plan 08 Ten Priority Sectors 09 Five Nationwide Initiatives 12 Specific Objectives 13 Opportunities by Sector 14 Opportunities by Location 15 Opportunities for UK Companies 17 Challenges for UK Companies 18 Conclusions & Next Steps 20 Appendix 22 Contacts 23 www.ukti.gov.uk www.cbbc.org | 01 Foreword Dr Mark Wareing Director Advanced Manufacturing & Transport UKTI China, British Embassy, Beijing UK Trade & Investment Together we provide a comprehensive service for British (UKTI) is the part of companies who are looking at the incredible opportunities UK Government that is in China and we bring more Chinese companies to the UK responsible for growing to join the UK’s leading innovation landscape to create the the UK’s exports and products for the future, for China and the world. attracting investment into the UK. Made in China 2025 is a truly exciting strategy and it is fantastic to see how closely the skills, experience and In terms of UK exports, capability of the UK’s industrial base align with China’s China is already our ambitions. In all of the 10 priority sectors China has second largest single identified, the UK is a world leader with the expertise to export destination with help China reach its goals. exports of £18.7 billion, of which £15.5 billion (83%) We see the next stage of China’s emergence as an economic are manufactured goods superpower in its ambition to design and make the products which demonstrates the of the future required not only by the Chinese consumer, but importance of manufacturing to the UK economy. -

Inside This Issue

1 December 29, 2015– Issue 174 INSIDE THIS ISSUE China To Raise Bar of Generic Drug Production China’s state regulator released a draft recently that aims to China To Raise Bar of Generic assess the quality of generic drugs. The drugs which fail the Drug Production assessment will be deprived of the official production approval. New Food Safety Regulation Industry people said that a large number of domestic generic Opens For Public Opinion drugs would fail the reassessment. Some said the failing rate could be as high as 80%. China Health Committee: Earlier this month, CFDA released a notice saying that 62 Research on Smog Takes Time domestic pharmaceutical companies have withdrawn registration application for 87 kinds of drug. Sales of Soft Drinks in China are Bleak In two weeks, the regulators have seen 164 withdrawals from 62 companies who previously applied for drug production approval, China’s New Food Safety Laws most of which are for generic drugs. Enable Further Rapid Growth ’ for Ireland’s Food Producers Analysts say that most drugs sold in China s drug market at this moment are generic drugs, as many Chinese companies lack for China's Medical Tourism Boom R&D capability to produce original drugs. It is hard to say how Gains Global Attention: Experts many generic drugs that are sold in China can pass the assessment. (Source: China Youth Daily) E-courts Promise Online Justice New Food Safety Regulation Opens For Public Opinion for Chinese Shoppers China’s state food and drug regulator starts to gather public opinion for the newly minted regulation on food safety. -

Selling to Made in China 2025: Opportunities & Challenges

Selling to Made in China 2025: Opportunities & Challenges Selling to Made in China 2025 Opportunities and challenges presented by China’s initiative to become a global leader in quality manufacturing October 2018 Accelerating Adoption of the IoT ONE Limited | www.iotone.com | Accelerating the Industrial Internet of Things Industrial Internet of Things 0 Selling toto MadeMade in in China China 2025: 2025: Opportunities Opportunities & & Challenges Challenges Table of Contents Industrial IoT market potential in China . 2 Digitized manufacturing in China: Why now? . 3 Current climate of Industrial IoT in China . 4 Industrial IoT trends in China . 5 China’s 13th Five-Year Plan . 6 Made in China 2025 Overview . 7 Priorities by region . 8 Pilot projects (2015 – 16) . 9 China Intelligent Manufacturing Solutions Vendor Alliance . 12 Evaluating Made in China 2025 . 14 Organizations supporting industrial upgrading . 15 Industrial IoT companies in China . .. 16 Featured Case Studies . .17 Summary . 22 About IoT ONE . 23 IoT ONEONE LimitedLimited | | www.iotone.com www.iotone.com| |Accelerating Accelerating the the Industrial Industrial Internet Internet of Thingof Thingss 1 Selling to Made in China 2025: Opportunities & Challenges Industrial IoT market potential in China The Government of China was the first to launch a comprehensive China is already the world’s second largest market for Industrial Industrial Internet of Things (IoT) strategy, announced in the ‘12th IoT technologies, despite initially-low adoption rates compared to Five-Year Plan’ in 2011. According to IoT Analytics, the industry North America and Europe. Deloitte reports that China will start to see some of the early investments pay-off in 2018. -

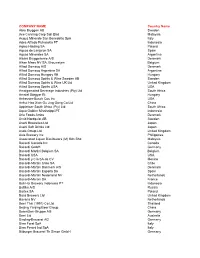

02-06-11 Companies Profiled in Directories

COMPANY NAME Country Name Åbro Bryggeri AB Sweden Ace Canning Corp Sdn Bhd Malaysia Acqua Minerale San Benedetto SpA Italy Ades Alfindo Putrasetia PT Indonesia Agros Holding SA Poland Aguas de Lanjarón SA Spain Aguas Minerales SA Argentina Albani Bryggerierne A/S Denmark Alken Maes NV SA, Brouweijen Belgium Allied Domecq A/S Denmark Allied Domecq Argentina SA Argentina Allied Domecq Hungary Kft Hungary Allied Domecq Spirits & Wine Sweden AB Sweden Allied Domecq Spirits & Wine UK Ltd United Kingdom Allied Domecq Spirits USA USA Amalgamated Beverage Industries (Pty) Ltd South Africa Amstel Sörgyar Rt Hungary Anheuser-Busch Cos Inc USA Anhui Hao Xian Gu Jing Gong Co Ltd China Appletiser South Africa (Pty) Ltd South Africa Aqua Golden Mississippi PT Indonesia Arla Foods Amba Denmark Arvid Nordquist AB Sweden Asahi Breweries Ltd Japan Asahi Soft Drinks Ltd Japan Asda Group Ltd United Kingdom Asia Brewery Inc Philippines Associated Liquor Distributors (M) Sdn Bhd Malaysia Bacardi Canada Inc Canada Bacardi GmbH Germany Bacardi Martini Belgium SA Belgium Bacardi USA USA Bacardi y Cía SA de CV Mexico Bacardi-Martini Chile SA Chile Bacardi-Martini Danmark A/S Denmark Bacardi-Martini España SA Spain Bacardi-Martini Nederland NV Netherlands Bacardi-Martini SA France Bali Hai Brewery Indonesia PT Indonesia Baltika A/S Russia Bartex SA Poland Bass Brewers Ltd United Kingdom Bavaria NV Netherlands Beer Thai (1991) Co Ltd Thailand Beijing Yanjing Beer Group China Berentzen-Gruppe AG Germany Berri Ltd Australia Binding-Brauerei AG Germany Birra Forst SpA -

Muddy Waters: the Public Health Risks and Sustainability of Bottled Water in China

MUDDY WATERS: THE PUBLIC HEALTH RISKS AND SUSTAINABILITY OF BOTTLED WATER IN CHINA Abigail Barnes* &Wei Cao**† INTRODUCTION The men took their positions in front of their lanes, elastic caps tightly gripping their heads and silver diaphanous bulbs shielding their eyes. As the Olympic swimmers geared up for the 400-meter freestyle in London in 2012, China’s Sun Yang cracked open a bottle of water and doused himself.1 His Hungarian competition took the more traditional approach, splashing himself with handfuls of pool water. At the 2012 London Olympics, a striking number of Chinese swimmers emptied bottles of water over their bodies before the start of each race.2 This public spectacle not only reflects China’s vibrant consumer culture, but also carries a note of irony given that water shortages affect over half of China’s cities.3 One cannot help but wonder whether these acts were inconsequential, or whether they reflect broader Chinese perceptions about water and the nexus between resource conservation and consumerism. Urbanization and rising energy demand have strained China’s fresh water resources.4 Approximately 70% of China’s fresh water supplies are polluted to some degree, and the water pipes in many urban areas are outdated, often leeching impurities into the public drinking water.5 The * Abigail Barnes is a J.D. Candidate at Vermont Law School and M.E.M. Candidate at the Yale School of Forestry and Environmental Studies. ** Wei Cao is a PhD Candidate at Renmin University. † The authors would like to thank Professor John D. Echeverria and David Zoppo for their insightful feedback and careful edits to earlier versions of this Article. -

天津泰達生物醫學工程股份有限公司 Tianjin TEDA Biomedical

IMPORTANT The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. If you are in any doubt as to the action to be taken, you should immediately consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Tianjin TEDA Biomedical Engineering Company Limited (the “Company”), you should at once hand this circular to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. 天津泰達生物醫學工程股份有限公司 Tianjin TEDA Biomedical Engineering Company Limited (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock code: 8189) MAJOR AND CONNECTED TRANSACTION IN RESPECT OF THE PROPOSED ACQUISITION OF THE REMAINING 49% EQUITY INTERESTS IN FULILONG Independent financial adviser to the independent board committee of Tianjin TEDA Biomedical Engineering Company Limited Hantec Capital Limited A letter from the independent board committee of the Company and a letter from the independent financial adviser, Hantec Capital Limited in relation to the Acquisition are set out on page 21 and pages 22 to 33 of this circular respectively. A notice convening an extraordinary general meeting of the Company to be held at 9th Floor, Block A2, Tianda High-Tech Park, No.80, The 4th Avenue, TEDA, Tianjin, the People’s Republic of China at 9:00 a.m.