INDIAN INGOME TAX RETURN ACKNOWLEDGEMENT Lec =^ Ta 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tollygunge Assembly West Bengal Factbook

Editor & Director Dr. R.K. Thukral Research Editor Dr. Shafeeq Rahman Compiled, Researched and Published by Datanet India Pvt. Ltd. D-100, 1st Floor, Okhla Industrial Area, Phase-I, New Delhi- 110020. Ph.: 91-11- 43580781, 26810964-65-66 Email : [email protected] Website : www.electionsinindia.com Online Book Store : www.datanetindia-ebooks.com Report No. : AFB/WB-152-0619 ISBN : 978-93-5293-827-8 First Edition : January, 2018 Third Updated Edition : June, 2019 Price : Rs. 11500/- US$ 310 © Datanet India Pvt. Ltd. All rights reserved. No part of this book may be reproduced, stored in a retrieval system or transmitted in any form or by any means, mechanical photocopying, photographing, scanning, recording or otherwise without the prior written permission of the publisher. Please refer to Disclaimer at page no. 167 for the use of this publication. Printed in India No. Particulars Page No. Introduction 1 Assembly Constituency at a Glance | Features of Assembly as per 1-2 Delimitation Commission of India (2008) Location and Political Maps 2 Location Map | Boundaries of Assembly Constituency in District | Boundaries 3-9 of Assembly Constituency under Parliamentary Constituency | Ward-wise Winner Parties- 2019, 2016, 2014, 2011 and 2009 Administrative Setup 3 District | Sub-district | Towns | Villages | Inhabited Villages | Uninhabited 10 Villages | Village Panchayat | Intermediate Panchayat Demographics 4 Population | Households | Rural/Urban Population | Ward by Population Size | 11-12 Sex Ratio (Total & 0-6 Years) | Religious -

THIS DEED of CONVEYANCE Is Made on This TH Day of November Two Thousand and Nineteen

THIS DEED OF CONVEYANCE is made on this TH Day of November Two Thousand and Nineteen BETWEEN 1 ROYALVISION CONSTRUCTION PVT.LTD (having PAN- AAGCR5126H). a private Ltd. Company having its Registered office at 7A, Bentick Street, 1st Floor, Room No-103, P.O. Hare Street, P.S - Hare Street ,Kolkata-700001 represented by its Directors and Authorized Signatory namely (1) SRI. SIDDARTHA GUPTA (having PAN- ADTPG6034E) s/o SUBHAS CHANDRA GUPTA by occupation Service, by faith - Hindu, by nationality Indian, residing at 10 Swami Vivekananda Road, Flat No-5D, near Diamond City North, Nager Bazar P.S – South Dumdum, Kolkata- 700074 and (2) SMT. VINITA AGARWAL (having PAN- ADKPA9449A) w/o Sri. Vishnu Agarwal, by faith Hindu, by occupation- Business ,by Nationality -Indian, residing at 33,Rash Behari Avenue, P.O. Kalighat, P.S.Tollygunge, Kolkata-700026 herein after called and referred to as the OWNERS (which expression shall unless excluded by or repugnant to the context be deemed to mean and include their heirs, successors -in-office, executors, administrators, legal representatives attornies and assigns) of the ONE PART as Land Owners. AND ALMOUR CONSTRUCTION (having PAN -ABJFA2812L) a registered Partnership firm having Its place of business at 12, Russa Road (East) 2nd Lane presently known as Chinmoy Chattopadhyay Sarani, 1st floor, P.O. Tollygunge, P.S. Charu Market, Kolkata- 700033, being represented by its Partners 1) SMT. SHIKHA MODANI (having PAN- AEJPM1038D) w/o Sri Sanjay Modani, by faith Hindu, by occupation-Business, by Nationality-Indian, residing at 137,S.P Mukherjee Road, Flat No-3D, Kolkata- 700026. -

A List of Terminated Vendors As on April 30, 2021. SR No ID Partner

A List of Terminated Vendors as on April 30, 2021. SR No ID Partner Name Address City Reason for Termination 1 124475 Excel Associates 123 Infocity Mall 1 Infocity Gandhinagar Sarkhej Highway , Gandhinagar Ahmedabad Breach Of Contract 2 125073 Karnavati Associates 303, Jeet Complex, Nr.Girish Cold Drink, Off.C.G.Road, Navrangpura Ahmedabad Breach Of Contract 3 132097 Sam Agency 29, 1St Floor, K B Commercial Center, Lal Darwaja, Ahmedabad, Gujarat, 380001 Ahmedabad Breach Of Contract 4 124284 Raza Enterprises Shopno 2 Hira Mohan Sankul Near Bus Stand Pimpalgaon Basvant Taluka Niphad District Nashik Ahmednagar Fraud Termination 5 124306 Shri Navdurga Services Millennium Tower Bldg No. A/5 Th Flra-201 Atharva Bldg Near S.T Stand Brahmin Ali, Alibag Dist Raigad 402201. Alibag Breach Of Contract 6 131095 Sharma Associates 655,Kot Atma Singh,B/S P.O. Hide Market, Amritsar Amritsar Breach Of Contract 7 124227 Aarambh Enterprises Shop.No 24, Jethliya Towars,Gulmandi, Aurangabad Aurangabad Fraud Termination 8 124231 Majestic Enterprises Shop .No.3, Khaled Tower,Kat Kat Gate, Aurangabad Aurangabad Fraud Termination 9 125094 Chudamani Multiservices Plot No.16, """"Vijayottam Niwas"" Aurangabad Breach Of Contract 10 NA Aditya Solutions No.2239/B,9Th Main, E Block, Rajajinagar, Bangalore, Karnataka -560010 Bangalore Fraud Termination 11 125608 Sgv Associates #90/3 Mask Road,Opp.Uco Bank,Frazer Town,Bangalore Bangalore Fraud Termination 12 130755 C.S Enterprises #31, 5Th A Cross, 3Rd Block, Nandini Layout, Bangalore Bangalore Breach Of Contract 13 NA Sanforce 3/3, 66Th Cross,5Th Block, Rajajinagar,Bangalore Bangalore Breach Of Contract 14 132890 Manasa Enterprises No-237, 2Nd Floor, 5Th Main First Stage, Khb Colony, Basaveshwara Nagar, Bangalore-560079 Bangalore Breach Of Contract 15 177367 Bharat Associates 243 Shivbihar Colony Near Arjun Ki Dairy Bankhana Bareilly Bareilly Breach Of Contract 16 132878 Nuton Smarte Service 102, Yogiraj Apt, 45/B,Nutan Bharat Society,Opp. -

Kolkata Merit List

NATIONAL MEANS‐CUM ‐MERIT SCHOLARSHIP EXAMINATION,2020 PAGE NO.1/63 GOVT. OF WEST BENGAL DIRECTORATE OF SCHOOL EDUCATION SCHOOL DISTRICT AND NAME WISE MERIT LIST OF SELECTED CANDIDATES CLASS‐VIII NAME OF ADDRESS OF ADDRESS OF QUOTA UDISE NAME OF SCHOOL DISABILITY MAT SAT SLNO ROLL NO. THE THE THE GENDER CASTE TOTAL DISTRICT CODE THE SCHOOL DISTRICT STATUS MARKS MARKS CANDIDATE CANDIDATE SCHOOL 7/1, CHANDITALA NEW ALIPORE MAIN ROAD, MULTIPURPOSE KOLKATA-700053, SCHOOL, 23A/439/1, NEW ALIPORE 1 123204307048 ACHINTYA DUTTA PO- NEW ALIPORE, KOLKATA 19170108427 DIAMOND HARBOUR KOLKATA M GENERAL NONE 57 53 110 MULTIPURPOSE SCHOOL PS- BEHALA,NEW ROAD, P.O-NEW ALIPORE,BEHALA , ALIPORE, KOLKATA - KOLKATA 700053 700073, PIN-700053 BEHALA SHARDA 6/D, SARADAMA VIDYAPITH FOR GIRLS, UPANIBESH,PARNA BEHALA SHARDA 2 123204306005 ADITI DAS KOLKATA 19170113412 PO - PARNASREE KOLKATA F GENERAL NONE 60 49 109 SREE,PARNASREE , VIDYAPITH FOR GIRLS PALLY, KOL-60, PIN- KOLKATA 700060 700060 MODERN SCHOOL, TILJALA 17B, MANORANJAN ROAD,TANGRA,BENI 3 123204306180 ADITYA ROY KOLKATA 19170106510 MODERN SCHOOL ROY CHOUDHURI KOLKATA M GENERAL NONE 54 35 89 A PUKUR , ROAD, KOLKATA - KOLKATA 700046 700017, PIN-700017 3A RAMNATH TAKI HOUSE GOVT. BISWAS LANE,RAJA SPONSORED GIRLS' TAKI HOUSE GOVT. RAM MOHAN HIGH SCHOOL, 299C, 4 123204307075 ADRIJA BASAK KOLKATA 19170103911 SPONSORED GIRLS' KOLKATA F GENERAL NONE 61 56 117 SARANI,AMHERST A.P.C. ROAD, KOL - 9 HIGH SCHOOL STREET , KOLKATA PO AMHERST ST., PIN- 700009 700009 BELTALA GIRLS' HIGH 30/25,TILJALA,TILJA BELTALA GIRLS' HIGH SCHOOL (H.S), 17, 5 123204306135 AFREEN AHMED LA , KOLKATA KOLKATA 19170107506 KOLKATA F GENERAL NONE 44 31 75 SCHOOL (H.S) BELTALA ROAD, 700039 KALIGHAT, PIN-700026 BEHALA GIRLS HIGH 30 BARIK PARA SCHOOL(H.S), 337/4, ROAD,BEHALA,BEH BEHALA GIRLS HIGH 6 123204306129 AHANA DAS KOLKATA 19170112202 DIAMOND HARBOUR KOLKATA F GENERAL NONE 49 43 92 ALA , KOLKATA SCHOOL(H.S) ROAD, KOL - 34 P.O. -

Galaxy: International Multidisciplinary Research Journal the Criterion: an International Journal in English ISSN: 0976-8165

About Us: http://www.the-criterion.com/about/ Archive: http://www.the-criterion.com/archive/ Contact Us: http://www.the-criterion.com/contact/ Editorial Board: http://www.the-criterion.com/editorial-board/ Submission: http://www.the-criterion.com/submission/ FAQ: http://www.the-criterion.com/fa/ ISSN 2278-9529 Galaxy: International Multidisciplinary Research Journal www.galaxyimrj.com www.the-criterion.com The Criterion: An International Journal In English ISSN: 0976-8165 The Refugee Settlements in ‘Calcutta’ and the Changes in the Refugee Colonies of ‘Kolkata’ Arunita Samaddar Research Scholar, Jadavpur University. Abstract: The partition of the Indian subcontinent not only killed thousands of people, but also uprooted and displaced millions from their traditional homeland – their ‘desher maati’. The severance of India’s unity, which has been described as the ground-breaking incident of reconfiguration of this nation, did not simply break the bonds between people or create territorial splits, but also partition of neighbourhoods, villages and cities. Gradually it caused rift between communitiesand families who had lived in harmony. In Bengal, the trauma of this divide reshaped the entire outlook. This paper traces how along with strong economic implications the act of Partition had a deep psychological impact on the settlers in an out of Bengal. Keywords: partition, Indian subcontinent, Bengal, economic implications. “the geography of partition is not that of a mountain amid plains, but of a thousand plateaus.”1 The recapturing of that schizophrenic moment of the partition of India is a daunting task, fraught with complexity, given the much-contested nature of ‘post-colonial’ subject. Thus the formation, rather the transformation of any city, especially Calcutta (now Kolkata), is mirrored in the multifaceted activities that surrounded the brink of colonialism and the onset of post-colonial era.2 The city of Calcutta was admittedly a social product and an economic construct, and as such it was brought into being by forces external to it. -

Disaster Management

ACTION PLAN TO MITIGATE FLOOD, CYCLONE & WATER LOGGING 2017 THE KOLKATA MUNICIPAL CORPORATION 1 2 ESSENTIAL INFORMATION INCLUDING ACTION PLANS ARE MENTIONED UNDER FOLLOWING HEADS Sl No Item Page A Disaster Management – Introduction 5 B Important Activities of KMC in 11 connection with the Disaster Management C Major Water Logging Pockets 15 D Deployment of KMC Mazdoor at Major 29 Water Logging Pockets E Arrangement all Parks & Square 39 Development required removal of uprooting trees trimining at trees F List of the Sewerage and Drainage 45 Pumping Stations and deployment of temporary portable pumps during monsoon G Emergency arrangement during the 77 ensuing Nor’wester/Rainy season in the next few months of 2017 (Mpl. Commr. Circular No 11 of 2017-18 Dated 06/05/2017) H List of the roads where cleaning of G. 97 Ps. mouths /sweeping of roads will be made twice in a day by S.W.M. Department I Essential Telephone Numbers 107 3 4 A. DISASTER MANAGEMENT – INTRODUCTION The total area under Kolkata Municipal Corporation (KMC) is about 204.75 Sq. Km. which is divided into 16 Boroughs from Ward No-1 to Ward No- 144. The total population of the KMC area as per 2001 Census is about 4.6 million. Moreover, the floating population of the city is about 6 million. They are coming to this city for their livelihood from the outskirt and suburbs of the city of Kolkata i.e. City of Joy. From the experience regarding the water logging/flood condition during rainy season for the last few years, the KMC authority felt to publicize the disaster management plan as well as disaster management system for the benefit of the citizens, local representatives, State Govt. -

Ward No: 093 ULB Name :KOLKATA MC ULB CODE: 79

BPL LIST-KOLKATA MUNICIPAL CORPORATION Ward No: 093 ULB Name :KOLKATA MC ULB CODE: 79 Member Sl Address Name of Family Head Son/Daughter/Wife of BPL ID Year No Male Female Total 1 140(MOLLAHATI)P.A. SHAH RD. AAN HALDAR LATE PATIPABAN HALDAR 1 1 2 1 2 MOLLAHHATI 126 P.A.S RD ABHIJIT DAS LT PRANPALLAV DAS 2 2 4 2 3 19(DASNAGAR COLONY)GOBINDAPUR ABU SARKAR LATE D. SARKAR 3 1 4 4 4 GOBINDAPUR 52 GOBINDAPUR ROAD KOL 45 ADHIR HALDER LT AMBIK HALDER 2 2 4 5 5 8E ROHIM OSTAGER ROAD ADHIR NASKAR G. NASKAR 1 1 2 6 6 MOJIT PARA 96 PRINCE ANWAR SHAH ROAD ADKHIR CH MONDAL KRISHNA PADA MONDAL 4 3 7 7 7 80 P. A. SHAH ROAD AHAMED GARI S. MONDOL 1 3 4 8 8 3NO RAIL GATE GOBINDA PUR ROAD AJAY PATRA SUDHARNA PATRA 3 1 4 9 9 156 P.G.H. SHAH ROAD AJAY SAHA RAJANDRA SAHA 3 1 4 10 10 2 RAHIM OSTAGAR ROAD AJIT MANDAL SREEDHAR MANDAL 3 2 5 11 11 MOLLAHATI 140 PRINCE ANWAR SHAH ROAD AJIT MONDAL LT. LAL MOHAN MONDAL 2 1 3 12 12 126 P. A. SHAH RD. AJIT NASKAR LATE F. C. NASKAR 2 2 4 13 13 52 GOBINDAPUR ROAD AJIT PARAMANIK RATI KANTA PARAMANIK 2 2 4 14 14 11A ROHIM OSTAGAR ROAD AJOY DAS LATE J. DAS 3 3 6 15 15 94 P.G.MD. SHAH RD. AJOY KAYAL A. P. KAYAL 1 3 4 16 16 52 GOBINDAPUR ROAD AJOY PATRA SUDDNA PATRA 3 1 4 17 17 52 GOBINDAPUR ROAD AKADASI JALENI LATE GAGADHAR JALENI 2 3 5 18 18 F/28 KATJUNAGAR AKHOY DAS SATHEN CHARAN DAS 2 1 3 19 19 31(C.I.T SCHEME) P. -

16‐06‐20 13 5 Seals Garden Lane Cossipore 700002 1 1

Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 13 5 SEALS GARDEN LANE The premises itself 1 1 1 Cossipore 16‐06‐20 COSSIPORE 700002 14 The affected flat/the 59 Kalicharan Ghosh Rd standalone house 2 kolkata ‐ 700050 West 2 1 Sinthi Bengal India 16‐06‐20 14 The premises itself 21/123 RAJA MANINDRA 3 31 Paikpara ROAD BELGACHIA 700037 16‐06‐20 14 14A BIRPARA LANE The premises itself 4 kolkata ‐ 700030 West 31 Belgachia 16‐06 ‐20 BBlIdiengal India 14 The flat itself A4 6 R D B RD Kolkata ‐ 5 41 Paikpara 700002 West Bengal India 16‐06‐20 14 110/1A COSSIPORE Road The premises itself 6 Kolkata ‐ 700002 West 6 1 Chitpur 16‐06‐20 Bengal India 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 7 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 8 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 1 RAMKRISHNA LANE The premises itself 9 Kolkata ‐ 700003 West 7 1 Girish Mancha 16‐06‐20 Bengal India 14 The premises itself 4/2/1B KRISHNA RAM BOSE 10 STREET SHYAMPUKUR 10 2 Shyampukur KOLKATA 700004 16‐06‐20 14 T/1D Guru Charan Lane The premises itself 11 Kolkata ‐ 700004 West 10 2 Hatibagan 16‐06‐20 Bengal India 14 Adjacent common 47 1 SHYAMBAZAR STREET passage of affected hut 12 Kolk at a ‐ 700004 W est 10 2 Shyampu kur iilditiltdncluding toilet and -

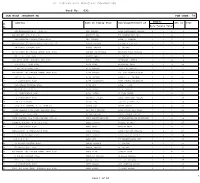

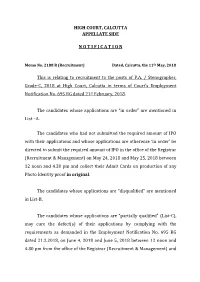

HIGH COURT, CALCUTTA APPELLATE SIDE N O T I F I C a T I O N This Is Relating to Recruitment to the Posts of P.A. / Stenographer

HIGH COURT, CALCUTTA APPELLATE SIDE N O T I F I C A T I O N Memo No. 2188 R (Recruitment) Dated, Calcutta, the 11th May, 2018 This is relating to recruitment to the posts of P.A. / Stenographer, Grade-C, 2018 at High Court, Calcutta in terms of Court’s Employment st Notification No. 695 RG dated 21 February, 2018. The candidates whose applications are “in order” are mentioned in List –A. The candidates who had not submitted the required amount of IPO with their applications and whose applications are otherwise ‘in order’ be directed to submit the required amount of IPO in the office of the Registrar (Recruitment & Management) on May 24, 2018 and May 25, 2018 between 12 noon and 4.30 pmin and original collect their Admit Cards on production of any Photo Identity proof . The candidates whose applications are “disqualified” are mentioned in List-B. The candidates whose applications are “partially qualified” (List-C), may cure the defect(s) of their applications by complying with the requirements as demanded in the Employment Notification No. 695 RG dated 21.2.2018, on June 4, 2018 and June 5, 2018 between 12 noon and 4.30 pm from the office of the Registrar (Recruitment & Management) and in collectoriginal. their Admit Cards on production of any Photo Identity proof In respect of the candidates in the group “partially qualified” (List-C), the defects are indicated in the “modalities of scrutiny” list (List-D). Sd/- Registrar (Recruitment & Management), A.S, High Court, Calcutta. LIST- A (IN ORDER) Sl. -

Supplementary List of BPL Households 2013-14 095 ULB

Supplementary List of BPL Households Ward No: 095 2013-14 ULB Name :KOLKATA MC ULB CODE: 79 Member Sl Address Name of Family Head Son/Daughter/Wife of BPL ID No Male Female Total 1 1/38 ,ARABINDA NAGAR ,JADAVPUR ,700032 ADITYA KUMAR PANDEY SURAJ PRASAD PANDEY 2 3 5 375 2 18A ,BIKRAMGARH COLONY ,BIKRAMGARH COLONY ,700032 ALO BRAHMA UPENDRA BRAHMA 0 1 1 376 3 3/120A ,AZADAGRH COLONY ,.......... ,700040 AMAR DAS LATE MANGAL DAS 3 1 4 377 4 121 ,REGEN PARK ,N S C BOSE ROAD ,700040 AMIT CHADRA DUTTA LATE AKUIT CHANDRA DUTTA 1 1 2 527 5 2/73A ,REGENT COLONY ,REGENT PARK ,700040 ANITA RANI MONDAL KANU MOHAN MONDAL 0 1 1 378 6 33E ,PRINCE GOLAM HOSSAINSHAH ROAD ,BIKRAM GALI ,700032 ANJALI CHOWDHURY LATE TAPAS CHOWDHURY 3 1 4 379 7 1/42 ,AZAD GARH COLONY ,MINA PARA ROAD ,700040 ANJALI DAS BIMAL DAS 1 2 3 380 8 81/13A ,REGENT COLONY ,REGENT COLONY ,700040 ANJALI GUHA LATE BIMAL KR. GUHA 0 1 1 381 9 44 ,NEW BIKRAMGARH ,NEW BIKRAMGARH ,700032 ANU SARKAR SIBESWAR SARKAR 1 1 2 382 10 22/B ,TIALGARH COLONY ROAD ,TILAK GARH COLONY ,700040 ANUPAMA DUTTA SITANGSHU DUTTA 2 2 4 383 11 22C ,TILAK NAGAR ,TOLLY GUNGE ,700040 ANURADHA DAS LATE HARI NARAYAN DAS 0 2 2 384 12 9/11 ,NEW BIKRAMGARH ,JADAVPUR ,700032 APARNA SAHA LATE PROJAL KUMAR SAHA 0 2 2 385 13 2/57 ,ARANBIBDANAGAR ,ARANBIBDANAGAR ,700040 ARATI SANYAL ANIL SANYAL 1 3 4 386 14 4/28 ,AZADGARH COLONY ,AZADGARH COLONY ,700040 ARATI DEBNATH LATE GOUR DEBNATH 5 7 10+ 387 15 2/A ,SAMAJGARH ,SANAJGARH ,700040 ARCHANA MONDAL JATIN MONDAL 2 2 4 388 16 8/83 ,BIJOYGARH COLONY ,JADAVPUR ,700032 ARUN BANIK LATE -

Active Agency List As on April 30,2016 Sr No Agency Name Address City State PIN STD Code Landline Mobile 1 P G Associates Room No

Active agency list as on April 30,2016 Sr no Agency Name Address City State PIN STD code Landline Mobile 1 P G Associates Room No. 5, First Floor, Ganesh Arcade, Near New Shah Market, Nehru Nagar, Agra, Agra Uttar Pradesh 282001 0562 3241045 Na 2 P C Associates 703-7Th Floor Maruti Plaza Sanjay Place Agra Agra Uttar Pradesh 282002 Na Na 9719344401 3 Kailash Associates S 13, Block No E 13/6, Raman Tower, Sanjay Place, Agra Agra Uttar Pradesh 202001 0562 3290521 9319072260/9319104191 4 Saraswat Associates Block No.11,Shop No.4,Shoes Market,Sanjay Place,Agra Agra Uttar Pradesh 282002 0562 4041762 9719544335 5 Shiv Associates Block S-8Shop No. 14 Shoe Marketsanjay Place Agra Agra Uttar Pradesh 282005 Na Na 09258318186 6 Sarbhoy Associates 7 Old Vijay Nagar Colony Agra 282004 Agra Uttar Pradesh 282004 0562 2852001/2852081 9719111717 7 Kaps Consultancy C/2/4 Shree Krishna Apartment Near Judges Bunglow Badakdev Ahmedabad Ahemdabad Gujrat 380054 Na Na 9909911983 8 Madhu Telecollection And Datacare 102, Samruddhi Complex, Opp.Sakar-Iii, Nr.C.U.Shah Colleage, Income Tax, Ahmedabad Gujarat 380009 079 40071404 Na 9 Shivam Agency 19,Devarchan Appartment Nr Bonny Travels Lane. Opp. Kochrab Ashram. Paladi Ahmedabadroom No-2 Ground Floor, Om Yashodhan Co-Operative Housing Societyltd SahyogAhmedabad Mandir Road, RamGujarat Maruti Road, Ghantali,380006 Nuapada,079 Thane(W)-4000602 30613001 9988093065 10 K P Services A/310,Tirthraj Complex,Next To Hasubhai Chambers,Opp.Town Hall Elliesbridge Ahmedabad Ahmedabad Gujarat 380006 079 40091657 9824653344 11 -

City Disaster Management Plan of Kolkata

CITY DISASTER MANAGEMENT PLAN OF KOLKATA 2020 KOLKATA MUNICIPAL CORPORATION 5, S.N. BANERJEE ROAD, KOLKATA - 13 Foreword Cities are important centres of modern societies that will continue to gain in importance in the future. Today, more than half the world’s population lives in urban areas. The high density and interdependence of urban lifestyles and work, and the growing dependence on increasingly complex infrastructure systems and services, are making cities more vulnerable to a variety of hazards — natural and man-made. These can be the result of technological, natural or social causes. The populous City of Kolkata is situated in the multi-hazard prone southern part of the state of West Bengal which has considerable risk of damage/loss of lives and property due to natural hazards like Cyclone, Earthquake and Flood even if we keep aside the threats due to human induced hazards as Fire, Accidents, Industrial & Chemical hazards etc. To minimize the losses due to disasters and to have a disaster resilient society, we must have clear understanding in regard to the type and strength of each of the probable threats which may cause disasters of medium or large scale in the city. The perception about disaster and its management has undergone a change following the enactment of the Disaster Management Act, 2005. The definition of disaster is now all encompassing that includes not only the events emerging from natural and man-made causes, but even those events which are caused by accident or negligence. There was a long felt need to capture information about all such events occurring across the sectors and efforts made to mitigate them in the city and to collate them at one place in a global perspective.