4 Anization Exempt from Incc,^ a Tax Return Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New York Fourth Quarter 2001 Analyzes: CBD Office Retail Apartments Suburban Office Industrial Local Economy Real a Publication of the Global New York Vol

NATIONAL REAL ESTATE INDEX M M ETRO New York ETRO Vol. 32 Fourth Quarter 2001 M M ARKET ARKET Analyzes: Reports: CBD Office Property Prices Retail Property Rents Apartments Sector Forecasts Suburban Office Demographic Highlights Industrial Job Formation Trends Local Economy Economic Base Profile Educational Achievement Tax Structure F F Quality of Life Factors ACTS ACTS A publication of the National Real Estate Index Global Real Analytics New York Vol. 32 ✯ The National Real Estate Index extends its deepest sympathies and condolences to the victims of the World Trade Center, Pentagon and Pennsylvania tragedies and their families and friends. We would also like to extend our gratitude to the rescue workers, medical personnel and other professionals and citizens who have come to the aid of those affected. Report Format This report is organized as follows. Section I costs and availability are detailed in Section VI. provides a snapshot that highlights the key eco- A series of other important factors, including nomic, demographic and real estate-related retail sales trends and international trade, are findings of the study. Sections II through IX reported in Section VII. Local and state fiscal provide an in-depth look (generally in a tabular policies, including taxes and federal spending, format) at the key economic, demographic, pub- are highlighted in Section VIII. Several key lic policy, and quality of life factors that can quality-of-life considerations are summarized in affect the demand for real estate. Section IX. In Section II, recent population trends are In Section X, local market price, rent and capi- reported. Section III analyzes the local eco- talization rate trends for the preceding 12 months nomic base and current labor force and job for- are reported. -

Asking Rents Remain Stable Despite Faltering Leasing Activity

MARKETVIEW SNAPSHOT Midtown Manhattan Office, May 2020 Asking rents remain stable despite faltering leasing activity Figure 1: Midtown Market Activity Apr. 2020 Mar. 2020 Apr. 2019 YTD 2019 YTD 2020 Leasing Activity 0.40 MSF 0.85 MSF 1.85 MSF 5.77 MSF 4.50 MSF Renewals 0.28 MSF 0.22 MSF 0.48 MSF 1.47 MSF 1.56 MSF Absorption (0.11) MSF (0.25) MSF 0.20 MSF (1.22) MSF (1.27) MSF Availability Rate 11.8% 11.8% 10.7% Vacancy Rate 8.0% 7.9% 7.6% Average Asking Rent $87.77 PSF $87.00 PSF $88.20 PSF Taking Rent Index 92.8% 93.2% 94.0% Source: CBRE Research, May 2020. MARKET HIGHLIGHTS • Monthly leasing activity totaled 405,000 sq. ft., 72% below the five-year monthly average of 1.43 million sq. ft. • Year-to-date leasing activity was down 22% from the same period last year. • Renewals totaled 277,000 sq. ft. in April, bringing the year-to-date total to 1.56 million sq. ft. • The availability rate was flat month-over-month but up 110 basis points (bps) year-over-year. • Net absorption was negative 109,000 sq. ft. in April, bringing the year-to-date total to negative 1.27 million sq. ft. • The average asking rent was essentially flat both month-over-month and year-over-year. • Sublease availability was 2.5%, with an average asking rent of $66.63 per sq. ft., up 18% year-over-year. Figure 2: Top Lease Transactions Size (Sq. -

Yale Law School 2007-2008

bulletin of yale university bulletin of yale Series 1o3 8 Number 10, 2007 August 2007–2008 Yale Law School Yale bulletin of yale university August 10, 2007 Yale Law School Periodicals postage paid Periodicals Connecticut Haven, New 06520-8227 CT New Haven Haven New bulletin of yale university bulletin of yale Bulletin of Yale University The University is committed to basing judgments concerning the admission, education, and employment of individuals upon their qualifications and abilities and a∞rmatively Postmaster: Send address changes to Bulletin of Yale University, seeks to attract to its faculty, sta≠, and student body qualified persons of diverse back- PO Box 208227, New Haven CT 06520-8227 grounds. In accordance with this policy and as delineated by federal and Connecticut law, Yale does not discriminate in admissions, educational programs, or employment PO Box 208230, New Haven CT 06520-8230 against any individual on account of that individual’s sex, race, color, religion, age, Periodicals postage paid at New Haven, Connecticut disability, status as a special disabled veteran, veteran of the Vietnam era, or other covered veteran, or national or ethnic origin; nor does Yale discriminate on the basis of Issued seventeen times a year: one time a year in May, November, and December; sexual orientation or gender identity or expression. two times a year in June; three times a year in July and September; six times a year University policy is committed to a∞rmative action under law in employment of in August women, minority group members, individuals with disabilities, special disabled veterans, veterans of the Vietnam era, and other covered veterans. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): April 26, 2012 (April 25, 2012) SL GREEN REALTY CORP. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) MARYLAND (STATE OF INCORPORATION) 1-13199 13-3956775 (COMMISSION FILE NUMBER) (IRS EMPLOYER ID. NUMBER) 420 Lexington Avenue New York, New York 10170 (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE) (212) 594-2700 (REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 2.02. Results of Operations and Financial Condition Following the issuance of a press release on April 25, 2012 announcing the Company’s results for the first quarter ended March 31, 2012, the Company intends to make available supplemental information regarding the Company’s operations that is too voluminous for a press release. The Company is attaching the press release as Exhibit 99.1 and the supplemental package as Exhibit 99.2 to this Current Report on Form 8-K. -

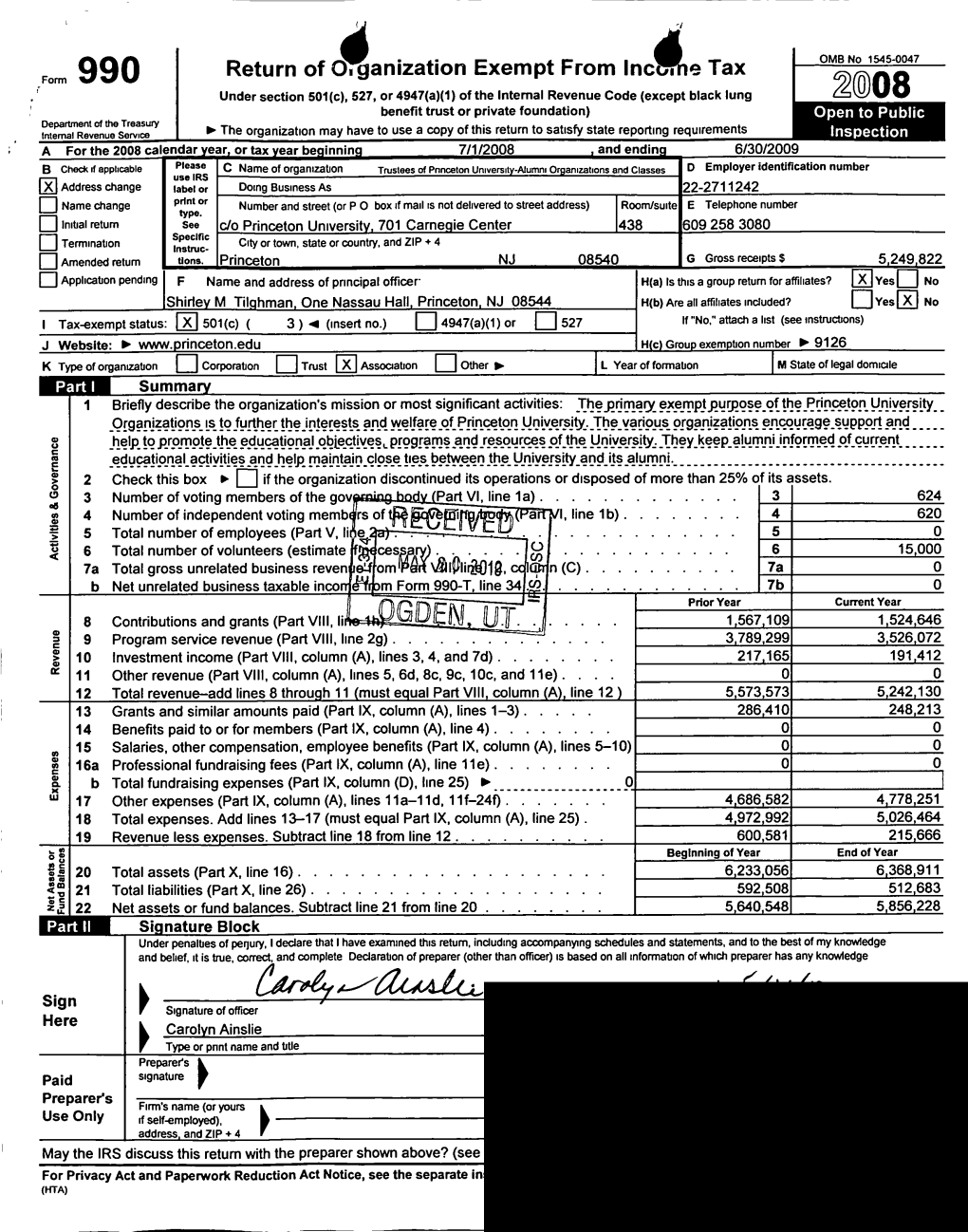

Return of Organization Exempt from Income Tax

0• • -19/ OMB No 1545-0047 Return of Organization Exempt From Income Tax 009 Form 990 Under section 501(c), 527, or 4947 (a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation ) • . - . Department of the Treasury Internal Revenue Service ► The organization may have to use a copy of this return to satisfy state reporting requirements . A For the 2009 calendar year or tax year beg inning 7/1/2009 and endin 6/30/2010 Please B Check if applicable C Name of organization Trustees of Princeton Universi ty-Alumni Organizations and Classes D Employer identification number - use IRS q Address change label or Doing Business As 22-2711242 q Name change print or Number and street (or P 0 box if mall is not delivered to street address) Room/suite E Telephone number typ q Initial return See c/o Princeton Universi ty, 701 Carneg ie Center 438 (609) 258-3080 q Terminated Specific City or town , state or country, and ZIP + 4 lnstruc- q Amended return tions Princeton NJ 08540 G Gross receipts $ 5 , 529 , 459 q Application pending F Name and address of principal officer H(a) Is this a group return for affiliates? qX No IShirley M . Tilg hman , One Nassau Hall , Princeton , NJ 08544 H(b) Are all affiliates Included? q Yes 191 No I Tax-exempt status q 501 (c) ( 3) ' (Insert no) q 4947 (a)(1) or q 527 If "No," attach a list (see instructions) J Website : ► www p rinceton edu H(c) Grou exem ption number ► 9126 q q q q K Form of organization Corporation Trust Association Other ► L Year of formation M State of legal domicile Summa ry 1 Briefly describe the organization ' s mission or most significant activities . -

July 2018 July 8Th, 2018 12 Men and 8 Women NBC's Meet the Press

July 2018 July 8th, 2018 12 men and 8 women NBC's Meet the Press with Chuck Todd: 5 men and 1 woman Sen. Roy Blunt (M) Sen. Dick Durbin (M) Frm. Mayor Rudy Giuliani (M) Eugene Robinson (M) Susan Page (W) Danielle Pletka (M) CBS's Face the Nation with Margaret Brennan: 4 men and 2 women Amb. Kay Bailey Hutchinson (W) Sen. Joni Ernst (W) Sen. Christopher Coons (M) Mark Landler (M) Reihan Salam (M) Toluse Olorunnipa (M) ABC's This Week with George Stephanopoulos: 5 men and 2 women Frm. Mayor Rudy Giuliani (M) Alan Dershowitz (M) Asha Rangappa (W) Leonard Leo (M) Sen. Richard Blumenthal (M) Sara Fagen (W) Patrick Gaspard (M) CNN's State of the Union with Jake Tapper: *With Guest Host Dana Bash 2 men and 1 woman Dr. Carole Lieberman (W) Dr. Jean Christophe Romagnoli (M) Frm. Mayor Rudy Giuliani (M) Fox News' Fox News Sunday with Chris Wallace: *With Guest Host Dana Perino 1 man and 2 women Amb. Kay Bailey Hutchinson (W) Sen. Lindsey Graham (M) Ilyse Hogue (W) July 15th, 2018 22 men and 6 women NBC's Meet the Press with Chuck Todd: 5 men and 1 woman Amb. Jon Huntsman (M) Sen. Mark Warner (M) Joshua Johnson (M) Amy Walter (W) Hugh Hewitt (M) Sen. Dan Sullivan (M) CBS's Face the Nation with Margaret Brennan: 7 men and 2 women Rep. Trey Gowdy (M) Sen. John Cornyn (M) Frm. Amb. Victoria Nuland (W) Tom Donilon (M) Rep. Joseph Crowley (M) Rachael Bade (W) Ben Domenech (M) Gerald Seib (M) David Nakamura (M) ABC's This Week with George Stephanopoulos: *With Guest Host Jonathan Karl 3 men and 2 women Amb. -

Palmer's Views of New York, Past and Present

COPy RIGHT /909 BY ROH'-HT M. PAl-WER . /A MS TZZjEB— Avery Architectural and Fine Arts Library Gift of Seymour B. Durst Old York Library ov<~ £io sr fc\ \ 3 PALMER'S VIEWS- 2—PALMER'S VIEWS VIEW OF FORT AMSTERDAM on the Manhattan. (Original in Holland.) Erected 1623, finished 1635 by Gov- ernor Van Twiller. Peter Minuit bought the Island, about 22,000 acres, for $24, a few baubles, beads and some rum. VIEW OF BATTERY PARK as it appeared in the more recent past, yet a marked contrast with the present-day view as seen on opposite page, showing the Whitehall Building, etc. L PALMKR'S VIEWS— Jersey Shore. Battery Park. Pennsylvania Freight Depots. Battery Place. Washington Street. WHITEHALL BUILDING, Battery Place, West to Washington Street, overlooking Hudson River and Battery Park, twenty stories, 254 feet high; one of the most conspicuous office buildings in the city as seen from the harbor, commanding view of New York Bay, New Jersey and South Brooklyn. General offices of the Otis Elevator Co., incorporated November, 1898, with branch offices in all principal cities. Otis elevators are successfully used in the tallest structures of the largest cities in the world. Eiffel Tower, 1,000 feet high, Metropolitan Life Tower, Singer Building, Hudson Terminal Buildings, etc.. etc. 4—PALMER'S VIEWS THE OLD FORT, built by Peter Minuit, 1626, was on site of present Custom House. (A.) White house built on Strand by Governor Stuyvesant; (B.) House built by Jacob Leisler ; first brick house on Manhattan. (C.) The "Strand." now Whitehall Street; (D.) Pearl Street; (E.) Rampart, now State Street; (G.) Mouth of Broad NEW AMSTERDAM, a small city on Manhattan Island, New Holland, North America, now St. -

How the Political Red Lines Disappeared: a Modern History of American Democratic Norm Decline

Wesleyan University The Honors College How the Political Red Lines Disappeared: A Modern History of American Democratic Norm Decline by Peter Wallace Dunphy Class of 2018 A thesis submitted to the faculty of Wesleyan University in partial fulfillment of the requirements for the Degree of Bachelor of Arts with Departmental Honors in Government and American Studies Middletown, Connecticut April, 2018 1 “Well, when the president does it, that means that it is not illegal.” - Richard Nixon 2 ACKNOWLEDGEMENTS Hillary Clinton once said it takes a village to raise a child. I think it took closer to a metropolis to write this thesis. I would be remiss if I did not first thank Professor Logan Dancey for serving as my thesis advisor. The most rewarding part of writing a thesis was cultivating an intellectual relationship with Professor Dancey. Thank you for providing me with academic, professional, and emotional encouragement throughout this year-long process. If anyone high up in the Government Department is reading this, I hope this serves as a strong recommendation to give Professor Dancey tenure. Throughout the year, I also had the immense pleasure of working with the Congressional Politics and Elections Lab to workshop theses and independent research. This group of fantastic scholars, Emma Solomon, Carly King, Tess Counts, and Sam Prescott, both provided incredible feedback while also serving as a fantastic way to spend every Tuesday night. Appreciation beyond words must be given to Frank Tucci, who has continued to support me throughout this entire endeavor, no matter how annoying it must have been to hear me talk about democratic norms for an entire year. -

America's Extraordinary Economic Gamble

The ascent of Elon Musk Germany’s miserable coalition Winter Olympics: slope-a-dope Guerrilla drones FEBRUARY 10TH–16TH 2018 Running hot America’s extraordinary economic gamble Only 1 in 10 organizations can deliver all of their strategic initiatives successfully! See what Leaders are doing at www.brightline.org/eiu-report Strategy has little value until it is implemented. In a world where disruption can happen overnight, moving rapidly from strategy design to delivery is critical. To understand why many organizations fail to bridge the gap between strategy design and delivery, Brightline Initiative commissioned The Economist Intelligence Unit (EIU) to conduct a global multi-sector survey of 500 senior executives from companies with annual revenues of $1 billion or more. Contents The Economist February 10th 2018 5 8 The world this week United States 33 The economy Leaders The great experiment 11 America’s economy 35 Politics and the FBI Running hot Against the law 12 Germany 35 Wildfire and fraud Reheating the GroKo Insult to injury 12 Philanthropy 36 Politics in South Dakota The billionaires and the Plains speaking Falcon Heavy 37 The Great Lakes German politics A new 13 Telecoms Mind-bending stuff government at long last. Next-generation thinking 38 Lexington Honest Injun Unfortunately, it will look very 14 Drugs in sport like the old one: leader, page On the cover Dope on the slopes 12. Germany’s main parties America is about to test the The Americas conclude a coalition deal, merits of running an economy Letters 39 Venezuala page 48 hot. Expect more bumpy 16 On Honduras, Italy, tech Lights out for democracy weeks: leader, page 11. -

Yaleceo Summit

YALE CEO SUMMIT Richard C. Adkerson Vice Chairman, President & CEO Freeport-McMoRan Mohamed Al Hammadi Chief Executive Officer Emirates Nuclear Energy Corporation Bader Saeed Al Lamki Chief Executive Officer Tabreed *William D. Anderson Senior Managing Director Evercore Michael Apkon Chief Executive Officer Tufts Medical Center Adam M. Aron President & Chief Executive Officer AMC Entertainment Norman J. Bartczak Founder, Financial Statement Investigation Professor, Columbia Business School Joseph Barton Founding General Partner White Rock Capital Management Bruce Batkin Vice Chairman Terra Capital Partners Michael Beer Professor Emeritus, Harvard Business School Chair, Ctr. for Higher Ambition Leadership *Taher Behbehani Senior Vice President Samsung Electronics America Lincoln Benet Chief Executive Officer Access Industries Jeffrey L. Bewkes Former Chairman & CEO Time Warner Inc. Arvind Bhambri Marshall Executive Education University of Southern California *Christina Bieniek Principal Deloitte Consulting LLP Dan Bigman Chief Content Officer & Editor-in-Chief Chief Executive Group Lloyd C. Blankfein Senior Chairman The Goldman Sachs Group *Morgan Brennan Co-Anchor CNBC Norman M. Brothers Jr Senior Vice President & General Counsel UPS Ashton B. Carter 25th Secretary US Department of Defense David Centner Chairman Centner Family Office James S. Chanos Founder & Managing Partner Kynikos Associates Kerwin Charles Dean YALE School of Management Sanford R. Climan President Entertainment Media Ventures John Henry Clippinger Research Scientist, City Sciences Group MIT Media Lab Marc S. Cooper Chief Executive Officer PJ Solomon • Sponsor YALE CEO SUMMIT Marshall Cooper Chief Executive Officer Chief Executive Group Wayne Cooper Executive Chairman Chief Executive Group James S. Crown Chairman & Chief Executive Officer Henry Crown and Company Neil de Crescenzo President & Chief Executive Officer Change Healthcare Kim G. -

Times Square Redevelopment: a Below Grade View

Missouri University of Science and Technology Scholars' Mine International Conference on Case Histories in (2004) - Fifth International Conference on Case Geotechnical Engineering Histories in Geotechnical Engineering 15 Apr 2004, 10:45am - 12:00pm Times Square Redevelopment: A Below Grade View Tony D. Canale Mueser Rutledge Consulting Engineers, New York, New York James L. Kaufman Mueser Rutledge Consulting Engineers, New York, New York George J. Tamaro Mueser Rutledge Consulting Engineers, New York, New York Follow this and additional works at: https://scholarsmine.mst.edu/icchge Part of the Geotechnical Engineering Commons Recommended Citation Canale, Tony D.; Kaufman, James L.; and Tamaro, George J., "Times Square Redevelopment: A Below Grade View" (2004). International Conference on Case Histories in Geotechnical Engineering. 6. https://scholarsmine.mst.edu/icchge/5icchge/session11/6 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Article - Conference proceedings is brought to you for free and open access by Scholars' Mine. It has been accepted for inclusion in International Conference on Case Histories in Geotechnical Engineering by an authorized administrator of Scholars' Mine. This work is protected by U. S. Copyright Law. Unauthorized use including reproduction for redistribution requires the permission of the copyright holder. For more information, please contact [email protected]. TIMES SQUARE REDEVELOPMENT: A BELOW GRADE VIEW Paper No. 11.07 Tony D. Canale, PE James L. Kaufman, PE George J. Tamaro, PE Mueser Rutledge Consulting Engineers Mueser Rutledge Consulting Engineers Mueser Rutledge Consulting Engineers New York, NY (USA) New York, NY (USA) New York, NY (USA) ABSTRACT The paper describes the design and construction of the foundations for two new high-rise structures in New York City (NYC). -

The Smear Campaign Against Mueller: Debunking the Nunes Memo and the Other Attacks on the Russia Investigation

The Smear Campaign Against Mueller: Debunking the Nunes Memo and the Other Attacks on the Russia Investigation Noah Bookbinder, Norman Eisen, Caroline Fredrickson, and Kristin Amerling1 January 31, 2018 1 Noah Bookbinder is the executive director of Citizens for Responsibility and Ethics in Washington (CREW) and a former federal corruption prosecutor. Norman Eisen, a senior fellow at the Brookings Institution, is the chairman of CREW, a former chief White House ethics lawyer and Ambassador to the Czech Republic. Caroline Fredrickson is president of the American Constitution Society (ACS). Kristin Amerling is special counsel for investigations for the joint ACS-CREW Presidential Investigation Education Project and former chief counsel to several congressional committees. This memorandum was prepared for the Presidential Investigation Education Project, a joint initiative by ACS and CREW to promote informed public evaluation of the investigations by Special Counsel Robert Mueller and others into Russian interference in the 2016 election and related matters. This effort includes developing and disseminating legal analysis of key issues that emerge as the inquiries unfold and connecting members of the media and public with ACS and CREW experts and other legal scholars who are writing on these matters. The authors would like to thank Jennifer Ahearn, Maya Gold, and Conor Shaw at CREW; Sathya Gosselin, Tamara Freilich, and Jeanette Bayoumi at Hausfeld LLP; and many others for their contributions to this report. Table of Contents Introduction .................................................................................................. 3 Executive Summary ..................................................................................... 5 I. Mueller Does Not Have Conflicts of Interest that Disqualify Him from Being Special Counsel ........................... 8 II. Mueller’s Investigative Team Does Not Face Conflicts of Interest ......................................................................