Mapletreelog Acquires Malaysian Property for Rm32 Million

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pandamaran Interpretation of Quantum Mechanics: the Second Interpretation

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/341756038 Pandamaran Interpretation of Quantum Mechanics: The Second Interpretation Preprint · May 2020 CITATIONS READS 0 64 1 author: Andrew Das Arulsamy Institute of Interdisciplinary Science, Pandamaran, Malaysia 108 PUBLICATIONS 464 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: Pancharatnam Phase View project All content following this page was uploaded by Andrew Das Arulsamy on 25 December 2020. The user has requested enhancement of the downloaded file. 1 Pandamaran Interpretation of Quantum Mechanics: The Second Interpretation Andrew Das Arulsamy Condensed Matter Group, Institute of Interdisciplinary Science, No. 24, level-4, Block C, Lorong Bahagia, Pandamaran, 42000 Port Klang, Selangor DE, Malaysia e-mail: [email protected] Abstract Interpreting quantum mechanics is a hard problem basically because it means explaining why and how the mathematics exploited to formulate wave-particle duality are related to obser- vations or reality. Consequently, interpretation of quantum mechanics should involve proper physical mathematics and physical logic, which is often not the case from the Copenhagen interpretation. Here, we shall revisit all the postulates of quantum mechanics with proper physics and physical logic and reconstruct them to establish the physically less-complex Pan- damaran interpretation of quantum mechanics. Keywords: Foundations of Quantum Mechanics; Copenhagen interpretation; Pandamaran interpretation. §1. Introduction Due to unsettled issues within the foundations of quantum mechanics, we have three main options for scientists to choose from when asked about the position of a ‘quantum’ particle before measurement.[1] A quantum particle here usually means an electron or a photon, which can be detected as free particles. -

Pulih Sepenuhnya Pada 8:00 Pagi, 21 Oktober 2020 Kumpulan 2

LAMPIRAN A SENARAI KAWASAN MENGIKUT JADUAL PELAN PEMULIHAN BEKALAN AIR DI WILAYAH PETALING, GOMBAK, KLANG/SHAH ALAM, KUALA LUMPUR, HULU SELANGOR, KUALA LANGAT DAN KUALA SELANGOR 19 OKTOBER 2020 WILAYAH : PETALING ANGGARAN PEMULIHAN KAWASAN Kumpulan 1: Kumpulan 2: Kumpulan 3: Pulih Pulih Pulih BIL. KAWASAN sepenuhnya sepenuhnya sepenuhnya pada pada pada 8:00 pagi, 8:00 pagi, 8:00 pagi, 21 Oktober 2020 22 Oktober 2020 23 Oktober 2020 1 Aman Putri U17 / 2 Aman Suria / 3 Angkasapuri / 4 Bandar Baru Sg Buloh Fasa 3 / 5 Bandar Baru Sg. Buloh Fasa 1&2 / 6 Bandar Baru Sri Petaling / 7 Bandar Kinrara / 8 Bandar Pinggiran Subang U5 / 9 Bandar Puchong Jaya / 10 Bandar Tasek Selatan / 11 Bandar Utama / 12 Bangsar South / 13 Bukit Indah Utama / 14 Bukit Jalil / 15 Bukit Jalil Resort / 16 Bukit Lagong / 17 Bukit OUG / 18 Bukit Rahman Putra / 19 Bukit Saujana / 20 Damansara Damai (PJU10/1) / 21 Damansara Idaman / 22 Damansara Lagenda / 23 Damansara Perdana (Raflessia Residency) / 24 Denai Alam / 25 Desa Bukit Indah / 26 Desa Moccis / 27 Desa Petaling / 28 Eastin Hotel / 29 Elmina / 30 Gasing Indah / 31 Glenmarie / 32 Hentian Rehat dan Rawat PLUS (R&R) / 33 Hicom Glenmarie / LAMPIRAN A SENARAI KAWASAN MENGIKUT JADUAL PELAN PEMULIHAN BEKALAN AIR DI WILAYAH PETALING, GOMBAK, KLANG/SHAH ALAM, KUALA LUMPUR, HULU SELANGOR, KUALA LANGAT DAN KUALA SELANGOR 19 OKTOBER 2020 WILAYAH : PETALING ANGGARAN PEMULIHAN KAWASAN Kumpulan 1: Kumpulan 2: Kumpulan 3: Pulih Pulih Pulih BIL. KAWASAN sepenuhnya sepenuhnya sepenuhnya pada pada pada 8:00 pagi, 8:00 pagi, 8:00 -

Collaboration, Christian Mission and Contextualisation: the Overseas Missionary Fellowship in West Malaysia from 1952 to 1977

Collaboration, Christian Mission and Contextualisation: The Overseas Missionary Fellowship in West Malaysia from 1952 to 1977 Allen MCCLYMONT A thesis submitted in partial fulfilment of the requirements of Kingston University for the degree of Doctor of Philosophy in History. Submitted June 2021 ABSTRACT The rise of communism in China began a chain of events which eventually led to the largest influx of Protestant missionaries into Malaya and Singapore in their history. During the Malayan Emergency (1948-1960), a key part of the British Government’s strategy to defeat communist insurgents was the relocation of more than 580,000 predominantly Chinese rural migrants into what became known as the ‘New Villages’. This thesis examines the response of the Overseas Missionary Fellowship (OMF), as a representative of the Protestant missionary enterprise, to an invitation from the Government to serve in the New Villages. It focuses on the period between their arrival in 1952 and 1977, when the majority of missionaries had left the country, and assesses how successful the OMF was in fulfilling its own expectation and those of the Government that invited them. It concludes that in seeking to fulfil Government expectation, residential missionaries were an influential presence, a presence which contributed to the ongoing viability of the New Villages after their establishment and beyond Independence. It challenges the portrayal of Protestant missionaries as cultural imperialists as an outdated paradigm with which to assess their role. By living in the New Villages under the same restrictions as everyone else, missionaries unconsciously became conduits of Western culture and ideas. At the same time, through learning local languages and supporting indigenous agency, they encouraged New Village inhabitants to adapt to Malaysian society, while also retaining their Chinese identity. -

Micare Panel Gp List (Aso) for (December 2019) No

MICARE PANEL GP LIST (ASO) FOR (DECEMBER 2019) NO. STATE TOWN CLINIC ID CLINIC NAME ADDRESS TEL OPERATING HOURS REGION : CENTRAL 1 KUALA LUMPUR JALAN SULTAN EWIKCDK KLINIK CHIN (DATARAN KEWANGAN DARUL GROUND FLOOR, DATARAN KEWANGAN DARUL TAKAFUL, NO. 4, 03-22736349 (MON-FRI): 7.45AM-4.30PM (SAT-SUN & PH): CLOSED SULAIMAN TAKAFUL) JALAN SULTAN SULAIMAN, 50000 KUALA LUMPUR 2 KUALA LUMPUR JALAN TUN TAN EWGKIMED KLINIK INTER-MED (JALAN TUN TAN SIEW SIN, KL) NO. 43, JALAN TUN TAN SIEW SIN, 50050 KUALA LUMPUR 03-20722087 (MON-FRI): 8.00AM-8.30PM (SAT): 8.30AM-7.00PM (SUN/PH): 9.00AM-1.00PM SIEW SIN 3 KUALA LUMPUR WISMA MARAN EWGKPMP KLINIK PEMBANGUNAN (WISMA MARAN) 4TH FLOOR, WISMA MARAN, NO. 28, MEDAN PASAR, 50050 KUALA 03-20222988 (MON-FRI): 9.00AM-5.00PM (SAT-SUN & PH): CLOSED LUMPUR 4 KUALA LUMPUR MEDAN PASAR EWGCDWM DRS. TONG, LEOW, CHIAM & PARTNERS (CHONG SUITE 7.02, 7TH FLOOR WISMA MARAN, NO. 28, MEDAN PASAR, 03-20721408 (MON-FRI): 8.30AM-1.00PM / 2.00PM-4.45PM (SAT): 8.30PM-12.45PM (SUN & PH): DISPENSARY)(WISMA MARAN) 50050 KUALA LUMPUR CLOSED 5 KUALA LUMPUR MEDAN PASAR EWGMAAPG KLINIK MEDICAL ASSOCIATES (LEBUH AMPANG) NO. 22, 3RD FLOOR, MEDAN PASAR, 50050 KUALA LUMPUR 03-20703585 (MON-FRI): 8.30AM-5.00PM (SAT-SUN & PH): CLOSED 6 KUALA LUMPUR MEDAN PASAR EWGKYONGA KLINIK YONG (MEDAN PASAR) 2ND FLOOR, WISMA MARAN, NO. 28, MEDAN PASAR, 50050 KUALA 03-20720808 (MON-FRI): 9.00AM-1.00PM / 2.00PM-5.00PM (SAT): 9.00AM-1.00PM (SUN & PH): LUMPUR CLOSED 7 KUALA LUMPUR JALAN TUN PERAK EWPISRP POLIKLINIK SRI PRIMA (JALAN TUN PERAK) NO. -

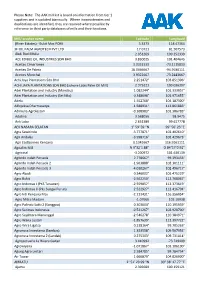

The AAK Mill List Is Based on Information from Tier 1 Suppliers and Is Updated Biannually

Please Note: The AAK mill list is based on information from tier 1 suppliers and is updated biannually. Where inconsistencies and duplications are identified, they are resolved where possible by reference to third party databases of mills and their locations. Mill/ crusher name Latitude Longitude (River Estates) - Bukit Mas POM 5.3373 118.47364 3F OIL PALM AGROTECH PVT LTD 17.0721 81.507573 Abdi Budi Mulia 2.051269 100.252339 ACE EDIBLE OIL INDUSTRIES SDN BHD 3.830025 101.404645 Aceites Cimarrones 3.0352333 -73.1115833 Aceites De Palma 18.0466667 -94.9186111 Aceites Morichal 3.9322667 -73.2443667 Achi Jaya Plantations Sdn Bhd 2.251472° 103.051306° ACHI JAYA PLANTATIONS SDN BHD (Johore Labis Palm Oil Mill) 2.375221 103.036397 Adei Plantation and Industry (Mandau) 1.082244° 101.333057° Adei Plantation and Industry (Sei Nilo) 0.348098° 101.971655° Adela 1.552768° 104.187300° Adhyaksa Dharmasatya -1.588931° 112.861883° Adimulia Agrolestari -0.108983° 101.386783° Adolina 3.568056 98.9475 Aek Loba 2.651389 99.617778 AEK NABARA SELATAN 1° 59' 59 "N 99° 56' 23 "E Agra Sawitindo -3.777871° 102.402610° Agri Andalas -3.998716° 102.429673° Agri Eastborneo Kencana 0.1341667 116.9161111 Agrialim Mill N 9°32´1.88" O 84°17´0.92" Agricinal -3.200972 101.630139 Agrindo Indah Persada 2.778667° 99.393433° Agrindo Indah Persada 2 -1.963888° 102.301111° Agrindo Indah Persada 3 -4.010267° 102.496717° Agro Abadi 0.346002° 101.475229° Agro Bukit -2.562250° 112.768067° Agro Indomas I (PKS Terawan) -2.559857° 112.373619° Agro Indomas II (Pks Sungai Purun) -2.522927° -

PEMNEWS WISMA ADVENTIST, 22-1, Jalan 2/114, Kuchai Business Centre , Jalan Kuchai Issue No.44 — Nov-Dec 2013 Lama , 58200 Kuala Lumpur Office No

PEMNEWS WISMA ADVENTIST, 22-1, Jalan 2/114, Kuchai Business Centre , Jalan Kuchai Issue No.44 — Nov-Dec 2013 Lama , 58200 Kuala Lumpur Office No. 03-79847795, Fax No. 03-79844600 www.facebook.com/peninsularmalaysia.com UPDATES OF JANUARY 2014 PEM EVENTS Ten Days of Prayer Message from Joshua Chee, Treasurer, Peninsular Malaysia Mission God poured out His Spirit in P e n t e c o s t Having begun the year with a budget of half a million deficit (RM500,000+) power after His our Mission has still progressed fairly well in this year. I believe this stems church spent from the faithfulness of our members and stewardship education. The Tithe ten days to- and offerings coming in on a monthly basis confirmed that both play an im- gether, plead- ing for His portant role. promised blessing. He is ready to do it again today! All around the world, Adventist churches I praise God for the good work of our pastors in nurturing and caring for our are experiencing the renewal of the Holy Spirit church members. It is Christ reflected in your care and concern through your ministry that by following the disciples’ example and partici- pating in Ten Days of Prayer. has brought PEM to where it is now. Church elders, pastors, and lay leaders have led prayer groups of all sizes in homes, schools, Above all, I praise God for His good work within each member, drawing each one of us churches, online forums, and teleconference. closer to Him through His loving kindness. As the year comes to a close, I urge you to look Groups unable to meet during the designated days have chosen an alternate ten days and towards the prize which He has set before us. -

CAC) Negeri Selangor NEGERI SELANGOR DIKEMASKINI 9/4/2021 JAM 12.00 TGH PKD PETALING PKD GOMBAK LOKASI CAC WAKTU OPERASI NO

Senarai COVID-19 Assessment JABATAN KESIHATAN Centre (CAC) Negeri Selangor NEGERI SELANGOR DIKEMASKINI 9/4/2021 JAM 12.00 TGH PKD PETALING PKD GOMBAK LOKASI CAC WAKTU OPERASI NO. TELEFON LOKASI CAC WAKTU OPERASI NO. TELEFON ISNIN-JUMAAT KK KUANG 03-60371092 011-64055718 10.00 PG – 12.00 TGH STADIUM MELAWATI (Telegram) ISNIN – JUMAAT SEKSYEN 13, 011-58814350 KK RAWANG 03-60919055 9.00 PG – 12.00 TGH ISNIN- KHAMIS SHAH ALAM 011-58814280 KK SELAYANG BARU 2.00 – 4.00 PTG 03-61878564 (Hanya waktu operasi sahaja) KK TAMAN EHSAN JUMAAT 03-62727471 2.45 – 4.00 PTG KK SUNGAI BULOH 03-61401293 PKD KLANG ---------------------- LOKASI CAC WAKTU OPERASI NO. TELEFON KK BATU ARANG 03-60352287 NO. TEL. BILIK KK GOMBAK SETIA 03-61770305 ISNIN – KHAMIS GERAKAN CDC 8.30 PG – 12.30 TGH KK AU2 DAERAH 03-42519005 Patient Clinical Assesment ( ) KK BATU 8 03-61207601/7607/ 03-61889704 2.00 – 5.00 PTG 7610 STADIUM HOKI (Home Assessment Monitoring) 010-9797732 KK HULU KELANG 03-41061606 PANDAMARAN (WhatsApp) JUMAAT (Hanya waktu operasi sahaja) 8.30 – 11.30 PG PKD SEPANG (Patient Clinical Assesment) 3.00 – 5.00 PTG LOKASI CAC WAKTU OPERASI NO. TELEFON (Home Assessment Monitoring) ISNIN – KHAMIS 011-11862720 8.00 PG – 1.00 PTG (Hanya waktu operasi sahaja) PKD KUALA LANGAT STADIUM MINI JUMAAT 019-6656998 BANDAR BARU LOKASI CAC WAKTU OPERASI NO. TELEFON 8.00 PG – 12.15 TGH (WhatsApp) SALAK TINGGI (Hanya waktu operasi sahaja) KK TELOK PANGLIMA SABTU & CUTI UMUM Email: GARANG ISNIN – KHAMIS 9.00 PG – 12.00 TGH [email protected] 2.00 PTG – 4.00 PTG KK TELOK DATOK JUMAAT 03-31801036 / PKD HULU SELANGOR 3.00 PTG – 4.30 PTG KK BUKIT 014-3222389 LOKASI CAC WAKTU OPERASI NO. -

Alternate Name Handphone Number Address PANDAN JAYA 42-44 012

Handphone Alternate Name Number Address 42 & 44, JALAN PANDAN 3/2, PANDAN JAYA, PANDAN JAYA 42-44 012-6580156 CHERAS, 55100 KUALA LUMPUR. 1012 & 1014, JALAN MERU 41050 KLANG, MERU 1012 & 1014 012-6580957 SELANGOR. 40&40-1, 42&42-1, BLOCK C, VISTA MAGNA, BATU 7, KEPONG 40-42 012-6580794 JALAN KEPONG, KEPONG, 52100 K.L. NO. 27-G, 29-G & 31-G, JALAN PJU 5/20, KOTA DAMANSARA 012-6580938 PUSAT PERDAGANGAN KOTA DAMANSARA PJU5, 47810 PETALING JAYA, SELANGOR. NO. 39-G, 39-1, 40-G & 40-1, JALAN NAUTIKA U20/A, SUNGAI BULOH 012-6954840 SEKSYEN U20, PUSAT KOMERSIL TSB, 40160 SHAH ALAM, SELANGOR. NO. 64 & 66 JALAN BESAR, PEKAN KAPAR, PEKAN KAPAR 012-6579017 42200 KLANG, SELANGOR. A15-G, A16-G, A17-G, JALAN REEF 1/1, PUSAT PERNIAGAAN REEF, RAWANG (THE REEF) 012-6589085 47800 RAWANG, SELANGOR. NO. 22 & 24, JALAN WAWASAN 2/12, BANDAR BARU AMPANG, BANDAR BARU AMPANG 012-6580743 68000 AMPANG, SELANGOR. NO.13A-G,13A-1,13A-2,15G,15-1 & 15-2, JALAN C 180/1, CHERAS BALAKONG 012-3963910 DATARAN C180, JALAN BALAKONG, BATU 11, 43200 CHERAS, SELANGOR. NO 30-G, 32-G, 32A-G, JALAN PUTERI 2/5, Bandar Puteri Puchong 012-6582054 BANDAR PUTERI, 47100 PUCHONG, SELANGOR SS2, PJ 012-6589044 NO.23-G, 25-G, 25-1 & 25-2, JALAN SS2/75, 47300 PETALING JAYA, SELANGOR. NO. 37G, 39G & 1ST FLOOR, AND 41G, JALAN KEMUNING A33/A, KEMUNING UTAMA 012-7748440 KEMUNING UTAMA, 40400 SHAH ALAM, SELANGOR. NO. 37, 37A, 39, 39A, JALAN ANGGERIK VANILLA X31/X, KOTA KEMUNING 012-6343840 KOTA KEMUNING, 40460 SHAH ALAM, SELANGOR. -

Trio Serviced Apartment E Pamphlet

TRANSIT • TREND • TRANSFORM SERVICED APARTMENT FREEHOLD All areas and / or measurements stated in this brochure are approximates only and are subject to final survey, and the above plans are subject to change(s) as may be required by the relevant authorities. Artist’s impression only Never before in Klang is there a mixed development that achieves such sophistication in contemporary quality, design and sustainability. Paving the way for a perfect new experience in TRANSFORMING COMMUNITY lavish living amidst modern amenities and all the conveniences CULTIVATING AN ICONIC & of an urban lifestyle. WHOLESOME LIFESTYLE Freehold The Tallest Walking Unobstructed Convenience Integrated Tower in Distance to Vista of Majestic at Doorstep Development Bukit Tinggi LRT3 Station Bukit Tinggi KESAS Hospital Highway Besar Klang Port Klang SJK(C) Hin Hua Pandamaran Bandar Bandar Bukit Tinggi 2 Bukit Tinggi Première Hotel Jalan Langat Upcoming LRT3 Station (Station 23 Klang Jaya) Artist’s impression only Bandar Utama Johan Setia (MRT 1 Interchange) Bandar Botanik Kayu Ara (Provisional) Upcoming LRT3 Station (Station 23 Klang Jaya) BU 11 Bandar Bukit Tinggi Tropicana Station 23 (Provisional) Klang Jaya Damansara Idaman Sri Andalas SS 7 Taman Selatan Glenmarie 2 Klang (LRT KJ Interchange) (KTM Interchange) Temasya Jalan Meru (Provisional) Kerjaya Pasar Besar Klang Stadium Shah Alam Bandar Baru Klang Bukit Raja Dato Menteri (Provisional) Raja Muda Seksyen 7 Shah Alam (Provisional) UiTM Shah Alam NEW GENERATION, CONNECTED Enjoy better accessibility at TRIO by Setia as the upcoming LRT3 system gives Klang Valley's public transportation a swift, much-needed boost. Immerse in the lifestyle vibrancy of modern living concept with ultimate conveniences under one roof. -

Program Pengawasan Covid-19 Negeri Selangor

PROGRAM PENGAWASAN COVID-19 NEGERI SELANGOR Selangor menunjukkan tren laporan kes COVID-19 harian yang tinggi selama beberapa minggu ini. Faktor yang amat membimbangkan adalah apabila rakyat Selangor yang dijangkiti COVID-19 tetapi tidak mengetahuinya, atau diistilahkan sebagai silent carriers. Mereka ini adalah golongan yang tidak bergejala dan sihat. Golongan ini amat merisaukan kerana mereka boleh menularkan dan menjangkiti kumpulan yang berisiko tinggi. Bagi memulakan Fasa Mitigasi Wabak Pandemik COVID-19 Negeri Selangor, Pelan Tindakan Kesihatan Awam Negeri Selangor akan melaksanakan program pengawasan melalui langkah active case detection ataupun mengenal pasti kes secara aktif. Program saringan COVID-19 ini akan berlangsung bermula 8 Mei 2021 di DUN Kajang dan DUN Semenyih dan akan berlangsung sehingga 10 Jun 2021 yang ditanggung sepenuhnya oleh Kerajaan Negeri Selangor. Saringan percuma ini akan dilaksanakan di dua DUN setiap hari dan akan meliputi seluruh 56 DUN yang terletak di dalam negeri Selangor. Program ini akan memberi manfaat dan peluang kepada rakyat negeri Selangor yang berisiko, pernah menjadi kontak dengan pesakit COVID-19, bergejala dan juga rakyat yang bimbang tentang status mereka. Diharap dengan program ini, rakyat Selangor akan mengambil langkah proaktif dengan menjalani saringan di kawasan- kawasan di seluruh negeri Selangor mengikut tarikh yang ditetapkan dan memainkan peranan untuk mengurangkan wabak COVID-19 di negeri Selangor. DATO’ SERI AMIRUDIN SHARI Dato’ Menteri Besar Selangor 4 Mei 2021 Lampiran 1 – -

Senarai Lokasi Wifi Selangorku

SENARAI LOKASI WIFI SELANGORKU DUN KAWASAN ALAMAT CATITAN N01001 Balai JKKK Sg Air Tawar, Sungai Air Tawar, 45100 Sungai Air Tawar, Selangor SUNGAI AIR TAWAR Surau Al-Khairiah, Jalan Kampung Dato Hormat, Sungai Air Tawar, 45100 Sabak N01002 Bernam N02001 Pekan Batu 39, No.74, Jalan 1/1, Taman Perpaduan, 45200 Sabak Bernam SABAK N02002 Balai Rakyat, Taman Berjaya 45200 Sabak Bernam Selangor Darul Ehsan N03001 Dewan Binjai Jaya, Jalan Parit 16, Kg Kelompok Binjai, 45300 Sungai Besar, Selangor SUNGAI PANJANG N03002 Balai Raya JKKK, Jalan Kg Parit 13, Sungai Panjang, 45300 Sg Besar. N04001 Dewan Seri Sekinchan, Taman Ria, 45400 Sekinchan, Selangor SEKINCHAN N04002 Dewan Perpustakaan Kg Penerangan, Kg Penerangan, Parit 5, 45400 Sekinchan. Dewan Orang Ramai Sungai Selisik, Kg. Sekolah Sungai Selisik, 44020 Kuala Kubu N05001 HULU BERNAM Bharu N05002 Balairaya Kg Hulu Bernam, Jln Besar Hulu Bernam, 35900 Hulu Bernam. N06001 Pejabat Majlis Daerah Hulu Selangor, Jalan Bkt Kerajaan, 44000 Kuala Kubu Bharu KUALA KUBU BAHARU N06002 Penempatan Semula N07001 Apartment Kenanga, Taman Bunga Raya, Bukit Beruntung, 48300 Rawang. BATANG KALI N07002 Dewan Komuniti Bukit Sentosa Masih dalam pemasangan N08001 Dewan Dato Hormat, Pekan Tanjong Karang, 45500 Tanjong Karang. SUNGAI BURONG Pejabat Kidmat Ahli Majlis Kuala Selangor, Zon 1 Tanjong Karang, Pasir Penambang N08002 Jln K/P2, 45500 Tanjong Karang. N09001 Penempatan Semula PERMATANG N09002 Medan Selera, Simpang 3 Kampung Parit Serong, 45500 Tanjung Karang. N10001 Kawasan Komersil, Batu 2 1/2 Jalan Klang Kuala Selangor, 45000 Kuala Selangor. Masih dalam pemasangan BUKIT MALAWATI N10002 Perkarangan Masjid Sultan Ibrahim, Jalan Besar 45000 Kuala Selangor, Selangor Bangunan Komersil, No 6 Jalan Ijok Utama 1, Taman Ijok, Bestari Jaya, 45600 Kuala N11001 IJOK Selangor. -

5. Soalan Bertulis (81-100)

PERTANYAAN-PERTANYAAN BERTULIS DARIPADA Y.B. PUAN WONG SIEW KI (N27 BALAKONG) TAJUK : PENGURUSAN KAWASAN PERINDUSTRIAN 81. Bertanya kepada Y.A.B. Dato' Menteri Besar:- a) Kebanyakan kawasan perindustrian lama terutamanya kawasan perindustrian di dalam kawasan DUN Balakong mengalami masalah kekurangan peruntukan untuk membaiki atau menaiktaraf infrastruktur mereka kerana kawasan- kawasan ini belum diserah balik ke PBT dan hanya bergantung dengan peruntukan Persatuan Pengilang sekiranya kawasan tersebut mempunyai persatuan sebegitu. Apakah usaha yang boleh dilakukan oleh pihak Kerajaan demi membantu dalam keadaan sebegini? JAWAPAN: a) Persatuan Pekilang Industri Kampung Baru Balakong dibenarkan membuat penyerahan infrastruktur secara berperingkat kepada pihak MPKj. Pihak Persatuan dikehendaki mematuhi syarat-syarat MPKj semasa permohonan penyerahan infrastruktur. PERTANYAAN-PERTANYAAN BERTULIS DARIPADA Y.B. TUAN EAN YONG HIAN WAH (N28 SERI KEMBANGAN) TAJUK : JALAN BARU DI ANTARA TAMAN UNIVERSITI INDAH SEK 1 DAN TAMAN BUKIT SERDANG SEK 1 82. Bertanya kepada Y.A.B. Dato' Menteri Besar:- a) Apakah status projek pembangunan jalan baru di antara Taman Universiti Indah Sek 1 dan Taman Bukit Serdang Sek 1? JAWAPAN: a) Status projek pembangunan jalan baru di antara Taman Universiti Indah Sek 1 dan Taman Bukit Serdang Sek 1 adalah dalam proses lantikan Jurukur bagi pengambilalihan tanah serta proses lantikan juruperunding bagi rekabentuk jalan sambung tersebut. PERTANYAAN-PERTANYAAN BERTULIS DARIPADA Y.B. TUAN EDRY FAIZAL BIN EDDY YUSOF (N23 DUSUN TUA) TAJUK : PENJIMATAN 83. Bertanya kepada Y.A.B. Dato' Menteri Besar:- a) Memohon data penjimatan yang berjaya dilakukan dari segi perolehan Kerajaan Negeri dari tahun 2016 sehingga 2019. JAWAPAN: a) Pengalaman lima belanjawan yang lalu membuktikan Kerajaan Negeri mengamalkan perbelanjaan berhemah, memperkukuh budaya kerja cekap dan berintegriti dan menutup ruang pembaziran serta ketirisan.