The Next Level

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NAV CANADA and DATA LINK IMPLEMENTATION

NAV CANADA and DATA LINK IMPLEMENTATION Shelley Bailey NAV CANADA May 2016 – Sint Maarten OPDWLG – Operational Data Link Working Group • 5 members here today representing ANSPs, manufacturers and regulators • Small representation of a multi-disciplinary group made up of such groups as, human factors specialists, regulators, aircraft systems specialists, air carriers, pilots, and controllers. • Make recommendations on operational datalink to the ANC. About NAV CANADA • Private, non-share capital company • 18 million square km of airspace • 2nd largest ANSP in the world • Regulated by Federal Government • 12 million aircraft movements on safety performance annually 3 Our People 4,600 employees across the country • Air Traffic Controllers • Engineering and IM • Flight Service Specialists • Corporate Functions • Electronics Technologists 4 Canadian Airspace Characteristics • Vast distances • Busiest oceanic airspace • Climate varies from polar in the world to temperate • Unique northern airspace operations • Crossroads of global air traffic flows • Stimulus for innovation 5 6 System Progress Investment $2 billion in new technology and facilities since 1996. 7 DATA LINK IN CANADA • OCEANIC SERVICES • DOMESTIC SERVICE • TOWERS 8 Gander Oceanic Controls between 1400-1600 transatlantic flights per day Two primary traffic flows Eastbound – catches the winds of the Jetstream Westbound – avoid the Jetstream winds First data link services to a FANS1/A aircraft was in 2001 Introduced the NAT Data Link Mandate in 2013 Now using 3 data link based -

600 Aviation Avenue &

600 Aviation Avenue & 100 Agnew Drive Brandon Manitoba ~ 5 Acres Land For Sale SUBJECT PROPERTIES Dan Fontaine Business Development Specialist 204.729.2133 or 1.866.729.2132 [email protected] EconomicDevelopmentBrandon.com 600 Aviation Ave & 100 Agnew Drive Page 1 of 5 Property Overview PROPERTY SUMMARY Roll Numbers: 540492 & 540476 Addresses: 600 Aviation Avenue & 100 Agnew Avenue Legal Description: Lots 1&2, Block 1, Plan 38795 Zoning: Industrial General (MG) Zoning By-law 7124.pdf Lot size: 600 Aviation Ave: 1.5 Acres approx. 100 Agnew Drive: 3.5 Acres approx. Assessed value: 600 Aviation Ave: $39,300 (land only) 100 Agnew Drive: $90,900 (Land only) Property Taxes: 600 Aviation Ave: $1,039 (2018 Net) 100 Agnew Drive: $2,403 (2018 Net) Property Search Asking Price: Negotiable HIGHLIGHTS • Located on the City of Brandon Municipal Airport (McGill Field). • Easy access to the Trans-Canada Hwy, via Highway #10/1st Street. • All utilities are available in the area. • Two parcels of land same ownership can be purchased individually or as one parcel. • The Airport provides daily West Jet air service to Calgary AB. • The Airport is home to: o New Terminal Building (arrival & departure lounges and extensive parking). o Nav Canada Flight Service Station. o Enterprise Rent-A-Car Services. o The Brandon Flight Centre. o The Manitoba Emergency Services College Training facility. o Maple leaf aviation, Clarks Poultry, The Commonwealth Air Training Plan Museum. 600 Aviation Ave & 100 Agnew Drive Page 2 of 5 Economic Overview of Brandon Manitoba At the very heart of North America lies Brandon Manitoba, a city that has built its reputation on providing an environment in which business can succeed. -

Annual Report 2017-EN.Pdf

We Are NAV CANADA ANNUAL REPORT 2017 We Are NAV CANADA ANNU A L REPO R T 2017 "I perform corrective and preventive maintenance or field modifications on electronic navigational aids used by NAV CANADA, helping to ensure the safety of the air navigation system." Marc Alivio Electronics Technologist St. John’s Control Tower For definitions of the abbreviations and acronyms that appear in this report, please refer to our glossary on page 48. Corporate Profile NAV CANADA is a private, not-for-profit company, established in 1996, providing air traffic control, airport advisory and aeronautical information services, and weather briefings for more than 18 million square kilometres of Canadian domestic and international airspace. The Company is internationally recognized for its safety record, and innovative technology used by ANSPs worldwide. OUR VISION, MISSION AND OBJECTIVES Our Vision Our Overarching NAV CANADA’s Vision is to be the world’s most Objectives respected ANSP: The Company will achieve its Mission by: • in the eyes of the public for our safety record; 1 Maintaining a safety record in the top decile • in the eyes of our customers for our fee levels, of major ANSPs worldwide; customer service, efficiency and modern technology; and 2 Maintaining ANS customer service charges, on average, in the bottom quartile (lowest charges) • in the eyes of our employees for establishing of major ANSPs worldwide by ensuring that the a motivating and satisfying workplace with growth in costs of providing air navigation services competitive compensation -

NAV CANADA and Airspace Change

NAV CANADA and Airspace Change Jonathan Bagg Senior Manager, Stakeholder and Industry Relations Blake Cushnie National Manager, Performance Based Operations Overview • NAV CANADA and Airspace Change • Non-acoustic factors that impact our work • Noise mitigation through PBN About NAV CANADA • Canada’s Air Navigation Services Provider • Private, not-for-profit organization • One of the largest in the world in terms of aircraft movements • ~5,000 employees at more 100 corporate and operational sites Airspace Change Context • Well in to a significant airspace modernization program. • Driven by our State Mandate, informed by ICAO Aviation System Block Upgrades (ASBU). • NavAid modernization program – shift from ground-based to satellite-based infrastructure. • 16 airports in the last three years, where we have deployed PBN improvements including RNP-AR Airspace Change Process Airspace Change Communication and Consultation Protocol – Established in 2015 – How and when consultation should occur • Altitude of change • Changes in frequency • Impact driven • Outreach mechanisms • Noise Modelling • Reporting Requirements – Promotes industry participation and highlights ANS-Airport Authority relationship Airspace Change Process Integration of our teams and stakeholders • Deployment Team and Stakeholder Relations work closely together from the beginning. • Airport and airline involvement participation. • Community Consultation on airspace proposals. PBN Opportunities • Increase use of quieter continuous descent operations. • Better avoidance of residentially populated areas in some cases. Non Acoustical Challenges • Range of individual concern can vary in relation to expected/actual level of exposure. • An information/understanding vacuum can be easily be filled with apprehension or misinformation. • It can take time for real improvements to the noise environment to result in improved community perception. -

Annual Reportopen a New Window

2019 › BEYOND THE SKIES NAV CANADA FIRST TO LAUNCH SPACE-BASED DOMESTIC AIRCRAFT SURVEILLANCE SAFER MORE EFFICIENT LOWER EMISSION AIR TRAVEL No matter how you look at it, space-based ADS-B (SB ADS-B) air traffic surveillance is a true game-changer. As an investor in Aireon, the joint venture deploying SB ADS-B, NAV CANADA continues to play a leading role in bringing this remarkable innovation to the world. For decades, air traffic surveillance and monitoring has relied mostly on ground-based radar—a system that has some shortcomings. Because it needs a line-of-sight to its target, ground-based radar can’t always track aircraft in hilly or mountainous terrain, and it can’t be deployed at all in the oceans. These kinds of limitations mean that the systems we have relied on to monitor global air traffic actually covered just 30 percent of global airspace. Looking down from a network of 66 satellites in orbit around Earth, Aireon SB ADS-B has no such limitations. It provides complete coverage—100 percent of global airspace—and it does it in real time, relaying the position, speed, heading and other data from transponder-equipped aircraft twice every second. The implementation of SB ADS-B offers tremendous benefits, especially where safety is concerned. With total coverage in real time, air traffic systems will be able to identify and address potential loss of separation between aircraft before it occurs. Should an aircraft go missing, its precise location will be known in a matter of seconds—at a time when seconds matter. -

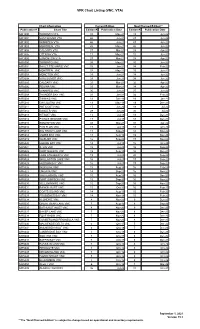

VFR Chart Listing (VNC, VTA)

VFR Chart Listing (VNC, VTA) Chart Information Current Edition Next Planned Edition** Publication # Chart Title Edition # Publication Date Edition # Publication Date AIR1900 TORONTO VTA 48 May-21 49 Jun-22 AIR1901 VANCOUVER VTA 46 Jun-21 47 Jun-22 AIR1902 WINNIPEG VTA 46 Jun-21 47 Jun-22 AIR1903 MONTREAL VTA 45 May-21 46 Jun-22 AIR1904 CALGARY VTA 27 Mar-21 28 Apr-22 AIR1905 OTTAWA VTA 11 May-21 12 Jun-22 AIR1906 EDMONTON VTA 27 Mar-21 28 Apr-22 AIR5000 TORONTO VNC 39 May-21 40 Jun-22 AIR5001 SAULT STE MARIE VNC 33 Jan-21 34 Feb-22 AIR5002 MONTREAL VNC 32 May-21 33 Jun-22 AIR5003 MONCTON VNC 33 Jun-21 34 Jun-22 AIR5004 VANCOUVER VNC 33 Jun-21 34 Jun-22 AIR5005 CALGARY VNC 31 Mar-21 32 Apr-22 AIR5006 REGINA VNC 33 Mar-21 34 Apr-22 AIR5007 WINNIPEG VNC 36 Jun-21 37 Jun-22 AIR5008 THUNDER BAY VNC 33 Jan-21 34 Feb-22 AIR5009 TIMMINS VNC 18 Dec-19 19 Jan-22 AIR5010 CHICOUTIMI VNC 18 May-19 19 Dec-21 AIR5011 ANTICOSTI VNC 17 Jun-20 18 Jul-22 AIR5012 GANDER VNC 29 Jun-20 30 Jul-22 AIR5013 KITIMAT VNC 17 Jul-19 18 Dec-21 AIR5014 PRINCE GEORGE VNC 17 Jul-19 18 Dec-21 AIR5015 EDMONTON VNC 33 Mar-21 34 Apr-22 AIR5016 FLIN FLON VNC 17 Jul-19 18 Oct-23 AIR5017 BIG TROUT LAKE VNC 17 Sep-20 18 Nov-22 AIR5018 JAMES BAY VNC 18 Aug-19 19 Nov-23 AIR5019 WABUSH VNC 16 Sep-20 17 Nov-22 AIR5020 GOOSE BAY VNC 14 Jul-19 15 Oct-23 AIR5021 ATLIN VNC 15 Jul-20 16 Sep-22 AIR5022 FORT NELSON VNC 15 Aug-19 16 Dec-21 AIR5023 LAKE ATHABASCA VNC 19 Jul-20 20 Sep-22 AIR5024 WOLLASTON LAKE VNC 16 Jul-20 17 Sep-22 AIR5025 HUDSON BAY VNC 16 Jul-20 17 Sep-22 AIR5026 INUKJUAK -

North Atlantic (NAT) Resource Guide for United States Operators

NAT Resource Guide for United States Operators Flight Technologies and Procedures Division The links within this resource guide are provided as a service to help you easily find pertinent information. The validity of the links is re-checked quarterly. Documents and other information may change between updates. Information provided by non-FAA sites should be considered strictly “for information only.” You should confirm the accuracy of all such non-FAA information against official FAA documentation. Contact us via e-mail with your questions and comments pertaining to this PDF document. Contacts Send Comments Acronyms Use Ctrl+F to search document or if you have Adobe Acrobat, click 3rd Quarter 2021 the Advance Search button Updated Quarterly Click to View Items • Emphasis Items, Page 1 • Emphsis Items, Page 2 • Oceanic Errors • SLOP • Contingency References, Page 1 • Contingency References, Page 2 • Volcanic Ash and Solar Storms • Weather Deviation • Flight Planning • ARINC 424 Coordinate Convention • Current and Planned Implementations Emphasis Items Federal Aviation Administration 2 Emphasis Items, Page 1 • COVID-19 TCAS/ACAS in HLA: International Oceanic Airspace (FAA Website Updates) • See ICAO Doc 7030 Regional Supplementary Pro- • International Notices • FAA Site to lookup Prohibitions, Restrictions and cedures (link to purchase) Notices • There are no additional TCAS/ACAS requirements • NAT Data Link Special Emphasis Items, NAT OPS for operation in the NAT. The global TCAS/ACAS PBCS Operations Bulletin 2017_004_Rev 1 Performance-Based -

Terms of Reference (TOR)

Terms of Reference - Title Terms of Reference Review of Air Traffic Service Requirements Windsor, Ontario NAV CANADA Level of Service 77 Metcalfe Street, 7th Floor Ottawa, Ontario K1P 5L6 November 2020 The information and diagrams contained in this Terms of Reference are for illustrative purposes only and are not to be used for navigation. TABLE OF CONTENTS 1.0 Purpose ...................................................................................................................... 1 2.0 Scope of the study ...................................................................................................... 1 3.0 Background ................................................................................................................ 1 4.0 Methodology ............................................................................................................... 1 5.0 Safety Management Plan ............................................................................................ 2 6.0 Human Resources ...................................................................................................... 2 7.0 Work Management Plan ............................................................................................. 2 8.0 Finance Resources ..................................................................................................... 3 9.0 Materiality of the changes ........................................................................................... 3 10.0 Consultation ............................................................................................................... -

Toronto-Buttonville, Ontario

NOTICE OF CHANGE Closure of the Air Traffic Control Tower and Contract Weather Office Toronto-Buttonville, Ontario NAV CANADA, the country's provider of civil air navigation services, conducted an aeronautical study that reviewed the Air Traffic and Aviation Weather Services at the Toronto-Buttonville Airport. The study recommended the closure of the Air Traffic Control tower (Twr) and Contract Weather Office (CWO). The part-time control tower service with Class D Control Zone (CZ) will be replaced with a Mandatory Frequency (MF) area using the current tower VHF frequency 124.8 MHz and the CZ will become Class E airspace for 24-hours per day. Note that a portion of the CZ ceiling was lowered to 2000’ ASL and the ABV 2,000' ASL Toronto Terminal Control Area (TCA) boundary was adjusted as per AIP Supplement 50/18 on 13 Sept 2018. See the map sketch below for a depiction of the final CZ and TCA airspace changes resulting from the aeronautical study. IFR approach clearances will continue to be issued directly to pilots from the Toronto Area Control Center (ACC) on the Terminal frequency 133.4 MHz. Arrival reports can be made after landing to the London Flight Information Center (FIC) via the on-site Remote Communications Outlet (RCO) on 123.15 MHz or by telephone. IFR departure clearances can be obtained from the London FIC via phone, via the RCO, or direct from the ACC on 133.4 MHz airborne after a VFR departure. The 24-hour aviation weather observation service provided by the CWO will be replaced with a Limited Weather Information System (LWIS). -

NAV CANADA Corporate Social Responsibility Highlights 2018

CORPORATE SOCIAL RESPONSIBILITY HIGHLIGHTS 2018 Serving a world in motion navcanada.ca TABLE OF CONTENTS Message from the President and CEO 2 Making a Safe System Safer 4 Innovating for Tomorrow 6 Leave Ordinary Behind 8 On the Cover: Less Is Best for the Planet 10 From left: Andre Lenarcik CNS Team Supervisor, and A Heart for Our Communities 12 Simon Premech Electronics Our Innovators and Achievers 14 Systems Technologist – CNS, Toronto Area Control Centre At NAV CANADA, our employees are air traffic controllers, flight service specialists, engineers, technologists, software developers, managers, analysts and other professionals who manage air traffic, maintain systems and infrastructure, run our business, and develop solutions for improving aviation safety and efficiency. They are shaping our future – helping to make aviation, our communities and the planet more sustainable. We are a private, not-for-profit company, of Canadian domestic and international established in 1996, providing air traffic airspace. The Company is internationally control, airport advisory and aeronautical recognized for its safety record, and its information services, and weather briefings innovative technology used by air navigation for more than 18 million square kilometres service providers (ANSP) worldwide. NAV CANADA | Corporate Social Responsibility Highlights 2018 1 MESSAGE FROM THE PRESIDENT AND CEO As Canada’s air navigation service From space-based innovation provider, NAV CANADA plays a unique There is a palpable energy in our organization role in society: we guide the millions of as we prepare for a global revolution in air aircraft that safely cross Canada’s skies traffic surveillance, which is mere months away. NAV CANADA is a founding partner of Aireon, which each year, managing one of the busiest will be the first system of its kind to deliver space- airspaces in the world. -

Aircraft Movement Statistics: NAV CANADA Towers and Flight Service Stations: Annual Report (TP 577)

Catalogue no. 51-209-X Aircraft Movement Statistics: NAV CANADA Towers and Flight Service Stations: Annual Report (TP 577) 2011 How to obtain more information For information about this product or the wide range of services and data available from Statistics Canada, visit our website at www.statcan.gc.ca,[email protected], or telephone us, Monday to Friday from 8:30 a.m. to 4:30 p.m., at the following numbers: Statistics Canada’s National Contact Centre Toll-free telephone (Canada and the United States): Inquiries line 1-800-263-1136 National telecommunications device for the hearing impaired 1-800-363-7629 Fax line 1-877-287-4369 Local or international calls: Inquiries line 1-613-951-8116 Fax line 1-613-951-0581 Depository Services Program Inquiries line 1-800-635-7943 Fax line 1-800-565-7757 To access this product This product, Catalogue no. 51-209-X, is available free in electronic format. To obtain a single issue, visit our website at www.statcan.gc.ca and browse by “Key resource” > “Publications.” Standards of service to the public Statistics Canada is committed to serving its clients in a prompt, reliable and courteous manner. To this end, Statistics Canada has developed standards of service that its employees observe. To obtain a copy of these service standards, please contact Statistics Canada toll-free at 1-800-263-1136. The service standards are also published on www.statcan.gc.ca under “About us” > “The agency” > “Providing services to Canadians.” Statistics Canada Transportation Division Aircraft Movement Statistics: NAV CANADA Towers and Flight Service Stations: Annual Report (TP 577) 2011 Published by authority of the Minister responsible for Statistics Canada © Minister of Industry, 2012 and the © Minister of Transport, 2012 All rights reserved. -

Canada-United States Relationship: an Example of and an Innovation for the World

Canada-United States Law Journal Volume 32 Issue 1 Article 49 January 2006 Canada-United States Relationship: An Example of and an Innovation for the World Colin Robertson Follow this and additional works at: https://scholarlycommons.law.case.edu/cuslj Part of the Transnational Law Commons Recommended Citation Colin Robertson, Canada-United States Relationship: An Example of and an Innovation for the World, 32 Can.-U.S. L.J. 296 (2006) Available at: https://scholarlycommons.law.case.edu/cuslj/vol32/iss1/49 This Speech is brought to you for free and open access by the Student Journals at Case Western Reserve University School of Law Scholarly Commons. It has been accepted for inclusion in Canada-United States Law Journal by an authorized administrator of Case Western Reserve University School of Law Scholarly Commons. CANADA-UNITED STATES LAW JOURNAL [Vol. 32] SPEAKER Colin Robertson* Well, thank you, Henry. I can tell you that the one truth in advertising, that last night as I was working on my remarks and I said to my 14 year-old son, I said, "Connor, do you want to listen to some of this?" So Connor lis- tened for about 90 seconds and said, "Dad, I am going to watch 'My Name is Earl."' So you are warned. As I look across, I see my friend Mark Romat and so many others, and I encourage you all perhaps to have another drink because probably the worst position one can have is speaking on a Saturday night. However, as they say, we have heard the best now, Henry, and I will try now to do what I can do.