Competition in Health Insurance: a Comprehensive Study of U.S. Markets I

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

It Doesn't Have to Be This Way: Obamacare's Troubling Reality

It Doesn’t Have to be This Way: Obamacare’s Troubling Reality Every day Americans are confronted with more bad news about Obamacare. Insurers are leaving the ACA marketplaces, premiums continue to increase, and fewer people are enrolling, which will likely lead to more premium increases. Lawmakers must act because the American people deserve better. Insurers Dropping Out CNBC: Anthem will drop out of Ohio's Obamacare market; 18 counties could be left with no ACA plan Alleigh Marré, spokeswoman for the U.S. Department of Health and Human Services, said “This news is heartbreaking for the millions of Ohioans who depend on access to affordable, high-quality healthcare, and this is a stark reminder that Obamacare is collapsing.” Times Free Press: Most of Tennessee will have only one insurer under Obamacare in 2018 Tennessee Insurance Commissioner Julie Mix McPeak said … "the market remains challenged as most Tennessee consumers will still face limited options and increasing premium prices. WTHR: Anthem, MDwise Pulling Out of Indiana’s Obamacare Exchange in 2018 Both companies cited a “volatile” marketplace filled with “growing uncertainty.” So what’s causing this uncertainty? In one word, Obamacare. The flawed design of Obamacare itself, particularly the flawed individual mandate and the instability of the Cost Sharing Reduction subsidies, written and implemented by Democrats, are causing the volatile marketplace. Declining Enrollment Politico: Nearly 2M Fell Off Obamacare Coverage Rolls Through Mid-March CMS said high costs and lack of affordability were the most common factors individuals cited when asked why they didn't keep their coverage. Obamacare’s actual enrollment has failed to meet projections every single year. -

Overview of Available Benefits - Supplemental 2

Overview of Available Benefits - Supplemental 2 BIBM benefits Your health. Your wealth. Our partnership: The benefits of working at IBM IBM offers a competitive benefits program, designed to help employees build a solid financial foundation for meeting a diverse array of needs — health care, income protection, retirement security, and personal interests. Supplemental 2 employees are eligible for the following plans and programs which address health care and savings and are described briefly below: Medical, dental, vision, flexible spending accounts, IBM 401(k) Plus Plan and Employees Stock Purchase Plan. Supplemental 2 employees are also eligible for time off and other benefits and services as outlined below. Please contact the IBM Benefits Center-Provided by Fidelity to obtain estimated annual cost for the medical options available in your zip code. BYou are eligible ...for these benefit programs, with the exception of the IBM Employees Stock Purchase Plan, beginning with your first day of employment. Health care coverage (medical, dental and vision) is available for you, your spouse/partner (some health plans may not offer coverage for partners), and eligible children and other dependents (documentation supporting eligibility is required). IBM provides a range of options, to allow employees to design a personalized program that meets their personal or family circumstances. You are covered for pre-existing conditions under IBM's health plans. Medical Benefits options IBM's medical options include the IBM Preferred Provider Organization (PPO), IBM PPO Plus, IBM PPO with Health Savings Account (HSA), IBM Enhanced PPO with Health Savings Account (HSA), the IBM Exclusive Provider Organization (EPO), and health maintenance organizations (HMOs), where available. -

National Organizations Ltr to NFL Re Anthem Policy.Pdf

Roger Goodell Commissioner National Football League 345 Park Avenue New York, NY 10154 June 18, 2018 Dear Mr. Goodell: The undersigned organizations, each of which is devoted to protecting the full civil and human rights of all Americans, write to strongly object to the National Football League’s coercive new rule requiring players to stand during the national anthem.1 This policy represses peaceful, non- disruptive protest of police violence against unarmed African Americans and other people of color. It is disappointing that a league built on grit and competition lacks the constitution to stomach a call for basic equality and fairness. Kneeling during the anthem seeks to raise awareness of police brutality and violence routinely perpetrated upon unarmed and nonviolent people of color. Even though people of color are only around 37% of the population, they are about 63% of unarmed people killed by the police.2 Police are twice as likely to kill unarmed African Americans as white people.3 African Americans experience physical force or its threat during police encounters up to three times as often as whites; Hispanics up to twice as often.4 Over and over again, our racially-biased criminal justice system causes families of color to mourn loved ones killed and maimed by excessive force. Afterward, this same system routinely fails to hold unreasonably violent officers accountable. The NFL in particular should be better attuned to the ongoing struggle for racial justice. Yet, its own franchise suffers from significant racial disparities. 70% of NFL players are black, yet 75% of head coaches and 100% of team CEOs and Presidents are white men.5 No team has a majority owner who is African American or Hispanic.6 Racially-biased police violence can also threaten players’ safety;7 the recent decision to mandate the silence of players wishing to demonstrate for 1 See, e.g., Kevin Breuninger, NFL bans on-field kneeling during national anthem, CNBC (May 23, 2018), https://www.cnbc.com/2018/05/23/nfl-bans-on-field-kneeling-during-the-national-anthem.html. -

Your Prescription Drug Benefits

MEMBER EDUCATION Your Prescription Drug Benefits Answers you need. From a name you can trust. Health and Pharmacy Benefits That Work Together Anthem Blue Cross and Blue Shield’s pharmacy program is Mail service is convenient for people taking medications on a about more than processing claims and making prescriptions regular basis. Eliminate the hassles of driving to the pharmacy available. It’s about looking at you as an individual. Because we and waiting in long lines. Prescriptions are delivered to your know people are more than their prescriptions; they have lives. home, office or vacation address. We’ll call to remind you that And we’re here to help YOU live a healthier life. you’re getting low on medication. And you can easily place a refill order by phone, online or by mail. Enjoy private prescription We’ve designed several programs to help you get the most from counseling with a licensed pharmacist. Plus, you may even pay your benefits. And, best of all, they’re available atno extra less for your medications. cost to you. Depending on your plan, you may receive tips for controlling a health condition. Mailings focusing on medication Our specialty pharmacy is uniquely designed for people with safety and compliance. Or, coupons for health and wellness chronic conditions. We offer a robust support program, including products. We can help you save money by suggesting affordable a team of pharmacy care advocates, pharmacists and nurses. generics. Recommend medications included on your drug Our goal is to help people taking specialty medications achieve list/formulary. -

Basic Plan Preferred Provider Organization

Basic Plan Preferred Provider Organization Evidence of Coverage Effective January 1, 2016 – December 31, 2016 A Self-Funded Plan Administered Under the Public Employees’ Medical & Hospital Care Act (PEMHCA) Health Plan Administration Division Self-Funded Health Plans California Public Employees’ Retirement System PER-0116-SEL HOW TO REACH US Important: For all members outside of the United States, contact the operator in the country you are in to assist you in making a toll-free number call. CUSTOMER SERVICE For information regarding Protected Health Information: For medical claims status, claim forms, identification cards, benefit information, or the latest CVS/caremark booklets, call or visit on-line: P.O. Box 6590 Lee’s Summit, MO 64064-6590 Customer Service Department Anthem Blue Cross ELIGIBILITY AND ENROLLMENT 1-877-737-7776 1-818-234-5141 (outside the continental U.S.) For information concerning eligibility and 1-818-234-3547 (TDD) enrollment, contact the Health Benefits Officer at Web site: www.anthem.com/ca/calpers your agency (active) or the California Public Employees’ Retirement System (CalPERS) Please mail your correspondence and medical Member Account Management Division (retirees). claims for services by Non-Preferred Providers to: You also may write: PERS Select Health Plan Member Account Management Division Anthem Blue Cross CalPERS P.O. Box 60007 P.O. Box 942715 Los Angeles, CA 90060-0007 Sacramento, CA 94229-2715 If you travel outside California, please see pages Or call: 19-20 for more information about the BlueCard Program Preferred Provider network. 888 CalPERS (or 888-225-7377) (916) 795-3240 (TDD) UTILIZATION REVIEW SERVICES ADDRESS CHANGE To obtain Precertification for hospitalizations and specified services, call: Active Employees: To report an address change, active Employees should complete and submit the The Review Center proper form to their employing agency’s personnel Anthem Blue Cross office. -

24/7 Nurseline & Future Moms Program Overview

24/7 NurseLine & Future Moms Program Overview September 29, 2010 11 am Central/ 12 pm Eastern Today’s webinar . We will provide in depth overviews of two 360° Health® Programs- 24/7 NurseLine and Future Moms with the main objective being to provide you with the tools to increase employee awareness of the programs available and thus increase program engagement. The call will last approximately 45 minutes. All lines will be muted but through the live meeting software you will be able to ask questions and we will pause to repeat and answer them. Our main presenter today is Lance Geiger 2 Agenda Goal: Learn about 24/7 NurseLine and Future Moms including how to promote the programs in the workplace. Frequently Asked Questions: .24/7 NurseLine and Future Moms are included in your Anthem benefit offering at no additional cost. .Promotional resources like posters, fliers, and promotional email templates are available at: group.anthem.com/360health .State specific phone numbers for the programs are printed on the materials available through the above referenced website. 3 Better Health = Comprehensive Wellness Benefits Financial Advantage – Fully Insured Core Programs Also Available Care Management • ConditionCare: Support • 24/7 NurseLine • ConditionCare: Kidney • Future Moms • MyHealth Coach • ComplexCare • Healthy Lifestyles • ConditionCare • Worksite Wellness • MyHealth Advantage • EAP Online Tools and Resources • Pharmacy Benefit Management • MyHealth@Anthem • Staying Healthy Reminders • MyHealth Assessment • MyHealth Record • Condition Centers • Online Community • Specialoffers@Anthem • AudioHealth Library • Time Well Spent 4 State Specific Phone Numbers Each state has one program phone number for all 360° Health programs. That means can employees can access all the programs by calling one central phone number. -

COVID-19 Information from Anthem Blue Cross

Medi-Cal Managed Care L.A. Care Medicare Advantage Cal MediConnect Plan Provider Bulletin January 2021 COVID-19 information from Anthem Blue Cross Updated to include vaccine information This communication applies to the Medicaid, Medicare Advantage and Medicare-Medicaid Plan (MMP) programs for Anthem Blue Cross (Anthem). Anthem will update FAQs as more information becomes available. Providers should visit the California provider communications COVID-19 page homepage for the latest information from Anthem about COVID-19. Anthem is closely monitoring COVID-19 developments and what it means for our customers and healthcare provider partners. Our clinical team is actively monitoring external queries and reports from the Centers for Disease Control and Prevention (CDC) to help us determine what action is necessary on our part. Providers may also visit https://www.dhcs.ca.gov/Pages/DHCS-COVID%E2%80%9119-Response.aspx for information from the CA Department of Healthcare Services. To help address care providers’ questions, Anthem has developed the following frequently asked questions: Waiver of member cost shares Will Anthem waive member cost shares related to screening and/or testing for COVID-19? (not applicable to Medicaid) Screening and testing: Yes, as of March 5, 2020, and until further notice, cost shares — including copays, coinsurance and deductibles for COVID-19 — will be waived by Anthem or its delegated entities for screening and testing for COVID-19. Test samples may be obtained in many settings including a doctor’s office, urgent care, ER or even drive-through testing once available. While a test sample cannot be obtained through a telehealth visit, the telehealth provider can connect members with testing. -

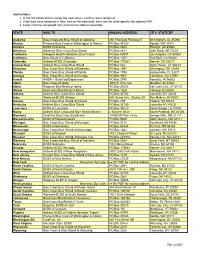

Instructions: 1. in the Left-Hand Column, Locate the State Where Services Were Rendered

Instructions: 1. In the left-hand column, locate the state where services were rendered. 2. If services were rendered in New York or Pennsylvania, then use the state-specific file address PDF. 3. Lastly mail the completed claim form to the address provided. STATE MAIL TO MAILING ADDRESS CITY, STATE ZIP Alabama Blue Cross and Blue Shield of Alabama 450 Riverside Parkway E Birmingham, AL 35298 Alaska Premera Blue Cross of Washington & Alaska PO Box 91080 Seattle, WA 98111 Arizona BCBS of Arizona PO Box 2924 Phoenix, AZ 85062 Arkansas Arkansas Blue Cross Blue Shield PO Box 2181 Little Rock. AR 72203 California Wellpoint Health Networks (Blue Cross) PO Box 60007 Los Angeles, CA 90060 California Blue Shield of California PO Box 1505 Red Bluff, CA 96080 Colorado Anthem BCBS (Colorado) PO Box 173681 Denver, CO 80217 Connecticut Anthem Blue Cross Blue Shield PO Box 522 North Haven, CT 06473 Delaware Blue Cross Blue Shield of Delaware PO Box 1991 Wilmington, DE 19899 Florida Blue Cross Blue Shield of Florida PO Box 1798 Jacksonville, FL 32231 Georgia Blue Cross Blue Shield of Georgia PO Box 9907 Columbus, GA 31908 Hawaii HMSA -- BlueCard Department PO Box 2970 Honolulu, HI 96802 Idaho Blue Cross of Idaho 3000 E. Pine Ave. Meridian, ID 83642 Idaho Regence BlueShield of Idaho PO Box 31603 Salt Lake City, UT 84131 Illinois BlueCross BlueShield of Illinois PO Box 1364 Chicago, IL 60690 Indiana Anthem Blue Cross Blue Shield PO Box 31780 Louisville, KY 40233 Iowa Wellmark BCBS of Iowa 636 Grand Ave., Station 39 Des Moines, IA 50309 Kansas Blue Cross -

Health Insurer Financial Insights Volume 3 | Summer 2020

Consulting Actuaries HEALTH INSURER FINANCIAL INSIGHTS VOLUME 3 | SUMMER 2020 As we present the third edition of our Health Insurer Financial Insights IN THIS ISSUE newsletter, we find ourselves in the midst of unprecedented times. Q2 YTD 2020 Statutory Results This newsletter focuses on market profitability and capitalization by Market trends for public and non-public health insurers, and their claims experience through the first half of 2020. Section 04 provides insight 01 into how health carriers are reporting the impact of COVID-19. Our Market aim is to keep you abreast of key market trends and dynamics that Capitalization: Statutory Capital/ impact health insurer financial results and profitability. We hope you RBC Trends enjoy the newsletter and find it informative. Please look for our next 02 edition this Fall. Public Companies Financial Q2 YTD 2020 Statutory Financials: Individual, Group, Medicare, and Medicaid Markets Performance Overall, health insurer profit margins improved in 2020. Pre-tax margins increased in Q2 2020 with decreased loss ratios in all markets due to the impact of COVID-19 on developing claims experience. The differences by line of business indicate that COVID-19 has had a larger impact 03 on the claim experience for certain services, such as Dental, when compared to major medical and Rx services. COVID-19 Corner 2019 Market Capitalization: Statutory Capital/Risk Based Capital (RBC) Trends Market capitalization measured by Total Adjusted Capital (TAC) increased due to small increases in market size (measured by premium) and very little total change in Risk Based 04 Capital ratios. Overall, Public Companies saw minor decreases to their RBC ratios in 2019, while Non-Public Blues saw increases in both TAC and RBC ratios. -

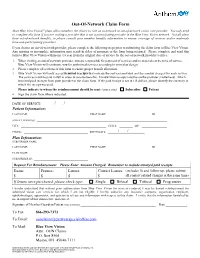

Out-Of-Network Claim Form /

Out-Of-Network Claim Form Most Blue View VisionSM plans allow members the choice to visit an in-network or out-of-network vision care provider. You only need to complete this form if you are visiting a provider that is not a participating provider in the Blue View Vision network. Not all plans have out-of-network benefits, so please consult your member benefits information to ensure coverage of services and/or materials from non-participating providers. If you choose an out-of-network provider, please complete the following steps prior to submitting the claim form to Blue View Vision. Any missing or incomplete information may result in delay of payment or the form being returned. Please complete and send this form to Blue View Vision within one (1) year from the original date of service by the out-of-network provider’s office. 1. When visiting an out-of-network provider, you are responsible for payment of services and/or materials at the time of service. Blue View Vision will reimburse you for authorized services according to your plan design. 2. Please complete all sections of this form to ensure proper benefit allocation. 3. Blue View Vision will only accept itemized receipts that indicate the services provided and the amount charged for each service. The services must be paid in full in order to receive benefits. Handwritten receipts must be on the provider’s letterhead. Attach itemized paid receipts from your provider to the claim form. If the paid receipt is not in US dollars, please identify the currency in which the receipt was paid. -

Anthem Bronze Pathway HMO 5500/20% POLICY What You Need

Anthem Blue Cross and Blue Shield is the trade name of Anthem Health Plans of New Hampshire, Inc. HMO plans are administered by Anthem Health Plans of New Hampshire, Inc., and underwritten by Matthew Thornton Health Plan, Inc., independent licensees of the Blue Cross and Blue Shield Association. ANTHEM is a registered trademark of Anthem Insurance Companies, Inc. The Blue Cross and Blue Shield names and symbols are registered marks of the Blue Cross and Blue Shield Association. Anthem Bronze Pathway HMO 5500/20% POLICY What You need to know about Your Individual health Policy. IMPORTANT NOTICE THIS POLICY REFLECTS THE KNOWN REQUIREMENTS FOR COMPLIANCE UNDER THE AFFORDABLE CARE ACT AS PASSED ON MARCH 23, 2010. AS ADDITIONAL GUIDANCE IS FORTHCOMING FROM THE US DEPARTMENT OF HEALTH AND HUMAN SERVICES, AND THE NEW HAMPSHIRE INSURANCE DEPARTMENT, THOSE CHANGES WILL BE INCORPORATED INTO YOUR HEALTH INSURANCE POLICY. IF THIS POLICY IS PROVIDED TO YOU AS A NEW SUBSCRIBER, YOU MAY, AT ANY TIME WITHIN THIRTY (30) DAYS AFTER ITS RECEIPT, RETURN IT TO US BY DELIVERING IT OR MAILING IT TO ANTHEM BLUE CROSS AND BLUE SHIELD. IMMEDIATELY UPON SUCH DELIVERY OR MAILING, THE POLICY WILL BE DEEMED VOID FROM THE BEGINNING, AND ANY PREMIUM PAID WILL BE REFUNDED LESS ANY CLAIMS PAID. THE BENEFITS DESCRIBED IN THIS POLICY ARE PROVIDED IN ACCORDANCE WITH THE REQUIREMENTS OF THE NEW HAMPSHIRE STATUTES APPLICABLE TO ACCIDENT AND HEALTH INSURANCE AND UNDER THE JURISDICTION OF THE NEW HAMPSHIRE INSURANCE COMMISSIONER. This product is administered by Anthem Health Plans of New Hampshire, Inc., operating as Anthem Blue Cross and Blue Shield, a stock corporation and licensed Accident and Health insurer in the State of New Hampshire. -

<Last Name> <Mailing Address> <City>, <State> <ZIP Code>

<Date> <First Name> <Last Name> <Mailing address> <City>, <State> <ZIP Code> Re: Anthem cyber attack Dear <First Name> <Last Name>, We’ve learned from the Anthem health plan that it’s likely that your name, date of birth, city and state of residence, and part of your HMSA membership number were accessed during the recent cyber attack. Anthem probably had your information because at some point since 2004 you were an HMSA member who received medical or hospital services in a Mainland state that Anthem serves. Based on Anthem’s information, we do NOT think your Social Security number, street or email address, telephone number, or financial or medical information was accessed. I know this news will cause concern. For your peace of mind, Anthem has automatically enrolled you in two years of identity theft repair at no cost. With this service, an investigator will work to resolve any harm if you’re a victim of fraud. In addition, you can enroll in additional layers of protection from Anthem, including two years of free credit monitoring and a $1 million identity theft insurance policy at AnthemFacts.com. While Anthem’s investigation to date shows no financial information was accessed, I urge you to sign up for these services for your security and peace of mind. Anthem will send you its own notification letter sometime in the next eight weeks. Why Anthem had your personal information We don’t share our members’ Social Security numbers, email or street addresses, telephone numbers, medical or financial information, or any other personal information. It’s likely that Anthem received your personal information from claims when you received medical or hospital services from providers in one of the states where Anthem operates a Blue Cross and Blue Shield health plan: California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, Nevada, New Hampshire, New York, Ohio, Virginia, or Wisconsin.