Bronx Q1 Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Saint Benedict's Roman Catholic Church 2969 Otis Avenue, Bronx, New York 10465

Saint Benedict’s Roman Catholic Church 2969 Otis Avenue, Bronx, New York 10465 The Home Parish of Terence Cardinal Cooke ~ (March 1, 1921 - October 6, 1983) Cardinal Archbishop of New York—Motto: Fiat Voluntas Tua, meaning, “Thy Will Be Done" RECTORY TELEPHONE NUMBER: 1-718-828-3403 Welcome to Our Parish (see page 3 for rectory staff extensions) Fax: 1-718-829-1304 E-mail: [email protected] Website: http://www.stbenedictchurchny.org Twitter: @Saintbenchurch RECTORY HOURS: (Please see page 2 for summer hours) Monday - Friday: 9:00am until 12:00pm 1:00pm until 5:00pm Saturday: 9:00am until 4:00pm Sunday: Closed SCHOOL: 1016 Edison Avenue, Bronx, NY 10465 Tel: 1-718-829-9557 Fax: 1-718-319-1898 Website: http://www.stbenedictschoolbx.org CLERGY: Reverend Stephen P. Norton Pastor Reverend Christian Amah M A S S E S: Parochial Vicar Weekdays: 6:45am and 8:30am Deacon A. Michael Salvatorelli Saturdays: 8:30am and 4:00pm Deacon John Scott Sundays: Vigil: 4:00pm (Saturday evening,) Sundays: 7:00am, 9:30am, 11:00am, 7:00pm PASTORAL STAFF: Holy Days of Obligation: Mr. Ray Vitiello, School Principal Vigil 7:00pm (Night before) Ms. Joann LaDisa, Religious Education Office - School 6:45am, 8:30am and 12:00 Noon 1-718-829-1200 or: [email protected] Mrs. Anne Myers, Director of Music THE SACRAMENT OF RECONCILIATION: (CONFESSION) Saturdays: 9:00am until 9:30am and 3:00pm until 4:00pm SERVING YOUR SACRAMENTAL NEEDS: The Sacrament of Baptism: Please call the Rectory for a date Any time by appointment soon after the birth of your child. -

Bronx Flu Vaccine Network Pharmacy List Bronx

BRONX FLU VACCINE NETWORK PHARMACY LIST Pharmacy Name Address City, State, Zip Phone 161 ST PHARMACY INC 275 E 161ST ST BRONX, NY 10451 (718) 742-3400 CARE PHARMACY 313 E161 ST STREET BRONX, NY 10451 (718) 822-3700 CVS PHARMACY 282 EAST 149TH STREET BRONX, NY 10451 (718) 665-5600 CVS PHARMACY 224 EAST 161ST STREET BRONX, NY 10451 (718) 588-5700 DUANE READE 3225 3RD AVE BRONX, NY 10451 (718) 292-7060 EVERS PHARMACY 226 E 144TH ST FL 2 2ND FL BRONX, NY 10451 (718) 292-0900 EXPRESS PHARMACY 273 E 149TH ST BRONX, NY 10451 (718) 292-7010 FEEL GOOD PHARMACY 3058 3RD AVE BRONX, NY 10451 (347) 918-9000 HEALTH CARE PHARMACY 567 COURTLANDT AVE BRONX, NY 10451 (718) 585-1117 LEFF DRUGS 70 E 161ST ST BRONX, NY 10451 (718) 665-1163 LINCOLN DRUGS INC 526 MORRIS AVE BRONX, NY 10451 (718) 993-6750 MELROSE PHARMACY 666 COURTLANDT AVE BRONX, NY 10451 (718) 292-1856 BRONX Page 1 of 27 BRONX FLU VACCINE NETWORK PHARMACY LIST Pharmacy Name Address City, State, Zip Phone MERCEDES PHARMACY 514 WILLIS AVE BRONX, NY 10451 (718) 292-7979 METCARE RX 305 E 161ST ST BRONX, NY 10451 (718) 410-4711 METRO PHARMACY 342 E 149TH ST BRONX, NY 10451 (718) 292-1212 MHN RX MELROSE INC 730 COURTLANDT AVE BRONX, NY 10451 (718) 292-5572 MORRIS AVE PHARMACY INC 675 MORRIS AVE STORE F BRONX, NY 10451 (718) 292-2500 OZ PHARMACY 322 E 149TH ST BRONX, NY 10451 (718) 292-8892 PHARMORE PHARMACY 337 E 149TH ST BRONX, NY 10451 (646) 314-7954 TARGET PHARMACY 700 EXTERIOR ST BRONX, NY 10451 (718) 401-5652 WALGREENS 244 E 161ST ST BRONX, NY 10451 (217) 709-2386 ZAMZAM PHARMACY 524 MORRIS -

Covid-19 Testing

COVID-19 TESTING Where To Get A Test For COVID-19 Students or staff who exhibit symptoms of COVID-19 or are concerned that they may have been exposed to the virus will be referred to their primary healthcare provide or local clinic/urgent care center for testing. New York offers multiple test sites throughout the state. Testing is free and available to all eligible New Yorkers statewide as ordered by a health care provider or by calling the NYS COVID-19 hotline at 1-888-364-3065. Individuals who might prefer test sites operated by the local government or private companies (including pharmacies, medical practices, or not-for-profit organizations) are advised to contact the testing site and check with their insurance carrier in advance to confirm they will not be responsible for any fees associated with a test1. Your local health department is your community contact for COVID19 concerns2. We encourage you to visit the NYS website for further information. 1 https://coronavirus.health.ny.gov/covid-19-testing 2 https://coronavirus.health.ny.gov/covid-19-testing Additional Information Free, walk-in testing is also available at the following NYC Health + Hospital Locations3: NYC Health + Hospitals/Gotham Health, Belvis NYC Health + Hospitals/Gotham Health, Morrisania 545 East 142nd Street 1225 Gerard Avenue Bronx, New York 10454 Bronx, New York 10452 844-NYC-4NYC 844-NYC-4NYC COVID-19 Testing Offered Here COVID-19 Testing Offered Here Monday – Saturday, 9 a.m. – 3:30 p.m. Monday – Friday, 8:30 a.m. – 4 p.m. Sunday, 9 a.m. -

Directions to the New Cemetery from the Tristate Area

DIRECTIONS TO THE NEW CEMETERY FROM THE TRISTATE AREA From Queens via the Whitestone Bridge • Upon crossing the Whitestone Bridge, bear right and prepare to exit onto the service road, which is the first exit on the right. • Go straight to the traffic light and make a right turn onto Lafayette Ave. • Proceed to the first entrance gate on the right. • Once through the gate, proceed straight to the first Stop sign. • Make a right turn and proceed to office, which is the red brick building on left. From the George Washington Bridge and the Cross Bronx Expressway • Take the Cross Bronx Expressway East following signs to the Throggs Neck Bridge. • Before the bridge, exit at Randall Ave. At the traffic light at the end of the ramp, make a right turn onto Randall Ave. • Proceed to the first entrance gate on the right. • Once through gate, proceed straight and make the first left turn. Drive to end of the road. • At the end of the road, make a right turn followed by a quick left turn. • Proceed straight past the Stop sign to the office, which is the red brick building on left. From the South Bronx via the Bruckner Expressway • Take the Bruckner Expressway Northeast. • Follow signs for the Throggs Neck Bridge. • Before the bridge, exit at Randall Ave. At the traffic light at the end of the ramp, make a right turn onto Randall Ave. • Proceed to the first entrance gate on the right. • Once through the gate, proceed straight and make the first left turn. Drive to end of road. -

Testimony of Fred Freiberg, Executive Director, Fair Housing Justice Center (FHJC) Hearing of the New York City Council Committe

Testimony of Fred Freiberg, Executive Director, Fair Housing Justice Center (FHJC) Hearing of the New York City Council Committee on Housing & Buildings November 8, 2017 – 10:00 a.m. The Fair Housing Justice Center (FHJC), a regional civil rights organization based in New York City, strongly supports passage of the Fair Residential Cooperative Disclosure Law (Intro 1458). In our view, this law will bring greater fairness, accountability, and transparency to a process that has, for too long, been cloaked in secrecy. The passage of laws that prohibit housing discrimination has resulted in some significant changes in housing market practices. The very “visible” walls that once characterized most housing discrimination still exist, but are far less common (e.g., slammed doors, blatant discriminatory comments, overt denials, etc.). Today, the bulk of discriminatory housing practices are more subtle and difficult to detect. More often it is the “invisible” walls that prevent people from obtaining available housing (e.g. selective marketing, misrepresentations about availabilities, policies that have a disparate impact, etc.). The problem with these invisible walls is that they are rarely detected by ordinary consumers and the practices are difficult to document. Consequently, few complaints are filed and enforcement action is rarely taken….so the discrimination continues. The invisibility of this housing discrimination ensures its sustainability. The late civil rights leader James Farmer, said it another way, “Institutional practices, it seems, perpetuate themselves by their invisibility.” Our organization has found that some of these “invisible” walls can be documented and eliminated through testing investigations conducted at the pre-application or pre-purchase stage of a housing transaction. -

Save the Date Thursday, August 1, 2019 6:30 - 10:30 PM Join Us for an Evening of Good Food, Music and Fun to Benefit PCC

Save the Date Thursday, August 1, 2019 6:30 - 10:30 PM Join us for an evening of good food, music and fun to benefit PCC Celebrating Service to the Bronx Community Honorees: AnaMarie Murphy – Administrative Assistant, Human Resources Officer, PHS For her faithful leadership, friendship and untiring dedication and service to the Sisters of Divine Compassion, PCC, and PHS for over 13 years. Robert Crafa – Waterfront Director, SUNY Maritime College For his extraordinary commitment to Preston Center of Compassion Summer Recreational Program and the Bronx community for over 12 years. Throggs Neck Community Action Partnership (TNCAP) under the auspices of Archdiocese of NY Drug Abuse Prevention Program (ADAPP) For TNCAP’s strong membership support and dedication to the Throggs Neck community since 1998. Outdoor Reception overlooking the East River on the Preston Campus, 2780 Schurz Ave, Bronx, NY 10465 Please come join us for an evening of good food and fun to benefit PCC, sponsored in part by: BRONX Watch for a formal invitation to follow Bring a Table of 10 to the Dinner and Receive 10 Free Yankee Tickets! Summer Fundraiser 1st Prize: $5,000 2nd Prize: 2 Tickets to Hamilton on Broadway, 3rd Prize: Manhattan Getaway, 4th Prize: iPad, 5th Prize: Sports Mania Package For the last three years, A PCC Summer Recreational Parent has earned 7 free weeks of camp for their child as a result of selling Raffle Tickets! Please see below for the offer! Help us reach our goal Raffle tickets are $25 each and help the Preston Center of Compassion Summer Recreational Program, to offer free snacks, early registration discounts, as well as defraying the annual increase in the cost of running the camp. -

Bronx Community Board #10

BRONX COMMUNITY BOARD #10 SENIOR SERVICES GLEBE AVENUE SENIOR CENTER 2125 Glebe Avenue, Bronx 10461 Sponsor: Bronx/Westchester YMCA 718-892-1564 http://www.nyc.gov/html/nycha/html/ccschtml/bronxglebesc.shtml JASA (Jewish Association Serving the Aging) JASA is proud to announce an affiliation with One Stop (One Stop Senior Services), a well-established agency founded in 1981 providing quality services to seniors living on the Upper West Side. With aligned missions and complementary service structures, the affiliation enables JASA and One Stop to coordinate and enhance the delivery of such services as case assistance, care management, advocacy training, and home care for a walk-in senior population as well as homebound seniors. For more information, please contact JASA's Help Center at 212.273.5272 or visit One Stop at JASA's website at: http://www.onestopseniorservices.org. Bartow Senior Center 2049 Bartow Avenue Bronx, NY 10475 718.320.2066 Dreiser Senior Center 177 Dreiser Loop Bronx, NY 10475 718.320.1345 Einstein Senior Center 135 Einstein Loop Bronx, NY 10475 718.671.5161 Throggs Neck Senior Center 2705 Schley Avenue Bronx, NY 10465 718.823.1771 NORTHEAST BRONX SENIOR CENTER 2968 Bruckner Boulevard, Bronx 10465 718-892-6090 1 | P a g e BRONX COMMUNITY BOARD #10 OUR LADY OF THE ASSUMPTION 50+ Club Widow & Widowers 1634 Mahan Avenue, Bronx 10461 1634 Mahan Avenue, Bronx 10461 718-319-1923, Sr. Veronica 914-637-6203, J. McGuinnes PSS City Island Senior Center 116 City Island Avenue Bronx, NY 10464 718 885-0727 Patricia Attis, Program Manager [email protected] R.A.I.N. -

May 2002 One Dollar a PRESIDENTIAL TEAM OPENS 2002 C.I.L.L

Second Class Permit Paid at Bronx, N.Y. USPS 114-590 Volume 31 Number 4 May 2002 One Dollar A PRESIDENTIAL TEAM OPENS 2002 C.I.L.L. SEASON! Photos by RICK DeWITT With Islander Tom Davis as Grand Marshal, the City Island Little League opened the 2002 season on April 13 with an enthusiastic parade down City Island Avenue. Dignitaries were on hand to pitch in, including the new Bronx Borough President, Adolfo Carrion, who threw out the first pitch, and New York State Assemblyman Stephen B. Kaufman. This year's opening day festivities were dedicated to the past presidents of City Island Little League, especially Mr. Davis, who dreamed of a club house and a batting cage when he was president from 1979 to 1986. Shown above (upper left, l. to r.) dedicating the new batting cage sign are the past and present Little League presidents, along with parade guests: Robert Whalan, Tom Vivolo, Tom Lyons, Tony Grimaldi, John Salacan, Bob Cortazzo, Chris McGuire, Tom Davis, Drew Davis, Ed Esposito, Walter Henning, Mr. Carrion and Frank Sena; kneeling are Dom DeMarco and Irwin Weinfeld. For the 2002 season, hundreds of boys and girls will participate in baseball, softball and T-ball on teams sponsored by City Island businesses and residents. Let the games begin! Page Two The Island Current May 2002 BRIEFLY... Police Investigate Home HI TEC ADVENTURE RACE SERIES returns to Orchard Beach, on Sunday, May 19. Six hundred racers will compete in biking, kayaking and running. Invasion on King Avenue Staging, start and finish areas are at the north picnic area. -

Property Management Office

DEVELOPMENT NAME MANAGEMENT OFFICE ADDRESS BOROUGH PHONE 1010 East 178th Street, Bronx, NY 1010 East 178th Street 1010 East 178th Street 10460 Bronx 7185898330 1162-1176 Washington Avenue Claremont Consolidated 1052 Teller Avenue, Bronx, NY 10456 Bronx 7185887411 1090 Rosedale Ave, Bronx, NY 10472- 1471 Watson Avenue SOTOMAYO 6006 Bronx 7188427164 Adams Adams 731 Tinton Avenue, Bronx, NY 10455 Bronx 7189931585 BAILEY AVENUE-WEST 193RD STREET Fort IndePendence 2663 HEATH AVE, BRONX, NY 10463 Bronx 7188846330 Baychester Boston Sector 3570 Bivona Street, Bronx, NY 10475 Bronx 7186712050 160 Saint Anns Avenue, Bronx, NY Betances II, 132 Mill Brook 10454 Bronx 7186650731 225 Alexander Avenue, Bronx, NY Betances II, 182 Mitchel 10454 Bronx 7189930630 160 Saint Anns Avenue, Bronx, NY Betances III, 132 Mill Brook 10454 Bronx 7186650731 225 Alexander Avenue, Bronx, NY Betances III, 182 Mitchel 10454 Bronx 7189930630 2420 Bronxwood Avenue, Bronx, NY Boston Road Plaza Pelham Parkway 10469 Bronx 7185472100 Boston Sector Boston Sector 3570 Bivona Street, Bronx, NY 10475 Bronx 7186712050 DEVELOPMENT NAME MANAGEMENT OFFICE ADDRESS BOROUGH PHONE 1605 East 174th Street, Bronx, NY Boynton Avenue Rehab Bronx River 10472 Bronx 7188429250 1605 East 174th Street, Bronx, NY Bronx River Bronx River 10472 Bronx 7188429250 1605 East 174th Street, Bronx, NY Bronx River Addition Bronx River 10472 Bronx 7188429250 649 Westchester Avenue, Bronx, NY Bronxchester Saint Mary's Park 10455 Bronx 7185851331 998 East 167th Street, Bronx, NY Bryant Avenue-East 174th Street -

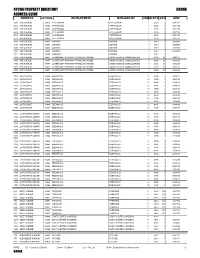

Nycha Property Directory Address Guide Bronx

NYCHA PROPERTY DIRECTORY BRONX ADDRESS GUIDE ADDRESS ZIPCODE DEVELOPMENT MANAGED BY CD# BLOCK LOT BIN# 2595 3RD AVENUE 10451 PATTERSON PATTERSON 1 2325 1 2091131 2615 3RD AVENUE 10451 PATTERSON PATTERSON 1 2325 1 2091125 2625 3RD AVENUE 10451 PATTERSON PATTERSON 1 2325 1 2091136 2635 3RD AVENUE 10451 PATTERSON PATTERSON 1 2325 1 2091135 2645 3RD AVENUE 10451 PATTERSON PATTERSON 1 2325 1 2091135 2715 3RD AVENUE 10451 PATTERSON PATTERSON 1 2324 1 2091121 3603 3RD AVENUE 10456 MORRIS I MORRIS 3 2910 1 2092082 3661 3RD AVENUE 10456 MORRIS I MORRIS 3 2910 1 2092079 3663 3RD AVENUE 10456 MORRIS I MORRIS 3 2910 1 2092079 3673 3RD AVENUE 10456 MORRIS I MORRIS 3 2910 1 2092079 3711 3RD AVENUE 10456 MORRIS II MORRIS 3 2911 1 3800 3RD AVENUE 10457 CLAREMONT PARKWAY-FRANKLIN AVENUE UNION AVENUE CONSOLIDATED 3 2928 28 2092127 3804 3RD AVENUE 10457 CLAREMONT PARKWAY-FRANKLIN AVENUE UNION AVENUE CONSOLIDATED 3 2928 28 2092127 3808 3RD AVENUE 10457 CLAREMONT PARKWAY-FRANKLIN AVENUE UNION AVENUE CONSOLIDATED 3 2928 28 2092127 3812 3RD AVENUE 10457 CLAREMONT PARKWAY-FRANKLIN AVENUE UNION AVENUE CONSOLIDATED 3 2928 28 2092127 3820 3RD AVENUE 10457 CLAREMONT PARKWAY-FRANKLIN AVENUE UNION AVENUE CONSOLIDATED 3 2928 28 2092127 1130 226TH DRIVE 10466 EDENWALD EDENWALD 12 4905 1 2094173 1131 226TH DRIVE 10466 EDENWALD EDENWALD 12 4905 1 2094163 1135 226TH DRIVE 10466 EDENWALD EDENWALD 12 4905 1 2094163 1138 226TH DRIVE 10466 EDENWALD EDENWALD 12 4905 1 2094173 1141 226TH DRIVE 10466 EDENWALD EDENWALD 12 4905 1 2094164 1145 226TH DRIVE 10466 EDENWALD EDENWALD -

Throggs Neck Community Action Partnership Creating a Bridge of Prevention and Promise for Our Community

THROGGS NECK COMMUNITY ACTION PARTNERSHIP Creating a Bridge of Prevention and Promise for Our Community FALL 2013 ily Newslette r Fam TNCAP HOSTS 14TH ANNUAL POSTER CAMPAIGN “The Risk Is Real. I Make Good Choices” Above, Senator Jeff Klein Neck community. Past campaign We received and Rep. J. Crowley’s district topics have targeted graffiti, drunk 600 submissions representative Thomas Messina driving and tobacco use. This year, from MS 101, Mott help our 2013 honorees celebrate middle-school students were asked Hall Community School, St. their achievements in the Poster to develop a poem, letter or poster Benedict School, St Frances de Campaign, “The Risk is Real. I Make on the theme “The Risk is Real. I Chantal School, Preston Center Good Choices.” Since 1999, the Make Good Choices.” Students for Compassion, Phipps Beacon Throggs Neck Community Action learned that underage use of alcohol and Kips Bay Boys & Girls Club. Partnership, with the support of has many consequences, some Many thanks go to these agencies, our elected officials, schools and immediate and some long-term, principals, teachers and students merchants, has hosted an annual on their school, family and social for their participation and to the poster campaign for area schools on lives, and on physical and emotional Throggs Neck Little League. issues of importance to the Throggs health. SENATOR JEFF KLEIN’S TEEN HEALTH AWARENEss CAMPAIGN News from Senator Jeffrey D. Klein Serving Bronx/ Westchester News from Senator Jeffrey D. Klein Serving Bronx/ Westchester CONTACT: Anna Durrett, 415.203.1455 One of my proudest achievements New Yorkers to “weigh-in” on how community is addressing the serious this year was launching the Teen much they know about important issue of underage drinking from all Health Awareness Campaign. -

Bronx, NY RETAIL SPACE for LEASE 815 Hutchinson River Parkway THROGGS NECK SHOPPING CENTER

Bronx, NY RETAIL SPACE FOR LEASE 815 Hutchinson River Parkway THROGGS NECK SHOPPING CENTER TURN-KEY RESTAURANT & MEDICAL SPACES AVAILABLE AVAILABLE: 900 – 2,114 SF CO-TENANTS: Target, TJ Maxx, Party City, Petco, T-Mobile, Skechers, Mattress For More Information, Firm, CKO Kickboxing, Charley’s Philly Cheesesteak, European Wax Center, Starbucks, Popeye’s, Five Guys, Subway, Chipotle, Sarku Please Contact: Japan, AFC Urgent Care, Professional Physical Therapy, Metro Optics, Rite Check and more NEIGHBORING RETAILERS: Karnit Mosberg Home Depot, Lumber Liquidators, Kmart, Marshalls, Gap, Old 914-237-3400 - Ext. 110 Navy, AutoZone, Carter’s, CubeSmart, KFC, Public Storage, UPS, Verizon, Rite Aid, Citibank, McDonald’s, CVS, TD Bank, T-Mobile, 516-782-5595 (Cell) Chase, and many more [email protected] ADDITIONAL INFORMATION: • 300,000 SF Retail Center Anchored By 165,000 SF Target • Situated in the Ferry Point Section of The Bronx on Brush & Lafayette Avenue OWNED & MANAGED BY • Turn-Key Restaurant Spaces with Fully Equipped Kitchen • Built-Out Medical Space • Redeveloped in 2015 • 625 Free Parking Spaces • End Cap & In-Line Spaces MODIFIED GROSS RENT: Call for Details All information furnished herein is from sources deemed reliable. No warranty or representation is made to the accuracy thereof and it is submitted subject to errors, omissions and/or changes without notice. www.RoyalPropertiesInc.com Bronx, NY 815 Hutchinson River Parkway THROGGS NECK SHOPPING CENTER TENANT 1 AVAILABLE – 2,114 SF 2 Charley’s Philly Cheese Steak 3 Five