Chap. 4: Summarizing & Describing Numerical Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

M2 Mid-Module Assessment Task

NYS COMMON CORE MATHEMATICS CURRICULUM Mid-Module Assessment Task M2 ALGEBRA I Name Date 1. The scores of three quizzes are shown in the following data plot for a class of 10 students. Each quiz has a maximum possible score of 10. Possible dot plots of the data are shown below. a. On which quiz did students tend to score the lowest? Justify your choice. b. Without performing any calculations, which quiz tended to have the most variability in the students’ scores? Justify your choice based on the graphs. Module 2: Descriptive Statistics 85 This work is licensed under a This work is derived from Eureka Math ™ and licensed by Great Minds. ©2015 Great Minds. eureka-math.org This file derived from ALG I-M2-TE-1.3.0-08.2015 Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Unported License. NYS COMMON CORE MATHEMATICS CURRICULUM Mid-Module Assessment Task M2 ALGEBRA I c. If you were to calculate a measure of variability for Quiz 2, would you recommend using the interquartile range or the standard deviation? Explain your choice. d. For Quiz 3, move one dot to a new location so that the modified data set will have a larger standard deviation than before you moved the dot. Be clear which point you decide to move, where you decide to move it, and explain why. e. On the axis below, arrange 10 dots, representing integer quiz scores between 0 and 10, so that the standard deviation is the largest possible value that it may have. You may use the same quiz score values more than once. -

Mgtop 215 Chapter 3 Dr. Ahn

MgtOp 215 Chapter 3 Dr. Ahn Measures of central tendency (center, location): measures the middle point of a distribution or data; these include mean and median. Measures of dispersion (variability, spread): measures the extent to which the observations are scattered; these include standard deviation and range. Parameter: a numerical descriptive measure computed from the population measurements (census data). Statistic: a numerical descriptive measure computed from sample measurements. Throughout we denote N: the number of observations in the population, that is the population size, n: the number of observations in a sample, that is, the sample size, and xi : the i-th observation. Measures of Central Tendency (Location) Population mean 1 ⋯ Sample mean 1 ⋯ ̅ Formulas> Insert Function () >Statistical>AVERAGE Note that the population mean and sample mean are arithmetic means or average, and computed in the same manner. Example 1. Find the sample mean of the following data. 5, 7, 2, 0, 4 Deviation from the mean: observation minus the mean, i.e. or ̅. The mean is a measure of the center in the sense that it “balances” the deviations from the mean. Median: The middle value of data when ordered from smallest to largest Formulas> Insert Function () >Statistical>MEDIAN Example 2. Find the sample median of the data in Example 1. The median is a measure of the center in the sense that it “balances” the number of observations on both sides of the median. 1 Example 3. Find the median of the following data. 5, 7, 2, 4, 2, 1 The mode is useful as a measure of central tendency for qualitative data. -

Modification of ANOVA with Various Types of Means

Applied Mathematics and Computational Intelligence Volume 8, No.1, Dec 2019 [77-88] Modification of ANOVA with Various Types of Means Nur Farah Najeeha Najdi1* and Nor Aishah Ahad1 1School of Quantitative Sciences, Universiti Utara Malaysia. ABSTRACT In calculating mean equality for two or more groups, Analysis of Variance (ANOVA) is a popular method. Following the normality assumption, ANOVA is a robust test. A modification to ANOVA is proposed to test the equality of population means. The suggested research statistics are straightforward and are compatible with the generic ANOVA statistics whereby the classical mean is supplemented by other robust means such as geometric mean, harmonic mean, trimean and also trimmed mean. The performance of the modified ANOVAs is then compared in terms of the Type I error in the simulation study. The modified ANOVAs are then applied on real data. The performance of the modified ANOVAs is then compared with the classical ANOVA test in terms of Type I error rate. This innovation enhances the ability of modified ANOVAs to provide good control of Type I error rates. In general, the results were in favor of the modified ANOVAs especially ANOVAT and ANOVATM. Keywords: ANOVA, Geometric Mean, Harmonic Mean, Trimean, Trimmed Mean, Type I Error. 1. INTRODUCTION Analysis of variance (ANOVA) is one of the most used model which can be seen in many fields such as medicine, engineering, agriculture, education, psychology, sociology and biology to investigate the source of the variations. One-way ANOVA is based on assumptions that the normality of the observations and the homogeneity of group variances. -

Stat 216 Excel/Phstat Homework Assignment #1

Stat 216 Excel/PHStat Homework Assignment #1 Please visit www.stat.wmich.edu/s216/phstat.html to learn how to start up Excel/PHStat. Tip: Read through this entire assignment before getting onto a computer. The data that you will need for this assignment can be found in the worksheet called cars. The worksheet contains on 80 different kinds of cars. From Motor Trend Car, we see that the variables include MPG, CYL (4, 6, 8), DISP (size), HP, DRAT, WT, QSEC, VS (=0, =1), AM, GEAR (3, 4, 5), and CARB (0, 2, 4, 6, 8). You will be obtaining a subset of this data. Every student will have a different data set. Directions for obtaining your unique data subset: • Go to www.stat.wmich.edu/s216/info.html and click on Winter 2002 link and HW Data link. • Choose Cars from the list of data sets. • Click on the Submit button. • Put check marks next to all the variables under Select variable(s) to be resampled. • Enter 50 for Sample size. • Enter the last four digits of your student ID for the PIN Number. • Click on the Submit button. • Follow the instructions on the page that comes up on your browser, which will tell you to click on the link provided. A text file containing the data will come up next, which you should download. Use a floppy diskette if you are on a lab PC. • Next, open the file into Excel. Choose Text files under Files of type. • Choose Delimited for the Text Import Wizard step 1. -

Math 366 Minitab Homework Assignment # 1 Due 28 February 2002

Math 366 Minitab Homework Assignment # 1 Due 28 February 2002 Please visit http://unix.cc.wmich.edu/lheun/ Tip: Read through this entire assignment before getting on a computer. The data that you will need for this assignment can be found in the file called BB97.txt. Click on Minitab Assignment 1 data and SaveAs. Once the data is on your computer, you may need to use EXCEL to reformat it so that you can read it into a Minitab worksheet. The worksheet contains data on 28 baseball teams. The data contains the following variables: Baseball team League (L) (American = 0, National = 1), Number of Wins (W), E.R.A. (ERA) (Earned Run Average), Runs Scored (RS), Hits Allowed (HA), Walks Allowed (WA), Saves (S), and Errors (E). Open worksheet in Minitab and follow dialog box instructions. (+5)1. Obtain the descriptive statistics for ERA. and W. In your report, include the output of Minitab (copy and paste), and make an additional table listing these particular measures of central tendency: mean, median, midhinge and midrange. Also include these measures of variation in your table: range, IQR, variance, standard deviation, and coefficient of variation. Note: A couple of these measures (midrange, midhinge, and CV) will require you to make some additional hand calculations. (+5)2. Get a stem-and-leaf plot of S. Determine the mode of S from the plot? (+5)3. Obtain a histogram of ERA. Based on the histogram, what is the shape of the data? (+5)4. Get a boxplot of ERA score. What is the shape? Does this agree with the shape you reported in #3? Remember that tilting you head to the left or turning the printout clockwise helps you determine skewness direction, if any. -

Rapid Assessment Method Development Update : Number 1

Rapid Assessment Method Development Update : Number 1 Introduction This document reports on RAM development activities. This update reports desk-based work on: • Improvements to the performance of the PROBIT estimator for GAM. • Extension of the PROBIT indicator to include SAM in order to provide a needs assessment estimate for CMAM programs. This is an extension to RAM as originally proposed. PROBIT for GAM : Introduction The PROBIT estimator takes two parameters: Location (central tendency) : The location could be the mean or the median or some other estimator of the centre of the distribution of MUAC values. Dispersion (or spread) : The dispersion could be the standard deviation (SD) or some other measure of the spread of the distribution of MUAC values about centre of the distribution of MUAC values. The mean and the SD are the most common measures of location and dispersion. They have the advantage of being easy to calculate because they do not require data to be sorted. The have the disadvantage of lacking robustness to outliers (i.e. extreme high or low values). This problem effects the SD more than the mean because its calculation involves squaring deviations from the mean and this gives more weight to extreme values. Lack of robustness is most problematic with small sample sizes as we have with RAM. There are two ways around this problem : 1. Transform the data to bring outliers closer to the centre of the distribution. This only works well when outliers occur to one side or the centre of the distribution. 2. Use robust estimators of location and dispersion. -

Robust Location Estimators for the X Control Chart

mss # 1500.tex; art. # 06; 43(4) Robust Location Estimators for the X Control Chart MARIT SCHOONHOVEN Institute for Business and Industrial Statistics of the University of Amsterdam (IBIS UvA), Plantage Muidergracht 12, 1018 TV Amsterdam, The Netherlands HAFIZ Z. NAZIR Department of Statistics, University of Sargodha, Sargodha, Pakistan MUHAMMAD RIAZ King Fahad University of Petroleum and Minerals, Dhahran 31261, Saudi Arabia Department of Statistics, Quad-i-Azam University, 45320 Islamabad 44000, Pakistan RONALD J. M. M. DOES IBIS UvA, Plantage Muidergracht 12, 1018 TV, Amsterdam, The Netherlands This article studies estimation methods for the location parameter. We consider several robust location estimators as well as several estimation methods based on a phase I analysis, i.e., the use of a control chart to study a historical dataset retrospectively to identify disturbances. In addition, we propose a new type of phase I analysis. The estimation methods are evaluated in terms of their mean-squared errors and their e↵ect on the X control charts used for real-time process monitoring (phase II). It turns out that the phase I control chart based on the trimmed trimean far outperforms the existing estimation methods. This method has therefore proven to be very suitable for determining X phase II control chart limits. Key Words: Estimation; Mean; Phase I; Phase II; Robust; Shewhart Control Chart; Statistical Process Control; Trimean. Introduction ters, and an optimal performance requires that any change in these parameters should be detected as HE PERFORMANCE of a process depends on the soon as possible. To monitor a process with respect T stability of its location and dispersion parame- to these parameters, Shewhart introduced the idea of control charts in the 1920s. -

Summarizing Data Major Properties of Numerical Data

Summarizing Data Daniel A. Menascé, Ph.D. Dept of Computer Science George Mason University 1 © 2001 D. A. Menascé. All Rights Reserved. Major Properties of Numerical Data • Central Tendency: arithmetic mean, geometric mean, median, mode. • Variability: range, interquartile range, variance, standard deviation, coefficient of variation, mean absolute deviation. • Skewness: coefficient of skewness. • Kurtosis 2 © 2001 D. A. Menascé. All Rights Reserved. 1 Measures of Central Tendency • Arithmetic Mean n ! Xi X = i=1 n • Based on all observations greatly affected by extreme values. 3 © 2001 D. A. Menascé. All Rights Reserved. Effect of Outliers on Average 1.1 1.1 1.4 1.4 1.8 1.8 1.9 1.9 2.3 2.3 2.4 2.4 2.8 2.8 3.1 3.1 3.4 3.4 3.8 3.8 10.3 3.5 Average 3.1 2.5 4 © 2001 D. A. Menascé. All Rights Reserved. 2 Geometric Mean 1/ n & n # • Geometric Mean: X $' i ! % i=1 " • Used when the product of the observations is of interest. • Important when multiplicative effects are at play: – Cache hit ratios at several levels of cache – Percentage performance improvements between successive versions. – Performance improvements across protocol layers. 5 © 2001 D. A. Menascé. All Rights Reserved. Example of Geometric Mean Performance Improvement Avg. Performance Operating Improvement Test Number System Middleware Application per Layer 1 1.18 1.23 1.10 1.17 2 1.25 1.19 1.25 1.23 3 1.20 1.12 1.20 1.17 4 1.21 1.18 1.12 1.17 5 1.30 1.23 1.15 1.23 6 1.24 1.17 1.21 1.21 7 1.22 1.18 1.14 1.18 8 1.29 1.19 1.13 1.20 9 1.30 1.21 1.15 1.22 10 1.22 1.15 1.18 1.18 Average Performance Improvement per Layer 1.20 6 © 2001 D. -

Mgtop 215 Chapter 3 Dr. Ahn

MgtOp 215 Chapter 3 Dr. Ahn Measures of central tendency (center, location): measures the middle point of a distribution or data; these include mean and median. Measures of dispersion (variability, spread): measures the extent to which the observations are scattered; these include standard deviation and range. Parameter: a numerical descriptive measure computed from the population measurements (census data). Statistic: a numerical descriptive measure computed from sample measurements. Throughout we denote N: the number of observations in the population, that is the population size, n: the number of observations in a sample, that is, the sample size, and xi : the i-th observation. Measures of Central Tendency (Location) Population mean 1 ⋯ Sample mean 1 ⋯ ̅ Formulas> Insert Function () >Statistical>AVERAGE Note that the population mean and sample mean are arithmetic means or average, and computed in the same manner. Example 1. Find the sample mean of the following data. 5, 7, 2, 0, 4 Deviation from the mean: observation minus the mean, i.e. or ̅. The mean is a measure of the center in the sense that it “balances” the deviations from the mean. Median: The middle value of data when ordered from smallest to largest Formulas> Insert Function () >Statistical>MEDIAN Example 2. Find the sample median of the data in Example 1. The median is a measure of the center in the sense that it “balances” the number of observations on both sides of the median. 1 Example 3. Find the median of the following data. 5, 7, 2, 4, 2, 1 The mode is useful as a measure of central tendency for qualitative data. -

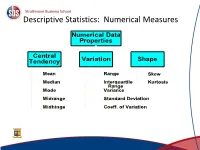

Descriptive Statistics .Pdf

Descriptive Statistics: Numerical Measures Numerical Data Properties Central Tendency Variation Shape Mean Range Skew Median Interquartile Kurtosis Range Mode Variance Midrange Standard Deviation Midhinge Coeff. of Variation Measures of Location Measures of Location Mode –If the measures are computed for data from a sample, they are called sample statistics.` Median Percentile –If the measures are computed for data Quartiles from a population, they are called population parameters. of the corresponding population parameter. For example, the sample mean is a point estimator of the population mean. –A sample statistic is referred to as the point estimator Mean • The mean of a data set is the average of all the data values. • As we said, the sample mean is the point estimator of the population mean m. Example: Apartment Rents Seventy efficiency apartments were randomly sampled in a small college town. The monthly rent prices for these apartments are listed in ascending order on the next slide. Sample Mean Example Continued 425 430 430 435 435 435 435 435 440 440 440 440 440 445 445 445 445 445 450 450 450 450 450 450 450 460 460 460 465 465 465 470 470 472 475 475 475 480 480 480 480 485 490 490 490 500 500 500 500 510 510 515 525 525 525 535 549 550 570 570 575 575 580 590 600 600 600 600 615 615 Properties of the Arithmetic Mean 1- Every set of interval-level and ratio-level data has a mean. 2- All the values are included in computing the mean. 3- A set of data has a unique mean. -

Visualizing Multivariate Data

1 Visual Analytics Visualizing multivariate data: High density time-series plots Scatterplot matrices Parallel coordinate plots Temporal and spectral correlation plots Box plots Wavelets Radar and /or polar plots Others…… Demonstrations of DVAtool and Matlab examples CCA 2017 Workshop on Process Data Analytics, S. Africa, December 2017 2 Visualizing Multivariate Data Many statistical analyses involve only two variables: a preDictor variable and a response variable. Such data are easy to visualize using 2D scatter plots, bivariate histograms, boxplots, etc. It's also possible to visualize trivariate data with 3D scatter plots, or 2D scatter plots with a third variable encoded with, for example color. However, many datasets involve a larger number of variables, making direct visualization more difficult. This demo explores some of the ways to visualize high- dimensional data in MATLAB®, using the Statistics Toolbox™. Contents High Density plots Scatterplot Matrices Parallel Coordinates Plots In this demo, we'll use the carbig dataset, a dataset that contains various measured variables for about 400 automobiles from the 1970's and 1980's. We'll illustrate multivariate visualization using the values for fuel efficiency (in miles per gallon, MPG), acceleration (time from 0-60MPH in sec), engine Displacement (in cubic inches), weight, and horsepower. We'll use the number of cylinders to group observations. >>load carbig >>X = [MPG,Acceleration,Displacement,Weight,Horsepower]; >>varNames = {'MPG'; 'Acceleration'; 'Displacement'; 'Weight'; 'Horsepower'}; Can do a simple graphical plot as follows: gplotmatrix(X); But this plot is not as revealing or informative as the next plot using the same ‘gplotmatrix’ function. Scatterplot Matrices CCA 2017 Workshop on Process Data Analytics, S. -

Mathematical Statistics

Selected Topics from Mathematical Statistics Lecture Notes Winter 2020/ 2021 Alois Pichler Faculty of Mathematics DRAFT Version as of March 10, 2021 2 rough draft: do not distribute Preface and Acknowledgment Die Wahrheit wird euch frei machen. Joh. 8, 32 The purpose of these lecture notes is to facilitate the content of the lecture and the course. From experience it is helpful and recommended to attend and follow the lectures in addition. These lecture notes do not cover the lectures completely. I am indebted to Prof. Georg Ch. Pflug for numerous discussions in the area, significant sup- port over years and his manuscripts; some particular parts here follow this manuscript “mathe- matische Statistik” closely. Important literature for the subject, also employed here, includes Rüschendorf [14], Pruscha [11], Georgii [4], Czado and Schmidt [3], Witting and Müller-Funk [19] and https://www.wikipedia.org. Pruscha [12] collects methods and applications. Please report mistakes, errors, violations of copyright, improvements or necessary comple- tions. Updated version of these lecture notes: https://www.tu-chemnitz.de/mathematik/fima/public/mathematischeStatistik.pdf Complementary introduction and exercises: https://www.tu-chemnitz.de/mathematik/fima/public/einfuehrung-statistik.pdf Syllabus and content of the lecture: https://www.tu-chemnitz.de/mathematik/studium/module/2013/B15.pdf Prerequisite content known from Abitur: https://www.tu-chemnitz.de/mathematik/schule/online.php 3 4 rough draft: do not distribute Contents 1 Preliminaries, Notations, ...9 1.1 Where we are......................................9 1.2 Notation.........................................9 1.3 The expectation..................................... 10 1.4 Multivariate random variables............................. 11 1.5 Independence..................................... 13 1.6 Disintegration and conditional densities......................