Hutchison Port Holdings Trust

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE INTELLIGENT ADVANTAGE Harnessing the Power of IT to Stay Ahead of the Game

THE INTERNATIONAL JOURNAL OF THE HUTCHISON WHAMPOA GROUP SPHERE 11 TTHEHE IINTELLIGENTNTELLIGENT AADVDVANTAGEANTAGE SPHERE CONTENTS Number 11 April 2004 2 14 UPDATES TELECOMS NEWSBITES 3 CHEERS Latest developments from the Hong Kong enters the new era Hutchison press box. of video mobile communications. 20 COVER STORY THE INTELLIGENT ADVANTAGE Harnessing the power of IT to stay ahead of the game. 9 COMMUNITY COMMUNAL BONDS HPH makes every effort to contribute to the well-being of the communities in which it operates. 28 HOSPITALITY CAPITAL COMFORT Beijing’s newest luxury hotel offers the best of both worlds for discerning travellers. Cover: Illustration by Eamonn O'Boyle PUBLISHED BY Hutchison Whampoa Limited, 22/F Hutchison House, 10 Harcourt Road, Central, Hong Kong.Website: hutchison- whampoa.com. In-house Editorial Team: Laura Cheung, Nora Yong, Jeremy Lau, Pamela Wan, Wendy Luk. Editor: Mark Caldwell – Great Pacific Marketing Services Ltd. Design and production: Fiona Wat,Alvin Fong,Tanny Shek, Kelly Cheung – , a division of the Asia City Publishing Group.Tel:2850 5500. Fax 2543 1220. Colour Separation and Printing by bigboXX.com Limited. No part of this magazine may be reproduced without the written permission of Hutchison Whampoa Limited.All rights reserved. Copyright © 2003 by Hutchison Whampoa Limited.Opinions expressed herein are those of the writers and do not necessarily reflect the opinion of Hutchison Whampoa Limited.All currency conversions are approximations. HUTCHISON UPDATES News CORPORATE HWL Annual Results Performance -

Shipping Gets Ready As Imo 2020 Looms 機匯

08 SHIPPING GETS READY AS IMO 2020 LOOMS 機匯 CONTENTS 01 GMD UPFRONT MESSAGE 02 SHIPPING GETS READY AS IMO 2020 LOOMS 08 MANAGING SUPPLY CHAIN RISK IN A TURBULENT WORLD 12 SHIPPERS URGED TO TAKE ANOTHER LOOK AT CARGO INSURANCE 16 CHALLENGES OF TRAINING IN THE LOGISTICS MULTIVERSE 20 UBI EXTENDS REACH TO NEW PORTS 26 NEW VENTURES AND OPPORTUNITIES AROUND THE WORLD 30 GEC LAUNCHES BOLD NEW GREEN VISION FOR THE FUTURE CAPITALISING ON NEW OPPORTUNITIES AND IDEAS Despite continuing uncertainty in global trade and We are also adopting new ideas and technology to volatile geo-political circumstances, we are moving enhance our operations, such as introducing remote- ahead to further develop our global ports network and to controlled equipment, autonomous trucking and the also expand our logistics footprint in strategic locations. proof of concept for blockchain solutions, where we are working with a number of companies across the The keynote agreement with the Government of supply chain. Pakistan will significantly expand our operations in Karachi Port and continue our support for the It is important that even though we are currently OPPORTUNITY #08 (December 2019) country’s economic development. The US$240 expanding our business portfolio, we retain a keen All rights reserved. No part of this magazine may be reproduced without written permission from Hutchison Ports. million of new investment in Pakistan is an indication focus on our costs and continue to look at ways to Opinions expressed herein are those of the writers/contributors and do not necessarily reflect the opinion of Hutchison Ports. of our confidence in the future of the country as a improve cost efficiency throughout the network. -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

Hutchison Port Holdings - Hong Kong Commercial Development Intern

Hutchison Port Holdings - Hong Kong Commercial Development Intern Hutchison Port Holdings Limited (HPH), a subsidiary of the multinational conglomerate CK Hutchison Holdings Limited (CK Hutchison), is the world’s leading port investor, developer and operator. The HPH network of port operations comprises 319 berths in 52 ports, spanning 26 countries throughout Asia, the Middle East, Africa, Europe, the Americas and Australasia. The history of HPH began in 1866 when the Hongkong and Whampoa Dock Company was established in Hong Kong as Registered Company Number One. For over 100 years, it provided ship construction and repair services before diversifying into cargo and container handling operations in 1969 when its flagship operation, Hongkong International Terminals Limited (HIT), was established. In 1994, HPH was founded to manage its growing international port network. Over the years, HPH has expanded internationally into other logistics and transportation-related businesses. These include cruise ship terminals, airport operations, distribution centres, rail services, and ship repair facilities. In 2014, the HPH port network handled a combined throughput of 82.9 million TEU worldwide. Becton Dickinson - China Position Description: HPH runs a regular summer intern program primarily from local Hong Kong universities but frequently has participants from other countries. The student will be part of this program and its related activities but specifically dedicated to the Group Commercial team or the Group Operations Technology & Development team. The internship will focus on similar activities and responsibilities for entry-level employees in the department. An internship with the Group Commercial team will involve reviewing / summarizing daily industry news for distribution to HPH business units, providing regular support such as data gathering for customer briefings and management presentations, and providing research/analysis support for market and shipping industry topics. -

Hutchison Whampoa Limited Annual Report 2004

4 Business Highlights 2004 February January Energy, Infrastructure, Finance and Investments April Telecommunications Hongkong Electric Hutchison Telecom becomes Energy, Infrastructure, International finalises the first operator to launch 3G Finance and Investments June shareholding arrangements multimedia services in Hong Cheung Kong Infrastructure with five other shareholders for Retail and Manufacturing Kong. Later, in May, the (“CKI”) acquires a 100% interest A S Watson acquires Drogas, a a 1,400-megawatt gas-fired company consolidates its 3G, in Cambridge Water in South leading health and beauty power plant project in Thailand GSM Dualband and CDMA Cambridgeshire, the UK. chain operating more than 80 and becomes the largest services under the “3” brand. stores in Latvia and Lithuania. foreign shareholder in the company. January Retail and Manufacturing Hutchison Harbour Ring July (“HHR”) and Global Brands Energy, Infrastructure, Group are named exclusive Finance and Investments licensing agent for the May CKI acquires a 40% interest in Mainland, Hong Kong and Retail and Manufacturing March the Lane Cove Tunnel Company Macau by Warner Bros. Hutchison Whampoa (China) Pty Ltd in Australia which has Consumer Products (“WBCP”). Telecommunications sells its remaining 20% interest been awarded a concession to HHR also provides sourcing The Group’s fixed line business in the Mainland joint venture build and operate the Lane services to WBCP licensees is listed on the Stock Exchange Procter & Gamble-Hutchison to Cove Tunnel and the Falcon worldwide outside of the US of Hong Kong by way of the Procter & Gamble for a cash Street Ramp in Sydney. In and Canada. acquisition of Vanda Systems consideration of US$2 billion, August, CKI acquires the North which is now renamed realising a gain on disposal of of England Gas Distribution Hutchison Global HK$13.7 billion. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Asia Pacific ex 19 August 2021 Japan ex Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.1 NEW CJ Cheiljedang 0.1 KOREA GPT Group 0.22 AUSTRALIA ZEALAND CJ CheilJedang Pfd. 0.01 KOREA Green Cross 0.05 KOREA AAC Technologies Holdings 0.16 HONG KONG CJ Corp 0.04 KOREA GS Engineering & Construction 0.07 KOREA ADBRI 0.04 AUSTRALIA CJ ENM 0.05 KOREA GS Holdings 0.06 KOREA Afterpay Touch Group 0.61 AUSTRALIA CJ Logistics 0.04 KOREA GS Retail 0.04 KOREA AGL Energy 0.12 AUSTRALIA CK Asset Holdings 0.5 HONG KONG Guotai Junan International Holdings 0.01 HONG KONG AIA Group Ltd. 4.6 HONG KONG CK Hutchison Holdings 0.64 HONG KONG Haitong International Securities Group 0.02 HONG KONG Air New Zealand 0.02 NEW CK Infrastructure Holdings 0.11 HONG KONG Hana Financial Group 0.36 KOREA ZEALAND Cleanaway Waste Management 0.08 AUSTRALIA Hang Lung Group 0.07 HONG KONG ALS 0.14 AUSTRALIA CLP Holdings 0.5 HONG KONG Hang Lung Properties 0.15 HONG KONG Alteogen 0.06 KOREA Cochlear 0.37 AUSTRALIA Hang Seng Bank 0.44 HONG KONG Altium 0.09 AUSTRALIA Coles Group 0.5 AUSTRALIA Hanjin KAL 0.04 KOREA Alumina 0.1 AUSTRALIA ComfortDelGro 0.08 SINGAPORE Hankook Technology Group 0.1 KOREA Amcor CDI 0.54 AUSTRALIA Commonwealth Bank of Australia 4.07 AUSTRALIA Hanmi Pharmaceutical 0.06 KOREA AmoreG 0.05 KOREA Computershare 0.21 AUSTRALIA Hanmi Science 0.03 KOREA Amorepacific Corp 0.21 KOREA Contact Energy 0.14 NEW Hanon Systems 0.07 KOREA Amorepacific Pfd. -

Principal Subsidiary and Associated Companies and Joint Ventures at 31 December 2020

Principal Subsidiary and Associated Companies and Joint Ventures at 31 December 2020 Nominal value of Place of incorporation / issued ordinary Percentage of Subsidiary and associated companies and principal place of share capital **/ equity attributable joint ventures operations registered capital to the Group Principal activities Ports and related services Alexandria International Container Terminals Egypt USD 30,000,000 59 Container terminal operating Company S.A.E. Amsterdam Container Terminals B.V. Netherlands EUR 18,400 80 Container terminal operating Brisbane Container Terminals Pty Limited Australia AUD 34,100,000 80 Container terminal operating Buenos Aires Container Terminal Services S.A. Argentina ARS 648,385,014 80 Container terminal operating ECT Delta Terminal B.V. Netherlands EUR 18,000 71 Container terminal operating Ensenada Cruiseport Village, S.A. de C.V. Mexico MXP 145,695,000 80 Cruise terminal operating Ensenada International Terminal, S.A. de C.V. Mexico MXP 160,195,000 80 Container terminal operating Europe Container Terminals B.V. Netherlands EUR 45,000,000 75 Holding company Euromax Terminal Rotterdam B.V. Netherlands EUR 100,000 49 Container terminal operating Freeport Container Port Limited Bahamas BSD 2,000 41 Container terminal operating Gdynia Container Terminal S.A. Poland PLN 11,379,300 80 Container terminal operating and rental of port real estate Harwich International Port Limited United Kingdom GBP 16,812,002 80 Container terminal operating ✡ Hongkong United Dockyards Limited Hong Kong HKD 76,000,000 50 Ship repairing, general engineering and tug operations ✡ 惠州港業股份有限公司 China RMB 300,000,000 27 Container terminal operating ✡ Huizhou Quanwan Port Development Co., Ltd. -

Acquisition of Subsidiary

(a business trust constituted on 25 February 2011 under the laws of the Republic of Singapore and managed by Hutchison Port Holdings Management Pte. Limited) ACQUISITION OF SUBSIDIARY Pursuant to Rule 704(17)(c) of the Listing Manual of Singapore Exchange Securities Trading Limited (the “SGX-ST”), Hutchison Port Holdings Management Pte. Limited, as trustee-manager (the “Trustee-Manager”) of Hutchison Port Holdings Trust (“HPH Trust”), wishes to announce that on 3 June 2014, HPH Trust has acquired 100% of the issued and paid-up capital of the following company (the “Company”) for nominal cash consideration reflecting its newly incorporated status, resulting in the Company becoming a wholly-owned subsidiary of HPH Trust: Name : HPHT Finance (14) Limited Principal Activity : Treasury company Paid-up Capital : US$1.00 Country of Incorporation : The Cayman Islands Nominal value : US$1.00 Number of share(s) : 1 ordinary share Acquisition of the Company does not have a material effect on the earnings per unit and net tangible asset value per unit of the HPH Trust and its subsidiaries (collectively, the “Group”) based on the latest announced consolidated accounts of the Group for the period ended 31 March 2014. Save for any interest from their respective unitholdings in HPH Trust, none of the directors of the Trustee-Manager and the controlling unitholders of HPH Trust has an interest, direct or indirect, in the acquisition of the Company. By Order of the Board Hutchison Port Holdings Management Pte. Limited (as trustee-manager of Hutchison Port Holdings Trust) (Company Registration No. 201100749W) Lim Ka Bee Company Secretary 3 June 2014 1 About HPH Trust HPH Trust is a container port business trust listed in Singapore. -

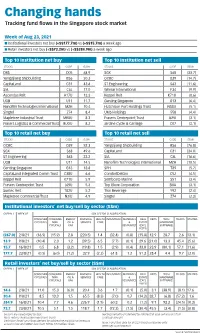

Changing Hands Tracking Fund Flows in the Singapore Stock Market

Changing hands Tracking fund flows in the Singapore stock market Week of Aug 23, 2021 I Institutional investors net buy (+S$177.7m) vs (+S$15.7m) a week ago I Retail investors net buy (+S$73.2m) vs (+S$384.9m) a week ago Top 10 institution net buy Top 10 institution net sell STOCKS CODE (S$M) STOCKS CODE (S$M) DBS D05 68.9 SGX S68 (33.7) Yangzijiang Shipbuilding BS6 50.3 OCBC O39 (14.7) CapitaLand C31 43.6 ST Engineering S63 (11.6) SIA C6L 17.0 Wilmar International F34 (9.9) Ascendas Reit A17U 13.3 Keppel Reit K71U (8.6) UOB U11 11.7 Genting Singapore G13 (6.4) Nanofilm Technologies International MZH 10.4 Hutchison Port Holdings Trust NS8U (5.1) Singtel Z74 8.4 UMS Holdings 558 (4.4) Mapletree Industrial Trust ME8U 8.3 Frasers Centrepoint Trust J69U (3.1) Frasers Logistics & Commercial Trust BUOU 8.2 Jardine Cycle & Carriage C07 (3.1) Top 10 retail net buy Top 10 retail net sell STOCKS CODE (S$M) STOCKS CODE (S$M) OCBC O39 52.3 Yangzijiang Shipbuilding BS6 (76.8) SGX S68 49.6 CapitaLand C31 (34.0) ST Engineering S63 22.2 SIA C6L (16.6) UOB U11 14.5 Nanofilm Technologies International MZH (10.5) Genting Singapore G13 13.8 SPH T39 (5.7) CapitaLand Integrated Comm Trust C38U 6.6 ComfortDelGro C52 (4.5) Keppel Reit K71U 5.9 Sembcorp Marine S51 (3.4) Frasers Centrepoint Trust J69U 5.3 Top Glove Corporation BVA (3.1) Suntec Reit T82U 5.2 Thai Beverage Y92 (2.4) Mapletree Commercial Trust N2IU 4.9 Singtel Z74 (2.3) Institutional investors’ net buy/sell by sector (S$m) OVERALL WEEK OF SGX SECTOR CLASSIFICATION CONSUMER CONSUMER ENERGY FINANCIAL -

Hutchison Port Holdings Trust Singapore | Industrials

Equity Research 15 December 2020 Company update Chu Peng Equity Research Hutchison Port Holdings Trust Singapore | Industrials Rating HOLD (as at 15 December 2020) Last Close SGD 0.182 Fair Value SGD 0.180 Recovery of throughput volumes Security information • Recovery of economic activities in China Ticker HPHT SP • Picking up of throughput volumes in 3Q20 Market Cap (USD b) 1.6 • Expecting a better 2H20 Daily turnov er (USD m) 2.1 Free Float 72% Investment thesis Shares Outstanding (m) 8,711 Top Shareholder HUTCHISON PORT HLDGS 27.6% Hutchison Port Holdings Trust’s (HPHT) share price jumped 30% in November, which was likely to due to Price performance chart easing impact from Covid-19 with a recovery in the 0.60 4,000 container throughput volumes as countries exit from 0.50 lockdowns and resumption of economic activities in 3,500 China. The throughput volumes of Kwai Tsing and 0.40 Yantian has recovered from the trough levels in 1H20 0.30 3,000 and saw a growth of 2.6% and 26.6% YoY respectively 0.20 2,500 in Oct 2020. While we could see further recovery in 4Q 0.10 due to catchup orders from Covid-19, outlook remains 0.00 2,000 uncertain given global economic weakness and Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 continued headwinds from U.S-China trade tensions. After adjustments, our fair value estimate increases HPHT SP Equity STI Index (RHS) from US$0.10 to US$0.18. Financial summary Investment summary HKD m FY19 FY20F FY21F • Throughput volumes recovered from trough levels in Gross rev enue 11,121 10,649 10,690 1H20 – Hutchison Port Holdings Trust’s (HPHT) share Cost of serv ices rendered -3,882 -3,414 -3,741 price jumped 30% in November, which was likely to PAT 1,821 1,834 1,724 due to easing impact from Covid-19 with a recovery PATMI 528 506 524 in the container throughput volumes as countries exit EPS (HK cents) 6.1 5.8 6.0 from lockdowns and resumption of economic activities in China. -

CK Hutchison Holdings Limited (CKHH) Facts and Figures

CK Hutchison Holdings Limited (CKHH) Facts and Figures. The company. CK Hutchison Holdings Limited (CKHH) is not only one of the largest companies that are listed at the Hong Kong stock exchange, it is also one of the oldest trade companies in Hong Kong – its roots go back to the year 1820. The various business sectors and around 290,000 employees in over 50 countries make the conglomerate one of the world´s leading companies. Business sectors. HWL operates in 5 core businesses: Ports and related services. Hutchison Port Holdings runs all the company‘s ports and related services in 25 countries. Currently, HPH holds a share of 269 berths in 48 ports. Retail. AS Watson is the largest international health and beauty retailer in Asia and Europe and runs more than 13,300 retail stores in 22 countries worldwide, counting more than 130,000 employees. In Hong Kong and on the Chinese mainland, AS Watson is responsible for the production, distribution and bottling of different mineral waters and other drinks. In Europe, the Group operates a number of health & beauty retail brands, chains - Drogas, including Kruidvat, Superdrug, Rossmann, Savers, Trekpleister, Spektr and Watsons. In addition, it also owns two luxury perfumeries and cosmetics retail brands ICI PARIS XL and The Perfume Shop. Infrastructure. The company operates in Hong Kong, the Chinese mainland, Great Britain, the Netherlands, Portugal, Australia, New Zealand and Canada. Its core fields are energy infrastructure, water infrastructure, transportation infrastructure, waste management and aircraft leasing. Energy. HWL holds about 40,2 % of Canadian Husky Energy, an energy-related company listed on the Toronto Stock Exchange. -

Hutchison Port Holdings Trust

Singapore Company Guide Hutchison Port Holdings Trust Version 5 | Bloomberg: HPHT SP | Reuters: HPHT.SI Refer to important disclosures at the end of this report DBS Group Research . Equity 8 Dec 2016 BUY Acquire or be acquired Last Traded Price ( 7 Dec 2016): US$0.42 (STI : 2,959.84) Price Target 12-mth: US$0.48 (14% upside) (Prev US$0.56) Unexciting outlook but stock looks oversold – BUY. Hutchison Port Holdings Trust (HPHT) offers investors an attractive 8.3% Potential Catalyst: Recovery in throughput volumes prospective yield even after our DPU forecast cut, and looks Where we differ: We have higher than consensus EPS and DPU forecasts oversold at the current price level. Further upside could come from Analyst a stronger-than-expected recovery in China’s exports, acquisition- Paul YONG CFA +65 6682 3712 [email protected] driven growth or privatisation by its major shareholders. Singapore Research Team Potential for acquisition-driven growth as organic growth stalls. What’s New Aside from the acquisition of ACT in 2013, which was partially HPHT stands at a crossroads given its sluggish sold down soon after, and declining to acquire a 50% equity outlook, declining DPU and depressed stock price interest in Zhuhai International Container Terminals, all has been quiet on the inorganic front for HPH Trust since 2011. Given that Acquisitions could help boost longer-term growth DPU is a critical factor for share price, we opine that HPH Trust should look out for acquisitions to boost longer-term DPU, taking Privatisation by major shareholders cannot be ruled into account its relatively benign gearing level.