Notice Regarding Change of Consolidated Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Wilmington Funds Holdings Template DRAFT

Wilmington Global Alpha Equities Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS USD/CAD FWD 20210616 00050 3.16% DREYFUS GOVT CASH MGMT-I 2.91% MORGAN STANLEY FUTURE USD SECURED - TOTAL EQUITY 2.81% USD/EUR FWD 20210616 00050 1.69% MICROSOFT CORP 1.62% USD/GBP FWD 20210616 49 1.40% USD/JPY FWD 20210616 00050 1.34% APPLE INC 1.25% AMAZON.COM INC 1.20% ALPHABET INC 1.03% CANADIAN NATIONAL RAILWAY CO 0.99% AIA GROUP LTD 0.98% NOVARTIS AG 0.98% TENCENT HOLDINGS LTD 0.91% INTACT FINANCIAL CORP 0.91% CHARLES SCHWAB CORP/THE 0.91% FACEBOOK INC 0.84% FORTIVE CORP 0.81% BRENNTAG SE 0.77% COPART INC 0.75% CONSTELLATION SOFTWARE INC/CANADA 0.70% UNITEDHEALTH GROUP INC 0.70% AXA SA 0.63% FIDELITY NATIONAL INFORMATION SERVICES INC 0.63% BERKSHIRE HATHAWAY INC 0.62% PFIZER INC 0.62% TOTAL SE 0.61% MEDICAL PROPERTIES TRUST INC 0.61% VINCI SA 0.60% COMPASS GROUP PLC 0.60% KDDI CORP 0.60% BAE SYSTEMS PLC 0.57% MOTOROLA SOLUTIONS INC 0.57% NATIONAL GRID PLC 0.56% PUBLIC STORAGE 0.56% NVR INC 0.53% AMERICAN TOWER CORP 0.53% MEDTRONIC PLC 0.51% PROGRESSIVE CORP/THE 0.50% DANAHER CORP 0.50% MARKEL CORP 0.49% JOHNSON & JOHNSON 0.48% BUREAU VERITAS SA 0.48% NESTLE SA 0.47% MARSH & MCLENNAN COS INC 0.46% ALIBABA GROUP HOLDING LTD 0.45% LOCKHEED MARTIN CORP 0.45% ALPHABET INC 0.44% MERCK & CO INC 0.43% CINTAS CORP 0.42% EXPEDITORS INTERNATIONAL OF WASHINGTON INC 0.41% MCDONALD'S CORP 0.41% RIO TINTO PLC 0.41% IDEX CORP 0.40% DIAGEO PLC 0.40% LENNOX INTERNATIONAL INC 0.40% PNC FINANCIAL SERVICES GROUP INC/THE 0.40% ACCENTURE -

Pzena Japan Focused Value As of December 31, 2019

PZENA JAPAN FOCUSED VALUE As of December 31, 2019 Investment Management STRATEGY FACTS PORTFOLIO CHARACTERISTICS TOP 10 HOLDINGS Inception Date July 1, 2015 Strategy Index HITACHI METALS LTD. 4.9% AUM ($B) 0.3 Price to Normal Earnings¹^ 10.1x 18.0x* JX HOLDINGS INC 4.6% 750 largest Japanese Investment Universe Price / Earnings (1-Year Forecast) 10.7x 14.6x companies HONDA MOTOR CO LTD 4.6% Price / Book 0.9x 1.3x # of Positions Generally 25-40 INPEX CORP 4.5% Dividend Yield 3.0 2.3 Available Vehicles Separate Account PANASONIC CORP 3.7% Median Market Cap ($B) 5.3 0.5 FUJITSU LTD 3.7% Weighted Average Market Cap ($B) 14.4 34.3 TSUBAKIMOTO CHAIN CO 3.6% Active Share 91.4% - RESONA HOLDINGS INC 3.6% Number of Stocks (model portfolio) 34 2,159 ZEON CORP 3.5% ABOUT US DIC CORP 3.1% Pzena Investment Management is a global deep value Source: TOPIX Index, Pzena Analysis equity manager that uses a priority research process ^Pzena's estimate of normal earnings. Total 39.8% *Japan Universe Median to buy companies we believe are priced significantly Numbers may not add due to rounding below their long-term earnings potential. A diverse team from a range of industry backgrounds, Pzena is dedicated to meeting client needs as thought leaders on value investing. PORTFOLIO MANAGERS SECTOR WEIGHTS Strategy Index Communication Services 2% 8% Consumer Discretionary 22% 18% Consumer Staples 5% 8% Energy 9% 1% Financials 16% 11% Health Care 3% 9% Industrials 16% 23% Information Technology 4% 12% John Goetz Takashi Okumura Materials 21% 6% With Pzena since 1996 With Pzena since 2007 Real Estate In Industry since 1979 In Industry since 2007 Utilities 0% 3% 0% 10% 20% 30% 2% 2% Sector weights adjusted for cash - may appear higher than actual. -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

Public Version

EUROPEAN COMMISSION Brussels,18.6.2021 C(2021) 4614 final PUBLIC VERSION Mizuho Bank Ltd. Otemachi Tower, 1-5-5 Otemachi, Chiyoda-ku, Tokyo 100-8176 Japan MUFG Bank Ltd. 7-1 Marunouchi 2-Chome, Chiyoda-ku, Tokyo 100-0005 Japan Resona Bank Limited 2-2-1 Bingomachi, Chuo-ku, Osaka 541-0051 Japan Saitama Resona Bank Limited 7-4-1 Tokiwa, Urawa-ku, Saitama 330-9088 Japan Sumimoto Mitsui Banking Corporation 1-2 Marunouchi 1-chome Chiyoda-ku, Tokyo 100-0005 Japan Subject: Case M.10294 – MUFG / SMFG / MHFG / RESONA HD / JV Commission decision pursuant to Article 6(1)(b) of Council Regulation (EC) No 139/20041 and Article 57 of the Agreement on the European Economic Area2 1 OJ L 24, 29.1.2004, p. 1 (the ‘Merger Regulation’). With effect from 1 December 2009, the Treaty on the Functioning of the European Union (‘TFEU’) has introduced certain changes, such as the replacement of ‘Community’ by ‘Union’ and ‘common market’ by ‘internal market’. The terminology of the TFEU will be used throughout this decision. 2 OJ L 1, 3.1.1994, p. 3 (the ‘EEA Agreement’). Commission européenne, DG COMP MERGER REGISTRY, 1049 Bruxelles, BELGIQUE Europese Commissie, DG COMP MERGER REGISTRY, 1049 Brussel, BELGIË Tel: +32 229-91111. Fax: +32 229-64301. E-mail: [email protected]. Dear Sir or Madam, 1. On 20 May 2021, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which the undertakings Mitsubishi UFJ Financial Group, Inc. (‘MUFG’, Japan), Sumitomo Mitsui Financial Group, Inc. -

FTSE Publications

2 FTSE Russell Publications 20 May 2020 FTSE Japan Indicative Index Weight Data as at Closing on 31 March 2020 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 77 Bank 0.03 JAPAN Denso Corporation 0.45 JAPAN Isetan Mitsukoshi Holdings 0.06 JAPAN ABC-Mart 0.04 JAPAN Dentsu Inc 0.13 JAPAN Isuzu Motors 0.1 JAPAN Acom 0.05 JAPAN DIC 0.06 JAPAN Ito En 0.09 JAPAN Advantest Corp 0.24 JAPAN Disco 0.17 JAPAN Itochu Corp 0.87 JAPAN Aeon 0.48 JAPAN DMG Mori Seiki 0.03 JAPAN Itochu Techno Solutions 0.08 JAPAN AEON Financial Service 0.04 JAPAN Dowa Holdings 0.04 JAPAN Itoham Yonekyu Holdings 0.02 JAPAN Aeon Mall 0.05 JAPAN East Japan Railway 0.84 JAPAN Iyo Bank 0.04 JAPAN AGC 0.14 JAPAN Ebara 0.06 JAPAN Izumi Co Ltd 0.03 JAPAN Aica Kogyo 0.05 JAPAN Eisai 0.6 JAPAN J Front Retailing 0.06 JAPAN Ain Pharmaciez 0.05 JAPAN Electric Power Development 0.1 JAPAN Japan Airlines 0.06 JAPAN Air Water 0.08 JAPAN Ezaki Glico 0.07 JAPAN Japan Airport Terminal 0.06 JAPAN Aisin Seiki Co 0.13 JAPAN FamilyMart 0.13 JAPAN Japan Aviation Electronics 0.02 JAPAN Ajinomoto Co 0.28 JAPAN Fancl Corp 0.05 JAPAN Japan Exchange Group 0.29 JAPAN Alfresa Holdings 0.1 JAPAN Fanuc 0.8 JAPAN Japan Petroleum Exploration 0.02 JAPAN Alps Alpine 0.06 JAPAN Fast Retailing 0.65 JAPAN Japan Post Bank 0.12 JAPAN Amada 0.08 JAPAN FP Corporation 0.05 JAPAN Japan Post Holdings 0.32 JAPAN Amano Corp 0.05 JAPAN Fuji Electric 0.09 JAPAN Japan Post Insurance 0.07 JAPAN ANA Holdings 0.08 JAPAN Fuji Media Holdings 0.01 JAPAN Japan Steel -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

Japanâ••S Consolidating Banking System: How Eighteen Became Six

Japan’s consolidating banking system: How eighteen became five 1995-2013 Daiwa Bank December 2001 Daiwa Bank October 2002. Merged entities Holdings results from merger become Resona Holdings between of Daiwa Bank, Kinki Red border (TSE 8308) including Asahi Bank Resona Bank which does indicates current (1991 merger of Kyowa Osaka Bank and Nara Bank. trust business entity. Red line Bank and Saitama Bank) indicates forthcoming event Sanwa Bank April 2001 ‘integrate’ businesses. Tokai Bank October 2005 form January 2002 form UFJ Group Mitsubishi UFJ Financial Group (TSE 8306) Toyo Trust & Banking including Mitsubishi UFJ Trust & Mitsubishi Bank Banking Corporation April 1996 form Bank of Tokyo Bank of Tokyo-Mitsubishi All the five surviving mega-groups were bailed out during April 2001 form this time by massive convertible loans .from government Mitsubishi Trust & Banking Mitsubishi Tokyo Financial During the same period: Group Long-Term Credit Bank of Japan was acquired from bank- Nippon Trust Bank ruptcy by Ripplewood Holdings of the US, renamed Shinsei [meaning reborn] Bank, rehabilitated, and relisted on the Yasuda Trust & Banking Tokyo Stock Exchange (TSE) in November 2004. Absorbed by Fuji in 1996 due to long-running NPL problems. The troubled Nippon Credit Bank was acquired and renamed September 2000 form Fuji Bank Aozora Bank by a consortium of Japanese financial Mizuho Holdings institutions led by Softbank Corp. It later sold its shares to In 2003 becomes Cerberus of the US which turned the bank around and listed it Dai-ichi Kangyo Bank Mizuho Financial Group (TSE 8411) on the TSE in November 2006. including Both Shinsei and Aozora ran into subsequent difficulties but Mizuho Trust & Banking (TSE 8404) Industrial Bank of Japan long-running merger talks were abandoned in May 2010. -

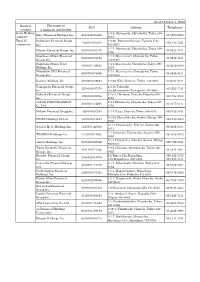

The Name of a Financial Institution JCN Address Telephone As of October

As of October 1, 2020 Business The name of JCN Address Telephone category a financial institution Bank Holding 1-9-2, Ohtemachi, Chiyoda-ku, Tokyo 100- Sony Financial Holdings Inc. 4010401053410 03-5290-6500 company 0004 Total 25 Hokuhoku Financial Group, 1-2-26 Tsutsumicho-dori, Toyama City 1230001004554 076-423-7331 companies Inc. 930-8637 1-5-5, Ohtemachi, Chiyoda-ku, Tokyo 100- Mizuho Financial Group, Inc. 9010001081419 03-5224-1111 8176 Sumitomo Mitsui Financial 1-1-2, Marunouchi, Chiyoda-ku, Tokyo 2010001081053 03-3282-8111 Group, Inc. 100-0005 Sumitomo Mitsui Trust 1-4-1,Marunouchi,Chiyoda-ku,Tokyo 100- 9010001139555 03-6256-6000 Holding, Inc. 8233 Mitsubishi UFJ Financial 2-7-1, Marunouchi, Chiyoda-ku, Tokyo 4010001073486 03-3240-8111 Group, Inc. 100-8330 Resona Holdings, Inc. 5010601039654 1-5-65, Kiba, Koto-ku, Tokyo 135-8581 03-6704-3111 Yamaguchi Financial Group, 4-2-36,Takezaki- 5250001007270 083-223-5511 Inc. cho,Shimonoseki,Yamaguchi 750-8603 Fukuoka Financial Group, 2-13-1, Ohtemon, Chuo-ku,Fukuoka,810- 9290001028986 092-723-2502 Inc. 8693 JAPAN POST HOLDINGS 2-3-1 Ohtemachi, Chiyoda-ku, Tokyo 100- 5010001112697 03-3477-0111 Co, Ltd 8791 Mebuki Financial Group,Inc. 1060001007582 2-7-2,Yaesu,Chuo-ku,Tokyo 104-0028 029-233-1151 3-1-24 Chuo Aoba-ku, Sendai, Miyagi 980- FIDEA Holdings Co.Ltd 4370001018694 022-290-8800 8800 18-14 Chayamachi, Kita-ku, Osaka 530- Senshu Ikeda Holdings,Inc 1120001140303 06-4802-0181 0013 7-1 Kameicho, Takamatsu, Kagawa 760- TOMONY Holdings, Inc. 5470001011928 087-812-0102 0050 2-1-1 Ichibancho, Aoba-ku, Sendai, Miyagi Jimoto Holdings, Inc. -

TOPIX100 Constituents (As of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD

TOPIX100 Constituents (as of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD. 2 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 52 7202 ISUZU MOTORS LIMITED 3 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 53 7203 TOYOTA MOTOR CORPORATION 4 1928 Sekisui House,Ltd. 54 7267 HONDA MOTOR CO.,LTD. 5 2502 Asahi Group Holdings,Ltd. 55 7269 SUZUKI MOTOR CORPORATION 6 2503 Kirin Holdings Company,Limited 56 7270 SUBARU CORPORATION 7 2802 Ajinomoto Co.,Inc. 57 7733 OLYMPUS CORPORATION 8 2914 JAPAN TOBACCO INC. 58 7741 HOYA CORPORATION 9 3382 Seven & I Holdings Co.,Ltd. 59 7751 CANON INC. 10 3402 TORAY INDUSTRIES,INC. 60 7832 BANDAI NAMCO Holdings Inc. 11 3407 ASAHI KASEI CORPORATION 61 7974 Nintendo Co.,Ltd. 12 4063 Shin-Etsu Chemical Co.,Ltd. 62 8001 ITOCHU Corporation 13 4188 Mitsubishi Chemical Holdings Corporation 63 8002 Marubeni Corporation 14 4452 Kao Corporation 64 8031 MITSUI & CO.,LTD. 15 4502 Takeda Pharmaceutical Company Limited 65 8035 Tokyo Electron Limited 16 4503 Astellas Pharma Inc. 66 8053 SUMITOMO CORPORATION 17 4507 Shionogi & Co.,Ltd. 67 8058 Mitsubishi Corporation 18 4519 CHUGAI PHARMACEUTICAL CO.,LTD. 68 8113 UNICHARM CORPORATION 19 4523 Eisai Co.,Ltd. 69 8267 AEON CO.,LTD. 20 4528 ONO PHARMACEUTICAL CO.,LTD. 70 8306 Mitsubishi UFJ Financial Group,Inc. 21 4543 TERUMO CORPORATION 71 8308 Resona Holdings, Inc. 22 4568 DAIICHI SANKYO COMPANY,LIMITED 72 8309 Sumitomo Mitsui Trust Holdings,Inc. 23 4578 Otsuka Holdings Co.,Ltd. 73 8316 Sumitomo Mitsui Financial Group,Inc. 24 4661 ORIENTAL LAND CO.,LTD. -

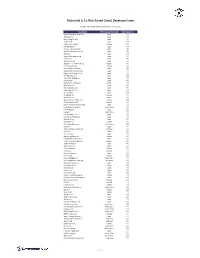

Rothschild & Co Risk-Based Global Developed Index

Rothschild & Co Risk-Based Global Developed Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Nippon Telegraph & Telephone C Japan 1.11 Softbank Corp Japan 1.10 Nitori Holdings Co Ltd Japan 0.75 Toshiba Corp Japan 0.67 Kirkland Lake Gold Ltd Canada 0.61 NTT DOCOMO Inc Japan 0.58 Mizuho Financial Group Inc Japan 0.54 Takeda Pharmaceutical Co Ltd Japan 0.50 KDDI Corp Japan 0.49 Japan Post Holdings Co Ltd Japan 0.48 Subaru Corp Japan 0.48 Sekisui House Ltd Japan 0.45 Singapore Telecommunications L Singapore 0.45 Franco-Nevada Corp Canada 0.43 Oriental Land Co Ltd/Japan Japan 0.43 Chugai Pharmaceutical Co Ltd Japan 0.40 Nippon Paint Holdings Co Ltd Japan 0.39 Fast Retailing Co Ltd Japan 0.38 Tokio Marine Holdings Inc Japan 0.38 ITOCHU Corp Japan 0.38 Bandai Namco Holdings Inc Japan 0.37 Bridgestone Corp Japan 0.36 MEIJI Holdings Co Ltd Japan 0.35 Japan Airlines Co Ltd Japan 0.34 Unicharm Corp Japan 0.33 Aroundtown SA Germany 0.33 Ajinomoto Co Inc Japan 0.33 Algonquin Power & Utilities Co Canada 0.32 Deutsche Wohnen SE Germany 0.32 MS&AD Insurance Group Holdings Japan 0.32 Lamb Weston Holdings Inc United States 0.32 ANA Holdings Inc Japan 0.32 Evergy Inc United States 0.32 Kirin Holdings Co Ltd Japan 0.32 Asahi Group Holdings Ltd Japan 0.32 Shiseido Co Ltd Japan 0.32 Wesfarmers Ltd Australia 0.32 Cboe Global Markets Inc United States 0.32 Canon Inc Japan 0.31 Jardine Matheson Holdings Ltd Singapore 0.31 Kao Corp Japan 0.31 Secom Co Ltd Japan 0.31 Agnico Eagle Mines Ltd Canada 0.31 -

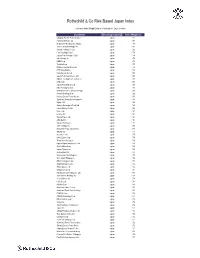

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo