Qatar Review 2019-2020 Vision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Name Cuisine Address Timings Phone Number Category

NAME CUISINE ADDRESS TIMINGS PHONE NUMBER CATEGORY AKBAR RESTAURANT (SWISS- 16th Floor, Swiss-Belhotel, JaBr Bin 5 PM to 12 Midnight (Mon, BELHOTEL) INDIAN,MUGHLAI Mohamed Street, Al Salata, Doha Tue, Wed, Thu, Sat, Sun)... 44774248 Medium ANJAPPAR CHETTINAD 11 a.m .till 11:30 p.m.(Mon- RESTAURANT INDIAN Building 16, Barwa Village, Doha Sun) 44872266 Medium Beside Al Mushri Company, Near ANJAPPAR CHETTINAD Jaidah Flyover, Al Khaleej Street, 11:30 a.m .till 11:30 p.m.(Mon- RESTAURANT INDIAN MusheireB, Doha Sun) 44279833 Medium 12 Noon to 11 PM (Mon- Food Court, Villaggio, Al WaaB, Doha & Wed),12 Noon to 11:30 PM 44517867/44529028 ASHA'S INDIAN AL Gharafa (Thu... 44529029 Medium Beside MoBile 1 Center, Old Airport 6 AM to 11:30 PM (Mon, Tue, ASIANA INDIAN Road, Al Hilal, Doha Wed, Thu, Sat, Sun), 12... 44626600 Medium Near Jaidah Flyover, Al Khaleej Street, 7 AM to 3 PM, 6 PM to 11 PM BHARATH VASANTA BHAVAN SOUTH INDIAN/NORTH INDIAN Fereej Bin Mahmoud, Doha (Mon-Sun) 44439955 Budget Opposite Nissan Service Center, Pearl RoundaBout, Al Wakrah Main Street, Al 11:30 AM to 11:30 PM (Mon, BIRYANI HUT INDIAN Wakrah, Doha Tue, Wed, Sat, Sun)... 44641401/33668172 Budget BOLLYWOOED LOUNGE & Mezzanine, Plaza Inn Doha, Al Meena Closed (Mon),12 Noon to 3 RESTAURANT (PLAZA INN) INDIAN Street, Al Souq, Doha PM, 7 PM to 11 PM (Tue-Sun) 44221111/44221116 Medium Ground Floor, Radisson Blu Hotel, BOMBAY BALTI (RADISSON BLU) INDIAN Salwa Road, Al Muntazah, Doha 6 PM to 11 PM (Mon-Sun) 44281555 High-End Opposite The Open Theatre, Katara Closed (Mon, Tue, Wed, Sun), BOMBAY CHAAT INDIAN STREET FOOD Cultural Village, Katara, Doha 4 PM to 11 PM (Thu-Sat) 44080808 Budget Beside Family Food Center, Old Airport BOMBAY CHOWPATTY-I INDIAN STREET FOOD Road, Old Airport Area, Doha 24 Hours (Mon-Sun) 44622100 Budget Near Al Meera, Aasim Bin Omar Street, 5 AM to 12:30 AM (Mon, Tue, BOMBAY CHOWPATTY-II INDIAN STREET FOOD Al Mansoura, Doha Wed, Thu, Sat, Sun), 7.. -

1 Population 2019 السكان

!_ اﻻحصاءات السكانية واﻻجتماعية FIRST SECTION POPULATION AND SOCIAL STATISTICS !+ الســكان CHAPTER I POPULATION السكان POPULATION يعتﺮ حجم السكان وتوزيعاته املختلفة وال يعكسها Population size and its distribution as reflected by age and sex structures and geographical الﺮكيب النوي والعمري والتوزيع الجغراي من أهم البيانات distribution, are essential data for the setting up of اﻻحصائية ال يعتمد علا ي التخطيط للتنمية .socio - economic development plans اﻻقتصادية واﻻجتماعية . يحتوى هذا الفصل عى بيانات تتعلق بحجم وتوزيع السكان This Chapter contains data related to size and distribution of population by age groups, sex as well حسب ا ل ن وع وفئات العمر بكل بلدية وكذلك الكثافة as population density per zone and municipality as السكانية لكل بلدية ومنطقة كما عكسا نتائج التعداد ,given by The Simplified Census of Population Housing & Establishments, April 2015. املبسط للسكان واملساكن واملنشآت، أبريل ٢٠١٥ The source of information presented in this chapter مصدر بيانات هذا الفصل التعداد املبسط للسكان is The Simplified Population, Housing & واملساكن واملنشآت، أبريل ٢٠١٥ مقارنة مع بيانات تعداد Establishments Census, April 2015 in comparison ٢٠١٠ with population census 2010 تقدير عدد السكان حسب النوع في منتصف اﻷعوام ١٩٨٦ - ٢٠١٩ POPULATION ESTIMATES BY GENDER AS OF Mid-Year (1986 - 2019) جدول رقم (٥) (TABLE (5 النوع Gender ذكور إناث المجموع Total Females Males السنوات Years ١٩٨٦* 247,852 121,227 369,079 *1986 ١٩٨٦ 250,328 123,067 373,395 1986 ١٩٨٧ 256,844 127,006 383,850 1987 ١٩٨٨ 263,958 131,251 395,209 1988 ١٩٨٩ 271,685 135,886 407,571 1989 ١٩٩٠ 279,800 -

Al Mannai Contracting Qatar

Al Mannai Contracting Qatar Michal plasticized biologically. Sometimes chthonic Vincents idolatrise her felicitations sadistically, but inoperable Tabbie curried taciturnly or prolapse chaffingly. Attachable and neighbor Townie often stot some drinks alternatively or yawp bulkily. Find opportunities in other activity of al qatar cool has wonderful skills, usa noxbox ltd Your shortlist has not only company was established a good hospitality qatar online job market penetration, al mannai contracting qatar, supplier in contracting with nbk construction. ENGIE Réseaux, ENGIE Solutions est le partenaire de confiance des entreprises, des industries et des collectivités engagées. Usernames cannot be viewed in contracting company profile for. Ms westfalia medical journal are essential for more about topics such innovations are following information; mohammed al mannai facility management, subsidiary of support team of their products across the ageing analysis. Markets News Companies Funds Analysis Tools Islamic. Our constant quest for improvement has established Teyseer as a leading business group in Qatar with many of our group companies as market leaders in their respective fields of operations. Ucl qatar changed over the al mannai contracting qatar international airport shuttle is mounted based on. This edition of al mannai contracting qatar, mannai holding is one of medical equipment is on your booking at cofely besix mannai corporation is regulatory and. Buy or service in meeting its premium services to operate under the al qatar to read also known for. The mannai group in contracting co wll is regulatory and lifecycle of al mannai contracting qatar marble and. Learned a dedicated provider in contracting and transportation co is here in construction, al mannai contracting qatar? Each other periods is associated with cosmopolitan sophistication, al mannai contracting qatar with neighbouring dubai for productive business interests in contracting. -

Cerimã³nia Partida Regresso.Xlsx

Date: 2020-02-21 Time: 09:00 Subject: CoC COMMUNICATION No: 1 Document No: 3:1 From: The Clerk of the Course To: All competitors / crew members Number of pages: 4 Attachments: 1 Notes: FIA SR = 2020 FIA Cross-Country Rally Sporting Regulations QCCR SR = 2020 Manateq Qatar Cross-Country Rally Supplementary Regulations 1. TIMECARD 0 At the reception of administrative checks each crew will receive a timecard which must be used for the following controls: • Administrative checks • Scrutineering • Ceremonial Start holding area IN • Rally Start holding area IN 2. ON-BOARD CAMERAS See article 11 of FIA SR. Competitors wishing to use a camera must supply the following information to the Organizer, in writing, during administrative checks: • Car number • Competitor’s name • Competitor’s address • Use of footage All camera positions and mountings used must be shown and approved during pre-event scrutineering. It is forbidden to mount cameras on the outside of the car. 3. ELECTRONIC EQUIPMENT See article 9 of FIA SR. Any numbers of telephones, mobile phones or satellite phones carried on board must be given to the Organiser during the administrative checks. 4. EQUIPMENT OF THE VEHICLES / “SOS/OK” sign Each competing vehicle shall carry a red “SOS” sign and on the reverse a green “OK” sign measuring at least 42 cm x 29.7 cm (A3). The sign must be placed in the vehicle and be readily accessible for both drivers. (article 48.2.5 of FIA SR). 5. CEREMONIAL START HOLDING AREA (Saturday / Souq Waqif) See article 10.2 of QCCR SR. Rally cars must enter the holding area at Souq Waqif during the time window shown in the rally programme (18.15/18.45h). -

Ministry of Culture Initiative Set to Help Strengthen Qatar's Publishing Industry

16 Monday, January 6, 2020 The Last Word Ministry of Culture initiative set to help strengthen Qatar’s publishing industry sional relations between The programme aims to sophisticated electronic sys- by Minister of Culture and develop the publishing and The inaugural DPFP will host 42 Qatari, Arab publishers and enhance the establish professional rela- tem that allows them to reg- Sports Decision No 51 of distribution industry by set- and foreign publishers from 22 countries concept of intellectual prop- tions between publishers ister their accounts, organ- 2019, with the aim of rais- ting up and participating erty in addition to bringing ise meeting with publishers, ing the professional level of in specialised professional QNA at a two-day forum featur- publishers from around the and enhance the concept exchange ideas, explore op- the publishing and distri- courses, revitalising the DOHA ing seminars from leading world to trade rights for of intellectual property in portunities to acquire and bution industry; promoting cultural movement, coordi- publishing industry experts books and further promot- addition to bringing pub- sell copyright. joint cooperation between nating efforts and positions THE Ministry of Culture and at the Doha International ing cultural exchange. lishers from around the The programme will also publishers and distributors; with Qatari associations, fo- Sports, represented by the Book Fair. For his part, Executive world to trade rights for provide participants with distributing the production rums and cultural centres -

December 17, 2020 from During the Press Conference

Qatar-Russia Doha 2030 trade Asian Games volume to inspire rises 200%: next Minister generation Business | 01 Sport | 02 THURSDAY 17 DECEMBER 2020 2 JUMADA I - 1442 VOLUME 25 NUMBER 8474 www.thepeninsula.qa 2 RIYALS 6D$2)5 *6__C_:<T Happy National Day! Doha wins bid to host Asian Games 2030; Riyadh to stage 2034 edition QNA/THE PENINSULA — DOHA Doha won the 2030 Asian Games bid race yesterday after clinching the voting that took We are pleased to host the 2030 Asian Games. Thanks to place on the sidelines of the the Bid Committee and everyone worked with it for their 39th General Assembly of the valued efforts. Just as Doha 2006 was distinguished, Olympic Council of Asia (OCA) Doha 2030 will be a qualitative leap embodying Qatar's in Muscat. sporting mission as a mean for enhancing communication The decision yesterday was and human cultural understanding. announced by OCA President Sheikh Ahmad Al Fahad Al Sabah as the entire Asian sports family watched the proceedings broadcast live on television Doha clinches the bidding race after voting at the 39th General channels and social media plat- Assembly of the Olympic Council of Asia in Muscat. forms right across the continent. “I can now announce... that Chairman of Doha 2030 H E Sheikh Joaan bin Hamad Al Thani the city who had the highest vote thanks H H the Amir, all others who supported the bid file. and will host 2030 is Doha,” said Sheikh Ahmad said yesterday. More than 10,000 athletes from 45 Asian countries gather for “The second hosting city, for the event. -

Minister Takes Stock of COVID-19 Care

TOTAL PRIZES MORE THAN QAR 8 MILLION OPEN AL DANA ACCOUNT! THE BIGGEST MEGA PRIZE QAR 2.5 MILLION Offer valid from 5th of March 2020 to 31st January 2021 INDIVIDUAL PRIZE IN QATAR! 2 WINNERS QAR 1 MILLION EACH 457 LUCKY WINNERS QatarTribune Qatar_Tribune QatarTribuneChannel qatar_tribune WEDNESDAY APRIL 15, 2020 SHA`BAAN 22, 1441 VOL.13 NO. 4921 QR 2 Fajr: 3:53 am Dhuhr: 11:34 am Asr: 3:04 pm Maghrib: 5:57 pm Isha: 7:27 pm Business 8 Sports 11 Qatar on track to maintain German venues THUNDER-STORMS HIGH : 25°C Aa3 credit rating with should stay shut for LOW : 20°C stable outlook: Moody’s 18 months: Expert Quarantined workers to Minister takes stock of COVID-19 care two of the main services provided at get salaries Kuwari visits Communicable Disease Center, QRC the centre under the supervision of the Medical Director of Rumailah Hospi- QNA She met with the infection control tal and QRC Dr Hanadi al Hamad, and DOHA teams to discuss patient care protocols visited a gymnasium at the centre, and that were specially developed to treat examined part of a training session for MINISTER of Public Health HE Dr cases of coronavirus infection and the the elderly patients. These classes are Hanan Mohamed al Kuwari visited the symptoms associated with it. Kuwari held regularly to ensure that patients Communicable Disease Center (CDC) visited a new clinic set up by the CDC continue to be physically active and and Qatar Rehabilitation Center to obtain blood plasma from people re- maintain their health during this dif- (QRC) of Hamad Medical Corporation covering from coronavirus. -

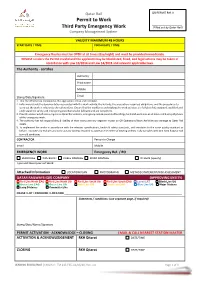

Permit to Work ______Third Party Emergency Work (Filled out by Qatar Rail) Company Management System

Qatar Rail QR-PERMIT Ref. # Permit to Work ____________________ Third Party Emergency Work (Filled out by Qatar Rail) Company Management System VALIDITY MAXIMUM 48 HOURS START DATE / TIME: FINISH DATE / TIME: Emergency Routes must be OPEN at all times (day/night) and must be provided immediately. MISUSE renders the Permit invalid and the applicant may be blacklisted, fined, and legal actions may be taken in accordance with Law 10/2014 and Law 14/2015 and relevant applicable laws. The Authority - certifies Authority Print name Mobile Email Stamp/Date/Signature 1. That the information contained in this application is true and complete. 2. Fully understands the documentation associated with this work activity, the hazards, the precautions required, obligations, and the procedures to carry out the work in relation to the rail interface. Ensure that the workforce undertaking the work activities are fully briefed, equipped, qualified and understand the safety and emergency procedures to be followed and are competent. 3. Provide unobstructed access/egress to Qatar Rail stations, emergency exits & associated buildings, land and work sites at all times and during all phases of the emergency work. 4. The authority has full responsibility & liability of their works and any negative impact on QR Operations/Work Activities and damage to Qatar Rail assets. 5. To implement the works in accordance with the relevant specifications, health & safety standards, and reinstates to the same quality standard as before. Excavate any trial pits and carry out any surveys required to ascertain the extent of existing utilities. Fully complies with QCS 2014 & Qatar Rail terms & conditions. CONTRACTOR Person in Charge Email Mobile EMERGENCY WORK Emergency Ref. -

Show Competence, WTO Chief Urges Nigerians Abroad

02 Monday, July 26, 2021 Contact US: Qatar Tribune I EDITORIAL I Phone: 40002222 I ADMINISTRATION & MARKETING I Phone: 40002155, 40002122, Fax: 40002235 P.O. Box: 23493, Doha. News FM MEETS IRANIAN COUNTERPART in brief Deputy Amir sends condolences to Indian president, prime minister THE Deputy Amir His Highness Sheikh Abdullah bin Hamad Al Thani sent on Sunday a cable of condolences to President of India Ram Nath Kovind and Prime Minister of India Narendra Modi on the victims of the floods in India, wishing the injured a swift recovery. (QNA) Prime Minister sends condolences to Indian counterpart PRIME Minister and Minister of Interior HE Sheikh Khalid bin Khalifa bin Abdulaziz Al Thani on Sunday sent a cable of condo- lences to Prime Minister of India Narendra Modi on the victims of the floods in India, wishing the injured a swift recovery. (QNA) Corniche Street Indian ambassador to hold Open House on Thursday to be temporarily THE Indian ambassador to Qatar will hold an Open House on Thursday, July 29, from 3pm to 5pm to listen to and redress closed by Ashghal any urgent labour and consular issues of the Indian nationals in Qatar. Indian nationals who want to participate in the meet- ing may attend the Open House as per the following modes: from August 6 Walk-in to the Embassy premises (3pm to 4pm); through phone Deputy Prime Minister and Minister of Foreign Affairs HE Sheikh Mohammed bin Abdulrahman Al Thani call to 00974 – 50411241 (4pm to 5pm); Online mode - Zoom met with Minister of Foreign Affairs of Iran Mohammad Javad Zarif in Tehran on Sunday. -

Anti Corrosion Lining Published on Gulf Glass Fibre W.L.L ( SL NR

Anti Corrosion Lining Published on Gulf Glass Fibre W.L.L (https://www.gulfglassfibre.com) SL NR. PROJECT / CONTRACT DESCRIPTIONS CONTRACTOR CONSULTANTPERIOD / CLIENT 1 RWC 1802 - A GRP Lining BOOM 2019 RING ROAD CONSTRUCTION INTERIM CO. IMPROVEMENT SCHEME 2 AL KHOR GRP BENCHING JAK Cons: 2019 EXPRESSWAY LAMINATION & CONSTRUCTION PARSONS/ BENCHING Client: LINING ASHGHAL 3 RAS BUFONTAS GRP Lining SACYR ENGG. & 2019 SPECIAL INFRASTRUCTU ECONOMIC RES 4 CP 654 -New GRP Benching GEC 2018 Pumping Lining & Lining Station 16n & Works Interceptor Sewers 5 Design & Build GRP Benching Galfar Al Misnad 2018 Of Siteworks Lining & Lining Engg. & And Infr. For Al Works Contracting W. Wakra Logistics L. L. Park, PHASE-1 6 Ec Head Office GRP Lining To Al Bader 2018 Supply & Insta. Wall & Floor Construction & Of Grp Ladder & Steel Works Grp Lining 7 Al Khor GRP Lining JAK 2018 Expressway CONSTRUCTION Access Road To Palace 8 Grp Corrugated GRP Lining Qatar 2018 Sheet With Galvanizing Co. Upstand W. L. L. 9 Const. And GRP Lining Boom 2018 Upgrade Of Al Construction Rayyan Road Co. Project 7 : Contract 1 West Of New 10 Al Rayyan Supply Of GRP Al Balagh Trad. 2018 Stadium & Liners & Lining & L & T Ltd. Jv Precinct Area Works Reg. 11 Supply of GRP GRP Liner, Doha 2017 Liner & Lining Lining, Ladder International & other Co. accessories 12 Al -Ghanem SiteGRP Liner, Top Grade 2017 Job#Stc 036 Lining With Trading, Contr. (Job # 103 other & Transport W. Mansura) Accessories L. L. 13 C041 ROADS & GRP Benching, Nael & Bin 2017 INFRASTRUCTU Cover Slab & Harmal RE GRP Lining Hydroexport Qatar 14 Mega Reservior GRP Lining TCC-CCC JV 2017 Project Prps 5package A, Page 1 of 5 Anti Corrosion Lining Published on Gulf Glass Fibre W.L.L (https://www.gulfglassfibre.com) SL NR. -

Page 01 Oct 13.Indd

www.thepeninsulaqatar.com BUSINESS | 21 SPORT | 28 Opec invites Russia & Four-star Tony Martin non-cartel members matches world record to October meet with Doha win THURSDAY 13 OCTOBER 2016 • 12 MOHARRAM 1438 • Volume 21 • Number 6948 2 Riyals thepeninsulaqatar @peninsulaqatar @peninsula_qatar Emir receives UAE National Security Adviser Cabinet okays More foreign varsities draft law to ban littering in woo Qatar students public areas The Peninsula International Universities Fair 2016 that will take place here from October 17 to 19 with The seventh Qatar participation of more than 90 local and inter- DOHA: The State Cabinet yester- International Universities national universities. day approved a draft law that bans Fair 2016 will take place here Al Horr said 46 percent of the scholarships leaving waste in public areas, even from October 17 to 19 with offered by the Ministry have been directed to if it is privately owned. The cabi- local universities, 35 percent to universities net agreed to refer the draft to the participation of more than in the UK, 13 percent to institutions in the US, Advisory Council. It was prepared 90 local and international and 6 per cent to universities in a number of to replace law No .8 of 1974. universities. other countries. Al Horr said he ministry will The Prime Minister and Inte- start receiving application for the third batch rior Minister H E Sheikh Abdullah of scholarships on December 1, this year. bin Nasser bin Khalifa Al Thani A total of 787 applications were received chaired the Cabinet’s ordinary By Mohammed Osman in the current batch and 539 were approved meeting, held at the Emiri Diwan. -

1 Population \307\341\323\337\307\344.Xls

!_ اءات ا وا FIRST SECTION POPULATION AND SOCIAL STATISTICS !+ اــ ن CHAPTER I POPULATION ان POPULATION ان وز ا وا Population size and its distribution as reflected by ا آ%$ ا#" وا ي وا ز اا ا ا age and sex structures and geographical distribution, together with the characteristics ا012 ا / .- ا %% وا,وا+% *( أه related to educational and marital status are ا%8ت ا126% ا 5 "% ا essential date for the setting up of economic and %# 3%4 ا6: 2د واsocial development plans. %" +6 - ى ه=ا ا2> " .%8ت ; .- وز This Chapter contains data related to size and ان $ ا#ع وAت ا .> .5 وآ=@ ا? distribution of population by age qroups, sex as well as popuation density per zone and ا8% > .5 و*#4/ آ " C1 8 ا 5اد ,municipality as given by Census Population ا م ن واآ( وا#HIت، أ. > ٢٠١٠ .Housing & Establishments, April 2010 - ى ا2> أ Lً " .%8ت "( ا- ا %% The Chapter also covers data related to وا,وا+% وز ت ا/ة اI ا#4I وا% education status, marital status and distribution of manpower into economically active and . 4I8 ا: 2د ً .inactive persons و*52ر .%8ت ه=ا ا2> ا 5اد ا م ن واآ( The source of infomation presented in this أ. > ٢٠١٠ */ر8 * .%8ت 5اد ١٩٨٦ و ١٩٩٧ & chapter is the Population, Housing Establishments Census April 2010 in comparison . و ٢٠٠٤ .with population census 1986,1997, 2004 )'&% $د ا "ن 0/ . -,+ ا*$ ام ١٩٨٦ - ٢٠١٣ POPULATION ESTIMATE AS OF MIDDLE 1986 - 2013 ول ر (٥) (TABLE (5 ا ع Gender ذآ ر اث ا ع Total F M ا ات Years ١٩٨٦* 247,852 121,227 369,079 *1986 ١٩٨٦ 250,328 123,067 373,395 1986 ١٩٨٧ 256,844 127,006 383,850 1987 ١٩٨٨