Valustrat Qatar Real Estate Research Q4 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Name Cuisine Address Timings Phone Number Category

NAME CUISINE ADDRESS TIMINGS PHONE NUMBER CATEGORY AKBAR RESTAURANT (SWISS- 16th Floor, Swiss-Belhotel, JaBr Bin 5 PM to 12 Midnight (Mon, BELHOTEL) INDIAN,MUGHLAI Mohamed Street, Al Salata, Doha Tue, Wed, Thu, Sat, Sun)... 44774248 Medium ANJAPPAR CHETTINAD 11 a.m .till 11:30 p.m.(Mon- RESTAURANT INDIAN Building 16, Barwa Village, Doha Sun) 44872266 Medium Beside Al Mushri Company, Near ANJAPPAR CHETTINAD Jaidah Flyover, Al Khaleej Street, 11:30 a.m .till 11:30 p.m.(Mon- RESTAURANT INDIAN MusheireB, Doha Sun) 44279833 Medium 12 Noon to 11 PM (Mon- Food Court, Villaggio, Al WaaB, Doha & Wed),12 Noon to 11:30 PM 44517867/44529028 ASHA'S INDIAN AL Gharafa (Thu... 44529029 Medium Beside MoBile 1 Center, Old Airport 6 AM to 11:30 PM (Mon, Tue, ASIANA INDIAN Road, Al Hilal, Doha Wed, Thu, Sat, Sun), 12... 44626600 Medium Near Jaidah Flyover, Al Khaleej Street, 7 AM to 3 PM, 6 PM to 11 PM BHARATH VASANTA BHAVAN SOUTH INDIAN/NORTH INDIAN Fereej Bin Mahmoud, Doha (Mon-Sun) 44439955 Budget Opposite Nissan Service Center, Pearl RoundaBout, Al Wakrah Main Street, Al 11:30 AM to 11:30 PM (Mon, BIRYANI HUT INDIAN Wakrah, Doha Tue, Wed, Sat, Sun)... 44641401/33668172 Budget BOLLYWOOED LOUNGE & Mezzanine, Plaza Inn Doha, Al Meena Closed (Mon),12 Noon to 3 RESTAURANT (PLAZA INN) INDIAN Street, Al Souq, Doha PM, 7 PM to 11 PM (Tue-Sun) 44221111/44221116 Medium Ground Floor, Radisson Blu Hotel, BOMBAY BALTI (RADISSON BLU) INDIAN Salwa Road, Al Muntazah, Doha 6 PM to 11 PM (Mon-Sun) 44281555 High-End Opposite The Open Theatre, Katara Closed (Mon, Tue, Wed, Sun), BOMBAY CHAAT INDIAN STREET FOOD Cultural Village, Katara, Doha 4 PM to 11 PM (Thu-Sat) 44080808 Budget Beside Family Food Center, Old Airport BOMBAY CHOWPATTY-I INDIAN STREET FOOD Road, Old Airport Area, Doha 24 Hours (Mon-Sun) 44622100 Budget Near Al Meera, Aasim Bin Omar Street, 5 AM to 12:30 AM (Mon, Tue, BOMBAY CHOWPATTY-II INDIAN STREET FOOD Al Mansoura, Doha Wed, Thu, Sat, Sun), 7.. -

Annual Report 2016

ANNUAL REPORT 2016 CONTENTS 3 - 8 BOARD OF DIRECTORS 9 - 10 BOARD OF DIRECTORS REPORT 11 SHARI’A SUPVERVISORY BOARD REPORT 13 - 14 MESSAGE FROM THE GROUP CHIEF EXECUTIVE OFFICER 15 - 16 FINANCIAL HIGHLIGHTS 17 - 18 COMPANY VISION AND STRATEGY 19 CORPORATE GOVERNANCE 21 BARWA REAL ESTATE GROUP 23 - 34 REAL ESTATE PROJECTS IN QATAR 35-36 AL AQARIA REAL ESTATE PROJECTS 37 - 38 INTERNATIONAL INVESTMENTS 39 INDEPENDENT SUBSIDIARIES 40 HELPING PEOPLE FIND THEIR DREAMS 41-42 COMMITMENT TO COMMUNITY 43 OUR EMPLOYEES 1 H.H. SHEIKH TAMIM BIN HAMAD AL THANI THE EMIR OF THE STATE OF QATAR 2 H.H. SHEIKH HAMAD BIN KHALIFA AL THANI THE FATHER EMIR 3 BOARD OF DIRECTORS HIS EXCELLENCY MR. SALAH BIN GHANEM BIN NASSER AL ALI CHAIRMAN OF THE BOARD OF DIRECTORS H.E. Mr. Salah Bin Ghanem Bin was appointed as a consultant in the Nasser Al Ali was appointed as Qatar’s office of the Heir Apparent till 2013. Minister of Sports and Culture on He was also appointed as the General January 27th, 2016 after more than Manager of the Sheikh Jasim Bin two years as Minister of Youth and Mahmoud Bin Thani Foundation Sports. His Excellency held a number for Social Care; a private institute of public positions such as Chief of for public interest established by the State Audit Bureau between His Highness The Father Emir 2006 and 2011, during which Sheikh Hamad Bin Khalifa Al H.E participated in developing a Thani. In 2012, H.E. participated in strategic plan for the Bureau aimed the launch of Al Rayyan TV with a at assisting in achieving sustainable mission to support the renaissance development for the Qatari society of Qatar, consolidate its national and to strengthen accountability. -

CLASSIFIED CONTD. on FOLLOWING PAGES Commission

Gulf Times 1 Thursday, May 4, 2017 CLASSIFIED ADVERTISING SITUATION VACANT A leading Car Rental CCheerfulheerful aandnd EEnthusiasticnthusiastic BBritishritish EEducatedducated DDentistentist AAUTOUTO PPARTSARTS MMANAGERANAGER WANTEDWANTED Sales Engineer Company requires rrequiredequired toto jjoinoin greatgreat teamteam atat BritishBritish WWee aarere ssearchingearching fforor a qqualifiedualified AutomotiveAutomotive SpareSpare PartsParts • 5-7 years’ experience, preferably Graduate Civil / Mechanical or Architect. Light & Heavy vehicle • Should have vast experience in Sales & Marketing of Aluminum Composite Panels or IInternationalnternational DentalDental Centre.Centre. ThoseThose withwith MManager.anager. MMustust hhaveave eexperiencexperience inin thethe locallocal MarketMarket asas wellwell asas related building products such as Insulated Metal Wall panels, Sandwich panels, Drivers Architectural cladding etc. llicenseicense inin QatarQatar ppreferred.referred. SendSend CVCV toto tthehe ccorrespondingorresponding educationeducation inin thethe field.field. PleasePlease sendsend CV’sCV’s toto GULF With valid Qatar driving • Ability to interact and sell to the key influencers: architects, consultants & façade tthehe ffollowingollowing EEmail:mail: [email protected]@gmail.com engineers. TIMES license for transfer [email protected]@gmail.com • Operational experience in dealing with Aluminum Cladding Contractors & consultants. or six months NOC • Results driven personality is a must. Classified -

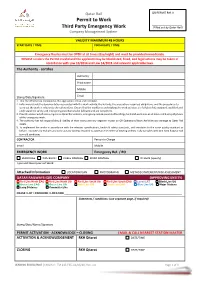

Permit to Work ______Third Party Emergency Work (Filled out by Qatar Rail) Company Management System

Qatar Rail QR-PERMIT Ref. # Permit to Work ____________________ Third Party Emergency Work (Filled out by Qatar Rail) Company Management System VALIDITY MAXIMUM 48 HOURS START DATE / TIME: FINISH DATE / TIME: Emergency Routes must be OPEN at all times (day/night) and must be provided immediately. MISUSE renders the Permit invalid and the applicant may be blacklisted, fined, and legal actions may be taken in accordance with Law 10/2014 and Law 14/2015 and relevant applicable laws. The Authority - certifies Authority Print name Mobile Email Stamp/Date/Signature 1. That the information contained in this application is true and complete. 2. Fully understands the documentation associated with this work activity, the hazards, the precautions required, obligations, and the procedures to carry out the work in relation to the rail interface. Ensure that the workforce undertaking the work activities are fully briefed, equipped, qualified and understand the safety and emergency procedures to be followed and are competent. 3. Provide unobstructed access/egress to Qatar Rail stations, emergency exits & associated buildings, land and work sites at all times and during all phases of the emergency work. 4. The authority has full responsibility & liability of their works and any negative impact on QR Operations/Work Activities and damage to Qatar Rail assets. 5. To implement the works in accordance with the relevant specifications, health & safety standards, and reinstates to the same quality standard as before. Excavate any trial pits and carry out any surveys required to ascertain the extent of existing utilities. Fully complies with QCS 2014 & Qatar Rail terms & conditions. CONTRACTOR Person in Charge Email Mobile EMERGENCY WORK Emergency Ref. -

Access to Quality Education for Displaced Children Stressed

BUSINESS | 23 SPORT | 29 Nebras records Disgraced Smith, huge jump in 2017 Warner out for 12 revenue months Thursday 29 March 2018 | 12 Rajab I 1439 www.thepeninsula.qa Volume 23 | Number 7480 | 2 Riyals Freedom to roam with Bill Protection! Terms & conditions apply Access to quality education for Emir holds talks with Rosneft Chief Executive Officer displaced children stressed THE PENINSULA H H Sheikha Moza Grandi. The discussion touched bint Nasser, while on the ways to ensure education GENEVA: H H Sheikha Moza speaking during for refugees and internally dis- bint Nasser, Chairperson of placed persons, in order to build Qatar Foundation (QF) and a high-level panel a prosperous future for all. Education Above All Foundation discussion at the During the discussion, H H (EAA), has urged the global UN headquarters in Sheikha Moza spoke about the community to facilitate access Geneva, urged the obstacles facing the education of to quality education for refugee and displaced children, displaced children and to global community to which prevents them from con- enforce severe penalties for facilitate access to tributing to the building of their perpetrators of armed conflict. quality education for communities. Her Highness H H Sheikha Moza bint added that education must be Nasser, Advocate for the UN displaced children given priority as it is the tool for Sustainable Development and to enforce the children of the present and Goals, participated yesterday future. A global approach needs severe penalties for Emir H H Sheikh Tamim bin Hamad Al Thani met yesterday at Al Bahr Palace office with Igor Sechin, in a high-level panel discussion to be adapted, in order to remove perpetrators of Chief Executive Officer of Rosneft, and the delegation accompanying him on the occasion of his visit organised by the EAA in coop- institutional barriers which eration with the United Nations armed conflict. -

Valustrat Qatar Real Estate Research Q1 2018-Final

st QUARTER REVIEW 2018 Qatar Real Estate Market www.valustrat.com VPI ValuStrat Price Index Residential Since the ValuStrat Price Index (VPI) began tracking in January 2016, Qatar residential prices have witnessed a fall in values. By benchmarking the index from Q1 2016 at 100 points, we found that values continue to fall displaying market corrections nationwide. The first quarter 2018 VPI displayed overall 9.4% annual and 1.6% quarterly declines. Villas and freehold apartments saw quarterly price declines of 1.6% and 1.7%, respectively. Whilst a few locations saw marginal declines, others experienced steeper falls. Quarterly capital depreciation between 0.4% and 2.7% was seen in clusters of Al Wakrah, Al Khor, Umm Salal Mohammad, Old Airport, Al Thumama, Al Waab, West Bay Lagoon, New Al Rayyan/Muaither and declines of 4% to 4.4% were seen in Ain Khalid/Abu Hamour and Umm Salal Ali. Gross yields for residential units averaged at 4.8%, with 6.0% for apartments and 4.2% for villas. ValuStrat Price Index 13 Villa and 3 Apartment Locations in Qatar [Base: Q1 2016=100] 120 100 100 96.3 94.2 90.9 89.8 87.2 84.9 82.7 81.3 80 60 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2016 2017 2018 Source: ValuStrat 1 | Qatar Real Estate Market 1st Quarter 2018 Review MacroEconomicSnapshot • Government launched a second National Development Strategy (2017-2022) in which they prioritised six sectors; manufacturing, tourism, logistics, financial services, information and communication and scientific research • Real Gross Domestic Product (GDP) increased 1.8% YoY (QAR 204.2 billion), driven by growth in non-hydrocarbon sector of 3.7% YoY in Q4 2017 - latest estimates released by Ministry of Development Planning and Statistics • Population is estimated at 2.68 million 1,836,000 2,045,000 2,235,000 2,421,000 2,597,000 2,641,000 2,685,000 2012 2013 2014 2015 2016 2017 2018-Q1 Qatar Population Source: Ministry of Development Planning & Statistics Consumer Price Index vs. -

1 Population \307\341\323\337\307\344.Xls

!_ اءات ا وا FIRST SECTION POPULATION AND SOCIAL STATISTICS !+ اــ ن CHAPTER I POPULATION ان POPULATION ان وز ا وا Population size and its distribution as reflected by ا آ%$ ا#" وا ي وا ز اا ا ا age and sex structures and geographical distribution, together with the characteristics ا012 ا / .- ا %% وا,وا+% *( أه related to educational and marital status are ا%8ت ا126% ا 5 "% ا essential date for the setting up of economic and %# 3%4 ا6: 2د واsocial development plans. %" +6 - ى ه=ا ا2> " .%8ت ; .- وز This Chapter contains data related to size and ان $ ا#ع وAت ا .> .5 وآ=@ ا? distribution of population by age qroups, sex as well as popuation density per zone and ا8% > .5 و*#4/ آ " C1 8 ا 5اد ,municipality as given by Census Population ا م ن واآ( وا#HIت، أ. > ٢٠١٠ .Housing & Establishments, April 2010 - ى ا2> أ Lً " .%8ت "( ا- ا %% The Chapter also covers data related to وا,وا+% وز ت ا/ة اI ا#4I وا% education status, marital status and distribution of manpower into economically active and . 4I8 ا: 2د ً .inactive persons و*52ر .%8ت ه=ا ا2> ا 5اد ا م ن واآ( The source of infomation presented in this أ. > ٢٠١٠ */ر8 * .%8ت 5اد ١٩٨٦ و ١٩٩٧ & chapter is the Population, Housing Establishments Census April 2010 in comparison . و ٢٠٠٤ .with population census 1986,1997, 2004 )'&% $د ا "ن 0/ . -,+ ا*$ ام ١٩٨٦ - ٢٠١٣ POPULATION ESTIMATE AS OF MIDDLE 1986 - 2013 ول ر (٥) (TABLE (5 ا ع Gender ذآ ر اث ا ع Total F M ا ات Years ١٩٨٦* 247,852 121,227 369,079 *1986 ١٩٨٦ 250,328 123,067 373,395 1986 ١٩٨٧ 256,844 127,006 383,850 1987 ١٩٨٨ -

Centre-Piece of the Mashaf Township

AL MASHAF DISTRICT 25°10’40.2”N 51°33’57.6”E MASHAFCROSSINGS.COM Mashaf township Centre-piece of the Centre-piece Embrace the new Mashaf lifestyle 001 Mashaf Crossings redefines the way you interact with the township and each other, bringing the best mix of retail, restaurants & entertainment. Where a young professional’s idea of style and sophistication crosses paths with the one’s seeking an uplifting experience. It’s a space where independent businesses nurture your passion, grocers keep you well-fed, and entertainment melts away the stress of daily work. MASHAF CROSSINGS 2 002 The space to grow and thrive. Mashaf Crossings’ newly designed 23,500sqm premier mixed- used community center will feature a modern lounge with extensive indoor-outdoor seating areas; seamlessly blending high caliber retail lifestyle amenities. Embrace the new Mashaf lifestyle 002 Site Plan 23,500 SQ METERS 215 C PARKING SPACES 62 LEASABLE UNITS D 2 FLOORS E A B A Building A C Building C E Building E • 5 Tenant slots • 17 Tenant slots • 4 Tenant slots • Slot sizes >220 sqm • Slot sizes 38 - 220 sqm • Slot sizes 76-160 sqm B Building B D Building D • 29 Tenant slots • 8 Tenant slots • Slot sizes 38 - 220 sqm • Slot sizes 76 - 160 sqm 003 A new way to dine, shop and play MASHAF CROSSINGS 7 8 MASHAF CROSSINGS 003 EXPERIENCE — DINE A CULINARY WALK IN A WORLD OF CUISINES Imagine a rich world of cuisine along the gastronomy corridors of Mashaf Crossings. Explore and discover a modern and constantly evolving selection of Qatar’s most tempting food and beverages establishments. -

Qatar Provider Network Call Center No. +974 4040 2000

QATAR PROVIDER NETWORK CALL CENTER NO. +974 4040 2000 Elite Network members have access to: All Elite, Premium & Prime Network Premium Network members have access to: All Premium & Prime Network (no access to Elite Network Providers) Prime Network members have access to: All Prime Network (no access to Elite & Premium Network Providers) NETWORK SPECIALTY ADDRESS TELEPHONE المركز الصحي العنوان التخصص المستشفيات HOSPITALS Elite Al Ahli Hospital Multispeciality Bin Omran St. Opp. Town Centre, near TV Roundabout 4489 8888 المستشفى اﻻهلي بن عمران, مقابل مركز المدينه قرب دوار التلفزيون تخصصات متعددة Premium Al Emadi Hospital Multispeciality Hilal West Area, Near The Mall R/A, along D-Ring Road 4466 6009 مستشفى العمادي المنطقه الغربيه, قرب دوار المول, الدائري الرابع, الهﻻل تخصصات متعددة Prime American Hospital Clinics Multispeciality C-Ring Road, Near Andaloos Petrol Station, Muntazah 4442 1999 المستشفى اﻻمريكي الدائري الثالث, المنتزه قرب محطة بترول المنتزه تخصصات متعددة Prime Doha Clinic Hospital Multispeciality New Mirqab Street, Fareej Al Nasr Area 4438 4390 مستشفى عيادات الدوحة شارع المرقاب الجديد / فريج النصر تخصصات متعددة Premium Dr Moopen's Aster Hospital Multispeciality Behind Family Food Center, Matar Qadeem, D-Ring Road 4031 1900 مركز استر الطبي - دكتور موبين الدائري الرابع , المطار القديم , خلف مركز التموين العائلي تخصصات متعددة انف واذن وحنجرةِ طب طب العيون Premium Magrabi Eye & Ear Centre E.N.T & Opthalmology & dental Old Airport near Al Safeer Hypermarket 4423 8888 مركز مغربي للعيون واﻻنف المطار القديم , قرب سفاري هايبرماركت واﻻسنان -

Quality of Service Measurements- Mobile Services Network Audit 2012

Quality of Service Measurements- Mobile Services Network Audit 2012 Quality of Service REPORT Mobile Network Audit – Quality of Service – ictQATAR - 2012 The purpose of the study is to evaluate and benchmark Quality Levels offered by Mobile Network Operators, Qtel and Vodafone, in the state of Qatar. The independent study was conducted with an objective End-user perspective by Directique and does not represent any views of ictQATAR. This study is the property of ictQATAR. Any effort to use this Study for any purpose is permitted only upon ictQATAR’s written consent. 2 Mobile Network Audit – Quality of Service – ictQATAR - 2012 TABLE OF CONTENTS 1 READER’S ADVICE ........................................................................................ 4 2 METHODOLOGY ........................................................................................... 5 2.1 TEAM AND EQUIPMENT ........................................................................................ 5 2.2 VOICE SERVICE QUALITY TESTING ...................................................................... 6 2.3 SMS, MMS AND BBM MEASUREMENTS ............................................................ 14 2.4 DATA SERVICE TESTING ................................................................................... 16 2.5 KEY PERFORMANCE INDICATORS ...................................................................... 23 3 INDUSTRY RESULTS AND INTERNATIONAL BENCHMARK ........................... 25 3.1 INTRODUCTION ................................................................................................ -

Qatar Real Estate Market Report

QATAR REAL ESTATE MARKET REPORT CONTENTS IN THIS ISSUE ISSUE 1 - MAY 2018 12 Property Trends TRENDS 16 Long Term Price Trends 1 18 Performance Review 30 The Case for Market Transparency 31 Qatar’s Commission Conundrum CONTRIBUTORS 32 Benefits of Property Management Services 2 33 Is Your Property Always Rent-Ready? CONSUMER 36 Top Searched Areas SEARCHES 38 Top Searched Keywords 3 EXPLAINED 39 User Behaviour 42 What Sets Us Apart WE ARE 44 Our Performance 4 PROPERTYFINDER 45 Awesome Agent Winners CONTRIBUTORS Sam Youssef Jeffrey Asselstine Adrian Camps James Townsend Managing Director, Managing Director, Country Director, Managing Director, Better Homes Qatar NelsonPark Property LCC Colliers Absolute Qatar BACKGROUND Sam established BACKGROUND Jeffrey founded BACKGROUND Adrian has BACKGROUND With a decade Better Homes Qatar in 2009 and NelsonPark Property nine years over 35 years’ experience, with of experience in the real estate has over 15 years of experience ago and has continued to lead 11 years spent in the GCC of market in Qatar and the GCC, in the real estate market. He has as its Managing Director. Armed which the last six years were James has know-how in both been instrumental in leading with a BBA from Wilfrid Laurier Qatar based. Heading the the residential and commercial Better Homes Qatar through University, and as a Chartered Colliers Qatar country team, fields. For seven years, he was remarkable growth and has Financial Analyst (CFA), he has he provides key property running his own agency, prior spearheaded the introduction of spearheaded the development advice to corporations and to launching Absolute Qatar. -

Red-Hot Al Sadd Favourites Against Al Duhail in Final

FFOOTBALLOOTBALL | Page 3 CCYCLINGYCLING | Page 7 Mendy’s late Pogacar strike puts Real holds lead, in sight of CL Vingegaard quarters wins fi ft h stage Friday, February 26, 2021 CRICKET Rajab 14, 1442 AH India crush England GULF TIMES inside two days in pink-ball Test SPORT Page 2 FOOTBALL / QATAR CUP SHOOTING / ISSF WORLD CUP Qatar’s Rashid Red-hot Al Sadd wins bronze favourites against in Cairo Al Duhail in fi nal ‘Al Sadd players have a winning mentality. This is an important feature of my team’ By Yash Mudgal in Rabat Grand Prix early this Doha month, had been in good form in the local competitions and won a gold and silver besides a fourth- Al Sadd (left) and Al Duhail players train yesterday on the eve of the Qatar Cup final. atar’s Rashid Hamad place fi nish in the Amir Cup and clinched the skeet Qatar Shooting Association Cup By Sports Reporter feating Al Gharafa (2-1) and Al think the Al Arabi match in the Duhail are one of the best teams to prepare in the best way to go bronze medal at the recently. Doha Rayyan (1-0) respectively in the league last week was a great ex- in Qatar. Both teams have very into the match with the aim of ISSF Egypt World Cup Talking about his Olympic semi-fi nals of the tournament, perience before facing Al Duhail, high-level players and from my achieving victory. Qfor shotgun yesterday. chances, Rashid was very opti- which features the top four clubs as we performed very well in it,” point of view, Al Sadd are bet- “We are trying hard despite Rashid fi nished with a score mistic.