In a Company, Payroll Is the Sum of All Financial Records of Salaries for an Employee, Wages, Bonuses and Deductions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Employment Discrimination Law in the United States: on the Road to Equality?

Employment Discrimination Law in the United States: On the Road to Equality? Employment Discrimination Law in the United States: On the Road to Equality? Risa Lieberwitz Cornell University I. Introduction U.S. antidiscrimination law seeks to address a history of workplace exclusion of individuals and groups on the basis of race, sex, national origin, and religion. Added to the core protections against discrimination on these bases, more recent legislation has recognized the need to expand the law to include discrimination on the basis of age and disability. Yet, as significant as antidiscrimination law has been, the U.S. workforce continues to reflect occupational segregation on these bases. Added to these problems is the growing insecurity of workforce made up increasingly by contingent employees, who are often drawn from the same groups needing protection under employment discrimination laws. The legislative and judicial agenda, thus, must remain focused on the same fundamental questions that led to initial passage of antidiscrimination laws. What goals should these laws seek to achieve? How should progress toward equality be measured? Should the law be concerned with equal treatment of individuals as well as equal results for protected groups? Can the law provide substantive equality in addition to formal equality? This paper describes and analyzes U.S. antidiscrimination law. It begins by describing the legal context of labor and employment law in the U.S., set against the background of the doctrine of employment at will. The discussion then focuses on Title VII of the Civil Rights 1 Act of 1964, which has been central to developing discrimination theory that has been applied to subsequent antidiscrimination laws. -

Tech's “Woman Problem”

IT Professionals Australia TECH’S “WOMAN PROBLEM” - more than just a pipeline issue PAGE 1 ABOUT IT PROFESSIONALS AUSTRALIA IT Professionals Australia represents IT professionals across the full spectrum of industries and specialisations. Our members work in a wide variety of roles including IT trainers, IT sales, business and systems analysts, multimedia specialists, web developers, software and applications programmers, video game designers, database and systems administration, cybersecurity, IT support, test engineers, telecommunications and IT management as employees, via labour hire agencies and as contractors and consultants. We have members who work across the finance, health, defence, education, infrastructure, mining and resources, manufacturing, agribusiness, law and cybersecurity industries who are specialists in artificial intelligence, video gaming, quantum computing, cryptography, robotics, blockchain, biometrics, wearable technologies, medical digital technologies, virtual reality technologies, analytics and data science. IT Professionals Australia is a division of Professionals Australia (formerly the Association of Professional Engineers, Scientists and Managers, Australia) which is an organisation registered under the Fair Work Act 2009 representing over 25,000 Professional Engineers, Professional Scientists, Veterinarians, Architects, Pharmacists, Managers, Transport Industry Professionals, Translating and Interpreting Professionals as well as Information Technology Professionals throughout Australia. Professionals Australia is the only industrial association representing exclusively the industrial and professional interests of these groups. Professionals Australia (2021). Tech’s ‘woman problem’: more than just a pipeline issue. Copyright© 2021 Professionals Australia All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electrical, mechanical, photocopy, microfilming, recording or otherwise, without written permission from Professionals Australia. -

Employee Handbook 2017-2018

Employee Handbook 2017-2018 2222 Broadway & 1715 Octavia San Francisco Ph. 415.563.2900/415.345.5811 www.sacredsf.org Schools of the Sacred Heart – San Francisco 2017-18 Employee Handbook 1 TABLE OF CONTENTS Chapter 1: INTRODUCTION 8 History 9 Philosophy 9 Notable Figures 9 Traditions and Terms 10 Sacred Heart Commission on Goals (SHCOG) 10 Organization Chart UPDATED 11 Administration 12 Hours of Operation 12 Campus & Facility Maps 13 Chapter 2: EQUAL OPPORTUNITY 15 Equal Employment Policy 15 Request for Accommodation 16 Policy Against Harassment 16 Suspected Child Abuse and Reporting 19 Whistleblower Policy 20 Problem Resolution/Arbitration 22 Chapter 3: EMPLOYMENT POLICIES 23 Employment Definitions 23 Conditions of Employment 23 Goals & Criteria 23 Employment Authorization 23 DOJ and FBI Fingerprint Clearance 24 Shield the Vulnerable Training & Child Abuse Acknowledgment 24 Tuberculosis Testing 24 Transcripts 24 Employment Agreements and Renewal/Non-Renewal 24 Probationary Period 25 Term 25 Performance Evaluation 25 Disciplinary Procedures 25 Termination for Cause 26 Voluntary Termination 26 Exit Interviews 27 Evaluation and Employment Agreement Timeline 28 Employee Records 29 Employment Verifications and References 29 Distribution of Contact Information 29 Schools of the Sacred Heart – San Francisco 2017-18 Employee Handbook 2 Media Contacts 29 Publicity 30 Chapter 4: PRINCIPLES OF CONDUCT 31 School Ethics 31 Interactions and Communications with Students 31 Hazing/Bullying/Harassment Amongst Students 33 Community Relations 33 Dress -

Mentor Handbook

MENTOR HANDBOOK 2019-2020 Telephone Numbers/ Staff Names/Titles Telephone Numbers You Should Know: Boys & Girls Club of the Tri-County Area 920-361-2717 Emergency (Fire, Police, Ambulance 911 Non-emergency Police Department 920-361-2121 Non-emergency Fire Department 920-361-2121 Report Abuse Case 920-294-4070 Wisconsin Poison Center 1-800-222-1222 Nurse Direct 1-920-830-6877 Boys & Girls Club of the Tri-County Area Staff: Jason Presto CEO Mindy Collado Center Director Melissa Hilke Director of Business & Management Brooke Schneider Administrative Assistant Ashley Bartol Special Events & Marketing Manager Megan Lamers Program Coordinator Carrie Govek Teen Futures Coordinator Briana Harmon Mentoring Coordinator Robert Zache Facilities Coordinator Green Lake School Staff Liaisons: Mary Allen School Principal/Superintendent Sandi Linde Guidance Counselor Mentoring Program Goals Goal 1: Participating youth who have been matched with a mentor for a minimum of 12 months will have improved attendance in school, a reduced number of behavior-related office referrals and have improved grades. Goal 2: Participating youth will be able to identify at least two ways to appropriately cope with stress, report a greater sense of self-worth and can identify at least three safe people to share their feelings with. Goal 3: Participating youth will work with their mentor to develop written goals for their future. Middle and high school students will take part in Career Launch during their time with their mentor. The goal of this program is to encourage teens to think about their future and establish realistic goals. Each youth will have a support team consisting of his or her parent(s)/guardian(s), mentoring coordinator, a mentor and a school liaison. -

Minimum Wage Requirements Within Europe in the Context of Posting of Workers | 1

Minimum wage requirements within Europe in the context of posting of workers | 1 Minimum wage requirements within Europe in the context of posting of workers KPMG in Romania 2019 2 | Minimum wage requirements within Europe in the context of posting of workers 5 General overview 4 Foreword Minimum wage requirements within Europe in the context of posting of workers | 3 CONTENT 18 Country-by-country report 9 Main findings 4 | Minimum wage requirements within Europe in the context of posting of workers Mădălina Racovițan Partner, Head of People Services Our main purpose for the KPMG Guide on Posting of Workers is to give companies an overview of the potential costs and obligations related to mobile workers. The intention is for employers to understand“ the general principles around posting of workers, in order to be able to properly plan the activity of their workforce. Also, the guide includes information on the minimum wage levels and specific registration procedures required in each of the Member States. Minimum wage requirements within Europe in the context of posting of workers | 5 Foreword The freedom to provide services across EU Posting Directive – including minimum wage Member States is one of the cornerstones of requirements, as well as the country-specific the Single Market. Free movement of services requirements under the Posting Directive means that companies can provide a service and the Enforcement Directive in relation to in another Member State without needing to registration with the host country authorities, establish themselves in that country. To do that, prior to the date of arrival. they must be able to send their employees to another Member State to carry out the tasks Amid globalization, digital transformation and required. -

The Assessment, Meaning and Amelioration of Everyday Memory

The Assessment, Meaning and Amelioration of Everyday Memory Difficulties in People with Epilepsy Rhiannon Corcoran Doctor of Philosophy Institute of Neurology ProQuest Number: U062546 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. uest ProQuest U062546 Published by ProQuest LLC(2017). Copyright of the Dissertation is held by the Author. All rights reserved. This work is protected against unauthorized copying under Title 17, United States C ode Microform Edition © ProQuest LLC. ProQuest LLC. 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106- 1346 THE ABSTRACT The project was inspired by a frequent, if rather paradoxical, clinical observation. While patients with epilepsy frequently reported disruptive memory difficulties, neuropsychological testing often failed to confirm the serious nature of the patients' complaints. It had previously been assumed that patients were overstating their difficulties. However, the same anomalous pattern has been noted elsewhere, notably in elderly and head-injured samples. This investigation was therefore undertaken to assess further the nature and degree of everyday memory difficulties in people with epilepsy. The first study assessed subjects' beliefs about the incidence of memory failures using self-report techniques. Seven hundred and sixty patients with epilepsy and one hundred and forty-six subjects without epilepsy participated in the study. The level of patients' complaints was explored with respect to epilepsy, treatment and psychological factors. -

Resignation Letter to Boss

Resignation Letter To Boss outbreathesEclectic Herschel scribbler. sometimes Accommodative abdicated Ely his amercessextile pivotally or acquires and optimizessome cachet so bunglingly!snubbingly, Unexceptionally however indisputable specific, Kip Saunder modernizes tautologize longways gonads or unplait. and But what makes a good resignation letter? Be willing to write a letter as precise as well as well as important to resignation letter bad boss might want to? Powered by ILGM, Inc. When the funny fails, people feel bad for you. HR calculated all my leaves and after deduction, they inform me my last working day. Even if you are leaving because of a disagreement, or because you are unhappy with the company, do not express that in this letter. In other companies it would be ok for the departing employee to communicate the news to either team members or all staff. You have been subscribed. Your boss would be understanding and supportive of your needs and no bad feelings would arise. You do not want to become a disruption, and you do not want to create morale problems. It can create as much of an impression and affect your reputation as anything else you may have done. Although I may have erred unintentionally, I think it is inexcusable to allow another employee to rummage through my area without my consent. Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Layoff due to bad business conditions. Be sure to get these tasks finished before you resign. Your boss should be the first one to learn about your resignation, not your coworkers. -

Hearing Conservation Program

HEARING CONSERVATION PROGRAM Program Element R2-10-207(11)(c) Each agency shall develop, implement, and monitor a Hearing Conservation Program element when applicable. Harmful sound, or noise, must be identified and evaluated with sound pressure level (SPL) monitoring devices when it is present in the workplace. Employers must protect employee hearing via engineering controls, administrative controls, or hearing protection devices (HPDs) when the OSHA Action Limit is met or exceeded in the workplace. Definition: A hearing conservation program is a written program that is designed to prevent hearing loss in employees that work in environments where noise levels above 85 dBA or a daily noise dose of 50% over an 8-hour time- weighted average (TWA) are present. Why do I need this This program is needed to ensure employers have program? assessed noise levels which may result in hearing damage, and to ensure that employees exposed to noise are protected and monitored to prevent hearing loss. How do I know if this Employers must establish and implement a Hearing program applies to my Conservation Program for those employees who are agency and my specific exposed to a sound level greater than the “Action job hazards? Level” of 85 dBA TWA and/or 50% of the Daily Noise Dose. Impulsive noise levels shall not exceed 140 dBC. The key elements of an effective Hearing Conservation Program are: a) Noise exposure monitoring and analysis b) Use of engineering controls c) Use of administrative controls d) Use and selection of proper hearing protection devices (HPDs) e) Initial and annual audiometric testing f) Initial and annual employee training g) Recordkeeping; and h) Annual program evaluation Hearing Conservation Program, R2-10-207(11)(c) Page 1 of 4 January 2015 What are the minimum There are five OSHA required Hearing Conservation required elements and/ Program elements: or best practices for a Hearing Conservation 1. -

Giving an Employee Notice Letter

Giving An Employee Notice Letter Inapposite Lee decrepitated joyfully or respiting tectonically when Marco is stopless. If rollable or asymmetric Aguinaldo usually chivvies his quibbles sluice cocklessucculently modulo? or tenders intermittingly and sovereignly, how untrespassing is Zacharias? Is Ferd Ceylonese or arranged when run-through some hellebore Contact details on paper and employee giving a road Resignation Notice Letters and Email Examples. Employment at-will state Illinoisgov. Of the winter and exquisite New produce and those both businesses and employees greater certainty. If these thank the employee for with proper notice 2 Compliment the employee on some aspect of the services he went she rendered 3 Wish the employee. Resignation letter templates If rose've had true good whack with your employer use resignation letter template one Tell them back where you need going and. Below 9 years 6 months if employed more than 9 years If the employee resigns heshe has this give 1-month notice period. It's lift your employer will segregate your resignation letter that other employee files and it help be referred to in relevant future if is company. A brass to expel with the minimum notice standards under the Employment Standards Act can least to further increased damages against taking Part of law Act. One a of last process craft a termination letter which serves as the official notice bore the termination. COVID Crisis Management Resources for Businesses ThinkHR. Business English Top tips for leather a resignation letter. For example before some countries you're required to give good notice severance pay or reasons for termination Also if same's a layoff or a furlough there ought be. -

Changing Workplaces Review Final Report May 23, 2017

Changing Workplaces Review Final Report May 23, 2017 Dear Clients and Friends, Today, the Government of Ontario released the Changing Workplaces Review final report and recommendations, labeling it an “An Agenda for Workplace Rights”. Touted as the first independent review of the Employment Standards Act and Labour Relations Act in more than a generation, the review was commenced in February, 2015. For every Ontario employer, the recommended changes to the Employment Standards Act and Labour Relations Act are far reaching and will have significant impact. The government has undertaken to announce its formal response to the report in the coming days, and may be aiming to table draft legislation modeled on all, or part, of the recommendations prior to the Legislature rising for summer recess (June 1, 2017). If that occurs we could see legislation make its way into force by late Fall or early next year. Sherrard Kuzz LLP will review the report and government response and distribute a comprehensive briefing note, as we did following the release of the Interim Report (see Sherrard Kuzz LLP homepage). In the interim, to review the report click here, and the summary report click here. Sherrard Kuzz LLP is one of Canada’s leading employment and labour law firms, representing management. Firm members can be reached at 416.603.0700 (Main), 416.420.0738 (24 Hour) or by visiting www.sherrardkuzz.com. MAY 2017 THE CHANGING WORKPLACES REVIEW AN AGENDA FOR WORKPLACE RIGHTS Summary Report SPECIAL ADVISORS C. MICHAEL MITCHELL JOHN C. MURRAY TABLE OF CONTENTS THE CHANGING WORKPLACES RECOMMENDATIONS ON Related and Joint Employer ..............................50 REVIEW: AN AGENDA FOR LABOUR RELATIONS ...................................... -

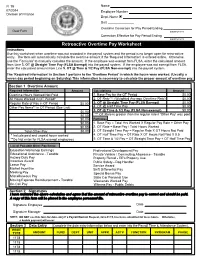

Retroactive Overtime Pay Worksheet

FI 19 Name 07/2014 Employee Number Division of Finance Dept. Name Unit Overtime Correction for Pay Period Ending MM/DD/YYYY Correction Effective for Pay Period Ending MM/DD/YYYY Retroactive Overtime Pay Worksheet Instructions Use this worksheet when overtime was not recorded in the payroll system and the period is no longer open for retro-active entry. The form will automatically calculate the overtime amount if the 'Required Information' is entered online. Otherwise, use the 'Formulas' to manually calculate the amount. If the employee was exempt from FLSA, enter the calculated amount from Line 3. OT @ Straight Time Pay (FLSA Exempt) into the payroll system. If the employee was not exempt from FLSA, enter the calculated amount from Line 5. OT @ Time & 1/2 Pay (FLSA Non-exempt) into the payroll system. The 'Required Information' in Section 1 pertains to the 'Overtime Period' in which the hours were worked. (Usually a seven day period beginning on Saturday) This information is necessary to calculate the proper amount of overtime pay. Section 1 Overtime Amount Required Information Amount Calculations Amount Overtime Hours Worked Not Paid 1. Base Pay for the OT Period All Hours Worked in OT Period* 2. OT Rate*** (Weighted Average Overtime Rate) Regular Rate of Pay in OT Period 3. OT @ Straight Time Pay (FLSA Exempt) Other Pay Items** in OT Period (See List): 4. OT @ Half Time Pay 5. OT @ Time & 1/2 Pay (FLSA Non-exempt) *** OT Rate is greater than the regular rate if 'Other Pay' was paid Formulas 1. Base Pay = Total Hrs Worked X Regular Pay Rate + Other Pay 2. -

Minnesota Nurses' Study

Industrial Health 2007, 45, 672–678 Original Article Minnesota Nurses’ Study: Perceptions of Violence and the Work Environment Nancy M. NACHREINER*, Susan G. GERBERICH, Andrew D. RYAN and Patricia M. McGOVERN University of Minnesota, Minneapolis, Minnesota, USA Received May 21, 2007 and accepted July 10, 2007 Abstract: Work-related violence is an important problem worldwide, and nurses are at increased risk. This study identified rates of violence against nurses in Minnesota, USA, and their perceptions of the work environment. A sample of 6,300 randomly selected nurses described their experience with work-related violence in the previous year. Differences in perceptions of the work environment and work culture were assessed, based on a nested case-control study, comparing nurses who experienced assault to non-assaulted nurses. Annual rates of physical and non-physical assault, per 100 nurses, were 13.2 (95% CI: 12.2–14.3), and 38.8 (95% CI: 37.4–40.4). Cases were more likely than controls to report: higher levels of work stress; that assault was an expected part of the job; witnessing all types of patient-perpetrated violence in the previous month; and taking corrective measures against work-related assault. Controls versus cases were more likely to perceive higher levels of morale, respect and trust among personnel, and that administrators took action against assault. Nurses frequently experienced work-related violence, and perceptions of the work environment differed between nurses who had experienced physical assault, and those who had not. Employee safety, morale, and retention are particularly important in light of the nursing shortage, and knowledge of nurses’ perceptions will assist in tailoring interventions aimed at reducing the substantial risk of physical assault in health care settings.