Final Annual Bill Review 2016-2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Utah's Official Voter Information Pamphlet

UTAH’S OFFICIAL VOTER INFORMATION PAMPHLET 2018 GENERAL ELECTION TUESDAY, NOVEMBER 6TH NOTE: This electronic version of the voter information pamphlet contains general voting information for all Utah voters. To view voting information that is specific to you, visit VOTE.UTAH.GOV, enter your address, and click on “Sample Ballot, Profiles, Issues.” For audio & braille versions of the voter information pamphlet, please visit blindlibrary.utah.gov. STATE OF UTAH OFFICE OF THE LIEUTENANT GOVERNOR SPENCER J. COX LIEUTENANT GOVERNOR Dear Utah Voter, My office is pleased to present the 2018 Voter Information Pamphlet. Please take the time to read through the material to learn more about the upcoming General Election on November 6, 2018. Inside you will find information about candidates, ballot questions, judges, and how to vote. In addition to this pamphlet, you can visit VOTE.UTAH.GOV to find even more information about the election. At VOTE.UTAH.GOV you can view your sample ballot, find your polling location, and view biographies for the candidates in your area. If you need assistance of any kind, please call us at 1-800-995-VOTE, email [email protected], or stop by our office in the State Capitol building. Thank you for doing your part to move our democracy forward. Sincerely, Spencer J. Cox Lieutenant Governor WHAT’S IN THIS PAMPHLET? 1. WHO ARE THE CANDIDATES? 2 U.S. Senate 3 U.S. House of Representatives 5 Utah State Legislature 9 Utah State Board of Education 28 2. WHAT ARE THE QUESTIONS ON MY BALLOT? 30 Constitutional Amendment A 32 Constitutional Amendment B 35 Constitutional Amendment C 39 Nonbinding Opinion Question Number 1 44 Proposition Number 2 45 Proposition Number 3 66 Proposition Number 4 74 3. -

Utah State Board of Education Meeting Minutes

UTAH STATE BOARD OF EDUCATION MEETING MINUTES January 8, 2015 A regular meeting of the Utah State Board of Education was held January 8, 2015 at the Utah State Office of Education, 250 East 500 South, Salt Lake City, Utah. At the direction of the Chair, Vice Chair David Thomas conducted. The meeting convened at 8:30 a.m. Board Members present: Chair David L. Crandall Member Mark Huntsman First Vice Chair David L. Thomas Member Marlin Jensen (non-voting) Second Vice Chair Jennifer Johnson Member Jefferson Moss Member Laura Belnap Member C. Mark Openshaw Member Leslie B. Castle Member R. Dean Rowley (non-voting) Member Freddie Cooper (non-voting) Member Spencer F. Stokes Member Brittney Cummins Member Teresa L. Theurer (non-voting) Member Barbara W. Corry Member Terryl Warner Member Kristin Elinkowski (non-voting) Member Joel Wright Member Linda Hansen Board Members participating by phone: Member Dixie L. Allen Member Steven R. Moore (non-voting) Executive and Board staff present: Brad Smith, State Superintendent Bruce Williams, Associate Supt. Joel Coleman, USDB Superintendent Lorraine Austin, Board Secretary Russ Thelin, USOR Executive Director Emilie Wheeler, Board Communications Sydnee Dickson, Deputy Supt. Specialist Judy Park, Associate Supt. Chris Lacombe, Assistant A.G. Others present: Chris Godfrey, Utah School Employees Association; Lydia Nuttall, parent; Kris Fawson, State Independent Living Council; Vincent Newmeyer; Frank Strickland; Jan Ferré, LCPD; Dessle Olson, UNBC; Rebecca Chavez-Houck, Utah House of Representatives; Rich Nelson, LITC; Blake Wight, Thanksgiving Point; Stephen Ward, Granite School District; Ken O’Brien, Salt Lake City School District. Utah State Board of Education Minutes -2- January 8, 2015 Opening Business Vice Chair David Thomas called the meeting to order at 8:30 a.m. -

Result Release

YOUR UTAH. YOUR FUTURE. Survey Results for Agriculture 1 YOUR UTAH. YOUR FUTURE. Executive Summary Utahns want to protect and increase food production in our State. • Current circumstances: • Utah’s food production has declined precipitously to where Utah now produces only 2% of its vegetables, 3% of its fruit, 25% of its dairy, 98% of its grains, and 135% of its protein needs, in part because the current land development process incentivizes the loss of water and land for farming. • These percentages could further decline significantly as Utah’s population nearly doubles and we lose more prime farmland by 2050. • Survey findings: • Ninety-eight percent of Utahns want to increase food self-sufficiency from agriculture by putting more land into production and/or changing crops to fruits and vegetables. • To do that, Utahns are willing to: • Cut back on watering their lawns and gardens to ensure we have enough water for agriculture • Avoid building on high-quality farmland • Spend more money to bring non-agricultural water to urban areas • Utahns do not want to take water or land from agriculture. 2 YOUR UTAH. YOUR FUTURE. Table of Contents Executive Summary 2 Agriculture Action Team Background 4 Agriculture Action Team Members 5 YUYF Survey Background 6 Survey Methodology 12 Utah Agriculture Values 21 YUYF Scenarios on Agriculture 24 YUYF Agriculture Results 31 Supporting Results 37 You May Still Take the Survey 40 3 YOUR UTAH. YOUR FUTURE. The agriculture action team worked for 18 months to create scenarios for the future of agriculture in Utah. Agriculture, Public Lands, Your Utah, Your Future & Recreation Action Team Utah Quality of Life Values Study Scenarios & Choices 2013 2014 2015 Envision Utah and Governor Herbert invited The values study found that agriculture The action team worked for 18 months to agriculture, public lands, and recreation has become increasingly important to research and model what Utah’s agricultural experts from across the state to join the Utahns across the state. -

Ebay Inc. Non-Federal Contributions: January 1 – December 31, 2018

eBay Inc. Non-Federal Contributions: January 1 – December 31, 2018 Campaign Committee/Organization State Amount Date Utah Republican Senate Campaign Committee UT $ 2,000 1.10.18 Utah House Republican Election Committee UT $ 3,000 1.10.18 The PAC MO $ 5,000 2.20.18 Anthony Rendon for Assembly 2018 CA $ 3,000 3.16.18 Atkins for Senate 2020 CA $ 3,000 3.16.18 Low for Assembly 2018 CA $ 1,000 3.16.18 Pat Bates for Senate 2018 CA $ 1,000 3.16.18 Brian Dahle for Assembly 2018 CA $ 1,000 3.16.18 Friends of John Knotwell UT $ 500 5.24.18 NYS Democratic Senate Campaign Committee NY $ 1,000 6.20.18 New Yorkers for Gianaris NY $ 500 6.20.18 Committee to Elect Terrence Murphy NY $ 500 6.20.18 Friends of Daniel J. O'Donnell NY $ 500 6.20.18 NYS Senate Republican Campaign Committee NY $ 2,000 6.20.18 Clyde Vanel for New York NY $ 500 6.20.18 Ben Allen for State Senate 2018 CA $ 1,000 6.22.18 Steven Bradford for Senate 2020 CA $ 1,000 6.22.18 Mike McGuire for Senate 2018 CA $ 1,000 6.22.18 Stern for Senate 2020 CA $ 1,000 6.22.18 Marc Berman for Assembly 2018 CA $ 1,000 6.22.18 Autumn Burke for Assembly 2018 CA $ 1,000 6.22.18 Ian Calderon for Assembly 2018 CA $ 1,000 6.22.18 Jim Cooper for Assembly 2018 CA $ 1,000 6.22.18 Tim Grayson for Assembly 2018 CA $ 1,000 6.22.18 Blanca Rubio Assembly 2018 CA $ 1,000 6.22.18 Friends of Kathy Byron VA $ 500 6.22.18 Friends of Kirk Cox VA $ 1,000 6.22.18 Kilgore for Delegate VA $ 500 6.22.18 Lindsey for Delegate VA $ 500 6.22.18 McDougle for Virginia VA $ 500 6.22.18 Stanley for Senate VA $ 1,000 6.22.18 Wagner -

2014 Legislative Wrap Up

Utah League of Cities and Towns 2014 General Legislative Session Wrap Up Wrap General Legislative 2014 1 ULCT Legislative Team Session Kenneth H. Bullock, Executive Director [email protected] Ken has worked for ULCT for 29 years and is responsible for the overall management of League operations and activities. He works closely with the ULCT Board of Directors, represents ULCT on various committees and boards, and communicates regularly with government officials, business leaders, and the public. Lincoln Shurtz, Director of Legislative Affairs [email protected] Lincoln has worked for ULCT for 15 years and coordinates ULCT policy outreach, administers the Legislative Policy Committee, & presents findings to state administrative and legislative branches. He specializes in the Utah state budget, transportation, economic development, and retirement issues. Jodi Hoffman, Land Use Analyst [email protected] Jodi has worked for ULCT for 11 years and for municipal government for over 25 years. She specializes in municipal land use and water issues. Roger Tew, Senior Policy Analyst [email protected] Roger has worked for ULCT for 18 years and within the state government structure for 35 years. He specializes in public utilities, judicial issues, tax policy, and telecommunications policy. Cameron Diehl, Policy Analyst/Attorney [email protected] Cameron has worked for ULCT for 6 years and coordinates LPC correspondence and organization. He specializes in federal relations, environmental policy, election law, and every other conceivable political issue. Nick Jarvis, Research Analyst [email protected] Nick has been with ULCT for 4 years and oversees the budget database and other research. Satin Tashnizi Legislative Intern [email protected] Satin was ULCT’s intern during the session and managed our logistics and sanity. -

Enrolled Copy HB 86 1 SOCIAL SECURITY TAX AMENDMENTS Chief Sponsor

Enrolled Copy H.B. 86 1 SOCIAL SECURITY TAX AMENDMENTS 2 2021 GENERAL SESSION 3 STATE OF UTAH 4 Chief Sponsor: Walt Brooks 5 Senate Sponsor: Wayne A. Harper 6 Cosponsors: Karianne Lisonbee Travis M. Seegmiller 7 Nelson T. Abbott A. Cory Maloy Rex P. Shipp 8 Carl R. Albrecht Kelly B. Miles V. Lowry Snow 9 Stewart E. Barlow Jefferson Moss Robert M. Spendlove 10 Kera Birkeland Merrill F. Nelson Jeffrey D. Stenquist 11 Steve R. Christiansen Val L. Peterson Jordan D. Teuscher 12 James A. Dunnigan Candice B. Pierucci Mike Winder 13 Steve Eliason Susan Pulsipher 14 Craig Hall Adam Robertson 15 Stephen G. Handy Mike Schultz 16 17 LONG TITLE 18 General Description: 19 This bill provides for an individual income tax credit for certain social security benefits. 20 Highlighted Provisions: 21 This bill: 22 < defines terms; 23 < enacts a tax credit for social security benefits that are included in the claimant's 24 federal adjusted gross income; 25 < provides that an individual who claims the tax credit for social security benefits may 26 not also claim the retirement tax credit; 27 < grants rulemaking authority to the State Tax Commission; and 28 < makes technical and conforming changes. H.B. 86 Enrolled Copy 29 Money Appropriated in this Bill: 30 None 31 Other Special Clauses: 32 This bill provides retrospective operation. 33 Utah Code Sections Affected: 34 AMENDS: 35 59-10-1002.2, as last amended by Laws of Utah 2016, Chapter 263 36 59-10-1019, as renumbered and amended by Laws of Utah 2008, Chapter 389 37 ENACTS: 38 59-10-1042, Utah Code Annotated 1953 39 40 Be it enacted by the Legislature of the state of Utah: 41 Section 1. -

April 2017 Newsletter

1 April 2017 Volume 42 Issue 4 THE UTAH TAXPAYER A Publication of the Utah Taxpayers Association If Congress Acts, What Will APRIL 2017 Volume 42 Federal Tax Reform Look Like? With Congress’s failure to repeal and replace the Affordable If Congress Acts, What Will Care Act, attention in Washington, D.C. appears to be turning Federal Tax Reform Look towards federal tax reform. This is a needed change as the Like? Page 1 United States has not seen any comprehensive tax reform since My Corner: Employed by 1986. The nation’s economy has evolved since the 1980’s and Page 2 Utah’s Tax Watchdog for 40 the tax code needs to be reformed to match the economic Years activity of today’s world. Page 2 Currently the federal tax code imposes high marginal rates on 2017 Legislative Session: A both businesses and individuals. According to the Washington, Page 4 D.C. based Tax Foundation, the United States has one of the Mixed Bag of Success, Tax Increases Page 5 highest corporate income tax rates in the world. Significant tax reform would be targeted at lowering those rates. The struggle 2017 Legislative Scorecard for the reform will be how to do it such that it best benefits the Released, 34 “Friend of the United States overall. Taxpayer” Awarded Page 7 The U.S. tax system is complex. The Tax Foundation has stated that individuals spent 8.9 billion hours complying with Utah’s Income Tax Rate the Internal Revenue Tax Code in 2016 and figures that the Ranks Second Highest total cost for tax compliance in 2016 was $409 billion. -

House Senate Rating

2010 Utah Legislature Rated How interest groups rated Utah lawmakers The "Red/Blue Index" standardizes and averages scores, so that the higher the number, the "redder" conservative a member is,and the lower the number, the "bluer" liberal. UTAH HOUSE MEMBERS Tribune Tribune Red/Blue Red/Blue Member Affiliation Index Member Affiliation Index Eric Hutchings R-Kearns 85.4 Jack Draxler R-N. Logan 65.0 Keith Grover R-Provo 84.8 Kay McIff R-Richfield 64.0 Stephen Sandstrom R-Orem 84.8 Ron Bigelow R-West Valley 62.2 Mike Morley R-Spanish Fk. 84.6 Doug Aagard R-Kaysville 62.0 Kenneth Sumsion R-Lehi 84.6 Melvin Brown R-Coalville 61.4 Craig Frank R-Pleasant Grove 84.6 Evan Vickers R-Cedar City 61.4 Merlynn Newbold R-S. Jordan 84.6 Johnny Anderson R-Taylorsville 61.2 Michael Noel R-Kanab 84.4 Todd Kiser R-Sandy 60.2 Brad Daw R-Orem 84.2 Jim Dunnigan R-Taylorsville 60.0 Christopher Herrod R-Provo 84.0 Ronda Menlove R-Garland 58.2 Wayne Harper R-West Jordan 82.0 Becky Edwards R-N. Salt Lake 55.0 Francis Gibson R-Mapleton 81.8 James Gowans D-Tooele 52.2 Rebecca Lockhart R-Provo 81.0 Steven Mascaro R-W. Jordan 51.6 Greg Hughes R-Draper 81.0 Neal Hendrickson D-West Valley 49.6 Ryan Wilcox R-Ogden 80.4 Jim Bird R-West Jordan 49.6 Carl Wimmer R-Herriman 80.2 Richard Greenwood R-Roy 48.2 John Dougall R-Am. -

House of Representatives State of Utah UTAH STATE CAPITOL COMPLEX • 350 STATE CAPITOL P.O

House of Representatives State of Utah UTAH STATE CAPITOL COMPLEX • 350 STATE CAPITOL P.O. BOX 145030 • SALT LAKE CITY, UTAH 84114-5030 • (801)538-1029 AGENDA TO: Members of the House Revenue and Taxation Standing Committee FROM: Rep. Ryan D. Wilcox, Chair Rep. Jim Nielson, Vice Chair RE: Committee Meeting DATE: Wednesday, February 5, 2014 TIME: 4:00 PM PLACE: 445 State Capitol - Call to order and approval of minutes - The following bills are scheduled for consideration: 1. HB0084 School District Amendments (C. Hall) (aos/ccs) 2. HB0273 Property Tax Residential Exemption Amendments (V. Snow) (rlr/lge) COMMITTEE MEMBERS Rep. Ryan D. Wilcox, Chair Rep. Jim Nielson, Vice Chair Rep. Jacob L. Anderegg Rep. Joel K. Briscoe Rep. Melvin R. Brown Rep. Tim M. Cosgrove Rep. Steve Eliason Rep. Gage Froerer Rep. Francis D. Gibson Rep. Eric K. Hutchings Rep. Brian S. King Rep. John Knotwell Rep. Kay L. McIff Rep. Douglas V. Sagers Rep. Jon E. Stanard Rep. Earl D. Tanner Committee Analyst: Leif G. Elder, Office of Legislative Research and General Counsel Committee Secretary: An Bradshaw In compliance with the Americans with Disabilities Act, persons needing auxiliary communicative aids and services for this meeting should call the Office of Legislative Research and General Counsel at 801-538-1032 or use Relay Utah (toll-free in-state 7-1-1 or Spanish language 888-346-3162), giving at least 48 hours notice or the best notice practicable. Every effort will be made to accommodate requests for aids and services for effective communication during the annual General Session. However, given the unpredictable and fast-paced nature of the legislative process, it is essential that you notify us as soon as possible. -

Minutes for 02/18

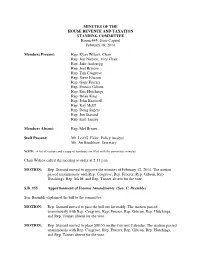

MINUTES OF THE HOUSE REVENUE AND TAXATION STANDING COMMITTEE Room 445, State Capitol February 18, 2014 Members Present: Rep. Ryan Wilcox, Chair Rep. Jim Nielson, Vice Chair Rep. Jake Anderegg Rep. Joel Briscoe Rep. Tim Cosgrove Rep. Steve Eliason Rep. Gage Froerer Rep. Francis Gibson Rep. Eric Hutchings Rep. Brian King Rep. John Knotwell Rep. Kay McIff Rep. Doug Sagers Rep. Jon Stanard Rep. Earl Tanner Members Absent: Rep. Mel Brown Staff Present: Mr. Leif G. Elder, Policy Analyst Ms. An Bradshaw, Secretary NOTE: A list of visitors and a copy of handouts are filed with the committee minutes. Chair Wilcox called the meeting to order at 2:11 p.m. MOTION: Rep. Stanard moved to approve the minutes of February 12, 2014. The motion passed unanimously with Rep. Cosgrove, Rep. Froerer, Rep. Gibson, Rep. Hutchings, Rep. McIff, and Rep. Tanner absent for the vote. S.B. 155 Apportionment of Income Amendments (Sen. C. Bramble) Sen. Bramble explained the bill to the committee. MOTION: Rep. Stanard moved to pass the bill out favorably. The motion passed unanimously with Rep. Cosgrove, Rep. Froerer, Rep. Gibson, Rep. Hutchings, and Rep. Tanner absent for the vote. MOTION: Rep. Stanard moved to place SB155 on the Consent Calendar. The motion passed unanimously with Rep. Cosgrove, Rep. Froerer, Rep. Gibson, Rep. Hutchings, and Rep. Tanner absent for the vote. House Revenue and Taxation Standing Committee February 18, 2014 Page 2 H.B. 77 Tax Credit for Home-schooling Parent (Rep. D. Lifferth) Rep. Lifferth explained the bill to the committee. Spoke for the bill: Hannah DeForest, citizen Elaine Augustine, citizen Connor Boyack, Libertas Institute Spoke against the bill: Deon Turley, Utah Parent Teacher Association Mark Mickelsen, Utah Education Association MOTION: Rep. -

Full Legislative Scorecard 2019

Legislative Scorecard 2 0 1 9 G e n e r a l S e s s i o n SENATORS DISTRICT H.B. 136 H.B. 166 H.B. 71 S.B. 96 SCORE (Against) (Against) (For) (Against) Senator Luz Escamilla Senate Dist. 1 Nay Nay Yea Nay 100% Senator Derek Kitchen Senate Dist. 2 Nay Nay Yea Nay 100% Senator Gene Davis Senate Dist. 3 Nay Nay Yea Nay 100% Senator Jani Iwamoto Senate Dist. 4 Nay Nay Yea Nay 100% Senator Karen Mayne Senate Dist. 5 Nay Nay Yea Nay 100% Senator Wayne Harper Senate Dist. 6 Yea Yea Yea Yea 25% Senator Deidre Henderson Senate Dist. 7 Yea Yea Yea Yea 25% Senator Kathleen Riebe Senate Dist. 8 Nay Nay Yea Nay 100% Senator Kirk Cullimore Senate Dist. 9 Yea Yea Yea Yea 25% Senator Lincoln Fillmore Senate Dist. 10 Yea Yea Yea Yea 25% Senator Daniel McCay Senate Dist. 11 Yea Yea Yea Yea 25% Vote For Reproductive Freedom Vote Against Reproductive Freedom Absent Votes Not Counted (Neutral) SENATORS DISTRICT H.B. 136 H.B. 166 H.B. 71 S.B. 96 SCORE (Against) (Against) (For) (Against) Senator Daniel Thatcher Senate Dist. 12 Yea Yea Yea Yea 25% Senator Jacob Anderegg Senate Dist. 13 Yea Absent Yea Yea 33% Senator Daniel Hemmert Senate Dist. 14 Yea Yea Absent Yea 0% Senator Keith Grover Senate Dist. 15 Yea Yea Yea Yea 25% Senator Curtis Bramble Senate Dist. 16 Yea Yea Yea Yea 25% Senator Scott Sandall Senate Dist. 17 Yea Yea Yea Yea 25% Senator Ann Millner Senate Dist. -

2020 Contributions

State Candidate Names Committee Amount Party Office District CA Holmes, Jim Jim Holmes for Supervisor 2020 $ 700 O County Supervisor 3 CA Uhler, Kirk Uhler for Supervisor 2020 $ 500 O County Supervisor 4 CA Gonzalez, Lena Lena Gonzalez for Senate 2020 $ 1,500 D STATE SENATE 33 CA Lee, John John Lee for City Council 2020 - Primary $ 800 O City Council 12 CA Simmons, Les Simmons for City Council 2020 $ 1,000 D City Council 8 CA Porada, Debra Porada for City Council 2020 $ 500 O City Council AL CA California Manufacturers & Technology Association Political Action Committee $ 5,000 CA Desmond, Richard Rich Desmond for Supervisor 2020 $ 1,200 R County Supervisor 3 CA Hewitt, Jeffrey Jeffrey Hewitt for Board of Supervisors Riverside County 2018 $ 1,200 O County Supervisor 5 CA Gustafson, Cindy Elect Cindy Gustafson Placer County Supervisor, District 5 - 2020 $ 700 O County Supervisor 5 CA Cook, Paul Paul Cook for Supervisor 2020 $ 1,000 R County Supervisor 1 CA Flores, Dan Dan Flores for Supervisor 2020 $ 500 County Supervisor 5 CA California Taxpayers Association - Protect Taxpayers Rights $ 800,000 CA Latinas Lead California $ 500 CA Wapner, Alan Wapner for Council $ 1,000 City Council CA Portantino, Anthony Portantino for Senate 2020 $ 2,000 D STATE SENATE 25 CA Burke, Autumn Autumn Burke for Assembly 2020 $ 2,000 D STATE HOUSE 62 CA California Republican Party - State Account $ 15,000 R CA Fong, Vince Vince Fong for Assembly 2020 $ 1,500 D STATE HOUSE 34 CA O'Donnell, Patrick O'Donnell for Assembly 2020 $ 4,700 D STATE HOUSE 70 CA Sacramento Metropolitan Chamber Political Action Committee $ 2,500 CA Patterson, Jim Patterson for Assembly 2020 $ 1,500 R STATE HOUSE 23 CA Arambula, Joaquin Dr.