Jana Holdings Limited: Rating Reaffirmed

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Annual DATABASE

bank-datatable-2021-revised.qxd 29/01/2021 07:01 PM Page 8 Banking Annual DATABASE (In %) FY 2018 FY 2019 FY 2020 (In %) FY 2018 FY 2019 FY 2020 FOREIGN BANKS PRIVATE BANKS Standard Chartered Bank 15.8 15.5 14.9 Yes Bank 1.3 3.2 16.8 Sumitomo Mitsui 37.6 30.3 40.9 SMALL FINANCE BANKS SOUNDNESS: GROSS NPA (%) AU Small Finance Bank 2.0 2.0 1.7 Equitas Small Finance Bank 2.7 2.5 2.7 PUBLIC SECTOR BANKS ESAF Small Finance Bank 3.8 1.6 1.5 Bank of Baroda - 10.0 9.4 Fincare Small Finance Bank 0.9 1.3 0.9 Bank of India 16.6 15.8 15.8 Jana Small Finance Bank 42.2 8.1 2.8 Bank of Maharashtra 19.5 16.4 12.8 Suryoday Small Finance Bank 3.5 1.8 2.8 Canara Bank 11.8 8.8 8.2 Ujjivan Small Finance Bank 3.7 0.9 1.0 Central Bank of India 21.5 19.3 18.9 Utkarsh Small Finance Bank 1.9 1.4 0.7 Indian Bank 7.4 7.1 6.9 Indian Overseas Bank 25.3 22.0 14.8 SOUNDNESS: NET NPA (%) Punjab & Sind Bank 11.2 11.8 14.2 PUBLIC SECTOR BANKS Punjab National Bank 18.4 15.5 14.2 Bank of Baroda - 3.7 3.1 State Bank of India 10.9 7.5 6.2 Bank of India 8.3 5.6 3.9 UCO Bank 24.6 25.0 16.8 Bank of Maharashtra 11.2 5.5 4.8 Union Bank of India 15.7 15.0 14.2 Canara Bank 7.5 5.4 4.2 Central Bank of India 11.1 7.7 7.6 PRIVATE BANKS Indian Bank 3.8 3.8 3.1 Axis Bank 6.8 5.3 4.9 Indian Overseas Bank 15.3 10.8 5.4 Punjab & Sind Bank 6.9 7.2 8.0 Bandhan Bank 1.3 2.0 1.5 Punjab National Bank 11.2 6.6 5.8 City Union Bank 3.0 3.0 4.1 State Bank of India 5.7 3.0 2.2 CSB Bank 7.9 4.9 3.5 UCO Bank 13.1 9.7 5.5 DCB Bank 1.8 1.8 2.5 Union Bank of India 8.4 6.9 5.5 Dhanlaxmi Bank 7.4 7.5 5.9 -

Products Launched by Various Banks

Products Launched by Various Banks PRODUCTS LAUNCHED BY VARIOUS BANKS Product Launched by Aim ‘Pay Your Contact’ Kotak Mahindra Bank The feature thus makes payment Ltd transactions easy and simple and it is associated with high security. ‘ICICI STACK for Corporates’ ICICI Bank The ‘ICICI STACK for Corporates’ solution enables the corporate sector and its associated entities to meet their banking requirements in a seamless manner. NR Savings Account Scheme for the Federal Bank The services under the schemes are Seafarer Segment integrated into the digital platform so that digital banking under the schemes can be performed by the mariners. Healthcare Credit, Business, & Canara bank The bank has launched healthcare credit, Personal Loans business, and personal loan schemes to its customers. ABSLI Vision LifeIncome Plus Plan Aditya Birla Capital The flexible bonus pay-outs can be Limited (ABCL) accumulated for wealth creation or withdrawn at the customer’s convenience for instant access to their money. IPOS (Integrated Partner Onboarding Edelweiss General The IPOS is an industry-first digital end to Solution) Insurance (EGI) end partner onboarding solution. It was launched to offer to digitise support to partner’s journey in an efficient manner. Exide Life Guaranteed Wealth Plus Exide Life Insurance It offers continuous life cover throughout Company Limited the income payout period with up to 350% guaranteed returns. Digigold Airtel Payments Bank To launch this platform, Airtel Payments Bank has collaborated with SafeGold which is a provider of digital gold. ‘I choose my number’ Jana Small Finance Bank To choose their favourite numbers as the last 10 digits of their bank account, savings or current. -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

Banking Annual DATABASE

bank-datatable-2021-revised.qxd 29/01/2021 07:00 PM Page 2 Banking Annual DATABASE (In ~ crore) FY 2019 FY 2020 % chg (In ~ crore) FY 2019 FY 2020 % chg PRIVATE BANKS FOREIGN BANKS City Union Bank 32,673 33,927 3.8 J P Morgan Chase 13,800 14,683 6.4 CSB Bank 10,615 11,366 7.1 Societe Generale 1,495 1,574 5.3 DCB Bank 23,568 25,345 7.5 Standard Chartered Bank 66,838 76,214 14.0 Dhanlaxmi Bank 6,289 6,496 3.3 Sumitomo Mitsui 6,920 10,920 57.8 Federal Bank 1,10,223 122,268 10.9 HDFC Bank 8,19,401 993,703 21.3 ICICI Bank 5,86,647 645,290 10.0 GROWTH: DEPOSITS IDBI Bank 1,46,790 129,842 -11.5 IDFC First Bank 86,302 85,595 -0.8 PUBLIC SECTOR BANKS IndusInd Bank 1,86,394 206,783 10.9 Bank of Baroda 9,15,159 9,45,984 3.4 Jammu and Kashmir Bank 66,272 64,399 -2.8 Bank of India 5,20,862 5,55,505 6.7 Karnataka Bank 54,828 56,964 3.9 Bank of Maharashtra 1,40,650 1,50,066 6.7 Karur Vysya Bank 48,581 46,098 -5.1 Canara Bank 5,99,033 6,25,351 4.4 Kotak Mahindra Bank 2,05,695 219,748 6.8 Central Bank of India 2,99,855 3,13,763 4.6 Nainital Bank 3,516 3,829 8.9 Indian Bank 2,42,076 2,60,226 7.5 RBL Bank 54,308 58,019 6.8 Indian Overseas Bank 2,22,534 2,22,952 0.2 South Indian Bank 62,694 64,439 2.8 Punjab & Sind Bank 98,558 89,668 -9.0 Tamilnad Mercantile Bank 26,488 27,716 4.6 Punjab National Bank 6,76,030 7,03,846 4.1 Yes Bank 2,41,500 171,443 -29.0 State Bank of India 29,11,386 32,41,621 11.3 UCO Bank 1,97,907 1,93,203 -2.4 SMALL FINANCE BANKS Union Bank of India 4,15,915 4,50,668 8.4 AU Small Finance Bank 22,819 26,992 18.3 Equitas Small Finance Bank -

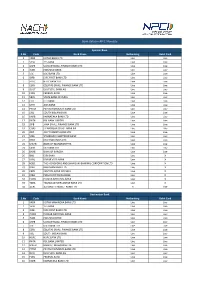

Live Banks in API E-Mandate

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4 INDB INDUSIND BANK Live Live 5 ICIC ICICI BANK LTD Live Live 6 IDFB IDFC FIRST BANK LTD Live Live 7 HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9 DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11 SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14 PYTM PAYTM PAYMENTS BANK LTD Live Live 15 SIBL SOUTH INDIAN BANK Live Live 16 KARB KARNATAKA BANK LTD Live Live 17 RATN RBL BANK LIMITED Live Live 18 JSFB JANA SMALL FINANCE BANK LTD Live Live 19 CHAS J P MORGAN CHASE BANK NA Live Live 20 JIOP JIO PAYMENTS BANK LTD Live Live 21 SCBL STANDARD CHARTERED BANK Live Live 22 DBSS DBS BANK INDIA LTD Live Live 23 MAHB BANK OF MAHARASHTRA Live Live 24CSBK CSB BANK LTD Live Live 25BARB BANK OF BARODA Live Live 26IBKL IDBI BANK Live X 27KVBL KARUR VYSA BANK Live X 28 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 29BDBL BANDHAN BANK LTD Live X 30 CBIN CENTRAL BANK OF INDIA Live X 31 IOBA INDIAN OVERSEAS BANK Live X 32 PUNB PUNJAB NATIONAL BANK Live X 33 TMBL TAMILNAD MERCANTILE BANK LTD Live X 34 AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3 IDFB IDFC FIRST BANK LTD Live Live 4 PUNB PUNJAB NATIONAL BANK Live Live 5 INDB INDUSIND BANK Live Live 6 USFB -

List of Banks in India

List of banks in India Banks in India are classified into four categories - Commercial Banks Small Finance Banks Payments Banks Co-operative Banks Banks in India Small Finance Co-operative Commercial Bank Payments Bank Bank Bank Public Sector Urban Co-op. Private Sector Rural Co-op. Regional Rural Bank Foreign Bank Contents Public-sector banks Private-sector banks Regional Rural Banks (RRBs) Foreign banks Foreign banks with branches Foreign banks with representative offices Small finance banks Payments banks Cooperative banks State Co-operative Banks (SCBs) Urban Co-operative Banks (UCBs) Local area banks See also References External links Public-sector banks Public Sector Banks (PSBs) are a major type of bank in India, where a majority stake (i.e. more than 50%) is held by the government. In April 2019, Vijaya Bank and Dena Bank were merged with Bank of Baroda.[1] On 30 August 2019, Union Finance Minister Nirmala Sitaraman announced merger of six public sector banks (PSBs) with four better performing anchor banks in order to streamline their operation and size, two banks were amalgamated to strengthen national presence and four were amalgamated to strengthen regional focuses. Subsequently, the number of public sector bank has been reduced to 12 from 27.[2][3] This new amalgamation came effective from 1 April 2020.[4] List of Public Sector Banks (Government Shareholding %, as of 1 April 2020): Anchor Merged Branches Established Headquarter Total Assets Revenues Refs Bank Banks Bank of Vijaya Vadodara, ₹16,130 billion ₹422 billion Baroda -

Terms and Conditions for UPI

Terms and Conditions for UPI UPI Terms and Condition for Loan Repayment This document prescribes the Terms and Conditions, which shall be applicable to all transactions initiated by the User/Customers through any UPI PSP app and for using Unified Payments Interface (UPI) services for the repayment of loan/credit facility obtained from Jana Small Finance Bank Limited (“JSFB”). The repayment may be either in partial/EMI/full repayment of loan amount outstanding. 1. Definitions • ‘Amount’ – The payment amount in question which is required to be transferred from the Payer to the Receiver via scanning the QR code generated in the website as a part of the UPI Transaction. • ‘Authorisation / Authorised Transactions – The process by which Issuing Bank approves a Transaction. • ‘Beneficiary Bank’ – Beneficiary Bank means “Jana Small Finance Bank Limited (JSFB) as the loan account will be held with JSFB. • ‘Commission’ means the commission, fees, charges or levies payable to Bank, for facilitating a Transaction. • ‘NPCI’ – The National Payments Corporation of India, a company incorporated in India under Section 25 of the Companies Act, 1956 (now Section 8 of Companies Act 2013) NPCI acts as the settlement, clearing house, regulating agency for UPI services with the core objective of consolidating and integrating the multiple payment systems with varying service levels into nation-wide uniform and standard business process for all retail payment systems. • ‘Payer’ – Customer of the Beneficiary Bank who is holding loan account with Beneficiary Bank and who intends to use the UPI services for loan repayment. • ‘Payment Service Provider’ (PSP) or “PSP App” – The entities which are allowed to issue virtual addresses to the Users and provide payment (credit / debit) services to individuals or entities and regulated by the Reserve Bank of India, in accordance with the Payments and Settlement Systems Act, 2007. -

DIGITAL PAYMENTS BOOK Part1

DIGITAL PAYMENTS Trends, Issues And Opportunities July 2018 FOREWORD A Committee on Digital Payments was growth figures for both volume and value. constituted by Department of Economic Notwithstanding this the analysis finds that Affairs, Ministry of Finance in August 2016 both the data are relevant and equally under my Chairmanship to inter-alia important. They are complementary. In recommend medium term measures of addition to this the underlying growth trends promotion of Digital Payments Ecosystem in Digital Payments over the last seven in the country. The Committee submitted its years are also covered in this booklet. final report to Hon’ble Finance Minister in December 2016. One of the key This booklet has some new chapters which recommendations of the Committee related cover the areas of policy developments, to development of a metric for Digital global trends and opportunities in Digital Payments. As a follow-up on this a group of Payments. In the policy space the important Stakeholders from Different Departments of developments with respect to the Government of India and RBI was amendment of the Payment and Settlement constituted in NITI Aayog under my Act 2007 are covered. chairmanship to facilitate the work relating I am grateful to Governor, RBI, Secretary to development of the metric. This group MeitY and CEO, NPCI for their support in prepared a document on the measurement preparing this booklet. Shri. B.N. Satpathy, issues of Digital Payments. Accordingly, a Senior Consultant, EAC-PM and Shri. booklet titled “Digital Payments: Trends, Suneet Mohan, Young Professional, NITI Issues and Challenges” was prepared in Aayog have played a key role in compiling May 2017 and was released by me in July this booklet. -

SOC Rupay Select Debit Card

SCHEDULE OF CHARGES – RuPay Select Card Effective Date: 01st January, 2021 PREMIUM SAVINGS & Other SAVINGS and CURRENT Accounts Charge Type / Product Name SILVER PREMIUM SAVINGS (chargeable) Debit Card Type Rupay Select Rupay Select Debit Card Issuance NA NA (InstaKit/Joining Fee) Debit Card Issuance NIL ₹ 749 (Personalised/Joining Fee) Debit Card AMC (Applicable Both for Instakit or/and NIL ₹ 1249 Personalised Cards issued to customers) Debit Card Re-issuance ₹ 249 ₹ 249 Card Charges (Instakit or/and Personalised) and other Features ATM cash withdrawal limit per day ₹ 250,000 ₹ 250,000 POS limit per day ₹ 500,000 ₹ 500,000 E-commerce limit per day ₹ 500,000 ₹ 500,000 Pin Generation NIL NIL (for Debit Card through physical dispatch) Page 1 of 3 SCHEDULE OF CHARGES – RuPay Select Card Effective Date: 01st January, 2021 At Jana Small Finance Bank ATMs (per month) No. of free ATM transactions Unlimited Unlimited Charges above free limit for financial NIL NIL transactions Charges above free limit for non-financial NIL NIL transactions At other bank ATMs(per month) 10 transactions No. of free ATM transactions per month Unlimited (financial + non-financial) Charges above free limit for financial ATM and N/A 20 other related transactions (per transaction) charges Charges above free limit for non-financial N/A 8 transactions (Per transaction) Charges for transactions on ATMs outside 150 150 India for financial Charges for transactions on ATMs outside 50 50 India for non-financial Decline Charges - Transactions declined at other bank ATMs or at a merchant outlet / NIL NIL websites due to insufficient funds will be charged Cross-currency mark-up charges on foreign 4 % 4 % currency transactions Page 2 of 3 SCHEDULE OF CHARGES – RuPay Select Card Effective Date: 01st January, 2021 List of other Savings and Current Accounts for which Rupay Select Debit Card is eligible: Savings Account: 1. -

Schedule of Charges for Savings Accounts

Schedule of Charges for Savings Accounts Schedule of Charges is effective from March 28, 2018 Particulars Regular Savings Plus BSBDA Small Savings Initial deposit 2,500 5,000 Nil Nil AMB ₹2,500 ₹5,000 or Nil Nil TRV1 ₹25,000 ₹50,000 Charges for non-maintenance of AMB/TRV ₹ ₹ Account If balance maintained is >= Opening & 10 20 NA NA Balance 50% of the Maintenance requirement ₹ ₹ If the balance maintained is < 20 40 NA NA 50% of the requirement ₹ ₹ 1TRV - total balance of SA+CA+FD+RD Either AMB or TRV will be applicable for the customer 4 withdrawals in a month (across all Unlimited channels) For minor 4 withdrawals in Cash withdrawal 1. Maximum of accounts: Unlimited a month (across Cash at branches 10000/transaction Maximum all channels) Withdrawal / 2. Maximum of withdrawal Deposit ₹10000/month 1,00,000/day 3. No foreign ₹ ₹ remittances Free limit for All credits in a FY cash deposit at Unlimited Unlimited Unlimited not to exceed branches 1,00,000 1 free cheque ₹ book every Cheque book quarter. There on, Nil NA NA issuance charges 25 for every 25 leaves cheque book₹ Cheque Stop payment of 50/transaction 50/transaction Book cheque (Leaf or NA NA Series) ₹ Free online ₹ Free online Cheque/ECS 300/transaction 300/transaction 200/transaction 200/transaction return (Inward) Cheque/ECS ₹ Nil ₹ Nil ₹ Nil ₹ Nil return (Outward) Abbreviations: AMB – Average Monthly Balance | AMC – Annual Maintenance Charges | ATM – Automated Teller Machine | BSBDA – Basic Savings Bank Deposit Account | CA – Current Account | DD – Demand Draft | ECS –Electronic -

Bank's Nodal Officer

PUBLIC SECTOR BANK DETAILS OF NODAL OFFICER Sr.No Bank Name NAME GMs LAND LINE EMAIL 1 Bank of Baroda Shri. Man Mohan Gupta GM 022-66985203 [email protected] 2 Bank of India Shri Mina Ketan Das GM 022-66684839 [email protected] 3 Bank of Maharashtra Mr. M Satyanarayana AGM 020-25614281 [email protected] 4 Canara Bank Sri.D.Madhavaraj GM 080-22248409 [email protected] 5 Central Bank of India MS. ASHA KOTASTHANE GM 022-61648728 [email protected] 6 Indian Bank Mr. Veeraraghavan B DGM 044-28134542 [email protected] 7 Indian Overseas Bank 8 Punjab & Sind Bank Sh. H.M. SINGH GM 011-25812931 [email protected] 9 Punjab National Bank Mr. Ashok Kumar Gupta GM [email protected] 10 State Bank of India S. Kalyanram GM 022-22740510 [email protected] 11 UCO Bank M K SURANA GM 033-44558027 [email protected] 12 Union Bank of India Mr. Manish Awasthi Chief Manager [email protected] PRIVATE SECTOR BANK DETAILS OF NODAL OFFICER Sr.No Bank Name NAME DESIGNATION LAND LINE EMAIL 1 Axis Bank Rahul Kumar Jain 02224252455 [email protected] 2 Bandhan Bank Ambuj Verma AVP [email protected] 3 Catholic Syrian Bank Roy Varghese [email protected] 4 Citibank Meenakshi Rajagopal 124-4186824 [email protected] 5 City Union Bank M.Mounissamy [email protected] 6 DCB Bank Shankershan Vasisth 022-24387000 [email protected] 7 Dhanlaxmi Bank 8 FederalBank Mr.Mohan K [email protected] 9 HDFC Bank Ashey Aggarwal Head - Inclusive 022-33959312 [email protected] Banking Initiatives Group 10 ICICI Bank Ravi Narayanan Senior General 022-62891578/ [email protected] Manager 62897681 11 IDBI Bank Limited Shri Mukesh Kumar GM [email protected] Rajpurohit 12 IDFC Bank Limited Mr. -

Definitions Terms and Conditions for Debit

Terms and Conditions for Debit Card Please read the Terms and Conditions listed below. Jana Small Finance Bank agrees to provide Debit card verified by Visa/RuPay to its Customer subject to agreeing & accepting the card application terms and the below mentioned Terms and Conditions applicable to Debit cards. These terms and conditions shall be in addition to any other Terms as stipulated by Jana Small Finance Bank. In addition, when using Visa/RuPay debit card, cardholder will be subject to all guidelines or rules applicable to Visa/RuPay Card that may be posted from time to time at the same website. Definitions 1. ‘The Bank’, ‘Jana Small Finance Bank’, means Jana Small Finance Bank Limited, a company incorporated under the Companies Act, 1956 and licensed under Banking Regulation Act,1949 to carry on the Small Finance Banking Business having its registered office at No.29,union street, Off Infantry Road, Bengaluru-560001 which expression shall, unless it be repugnant to the subject or context thereof, include its successors, representatives and assigns. 2. ‘Card’ or ‘Debit Card’, refers to the Jana Small Finance Bank Visa/RuPay Debit Card issued by Jana Small Finance Bank (the proprietors / owners of the Card) to a Cardholder. 3. ‘Account(s)’, refers to the Cardholder's Savings or Current Account that have been designated by Jana Small Finance Bank to the eligible account(s) for the valid operation of the Debit Card. 4. ‘Cardholder’, ‘you’, ‘your’, ‘him’ or similar pronouns shall, where the context so admit, refer to a customer of Jana Small Finance Bank to whom Jana Small Finance Bank have issued a Card with respect to an account opened in bank 5.