Breadtalk (BREAD SP) Neutral (Maintained)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Acquisition of 100% Stake in Food Junction Group of Companies

Investor Presentation Acquisition of 100% Stake in Food Junction Group of Companies 2 September 2019 Acquisition of 100% Stake in Food Junction (“FJ”) Group . Transaction Summary . Food Junction Business Overview . Appendix – List of Food Republic Food Courts in Singapore and Malaysia 1 Acquisition of 100% Stake in FJ Group TRANSACTION SUMMARY Acquisition BreadTalk Auric Pacific Structure Group Limited (“BTG”) Group Limited Singapore Singapore 100% 98.10% Topwin Investment Food Junction Holding Pte Ltd Holdings Ltd Singapore Singapore 100% Acquisition of 100% Stake Food Junction Management (“FJM”) Pte Ltd Singapore 100% 100% Food Junction T&W Food Singapore (“FJS”) Junction (“T&W”) Pte Ltd Sdn Bhd Singapore Malaysia Acquisition . Enterprise Value S$ 80 million. Terms . Funded by approximately 60% borrowings and 40% cash. 2 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Singapore FJ operates 12 food courts and its direct operated stores across Singapore, including the newly opened Five Spice Food Court at Jewel Changi Airport. Lot One Shoppers’ Mall Junction 8 Nex Serangoon Jewel Changi Airport Food Junction Food Court LocationsList of Food Junction Food Courts 1. Bugis Junction 2. Century Square 3. Great World City 4. Harbourfront Centre 5. Junction 8 6. Lot One Shoppers’ Mall 7. Nex Serangoon 8. One Raffles Place 9. Raffles City 10. Rivervale Mall 11. United Square 12. Jewel Changi Airport Source: Google Maps, Food Junction Website 3 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Malaysia FJ operates a total of 3 food courts and its direct operated stores in Kuala Lumpur, Malaysia. The 4th food court is scheduled to open in 2020 at The Mall, Mid Valley Southkey in Johor Bahru, Malaysia. -

Shwe Taung Group Breadtalk ့

Shwe Taung Group BreadTalk ႔ BreadTalk new concept store at Vivo City Singapore. Photo courtesy of BreadTalk Singapore - ၂၀၁၆ (၃) - BreadTalk Group Limited ၸဏီတစ္ခ ႔ BreadTalk Pte. Ltd. Shwe Taung Group ႔၀ ျဖစ သည္႔ Myanmar Bakery Co., Ltd ႔ BreadTalk Bakery ႔ Myanmar Bakery Co., Ltd Franchise Bakery မ်ား BreadTalk ၏ Singapore, Mainland China, Hong Kong, Indonesia, Thailand and the Middle East ၀ (၁၆) (၈၀၀) ႔ BreadTalk ႔ ၀ BreadTalk ၏ ႔ Shwe Taung Group ၏ ႔ 1 ၊ ၄ ၏ ႔ ႔ ၾ ႔ BreadTalk ႔ Shwe Taung Group shopping centre ၌ ၀ှဿ၇ ဖြင့္လွစ္မည္ျဖစ္သည္။ Shwe Taung Group Junction Centre group of shopping centres ႔ shopping centre (၄) (၁) ႔ ႔ ၻာ႔အဆင့္မီဖံြ႔ၿဖိဳးေရးအသြင္သ႑ာန္မ်ိဳးစံု ေပါင္းစည္းထားသည္႔ Junction City Shwe Taung Group Master Developer ၂၀၁၇ ႔ Phase1 ၀ ႔ shopping centre ၊ ၀ ႔ Grade A office tower ၊ၾ ႔ luxury hotel ႔ ၀ “ ၏ Retail BreadTalk ၾ ၊ ႔၏ Singapore ႔ ၏ Shwe Taung Group ၊ ႔ BreadTalk ၏ boutique Bakery ႔ ၀ ၾ ၾ ၊ ႔ Shwe Taung Group ၏ ႔ ၾ ႔ ၾ ၾ ” Mr. Tan Aik Peng (Chief Executive Officer, Bakery Division) ၾ ႔ ၵ (Deputy Managing Director, Shwe Taung Group) “ ႔ ႔ BreadTalk ႔ ၀ BreadTalk Bakery Bakery ႔ BreadTalk ႔ ႔ ” ၍ လည္းေကာင္း၊ “ Shwe Taung Group ႔ ၾ ၊ ႔ 2 Café and Restaurants, Fast Food Chains ႔ Modern Food Courts ႔ ႔ food and beverage ႔ ႔ ” ၍ လည္းေကာင္း၊ ၾ ### BreadTalk Group Limited ၾ ၂၀၀၀ ႔ BreadTalk Group Limited ၄ ၏ ာၻ႔အဆင့္အတန္းမီ bakery, restaurant food atrium footprints ႔ ၄ ၏ BreadTalk, Toast Box, Food Republic, Din Tai Fung, The Icing Room, Bread Society, RamenPlay, Thye Moh Chan Carl’s Jr. -

(Awarded in 6X STAR$®) with the American Express® Capitacard

Earn up to 3% rebate (Awarded in 6X STAR$®) with The American Express® CapitaCard Participating Merchants at CapitaLand Malls in town (S$1 spend = 30 STAR$®, T&Cs Apply) Updated as of 1 July 2021 Important Notes Please visit amex.co/capitacardterms for the full terms and conditions for earning STAR$® with your American Express® CapitaCard. Please note that under the terms and conditions: 1. Additional 25 STAR$® will be awarded, on top of the base 5 STAR$, on eligible purchases of goods and services, in blocks of S$1, on a cumulative basis at the end of every calendar month, capped at S$1,200 per calendar month. 2. On top of excluded charges and purchases, the following transactions are also not eligible to earn additional 25 STAR$®: charges at pushcarts, temporary vendors/pop-up shops, events, roadshows, SISTIC, SAM machines and AXS machines within CapitaLand Malls in town. American Express International Inc (UEN S68FC1878J) 1 Marina Boulevard #22-00, One Marina Boulevard, Singapore 018919. americanexpress.com.sg. Incorporated with Limited Liability in the State of Delaware, U.S.A ®Registered Trademark of American Express Company. © Copyright 2021 American Express Company. AXP Public 1 American Express® CapitaCard Participating Merchants @ Bugis Junction 200 Victoria Street Singapore 188021 Participating Merchant Name 6IXTY8IGHT Hi-Tec Mobile Polar Puffs & Cakes Action City HLH SABER LILY Pop Mart adidas HoneyMoon Dessert Premier Football Ajisen Ramen Honguo Purpur Akihabara HP By AddOn Q & M Dental Centre (Bugis) Alcoholiday HUAWEI Raffles -

Breadtalk Group Ltd

Singapore Company Guide BreadTalk Group Ltd Bloomberg: BREAD SP | Reuters: BRET.SI Refer to important disclosures at the end of this report DBS Group Research . Equity 4 Apr 2017 BUY Piping hot bread in the making (Re-instating Coverage) Last Traded Price ( 3 Apr 2017): S$1.36 (STI : 3,187.51) We see earnings recovering led by Foodcourt Price Target 12-mth: S$1.69 (25% upside) business which has turned around in 4Q16 Bakery’s cost rationalisation & better Din Tai Fung Potential Catalyst: Earnings turnaround sales mix will support operating margin expansion Analyst Alfie YEO +65 6682 3717 [email protected] Project 3-year CAGR growth of 63% for FY16-FY18F Andy SIM CFA +65 6682 3718 [email protected] Re-instating coverage with BUY and SOTP-based TP of S$1.69 backed by investment properties worth Price Relative S$0.43 per share S$ Relative Index Foodcourt earnings has turned around in 4Q16 and 1.7 BreadTalk is poised for earnings growth 1.6 205 poised for growth. 1.5 185 this year. After dismal performances in FY15 and 1H16, we 1.4 1.3 165 saw a turnaround in 2H16 earnings. Its cost saving initiatives 1.2 145 1.1 125 led to margin improvements and we saw a recovery of its 1.0 105 0.9 Foodcourt business through outlet rationalisation in China. 0.8 85 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 We see earnings recovery momentum spilling over to FY17F. Breadtalk Group Ltd (LHS) Relative STI (RHS) All three business segments are now better positioned for earnings growth. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Breadtalk Group Ltd

Singapore Company Guide BreadTalk Group Ltd Version 9 | Bloomberg: BREAD SP | Reuters: BRET.SI Refer to important disclosures at the end of this report DBS Group Research . Equity 2 Aug 2019 HOLD Drag from bakery and start-up losses Last Traded Price ( 1 Aug 2019): S$0.715 (STI : 3,291.75) Price Target 12-mth: S$0.77 (8% upside) (Prev S$0.92) Maintain HOLD, with a lower TP of S$0.77. We remain neutral on BreadTalk. The weak bakery performance in China in the Analyst current quarter, along with wider than expected start-up losses Alfie YEO +65 6682 3717 [email protected] from 4orth division led us to reduce our FY19-20F earnings by Andy SIM, CFA +65 6682 3718 [email protected] 18-19%. While we expect modest EBIT growth led by What’s New Restaurant and Food Atrium divisions, higher interest costs due • 2Q19 earnings below estimates, dragged by losses in to SFRS (I) 16 will be a drag on earnings from FY19F. The stock bakery and 4orth division is fairly valued trading at 19.5x PE for its core F&B business, in line with Singapore-listed F&B peers’ average. • Interim DPS of 0.5 Scts declared • Cut FY19-20F earnings by 18-19% Where we differ. Our earnings forecasts are below consensus as we factor in a longer breakeven period for the new 4orth • Maintain HOLD, TP lowered to S$0.77 division. The division is in its infancy with scope to increase store count, that will lengthen the division’s EBIT breakeven period. -

Where Businesses Take Flight Why Ngee Ann Poly Is the Place to Be for Young Entrepreneurs

A publication of Ngee Ann Polytechnic Issue 1 of 2018 Where Businesses Take Flight Why Ngee Ann Poly is the place to be for young entrepreneurs FUTURE-PROOFING CAREERS: SKILLS TRAINING FOR ADULT LEARNERS AT NGEE ANN POLY / contents / GET THE The Heart of Human Resources features 13 How Ms Ho Wei Yee, Finalist, On Course for the Future President’s Award for Teachers, Ngee Ann’s Continuing Education 02 nurtures students through hands-on & Training Academy offers curated learning programmes and future skills training for adult learners TRA EDGE Getting a World of Experience Future-proofing careers through courses Innovation for the Community 14 Our students traverse Asia on 04 Find out how Ngee Ann students meaningful learning journeys 04 are changing lives for the better at Ngee Ann’s CET Academy with their final-year projects A Film about Dad 16 Touching short film by Ngee Ann 14 cover story graduates now available on Toggle What it Takes to Boost 08 Entrepreneurship EMERGING SKILLS Ngee Ann’s initiatives are nurturing the last page Data Analytics young entrepreneurs 17 A Symphony of Arts and Heart Digital Media EARN & LEARN Entrepreneurship highlights PROGRAMME A Vision for Service-Learning Financial Services & Upgrading programmes Governance 12 Partnership with World Vision to for fresh polytechnic boost Ngee Ann’s Service-Learning Tech-enabled Services efforts Advanced graduates, offered in Manufacturing partnership with the industry A publication of Ngee Ann Polytechnic Issue 1 of 2018 Where Businesses Take Flight DIPLOMAS: PART-TIME -

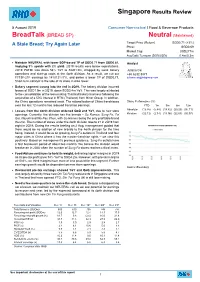

Breadtalk (BREAD

Results Review Singapore 5 August 2019 Consumer Non-cyclical | Food & Beverage Products BreadTalk (BREAD SP) Neutral (Maintained) A Stale Bread; Try Again Later Target Price (Return) SGD0.71 (+3%) Price: SGD0.69 Market Cap: USD277m Avg Daily Turnover (SGD/USD) 0.4m/0.3m Maintain NEUTRAL with lower SOP-based TP of SGD0.71 from SGD0.81, Analyst implying 3% upside with 2% yield. 2Q19 results were below expectations. 2Q19 PATMI was down 58% YoY to SGD1.0m, dragged by weak bakery Juliana Cai operations and start-up costs at the 4orth division. As a result, we cut our +65 6232 3871 FY19F-21F earnings by 14%/12%/7%, and derive a lower TP of SGD0.71. [email protected] Short-term catalyst is the sale of its stake in AXA tower. Bakery segment swung into the red in 2Q19. The bakery division incurred losses of SGD1.9m in 2Q19, down SGD3.4m YoY. This was largely attributed to the consolidation of the loss-making Thailand bakery business following the acquisition of a 50% interest in BTM (Thailand) from Minor Group. In addition, the China operations remained weak. The rationalisation of China franchisees Share Performance (%) over the last 12 months has reduced franchise earnings. YTD 1m 3m 6m 12m Losses from the 4orth division widened QoQ and YoY, due to new store Absolute (15.85) (5.48) (18.82) (20.23) (36.11) openings. Currently, the division has five brands – So Ramen, Song Fa, Tai Relative (22.12) (2.34) (14.96) (22.63) (35.97) Gai, Nayuki and Wu Pao Chun, with So Ramen being the only profitable brand thus far. -

Financial Results for FY2016

FOR IMMEDIATE RELEASE BreadTalk Group Appoints Henry Chu as Group CEO In Line with Business Expansion and Succession Planning SINGAPORE – 20 June 2017 – Mainboard-listed BreadTalk Group Limited (“the Group” or “BreadTalk”), a leading lifestyle F&B group, is pleased to announce the appointment of Mr Henry Chu as Group CEO with effect from 1 July 2017. Henry rejoined BreadTalk as Group Managing Director (MD) on 17 October 2016 having served previously as CEO, Bakery Division between May 2010 and April 2012. As Group MD, he oversees the Group’s global Food and Beverage (F&B) operations, comprising the core businesses of Bakery, Food Atrium, and Restaurants. In addition, Henry leads all F&B-related investments. Since October 2016, Henry has worked tirelessly with the senior management team to maximise growth opportunities in more profitable segments of the Business. Together with the team, he assessed the overall health of each business, consolidated underperforming assets, and enhanced the current operating systems and processes. Most recently in March, Henry led a team to rebrand RamenPlay to Sō Ramen, a specialty ramen restaurant with five distinctive soup broths and rice dishes served with premium Koshihikari rice, cultivated and grown on the pristine rice paddies in Niigata, Japan. The results are positive till date and the team will rebrand the remaining stores by end of 3Q 2017. In the same month, Henry and his team successfully opened our first BreadTalk outlet at Junction City in Yangon Myanmar, signifying our ability to navigate a challenging F&B retail landscape in 2017. Henry has vast experience in the regional F&B and retail space, spanning more than 20 years across renowned brands in different geographical regions. -

CFA Society Taiwan National Taiwan University

CFA Institute Research Challenge Hosted by CFA Society Taiwan National Taiwan University The CFA Institute Research Challenge is a global competition that tests the equity research and valuation, investment report writing, and presentation skills of university students. The following report was prepared in compliance with the Official Rules of the CFA Institute Research Challenge, is submitted by a team of university students as part of this annual educational initiative and should not be considered a professional report. Disclosures: Ownership and material conflicts of interest: The author(s), or a member of their household, of this report does not hold a financial interest in the securities of this company. The author(s), or a member of their household, of this report does not know of the existence of any conflicts of interest that might bias the content or publication of this report. Receipt of compensation: Compensation of the author(s) of this report is not based on investment banking revenue. Position as an officer or director: The author(s), or a member of their household, does not serve as an officer, director or advisory board member of the subject company. Market making: The author(s) does not act as a market maker in the subject company’s securities. Disclaimer: The information set forth herein has been obtained or derived from sources generally available to the public and believed by the author(s) to be reliable, but the author(s) does not make any representation or warranty, express or implied, as to its accuracy or completeness. The information is not intended to be used as the basis of any investment decisions by any person or entity. -

Breadtalk Group

Consumer Staples / Singapore BREAD SP Consumer Staples / Singapore 9 September 2015 BreadTalk Group BreadTalk Group Target (SGD): 1.31 Upside: 16.4% BREAD SP 8 Sep price (SGD): 1.13 Initiation: comfort food 1 Buy (initiation) • A bakery, restaurant and food-court company whose share price 2 Outperform has underperformed peers on the back of negative news flow 3 Hold • This seems unjustifiable given its revenue growth for 2015-17E, 4 Underperform and as we expect further upside from outlet and margin expansion 5 Sell • Initiate coverage with Buy(1) rating and 12-month TP of SGD1.31; we see a net-profit CAGR of 26.3% over 2014-17E How do we justify our view? Accordingly, we initiate coverage on SGD1.31, based on 2016E PER of BreadTalk with a Buy (1) rating, and 19.6x, which is the stock’s past-5- forecast a 26.3% net-profit CAGR year mean. over 2014-17, on the back of a 9.6% revenue CAGR and 3pp EBITDA ■ Risks Shane Goh margin expansion. The key risks to our call would be: 1) (65) 6499 6546 more food scandals, and 2) if the [email protected] ■ Catalysts company were unable to find good Bakeries: we expect 189 new locations for new outlets. outlets (20% rise from 30 June ■ Investment case 2015) to open by the end of 2017E, BreadTalk’s share price has with 150 franchised bakery stores. Share price performance underperformed the FSSTI and the We view this positively as franchised (SGD) (%) average of its local consumer peers outlets allow BreadTalk to expand 1.60 115 by 16% and 24% YTD, respectively, store count without much risk (low 1.48 108 on the back of a slew of negative capital outlay). -

Breadtalk Group Expands Into Chongqing with New Strategic Partnership

BreadTalk Group expands into Chongqing with new strategic partnership SINGAPORE – 27 June 2018 –BreadTalk Group Limited (“Group” or “BreadTalk Group”), via its wholly- owned subsidiary, Shanghai BreadTalk Gourmet Co Ltd (“Shanghai BreadTalk”) had entered into a joint venture agreement (“JVA”) on 13 June 2018 with Mr Ge Ying (“GY”) to operate the BreadTalk brand of bakeries in Chongqing, China. This strategic partnership combines BreadTalk Group’s wealth of experience in managing and developing franchisee relationships with GY’s strong understanding of Chinese consumers’ preferences. Currently, GY and his team is an existing franchisee and manages the BreadTalk brand of bakeries in Tibet Autonomous Region (“TAR”) for the last six years. With proven track records, the Group is confident of his team’s capabilities to lead the growth plans for Chongqing, China. The Group is therefore pleased to announce that Shanghai BreadTalk has entered into a JVA with GY, 30% shareholding will be owned by Shanghai BreadTalk and 70% owned by GY. The joint venture company will operate and manage the BreadTalk brand of bakeries in Chongqing and potentially expand across the South-western market. Under this agreement, Shanghai BreadTalk retains the rights to appoint exclusive partners to operate the BreadTalk brand in major transportation hubs. Mr Tan Aik Peng, Chief Executive Officer (“CEO”) of BreadTalk Group’s Bakery division said, “We are excited to have another opportunity to serve consumers in Chongqing, with a joint venture instead of a pure franchise arrangement. This joint venture is aligned with our Group’s long term direction of increasing direct owned outlets in Mainland China.